Introduction

Louis Vuitton (LV) had the prolific year 2014 because it continued to grow, despite changes in its market environment. The company has been responsive in its strategies and has maintained a long-term future (LVMH 4). Nevertheless, the company continues to face competitive challenges in the luxury product market. It faces the challenge of sustaining its performance amid the growing difficulties in penetrating new markets and the improvement in the activities by rivals to target its dominant market segment. The company follows a differentiation strategy.

External Analysis

Economic

The overall strategies are taken by LV also lead to changes in the parent company, as LV is the main revenue contributor to the LVMH group. The company has to sell to three main customer segments without jeopardizing its reputation in any of them. The segments are absolute, aspirational, and accessible. The absolute segment is very critical of customer care, product quality, and overall brand reputation. It also has the widest variation in preferences in the main global markets of LV. Besides, it has a substantial demand that has forced LV to reconsider many of its decisions that could have affected its performance in this segment. The aspirational segment has mixed characteristics while the accessible segment is less critical to brands and, therefore, most prone to sway to the competition. All the customer segments are collectively influenced by a great brand and product innovation strategy that LV has been exploring in the past few years (LVMH 34-56). The European monetary problems are easing, which should present a good environment for growth in the market (LVMH 5).

Social

The company has relied on leaders brought in by its parent company LVMH. It has also relaxed its use of in-house production resources in the past to focus on outsourcing (LVMH 54-55). However, the decision was reversed to save the company’s brand. Another problem is that the personal luxury business is growing in different directions in separate markets that LV serves. Its biggest market continues to be China, Europe, Japan, and the United States. Its Chinese market characteristics are different from those of Europe and Japan. However, the company has to meet the challenges of these markets without seeming to abandon any of its quality standards for customer service and product development. For example, it cannot discount products or follow noncompany-owned distribution models even when such strategies would significantly lead to a rise in revenues in the respective markets. These issues include a balance of the values and heritage of Louis Vuitton. The company has a 150-year reputation that it has to uphold while responding to the modern challenges of the business (Mahbubani 4).

Technological

The company has a limited product range, and the main products are more than a century old. The leather bag collection and the trunks with a five number combination lock have been in production since the late nineteenth century. They can rely on this technological reputation to defend their market share and appeal to the absolute and aspirational customer segments that are fixated on getting true luxury regarding uniqueness, heritage, quality, and visibility. The product line allows LV to claim that it is offering the most beautiful specimens of French manufacturing (Mahbubani 2). The exclusivity of the designs and their ruggedness are reputations that help the LV brand to sell to existing and new luxury customers. Customers get information and look up things or exchange views online, which is the way they shop. The behavior shapes the direction that LV is taking when differentiating its experience online. The company is building a following in social media channels to improve interaction with its brand. The digital platforms also use new forms of advertising to different niches like soccer fans (LVMH 11).

Internal Analysis

Resource-Based View VRIO analysis of LV

As the analysis below shows, the main competencies for LV are brand and its designs. They give it sustainable competitive advantages. However, they depend on the success of management of its stores, factories, employees, and supplier relationships, which are part of its tangible and intangible assets (Mahbubani 2-4).

Resource

Tangible assets

The unique product portfolio includes trunks and leather bags. There are twelve manufacturing facilities in France as part of 17 total factories operated by the company. LV also has manufacturing technologies for enhancing product quality and knowledgeable staff. The LVMH group has set up an ultra-modern manufacturing facility that will have the highest quality in terms of production and will offer favorable working conditions, as well as being responsive to environmental concerns that preserve the riches of nature (LVMH 5).

Intangible assets

The leadership of Michael Burke, who has sufficient experience in running and turning around the business, is an intangible asset. Besides, a rich leadership history that includes lessons from Bernard Arnault on turning the brand around is an asset. Other assets include the brand reputation of LV and its constituent product in its traditional markets of Europe and emerging markets. There have also been significant investments in awareness campaigns that have supported the growth of the brand (Mahbubani 7-9).

Capabilities

Brand management and couture marketing efforts by the company are significant for revenue generation and market share growth. Controlled management of manufacturing by the company controlled factories helps to amplify the company-branded retail stores for LV to dominate customer service experience.

VRIO framework

Valuable

The LV brand name and logo, the unique designs of the LV products, and the designer talent at the company are valuable.

Rare

The brand heritage spanning more than 150 years is rare (Mahbubani 2). Creativity in leadership and design is also real as other companies do not have exact capabilities. Production culture is rare because of close management within the company.

In-imitable

Licensing and franchising arrangements can be copied. The formal organizational structure can be copied. Also, pricing strategies can be copied as well as marketing. Brand and design remain the imitable capabilities for LV.

Organize

Skills and technologies used for production and marketing are organizable. The leadership has succeeded in promoting innovation, and retaining the company and brand reputations. The company has strategies for organizing brand and product innovation and maintains its reputation for quality.

Company’s Corporate and Business Strategy

LV follows a differentiation strategy based on the generic strategies model where it develops high-quality products and sells them at a high price. Its products are luxury-oriented and include leather bags and accessories (Mahbubani 4).

Based on the strategy clock model by Bowman, the company follows a focused differentiation strategy where it has very high prices for its products, and it also enjoys a high perceived value offering to consumers (Mahbubani 4).

Identifying Issue and Challenges Facing the Company

The luxury industry continues to record profits quarter after quarter, and this is mainly due to the acceleration of growth in global markets. Meanwhile, all companies are experiencing difficulties with traditional clients because of increased competition at home and negative economic indicators. Markets in China, Russia, Brazil, India, and South Korea are expanding while styling the same in Europe and the United States. Many rivals to LV are shifting focus to the new markets, and they are increasing their advertising to appeal to customer groups. The threat to LV is very high (LVMH 20). Without a matching budget for marketing and advertising, LV may miss customer awareness targets. This can negatively affect the reception of its brand to new buyers in these markets. Advertising and other forms of market awareness are the only forms of strategy that LV can freely copy its rivals without risk of brand dilution or negative reputation (LVMH 45).

The designs brought by Marc Jacobs introduced fashion aspects of the luxury brand. They are good for short-term brand visibility, but they have the potential for diluting the luxury image of the brand. Therefore, LV has to consider reducing its reliance on fashion-oriented designs. They make the company appear as if it is following customer expectations and trends, which is not the correct marketing strategy for a luxury brand. Luxury brands are beyond fashion and premium. They appeal to a lifetime usage strategy where customers will be able to get their value of purchase irrespective of the duration of owning the product (Kapferer and Bastien 114).

The company has its distribution network of branded LV stores in different cities globally. The company-owned distribution network allows it to manage prices effectively and prevent grey markets that would arise when there are price differences in different official markets. Merchants may take products from one market to sell to another for profit, which is not reflected in the company. LV faced a similar problem when its prices in Europe were different from those in China, due to Chinese custom duty laws. The company had to increase European prices to counter the trend of Chinese customers opting to buy their luxury in Europe. It might have been impossible or difficult to execute the price increase strategy across all its European operations without company-controlled stores (Mahbubani 6).

Identification and evaluation of the main strategic options for growth

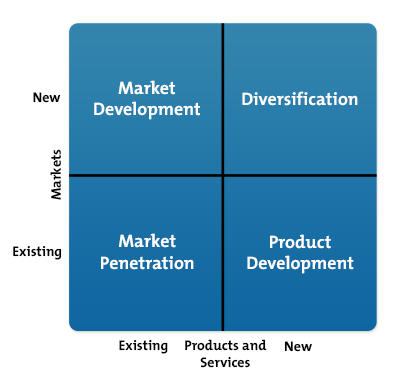

From the ANSOFF matrix, LV pursues a market product development strategy. It continues to update its portfolio so that it remains relevant in the luxury commodities market globally (Mahbubani 4).

Based on the TOWS matrix, there are four strategy categories applicable to the LV case as discussed after the SWOT analysis below.

SWOT analysis of LV

Strengths

The company is maintaining its production facilities in France instead of concentrating on outsourced services around the world (Mahbubani). Therefore, it has full control of production. This strategy is important for the luxury business where the winning strategies tend to be the ones that break the rule of conventional marketing (Baron, Milner, and Naseraldin 800). For example, instead of having the lowest costs of production through outsourcing, true luxury demands take care of quality above everything else. Maintaining production in France, in the case of the LV, ensures that there are no compromises in quality. This approach to manufacturing also gives customers satisfaction for their purchase.

Weaknesses

The brand logo in recent product lines has been emphasized a lot, and that is likely to draw attention to the purchasers of the brand that goes contrary to their intentions to purchase. Luxury buyers have different intentions for buying. While the accessible segment seeks to belong and may appreciate the very visible logos, the absolute segment is more concerned with the brand reputation that goes beyond logos plastered on products. Thus, having large logos in addition to the visual identity of LV that includes a signature pattern that has LV initials may seem like a design overkill for markets that are ethically critical about luxury (LVMH 36). The company must protect its customers against non-customers as it follows the laws of anti-marketing.

Opportunities

With a large product portfolio, LV has the opportunity to cut back on production and highlight its main products as limited edition models. It should also take more orders on its waiting list to inspire customer decisions for purchasing LV (LVMH 46).

Threats

Recessions in dominant markets will negatively affect the size of the different market segments. The aspirational and accessible market segments are most vulnerable to recessions. In the case of stagnating or loss of income, these customers cut back on luxury purchases as their reasons for self-indulgence reduce.

SO Strategies

The company does well to control prices and not to discount products. It also does well to destroy any excess stock. A feature of luxury is that it’s brand value equation must remain positive. The equation is derived from the product of subtracting actual purchases for a specific period of brand awareness in that period. As long as brand awareness remains high within all segments, a reduction in the actual number of available products for sale will improve the value of the luxury brand.

WO Opportunities

LV should use waiting lists. Waiting lists demonstrate the visibility of a brand and its exclusivity. They also demonstrate other values that a brand may try to communicate with its customers, such as the use of premium materials, extensive product innovation, and development routine, handcrafting, and customized product schedules.

ST strategies

Many accessible segment customers buy luxury because of self-indulgence and hedonism. They may also do so to celebrate moments or a person. When buying, they are attracted to the luxury appeal rather than premium or fashion appeals. Stagnating incomes in Europe are also affecting the purchasing ability of the accessible segment making it more critical to the brand reputation. Thus, a strategy for LV should be to focus on luxury rather than fashion with its designs that are mostly priced within the reach of many customers falling into the accessible segment. One of the challenges facing LV is that customers in its accessible and aspirational segments are becoming value conscious (Mahbubani 9).

WT Strategies

The company may try to lower its prices or hold back against going on with the scheduled price increase in such markets. However, the strategy is also likely to hurt the overall reputation of the brand. Thus, the threat is both to the revenues of the company in the short-term and to the reputation of the company in the long-run about its competition in cases where LV opts not to increase its prices. The aspirational and accessible segments of the market may show increased demand for price increases when market demand rebounds after a recession. Thus, LV needs to retain its high price reputation as a luxury product.

Evaluation of strategic option available

The threat of substitute products for luxury is almost non-existent. Luxury is an abnormal good that does not observe conventional laws of demand and supply. The three market segments for LV are all wealthy by different measures and are moved to purchase the brand because of its reputation, its quality, and its expectations for luxury. They are unlikely to get a similar value when taking up a non-luxury product. Thus, their choices are limited. The potential substitute is the counterfeit product that is mass-produced and sold at a fraction of the price of the real product. However, crackdowns on counterfeits by different country laws as well as a controlled distribution channel. The threat of the substitutes would be significant if the counterfeits also had formal channels of distribution such that they can reach a large number of genuine luxury customers (Baker 57-66). Otherwise, they appeal mostly to people who conventionally not afford the luxury. Nevertheless, their presence threatens the brand reputation of LV.

The LV brand and company operations are managed internally. With absolute control of the manufacturing process and distribution, the suppliers only engage in the company on an individual basis (Barnes 187). Their power is very low. Suppliers do not affect the quality of the products, and they also do not affect its price. The product price is at a high margin of the production cost. LV has much power to dictate the quality of products that it gets from its supplier and is even fixated on getting the best hide from Northern Europe with possibilities of shifting the location to any other party that offers better raw material. Therefore, sellers have very low bargaining power.

New entrants into the luxury business have a high cost of entry. They must spend a lot of money on advertising to create awareness of their brands. They must also engage in industry marketing activities that are very costly. Also, to match the incumbents, the new entrants have to set up very large distribution networks of company-owned stores. These costs make it difficult to enter into the luxury segment as a new market.

Implementation

The chosen strategy is SO strategies and market development strategies for TOWS and Ansoff matrix respectively. Buyers have limited bargaining power over the business strategies of LV. Nevertheless, they still play a major role in the eventual strategies that LV will use. The absolute customer segment already has wealth and does not need to communicate its status. Thus, it demands small logos in designs. On the other hand, the accessible segment is keen on communicating wealth and status and having a large logo. Buyers influence the four options of luxury brand distinction. For LV, the influence of buyers comes mainly from the French and English approach to luxury. It also comes from the expectations of the Russian, American, and Chinese regarding luxury. English approach and Russian expectation stress disruption as a way of making the luxury brand distinguishable. The approach of the English and the French is to make the product for the sake of it and then have value as part of its lifestyle. On the other side, the French approach combines with the American and Chinese approach to show that integration into an aspirational world is important for success. Finally, Russian, American, and Chinese expectations of luxury include the emblem and the logo emphasis (Kapferer and Bastien 122). With the above considerations of manufacturing and customer expectations, the buyers are likely to influence strategies that LV eventually implements to sell more than its competitors do at a high-profit margin.

Recommendations and conclusions

LV has to be watchful of the dilution risks that it faces. The fashion-centric designs and the subsidiary management at LVMH have the potential to change the strategic direction of the company amid decreasing revenues. Thus, the current leader must remain watchful not to deviate from the fundamental laws of anti-marketing for luxury products. The company must also keep on protecting its customers from being absorbed by premium products and other mass-affordable luxury products that can dilute their value of luxury. It must refocus its efforts on innovation and product development to introduce new concepts without promoting brand dilution. It must create an element of scarcity in the availability of its most valuable products to enhance the value it offers to its customers (Som and Blanckaert 102-108). This strategy will be critical for the company’s long-term success, especially in the defense of its brand image. Also, the new leader Michel Burke must check that it continues with the efficacy and tight control principles of its former leader Yves Carcelle that have been instrumental in making it profitable. However, the main task will be to focus the innovation and design efforts on business distribution avenues rather than additional products because the brand is already risking dilution.

The company should continue investing in the training of staff to improve its innovative capacity and enhance the aspirational dimensions of its brands. It should also extend the luxury awareness training beyond the company to include customers so that it succeeds in building the brand to withstand future market challenges. The company has done well to develop house schools that exist to transmit and develop artisanal savoir as it pursues excellence. It should continue with the move and include executives in-country operations to make sure that brand communication and staff culture are the same across the world, despite cultural diversity. This will be a way of taking advantage of the existing strengths of the brand, which are artistic and quality inputs for the brand and infusing them with opportunities for the growth of the brand to new populations that do not have an intimate relationship with Louis Vuitton (LVMH 26).

Conclusion

Louis Vuitton (LV) has benefited from the restructuring of LVMH business units and the establishment of an ultra-modern manufacturing facility in France, as well as increased digital marketing efforts. This report reveals the strengths and weaknesses of the company showing that its fashion-centric designs can cause dilution of the luxury brand reputation. Meanwhile, tight control of production and distribution resources and limited production choices improve the core competencies of LV, which are brand and design. The report recommends management consider limiting future production to reduce product availability and justify price increases. The move is also going to help the company earn higher revenues for the same production capacity and enhance its luxury brand for all its customer segments, which are absolute, aspirational, and assessable. This analysis of the prospects for LV has highlighted the vulnerability of luxury brands when they are too fixated on past success. In LV’s case, the looming threat of brand dilution is real. The new CEO must be careful to keep on improving the company’s efficiencies in manufacturing, but he must also make tough decisions regarding production to create scarcity and thus improve brand value.

References

Baker, Michael John. Marketing: Critical perspectives on business and management. London: Routledge, 2001. Print.

Barnes, David. Operations management: An international perspective. London: Thomson Learning, 2008. Print.

Baron, Opher, Joseph Milner, and Hussein Naseraldin. “Facility location: A robust optimization approach.” Production and Operations Management, 20.5 (2011): 772 – 785. Print.

Kapferer, Jean-Noel and Vincent Bastien. “The Luxury Strategy: Break the Rules of Marketing to Build Luxury Brands.” 2012. Web.

LVMH. “Annual report 2014.” 2014. Print.

Mahbubani, Manu. “Louis Vuitton.” Case. 2013. Print.

Som, Ashok and Christian Blanckaert. The road to luxury: the evolution, markets and strategies of luxury brand management. Singapore: John Wiley & Sons, 2015. Print.