Introduction

For an effective operation, a business required adequate capital to finance its operations; there are different sources of business finance, it is the role of the finance manager to develop a strategy that combines available sources of finances to the benefit of a company and its stockholders. The trade-off theory of capital structure advocates that a company should aim at having an optimal combination of financing methods as a tool of financial management and control (McLaney,2009). Capital sources can broadly be classified as equity capital and borrowed capital; equity capital is owners money while borrowed capital are finances gotten from third parties and takes different forms. Supporters of classical capital structure theory believe that debt is detrimental to a company and does not add value; they see debt as an added obligation to a company that does bring a substantial tax advantage (Helfert, 1997). This paper focuses on the role played by debt financing in lowering the cost of business as well as adding value to equity holders.

Literature review

Debt is borrowed capital that comes in different forms, the capital come from other parties other than owners of the business and internal capital sources. When a company gets a debt, it registers a creditor of which it has the responsibility of fulfilling the legal obligation holding them together. The following are the debt options available for a business, hire-purchase, mortgage finance, bank loans and overdrafts, trade creditors and other trade financing instruments like debentures and share certificates.

To qualify for debt finance, a company need to have a good reputation and has the capability of paying the loan principal plus the interest accruing from the loan; leaders are concerned about the history that a company has had with other lenders as well as the assets that the company has must be adequate to qualify the loan (Dlabay and Burrow, 2007).

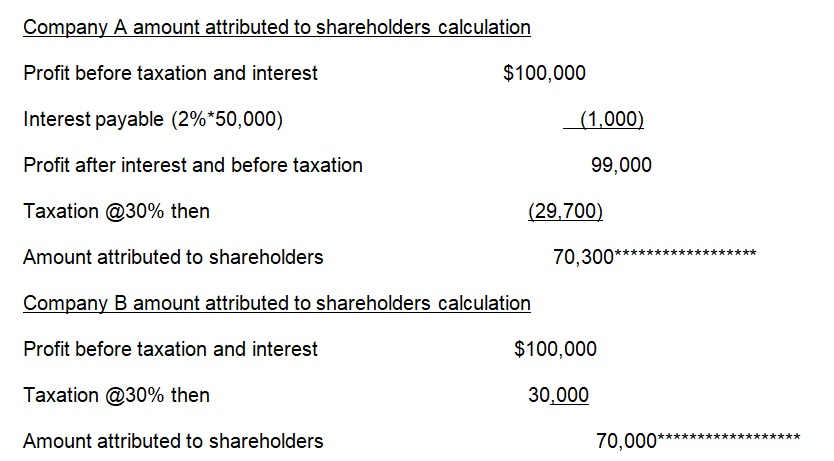

According to International Accounting Standards, interest paid on loans for business purposes is an allowable deduction when calculating corporation tax payable over a certain period. An allowable deduction means that the amount is allowed to be deducted when calculating the income that a company can have, the effect of a deduction is in two folds, it reduces the interest payable and increases the revenue of a company. Shareholders gains from a company are from the net results after all financial obligations have been met, the available amount distributable to shareholders is calculated from the difference between net profits and taxation. In the case that a company has financed its operations from debt, then the company will have an increased cost of running a business in the form of interest payable thus its relative amount declared as income for a certain period will be reduced (Michael, 2006). Consequently, tax payable is calculated as a percentage of income; let’s take a hypothetical case;

Company A has its capital financed by debt finance and equity shares; the ratio of the share is as follows, 50:50; the company has a total capital of $1,000,000, thus the debt is $500,000 payable in ten years.

Company B policies do not allow the use of debt financing, it has the same capital as company A, both the companies made a profit before tax and interest of $100,000. Both companies policy attributes all net profit to their shareholders.

The rate of taxation is 30% and the rate of debt finance is 2%.

The following is the company’s shareholders amount:

From the above analysis, despite the companies having earned the same profit before taxation and interests, after interest and taxation, company A with the debt obligation records a higher amount attributed to its shareholders. It has paid less tax than company B. Alternatively, the amount that is financed by shareholders equity is $500,000; if we assume that both companies par value of shares is $500, then company A will have 1000 shareholders while company B will have 2000. According to dividend policy, dividends are decreased according to the value of a share, if in the case above divided per share, then:

In company A each shareholder is likely to get 70,300/1000 = $70.3 per share, then in company B, the gains per share will be 70000/2000 = $35. The gains that shareholders get are higher when the company uses debt capital than when using only.

Despite the advantage in taxation angle that a company is prone to enjoy, different legislations have set on mechanisms to control the liquidity and debt ratio that a company can adopt in a certain period. There are certain levels that the interest payable is not allowable. Finance managers should understand well the game of tax planning using debts. They should maintain an optimal debt level that does not create anxiety or misunderstanding that a company cannot meet its financial obligation and must consider loan finances (Fridson and Fernando, 2002)

To succeed in the current business environment, a business should have robust management that can take advantage of opportunities that arise; opportunities can only be tapped when a company has adequate working capital. Getting debt finance is one of the simplest methods of getting finances, it can be a called throw away, thus when opportunities arise, a company can be assured of getting finances immediately to tap the gains. When compared with the time and process of floating shares the costs involved are much lower and higher assurance that the company with getting the finances. When accompany gets its finances at an appropriate time to tap available resources, then it gets higher returns to the benefits of shareholders. With higher returns a company pays higher taxes to the concerned authorities; when a certain section of an economy pays a higher rate of taxes, then the company attracts higher government investment in the area. This further reduces the cost of business operation (Bill and McKeith, 2009)

Analysis and Discussion

Classical capital structure theory is misleading when it illustrates that debt has not much positive implication to the value of shareholders and in reduction of operation costs. When a company manages its debts effectively and there is an optimal rate, then it enjoys a taxation gain since interest payable on loan capital is an allowable expense according to international accounting standards and GAAP. The above benefits are more direct since the company can attribute the amount saved directly from the amount of interest paid. From an indirect angle, when a company is using debt finance, it enjoys a low rate of capital acquisition, compared to floating of shares; debt financing costs are much lower. This reduces the cost of operating business (Weygand, Kimmel and Kieso, 2010)

In the changing business environments, there is a need for a company to have adequate working capital to take advantage of the opportunities offered by the market. Debt is a fast way of getting financing amount thus a company can fully enjoy benefits brought by the market situation. Taking advantage of a prevailing condition results in an improved business and increased gains in a company; the net effect is an increased value on shareholders. To qualify for a loan, a business must satisfy its shareholders that it has the capability and will to cater for the legal obligation. The psychological approach makes the manager more robust and makes strategic decisions; the success of an organization is dependent on the quality of the decision made by its manager; thus a company will be making major gains from the strategic decisions. One of the major attributes that make a good manager stand out is his or her decisiveness, when managers make effective debt financing decisions, they lay a platform for gauging their effectiveness and decisiveness (Atrill and Jenner, 2009)

Conclusion

Debt is borrowed capital that comes in different forms, the capital come from other parties other than owners of the business and internal capital sources; supporters of classical capital structure theory oppose using debt capital has a positive effect on a company. However, when a company is using debt finance, it enjoys a reduced taxable amount, thus paying low taxes and can take advantage of opportunities offered by industry.

References

Atrill, M. H. and Jenner., 2009. An Introduction: Accounting 4. Boston: Pearson Education Inc.

Bill, C.and McKeith, J., 2009. Financial Accounting & Reporting. New York: McGraw.

Dlabay, R. and Burrow. J. 2007. Business Finance. New York: Cengage Learning.

Fridson, M. and Fernando A.,2002. Financial Statement Analysis: A Practitioner’s Guide.New York: John Wiley.

Helfert, A., 1997. Techniques of Financial Analysis: A Modern Approach. Chicago: Richard D. Irwin, Inc.

McLaney, E., 2009. Business finance: theory and practice. New Jersey: Prentice Hall.

Michael, S., 2006. Advanced Accounting: Concepts & Practice. Issues in Accounting Education, 21(1), 69.

Weygand, J., Kimmel, P. and Kieso, A., 2010. Financial Accounting: IFRS. Illinois: Northern Illinois University.