Introduction

Over the span of sixty years, the global economy has experienced remarkable changes. Findlay & O’Rourke (2007) states that “In the early 1950’s, the world economy was essentially divided between developed or industrialized countries in the “North” and developing or non-industrialized countries in the “South”(as cited in Ahearn, 2011,p.1).

Findlay & O’Rourke (2007) further mention that 90% of the world manufacturing output and manufactured goods export was limited to the developed countries. There was a clear imbalance evident in the production structure, exports, living standards, and political power (as cited in Ahearn, 2011). The changing circumstances during 1950’s and 1990’s have caused drastic decrease in the output share of developed countries.

During this period it went down to 80%With the commencement of 20th century the division kept contracting, reaching a high in the past two decades as there has been a substantial emergence of new and more balanced patterns that have taken over the old and conventional manufacturing, finance patterns, and business dealings. Relocating extensive financial movement from the developed countries to developing nations, together with increased labor supply and reduced obstructions in trading has been possible due to the lessening of communication and transportation expenditure as a result of technological advancements. A few developing countries have grown keeping pace with the developed countries and have contributed to the world economic growth (Ahearn, 2011).

Economy in the UAE

The GCC (Gulf Cooperation Council) countries are part of the World Trade Organization and need to liberalize their financial markets adhering to the norms set by WTO in terms of banking, insurance industry, and securities. The GCC financial institutions and mainly banks have a monopoly in this sector due to the lack of competition from foreign banks. ME banks are earning more profit as compared to their global competitors due to posing minimal or no tax and prohibition of interest based on Islamic banking.

The concern shown by the UAE government in providing financial backing to significant projects and instilling liquidity into the financial institutions has minimized the impact of the global recession on the economy of the UAE. The local economy is expected to rise with the revival in oil prices that has endowed the financial system with much liquidity. The government has also been able to sustain a strong balance sheet in spite of the escalating expenditure (Fatma, 2011).

The UAE’s economy holds 28th rank in the 2013 freedom index as it acquires 71.1economic freedom score. The rise of 1.8 points from 2012 is an indication of considerable upgrading in business related freedom, improvement in the management of government spending, enhanced monetary freedom and freedom from corruption. Among 15 countries in the Middle East and North Africa province the UAE holds third rank. Compared to the world and regional averages UAE acquires greater overall score.

The economy in the UAE is ranked as mostly free as it was in 2003. Different parts of economic freedom are covered competitively and there are not many barriers to trade. Regulations backing open- market policies support commercial operations. The UAE provides a vibrant environment to entrepreneurs by creating a transparent and encouraging climate and adequate political solidity (United Arab Emirates, 2013).

Banking Industry in the UAE

In the past five years, the banking sector in the UAE has shown 30% growth per year. UAE has a combined network of 650 branches of 25 local and 30 foreign banks that represents the highest ratio between the population and banks in the world. However, banks have been adversely affected by the issues like credit shrinkage, cancellation of projects and decreasing work force.

In the recent years, Islamic banking has experienced considerable growth in the UAE. The public interest in the Shariah compliant products like Ijarah, Islamic Sukuk, and Murabaha has been increasing consistently in the past few years. It is demonstrated by the conversion of large number of conventional banks into Islamic banks or creation of a new Islamic banking division along with the conventional banking system (Fatma, 2011).

The global financial crises have generated a new international financial order that has a significant place for the Islamic banking system. Proving its command over the MENA region, it is now growing to hold a place as one of the economic power at the global level. The malfunction of the conventional banking system in the hour of financial crises due to their systems of governance and procedures related to funding has led a huge group of customers to shift to Islamic banking. This changeover has a great influence on the banking system and given rise to competitive pressure in the MENA region. Islamic banks have proved to be more competitive and have shown increasing market power in the past two decades (Sahut, et.al. n. d).

Islamic banking has compelled people to reconsider the viability of interest-based banking and divert its focus towards the interest –free banking. Recently, Ethica, one of the largest global banks based in Dubai, has been assigned the task of training thousands of bank employees about Islamic finance e- learning. Bankers coming from eight countries will be receiving this training. Ethica, holds number one position in the world for endorsing biggest number of bank officials and professionals.

It provides training in Islamic finance in about hundred financial institutions. The spokesperson speaking on behalf of Ethica said, “If banks are going to leave interest, we have to show them how. In many countries Islamic banking is attracting more customers than conventional finance for the same products because the terms are simply better” (Can Global Banking Giants Learn Islamic Banking, 2013, Para 3).

Islamic banking is leading the race in the global financial market because of the increasing importance of Islamic countries in the world economy and the huge number of Muslim population in places like Europe. China’s permission for establishing the first Islamic bank in the country is the next step in the direction. The number of countries incorporating Islamic banking and financial institutions has gone up to 75 and there are about 310 Islamic financial institutions in service in the world. For reinforcing the development of Islamic banking, Bahrain has been chosen to become the headquarter of the world’s largest Islamic bank.

The shock of the global financial crises was apparent in the Islamic financial institutions as well, however, the outcome was not as severe as experienced by the traditional banks. Nevertheless, it represents the association that Islamic banking shares with international banking. This was due to the principle of Islamic finance that denounces overestimation of the assets in the absence of sound financial basis, and financial derivatives (Asoomi, 2012).

The impact of the financial crises on Islamic banks was less during the preliminary phase in 2008. But, the first half of the year 2009 was indicative of some major turndowns in the profitability for Islamic banks affecting the real economy in the second phase of the crises. However, Islamic banks endured this added pressure with poise. Islamic banking investing and lending functions are based on morality. It is not necessary to be a Muslim in order to be the client of an Islamic bank, however, adherence to the ethics emphasized by Islamic values is essential (Hameed & Ahamed, n. d.).

Islamic Finance is based on the fair remuneration to the various aspects of production. There is an unbiased gush of money into economy present in the Islamic Financial system. This system reinforces fair and just practices by promoting permissible means of transactions. The Islamic banking and finance is growing speedily and has become a well-developed economic sector in the world. It comprises around 400 institutions spread over 51 countries and assets in excess of US$ trillion (US$1,000 billion) under management (Dubai Islamic Bank 2009 as cited in Hameed &Ahamed, n.d.).

It is anticipated that at the international financial market the industry is values 200bn to 300bn a year. The authoritarian administration that governs the Islamic Financial Institutions is not of the same nature across countries. To strengthen and harmonize the policies, International organizations have been set up. These organizations set standards that can be sensibly applied to the IFI’s (Hameed & Ahamed, n.d.).

The banks abiding by the Sharia principles do not charge interest and they do not finance ventures that invest in gambling, alcohol production etc. The Islamic business model is based on shared interests’ policy and it avoids practicing immoral or unethical use of monetary loans as it is prohibited in the Koran. However, the risk involved in any investment is also shared by the customer and bank both as in the case with the profit.

According to Al Baraka (2010), Islamic bank is an institution that mobilizes financial resources and invests that money in an attempt to achieve pre-determined islamically-acceptable social and financial objectives. Both mobilization and investment of money should be conducted in accordance with the principles of Islamic Shari’a (as cited in Hameed & Ahamed, n. d.).

Basic principles of Islamic banking

- Sharing of profit and loss by the bank as well as the customers and encouraging investment for the benefit of the society

- Prohibition of Usury, which means there can be no interest drawn on the amount over the money lent

- It is restricted to Islamic trading transactions excluding transactions for alcohol, gambling, pork etc.

- Islamic banking encourages investment through which the community may get some advantage. It is forbidden to trade money for money; therefore, it should be used for purchasing goods or services. These goods and services can then be sold to earn profit.

- Islamic banking is based on the principle of certainty and it disapproves any transactions based on speculation or which may face risk in future (Hameed & Ahamed, n.d.).

Goals of Islamic banking

The popularity of Islamic banking is not confined to the Muslim countries only but it has also started gaining grounds in some of the countries of Non- Muslim origin. Making slight changes in the practices of Islamic banking can release their unwieldy and doubtful financing structure and make it a clean and efficient interest free banking. A unique feature of Islamic banking is participatory financing that provides accountable financing to the ventures of social and economic interests. “The main goal of this system is international economic well- being with bursting employment and greatest level of economic growth and constancy in the value of money to enable the medium of exchange to be dependable unit of account and a stable store of value”(Hameed &Ahamed, n.d., p.7).

Challenges

The profitability of Islamic banking is not reaching the expected increase due to various issues like “subscale operations, very basic risk culture, incomplete market segmentation, low engagement with clients and an absence of technologically oriented value propositions”( Adil, 2013,Para 9).

It has been evident that the Islamic banking has focused extraordinarily to the projects related to real estate sector. Islamic banks’ involvement in the real estate sector led to the generation of high profitability before the global financial crises, however, it concealed many functional inefficiencies in those institutions related to their key business (Adil, 2013).

Islamic banking needs to find some solution to existing dilemma related to Sharia and professionalism to achieve a stature in the global banking, as it is difficult to tackle the complex financial instruments and derivatives according to Sharia principles only. Further, the crucial stock exchanges including oil, gold and commodities takes place on a daily basis and includes transaction of billions of dollars. These are huge and fast transactions and put a lot of burden on the financial institutions. Hence, Islamic banking needs to find solutions to these issues for being a part of the global banking system (Asoomi, 2012).

Sharjah Islamic Bank

The members of financial community in the UAE are pursuing the expansion of Islamic finance globally. The Islamic finance industry is on the rise with an annual rate of 20%.Two prominent conventional banks have converted to Islamic banking pursuing the demand for Islamic finance. Sharjah Islamic Bank (earlier known as the National Bank of Sharjah) is one of them that converted its operations successfully to Islamic banking in 2002.

Presently it offers “sharia-compliant financial services and products, whether in corporate, personal, commercial, retail, investment and international banking services as well as traditional products” (Oxford Business Group, 2008,p.38). The Sharjah Islamic Bank was formed in the year 1975. The key motive of the bank was to offer commercial banking services to company and people. It was formed by Sultan Bin Mohammad Al Qassimi who was the member of the UAE Supreme Council. He was also the Ruler of Sharjah. The bank was initially founded as National Bank of Sharjah but later converted to Islamic banking in 2002.

It was a major step to convert from a traditional banking to an Islamic banking and it required changing of all the systems related to accounting and information along with creating specialized products and services for the customers that would back up the Islamic regulations. A Sharia and Fatwa Board was formed through election for carrying out the task of advising and supervising the officials. It was also dedicated to provide training and services with reference to the Islamic finance. The members of these Boards were the renowned Islamic scholars and specialists.

There was a sincere effort to train the employees in accordance with the Islamic banking system so that they could acclimatize to it adequately and deliver excellent services to the customers. To benefit the women customers, a particular branch was introduced for them. In the existing branches, a separate section was created to offer them facilities and convenience in banking procedures.

Sharjah Islamic Bank has seen a fast growth since it was founded in 1975. There are 26 branches of the bank spread over in the UAE facilitated with an increasing number of ATM’S and CDM’s , located in different trendy shopping areas, business joints and holiday destinations. The policies of the bank stick to the economic and financial development and are formed with respect to the social, moral, and religious beliefs to accomplish the needs of a vast customer base (Sharjah Islamic Bank, 2013).

Sharjah Islamic Bank is a PJSC(Public Joint Stock Company) and is associated with banking, finance, and investment purposes in the UAE. A wide range of Islamic financial products and services are offered to a variety of institutions including private and government companies. The retail banking products and services include “current saving, Hassalati, Watani, and fixed account products; and Islamic cards, car and home finance, personal finance, online banking ATM and motor Takaful” (Company Overview of Sharjah Islamic Bank, PJSC, 2013).

The banking products and services in the investment segment comprises “asset management products such as portfolio and fund management, and wealth management; investments products and services, including structured finance, equity investments, and financial advisory services; and international banking and treasury products and services” (Company Overview of Sharjah Islamic Bank, PJSC, 2013).

In the corporate banking, products and services include “assets rental, contracting, partnership, and pre-agreed profit products and services; and business solutions consisting of cash management, as well as trade services, including letter of credit and letter of guarantee” (Company Overview of Sharjah Islamic Bank, PJSC, 2013). The other services except the banking sector include catering and related services. The company also works as an intermediary in the trading in local market shares (Company Overview of Sharjah Islamic Bank, PJSC, 2013).

Corporate Value

Sharjah Islamic Bank is based on following values that represent its key values:

- Fairness: It offers equal prospects for all employees and customers.

- Initiative: It offers appropriate and best resolution to the customers.

- Reciprocity: It is based on the values of shared risks, resources, and profits.

- Simplicity: It is engaged in constant endeavor to provide easy to understand and best possible solutions to the customers.

- Trust: It attempts to build trust on uprightness and stability through transparency and fairness.

- The bank adheres to this notion: “To be the bank of choice, delivering creative solutions based on the Islamic principles of partnership, trust and fairness for all” (Sharjah Islamic Bank, 2013, Para 5).

Mission of Bank

The mission of Sharjah Islamic Bank is multidimensional. It aims at facilitating the growth of people and society through utmost dedication and commitment. Its main objective is to serve a variety of audiences with dedication.

- Customers: Enhancing experiences of individual customers and offering innovative and creative solutions to their problems.

- Society: Society development through adhering to the values of social responsibility stated in the institution’s vision.

- Staff: The Islamic banking values are devoted to create a culture where everyone shares awareness, foster the traits of leadership and initiative, promote teamwork, and inculcate the sense of respect in the employees.

- Shareholders: Islamic banking is committed to satisfy the stakeholders by providing them nonstop and sustainable growth (Sharjah Islamic Bank, 2013).

- Market Share of Sharjah Islamic Bank: Sharjah Islamic Bank is a PJSC (Public Joint Stock Company). The government of Sharjah and the Kuwait Finance House are the two major shareholders (47%) of the company. Individuals and companies hold the rest i.e. the 53% shares privately. The listing and trading of the Sharjah Islamic Bank is conducted on the Abu Dhabi Securities Market (Sharjah Islamic Bank, 2013).

The financial statistics related to the bank’s performance and investments is presented on time and with accuracy. The UAE media and varied other sources announce the information regarding the activities of the bank. The bank carries out regular annual meetings. The shareholder meetings are conducted as and when required. Sharjah Islamic Bank is committed to offer this information to its shareholders, investors, and customers with fairness and convenience (Sharjah Islamic Bank, 2013).

New Ventures

The bank successfully initiated the brokerage services company named Sharjah Islamic Financial Services in 2006. It offered a series of Sharia-compliant business operation tools and pioneered the trading of securities on the Abu Dhabi and Dubai market simultaneously.

In 2006, the bank got hold of the Sharjah National Hotels Company from the government. It was among the four banks chosen to arrange a$350m( $95.2m) sukuk i.e. an Islamic bond in 2006.The Sharjah Islamic Bank is planning to expand its business beyond UAE. It has also obtained 10% share of a real estate investment company, Majan Development Company from Oman in the year 2008.The Sharjah Islamic Bank has successfully established itself and is showing consistent growth ever since it was founded (Oxford Business Group, 2008).

The Sharjah Islamic Bank has introduced its latest banking program in a joint venture with the Al Hamriyah Free Zone Authority, Sharjah. The program will make the progress of banking procedures and transactions for companies registered in Al Hamriyah Free Zone easier and will facilitate them with exceptional services.

The newly launched programme called ‘Red Carpet’ is aimed at escalating the sales of finance products and increases the support of customers who transfer their salaries to the bank. The target of this new package is to engage customers from three main segments: government institutions and firms, semi government groups and institutions and foremost corporations in Sharjah.

The bank has attained its repute and status over the years through its constant efforts in providing high-level services to the customers. The positive strategic planning and policies with respect to risk management and cost control has contributed to its growth and increased its customer’s loyalty. The bank has contributed to the economic and social development of the society (Sharjah Islamic Bank launches ‘Zone’ package for companies in Al Hamriya Free Zone, 2013).

Before analyzing the balance sheet of the bank, first we will understand the concept of a balance sheet.

Balance sheet is an indicator of the financial shape of a business. The information regarding the performance of the business can be obtained by comparing the balance sheets through time. For analyzing the balance sheets, the first step is to compare the total assets and liabilities. If total assets are more than total liabilities, it indicates the profit of business and positive net worth. On the contrary, if the more liabilities are the sign of loss and negative net worth. Balance sheet represents the comparison of existing assets and existing liabilities in order to face the present cash requirements. The ability of a business to meet its due obligations expresses the liquidity of that business. A healthy business shows one and one half to twice-surplus existing assets in comparison to the existing liabilities.

The reasons to have this excess of assets are required for few reasons. Excess assets offer a financial support in times of a rapid drop in the prices that may decrease the liquidity of a business. Moreover, this surplus asset is the basis of working capital for the business that provides finance for regular operating expenses of the business (Balance Sheet Analysis, 2013).

While analyzing the balance sheet, top down approach has been adopted that is another name of analysis in many cases. This approach is about breaking down the system to understand the perception of the sub system of its composition. This approach reflects the gestalt of the system up to some specific level but it does not go into much details of its first level sub systems. As the analysis grows each subsystem then have greater details. Sometimes, it adds more levels of subsystem, until the whole description is condensed to base components.

Following is the analysis of asset structure and balance sheet of Sharjah Islamic Bank

Asset Mix

During the period of 2008 to 2009 the government contribution has fallen down drastically and its presence on the books has been very low. Same is the case with the assets exposed to construction. Since construction assets are highly risky so their decline on the books shows a good sign. At the same time retail assets and personal assets have grown considerably which is a good sign for the bank. Another very important thing is the growth of assets exposure to manufacturing sector.

This also reflects the bank’s pro activeness in recognizing the growing sectors of UAE. After 2008 the manufacturing activities have gained focus in the economy and construction business started showing signs of surplus and overcapacity. It makes sense to grasp the asset mix according to the dynamic environment and the bank has been successful in doing the same so far. The following chart shows the sector wise asset break-up of the bank:

In Fig 2 the break up is again sector wise but it is not much showing the other services.

Analysis of the components of the income statement and Analysis of the profitability of the bank

Income Trend

Over the past 5 years the Income from Murabaha has been the main source of income for the Bank of Sharjah. This income has almost been not much moving but having minor variations. Incomes from Fee and Commission have contributed a small part of the total income and it has considerably decreased as compared to 2008. Financial Year 2012 has been good for Fee and Commission income. The bank needs to focus on Fee and Commission income as well to increase the top line. Besides bank needs to look for increasing its Murabaha and leasing activities in order to increase the overall income.

Fig 3 shows the income from Murabah and other sources, profit from Sukuk and leasing. Fig 4 shows the considerable decrease in income from Murabah and other sources.

Income Segmentation

Corporate and Retail businesses have given the bank a very balanced and mixed kind of income. Over the years corporate business has shown good traction but at the same time retail income has steadily declined. Treasury income has declined considerably and has little contribution to the overall income in recent years.

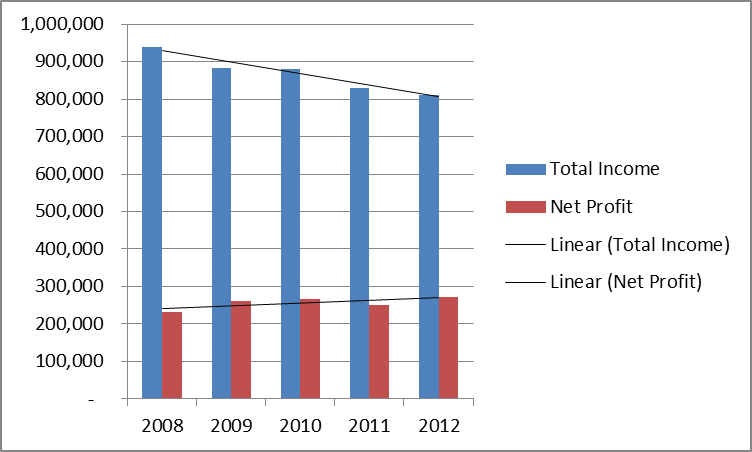

Top Line and Bottom Line/ revenue and profit/ total income

The top line has been declining over the years, on the other hand bottom line has been increasing. This indicates an improvement in the net operating margin, let to marginal increase in the overall profitability of the bank. The bank needs to focus on the top line growth because there is always a limit for bottom line improvement without proportional increase in the top line. And the bank should also focus on generating income from other sources as well in order to increase overall profitability

Analyzing the risk profile of the bank

McNamara (2011) mentions that financial performance of Sharjah Islamic Bank has shown elasticity during these years and it has improved its funding profile and liquidity. It is expected that the bank will be directed out of the crisis and will have a safe financial profile. “With UAE dirham (AED) 16.7 billion of assets at year-end 2010, the bank is primarily a Sharjah-focused commercial lender. SIB will keep its conservative strategy of maintaining its current financial profile in the still difficult operating environment, while cautiously expanding its operations” (McNamara, 2011, Para 1).

Solvency and Asset Liability Management

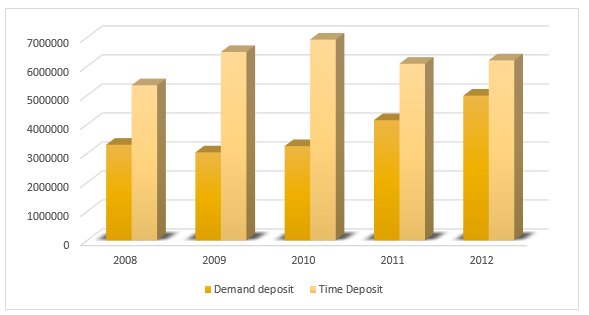

The graph in Fig 8 shows that short term assets are too low as compare to short term liabilities in fact the bank has been funding its long term assets from its short term liabilities itself. This can lead to problems in case of liquidity crunch, the bank needs to manage its assets and liabilities in order to avoid liquidity crisis. Also as apparent from the graph in Fig 9 that demand deposits are lower than time deposits which has helped the bank to manage its asset-liabilities in a better way. There is a clear trend of increase in the percentage of demand deposits in total customer deposits. Still there is healthy bias towards time deposits which is good for the bank.

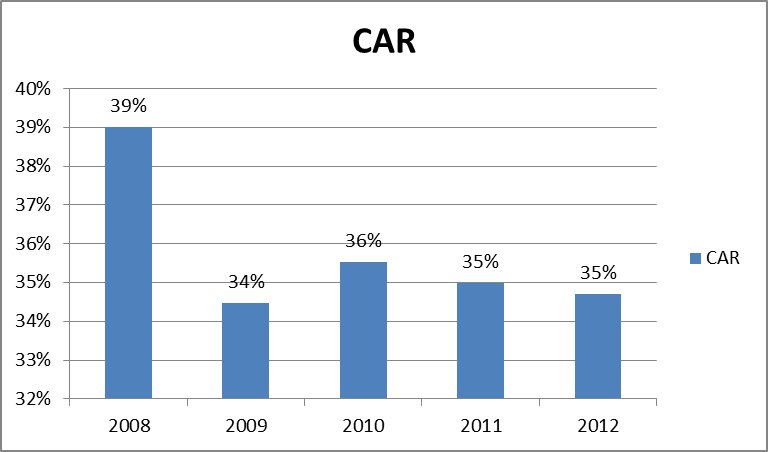

Capital Adequacy Ratio

The bank has maintained an abnormally high CAR of over 30% through-out the past 5 years. It has given the guide lines of Bank of UAE, 10% is the required CAR. It indicates very good solvency for the bank but at the same time such a high CAR is unwanted and indicates that the bank is not using its liabilities properly and lot of fund is lying unused. This may be due to lack of business opportunities and the bank should look for new business opportunities to maximize the shareholders wealth.

Fig: 11 Capital Adequacy Ratio.

Deposit Ratio

The customer deposit to the total deposit ratio is extremely healthy. This also indicates the inclination of bank towards retail business. Major funds for the bank come from retail customers which is a volatile source of fund. The bank needs to look for bulk and corporate businesses as well in its liability mix.

Conclusion

There has been a persistent growth in the Islamic banking and finance industry ever since it was introduced. However, in the recent years, factors like the increased oil prices all over the world, thriving economies of the Middle East, branching out Islamic banking products, clients and markets, and other transformations in the world politics have contributed to the extraordinary growth of Islamic banking and finance industry.

Islamic banking is incorporated in many of the Western financial institutions in order to be innovative and diversified in their operations and draw the oil-wealth and clients of Muslim origin. Islamic financial institutions are increasingly becoming a part of Western and European market performers. These traits are very promising for the development of Islamic banking and finance industry and making it an essential division of the international financial market (Khan & Bhatti, 2008).

In the 37th meeting of the General Assembly of Sharjah Islamic Bank, the financial outcomes for the financial year 2012 were declared. The Assembly also gave green signal to the Board’s suggestion of sharing out 6% cash dividends of the bank that is worth Dhs145. “The annual report of the bank suggested that there has been an increase of 3% in the total assets with Dhs18.3bn in 2012 in comparison to the previous year when it was Dhs17.7bn.

Further, 23% of the total assets is covered by the liquid assets reaching the figure Dhs4.2bn. The net customer receivables were Dhs10.4bn in the year 2011 and have grown to 3% in a year showing Dhs10.7bn in 2012” (Sharjah Islamic Bank achieves net profit of Dhs272m in 2012, 2013, Para 6).The growing status of the bank is a sign of its solidity at the time when various changes and risks are involved in the economic sector. The bank has reached an increase of 9% in the customer deposit segment making it Dhs11.3bn by the end of 2012 from Dhs10.4bn in 2011.The total shareholder equity of the bank correspond to the 24% of the total assets and amounts Dhs4.4bn.

The bank is keeping its solidity intact and strengthening its financial position in the local as well as international market by strategic goal attainments. The bank is committed to provide its contribution to the national ventures covering economic and government sectors. Moreover, it is dedicated to develop infrastructure and reinforce the functioning of a range of national and humanitarian schemes.

Awards and Achievements

The achievements of Sharjah Islamic bank are innumerable. Adding the number of awards in its list, it has bagged the esteemed “Sheikh Khalifa Excellence Award”, the “Best Contribution to the Mediterranean by Islamic bank” honor and has also been awarded with the title of “Best Customer Experience Provider” in the Middle East. Besides this, Fitch Ratings, Standard & Poor’s Ratings Services and Capital Intelligence has allotted BBB+ to the Sharjah Islamic Bank (Sharjah Islamic Bank achieves net profit of Dhs272m in 2012, 2013).

Sharjah Islamic Bank has been awarded the Human Resources Development Award for the year2012 for its excellent efforts to expand and qualify national human resources and make an efficient use of their skills and capacity to accomplish the objectives and mission set by the bank. The Human Resource Development Awards are endowed with a purpose to motivate banking and financial institutions to foster Emiratisation. It is done by encouraging more and more Emirati employees to join their organizations and prepare them as national human resources to fit in the banking and financial divisions of the nation (Tal, 2013).

Recommendations

The Islamic banking system needs to work on certain issues to combat the hurdles restricting them to be a prominent market player at the global level.

- Incorporating innovative financial options in terms of new Shariah-compatible products that enhance liquidity, risk management, and foster diversification. Islamic finance needs to focus more on enhancing the quality of their products to promote market integration and pull a large number of investors and capitalists on the grounds of risk-return quality of their products instead of emphasizing on amplifying the product on the grounds of being Islamic or non-Islamic.

- Islamic financial institutions need to create an infrastructure for the execution of suitable actions, controls, supervision, and management of risk. There is an urgent requirement to introduce new devices to share, transfer, and reduce financial risks motivating entrepreneurs to focus on their business by minimizing the risk exposure to their business. The bank needs to focus on Fee and Commission income as well to increase the top line. Besides bank needs to look for increasing its Murabaha and leasing activities in order to increase the overall income.

- The Islamic Financial institutions need to widen the capacity and variety of the financial services provided to the clients. These should operate as a one-stop shop covering all sorts of financial services. These institutions should be covering the operations like helping retail customers, organizing investment cases, and serving corporate customers in a variety of ways. Besides this, these should be working as the retail companies, involved in the organization of assets and offering payments and agreement services.

- Islamic banks need to develop capital market in order to offer benefit to the borrowers and the institutional investors. Moreover, it is also required to boost the solidity of Islamic banks that can be achieved through enhanced portfolio, liquidity, and risk management devices (Iqbal, n.d.).

References

Adil, M. (2013). Robust Growth for Islamic Banking. The Edge. Web.

Ahearn, R. J. (2011). Rising Economic Powers and the Global Economy: Trends and Issues for Congress. Web.

Asoomi, M. A. (2012). Challenges to growth of Islamic banking. Web.

‘Balance Sheet Analysis’. (2013) Penn State. Web.

‘Can Global Banking Giants Learn Islamic Banking’. (2013). PRWeb. Web.

‘Company Overview of Sharjah Islamic Bank, PJSC’. (2013). Bloomberg Business Week. Web.

Fatma, S. (2011) Banking Industry in UAE. Web.

Hameed, G. H. & Ahamed, F. (n.d.) Development of Islamic Banking with reference to UAE. Web.

Iqbal, Z (n.d). Challenges Facing Islamic Financial Industry. Journal of Islamic Economics, Banking and Finance 1. Web.

Khan, M.M. & Bhatti, I. M (2008) Islamic banking and finance: on its way to globalization. Managerial Finance. 34 (10), 708-725.

McNamara, P. (2011). Sharjah Islamic Bank rating raised. The Islamic Globe. Web.

Oxford Business Group. (2008). The Report Sharjah. Dubai: Oxford Business Group.

Sahut, J.M., Mili, M. & Krir , M.B. (n.d.). Factors of Competitiveness of Islamic Banks in the New Financial Order, 8th International Conference on Islamic Economics and Finance. Web.

Sharjah Islamic Bank. (2013). Web.

Sharjah Islamic Bank achieves net profit of Dhs272m in 2012. (2013). Web.

Sharjah Islamic Bank launches ‘Zone’ package for companies in Al Hamriya Free Zone. (2013). Web.

Tal, I.A. (2013). Sharjah Islamic Bank wins Human Resources Development Award 2012. Web.

United Arab Emirates, (2013). Web.