Introduction

Background to the study

The core objective of every business establishment as a going concern entity is to maximize its level of profits and the shareholder’s wealth. Before investing in any industry, investors conduct a comprehensive analysis to determine the trends in the industry. The information obtained from market analysis forms the basis upon which the investors make their investment decision. For a firm to maximize on the level of profit and the shareholder’s wealth, it is important that the management team develop effective business strategies.

Scholes and Johnson (2009, Para. 1) defines strategy as the direction taken by a particular organization in attaining its long term goals. Strategy enables the firm to attain a higher competitive advantage compared to other firms within the industry. The business environment is becoming more complex and competitive which makes firms to operate in challenging environment. To be able to thrive in this environment, it is important for a firm to attain a higher competitive position within the industry. The degree of competition varies across the various industries.

According to Porter (2008, Para. 1), competition plays a key role in the determination of strategy to be adopted. This is due to the fact that management teams are more concerned on how they can develop strategies to improve their competitive advantage. Porter argues that effective strategies act as a defense to a firm’s competitive challenges. Porter (2008, Para. 6), asserts that the nature of competition in an industry is determined by the industry structure. According to Mohammed (2007, Para. 5)), petrochemical industry has become very competitive over the past few decades.

This is due to increased rate of globalization which has resulted into increased market openness. In addition, the lucrative nature of the industry has resulted into an increment in the number of investors venturing the industry. This is in line with what evolutionary perspective theory postulates. The theory postulates that upon the market becoming hostile, competitive and dynamic, it becomes challenging for the firms in the process of formulating strategies aimed at attaining its long-term success. To be able to overcome the competitive challenge, firms in the petrochemical industry should have the necessary resources in terms of human and financial capital. Effective implementation of the formulated strategies culminates into increased customer satisfaction and other interested parties. In addition, the firm is able to maximize the shareholders wealth. This paper is a report on strategy, business information and analysis.

Aim

The aim of the report is to conduct a strategic assessment of the Saudi Arabian petrochemical industry. In addition, it is also the objective of the report to analyze how a firm’s competitive position is determined by the industry structure in which the firm operates.

Scope

The report considers the current trend within Saudi Arabian petrochemical industry. The assessment entails and an analysis of the environment in petrochemical industry. The changes which have taken place in the industry are illustrated. The report also considers the application of evolutionary perspective theory amongst firms in their process of formulating competitive strategies. A SWOT analysis of the industry is also conducted to illustrate the strengths, weaknesses, opportunities and threats facing the industry.

The principal strategic groups are also illustrated. An analysis of Saudi Arabian petrochemical industry is conducted with more emphasis on the lifecycle that the industry has undergone. The report also involves a critical analysis of industry structure as a key determinant of competitiveness of a firm in a given industry. Analysis of industry structure is achieved through consideration of Porter’s five forces and PESTLE analysis. Finally the conclusion and recommendations are made.

Trends in Saudi Arabian petrochemical industry

Petrochemical industry is a key economic sector in various countries. This is due to the fact that it supports both the consumer and manufacturing sectors of the economy which are significant contributors to the country’s Gross Domestic Product (GDP). Saudi Arabian petrochemical industry is one of the major sources of revenue for Saudi Arabian government. Abdullah (2003, para.4) asserts that Saudi Arabia is the pioneer of the petrochemical industry within the Middle East region.

Petrochemical industry has witnessed a numerous changes globally. For example, there is a shift in petrochemical businesses from Western countries to Eastern countries. Emerging economies in the Middle East are currently acting as a hub for the production of petrochemical products. One of the countries that investors are considering as a feasible investment destination in relation to petrochemicals is Saudi Arabia. This has resulted into enormous growth within the industry. According to Abdullah (2003, Para. 4), it is estimated that Saudi Arabian petrochemical exports accounts for 80% of the petrochemical exports from GCC countries.

The country’s strategic location in a region with growing markets of Southern and Central Asia and the Pacific Rim has also contributed to the industry’s growth. In addition, there is a shift in consumption of petrochemical products from western countries to Asian and Middle East countries. This results from increased demand for petrochemical products in these countries. For example, emerging economies such as India and China are emphasizing on development of chemical intensive industries. This has made these economies to become global consumption centers for these products. Most of these countries imports of petrochemical products come from Saudi Arabia.

The global economic slowdown which began in 2007 resulted into a decline in the industry’s level of revenue. For example, Saudi Basic Industries Corporation which is the leading producer of petrochemical products in Saudi Arabia reported a decline in its profit during the 2009 financial year with a margin of 50% (Aruvian, 2009, Para. 6).The slowdown resulted from the fact that other industries such as the construction and automobile industry were affected by the global recession. This culminated into a reduction in the amount of petrochemical exports from Saudi Arabia to other countries such as India and China.

However, it is expected that with the recovery of the economy, this trend will be reversed. This translates into a high probability of increase in the industry’s rate of growth due to an increase in demand for various petrochemical products. It is expected that the average annual demand for petrochemical products for the period ranging from 2000 to 2020 will be 4.6%. For example, the China is expected to increase its import of ethylene for the next 5 years (Aruvian, 2009, Para. 4).

According to Tim (2008, p. 3), increased competition within the petrochemical industry has culminated into firms integrating the concepts of forming acquisitions, mergers and strategic alliances in their strategic management(Fast market research, 2009, Para. 3). For example, firms in Saudi’s petrochemical industry are witnessing increased competition from China. This is due to the fact that the Chinese government is increasing its investment in the petrochemical industry. This will have a negative impact on some of Saudi’s petrochemical exports. For example, expansion of China’s petrochemical industry will diminish its petrochemical products imports from Saudi Arabia.

For firms in this industry to survive in petrochemical industry, their management will be forced to formulate effective survival strategies. This means that these firms have to consider evolutionary perspective theory. For example, some of the strategies that the management of firms in petrochemical industry should consider relate to entering into strategic alliances or formation of partnerships with other firms in the Middle East countries. This will enable these firms to attain a high competitive advantage (Aruvian, 2009, Para. 4).

SWOT analysis of Saudi’s Petrochemical industry

The table below represents a SWOT analysis of the industry.

PESTLE Analysis of Saudi Arabia Petrochemical industry

Political and legal environment

Saudi Arabia has a relatively high political stability. This makes it possible for firms in the petrochemical industry to operate more effectively due to low political risk. In addition, the country has effective an effective legal system. The legal system contains comprehensive commercial regulations which ensure that business operates more efficiently (Fredrick & Fawaz, 2008, p.4).

Economic environment

Saudi Arabia has a strong economy which supports the performance of firms in the petrochemical industry. Economic globalization has impacted Saudis petrochemical industry. For instance, the country’s accession into World Trade Organization (WTO) has greatly impacted the petrochemical industry. As a member of WTO, Saudi Arabia is still in a position to price its petrochemical products using its original cost basis (Tim, 2008, p.3). This means that the government was not required to change its petrochemical pricing mechanism. By joining WTO, Saudi Arabia was able to expand its market size. This will increase the country’s trade since through a reduction in tariffs between member states. It is expected that the existing tariff in trade of petrochemical products between member states will be less than or equal to 6.5%. In 2005, the government reduced the custom duty levied to petrochemical products. This has enabled foreign firms to operate in the same environment as the local firms (Tim, 2008, p.4).

Technological environment

Saudi Arabia has a well established technological environment. This makes the country to be able to conduct efficient production of petrochemical products. According to Fredrick and Fawaz (2008, p.3), most of the plants within the industry are utilizing the current technologies in their operation. In addition, the country has a well established infrastructure which supports the operation of the petrochemical plants. These infrastructures relate to mode of communication and transport means.

Social-cultural environment

Firms operating in Australian petrochemical industry have integrated effective business strategies. Some of these strategies relate to operating in a social responsible manner through incorporation of the concept of Corporate Social Responsibility (CSR). Through CSR, the society has developed a positive attitude towards these firms (Fredrick & Fawaz, 2008, p. 7).

Position of Saudi’s petrochemical industry in its lifecycle

Saudi’s petrochemical industry has witnessed growth over the past years which resulted into expansion of the industry. The industry has undergone through various phases in its development which include initial phase, growth phase. Currently, the industry is in its growth phase. This results from the fact that most of the economies in Middle East and Asia are in their growth phase (Fredrick & Fawaz, 2008, p.4).

This has resulted into an increment in demand for petrochemical products as a major factor to steer their economic growth. In addition, there has been a reduction in the production of petrochemical products in Western countries. The result is that a large number of western countries are becoming net importers of petrochemical products. This has culminated into an increase of Saudi’s export for petrochemical products. Despite the competitive challenges from China and effects of the financial crisis that are facing the industry, Saudi’s petrochemical industry will still experience growth into the future due to increasing global demand for petrochemicals by both industrial and individual consumers.

Industry structure

Environment plays a significant role in the success of a firm’s competitive strategy. The environment in which a firm operates is broad since it entails both economic and social forces. However, the industry in which the company operates is the most important element of a company’s environment (Strategy, Business Information and Analysis, 2009, p.5). Therefore the industry structure plays a significant role in the process of determining the competitive strategy to be adopted by a given firm. This is a high level of diversity in relation to profitability level across various industries.

As a result, the competitive forces also differ across firms in different industries. Some industries are characterized by intense competition while the intensity of competition in other industries is mild. The objective of a firm developing a competitive strategy is to enable it position itself more optimally in the industry. Effective positioning enables a firm to deal with the competitive forces. According to Porter (2008, Para. 4), competition within an industry is influenced by the competitive forces which determine the industry structure. Porter argues that the strength of the forces have an impact on the industry’s profit potential. The competitive forces include of threat of a new entrant, suppliers and customers bargaining power, degree of rivalry and threat of substitutes. The Competitiveness within petrochemical industry is a key element that other downstream firms should consider in developing their competitiveness.

GE Energy is a public limited company which was established in 1901 within the Oil and Energy industry. The firm operates in 100 countries with its headquarters located at Greater Atlanta Area. Over the years, the firm has had superior financial performance which has resulted from increased customer loyalty. The effect has been an increase in the number of customers utilizing the firm’s power system.

For example, during the financial year that ended 2008, the company had revenue of $38.5 billion. In its operation, the firm deals with a wide variety technologies in relation to energy infrastructure. An example of its products includes gas turbines. The firm has installed approximately 6000 gas turbines making the firm to be the largest gas turbine supplier (GE Energy, 2009, Para. 1). In addition, the firm also deals with other forms of energy such as renewable sources of energy, nuclear energy, oil and natural gas, and coal.

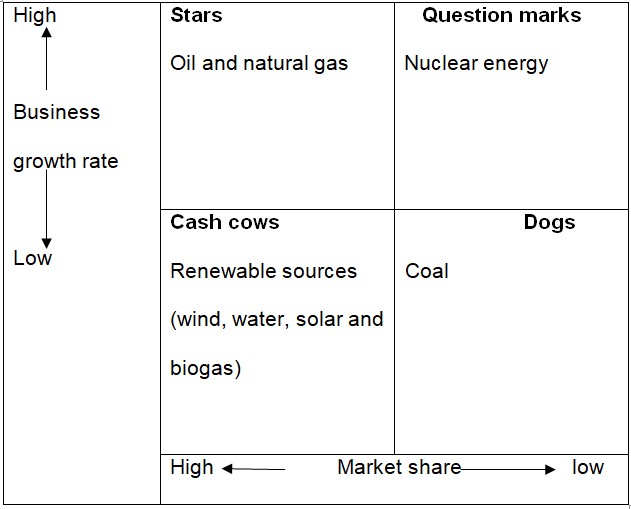

The BCG matrix below illustrates a categorization of GE Energy strategic business units into stars, cash cows, dogs and question marks. Oil and natural gas energy have a high growth rate and a high market share.Renewable sources have a high market share but a low growth rate. This makes it to be a major source of revenue for GE Energy. On the other hand, coal has low market share and low growth rate. Nuclear energy has a high growth rate but a low market share. The management of GE energy should ensure that it expands its nuclear business into stars. Coal energy has a low market share and growth rate. As a result, the management of GE Energy should divest it.

According to Jayarethanam (2005, p. 8), petrochemical industry is one of the most challenging industries to operate in. Therefore firm’s within this industry have to develop strategies to enable them attain a high competitive position.

Analysis of petrochemical industry using Porter’s five forces

Threat of new entrant

The viability of a firm succeeding upon venturing into petrochemical industry is very high due to the high profitability characteristic of the industry. For example, globally, the industry has an earning capacity of approximately $1.4 trillion per year. This constitutes approximately 3.5% of the total global wealth that is generated per year. The high profitability level of the industry is culminating into an increase in the number of investors venturing into the industry.

According to Porter (2008, para. 5), new entrants into a given industry result into an increase in the degree of rivalry. This is due to the fact that the entrants may bring into the industry substantial resources as an entry strategy to attain a higher market share. However, increase in the number of competitors will result into an increment in price war between the firms and hence a reduction in price of the products. This may have a negative impact on the firm’s revenue.

However, there are high costs that potential investors have to incur in an effort to venture into petrochemical industry. These costs relate to high financial and human capital. For example, a significant amount of finances will be required to install the necessary infrastructure. In addition, specialized skills will also be demanded to operate these facilities. Petrochemical industry is characterized by intense investment in research and development. The high entry costs act as barriers to entry into the industry. GE Energy has been able to attain a high competitive position in the industry since it has a strong financial base.

This is due to the fact that the firm has been in operation for 99 years. The financial strength of the company has enabled GE Energy to restructure its infrastructure through installation of the emerging petrochemical industry technologies. For example, the company has invested in the next generation of gas turbine technology. An example of technology that the firm has invested in is the Frame 7FA gas turbine. This has resulted into an increment in the company’s competitive advantage in relation to technology (‘GE Energy’s Frame 7FA gas turbine’, 2009, Para. 3). The firm has also been able to attain economies of scale through its global operation. The effect has been a reduction in its unit cost of production making its products to be competitive. Considering the fact that there is minimal product differentiation in petrochemical industry, competition is based on price. Through high economies of scale, GE Energy has been able to attain a higher competitive position.

Rivalry within the industry

The degree of rivalry within an industry is determined by the extent in which firms in the industry compete amongst themselves in an effort to earn above average returns. Competition in a given industry is based on various elements such as quality, innovation and quality of products. In the 21st century, the degree of rivalry within petrochemical industry is being increased due to increased investment into the sector especially in emerging economies such as Asia and Middle East. The reason behind increased growth of petrochemical industry is that more people have discovered that petrochemical products can act as substitute products for metal, wood, glass and paper products.

According to Jayarethanam (2005, p. 6), increase in demand for petrochemical products has made the industry to be characterized by a high rate of growth. To keep up with changes in the industry, management teams of firms in this industry are more concerned with development of evolutionary perspective in the development of competitive strategies. According to Richard (2001, p. 34), this will enable the firms to survive within petrochemical industry which is very hostile. The management team of GE Energy is increasingly committing a significant proportion of its managerial and financial resources towards attaining a high degree of expansion. As a result the management is sacrificing a substantial proportion of the firm’s profits so as to expand. Rivalry within petrochemical industry is also increased by high exit cost. This is due to the fact that the industry is characterized by investing in specialized technology. This makes it difficult for firms within the industry to exit despite reduction in their level of revenue resulting from increased competition.

Bargaining power of suppliers and buyers

The cost of raw materials has a significant impact in the operation of a firm since it influences the level of profitability (Porter, 2008, para.7). Suppliers in petrochemical industry have moderate power in determining the price of feedstock. This is due to a high concentration in the number of feedstock suppliers. A high supplier power makes it possible for the suppliers to have an influence on the price of products in the industry.

On the other hand, the bargaining power of buyers in petrochemical industry ranges from being moderate to low. This is due to high fragmentation of downstream firms which culminates into a decline in their combined bargaining power. In addition, lack of close substitutes makes it possible for firms such as GE Energy to be able to operate effectively due to a reduction in buyers bargaining power. However, there has been a decline in import duties in relation to petrochemical products due to increased free trade agreement. Decline in import duties also results from an increase in market size due emerging economies in Middle East. This presents a bright future for the buyers since their bargaining power will increase.

Substitute products

Substitute products result into a reduction in an industry’s profit potential. This is due to the fact that substitute products place a ceiling in relation to the price that a firm can charge. Currently, there are limited substitute products within the industry (Jayarethanam, 2005, p.5). This means that GE Energy has a bright future in supplying petrochemical products. This is due to the fact that petrochemical products will continue to be utilized by both the industrial and individual consumers. For instance, there is an increase in the number of firms manufacturing household petrochemical products such detergents.

Conclusion

Petrochemical industry has witnessed rampant growth over the past decades. However, there has been a shift in production of petrochemical products from the Western countries to Eastern countries. This is due to high availability of feedstock in the Middle East and Asian countries. In addition, there has been increased demand for petrochemical products. This has made Middle East and Asian countries to be major consumers of petrochemical products. Currently, Saudi Arabia petrochemical industry is in its growth stage. Despite the effects the slowdown in the industry’s due to global economic recession, this trend will be reversed upon the recovery of the global economy.

The shift has also resulted into an increase in the degree of competition within the industry. As a result, managements of firms in this industry are being more concerned with how they can survive in the market. This has resulted into increased need to formulate effective competitive strategies.

To attain a higher competitive position, firms in petrochemical industry have to consider the industry structure in formulating their competitive strategies. Firms in this industry such as GE Energy are facing threat of new firms venturing the industry due to its profit potential. However, there are barriers to entry such as human and financial capital requirements that hinder entry. High profit potential and high exit costs have resulted into an increase in rivalry within the industry. This is due to the fact that there are many firms in industry which results into an increase in the level of competition. The industry is characterized by minimal substitute products. On the other hand, buyer and supplier bargaining power in the industry is relatively low.

Recommendations

- The management of firm’s in petrochemical industry should consider conducting industry structural analysis during the process of formulating their competitive strategies.

- Firms in the petrochemical industry should invest in infrastructural development for them to attain a high competitive position.

- Evolutionary perspective theory should be incorporated by firms in petrochemical industry in formulating their strategies due to its competitive nature. This will enable the firms to survive in the challenging environment.

- Research and development should form a key strategy in the effort of firms in petrochemical industry to attain a higher competitive position relative to their competitors.

- The competitive structures developed should be in line with government policies.

Reference List

Abdullah, A. 2003. Development of Middle East Petrochemical Industry. Web.

Aruvian, R. 2009. Analyzing global petrochemical industry. Web.

Braskem. N.D. Petrochemical industry: world petrochemical market. Web.

EquityMaster.com. 2004. Petrochemicals: SWOT analysis. Web.

Frederick, M. & Fawaz, B. 2008. Factors affecting foreign direct investment location in the petrochemical industry: the case of Saudi Arabia. Brunel, UK: Brunel Business School. Web.

GE Energy. 2009. The power that turns the world. Web.

Jayarethanam, P. 2005. Cluster development: a case of Singapore petrochemical industry. Sydney: The Australian National University. Web.

Johnson, R & Scholes, E. 2009. Strategy: what is strategy? Tutor2U. Web.

Porters, M. 2008. The five competitive forces that shape strategy. Harvard Business Review. Web.

Richard, W. 2001. What is strategy and does it matter? London: South Western Cengage Learning. Web.

Timothy, D. 2003. Internal analysis: competencies and assets.

Tim, N. 2008. Commentary on Saudi Arabia. Chatham House, London: Chatham Publishers. Web.

Utilities-ME. 2009. Tech focus: GE Energy’s Frame 7FA gas turbine. Web.

University of Leicester. 2009. Strategy, Business Information and Analysis. London, UK: University of Leicester Learning Resource.