Introduction

An open economy is an analysis of an economy where we consider the foreign sector, by considering the foreign sector we mean that the economic performance of a country depends also on other countries in terms of imports and exports.

Open economy the model is Y=C + I + G + (X-M) while in a closed economy the model is Y=C + I + G, Where Y is the level of national income, C is the consumption level, G is government, X is exports and M is imports.

In an open economy where we have the foreign sector, the government has to consider the effects of internal policies that affect the foreign sector for example if a country is to increase its interest rates this discourages capital outflow and encourages capital inflow, the difference between capital inflow and capital inflow will, in turn, influence the exchange rates.

The government’s objective is to achieve low levels of unemployment; low inflation rates and achieves high economic growth through the use of the various tools and instruments at their disposal which include interest rates, money supply, government spending, and taxation.

This paper defines internal and external economic balances and also establishes the difficulties and paradoxes a government faces in trying to attain both internal and external balances, it will focus on the effects of domestic economic policies and their effects on the foreign sector.

Internal Versus External Balances

Internal balance involves the government’s efforts to attain growth, full employment, and price stability to avoid inflationary pressure, internal balance is achieved through the use of government spending, taxation, interest rates, and money supply.

External balance involves achieving a favorable balance of payment where a country aims at achieving high levels of exports; the balance of payment depends on the terms of trade where these terms of trade depend on the prices of goods and services and also the exchange rates.

Difficulties Faced in Maintaining Internal and External Balances

Internal balances

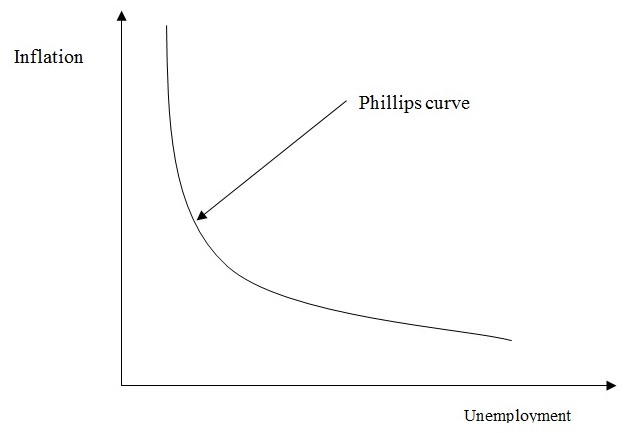

An economy will aim at achieving a high economic growth rate, high employment levels, and also low inflation levels, however, to achieve high employment levels means that the level of inflation will rise and this means this may not be a good policy. The diagram above depicts the relationship between inflation and employment.

The Phillips curve shows that the higher the level of inflation then the lower is the level of unemployment, therefore governments will not like the high levels of inflation which may lead to a recession, therefore governments will maintain a certain level of unemployment to maintain low levels of inflation.

Government spending

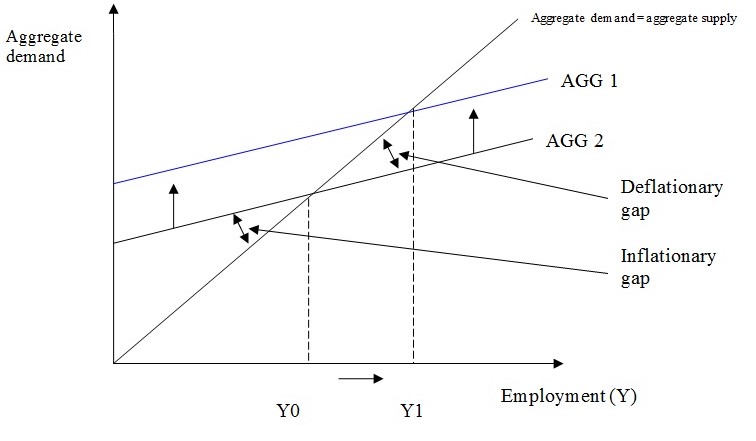

An increase in government spending will stimulate aggregate demand, when aggregate demand increases it signals to investors to invest more, and therefore there is an incentive to increase aggregate supply, the overall result of an increase in government spending is an increase in the level of employment, the diagram below represents the result an increase in government spending;

From the above diagram, AGG represents aggregate demand, aggregate demand = C + I + G, the government will increase government spending, and therefore the aggregate demand will shift from AGG 0 to AGG 1, also the level of employment will shift from Y0 to a new employment level Y1. Therefore the government will achieve a high level of employment but the problem the government will have to face next is high inflation due to its increase in spending, this is the new paradox the government will face despite achieving a new and higher employment level.

Money supply

We will use an LM and IS curve to demonstrate the effect of an increase in the level of money supply, the LM curve joins together the levels of rates of interest and national income a at which the monetary sector is at equilibrium, the IS curve joins together the levels of interest rates and levels of income at which the real sector is at equilibrium.

In case there is an increase in the level of money supply the LM curve will shift to the right as shown by the movement from LM 0 to LM1, this will at the same time increase the level of national income from Y0 to Y1, interest rates will also go down from I0 to I1.

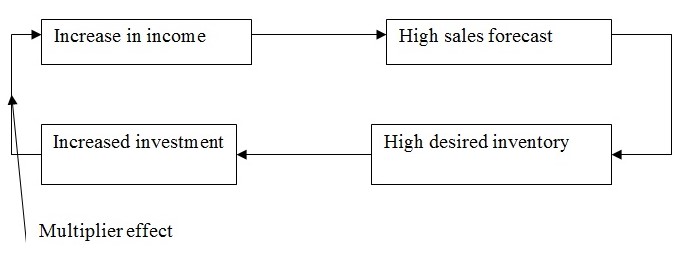

An increase in the level of national income will lead to increase investment as depicted by the accelerator theory which is demonstrated below:

From the above an increase in national income will tend to lead to an increase in investment this is known as the accelerator effect; however, an increase in investment that is caused by an increase in investment is called the multiplier effect:

∆ Y→ ∆ I accelerator effect

∆ I → ∆ Y multiplier effect

By increasing money supply the government will achieve higher national income, however, the increase in money supply will increase the level of aggregate demand, and therefore there will be an increase in the level of inflation due to higher demand than supply known as demand-pull inflation.

Interest rates

If the government decides to decrease the level of interest rates to increase the level of investment then it will have to face inflationary pressure, interest rates are the cost of borrowed funds, and when the level of interest rates decreases this means that more funds will be available for investors at low cost, therefore, more investment. However, the reduction in interest rates will increase the level of money supply which may result in inflation.

Internal and External Balance

It is important for an economy to maintain both internal and external balances, due to external pressure the internal balance may be affected, this effect will be as a result of increased exports, political factors, exchange rates, oil shock, and capital flow and outflow.

Exports

An increase in exports will results in higher foreign income into a country, as a result of this there may be what is known as a boom, in case of a boom the government will try to move the economy to the new potential level of output through an increase in interest rates to move the economy to the new potential output, a failure to increase the interest rates will result to high inflation in the entire economy.

When the level of exports increase this means that there is a high level of foreign earnings that enter the economy, there will be a need to increase the interest rates in order to reduce the effect of high liquidity level which is inflation, an increase in interest rates will ensure that the economy moves to a new potential output through an increase in savings, the higher the interest rates the higher the savings level and the higher the savings level the higher is the level of investment.

Oil shock

A sudden increase in the level of oil prices will cause a rise in price in the entire economy, this will lead to high inflation rates which will lead the economy into a recession, the government may choose to allow inflation to rise and then fall and then facilitate the recovery of the recession through lowering the interest rates, however, the government may choose to lower the interest rates immediately so that to avoid a recession, the choice of these two actions depending on the level of interest rate and inflation in an economy.

By lowering interest rates the aggregate demand will increase shifting back the potential output to the original level, therefore from the above an economy can avoid a recession but cannot avoid inflation.

Capital flow

An increase in the level of domestic interest rates will increase the level of capital inflow, this is because people will obtain funds from other sources other than obtaining funds domestically, a reduction in interest rates will increase capital outflow and at the same time reduce capital inflow, the importance of capital inflow and outflow is their determination of the exchange rates, every economy wants its economy to have a strong currency and this is achieved by high capital inflow and low capital outflow, therefore, economies will ensure that their interest is high-interest rates. When the exchange rates change in such a way that the currency of a country devalues then the level of exports increases while the level of imports reduces, this is due to the fact that the imports become relatively expensive while the exports become relatively cheap.

Conclusion

From the above analysis of internal and external balances, it is evident that a country should always take into consideration the effects of policy implementation on its external balances.

The government should therefore act accordingly to any external influence if the level of exports increases this means that there will be a favorable balance of trade but at the same time the internal balance may be threatened by high inflation levels, therefore, the government should increase interest rates.

In the case where there is an oil shock, the government will choose from acting immediately by increasing interest rates or wait for the economy to undergo a recession and then aid in recovery by increasing interest rates, however, this will depend on the level of inflation and interest rates that prevail in the economy.

An increase in interest rates, however, will reduce the level of domestic borrowing and therefore reduce investment there will be greater demand for foreign currencies which will lead to a devaluation of the currency, therefore the government should consider the use of moderate increases and decreases of interest rates.

However the policy measures to be used to maintain both internal and external balances depends on the current state of an economy, if an economy is currently experiencing high inflation rates then the policy measures to be undertaken will be those that will avoid inflationary pressure, also if the level of interest is already high then the policy measure to increase interest rates will not be a good option.

References

Brian Snow (1997) Macroeconomics: introduction to macroeconomics, Rout ledge publishers, UK.

Stratton (1999) Economics: A New Introduction, McGraw Hill Publishers, UK.

Codington A. (2003) Keynesian Economics: The First Principles, Rout ledge publishers, US.

Alfred William (1991) The Classical Economists and Economic Policy, University of Michigan press, Michigan.

John Fender (1981) Understanding Keynes: An Analysis of the General Theory, Wiley publishers, US.

John Sloman (2003) Economics, Prentice Hall publishers, New York.

Hadjimichalakis M. (1982) Modern Economics, Prentice Hall Publishers, New Jersey.

Paul Anthony Samuelson (1964) Economics, McGraw-Hill publishers, USA.