Trading Report

ARAFAT is a new small business venture started in January 2009. The product of the company is a novel idea for the customers. The firm has gathered a reputation for integrity, quality work, and excellence in management. In the last one year of operation, the company has posted an annual sale of over ten thousand pounds.

ARAFAT was formed by [name] as a sole proprietorship in January 2009. In 2009, a host of activities including activities like designing the production sites, general construction, and sale of the finished product brought the Gross Sale to £10920. The company has experienced steady growth with profits being earned since April 2009. Over the period of 12 months, the company showed steady growth in sales.

Presently the company intends to expand its operations further and to achieve the short-term goal of attaining a net after-tax profit of $40000 by 2015. Our long-term objectives are to (a) maintain the sales level achieved in 2009, and (b) increase our market penetration by increasing our target market through geographical expansion.

In order to implement these objectives, the company requires a loan of £30,000 at an interest rate that the bank offers to small start-up businesses. The loan will be used to increase the premises of the store which will enable us to have larger stocks, increase production, and hire more workers. The loan will be repaid in 5 years.

The prospect of ARAFAT’s continuous growth is excellent as the company has 13 orders underway which exceeds £10000. The company has an asset base of more than £15000 which the company will put as collateral for the loan.

The company aims to satisfy that market segment that high-quality products and on-time delivery, and to continue a sound growth in sales volume that will keep going the company for ten years. Our internal market research shows that the target market has increased considerably and the demand for the product was so high that we failed to produce enough products to satisfy demands. Thus, there is a necessity to expand our operations in order to satisfy the increased market demand.

The financial target of the company is to attain the following sales and income targets in the next 5 years:

The company has posted excellent financial performance in the year 2009. Figure 4 (see Appendix) shows the financial performance of the company for the 12 months of 2009. Though the company posted an annual net loss of £13919, the inability of the company to attain a profit was primarily due to low production and inability to fulfill the orders. Total sales revenue has been posted which equals £58500. While analyzing the figures for expenses we see that wages have remained constant, implying the workforce capacity has not been increased after the recruitment drive in Aug-09. As the operations are experiencing a dire, need of extra space and premises expansion for storing a larger amount of stock and production. We see that the expense on-premises has undergone an increase from October 2009 with the addition of 150 sq. ft of space in September 2009. This additional space has affected sales revenue positively as it has increased since then. This shows that the company needs more space to increase its operations.

But if we analyze the sales revenue vis-à-vis sales and marketing expenses there has been a negative correlation between the two implying that the sales revenue was negatively related to an increase in sales and marketing expenses. This shows that sales and marketing expenses need not be increased to increase sales. What was required for the company to do in 2009 was to get more premises and increase production and storage capacity to meet the increasing demand. Further, if we expect to keep all other expenses (except for the expense on-premises) to increase in the forthcoming year, the profits will also increase.

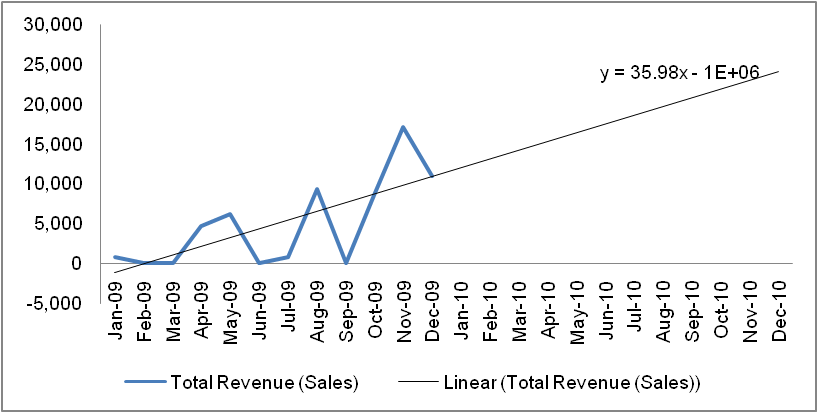

If we do a month-wise analysis of the sales of the company, taking a linear of the monthly sales figures we see that the sales in the next 12 months in 2010 is expected to have an upward trend in sales figures. As the sales figures are expected to rise in the next year, the prospect of the business is excellent in terms of the problems that the company faced due to paucity of funds in 2009. Based on the sales of 2009, the sales revenue of 2010 is projected to increase. The trend line indicates that in December 2010 the sales figure for the company is expected to exceed £25000.

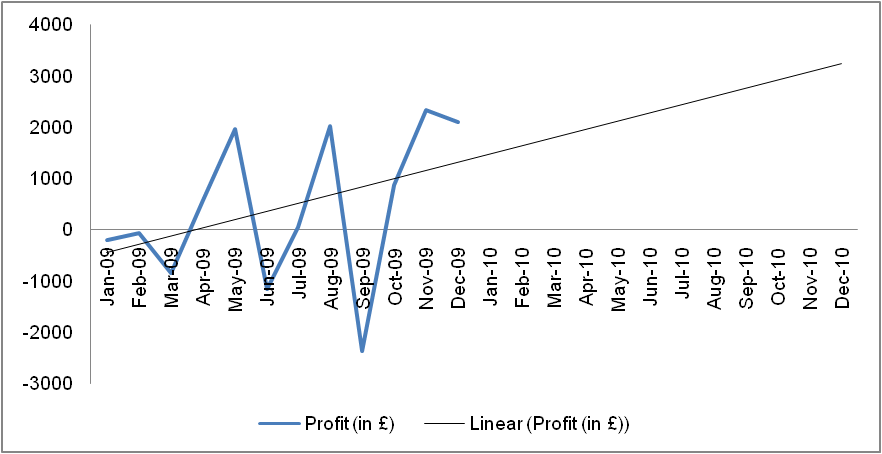

Further, the profit figures for the company from January ’09 to December ’09 are shown in figure 2. We see that the monthly profits for the company have been fluctuating in the same manner as the sales. So when a trend line is drawn off the profit figures for the next 12 months, we see that the profit to is expected to increase linearly and in December 2010, the profit is expected to attain £3000 figure. Thus with an increase in sales revenue, the profits are also expected to increase in 2010.

Thus, it is apparent that the sales revenue and profits are expected to increase over the next 12 months. Given this estimate, we now try to understand which factors the company management failed to look at in the first year of the start-up. First was the problem of low storage space. As there was a problem of crammed space, production could not be done at optimum as there was not enough space to store the products. This increased the problem of meeting the orders that the company got. Clearly, the orders were not met in first year. Second problem that the company faced was lack of efficiency which too was due to crammed space. The company faced a cash crunch. All these problems can be solved with the aid of a bank loan. We could expand the premises which will reduce the problem of inefficient production and increase production to meet demand. Further, a problem of cash crunch would well be removed with the aid of the loan.

So if we assume that the company was able to fulfill the orders the sales of the company would have posted sales of 97 percent more. As figure 5 (see Appendix) shows that in the hypothetical case, sales growth for 2009 would have been £82099 and the Net Profit of the company for 2009 would have been £18836. Clearly if the company was able to meet the market, demand the profit figures would have soared.

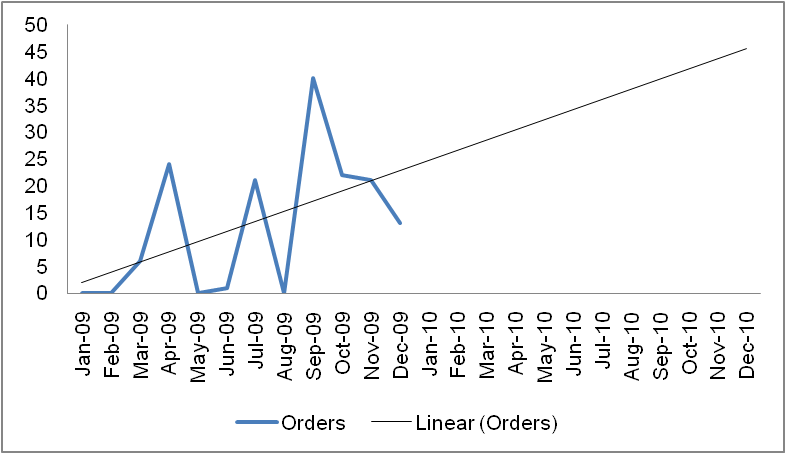

Now the expected demand for the product must also be mentioned for this will clearly demonstrate to you the increasing and expanding market for the product. We expect the demand to increase in 2010. Figure 3 demonstrates the linear trend line for order forecasts for 2010. The trend line clearly shows an increasing trend in the orders placed with the company for 2010. A closer look shows that for month the demand for the product is expect to more than double than the demand in 2009. This paints a pleasant picture for the company’s expected demand in 2010.

So far, the credit that the company had in the market was constant at £40 till September 2009 and it increased to £180 in October 2009. This shows that the company so far has not taken any loans. The credit money that it has to give is very low. So there are no external credits that the company has to pay.

Given this brief financial background of the company, it can be concussively stated that the company is in a position to attain the profit mark the projected profit mark if the bank cordially extends its financial assistance to the venture. Clearly, the aim of the company i.e. to attain a £2000000 sales revenue figure by 2015 is possible only with the financial support from the bank. The product is a very sought after product in the market and there are positive signs of increasing demand for it. An increased capacity to produce more products with greater efficiency will be the primary solution to the problems that ailed the company in 2009 and will help it to overcome it. Further, the company will be in a better position to face fluctuating demands of the product and be prepared for excess demand in certain months with increased premise space. These problems can be solved only with the aid of the loan.

ARAFAT is in a sector which is expected to grow and there is high expected demand for the product in the future. Hence, sales revenue for the company will increase in future. As the company presently faces a cash crunch, we hereby request you to help us financially to make the business grow to its potential. Please review the business plan and loan proposal enclosed herewith, and feel free to ask any additional information that you may deem necessary. I look forward to a mutually profitable relationship with your bank.

Appendix

Reflective Paper

Starting of a real business are subject to many trade-offs and commitments. When we started the business on January 2009. Throughout the operation of our business, we realized that there various decisions that need to be taken considering the external and internal environment of the company and foregoing the primary aim of any profit making organization. There were instances of indecisiveness and debate regarding which was the right path to take. But there are no right ways that is what I have learnt from the simulation. The paths we take are always ‘better’ than the other but never the ‘best’ alternative. In this paper I present my personal leanings from the simulation and the trade-offs we had to take while taking real business decisions.

After completion of the market research, we were ready to identify the target market. In the first month itself, we had to apply for a grant but then we had too little time to apply for it. So we decided not to. In the second month itself, we got two grants of £500 for research and £250 for training. Bit by the end of the year we sent only £40 each in both the activities. Here we had to compromise with the time we had spent on production, sales, and marketing or for research or training. In this month we spent 49 hrs for research and 0 hrs for training.

In March, there has been an increase in prices of the product of competitors. For us the trade off was to increase prices or reduce cost in order to gain more profit. We did not increase price but we also failed to reduce cost as the overhead cost increased and so did other expenses with no sales. We advertised in a trade magazine which was the most cost effective option for promotion to increase enquiry of the product. But the trade-off was to increase our cost. This dipped our profits further.

Advertising in the magazine had its desired effect with an increase in enquiries from 0 to 18. We received more orders in April which increased from 0 to 24. Thus, our product got recognition among target customers. As we visited business club meeting in April, we increased our contacts even further. At the same time over the two months, our profits declined from April 1009 to June 2009. This was due to our emphasis on looking at the company’s prospects in the long-run where a bigger customer base and increased awareness of the product will be helpful than short-term profits. So even though there were 24 orders in place for the month of April we produced for only 21 hours and 61 hours were put into marketing. This clearly showed our focus for long term growth. But then due to over stress on marketing of the product did not help to put any hours for sales functions. Thus, there was a need to increase sales and production functions. The marketing focus of the company continued till September with very little time spent on other functions. This indicated that the company was clearly inclined to increase their growth opportunities than to gain profit in the short run.

So if we analyze the hours put in marketing function for the month vis-à-vis gross profit of those months we get a positive correlation indicating that with an increase hours put in for marketing there was an increase in gross profit. Further, we see that the ration of profit to cost fluctuates following no apparent trend. On doing a trend analysis of the ratio we see that the ratio of revenue to cost is expected to decline in 2010 which indicates that there will be a decline in revenue, cost remaining same or vice versa. Thus, the trend also shows that in the long run the company if follows the following decision making process will expect to face an increasing cost or a declining revenue.

So here, we compromised with higher cost with lower revenue. The reason for this trade off was to gain more market acceptance, and increase capacity and setup the business properly. Thus, short term goals found precedence over long term objectives.

Clearly, in doing business for 12 months asked for making decisions which has various trade-off. The company had a goal to grow in the future. We took all the decisions keeping the long-term goal in mind. For this, we planned to expand our company and increase awareness than to make profit. This aim was the strategy of the company to enter the market. We even did not increase the prices of our product when our competitors did in order to penetrate the market with our low prices. So the trade-off was always between profit and establishing market for the company and long-run growth.

A real business required a lot of time commitment in order to attain the desired goals. We did not employ any workers till August. Till then we did all the works right from accounts to production. So we had to put in long hours ourselves to do all the functions. We were being warned of overworking ourselves till the time we hired workers. This shows the level of personal commitment required to build a business. We were putting in 7 to 12 hours a day on business work with no support. Further, it involves a lot of travelling and meeting people at odd times which actually leaves less hours to one. The business was at its nascent stage and so required extra hard work to be done. All meetings had to be attended. Sales pitch had to be made. Then there was taking calls for providing support to customers. All these require a lot of commitment in terms of time and effort. As there was no hired support all jobs from website building to handling enquiries had to be done by us. Further there was a necessity to increase the production and sales of the company to get profit. This required gathering more contacts and increase customer base. Any marketing or sales pitch required extensive amount of time and follow-up. Workload was increased the stress level but there was a need to make the company grow which made us work even harder.