Executive Summary

‘Bob & Lloyd Pizzeria’ will present a relaxing, neighborhood-centered eatery where the restaurant will serve Pizzas and other rice items to customers. Bob & Lloyd Pizzeria will render different services to the customers much different from other fast-food restaurants existing currently in the vicinity. The objective of this paper is to develop a business plan for the successful creation of Bob & Lloyd Pizzeria. The business plan makes a market analysis of the fast-food industry. As a part of the business plan, the paper makes use of the analytical tool of Porter’s Five Forces Model. The plan further provides a strategic growth plan for the medium term of the future. Estimated with a conservative outlook, the overall investment in the project is estimated to be £ 300,000 and the project is expected to ensure a return of £ 46,552 after taxes in the first year of its operation.

Introduction

With a great idea and a viable business plan, it is possible to start a Pizzeria and fast food restaurant with a reasonable sum of money as an initial investment. The ideal scenario is to start the noodle bar business with enough capital to enable the owner to move aggressively and expand the business faster. A business plan for Pizzeria should serve as a visualization of how exactly the business is going to work. The purpose of the business plan is to enable the reader to decide whether the Pizzeria business is viable; whether the business can be improved and the scope for future expansion and growth. A well-drafted business plan is a valuable tool for growing the business. This paper provides a detailed business plan for the creation of a noodle bar in the name and style of ‘Bob & Lloyd Pizzeria’ to become operative in Cambridge.

Market Analysis

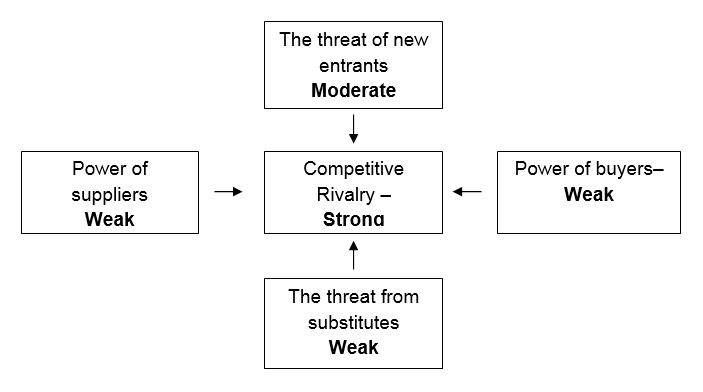

The fast-food industry in the UK can be analyzed through Porter’s five forces (Mindtools, 1995) for market analysis. The study of various factors having their influence on Bob & Lloyd Pizzeria will facilitate the establishment of core strategies for the establishment of the fast-food restaurant.

Porter’s five forces analysis

In Porter’s 5 Forces, there are major elements: supplier, buyer, competitors, new entrants and substitutes. It will help Bob & Lloyd Pizzeria to contrast a competitive environment by this analysis. Hence, Bob & Lloyd Pizzeria should recognize the forces that decide the conclusive profit potential.

Rivalry among competitors

For fast-food restaurants, the outlook is a bit brighter. According to Key Note (2008), the market remaining ethical and healthy has been emphasized in the past 5 years. Moreover, due to the revival of the economic climate, the forecasted market growth for 2008 is 8%. Therefore, it seems that the fast-food industry is at mature stages of the product life cycle (Kuhn, 2009).

The competitors operate several formats, such as large, out-of-town restaurants and smaller, High Street bar, which compete more directly with smaller local fast-food restaurants. Compared to this, Bob & Lloyd Pizzeria’s food differentiation is low. Therefore, it seems that competition for sales tends to be more intense. Most fast food outlets are labor-intensive and have high fixed costs in rents, rates, and labor costs capital investment. Because of losses that occurred early in UK’s economic downturn, their high fixed costs were difficult to cut back and losses lasted for a long time. Moreover, this weakens the fast-food market. However, the industry outlook is strong (Riely, 2010).

Threat of entry

Fast food restaurants are sprouting everywhere, with new concepts, sleeker designs, and offering more than a typical restaurant. Moreover, multi-cuisine food ingredients are easily available nowadays and with the growing population of immigrants, the industry is becoming attractive for new entrants. Consequently, the fast food business in Cambridge was concluded that it will be still an attractive market to enter and the growth prospects are still reasonably good. As the concentration of power from the players in this industry is low due to its high fragmentation level, the retaliation power of its players will also be below.

Reprisal by currently operating firms, such as the beginning of competition based on prices, is a chance, particularly where a new firm enters into a cluster having a number of firms operating in the same market. The brand equity of the large chain stores is substantial, which may reverse the impact of lesser leveraging costs. Finally, growth rates of profitability have been adequate as compared to impressive in the latest periods, keeping the market less inviting. Generally, there is a big chance for new firms to enter the market.

Threat of substitution

Healthier options such as oriental cuisines including noodles are offered increasingly as an alternative to traditional pizza. Pizza is served increasingly in the local restaurant and in this context, restaurants have been moving more into high-level restaurants with an emphasis on better quality food offerings. There is also an abundance of Pizza takeaways, which are convenient, cheaper and of good quality.

Alternates for Pizza contain other types of profitable foodstuff (like ready to eat or items for home preparations). Pizza as fast food tends to be inexpensive than other varieties of foodstuff. Alternate products, therefore, do not compete with Pizza on price, and they are deficient in the advantage of handiness that identifies fast food. Moreover, it is worth highlighting that a switch in consumer expenditure patterns from noodles to other foods can negatively affect the demand for Bob & Lloyd Pizzeria.

Bargaining power of buyers

Consumers can research the Pizzeria’s options over the internet by looking through the menus, comparing price offerings, and most importantly read customer feedback prior to deciding where to have noodles. The Pizza fast food market will be analyzed taking independent and chain restaurant companies as players and consumers as buyers. Buyer power is weakened by the fact that, while not everyone enjoys Pizzas, it is nonetheless highly popular with large numbers of individual UK consumers. Firms distinguish their offers through the variety of foodstuffs on promotion.

Bargaining power of suppliers

Bob & Lloyd Pizzeria will have bargaining power with its suppliers. With a centralized purchasing process, Bob & Lloyd Pizzeria will be also optimizing its resources. Therefore, key inputs for food retailers include commodity foods. While the ultimate suppliers of rice, wheat, livestock, etc are numerous, often relatively small, farmers and growers, many food retailers do not buy directly from these sources. Buying commodity foods from direct farmers boosts supplier power from the point of view of noodle fast food bars. However, some vertical integration occurs, as does sourcing direct from the grower.

Marketing Plan

Bob & Lloyd Pizzeria is faced with the exciting challenge of competing with a number of other establishments already existing in the market. The provision of Pizza and rice dishes with the original ‘oriental’ taste combined with the courteous service of Bob & Lloyd Pizzeria is the winning concept and is expected to produce overwhelming results. The target market for Bob & Lloyd Pizzeria includes customers from developed and mature segments. This section analyses the market in which Bob & Lloyd Pizzeria is planning to operate.

Segmenting

The objective of attempting market segmentation is to enable the marketing program of the organization to concentrate on the sub-sect of customers most likely to be attracted by the product being offered (Business Resource Software, n.d.). Once the market segmentation is attended to correctly, the segmenting will ensure the organization secures soaring profits in relation to the investment in sales promotion.

The foremost factor that needs to be ascertained is the group of people that the product offered by the organization makes happy. The main consideration for market segmenting is to improve the market share/competitive position and improved cash flows from the business. Accordingly, the market segment identified for Bob & Lloyd Pizzeria consists of people from the age groups 25 to 35 and 35 to 64 having annual income of £ 15,000 to £ 50,000. This segment of customers is expected to have medium to heavy spending capacity. Since these customers are, more developed and matured as compared to the youngsters there, may not be any drastic changes in the needs and tastes of these customers except that they will expect the quality of food and service. Therefore, this is the perfect market segment, which the company can look for.

Four Ps of Marketing

McCarthy (1960) first introduced the concept of the four P’s of marketing. This marketing concept incorporates strategies on “product, pricing, place and promotion” (McCarthy 1960). In its simplest sense product covers all attributes and mixtures of products and/or services a firm can present to its clientele. The analysis of the product should ideally consider all the aspects related to products like quality, features, options, style, brand name, packing, sizes, returns, etc. Kotler & Armstrong, (2004) relates the term pricing to the quantum of money that the customers would have to pay to acquire the product. The pricing strategy to be adopted by the firm depends on the product’s position in the market. According to Kotler & Armstrong, (2004) placement encompasses all the activities of the company undertaken to make the product accessible by the customer.

The analysis of placement with respect to a particular product needs a thorough knowledge of the available channels of distribution including the involvement of intermediaries. Kotler & Armstrong, (2004) identify the objective of the promotional activity of a company is to communicate the benefits and values of the products to the customers and convince the targeted customers to make their purchasing decisions in favor of the products of the firm. Promotion analysis covers identifying the communication objective, which the company would like to pursue in respect of the product the firm is launching.

Based on this analysis, Bob & Lloyd Pizzeria has identified pizza as the basic product to be offered to the target segment of the customers. In addition to the pizza, the Pizzeria will also cater to other segments by offering side dishes like soy chicken and spring rolls. The product offerings will include rice items also. The pricing of the Pizzeria to be supplied by Bob & Lloyd Pizzeria has been fixed based on the market standards. In order to penetrate the market, the company will offer promotional offers.

The pricing strategy has been fixed keeping the developed and mature market segment customers who are very conscious of both price and quality. As regards the promotion of the products of Bob & Lloyd Pizzeria, the restaurant will use the internet as the best medium of marketing communication. The marketing strategy of Bob & Lloyd Pizzeria will be to position itself as a specialized high-quality Pizzeria. The marketing communication strategies include

- Create awareness among the target customers about the range of products and quality of customer service level.

- Build up a database of the potential repeat customers to provide them offers and discounts on important occasions like birthdays, anniversaries.

- Increase the visibility of the product range through the internet, and other print media.

- Position Bob & Lloyd Pizzeria as a specialized pizzeria and fast food joint meeting the needs of the younger population also.

The location for Bob & Lloyd Pizzeria has been selected keeping in view the availability of parking places and the proximity to other restaurants in the locality. The place has been ideally chosen on the eighth floor of a shopping mall, which also consists of the basement parking lot. There are many offices also located in the building. The lift to the eighth floor exactly opens in front of the Bob & Lloyd Pizzeria, which is an added advertisement for the Pizzeria. This also attracts more customers because of easy accessibility.

Organizational Plan

The organizational plan comprises the people constituting the company (Zigmont, 2005). According to the requirement of business, it is estimated that six people including a professional chef are enough for running this business. The profiles of the individual executive-level people are shown below.

- General Manager and IT Specialist:

- Responsible for sales and organization of production;

- The leader of the business is responsible for signing contracts, allocating jobs, and managing resources.

- Building up the website and design the context of it; Establishing the business module;

- Finance and Administration Executive:

- Responsible for financial control;

- Researching for the market information and analyze the customer segments and demands. Design catalogue, advertisements and promoting materials.

- Financial Accountant:

- Dealing with book-keeping and preparation of final accounts along with cash flow and budgets forecasts;

- Reviewing the contracts and legal affairs; Contact with shareholders and stakeholders.

- Operations Executive:

- Arranging the procedure of the operations,

- Human resources, purchasing, product delivering, job allocating, equipment maintenance and the operations of manufacturing;

- Chief Chef:

- Responsible for preparing the recipes of Pizzerias and supervising the quality of the products being; prepared by the subordinate chefs;

- Responsible for checking the quality of materials being purchased by the company from various source;

- Procurement Executive:

- Responsible for identifying the sources of various materials required by the restaurant;

- Responsible for procuring quality materials at cheaper prices;

- Responsible for identifying foreign sources for import of materials.

Apart from the above key personnel, the company will appoint as many levels of workers and waiters as may be required from time to time to ensure better service to the customer.

Table: Summary of Organizational Plan.

Leadership, Motivation and Team Working

A number of past studies have focused on the impact of leadership styles on organizational performance (CannellaJr & Rowe, 1995; Giambatista, 2004; Rowe et al., 2005). Leading is the ability of an individual to influence the actions of other people in a group. Therefore, a leader must understand the things, which will motivate others. Leaders who would like to influence others are most likely to create or change things so that they can inspire others (Avolio, 1999; Rowe, 2001).

This character of leaders calls for the acquisition of a special skill to perform the task. To become a leader, one has to understand what things motivate the employees working under him as well as the co-workers. In general, all people have some basic needs covering their income and necessities and in addition, most people need to establish social connections and friendships with other people.

Some other types of people have the aspiration of growth in their personal careers and they would like to take up new challenges to grow in their professional fields. “A staff member lured to a job by high salary may find their job dissatisfying if she is unable to have friendships and connect with other people at work,” (Freeman & Stone, 1992). It is for the leader to understand the basic and other needs of the people whom he wants to motivate and try to meet these needs.

It is a misconception people who are brave, outgoing, having a good physique, and are task-oriented only could become leaders. Although these are some of the qualities that will enable a leadership position even people without these qualities could lead and motivate people. A number of factors influence the ability of a person to become a leader, but it relies largely on the faction of people that the individual tries to lead and motivate make the leader.

The goal of a leader is to guide the motivation into practical ways, which will be useful for the society or for the organization. A number of factors influence the motivation of employees. The most regular factor for motivating an employee is the kind of task the individual is performing regularly.

It is the common understanding that an employee when does the same job on a routine basis is likely to become proficient in that job over time. However, it is a fact that doing the same job repeatedly will make the person frustrated and boring. Therefore, a leader has to understand that when employees are given a variety of tasks with the opportunity to grow, the employees will remain motivated. Nevertheless, “many workers are underutilized and do not get challenged or the ability to show their creativity to its fullest potential,” (Freeman & Stone, 1992).

There are certain other categories of employees, who are goal-oriented. These people follow the leader to get the direction for focusing their efforts. They are able to respond well towards meeting the deadlines and they are found good in planning. For these people, having the ability to achieve a goal becomes the motivating factor. Any business organization must establish its own goals to achieve and these organizational goals are broken down into individual employee goals.

Attempts on the part of the employees to attain these personal goals provide strong motivation, drive for them, and make them remain motivated. However, it is the responsibility of the leader to ensure that these goals are reasonable and are achievable by the employees. Unattainable setting goals may create a negative effect and can cause discouragement and frustration among the employees.

When the employees attain the goals, they would like to be rewarded. Some of the goals set, when achieved are able to provide personal satisfaction to the employees in the form of new learning, growth and self-esteem. Employees expect additional rewards like a pay rise, bonus, and cash awards in recognition of the tasks completed by them successfully. Rewards are often found to be successful motivating tools, that employees in anticipation of rewards do all necessary to complete the tasks that offer them additional rewards. However, it should be remembered rewards act as a double-edged sword because employees will be tempted to work more on tasks, which provide them rewards in preference to the non-rewarding tasks.

The work atmosphere is an important factor in influencing employee motivation. Generally, a manager who has a friendly and cordial relationship with the subordinates is able to evoke a positive response from the subordinates. The work atmosphere should enable individuals to enjoy their work. “If an employee feels that they are not being treated fair, they will lack the motivation to work hard,” (Freeman & Stone, 1992). It is to be understood, that every employee prefers to enjoy some amount of freedom in his work and he wants to contribute to the success of the organization while he performs his task.

Therefore, the leader should exercise control over the subordinates, and at the same time, he should be flexible enough to make the employees feel that they are independent to work. Work environments and individual culture of the employees tend to foster employees who are rugged in nature and these employees have a tendency to work on personal goals rather than to meet the organizational goals. It is the efficiency of the leader to identify the individuals who will fit into a team and to promote effective team working. Good teamwork and effective team building are at the root of the success of any organization.

Here a selection of team members becomes crucial to ensure successful team working. The leader should allow the teams to make mistakes and learn from the mistakes committed. “Team-learning is psychological as well as practical.” (Bono & Heller, 2008) The success of teamwork depends not only on the individual confidence of the team members but also on the collective confidence of the team, which each teammate has in the other. The leader should allow the team to “perform and learn together over time to develop real trust and confidence in each other,” (Bono & Heller, 2008).

Communication is the major determinant for the consistency and progress of team working. Communication between a leader and the team members and between the team members is crucial for the success of teamwork. Therefore, developing good communication is vitally important for the leader to ensure organizational success through team working. “If the members sense that the leader is still convinced and confident about the team’s direction and prospects, the passing moment of doubt will be converted into a lasting boost to morale,” (Bono & Heller, 2008).

Financial Plan

Bob & Lloyd Pizzeria is basing projections of its sales on market research, industry analysis, and proximity to other Pizzerias in the locality. The company expects to obtain a modest 0.5% of the market share. The cost of goods sold is based on the price list of renowned suppliers of basic materials required for supplying Pizzas, Pizzerias, rice dishes, and other side dishes and are generally found to be consistent with the fast-food industry standards. The cost of sales is 55% of the selling price.

Bob & Lloyd Pizzeria will use its ‘Point of Sales’ (POS) system to keep cash flow and sales goals on track. It will also help the company to monitor whether the marketing efforts are worth the investments made.

Assumptions

Eighty percent of the sales of Bob & Lloyd Pizzeria are assumed to be on a cash basis. All the purchases of materials will be done on a cash basis to get the best advantage of prices and quality. The debtors will be collected one month in arrears. Interest on the loan is assumed at 6% per annum payable per quarter. The loan repayment will start from the third year onwards. Wages and salaries have been assumed to be at the current market standards and escalations in the cost for the future period are assumed between 15% and 20%. It is also assumed that there will be no drawings by the owners and all the profits earned will be ploughed back into the business. The corporate tax is assumed to be uniformly at 25% for the projected five-year period.

Financial Highlights

The financial statements of five years projected profitability, break-even volume, sensitivity analysis assuming a variation of 20% in the number of customers and resultant sales, projected cash flow for the year 2010, projected profit and loss account, cash flow statement, and Balance Sheet for the year 2010 are prepared for presentation in this business plan. The salient aspects are discussed below:

Financing of the Venture

The initial start-up expenditure of the proposed venture of Bob & Lloyd Pizzeria is worked at £ 300,000. Out of the total requirements of £ 300,000, the owners will contribute an amount of £ 100,000 as their capital. The balance of £ 200,000 will be secured from a bank as a loan repayable over three years after the initial holiday period of three years. The major capital expenditures in respect of the purchase of equipment and furniture will be met from the initial funds. The company will also invest the initial funds in computers and in buying the necessary software to run the business. The cost of the software will be amortized over five years.

The other assets will be depreciated at the rate of 10% on the straight-line method during the anticipated duration of the functional working of the assets. The breakup of the expenditure and the proposed method of financing the required funds are shown below:

Table: Finance Requirements.

Turnover and Profitability

The turnover for the yearly growth has been assumed to be at 18% to 20% per annum. The average number of customers attending with an average volume of sales per person at £ 45 per visit has been assumed for arriving at the turnover. It may be observed that the gross profit projections for the years gradually increase over the years as compared to that of the initial year.

This is because the company will try to establish reliable and cheaper sources of materials from the Far East and for sure, it will lead to reduced costs of materials when the company is going to buy directly from the supplier sources. The net margin percentage has been showing an increasing trend progressively from the second year onwards. The abridged version of the projected earnings statement of Bob & Lloyd Pizzeria is presented below:

Table: Finance Requirements

The increase in net profit is due to the popularity of the restaurant gained over the period and therefore the advertising expenses are reduced largely. The return on owners’ equity for the first year is calculated at 46.5%, which can be considered as a very good performance of the fast-food restaurant when achieved.

Cash Flow

The cash flow statement indicates that the business in the first year has generated £ 51,252.50 from the operations. Assuming the same amount of cash flow generations from the operations, the entire capital introduced by the owners will be paid back in 2 years. With the increased net profit and retained earnings, the business will pay back the owner’s equity and the bank loan within the fourth year of operations. The financial statements attached to this business plan are self-explanatory and exhibit a clear positive trend of the business. The projected cash flow statement for the year 2010-11is appended below.

Accounting Concepts

Accounting concepts represent the basic rules of accounting, which are required to be followed in preparing the financial and accounting statements of an entity (BusinessDirectory, 2010). The accounting of the business will be done based on Generally Accepted Accounting Principles (GAAP) catering to the industry in general. The accounting will follow a mercantile system of accounting. The system will follow the four major accounting concepts of matching, accrual, realization, and dual aspect concepts.

Under matching, earnings will be equated with expenditure for the applicable period. The accrual concept assumes that revenue is realized at the time of the sale, irrespective of the time when cash is realized. The realization concept indicates when the revenue should be recorded in the books of accounts. The dual aspect concept takes into account two aspects in respect of any transaction undertaken by the company. “It signifies that every transaction in accounting has two aspects. For example, in the transaction of goods purchased for cash, the two aspects are ”giving of cash’ and ‘receiving of goods. Similarly, each transaction in accounting has two aspects.” (EAccounting, n.d.)

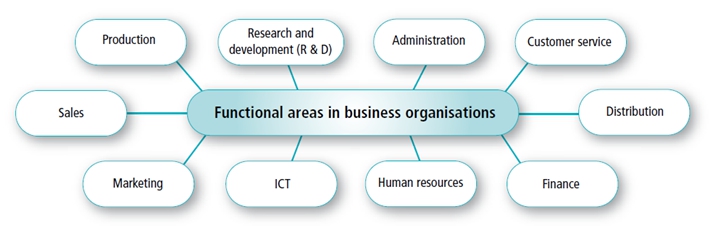

Functional Areas within Business Organizations

Even small businesses have a number of tasks to be performed regularly in key functional areas. For instance, materials are to be bought, payments to supplies and services are to be made and customer queries need to be answered. In a small firm, one or more people perform these tasks, whereas in larger organizations there are specialized departments to look after these functions headed by a senior executive assisted by a number of people at lower levels.

Some people have acquired specialized qualifications and experience in different functional areas like marketing and finance. In large organizations, each of the functional departments is entrusted with the responsibility of performing the day-to-day operations relating to their respective functional areas. The following figure represents the different departments functioning in a manufacturing organization.

There are differing views on the importance of various functional areas. While Armstrong (1987) says HR is important Capon (2000) feels marketing is important. Among all the functional departments within an organization, finance, marketing, and human resources functions assume increased importance and frequent and positive interaction among these departments is essential for the success of any business organization.

Purpose of Functional Areas

Different functional areas within a business organization are created to make sure that the essential actions connected with the conduct of the business are performed professionally and in time. Performing the various business activities efficiently becomes important for achieving the overall goals and objectives of the business. In addition, individual departments are made responsible for achieving the set goals in the respective functional areas. For example, the marketing department is made responsible for achieving the marketing targets. These targets might have been linked to developing new market segments or enlarging the sales growth.

Similarly, the human resources department has the responsibility to arrange for the training of staff and is responsible for the continuous professional development of the employees, so that the employees are motivated to stay with the company for a long period. The finance department is obligated to support the goal of keeping the costs at the minimum level to make the organization function efficiently and profitably. This part of the paper describes the role and functions of HR, finance, and marketing being the important functions of an organization and the interaction among these functions.

Human Resource Function

Employees represent the human capital of an organization (Lussier, 2008). The functions of HR, therefore, become important in the smooth running of any organization. Some of the important functions of the HR department include new employees are recruited in time so that each vacant position in the organization is filled with the best available person and proper training is provided to the recruited candidates. In view of the fact, the recruitment and hiring process is time-consuming and is expensive, the selection of the right people becomes an important task for the HR department.

The HR department is involved in providing the orientation to the newly recruited people and training on improvement of technical skills to those employees, who are already in employment with the company. The goal of the HR department is to ensure that skilful and efficient employees are retained with the company for long periods. It is the function of the HR department to review the employee turnover ratios and in case the turnover is high, to find out the cause of such attrition. Identifying the cause of employee turnover and remedying the problem is another important function of HR. There may be different reasons for people to leave an organization and it is for the HR department to find the real cause and rectify it. Maintaining harmonious industrial relations is also one of the key functions of the HR department.

Finance Function

Most business owners consider finance as the most important activity connected with the business because every business needs a steady stream of cash flows to enable the business to meet its financial obligations to all the stakeholders. It is the function of the finance department to make a record of all the earnings and expenditures of the company so that the business owner and managers are informed of the profit or loss made by the company from the business done during a period. Such financial information enables the business managers to make crucial decisions concerning the future course of action in several business situations.

Many of the large business enterprises employ different kinds of finance personnel – management accountants, financial accountants, and financial controllers. The function of the management accountant is to evolve monthly budgets, monitor the actual performance of different divisions against the budgets, provide an analysis of the financial information including costs of the products to the managers for informed decision-making by them and to prepare cash flow forecasts (Horngren et al., 2002).

A financial accountant is entrusted with the task of preparing the statutory accounting statements periodically for the information of all the stakeholders of the company. The financial controller monitors the collection of amounts due from parties to the company and the settlement of bills of suppliers and service providers on a timely basis without any delay.

Marketing Function

Marketing is concerned with the identification and meeting of the needs of the customers (Kotler & Armstrong, 2000; Kurtz, 2008). For many businesses marketing function assumes large significance, because all the business activities are integrated with the success of marketing, which leads to growth in sales and profitability for the organization. In fact, the modern marketing concept recognizes that all the organizational members need to be oriented towards putting the customer needs first so that organization can beat the competition from other firms (Gronroos, 2004; (Gummesson, 1998; Kotler, 2006).

For instance, the production worker needs to be trained to produce goods of high quality and the accounts personnel need to be trained to provide an efficient and prompt reply to the customer queries. The function of marketing is described usually through four P’s of marketing – Product, Price, Promotion and Place. These factors constitute the basic elements of marketing function dealing with the attributes of the product, customer segments, competitiveness of price, marketing communication to reach the target market, and the identification of proper distribution channels for reaching the products to the user.

Advertising, sales promotions, and campaigns support the marketing function in providing adequate information on the products to potential customers. With the advancement of information and communication technology, Internet and company Websites offer tremendous scope for communicating with a wide range of customers without any geographical Pizzerias.

Interaction among HR, Finance and Marketing

“As far as the whole organization is concerned, each functional area has its own strategic management,” (Jiang, 2009). In order that any business organization can run smoothly, there is the need that all the functional areas in the organization interact with each other closely and support each other in the process (Ross et al., 2005). Between finance and marketing, this need can be observed from the fact that all well-conceived marketing plans include major financial decisions. For example, the marketing plan for the ensuing period can be drawn based on the historical figures of sales data in respect of each brand, product line, and/or territory.

Profitability and budgeting are some of the key elements for efficient marketing planning, where the finance department has to function closely with the marketing department for the generation of the information and data required by the marketing department. The marketing investments decisions in the areas of advertising, pricing, promotional activities, and fixing of distribution channels depend entirely on the inputs provided by the finance departments.

On its part, marketing provides information to the finance department for its capital budgeting decisions, formulation of credit policies, and preparation of cash flow projections (Van Horne, 2004). The interaction and information sharing between finance and marketing functions thus become vital for the efficient management of a business.

Since the human resources department is concerned with the hiring of suitable personnel for both finance and marketing departments, it is essential that both the departments function in close coordination with the human resources department to get them efficient and suitable persons for various positions. Marketing and finance departments should interact with the human resources department for developing job descriptions, screening the candidates during the hiring process, and designing appropriate training programs. In most the organizations, HR department undertakes the performance evaluation of the employees in close coordination with other functional departments. Under such circumstances, the interaction between HR and finance and marketing functions becomes significant to arrive at proper rewards and promotions for the employees including pay rises.

Drawing up proposed budgets by the finance department for human resources necessitates close interaction between finance and HR functions. The HR department has to work closely with finance and marketing for drawing up the orientation programs for the new employees recruited for these departments. It may not be possible for the HR department to evolve a comprehensive orientation program without close interaction with the finance and marketing functions. In manufacturing organizations, the direct labor hours involved in the production are monitored and recorded by the HR department, which is a valuable input for arriving at the cost of production of products/services. Data and information from HR in this area will greatly help the finance department to calculate the cost of a product accurately.

Conclusion

Having made a detailed business plan for venturing into a pizzeria in London, with respect to its operations, organization, financing, marketing, and external and internal analysis of the market for pizzeria it can be assertively said that the market for Pizzeria is an ever-expanding one. Especially with the increased demand for fast food even from European citizens, the market for fast food in the UK is bound to go up tremendously in the years to come. This plan thus forecasts fabulous business growth for the company Bob & Lloyd Pizzeria in the next five years period and the company is sure to achieve its organizational goals and position itself as a specialized fast food restaurant as spelled out in the business plan of the company.

Reference List

Armstrong, M., 1987. Human Resource Management: a case of the Emperors New Clothes. Personnel Manager, 19(8).

Avolio, B.J., 1999. Full Leadership Development: Building the Vital Forces in Organizations. Thousand Oaks CA: Sage.

BITEC, 2005. The Main Functional Areas within business Organizations. Web.

Bono, E.d. & Heller, R., 2008. Team Leaderhsip: the Art of Communication. Web.

BusinessDirectory, 2010. Accounting Concepts. Web.

Business Resource Software, Market Segmentation. Web.

CannellaJr, A.A. & Rowe, W.G., 1995. Leader capabilities, succession & competitive context: A Baseball Study. The Administrative Quarterly, 1, pp.69-88.

Capon, C., 2000. Understanding Organizational Context. London: Financial Times Prentice Hall, Pearson Education.

EAccounting, Accounting Concepts. Web.

Freeman, E.R. & Stone, J.A., 1992. Management 5th Edition. Englewood Cliff NJ: Prentice Hall.

Giambatista, R.C., 2004. Jumping through hoops: A longitudinal study of leader life cycle in the NBA. The Administrative Quarterly, 15, pp.607-24.

Gronroos, C., 2004. The relationship marketing process: communication, interaction, dialogue, value. Journal of Business & Industrial Marketing, 19(2), pp.99-113.

Gummesson, E., 1998. Total relationship marketing: experimenting with a synthesis of research frontiersl. Australian Marketing Journal, 7(1), pp.72-85.

Horngren, C.T., Foster, G. & Datar, S.M., 2002. Cost Accounting: A Managerial Emphasis. New Delhi: Prentice Hall of India Private Limited.

Jiang, X., 2009. Strategic Management for Main Functional Areas in an Organization. International Journal of Business Management, 4(2).

KeyNote, 2008. Fast Food & Home Delivery Outlets 2008. Web.

Kotler, P., 2006. Marketing Management, 12th Edition. Englewood Cliffs NJ: Prentice Hall.

Kotler, P. & Armstrong, G., 2000. Marketing – An Introduction 5th Edition. Upper Saddle River NJ: Prentice Hall.

Kotler, P. & Armstrong, G., 2004. Principles of Marketing Tenth Edition. New Jersey: Pearson Education Inc.

Kuhn, K., 2009. Recession fuels 8% growth in UK fast-food industry. Web.

Kurtz, D.L., 2008. Contemporary Marketing. Stamford Connecticut: Cengage Learning.

Lussier, R.N., 2008. Management Fundamentals: Concepts, Applications, Skill Development 4th Edition. Stamford Connectcut: Cengage Learning.

McCarthy, E.J., 1960. Basic Marketing: A Managerial Approach. Ilinois: Irwin.

Mindtools, 1995. Porter’s Five Forces. Web.

Riely, J., 2010. Recession turns the UK into a fast-food nation. Web.

Ross, S.A., Westerfield, R.W. & Jaffe, J. 2005. Corporate Finance Seventh Edtion. New Delhi: Tata McGraw Hill.

Rowe, W.G. 2001. Creating Wealth in Organizations: The Role of Strategic Leadership. Academy of Management Executive, 15, pp.81-94.

Rowe, W.G., CannellaJr, A.A., Rankin, D. & Gorman, D. 2005. Leader succession & organizational performance: Integrating the common-sense, ritual scapegoating & vicious-circle succession theories. The Leadership Quarterly, 16(2), pp.197-219.

VanHorne, J.C. 2004. Financial Management Policy XII Edition. New Delhi India: Prentice-Hall of India Private Limited.

Zigmont, J. 2005. Part4: Operating & Organizational Plans. Web.