Introduction

The influence of innovation and the impact of constant technological advancement in the world today have greatly transformed social interaction. The existence and expansion of the computer industry, smartphone, and media player industry are due to advancements in technology and continuous innovation. Stephen Wozniak founded Apple, a computer company, in 1976 in collaboration with Steve Jobs.

The company manufactured and sold computer hardware devices, Apple Inc., to a target customer group of computer enthusiasts living in Silicon Valley. This customer-centered approach in design and innovation became the driving force of product differentiation strategy by Apple in gaining competitive advantage and enhancing its market share throughout its growth and expansion in the industry. The readily available market for company products positively influenced continuous product revision and improvement.

Despite the challenges of competition, Apple continued to strive for innovation and expanded its product line to tablet computers, smartphones, and the personal media player industry. The company experienced a growth rate of 275% from 2010 to 2014 making the company among the top five ranked companies in the world.

Apple adopted a systematic customer-centric approach with a broad product differentiation strategy to improve customer satisfaction and enhance competitive advantage over its rivals. The company’s mission behind the strategy is to enhance social experiences through innovation and improvement in technological. The objective to grow its market share both in the local and international markets has enhanced the growth of the company.

Apple product offering has faced stiff competition from different rivals in the extended global market. Samsung, HP, Lenovo, Google, Netflix, and Amazon are among the top rivals that have adopted low-cost leadership and focused low-cost strategies hindering Apple’s growth and expansion of market share. However, Apple has enhanced its competitive advantage through industry diversification and product differentiation to sustain its business activities.

Strategic Issue

The strategic objective of the company is to sustain innovativeness in product diversification to meet diverse consumer demands. Market penetration strategy involves product improvement and industry diversification to support customer brand loyalty. The improvement of products to adopt new technology has enhanced the company’s competitive position. However, with the continued advancement in technology and innovation, Apple has discontinued some of its low capability and market non-profit generating products to improve its profitability and expand its market share. Industry diversification to the personal media player is one of the best diversification strategies that enhanced Apple’s sales growth and market share, though the company experiences additional challenges from other media player firms.

Moreover, the company has adopted a leadership strategy in innovation and has expanded its market share through the improvement of the media player product line to cable-free TV streaming services. This leadership approach and the shifting consumer demands to mobile technology have greatly influenced consumer needs in the global market shifting technological innovation and creating space for industry growth.

Despite this leadership approach, the company faces challenges of expanding its market share. The dynamic consumer needs made the company discontinue some of its product lines including iPod classic and original iPad. The expansion of distribution channels in foreign countries faced challenges of emerging counterfeit products in China that damaged the company brand.

Additionally, competition from established global firms with strong consumer brand loyalty, low-cost production, and products with compatible features has greatly hindered Apple’s growth in the global market. Moreover, the industry is experiencing a technological shift, and thus, threatening the current business of the company. The PC market is diminishing while the smartphone market is maturing. Therefore, the strategic issue is, “What strategic measures must Apple adopt to sustain its expansion and profitability?”

External Environment

The analysis of the external environment describes the elements that affect industry business and expansion. This analysis outlines the threats and opportunities existing in the industry that significantly defines its attractiveness. Therefore, considering the external environment of Apple involves an analysis of the factors within the large business environment that influence the company’s performance in the global market. The evaluation of the large business environment includes identification of macro-environment factors, analysis of forces that affect market share, the fundamental strategies of achieving set goals, and industry profile and attractiveness.

Macro-Environment

Macro-environment comprises economic conditions, environmental factors, social-cultural factors, legal factors, political factors, and technological factors. The continued technological innovation greatly influences social interaction. These changes affect the socio-cultural elements of the world by positively influencing the sharing of ideas, events, and activities in different geographical locations. Additionally, technological advancement positively influences socio-cultural factors as leisure activities, business, and education. In this view, change in technology greatly influences the shift in socio-cultural factors and positively impact industry attractiveness

The growth and stability of the global market economic conditions are essential to industry profitability and expansion of market share. However, economic conditions depend on the stable political environments that promote industrialization and technological advancement around the global market. Therefore, the attractiveness and expansion of the industry depend on stable political conditions. The stable political climate in the developed countries and developing countries have significantly contributed to growing economies that has expanded the global market such as the Middle East, and Africa. Thus, stable political conditions improve economic growth and open new markets in the world.

The influence of legal requirements is essential for the protection of property rights. Establishment and enactment of proper regulations governing intellectual property significantly affect business and industry growth rate by limiting the manufacture of counterfeit products that damages the product brand and enhances unlawful competition. Therefore, legal protection is essential in enhancing market growth and expansion.

Porter’s Five Forces Analysis

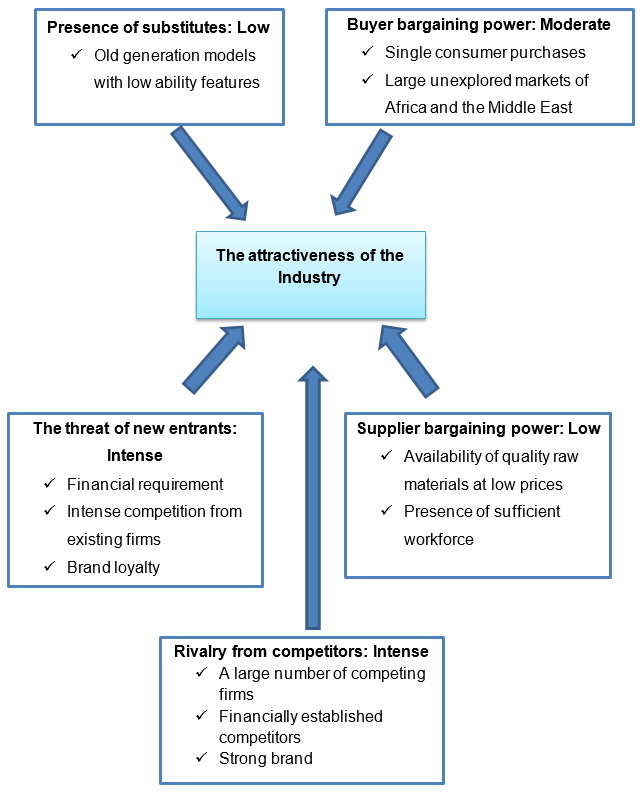

This analysis is essential in determining the forces that affect a company’s market share, its expansion, and profitability (Appendix A). These forces define the competitiveness of the industry and include the presence of substitute products, buyer bargaining power, rivalry among competitors, pressure of supplier bargaining power, and pressure of new entrants.

The threat of substitute products in the industry is low. The available substitute products include old generation models with little ability features. Adoption of improved technology and the advancement of product features through constant innovation significantly influences customer purchase of quality products enhancing competitive advantage over substitutes.

The industry also faces moderate buyer bargaining power. The single consumer purchases of devices present low buyer bargaining power. However, the large unexplored markets of Africa and the Middle East significantly pose strong buyer bargaining power that forces firms to offer product price cuts to promote their market penetration.

Competitive rivalry in the industry is intense. The presence of a large number of competing firms and products pose a significant threat to business activities. The competing firms have established financial abilities, strong brand recognition, innovative strategies, and collaborations that intensify competition in the industry.

The pressure of supplier bargaining power is low. The advancement in technology significantly influences the availability of quality raw materials at low prices. Additionally, advancement in education has improved the presence of a sufficient workforce in the market. Apple, therefore, does not face pressure from suppliers for it sources its workforce and materials as per the company’s needs. The enhanced market availability of sufficient quality materials and workforce lowers the bargaining power of suppliers.

Intense barriers to entry significantly affect the industry. These barriers include a high financial requirement, intense competition from existing firms, and brand loyalty. Established firms enjoy strong brand loyalty and large market share limited entrance by new firms. Competition quality products in the market increase the barriers to entrants as small firms need large capital requirements to acquire advanced technology, machines, and the workforce necessary for the production of high-quality products. Thus, entry by small firms is limited and the already existing industry players enjoy the low influence of intruders.

Key Success Factors

Key success factors are essential strategies to enhance performance and expand market share in the information technology industry include adjustment of policies, consistent innovation, and adoption of advanced technology. These factors enhance market penetration through collaboration and co-production to improve product features and the production of enhanced quality products.

The dynamic information technology industry requires frequent adjustment of production policies and adoption of best practices to improve product features and diversify product lines. Adjustment of company policies to limit restriction of exchange of ideas helps in facilitating the availability of better-performing software and hardware devices through joint innovation and coproduction to match customer needs and compete in the market. Additionally, adjusting policies enable the firm to offer its software platform for use by other industry firms offering complementary products and positively influences market penetration and expansion.

Consistent innovation enhances product-line expansion, revision, and improvement of products. This element of achieving company goals is essential in enhancing a company’s competitive edge and creating customer loyalty through improved product brands and capabilities. The development of innovativeness in an industry is essential in the production of improved quality products with broad product capabilities that boost satisfaction of the need of global market consumers. This factor thus enhances the competitiveness of a company, improves product quality, and sustains business activities through improved customer satisfaction and expansion of market share.

Adoption of advanced technology is an essential factor in the information industry for it reduces cost, improves product quality, and expand market share. Advanced technology helps in the adoption of low-cost production processes that positively affect product pricing. Additionally, improved technology enables the production of good quality products to satisfy diverse customer needs. Low-cost production and manufacture of good quality products reduce company expenses and increase market growth and profitability.

Industry Profile and Attractiveness

The forces that affect the attractiveness of the information technology industry include elements of the external environment. The industry faces growth and expansion challenges due to the political climate and regulatory laws. The constant change of leadership and political policies in the global market significantly affects the economic growth and stability of the countries. The establishment of regulatory laws is also a factor of both political conditions and the country’s legal policy development.

The two elements affect economic growth, influence terms of business engagement, and impact on market stability that significantly affect industry profitability and attractiveness. However, diverse socio-cultural factors, technological advancement, and the growing economic stability help enhance the attractiveness of the market by expanding the global market and supporting business profitability. In my view, I allege that there is a high attractiveness of the information industry to the existing companies in terms of sales, competitive intensity, and profitability.

Company Situation

The conception, growth, and expansion of Apple in the market are due to improvement in technology and the adoption of innovative culture into the company life. The adoption of innovative culture has facilitated the consistent improvement of company product qualities and features, which have positively influenced the global market share. Apple pride in a continuous yearly increase in percentage growth rate and recorded a growth of 275% of its net sales from 2010 to 2014.

In 2014, the company’s leading revenue-generating products were iPhone and iPad contributing sales of $102 billion and $30.2 of total revenue net sales respectively. However, the company iPod product experienced market challenges and recorded a decline of 48 percent prompting the company management to discontinue the product from the market. This intention of the strategy was to guard the company against losses and market fallout. In 2015, the major products had maintained good market performance.

iPhone, iPad, and Mac all posted the high performance on sales income of $170 million, $70 million, and $19 million respectively. However, the company has recently expanded its market through industry diversification to the media player industry and Apple watch market. This industry diversification shows that the company is in its expansion phase of the business life cycle. The company has adopted collaborative strategies to boost sales of the new products in the market and improve its market penetration.

Despite leadership in innovation and directed influence on customer needs, Apple is facing great growth challenges that include rivalry and the low PC market. The industry is full of strong and established innovative firms such as Google, Samsung, and Netflix.

Google Android system and Netflix media player services have negatively influenced Apple’s smartphone and media player market. The company has however assessed its only major rival in smartphone software, Google, to understand the success of its Android operating system breakthrough in market penetration, achieved through collaboration to guide in establishing its product market penetration and increase market share. The company has thus adopted this strategy by collaborating with HBO in offering consumers cable-free TV services.

Financial Analysis

Financial analysis of Apple’s financial records from 2010 to 2014 indicates that it has modest financial status (Appendix B). Profitability ratios show that the profit margin was about 23% while the gross profit margin was about 45%. Superficially, profit margins during 2010 through 2014 were 21.48%, 23.95%, 26.67%, 21.67%, and 21.61% whereas the gross profit margins were 39.38%, 40.48%, 63.04%, 37.62%, and 38.59% in the same period respectively.

While the profit margin relatively remained the same during the period, gross profit margins fluctuated significantly. Similarly, return on assets and return on equity stagnated during the period. Return on equity ratios were 29.32%, 33.83%, 35.30%, 29.98%, and 35.42% while return on assets ratios were 18.64%, 22.28%, 23.70%, 17.89%, and 17.04% respectively during 2010-2014 period. Liquidity ratios were low, which means that Apple struggled during the five years to meet its short-term financial obligations. The working capital ratios were 2.75,.93, 3.04, 2.48, and 1.93 while the quick acid ratios were 1.86, 2.05, 2.10, 1.76, and 1.29 in 2010 through 2014 in that order.

Leverage ratios show that Apple was able to utilize its financial capital well in making profits. Equity ratios were 1.57, 1.52, 1.49, 1.68, and 2.08 whereas debt ratios were 0.36, 0.34, 0.30, 0.40, and 0.52 in 2010 through 2014 respectively. Similarly, the debt-to-equity ratio increased over the period from 0.57 to 1.08 while the debt ratio increased from 0.36 to 0.52. The increment in leverage ratios shows that Apple improved its financial performance in the period.

Regarding activity ratios, the financial activity of Apple was fairly constant and stagnant from 2010 to 2014. Operating efficiencies were 0.40, 0.29, 0.24, 0.31, and 0.34 while cash turnover ratios stabilized at about 0.75 and total asset turnover stabilized at about 0.20. Therefore, the financial analysis shows that Apple has a weak financial status, which requires financial strategies for it to remain competitive in the global markets.

SWOT Analysis

Strength

Apple enjoys an inspiration for innovation that has been essential in boosting product features and capabilities (Appendix C). This strength has enabled the company to keep in tandem with diverse customer needs and enhance consumer brand loyalty. The company’s incorporation of improved technology into production with consistent innovation has significantly facilitated the adoption of product differentiation strategy to meet specific customer identified needs.

Industry diversification, joint venture, and product-line diversity have been essential in enhancing competition in the market and enhancing company productivity through ensuring product availability in all market segments. Additionally, the adoption of flexible investment strategies is a value to the company and facilitated the exit of non-profitable ventures that threatened the profit margin.

Opportunities

The company has great growth opportunities. The untapped market of the growing global economies presents growth opportunities regardless of intense competition from rival firms. Joint venture initiatives of coproduction, product marketing, and sales are significant market penetration and product diversification opportunities. Moreover, the shifting consumer needs to better quality products and diverse demands provide the opportunity for product diversification to promote customer satisfaction and enhance the global market expansion.

Weaknesses

Apple faces business risks that challenge its growth and expansion. Lack of flexible production policies is a critical factor that reduces Apple’s competitive strategy and product diversification. The company risks market fall-out of its major products and ultimate exit due to intolerable competition from its flexible rival firms offering compatible products. Additionally, the continuous shift of consumer needs and the adoption of product differentiation strategy have significantly affected the sustenance of Apple’s high investments and high priced products in the market-leading to losses and discontinuation of unprofitable investments. Overall, these weaknesses have led to poor market sales and reduced profitability.

Threats

The threats faced by the company include counterfeit products, rival firms’ flexible market policies, and intense rivalry. The presence of counterfeit cheap products discourages foreign market penetration. Additionally, threat identified in five forces analysis involves intense rivalry that forces market Apple to cut product prices resulting in low profitability due to the company’s expensive product differentiation production strategy. The flexible market policy approach adopted by rival firms significantly limit and threaten Apple’s market expansion has rival companies have jointly enhanced their marketing strategies and commands a large global market share.

Recommendations

Strategic Issue

The strategic issue revolves around the advancement of key success factors through the review and establishment of strategic objectives to enhance the company’s global market growth, expansion, and profitability. The processes of enacting strategic objectives aim at reducing market threats and utilizing company strengths in the exploitation of opportunities to increase total market share and overall profitability.

Strategic Recommendation

For the generic strategy, the strategic aim for the company should involve expansion of its product line in the high income-generating investments such as smartphone and media player industry through continued innovation while focusing on reducing its investments in PC hardware. The company should also focus more on enhancing its global competitive strategies by reducing its product pricing and improving distribution channels while maintaining a high-quality product that has been a key success factor for the company.

For grand strategy, Apple must reduce its weaknesses and break barriers to enhancing its competitive advantage in the global market by adopting flexible production policies and the best low-cost production strategy that will enable the company to manufacture high-quality moderate cost devices and software to match rival products prices. Additionally, flexible production policies are essential in guiding Apple to choose the correct platform for the joint venture in the enhancement of product-service features such as the HBO collaboration of cable-free TV service. These collaborations help enhance product capabilities and shift customer demands to their line of innovation.

Objectives

Periodic appraisal of both generic and grand strategies is essential in providing Apple with adequate information on the company’s performance about rival market performance. The assessment is also essential in understanding rival firms’ strategies and facilitating the formulation of counteracting approaches through review and improvement of company strategies to enhance market competition and enlarge the company market share.

Strategic Justification

Expansion of high income generating product line helps the company build a strong financial position as the market is still in its formative stage. The strong financial position is essential for supporting industry diversification and competition. The adoption of the best low-cost strategy and flexible production policies are effective strategies for enhancing competitive advantage, expanding the product line, and improving its income revenue. The periodic assessment is essential in steering and guiding the company to achieving its market objectives through continuous review and improvement of business activities. These strategies will enhance Apple’s competitive advantage by addressing its weaknesses and enhancing overall market share.

Appendices

Appendix A: Porter’s Five Forces