Introduction

Boeing Co. is currently one of the world’s leading companies within the aerospace industry, with a particular focus on developing and producing jets, military aircraft, strategic defense, intelligence systems, and weapons. One of their biggest customers is the U.S. government. The effect of this relationship can be observed in the breakdown of their operating earnings, of which 75 percent originate from defense, space, and security. Defense and security also make up the largest chunk of their revenue at 45 percent.

Defense, space, and security are only one of four business segments that Boeing uses to operate all activities. The commercial airplanes segment, perhaps what Boeing is most notable for in an international landscape, is responsible for the development, manufacturing, and marketing of commercial jet aircraft and the provision of fleet support services inside the global airline industry.

Operational Summary

Boeing’s worldwide services business delivers international services to both commercial and defense customers. Its operational focus and general assortment include independent platforms, systems, logistic management tools, construction, maintenance, upgrades, conversions, replacement components, training initiatives, modification, and digital services. Boeing’s capital division is in charge of providing clients with financing for the purchase and delivery of their orders, as well as managing the parent company’s total financing exposure.

Equipment under operating leases, assets held for sale or rerelease, investments, financing leases, and other receivables make up the Boeing capital segment’s current portfolio. Boeing’s defense and security segment largely researches, develops, manufactures, and alters military aircraft and weapon systems with the purpose of strikes, surveillance, and mobility. Additionally, the segment is also involved in the production of strategic defense, satellite, and intelligence systems.

With the merging of all the segments and business activities, Boeing is able to observe impressive growth in many of its sectors and still remains one of the leaders in the aerospace industry. However, due to recent global and internal issues, Boeing has noticed some decreases in growth and stock value in certain segments. In the financial year of 2020, like many aerospace companies, Boeing saw a notable loss, though it amounted to 13.8 billion dollars worth of loss in operations for the firm.

Revenues decreased by 49.9 percent (Zakaria & Dejong, 2020). This could be largely attributed to severe travel restrictions that were in place through most of 2020 due to the Covid-19 pandemic. Nevertheless, some of the losses of 2020 could be traced back to 2019, the year during which the Max 737 model was grounded due to safety issues and two cases resulting in deaths. Global services noticed a similar decline, with even worse losses in certain areas, such as an 83.3 percent drop in operations and a 15.8 percent loss in revenue.

However, both the defense and capital segments saw growth, likely as Boeing was able to continue operations on a national scale. Boeing’s capital segment noted a 125 percent growth in operations and a 7 percent rise in revenue, while the defense segment displayed a 0.6 percent growth in revenue but a 41.1 percent fall in operations. As such, the currencies selected by the study will largely focus on those that are relevant to the segments presented by Boeing. It will require identifying currencies that interact with Boeing in terms of consumption and manufacturing. Outside of the U.S., Boeing is most involved in the aerospace markets of China, Europe, and Canada. Though the Middle East is actually responsible for much more business activity than China and Canada, it does so only as a united market but cannot present a unified currency that can be analyzed.

The interaction between the three currencies and their role in Boing’s business operations is relevant to the general understanding of the company’s financial performance. While Boeing’s largest presence can be noted in the U.S. aerospace market, the company is also prevalent in European, Chinese, and Canadian markets. Boeing has been operating in the European aerospace market for sixty years and has been in a competitive rivalry with Europe’s own firm, Airbus, for the past seventeen (Woo et al., 2021).

The high-stakes competition is one reason for the euro being chosen as a currency to be analyzed, but with recent developments in a truce-like deal between Boeing and Airbus, financial collaboration within the market has also become important. The deal outlines an agreement to suspend tariffs for five years and other discussions over subsidies, which will likely affect the ways in which Boeing interacts with the euro.

The Chinese Yuan has been selected due to the continuous high-production of parts that are manufactured in China. China has been and seemingly will continue to be a major component of the Boeing supply chain, as a deal from 2015 has outlined a plan that plants in China will produce up to 6330 new aircrafts worth 950 million dollars by 2034 (Welch, 2021). Like Airbus, Boeing is increasing its manufacturing presence in China for commercial purposes as it is expected to lead to continuous interaction with the Yuan in the near and long-term future.

Boeing Canada, a subsidiary of Boeing, upholds a significant number of offices, operations, and employees in Canada. It houses facilities responsible for both manufacturing and other commercial services, and it has become a successful employer in the country. Boeing Canada is an interesting case as it is both geographically, economically, and politically close to Boeing’s operations in the U.S. As such, the Canadian dollar was chosen for this paper in order to observe the ways in which a closely connected market may interact between Boeing and the foreign currency.

With the current economic climate surrounding Boeing’s commercial segments, it is likely that foreign currency will interact with the company’s stock and value in ways that decrease it. Boeing themselves have noted that the financial year of 2020 was so adversely affected by the pandemic that it may take up to three years before, but travel rates, growth, and value can return to the very advantageous rates of 2019. As such, the hypothesis of the paper finds that Boeing is likely to notice only slow growth in value within the next few years.

Foreign Currencies Contribution

Forecasts of the foreign currencies against the dollar should be done in order to begin testing the hypothesis. The International Fisher Effect, or IFE, is an economic theory that states that the predicted difference in exchange rates between two currencies is approximately equal to the difference in nominal interest rates between the two nations (Ferrea et al., 2021).

With the current exchange interest rates of the U.S. (0.25%), the EU average (0.38%), China (2.95%), and Canada (0.25%), the IFE formula can determine a hypothetical forecast percentage change in the exchange rate of the country’s currency (Thomas, 2020). The IFE estimations are made based on the current spot exchange rate of 1 YAN/0.2 CAD and 1 USD/1.26 CAD. The forecast between the euro and the U.S. dollar depicts a depreciation in the euro down to 1.06. The exchange between the yuan and the U.S. dollar depicts a depreciation in the U.S. dollar, with it dropping to 4.44 yuan.

The purchase power parity can also be used to assess the forecast of the exchange rate. The purchasing power parity analysis is a concept in macroeconomics that compares economic productivity and the standard of living between countries through currencies. In the case of Boeing, the products of which are both manufactured and purchased through the selected currencies, the most popular product, the Boeing 737-700 was chosen. This is because it has at least 4989 crafts delivered worldwide. The 737-700 has been estimated to cost 89.1 million dollars in 2021. The sales of these models outside the U.S. vary by case but are within the range of 113 million CAD, 75 million euros, and 573 million yuan. As such, the purchase power parity of 1.26 CAD, 0.84 euros, and 6.43 yuan to a dollar.

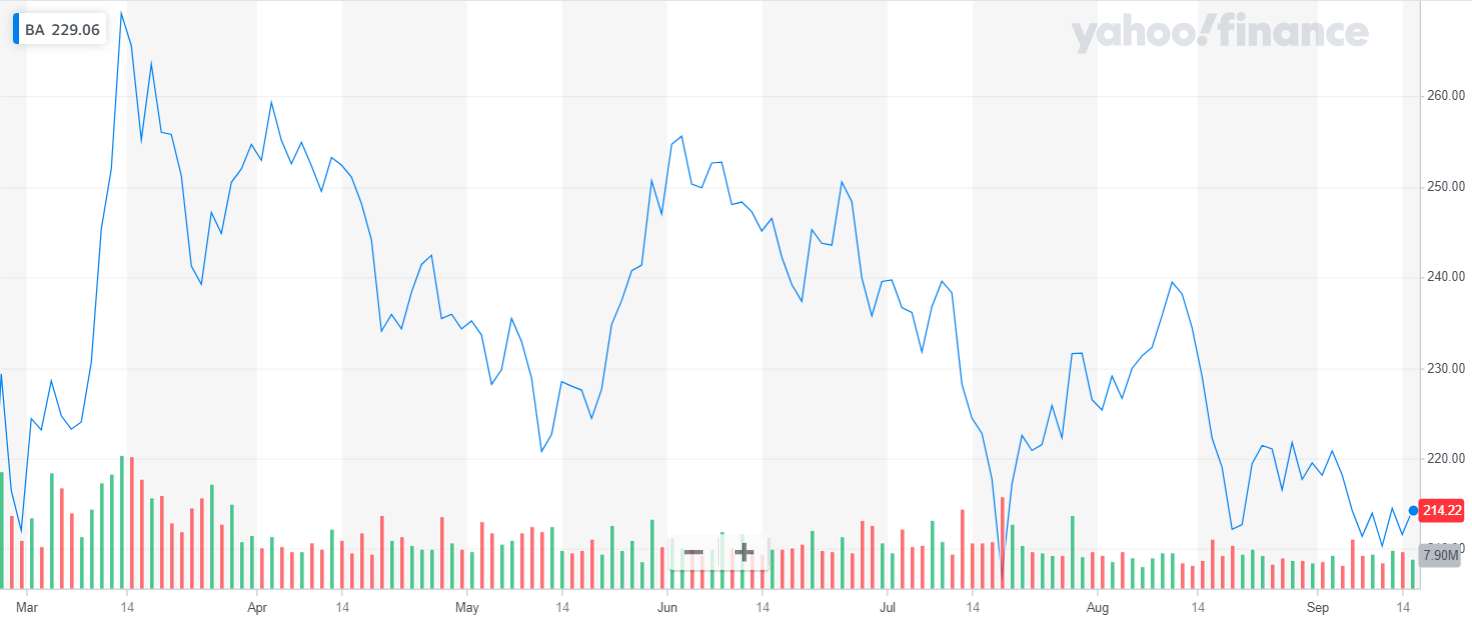

The graph below indicates the monthly changes in the stock prices for Boeing. The price is currently on the rise, illustrating the improving financial performance for the company. The linear regression analysis as calculated in Excel demonstrates the changes in the closing stock prices for Boeing as per the most recent financial period. It indicates the rather fluctuating financial performance of the firm with the established trends towards improvement.

Conclusion

The hypothesis was not entirely accurate but did predict certain assessments made by the forecast. Primarily, through the exchange rate forecast, the depreciation of the dollar is likely to result in the slow growth of Boeing’s value. As the dollar weakens between their manufacturing and purchasing in Canada and China, Boeing is likely to notice very gradual increases in value, unlike in Europe, in which the depreciation is likely to occur with the euro. Otherwise, Boeing holds purchase power parity in their markets in Canada and China, but they are less influential in Europe.

References

Ferrera, L., Metelli, L., Natoli, F., & Siena, D. (2021). Questioning the Puzzle: Fiscal Policy, Real Exchange Rate and Inflation. Crawford School of Public Policy Australian National University Research Paper Series, 38, 1-40. Web.

Thomas, N. (2020). For Company and for Country: Boeing and US–China Relations. China’s Economic Arrival, 131-180.

Welch, J. (2021). Will Boeing soar again? Navigating a corporate recovery process. Journal of Business Strategy, 42(5), 323-331. Web.

Woo, A., Park, B. Sung, H., Yong, H., Chae, J., & Choi, S. (2021). An Analysis of the Competitive Actions of Boeing and Airbus in the Aerospace Industry Based on the Competitive Dynamics Model. Journal of Open Innovation: Technology, Market, and Complexity, 7(3), 192. Web.

Zakaria, R., & Dejong, D. (2020). Dominance to Near Demise: Can Boeing Return to Its Position as the World’s Largest Aircraft Manufacturer? Sage Publishing.