Introduction

The Kingdom of Saudi Arabia adopted railways as the fastest and reliable mode of transportation. Historically there was vast distance to cover. Environmental conditions prevented the speedier development of railways. Therefore, air travel was considered as the feasible mode of transportation within different regions of the Kingdom. With major development programs undertaken by the country during the second half of the twentieth century, development of railways has become inevitable for a rapid progress. The Hejaz railway was the first rail project to be developed in the country. It was a narrow-gauge railway. The route taken was from Damascus to Medina. This train was operated through the Hejaz region of Saudi Arabia. The original objective of building Hejaz railway is to transport pilgrims from Damascus to Medina. Even though the idea was conceived in the year 1864, it took almost 40 years for realizing the project. The Construction of railway projects in Saudi Arabia had to face several challenges. Some of the challenges were financial ones and some other challenges related to technical issues. Construction, maintenance and guarding of the railway lines were the difficult tasks amidst problems of unpredictable and local tribesmen and variations in the terrain. Nature of the ground also posed significantly problems in constructing railways. Water scarcity was yet another problem faced by the railways. Maintenance of railway lines was also disrupted by occasional torrential rains causing flash floods washing away bridges and banks. This caused collapse of the lines on several locations. However the Kingdom witnessed the introduction of modern railways after World War II. Improvements in the railway were implemented for the transportation of petroleum products of Saudi Aramco from the Persian Gulf ports to different warehouses in Dhahran. Railways in the early stages were operated by Saudi Aramco. Later on from the year 1968 a state-owned Saudi Railways Organization (SRO) corporation was made responsible for running the organization. The organization undertook several development projects. The projects related to the extension of railway line to Riyadh. Development of a number of passenger terminals and constructing and operating a dry port in Riyadh were some of the other projects completed by SRO. With an idea of bring up a full-fledged Haramain High Speed Rail (HHR) project fully operational within 2012, SRO has entered into several key contracts with international design and construction firms as the first phase of development. One of such contracts has been entered into with the joint venture of Dar Al Handasah (Shair and Partners) and Getinsa of Spain. This contract is for the “supervision of construction, design and project management of the project.”(Gulf Construction, 2009) This paper presents a case study on the organizational structure and operations of the Spanish company Getinsa within Saudi Arabian railways.

Getinsa – an Overview

“GETINSA is an engineering company founded in 1984. Its human and material resources enable the company to embark on a full range of projects and studies in the field of civil works and lineal infrastructures.” (Devex, 2000) Getinsa develops a wide range of activities within the railway sector, from feasibility studies and environmental impact assessments to technical assistances in railway infrastructure maintenance, as well as final design, control and supervision of works, platforms, rails, traction elements (electric sub stations, catenary, etc), signalling systems, telecommunications and security.” (GETINSA, 2009) The company started its expansion in the international arena in the year 1989 using its expertise in the engineering projects. Presently the Company is registered in world-renowned institutions like World Bank, United Nations Development Projects, and European Union.

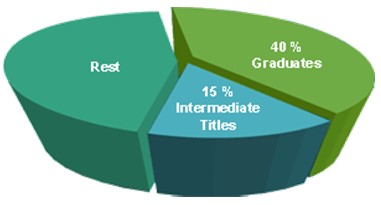

Getinsa is staffed with more than 250 professionals working in its various international projects. The following figure shows the composition of the professional team of the company. It may be observed that more than 40% of the team consists of professional graduates like engineers, lawyers, biologists and geologist. Considering the value of the human capital the company provides a number of external and internal training programs to enhance the knowledge and expertise of the people in the related fields. A significant proportion of the employees have wide experience in the civil engineering discipline.

In the year 2001, Getinsa created a consortium together with five other industrial companies for the promotion of international operations of the founding partners. The new consortium created has carried out several large design projects including a new massive transport system in Mexico City. The Company has expanded its operations in the Eastern European countries focusing mainly on Poland and Hungary, through various projects financed by the European Union. Getinsa entered the Asian market in 2003 by opening its branch office in Manila looking after projects that came up in Afghanistan and China.

In the Kingdom of Saudi Arabia, the Company has undertaken the project of supervision and control of design, supply, installation and maintenance of the signaling and telecommunication system in certain specified sectors and the project management of Haramain High Speed rail project.

According to the Transport Minister Dr. Al Suraisry

“The contract aims at providing consultancy services to ensure the quality in the project implementation according to the highest international standards with high quality specifications as well as to guarantee the optimal use of the huge amounts approved to achieve the required consequences, economic and social returns planned by the country for such strategic projects.” (Saudi Railways Organization, 2009)

Getinsa is awarded the contract keeping in view its technical knowledge and experience in similar international projects of repute.

Business Strategy and Motives for Expansion

Business strategy of a firm may be defined to include a business plan that encompasses the company vision and the strategies which will help the company to achieve the established objectives. The business strategies should also identify the resources required and the ways in which such resources may be accumulated for use by the firm. The strategies must define the significant milestones and the process to reach such milestones. Through the business strategies the firm should be able to identify the organizational members responsible for causing each step in the process of achieving the objectives. The strategies should be capable of indicating the potential business risks and external factors which need to be kept under review for informing the management the changes required to be adopted in the strategies or long-term plans.

Since the Company was founded in the year 1984 there has been a continuous effort on the part of the company to consolidate its market position. The company has supplemented these efforts “by performing Studies, Projects & Technical Assistances at Civil Engineering, Transport, Telecommunications, Hydrology and Hydraulics, Environment, Natural Resources and Social Development.” (ICEX, 2007) The Company manages its projects pursuing a global and integral perspective in the different phases of each project. The Company follows a systematic planning and exploitation in the execution of all its projects. The execution encompasses intermediate steps like feasibility studies, final design and supervision of the project management. Getinsa is keen on strengthening the institutions with which it is associated by training the people as well as transferring its own expertise to the members of the client organization. The core competence of the Company is that it can undertake projects of a complex nature and the company is able to execute the projects from an independent and professional point of view.

With a view to enhance its professional knowledge and expertise Getinsa has associated itself with several international professional bodies. The Company has become a member of international technical organizations, standardization bodies and the Company has also encouraged its professionals and managers to hold recognized positions in a number of international organizations. In addition, the Company has implemented and continues to maintain quality and environmental management systems which meet the requirements of the national and international standards organization which lay down the standards in these respects.

Resources and Capabilities of Getinsa

In general, formulating strategies focuses on matching the resources and capabilities of a firm to the opportunities arising from the external environment. The ultimate aim of evolving and implementing strategies for a firm is to attain sustainable competitive advantages. Therefore a resource based view postulates that a firm has to use its available resources and capabilities for garnering distinctive competitive advantages which enables the firm to add value for the firm. Value can be defined as what customers assign to a product based on its attributes. A competitive advantage can become a distinctive one when it allows the firm to differentiate its products. Although all the resources and capabilities are important to an industry, the firm has to identify the important ones based on the factors that make them useful for the firm to become successful. The firm has to organize its resources and capabilities based on their relative importance and compare them with those of the competitors. This process will enable the firm to identify its strengths and weaknesses which can be manipulated intelligently to achieve sustainable competitive advantages. Competitive advantage enables a firm to outperform rivals on profitability. Innovation and responsiveness to change are the bases on which competitive advantages can be developed. In order to be sustainable competitive advantages should possess the characteristic features of uniqueness and they should be difficult to replicate. The competitive advantages should also be superior to competition. Then they remain sustainable and applicable to multiple situations.

Getinsa is a leading provider of specialized project management services essential for various large scale infrastructural and engineering projects such as railway projects, road and bridge constructions. The company occupies a unique position in the industry because the company provides excellent project management solutions for the total completion of the projects. The integrated solutions offered by the company are designed for efficient project management and execution. By acquiring core expertise and applying an integrated approach to projects on hand and offering assistance from the company’s own technical teams capable of managing infrastructural management issues in all the phases from planning to completion and maintenance. Another distinct resource the company possesses is the provision of expert in-house staff which enables the company to provide services connected with all intermediate phases such as profitability assessment, feasibility studies and pilot studies to evaluate the project feasibility. This offers greater chances for the clients to maximize their revenues with minimum risk. Turnkey manufacturing solutions represent total production solutions for meeting a required level of output. Turnkey solutions for construction of new production facilities are normally offered to new factories entering the industry.

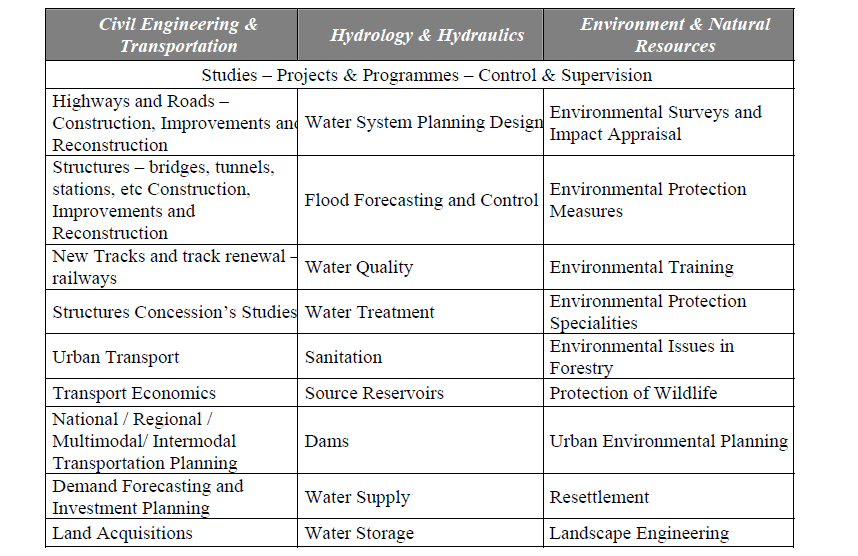

With respect to the resource and capabilities of Getinsa it is observed that the company has extensive capabilities to assist large corporations in various fields. This can be seen from the following table which indicates the core competencies of Getinsa.

From the table it may be observed that the company has specialized in several areas and has competency to assist private and public sector organizations in large projects. A high level of specialization in road-rail transport projects has enabled the company to earn international reputation. Saudi Railways Organization has awarded the contract to maintain the HHR project based on the capabilities of the Company.

Growth Strategies adopted by Getinsa

With a view to increase the market share and optimize the revenues and profitability, Getinsa mainly relies on expansion strategy. This has made the company to penetrate in to different regions of the world that offered potential market for the knowledge and experience of Getinsa. In order to supplement the expansion strategy the company is also keen in forming different consortiums in a global context. This has increased the competitive strength of the Company. The company is striving to supplement its competitive strength through rigorous research and development. In order to expand its knowledge in different areas the Company has created R&D department to explore under-researched areas and technical problems connected with those areas. Getinsa is currently working on research projects relating to tunnel modeling and instrumentation systems for construction, operating and maintenance management. The Company has also initiated research programs aimed at developing a computerized works management system.

With the change in the world economic scenario from a downward trend to recovery there is the likelihood that a number of infrastructural projects are committed by several public sector organizations worldwide which enhances the opportunities for Getinsa. The industry experts are of the view that there is a major upheaval in the industry with weaker firms either closing down or selling off their major portions of their operations to other large players in the industry. This offers a wide opportunity for Getinsa for trying out an acquisition strategy for its expansion.

SWOT Analysis of Getinsa

The environmental factors internal to the organization can be classified as strengths (S) or weaknesses (W). Opportunities (O) or threats (T) of the firm are the results of the impact of the operation of the external environment on the firm. The analysis that contains all these four elements is described as a SWOT analysis. SWOT analysis presents an analysis of the internal environment of the firm which enables the matching of the resources and capabilities of the firm to the external environment that remains competitive. Therefore SWOT analysis becomes important in formulating the strategies and their selection for implementation. In order to be profitable and growth oriented a firm should function on its strengths, improve upon its weaknesses. At the same time the firms should protect itself against the impact of threats and vulnerabilities both external and internal to the firm. The SWOT analysis of Getinsa is presented in the following section.

Strengths

- The expertise and exposure of the Company to different areas of specialization add to the versatility of the firm to undertake and execute any type of project which is a distinct strength for the Company.

- The reputation of the Company in the international market is an additional strength for the company which enhances its chances for a multi-national presence.

- The human resources competency exhibited with the availability of a number of professional teams and members adds to the strength of the company.

- The organizational structure of the company with clearly defined functional areas enable the company to execute the projects awarded to it efficiently. In addition, the company is delinked from financial and construction groups and the professionals working with the Company owns the share capital. This provides an additional incentive for the organizational members to work with more commitment towards the organization.

Weaknesses

- Lack of specialization in specific areas of performance may become a weakness as well for Getinsa. By undertaking projects in different areas of operation the company may the advantage of specializing and becoming more professional in particular field. Thisthe quality of professional service the company provides to its clients. The multi-area specialization may amount to growth of the organization without direction.

- Multi-national presence of the organization may give rise to problems associated with human resources in the respective countries because of different cultural orientation specific to the respective countries. The Company has to safeguard its interest in this respect.

- With the expansion of activities in different geographical locations, maintaining the present organizational structure may become a complex affair in the long-run. Changing the structure at a later stage may affect the morale of the professionals and hence the profitability and growth of the Company.

Opportunities

- Change in the world economic climate may lead to wide range infrastructural development projects like road and bridge construction in many of the economies. This offers a potential business opportunity for the company. Stricter environmental legislations and awareness among the nations also provide an enhanced opportunity for the growth in the Company’s business.

- Change in the attitude of public sector undertakings and governments to entrust the management of large scale projects to specialize organizations such as Getinsa increase the chances of getting more number of large contracts.

- Economic globalization has enlarged the opportunities for more strategic alliances of firms operating in different geographic locations which increase the opportunities for Getinsa to enter into more purposeful consortiums with different organizations.

Threats

- Growing competition from more specialized firms is the major threat for the Company. The company has not formulated any specific corporate vision or objectives based on which it can develop the competitive abilities. Corporations having defined mission, vision and values and objectives can easily capture the market share of Getinsa, unless the company defines its business boundaries more clearly.

- With tighter federal and national budgets the governments may find it unviable to appoint specialized agencies like Getinsa for controlling and monitoring their projects. This is a serious threat to the business growth of Getinsa.

- With more professionals opting to serve information and communication technological (ICT) firms pursuing their careers in ICT fields, attracting best talents in core engineering fields may become scarce making it expensive to retain best talents affecting the quality of service provided by the Company.

The SWOT analysis reveals that despite possessing certain distinct resources and capabilities, there are weaknesses and threats that the company has to consider and take suitable actions to convert such weaknesses and threats to its advantage. This requires a careful strategic planning and implementation of the strategies in a formalized way. Even though expansion strategy is considered as suitable for the company, there is the need for the company to strengthen its professional base before the company can expand to external markets.

Competitive Advantage and Mode of Entry Strategies in Saudi Arabia

Entering a new market is a complex decision which must be approached with great focus and attention. More and more firms are desirous of entering foreign markets with a view to establish a business that would attract the recognition and patronage from the customers in different geographical regions. One of the motivational factors identified to have induced companies to expand globally is to acquire a distinctive competitive advantage unavailable to the competitors. There are a number of factors such as technology, availability of finance, factor supplies and political, legal and regulatory climate which play a dominant role in the selection of a suitable mode of entry strategy. The choices of market entry mode are interdependent on the type of market that a firm will consider for entry. These choices possess an endogenous character and are often self-selected by the firm itself based on the internal capabilities of the firm and the external contingencies (Luo, 2001). According to experts in this field, each entry influences the level of control that the organization can exercise on its foreign operations. The extent of capital investment required and the degree of risk the firm faces in venturing into a foreign market are some of the other factors that the firm has to consider in choosing the entry mode (Hennart, 1988).

While Saudi Arabia is considered as an attractive market with actual returns in excess of the anticipated returns, it is not an easy market to penetrate. Branch, (2000) is of the view that Saudi market is one which is steady within its local cultural bounds and is increasingly becoming modernized. With its large size and the wealth of the urban middle class Saudi market has been found to be an attractive destination for many of the foreign firms. Accession to the World Trade Organization (WTO) has been instrumental for a change in the outlook of the government towards the long-term economic reform programs in compliance with the WTO regulations.

The entry strategy for Getinsa for the implementation of the HHR project is on a joint venture basis with Dar Al-Handasah (Shair and Partners). The objective of awarding the contract to the local firm jointly with the Getinsa was to ensure a quality level in the implementation of the project according to the international standards. The contract also aims to guarantee the optimal use of the huge financial and other resources committed to the project. The service by Getinsa is to be offered from the start of the project until the completion.

The following are some of the competitive advantages that Getinsa has depended on for its entry into Saudi Arabian market. Getinsa

- is already executing prestigious consulting and engineering contracts in various other countries across the world which has enabled the company to acquire extensive experience and specialization in railway construction activities.

- has vast experience in designing, manufacturing and maintaining high speed trains.

- is well experienced in the provision of rail services and systems integration

- has earned the reputation of providing reliable customer service in respect of all the intermediate processes in any project execution

- has the financial and human resource capability to serve a project of this size.

Entry Strategy of Getinsa

The entry strategy adopted by Getinsa into Saudi Arabia can be considered as a strategic alliance based on a joint venture. In general any relationship between two firms which involves mutual dependence and shared decision-making can be considered as a strategic alliance. Such strategic alliance differs from the traditional form of joint venture since strategic alliances are increasingly formed between the firms functioning in industrialized nations and in the case of strategic alliances the focus of the firms is towards developing new technologies rather than engaging themselves in the distribution of existing products or services. There are a number of reasons for a firm to opt for a strategic alliance. They are: (i) growing barriers for a firm to enter into a foreign market, (ii) expanding importance to adopt global standards, (iii) for building and sustaining the market position in a foreign market, (iv) for gaining competitive advantages in industries undergoing major transitions, and (v) for ensuring that the cultural factors in the country of entry do not affect the progress of the business.

Managing International Alliances

Getinsa has to take into account several elements into account for managing its international alliances including the one which it has entered into in Saudi Arabia. The logic of collaboration is the first and foremost factor for Getinsa to consider which involves identifying the circumstances under which it should opt to collaborate. While an alliance can be considered as one among several options open for pursuing a strategic goal, it cannot be considered as the end by itself. The strategic goals may be the exchange of products or services, corporate learning and market positioning in the new market. Buying the inputs or skills or full acquisition are the alternatives available for collaboration. There are a number of key issues in managing international alliances. They are: (i) selection of a suitable partner, (ii) proper structuring of the alliances, (iii) building constructive networks for ensuring success of the alliance and (iv) recognizing the limits of alliance including the constraints on collaborative strategies and other organizational constraints.

Structuring alliances implies the selection of organizational forms which will ensure success for the alliance partners. The contractual terms and conditions of equity relationships must be properly laid down to avoid any issues in the future. While building an alliance network it is important to define the role of each alliance partner and also the party who is to control the network. The source of competitive advantage should also be identified while building the alliance network. In the case of Getinsa, the source of competitive advantage lies with the company as the Company is providing the necessary technical expertise for maintaining the HHR project in Saudi Arabia. Since the project is expected to bring an essential change in the land transport services in the Kingdom of Saudi Arabia, the expectations from Getinsa is more in terms of assistance in efficiently managing the project for the timely completion with the highest international standards. Therefore, Getinsa should have proper strategic plans in the selection of their alliance partner as well as in the execution of the project so that the company will be able to meet the expectations of SRO.

Challenges, Issues and Prospects in Saudi Arabia

Even though the entry into Saudi Arabia market provides a valuable business opportunity for Getinsa the company has to face a number of challenges and issues and provide for these exigencies, if the company has to sustain its growth in the country. The experience of Jordanian government to award a lease to a consortium to upgrade the existing railway lines and build a new one has to be remembered. The project undertaken in the year 1999 failed because of lack of preparation and lack of the Jordanian government’s ability to secure the agreement of third parties to the usage levels and tariffs. The Jordanian experience needs to be applied to the Saudi Arabian context where there is an excessive dependence on the third party usage for realizing the revenues for the project. Investments in large railway projects will not be without risk. There will be a wide range of commercial and legal issues that the contractors and investors are likely to confront while carrying out the projects.

Issues connected with Financing

A major part of the projects of large sizes will be in trying to reconcile the differing objectives of the different parties involved in the project. It is important that a perfect understanding of the perspective of the other parties is arrived at to ensure the success of the execution of the project. There are a number of considerations like (i) the project should ensure a reasonable return to the investors, (ii) the public sector should provide a conducive legal and regulatory requirement to support the execution of the projects, (iii) there should be project organizations established which support and encourage a proper utilization of the resources and (iv) there should be a guarantee that the political environment in the region ensures the safety of the investment.

Legal and Regulatory Issues

It is vitally important that the contractors and investors get a clear understanding of the legal and regulatory environment in which the project will be executed. The review of local laws and regulations will have to be extended to both specific laws as they are applied to railways and the general laws prevalent in the country that may have an indirect impact on the participating agencies. Key local issues that may need a consideration are:

- Terms on which the railway projects and operations are regulated in the Kingdom. This review should extend to the right of private sector organizations to construct public infrastructure. It also should cover the licensing and operation permissions, safety and fares regulations, protection from other competing transportation modes and a study of the competition laws that are applied to rail industry and other transportation sectors

- The constitution of the new organization to be established with relevance to the incorporation laws in Saudi Arabia

- The fiscal and tax laws of Saudi Arabia governing transfers of business assets

- The provisions of the existing Saudi laws in respect of assignability or transferability of existing third party contracts. The company should consider the extent to which such transfers or assignments are dependent on the consent of third parties and the legal provisions

- The employment laws applicable to the expatriate staff and the laws governing the employment of local people for the timely execution of the project

- “The non-applicability of standard “Western-style” security mechanisms in Saudi Arabia (for instance, true security cannot be taken over shares in a project company, there is no effective mechanism for registration of security in Saudi Arabia, and there is no concept of a floating charge such that asset security is essentially ineffective)”

- Difficulties involved in enforcing standards of care within the Kingdom. This implies that there should be professional bodies or governmental authority which are capable of officially recognizing the standards imposed. This also calls for a careful structuring of the project maintenance agreements and other operation and maintenance agreements.

- There is the existence of an uncertainty with respect to resorting to arbitration in case of disputes. The fact of existence of difficulties in enforcing foreign judgments when they are opposed to public policy also needs specific consideration in entering into railway-related projects in Saudi.

Project Structure Issues

There are a number of issues that are connected with the structuring of the project organization, which need careful attention before concluding the contract. They are:

- The division of responsibility for the operation and maintenance of the non-private sector assets or covering the joint use of railway assets is one major issue that needs to be resolved.

- Funding of the project as to whether the entire financing will be done by the government and if there is private financing participation, the extent of such participation needs to be ascertained. The extent of contribution by the government must be assessed to have a clear understanding of the strength of the project

- The thinking of the government with respect to its wish to be part of the project organization and if so the level of the governmental exposure is to be ascertained before signing the contract

- The extent of risk transfer to the participating agencies needs a special consideration. For instance, risks in relation to existing asset condition, cost of construction and schedule of completion, operational costs, volume and tariff concerning the freight movements and insurable and financing risks will have a bearing on the decision to enter a foreign market.

- The jurisdictional powers of regulatory authorities over the contractual terms are of significance while deciding on accepting the contract

- There may be instances where it becomes important to fix the responsibility on any one party to look after land acquisition process and to ensure vacant possession of the required land. Clear lines of demarcation on the responsibility for making compensatory payments to landlords and other persons entitled to acquisition compensation should be established to avoid future disputes and development of unpleasant situations

- It has to be ensured that the construction and operational requirements of SRO are clearly and adequately defined so that there can be a proper allocation of construction period risks among the participating agencies

- There must be complete freedom given to the contracting parties to develop its own operation and maintenance functions. However there may be certain areas where the government would like to retain its control like on procurement of rolling stock, performance measures and penalties and deciding on the level of system enhancement to be provided.

Thus the task of identifying and allocating risk and responsibilities is complex, time-consuming, but is of vital importance if the projects undertaken are to be completed successfully. In addition, there may be issues connected with the interfacing of the projects with ports, with other Saudi rail schemes and with passenger concessions that may be considered by SRO during the periods of construction. For instance the Saudi ports are under the direct supervision of Saudi Port Authority which may create some interfacing issues with other railway projects.

Prospects

Although the privatization move of the government of Saudi Arabia is a major step towards economic liberalization in the Kingdom, this move is affected by various challenges and issues that the participating agencies have to consider before deciding to expand more in the Kingdom.

However, the Government of Saudi Arabia has anticipated that an expanded railways network will be able to support the rapid growth of the national economy. With this expectation the government has started financing large scale investment projects in railways and the government also encourages private sector participation in a larger proportion. This has widened the scope for international contracting companies to enter Saudi Arabian market.

There are other financial concessions that provide the necessary incentives for the international firms to consider expanding into the Kingdom. Since there is no exchange control mechanism operating in the country, funds are freely transferable from and to the country and are also convertible without any restriction. Moreover the Saudi Riyal is pegged o the US dollar which offers a safe playing field without the fear of any losses due to exchange fluctuations. Downward changes in tax rates and the facility to carry forward the losses encourage more number of firms entering the Saudi market.

Conclusion

Railway transportation has distinct advantages over other modes of transportation. Railways enable transportation of large volumes of cargo. The transportation is facilitated based on regular schedules over long distances. The cost of transportation is also comparatively low. This mode is also safe and efficient in energy consumption with lower impact on the environment. Railway projects in general have large initial capital investment with lower operating costs. In addition large industrial and agricultural projects depend on the existence of a reliable and cost-effective transportation system like railways for their success. “The geographical expanse of the Kingdom, the obvious economic benefits of connecting the different regions of the Kingdom by railways and the discovery of large mineral ores in different parts of the Kingdom; such as Phosphate deposits in Hazm al-Jalamid north of Sakakah and bauxite deposits i n a l-Zubayrah; northeast of Buraydah, made the expansion of the current railways network inevitable.” (Saudi Railways Organization, 2009) Therefore based on the recommendation of the Shura (Consultative) Council, feasibility studies of expanding the railway networks were undertaken. As suggested by the World Bank study the Kingdom adopted an ambitious program of developing and expanding railway network in the country. This program included four major projects. Out of these four projects, three were assigned to Saudi Railways Organization (SRO) which in turn awarded one of the High Speed rail projects to local firm jointly with Getinsa, a Spanish firm.

This paper assessed the relative strengths and weaknesses of Getinsa, the Spanish company engaged in the provision of engineering and infrastructural consultancy and project maintenance. The opportunities for the company in the Kingdom of Saudi Arabia appear to be bright in the light of the radical moves by the Saudi Railways Organization to promote a major overhaul of the country’s railway infrastructure. This offers clear opportunities for contractors and potential investors in large railway projects in the Kingdom of Saudi Arabia. At the same time the contractors and investors should consider a number of complex challenges and issues associated with the relationship between Western and Islamic legal systems. There are other environmental and societal issues that may also impede the progress of the project work which need careful consideration by the company. This necessitates Getinsa to ensure its legal and commercial teams to become familiar with the railway transport sector in the Kingdom. The teams should also enlarge their knowledge on the domestic and foreign laws which enable them to anticipate and deal with the complexities so that they can contribute to an effective project planning.

This paper also presented several challenges and issues connected with the implementation of large scale infrastructural projects in the Kingdom of Saudi Arabia, which includes financial, legal and regulatory issues. The paper also discussed the issues connected with structuring the project organization within the Kingdom for the proper execution of the project. Getinsa in order to be successful in executing its project in Saudi Arabia has to take into account the impact of these challenges and issues discussed herein. The Company has to incorporate necessary terms and conditions in the project implementation or maintenance contract so that it can safeguard its interest against the potential risks and losses arising from such challenges and issues. It can be reasonably be stated that, the company can establish its presence in the Saudi market successfully, provided the company can take adequate measures to combat the likely challenges in the railway projects within the Saudi Arabian context.

Recommendations

Though the company’s expansion strategy would bring it the additional market exposure it requires, exposure to local environment in Saudi Arabia appears to be a critical factor that would enable the company to sustain its leadership position. This necessitates the company to work towards strengthening of its local base given the cultural background and legislative environment prevailing in the Kingdom. Getinsa can work towards this through the process of entering into more strategic alliances with established firms in Saudi Arabia. This strategy would not only improve the inherent strength of the company but would also add to the existing non-technical strength of the Company. This non-organic growth initiative will support the development and execution of other business strategies to drive the organic growth of the company. However the company should consider all the relevant aspects in choosing its alliance partner and the conditions attached to the forming of the strategic alliances.

Strengthening research and development activities to supplement the introduction of new initiatives in environmental and other areas of specialization is another important strategy that the company should adopt to improve its market position. The strategies to acquire technologies, strengthening the research and development area and venturing the new markets are the best defensive strategies that Getinsa can adopt in the context of a perceived opportunities existing in the Kingdom of Saudi Arabia and anticipated increase in the global demand for infrastructure consultancies.

Reference List

Branch, A.E., 2000. Export Practice and Management, 4th edition. London UK: International Thomson Business Press.

Devex, 2000. Getinsa. Web.

GETINSA, 2009. Railways. Web.

GulfConstruction, 2009. Makkah & Madinah $ 7 bn Railway Streams Ahead. Web.

Hennart, J., 1988. A transaction cost Theory of equity joint ventures. Strategic Management Journal, 9, pp.361-74.

ICEX, 2007. Spanish Companies Active in EU External Programmes and International Development Institutions. Web.

Luo, Y., 2001. Determinants of entry in an emerging economy’s multilevel Approach. The Journal of Management Studies, 38(3), pp.443-72.

SaudiRailwaysOrganization, 2009. Expansion & Privatization: Moving Forward wih a Clear and Promising Vision. Web.

SaudiRailwaysOrganization, 2009. Latest News: Speed & Luxury are our Features. Web.