Company Information

Introduction

Saudi International Petrochemical Company (Sipchem) is located in Saudi Arabia and was formed in the year 1999 after the individuals listed below came up with the business idea. It is a joint-stock company registered in the Kingdom of Saudi Arabia under commercial registration No. 1010156910 dated 14 Ramadan 1420 H which corresponds to 22 December 1999 (Sipchem Annual report, pg 7). The company has its head office located in Riyadh and a different branch in Al-Khobar the location of the executive management head office. Sipchem is now an established company that is also listed in the stock market and specializes in petrochemical products. In this report, I analyze the business venture, its position, and the future directions of the company starting from the year of operation.

History of the Company

The company was established to operate in the Saudi region with the intentions of making it a successful venture which shall serve the local and international market with professionalism (Sipchem in brief). The company was started by experienced and famous individuals residing in the Saudi region. The company was formed in late 1999 in the Saudi region. Since this period, the company has developed gradually and is now among the companies that are listed in the Saudi stock market.

The company works hand in hand with the petrochemical and chemical industries. By developing and investing in such companies, Sipchem helps in the manufacture of many products which is made possible by their product chemicals. Currently, it has a high production of methanol and butanediol at over 1 million and 75 thousand Metric tons per annum respectively (Sipchem in brief). Sipchem has continuously put strategies for its overall expansion.

A good example is the establishment of the Acetyl complex in 2006 which is composed of different types of plants as shown in the table below. The establishment of these companies is very important due to the increase in production and manufacture of newer products. These companies that were created are expected to generate a stable income at the start of the commercial operation in the year 2009. Therefore, Sipchem petrochemical will grow both in size and geographical cover to enable maximization of performance and profits.

Table 1.0: Showing the major plants and the capacity production – Sipchem.

The company also has major projects that should be located in strategic locations in the entire Saudi region such as in Jubail city. Ethylene Vinyl acetate and polyvinyl acetate are products that are to be produced by this company at 200 and 125 metric tons respectively every year. This is a major construction project and requires a high investment but the investment is considered viable and payback may not take too much time. These massive projects have been taken to ensure that Sipchem grows into the leading petrochemical company in the whole of the Middle East region.

Sipchem petrochemical was established with the sole purpose of providing the highest level standard of products and services to their customers and becoming recognized globally as an efficient company. This is the driving force of the company since the management always strives to achieve the purpose of the company. The company also needs to fulfill these requirements in a way that will not compromise the relationship with its customers. Therefore, to maintain a good reputation locally and globally, products should be of high standards, customers handled respectively, and marketing should be as effective as possible. Recently, marketing for the company products has been greatly improved through the provision of a marketing body. This has been a major success for the company since marketing is more advanced and not fixed to particular companies.

Management structure

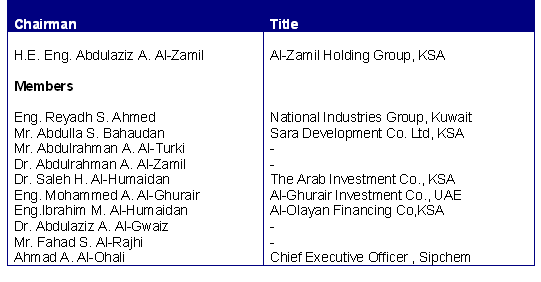

Sipchem has effective management which has enabled the smooth running and development of the company. Effective management of a company ensures maximum performance is attained and the growth and expansion of the company exist. Sipchem petrochemical has an advantage such that it has both experienced and professional individuals at the management level which ensures the company runs according to their strategies. The table below shows the board of directors which consists of the chairman (H.E. Eng. Abdulaziz A. Al-Zamil) and ten other board members where the management and decisions of the company start.

The company has organized and strategically assigned positions to its executive members about their specialties, skills, and work experience. This ensures that there is effective management in the company’s activities which is reflected in the ideas and works that have already been implemented and executed respectively. The executive management officials of the company that are currently in office are shown in the table below.

Products of the company

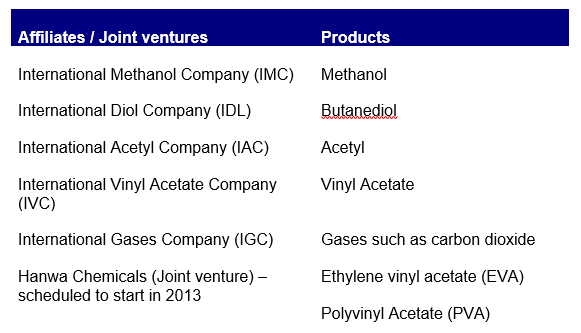

This is a petrochemical company and is intended to collaborate with related companies to provide important chemicals for various uses. Some of the products that are produced by the company include methanol and butanediol. The production has been successful and is done by its affiliate companies which are the International Diol Company (IDC) and the International Methanol Company (IMC). These are the companies that were formed after Sipchem’s inception and fall within the first phase of development. Other products that are produced by the company include; acetyl, vinyl acetate, ethylene vinyl acetate, and polyvinyl acetate among other potential products.

All this is made possible through affiliations and joint ventures which Sipchem enters into as a strategy to its growth and expansion. In all the activities undertaken by the company, there are many guiding principles which ensure that there is maintenance of a sustainable environment and that all persons are enjoying their products in a safe environment. The table below shows the affiliates and joint ventures that Sipchem has with their corresponding productions.

Growth of the company

Since its establishment, Sipchem has continued to gain momentum and has grown into a stable petrochemical company over the years. From the date of inception in 1999 the company has employed strategies that have sustained its growth into a large and well known company in the Middle East region. Some of the major strategies of its expansion have been the affiliations and joint ventures with other related companies which have greatly increased its production, variety, and radius of operation.

According to the National newspaper (2010), the company had a major reduction in its profits margin during the last financial year of 2009 due to the effects of the global recession. However, the earlier investments by the company have ensured its stability since the benefits from such investments are a prime driving force at the moment. The completion of the acetyl complex which has come after a long three year period is also expected to boost its growth by a great percentage when production kicks off (Sipchem Gears for Growth after long wait).

The acetyl complex has come in the right time to reduce the company’s dependence on methanol and this therefore defines the future of Sipchem from a positive perspective. In 2010, the company’s profitability and gross margins is expected to increase with a prediction of pre-tax profit of 177.8% which is high compared to last year (Sipchem Gears for Growth after long wait).

Market and competitors

The market for petrochemical products is high due to global needs for the products. This enables the petrochemical companies to make large sells especially when company is located in high demand areas and near export facilities. Sipchem petrochemical has utilized some of these advantages by strategically locating its industrial complex in Jubail Industrial city which is fully equipped with infrastructure to handle massive projects. Raw materials in this location are also available at lower costs thereby substantially lowering the overall operation costs. King Fahd Industrial Port also offers a faster way of exporting products from the region to the major markets such as the South East Asian countries. This makes it a successful venture because these Asian countries are a major market for petrochemicals.

Technologies used by the company

Sipchem petrochemical has employed efficient technologies which enable them to run the company smoothly and economically leading to maximization of profits. Examples of the technologies used by the company include the DuPont technology, and Eastman Chemical Co’s acetyl co-production technology. The installation and use of this technology is expected to improve the overall performance of the company in terms of quality and capacity of production. Therefore, the positive results of employing its use will enhance growth of the company by increasing the overall profits.

Analysis of Sipchem

Performance of the company

Sipchem petrochemical profits have been increasing significantly over the years with their major investments paying back into their systems. These have come as a result of an increased demand in the products they offer especially in the Asian markets like China. Some of the improvements that have been realized and still expected to rise have been achieved through the following ways.

Maintenance shutdown

As a way of ensuring maximum performance and efficiency in their production, the company has conducted maintenance shutdown on its major plants. A perfect example was the 25 days shutdown of IDC & IMC plants in the third quarter of the year 2009 (NCB Capital, 2009). This maintenance approach is practiced by the company after every 4 years of operation and ensures that production efficiency is maintained at high levels. The activity however, has negative short-term effects on the profits margin of the company due to loss of time and overhead accumulations during the maintenance periods. The most important factor on the other hand is that this practice reduces mechanical breakages and failures in the plant during the long periods of operation. The overall benefit therefore, is the maximization of profits through sound production.

Operating margins and realization improvements

In the third quarter of 2009, the operating margins improved significantly standing at 16% which happened to be 5% higher than the expectations of the company executives. These amazing results are credited to the effective management and better market prices for their products. In this year of 2010, the operating margins are expected to be even higher due to the efficiency attained by plant maintenance and the outstanding results that were obtained in the year 2009.

Demand increase improves outlook

Sipchem’s products sell the greatest in Asian countries with the accounts amounting close to half of their total sales. This is therefore a great market determinant for petrochemicals in the whole region. For instance, China has maintained and increased imports of these products and this has significantly improved the company’s performance by providing it with a stable market for its products. The stability of the market in China is predicted to provide a major source of stability in the company’s income in the short to mid-term period. This will enable efficiency in running the company with easier developments by the company to kick-off during these periods.

Estimate and Valuations

The company has boosted confidence of performance cycle due to the clarity of improvements from the bottom line expectations. The assumptions are therefore applicable and can be used for long-term valuations of their positions. The company has therefore, has confidence in their price targets of SR27.9 which is a 10.3% increase in price. The Acetyl complex completion is also expected to have a much more positive influence on the companies stock due to the increased production and profits that are expected when its operation begins. The financials below are obtained from the NCBC research estimates.

Financials

Sipchem also enjoys an increase in the prices of natural gas which translates into their direct profits. This is because the company specializes in natural gas which is one of their major products. An increase in the costs of natural gas will therefore contribute positively to the profits of the company. This is also made even more of a success considering that Sipchem petrochemicals produces natural gas at a lower costs than the average market price (NCB Capital, 2009). The completion of the acetic acid plant has also yielded great results for the company through exportation of acetic acid to other countries where the demand is high. These factors help Sipchem petrochemicals to maintain a competitive edge against its major competitors such as TASI.

Statistics of the company

Saudi international petrochemical company has obtained good reputation and positive value in its growth over the years. Since its establishment, the company has continuously made significant profit margins and has now attained stability in its operations. The main reasons for this success is credited tot the effective management provided by the experienced executive leadership. Some statistics about the company have been undertaken to measure its position in the Saudi market, which has given positive results. According to the accounts shown in the financial statements, we can conclude that the company has a stable growth and therefore maintains a competitive edge.

According to Sipchem petrochemical annual report (2009), the share capital of the company after increase through rights issue as mentioned below is SR 3,333 million, divided into 333.3 million shares of SR 10 each. This occurred after the meeting by the board of directors in 9 July 2007 who came up with the solution as to increase the share capital of the company by rights issue. This was authorized by the Capital Markets Authority in 2007 and was later implemented in 2008. The issued shares were valued at SR 5 per share with a total number of shares issued of 133,333,333. Sipchem and its subsidiary companies are listed as shown below in terms of the shareholding percentages.

The table therefore provides the current shareholding percentage of each partner, affiliates, or companies that have formed a joint venture with Sipchem petrochemicals. This has been calculated according to the sitting boards of such companies and the terms and conditions therefore apply in all means. Another factor that greatly influences the shareholding capacity is the capacity of production and the type of product manufactured by the concerned company. For instance, all the above listed companies have different functions which prompted its development and affiliations. Some of the functions of the listed companies are as described below.

The main objective of the International Methanol (IMC) is the production of methanol for sale. This was among the first ventures with its operations starting in the year 2004. The venture was successful after undergoing and passing various requirements by the main contractors of the project such as the commissioning and testing. The IDC Company was started so that the manufacture of Butanediol, and Maleic anhydride among other products could be made possible. This was second in the line with its operations starting in the year 2006 after successful commissioning, testing, and completion of acceptance formalities with the main contractors (Sipchem Annual Report, 2009).

The International Vinyl Acetate Company was formed with the main intensions of manufacturing Vinyl Acetate Monomer. However, the production of the monomer is expected to start in the second quarter of the year 2010 after the announcement is made by the board of directors. Currently, the systems are still in the trial stage and official production has not yet commenced. The International Acetyl Company venture was established for the main purpose of manufacturing acetic acid.

This is however in the trial stage of production and no major productions have commenced for that reason. The commercial operation of this company is expected to be announced soon in the second quarter of 2010 (Sipchem Annual Report). All this companies are very important to Sipchem in a way that could not be avoided regarding the fact that there are many expectations from the productions.

The International Gas Company was established to make possible the manufacture of carbon dioxide for sale. Currently, the production of carbon dioxide is in the trial stage with the commercial production expected to begin in the second quarter of 2010. This name IGC was obtained in the year 2008 after renaming it from United Industrial Gases Company Limited. The Sipchem Marketing & Services Company was established so that it can offer efficient marketing services for all the products made by the group. This company is expected to boost sales of their products by a significant percentage considering its location in Al-Khobar.

The International Utilities Company was established to provide effective management, operation, development and maintenance services for the situations which are related to petrochemical industries facilities (Sipchen Annual Report, 2009). Necessary studies are currently being conducted by the company to measure the viability of this project. Jubail Industrial City is the place where all these plants of the group have been located since it has many advantages in production, transport, and exportation to other regions.

Business strategies

Business strategies give a clear picture of the direction and scope of a particular business in the long-term period thereby giving the best options that a business can take at a time. This will therefore ensure that effective management is provided by the company’s officials keeping in mind their strategies. A business strategy therefore, helps a business to position itself in the best shape to effectively compete in a market. Sipchem petrochemical has effectively used its business strategies to expand into the market and maintain a competitive advantage. Some of the strategies that have been used by the company are as discussed below.

International Trade (Globalization)

One of the major strategies used by Sipchem is globalizing its trade networks to ensure it gains a stable market and maintain a stable income level in the short-term and long-term periods. This is done by ensuring the international markets are supplied with the required products in time and according to specifications. The company has established its market with many countries in Asia which are their giant consumers at the moment

. A more specific client for their products is China which uses close to half of all their productions making it a stable partner. Sipchem ensures that such markets are maintained by meeting their needs at the right timing and that the products are of good quality. Another example of globalization by the company is the renaming companies they merge with such as the United Industrial Gases Company Limited which was renamed to International Gas Company in 2008. This is a strategy that allows a company to be identified on a more global way to improve its reputation and increase its international operations.

Affiliations and joint ventures

Sipchem uses the advantages of affiliations and joint ventures to market, grow, and maintain a competitive edge. The company has several affiliations which ensures that it reaches a wider range of markets and maintains consumers of their products. This strategy also helps in increasing the production rates to meet all the rising demands of petrochemicals in the Saudi region and the international market as a whole.

Different branches which are located in different positions ensure maximization of the available resources in the region while ensuring maximum production at any time. Since the different branches of the company are intended to produce specific products, there is specialization which ensures efficiency in production and marketing of the products. There are many examples of companies that have been founded under Sipchem for specific production as explained. This makes it possible to produce larger amounts of products in an efficient way as to meet all the customer requirements.

Expansion and Globalization

Sipchem has an effective expansion strategy which has been initiated over the years after its actualization in the year 1999. Some of the giant steps that the company has used are the affiliations and initiation of new developments in the Saudi region. The location of more of its branches in the region such as in Jabail Industrial city gives the company the ability to reach more customers at different parts of the world.

This is true because Jabail Industrial City has major resources and infrastructure to support large developments of the kind. The city is also recognized among the world’s most industrialized cities and has efficient connections such as heavy roads and an efficient airport which can effectively handle the exports and import cargos in and out of the city. Such connections ensure that the expansion is successful and globalization is easier. An example of an expansion project that has been undertaken is the Acetyl complex where the International Acetyl company is located. The IAC in this case has been developed to provide room for the manufacture of acetic acid which has a good market at the moment.

The strategy is usually adopted by growing companies to ensure some specific goals are attained for effective product distribution in such locations. This strategy however, should have an effective structure of organization to ensure maximum efficiency is attained. Sipchem’s petrochemical should therefore ensure that their services are efficient so that it maintains a competitive edge in the global market.

New product development

The company began its operations with few product manufactures which could sufficiently generate some profits to keep it in operation. This however, was not sufficient enough to help compete in the petrochemical market and maintain a competitive edge. Years down the line, the company started form branches and entering affiliations which helped in introducing other valuable productions. Some examples of such productions include natural gas and carbon dioxide produced by the International Gases Company.

Marketing management

Another business strategy that the company has employed is the marketing of its product for the whole group as one body. This strategy will ensure an effective marketing for all the products of their groups and lead to a boost in sales which will increase the profits for the company. Initially the all the associate companies in the group would produce and market a product by themselves which may be inadequate for some of the companies that are still in the development stages. To solve this problem, the group of companies formed a common marketing body referred to as Sipchem Marketing & Services Company (SMSC).

This company was formed to form a common and strong marketing channel for all the companies in the group which also makes it easier to discover products of the same company. Effective marketing through this common body is expected to increase the company’s sells by a great margin and increase their overall profits in the end. This is therefore an important way of marketing for the betterment of the company.

Technologies used by the company

Sipchem petrochemical has employed efficient technologies which enable them to run the company smoothly and economically leading to maximization of profits. Examples of the technologies used by the company include the DuPont technology, and Eastman Chemical Co’s acetyl co-production technology. The installation and use of this technology is expected to improve the overall performance of the company in terms of quality and capacity of production (Sipchem selects DuPont VAM technology). Therefore, the positive results of employing its use will enhance growth of the company by increasing the overall profits. The use of such technologies reduces the production costs of the company while it increases the quantities of production. This ensures maximization of profits for the company since more products are supplied to the market over a short period.

Market dominance

One of the major objectives of the company is to get into the market, maintain a stable market, and in the long-run have dominance in the market. This strategy is materializing as the internal growth of the company is gradually increasing.

Corporate strategies

Sipchem petrochemical was established the sole purpose of providing the highest level standard of products and services to their customers and become recognized globally as an efficient company. This is the driving force of the company since the management always strives to achieve the purpose of the company. The company also needs to fulfill these requirements in a way that will not compromise the relationship with their customers. Therefore, to maintain a good reputation locally and globally, products should be of high standards, customers handled respectively, and effective marketing should be used. The company tries to fulfill these requirements through the means discussed below.

SWOT Analysis

The major strength of Sipchem Petrochemical Company lays in its massive growth and expansion over the years to form a strong petrochemical company in Saudi Arabia. This has been brought about by the effective management board which has initiated the construction of major branches to their completion. These projects have ensured an effective performance of the company due to the increased production of their products and efficient marketing programs. The company has established a solid income from its market and is now financially stable. This has also been a positive effect from their earlier investments which are a constant source of income currently.

Therefore, the company is much more stable than many of its rivals and can effectively invest and market its products perfectly, both at the local and international market. The mass production by the company partners ensures that the production costs are lowered thereby increasing the profits margins for the company. The major weakness however, is the high competition from other established petrochemical companies in the region.

This high competition offered by rivals may affect the business performance in the local market and the global market as a whole. Another possible weakness that Sipchem is exposed to is the product price which may result in other rivals feeling an unused capacity caused by price cutting.

The company has many opportunities that can add a great value to the business and increase its growth and profits margins. Some of the existing opportunities include the steady market for petrochemicals in close markets such as China. Being the major consumer in its petrochemical products, China offers a good business market for the company’s products. Sipchem can put strategies to ensure it does not lose this market putting in mind that China uses close to half of all its products while the rest of the world shares the rest. Another opportunity occurs due to the strategic locations of their companies and affiliates in Jabail Industrial City.

Jabail Industrial City is classified among the world’s major industrial cities with major resources and infrastructure. Due to the availability of resources at competitive prices in the city, the production rates of the company become significantly lower. This enables the company to produce at lower rates leading to a higher profit margin for such products.

From the analysis, we can conclude that the company is well positioned for much more development, growth and expansion which have already been attained from the earlier stages of the company’s growth. Sipchem should ensure that their vision is not compromised by the competition from their opponents but pull along to attain their already defined mission. The table below shows the strengths, weaknesses, opportunities, and threats which affect the company in a much more simplified manner.

From the above analysis, the strategic intents of the company are confirmed to be in line. However, the threats should be well thought about and taken care of to ensure there is major performance risks and at the same time work to reduce the weaknesses as much as possible.

PESTLE Analysis

The PESTLE analysis of the company is as shown in the table below. This helps to show the position of a company in terms of the political, economical, sociological, technological, legal, and environmental perspectives. A business direction and its future position can be predicted using the analysis.

The political stability in the Saudi region is a strong point for all the operating companies. This means that there are no loses accrued due to insecurity, plant close down and other related insecurity problems. This ensures smooth running of the company therefore reducing the overheads and increasing the profits margin. The economy has just recovered from the 2008 global financial recession therefore good market for the products is currently available.

Stable markets such as China have been achieved which provides a solid source of income for the company. The employment of new technologies by the company is also a great move forward since rates of productions have been increased while the production cost lowered to a certain minimum. This situation increases the profits margin of the company and growth is therefore inevitable. Sipchem petrochemical company is determined to provide all its services and products in a professional way which is currently a success because of the supporting conditions as shown from Pestle analysis above.

Conclusion

Effective management is very important and companies should therefore have a proper management body so that effective decisions are executed by the officials. When such a management body exists the company’s direction is efficiently determined and strategies can be employed to drive towards attaining them. This therefore ensures the growth and expansion of the company continues to high levels of operations. The functional departments which play a major role in management of a company should be selected wisely so that this could be attained. Sipchem petrochemical has an efficient management system which strives to make their vision and purpose statement is attained.

This is indicated in the way the company grows and ideas are implemented for the smooth operations of the company. A good example is their decisions to merge with related companies to produce specific products which in the long-run payback to the company. The company’s growth has been strategic and this is due to the management that is in place. The idea of forming a separate marketing body for marketing the products made by the group of companies is a perfect strategic move. This is because it ensures an efficient marketing of their products is available both for the local market and the international market.

Appendix 1

Works Cited

NCB Capital, 2009. “A good run with more to come.” Sipchem, pg: 1-3.

Sipchem. Annual Report. Saudi International Petrochemical Company. Alkhobar, 2009.

“Sipchem Gears for Growth after long wait.” Thenational. the national. 2010. Web.

“Sipchem in brief.” Sipchem. Sipchem, 2010. Web.

“Sipchem selects DuPont VAM technology.” Accessmylibrary. access my library. 2010. Web.