Introduction: An overview of Apple Inc

Apple Inc is a multinational company that is based in the United States of America and has operations in different parts of the world. The company has its headquarter situated in California in a place called Cupertino. It was founded by Steve Jobs and two other colleagues in 1976 and has grown into a multinational company over the 36 years that it has been in operation. The company designs develop and sell products such as computer software, electronics and computers among others. Its product line has extended over the years to incorporate products such as iPod, iPhone, iPad among other hardware products.

The current company CEO is Tim Cook who took over from Steve Jobs on August 24, 2011, when he resigned and became the Chairman. The company has created many jobs in all the countries where it operates (White, 2010). It had 72800 full-time employees by September 2012 who are on a permanent basis, and about 3300 that are on a temporary basis but full-time. According to Reuters (2012), “The Company operates in five segments including America, Europe, Japan, Asia-Pacific, and retail.” (p. 1). The company distributes its products throughout the world using its retail shops, online stores, and direct sales force among other means.

The latest financial statements

The most recent financial statements of the company were prepared in 2012. Since we are analyzing the financial statements of the company for the past 5 years, we present the financial statement for the years 2008 to 2012.

Income statement: obtained from Market Watch (2012). Web.

Balance Sheet: obtained from Market Watch (2012). Web.

Cash flow statements. Obtained from Market Watch (2012). Web.

Description of the financial statements

Income statement

The company’s revenue from sales for 2012 was 155.97B. The cost of goods sold was 87.78B. The gross income, therefore, was 68.2B. The pretax income was 55.76B. The income tax amounted to 14.03B. This led to a consolidated net income of 41.73B and because there was no Minority Interest Expense, the net income was represented by the same figure.

Balance Sheet

The company’s total assets for the year 2012 amounted to 176.06B. 5.36B of this figure represented the total amount of intangible assets, 57.65B represented total current assets and the rest were the non-current assets. The value for the total liabilities of 57.85B included 38.54B of current liabilities, 13.85B deferred taxes, and 5.47B were other liabilities.

Cash Flow Statements

The cash flow included cash flow from Operating Activities, investing and financing activities (Faas, 2011). In 2012, the net cash flow from operating activities amounted to 50.86B. The investing and financing activities had negative cash flows of (48.23B) and (1.7B) respectively. The net change in cash that remained was 931M.

Ratio Analysis

The Ratios for APPLE and Google Are Represented In the Tables Below

Apple Ratios

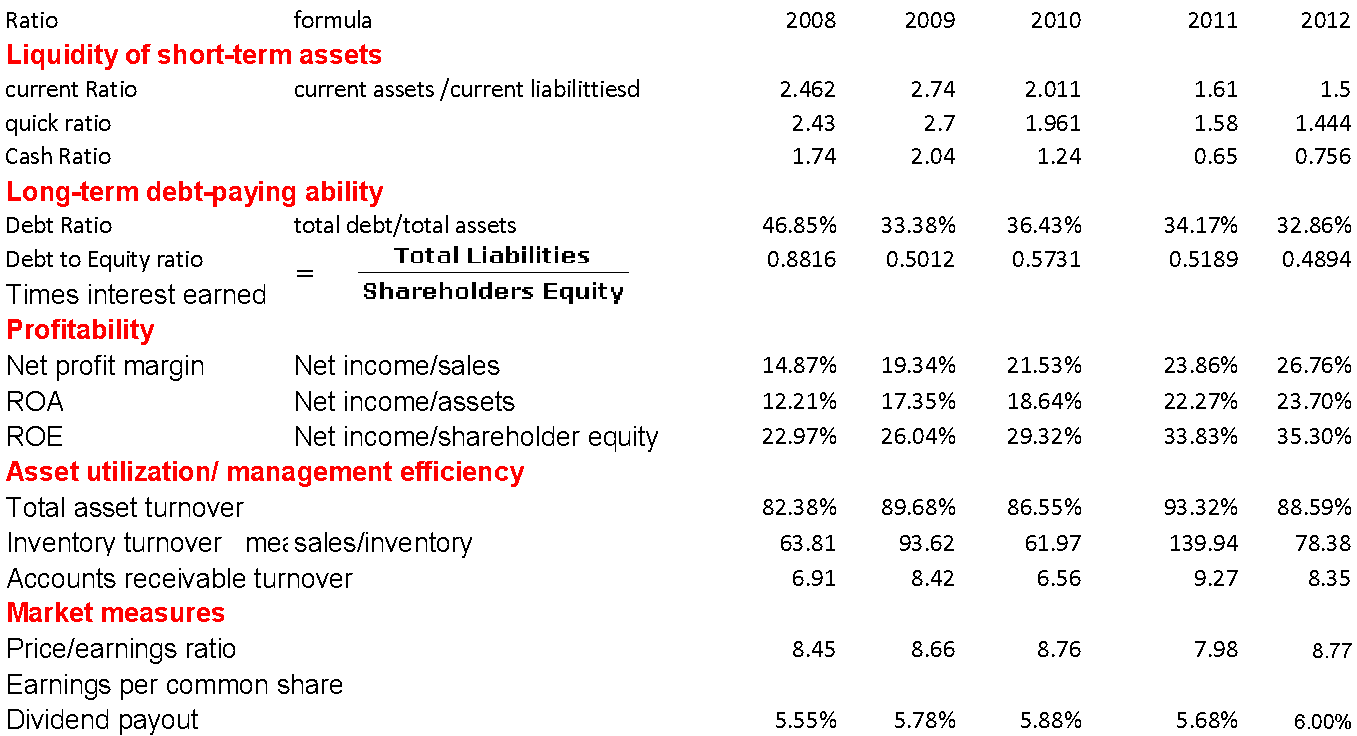

The liquidity ratios show that Google has strong liquidity than Apple. For instance, Google has a current ratio of 8.27 while that of Apple is 2.462 in 2008 and 1.5 in 2012. Other liquid ratios like quick ratio and cash ratio have the same information the two companies. Return on equity for Google is 15% while that of Apple is 22.97 in 2008. It increased between 2008 and 2012. This means that Apple is better to invest in than Google because it has a higher return on equity (Fox News, 2012). The Debt ratio of the company also reveals the amounts of assets that are financed by borrowed funds are at a reasonable level (Gallagher, 2007).

The Debt Equity ratio is below 50 % which is healthy for a company. The time interest ratio was not computed because there was no interest expense for Apple. According to Gibson (2012), the ratio is supposed to indicate the number of times a company can pay interest from its earnings before paying taxes. The company’s net profit margin for the period from 2008 to 2010 was less than that of its competitors. A company with high profitability ratios will be worthy to invest in because it will have a higher return on equity (Morrell, 2007). The dividend payout ratio for Apple increased slightly between 2008 and 2012. This means that more profits were paid out as dividends (Megginson, W. L and Smart, 2008).

Key Statistics

There are other statistics for the companies that can help an investor determine the best company to invest in. for instance, the current market value for APLE is 475 billion according to Forbes.com (2012). The company has a beta of 0.93. According to Forbes.com (2012), the company has a market value of 186 billion and a beta of 1.23.

Recommendations

Firstly, based on key statistics, Apple is found to be better than Google invest. The beta for Apple is less than that of Google, meaning that Apple is less risky to invest in compared to Google (Taylor, 2010). According to Gustin (2012), a higher beta means a higher risk. Apple also has a higher market value than Google. A rational investor will consider investing in Apple instead of Google because he will be faced with minimal risks (Burrows, 2010).

References

Burrows, P. (2010). Apple vs. Google. Web.

Faas, R. (2011). How the Apple iCloud compares to Google’s cloud. Web.

Forbes. (2012). Apple Inc (NASDAQ: AAPL). Web.

Fox News. (2012). Apple vs. Google: Who Will Own the Tech World? Web.

Gallagher, A. (2007). Financial Management; Principles and Practice. Uk: Freeload Press, Inc.

Gibson, C. (2012). Financial Reporting & Analysis: Using Financial Accounting Information. London: Cengage Learning.

Gustin, S. (2012). Apple vs. Google Is the Most Important Battle in Tech. US: Time Inc.

Market Watch. (2012). Annual Financials for Apple Inc.: Balance Sheet. Web.

Market Watch. (2012). Annual Financials for Apple Inc.: Cash flow Statement. Web.

Market Watch. (2012). Annual Financials for Apple Inc.: Income Statement. Web.

Megginson, W. L and Smart, S. B. (2008). Introduction to Corporate Finance. Cambridge: Cengage Learning.

Morrell, P. S. (2007). Airline Finance. US: Ashgate Publishing, Ltd.

Reuters. (2012). Profile: Apple Inc (AAPL.O). Web.

Taylor, D. (2010) The Ask Dave Taylor Apple iPad Answer Guide. London: BookBrewer.

White, M. (2010). Apple, Google, Microsoft Intranet Focus Ltd Winners and losers. London: Intranet Focus Ltd.