Executive Summary

To establish a successful business, it is important to develop a comprehensive strategic plan which is the basic blueprint for the actualization of a business plan. Reflectively, the strategic plan is inclusive of the SWOT of the business environment, penetration strategies, and success measurement parameters at the micro and macro business environment. This strategic plan is for the proposed New Age Recyclers located in the UAE within the region of Abu Shagara, Sharjah. The business intends to enter into the waste management business and will offer different services such as waste collection, recycling, and market waste consumables. The mission of the business is to provide the most cost-effective and reliable waste management services within the targeted region and beyond.

The business will serve customers from the high, medium, and low economic ends since waste management services are used across all classes. The waster management services will be the most affordable within the Abu Shagara region. At present, the waste management service industry within the targeted region is relatively noncompetitive since very companies are offering these services. The firm will also employ highly proficient personnel to offer various services to customers. Since the business targets to introduce unique market waste consumables, it will not face much competition since most of the other similar ventures in the region do not have this service option. Thus, the New Age Recyclers are projected to penetrate this market with very minimal resistance. The business is likely to breakeven within six months since the unique services will form part of its competitive advantage.

Problem/Opportunity

Studies in the UAE show that up to 20% of the wastes are not properly managed and instances of recycling such wastes have not been very effective. The rates are expected to keep rising owing to the modern lifestyles of most of the citizens, especially with the surge in the use of plastic materials. This is compounded by the fact that there are no specifically designed recycling plants for these types of wastes. The proposed recycling plant will incorporate the special considerations towards addressing the above challenge. Hence, the business idea is likely to cure this problem by providing sustainable waste management services. In the dynamic waste management sector in Sharjah, there is a need for a flexible, sustainable, and affordable waste management venture. Currently, the businesses dealing in waste management are not practicing sustainable waste management and prefer the landfill approach in the garbage disposal. The proposed waste management venture will offer a feasible alternative to landfills since the collected waste will be recycled.

Besides, the New Age Recyclers will strive to turn any collected waste into raw material for organic manure, paper recycling, plastic recycling, and metal remolding. This means that the business will facilitate the meeting of the demand for organic soil enhancers. Since the entire platform of the business is complete recycling of all wastes, the proposed New Age Recyclers will address the current challenges of government-owned recycling plants especially in terms of capacity and sustainability. The demand for the proposed New Age Recyclers is high since almost 20% of the wastes are not properly managed because the government recyclers do not have the capacity for sustainable waste management. The New Age Recyclers will offer the latest and most sophisticated waste recycling equipment that may improve the approach to sustainable waste management. Detailed analysis of the market and secondary data were collected in addition to financial projections to indicate how the business will be successful. The opportunity is capital intensive. However, once the New Age Recyclers breakeven in three years, the forecasted financial performance shows a very healthy margin in addition to a steady and predictable income.

The methodology used to assess the opportunity for the New Age Recyclers is the Five Dimensions Opportunity Model (FDOM) (Hiam 2014, p. 38) summarized in the table below.

The business will have a specified range of modern recycling plants. The business will require the highest start-up cost estimated to stand at AED 2,080,000. One element that allows risks to be minimized in a business is the proportion of the investment realized through the sale of tangible assets. It is estimated that 40% of the investment can be recouped through the resale of equipment if the business fails to pick up. The first year is the only period when the business should expect losses; this is mainly due to the high initial cost of buying and shipping the equipment. Thereafter, the expected margin loss will be around negative 76%. The business will use new technology that is unavailable in the country and specifically designed for human waste recycling. The business has a renewable life cycle and will produce returns indefinitely if successfully implemented. Moreover, about opportunity creation, the business will try to expand into other markets.

Unfair Advantage

The proposed New Age Recyclers is likely to penetrate the market and established a sustainable business model because it targets abundant human waste. The market remains open to any venture since human waste is piling up each year. Since most of the garbage collection is done by the state agencies, there is unlimited opportunity for the New Age Recyclers to negotiate for a working partnership to improve the efficiency in operation and cost-cutting. Through such partnerships, the New Age Recyclers will be in a position to reduce the impact of competition since it will widen the market network and physical presence (Bowden 2013, p. 68). The green business approach that the New Age Recyclers will adopt will auger well the customers and increase the chances of market acceptance or customer loyalty in the short and long-run. For instance, the current organic green movement in the Middle East is likely to endorse this business because of its sustainability approach and complete recycling of human waste. Such endorsement might help the venture to overcome possible stigma on human waste fertilizers. Besides, the New Age Recyclers are expected to enjoy a series of federal and state subsidies due to their green status and innovativeness towards human waste recycling. Besides, a healthy business environment is a guarantee for the survival and profitability of the New Age Recyclers venture.

The ownership of the company is based on the partnership model consisting of the founder and two partners. Since the founder has a 70% stake in the business, it would be easy to influence major decisions and actions that might promote faster business growth in the targeted market. Besides, the partnership model will make it easy to raise the start-up cost that is estimated at AED2,080,000. This saves the founder the headache of having to raise this capital alone. The high startup cost is associated with the initial capital outlay for a modern recycling plant (Hiam 2014, p. 23). However, this is a one-time cost and an eventual asset to the company. Also, being a privately owned business, the owners of the New Age Recyclers will have will control of all processes with minimal interference from state agencies or other interested parties. Besides, its current location is viable for the next 25 years, thus, stability in terms of physical presence. Besides, the business will have a longer time in tapping into the opportunity of exhausting landfills.

The New Age Recyclers intends to widen its market niche by opening more than in at least seven regions to gain from economies of scale. As a legal requirement, companies in the UAE are expected by the regulatory authorities to be tax compliant. The taxes are remitted directly to the government of Abu Dhabi. In the UAE laws on commerce, certificates of compliance to taxes are issued to businesses that remit their returns accurately from which taxes are deducted (Mariotti & Glackin 2015, p. 19). The proposed company complies with the above laws. This will create an easy environment for its introduction and marketing. It is difficult for any aspiring waste recycling company to enter into the industry in the UAE market and manage to breakeven easily. Given its unique product, reliable customer base, and stable market niche, the New Age Recyclers can offer the element of affordability to its customers, especially through the organic human waste fertilizer. The company is well-positioned to survive in the competitive market through gaining from economies of scale and competitive price tags for this product (Kotler & Keller 2013, p. 68). The balanced scorecard for the competitive advantages for the business is summarised in table 1 below.

Sales and Marketing

To penetrate the market, the New Age Recyclers intend to employ a series of sales and marketing strategies. Among the proposed approaches to effective marketing and sales include tangible propositions to consumers and municipalities, competitive advantage facilitation, public awareness through advertisements, strategic business alliances, marketing, and expert education, and expansion of production capacity through the hiring of more experts. These aspects are discussed below:

The marketing goal will be to acquire an average of 100 clients per week for the first 12 months. With a typically well-organized commodity pool, this business is geared to quickly increase its market share since the beneficial interests can be distributed across the commodity users. This strategy will facilitate the restructuring of effective sales and public awareness to develop product knowledge. One of the product strategies that the business will utilize is to make sure that it attributes the recycling services to convenience and affordability (Mariotti & Glackin 2015, p. 17). The business will charge a lower price for the organic fertilizer as a strategy to attract consumers within the second quarter of the first years of operation. The business aims to expand its customer base to regions outside Sharjah by recruiting three salespersons who will double up as pick and delivery service providers, for special orders where the vehicles cannot reach, within the first six months of operation.

The New Age Recyclers intends to roll out a new production plant each year within the next three years after capturing the Sharjah market. When the plan is successful, the business will purchase more vehicles and roll out other plants in the regions surrounding the targeted market. The business intends to franchise its operations to remote areas within the Sharjah region in the next three years. If well merged with the appropriate market mix, the strategy will secure a continuous quantitative increase of the market by constantly maintaining relatively fair prices of the services it is offering as well as the maintenance of up to per competition levels from other competitors. The majority of potential competitors rely on local customers. The New Age Recyclers business will have an advantage since it will create consumer awareness through its promotions and advertisements (Kotler & Keller 2013, p. 29). The business will use strategies like consumer education through its expert to erase the stigma of using human waste fertilizer and explore potential benefits at the most price-friendly packages.

With a typical well-organized commodity pool, this business is geared to quickly increase its market share since the beneficial interests can be distributed across the commodity users. This strategy will facilitate the restructuring of effective sales and public awareness to develop product knowledge. If well merged with the appropriate market mix, the strategy will secure a continual quantitative increase of the market by constantly maintaining relatively fair prices of the services it is offering as well as the maintenance of up to per competition levels from other competitors (Rhim & Lee 2013, p. 167). For instance, the business will be actively involved in signing a memorandum of understanding with the municipalities and customer protection agencies to ensure that its interests and that other parties are well taken care of. The business also intends to hire more experts in the second and subsequent phases to expand its current market niche beyond Sharjah.

The business targets to reach 6,000 customers in the first year, 9,000 customers in the second year, and 12,000 customers in the third year totaling 27,000 successful orders and deliveries at the end of the third year in the Sharjah market. The business will target three types of customers, which are the aged, middle-aged, and youthful segments. Further, the customers will be segmented into regular clients and first-time clients to ensure that the needs of these segments are customized based on the level of loyalty. The main value drivers that the business will use in reaching out to the three customer segments are the current demand for cheaper, green, and readily available organic fertilizers. Besides, the business will consider the specific needs of customers in terms of convenience and customer service to create a need-based marketing strategy through proactive customer participation in information search and product acceptance (Rhim & Lee 2013, p. 169). To increase credibility and maintain product visibility, the company’s marketing channels will encompass processes and features that flawlessly facilitate a healthy lifetime relationship between its products and clients in the UAE through the use of trad

Competition

The main competitors of the New Age Recyclers are commercial fertilizer manufacturers, government agencies, and environmental startups. The commercial fertilizer manufacturer enjoys economies of scale beyond the reach of the New Age Recyclers. However, the proposed business can counter commercial fertilizer producers on the ground of environmental sustainability. On the other hand, government agencies have an advantage over the New Age Recyclers because they enjoy massive taxpayer support and funding. However, the New Age Recyclers will counter this challenge by offering a better processing approach and strategic marketing technique. Lastly, the environmental startups form the third group of competitors of the New Age Recyclers since they have more experience in sustainability and use of technology in recycling. However, the New Age Recyclers may counter this challenge through its well structured in-house distribution chain. The competitive analysis is summarized in the table below.

From the analysis of competitors, the New Age Recyclers will succeed in attracting potential customers. Given the low competition and increased possibility of new entrants into the market, the business will attract a reasonable quantity of clientele that would enable it to sustain growth in returns. The firm identified a potential primary target market that will provide a distinct competitive advantage (Mariotti & Glackin 2015, p. 69). Besides, the location of the business may not be near the majority of the target market. However, the firm is located at the business district center where most of the potential clients visit almost daily. Also, all the product lines will be customized in a sequence of initiatives such as product diversification, multiple-branding, and incorporation of the latest technology. Despite competition from the other ventures, the above analysis indicates that the New Age Recyclers has potential for penetration, growth, and expansion in the UAE market and beyond.

Business Model

The proposed business will make use of several models. First, the resource-based model will be essential to developing the firm’s competitive advantage because it views a company’s internal resources as key to its overall competitive performance. The resource-based view assumes that the company depends on its tangible and intangible resources to remain competitive (Bowden 2013, p. 68). Using this analogy, the main sources of competitive advantage for the New Age Recyclers would come from its intangible assets such as lower pricing about chemical fertilizers and rapid expansion. For instance, the proposed pricing will range from $150-$190 per ton of compost. Quality customer service, brand reputation, and intellectual property are a few of the intangible assets that New Age Recyclers could leverage for better market positioning. Some of these intangible assets are difficult to replicate, as we will develop them over a long time. Furthermore, some of them are intertwined and interdependent. For example, the company’s reputation would be subject to excellent customer service because poor customer service would ultimately dent the company’s image (Mariotti & Glackin 2015, p. 33). Relative to this reasoning, we intend to trademark the company’s name to, possibly, trade it in the future.

Forecast

The financial forecast for the New Age Recyclers was estimated over five years. The forecast considered investment costs, other expenses, sales, and profits through a review of the income statement, cash flows, and breakeven analysis as summarized in appendix 1, 2, 3, and 4. The summary of the financial forecast is summarized in the table below:

Team

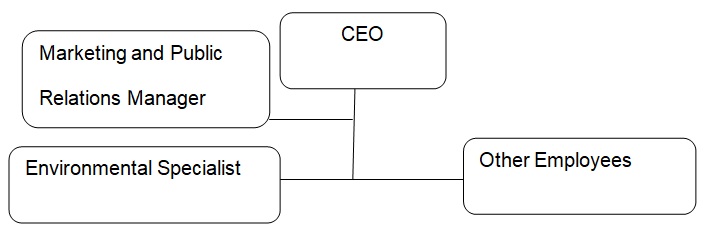

The board of directors consists of the founder, Marwan Bin Fares, who doubles up as the CEO, Dr. Abdulla Ibrahim who is the environmental specialist, and Yousef Ahmad who is the marketing and public relations manager. Below the board of directors is other employees. The CEO will be tasked with the duty of ensuring that the business guidelines are met within an efficient utilization of resources. Under the CEO will be the marketing and public relations manager who will form the primary link between the CEO and other units of the business. Under the marketing and public relations manager will be the environmental specialist and the other employees as summarised in the organizational chart below:

The New Age Recyclers business will adopt the professional approach and each employee will have specific duties to perform. A performance review will be carried out every three months to ensure that the employees obey the culture of hard work, quality, and transparency in serving the interests of the business. The organization structure of the New Age Recyclers business will be characterized by a streamlined chain of bureaucracy in the chain of command from the CEO down to the sales team. The structure will encourage security, comfort and safety, and prevailing physical convenience of the staff. Measuring factors such as interpersonal relations, working conditions, support and trust, welfare provisions, and work environment will greatly contribute to the organizational effectiveness within the business’ corporate culture (Rhim & Lee 2013, p. 169).

The New Age Recyclers’ leadership philosophy will operate on the periphery of Patagonia’s philosophies of management as mere guidelines for rationale rather than rules cast on stones. This philosophy of ethical conduct code functions on responsible business undertakings with moral worth. This philosophy will create a sense of responsibility among the employees to promote business environmental sustainability through the preservation of professionalism and the general business environment for success. Developing a training and development strategy requires the creation of relevant objectives and a realistic budget. The first phase of training will be on personal development while the second phase on teamwork and production quality skills. The two phases will target the Intra and interpersonal development of the employees to perform in the work environment (Mariotti & Glackin 2015, p. 21).

Status and Milestones

It is estimated that the timeline for implementation will be six months. The breakdown for the implementation timeline is summarized in the table below.

Reference List

Bowden, J 2013, ‘The process of customer engagement: a conceptual framework’, Journal of Marketing Theory & Practice, vol. 17, no. 1, pp. 63-74.

Hiam, A 2014, Marketing for dummies, John Wiley & Sons, New York.

Kotler, P & Keller, K 2013, Marketing management, Pearson Prentice Hall, New York.

Mariotti, S & Glackin, C 2015, Entrepreneurship: starting and operating a small business, Prentice Hall, Alabama.

Rhim, H & Lee, C 2013, ‘Assessing potential threats to incumbent brands: new product positioning under price competition in a multi segmented markets’, International Journal of Research in Marketing, vol. 22, no. 1, pp. 159-182.

Appendices

Appendix 1: Income Statement

New Age Recyclers

Income statement (AED). For the three year period.

Appendix 2: Balance sheet (AED)

Appendix 3: Cash flow (AED)

Year 1.

Year 2.

Year 3.

Appendix 4: Break even analysis

Total revenue (P * Q) = total cost [Variable (VC * Q) + fixed cost]

1.46 * Q = (0.46 *Q) + 75.66046

1Q = 75.66046

Q = 75.66