Introduction

Information technology has the potential of changing the way organizations do business (Porter & Miller 1985). It has created a plethora of opportunities for businesses to tap strategic opportunities and increase cost performance (Benjamin et al. 1983). The climate for business environments for traditional form of business has continuously changed and this has given rise to the need for companies to leverage the information edge. Many companies have taken advantage of the information revolution that spread the business world, and one such company is leading air freight and logistics company FedEx.

FedEx is one of the leading overnight courier and freight service, logistical solutions, and business support services (Datamonitor 2008). It operates primarily in the US and in 220 countries around the world. It earned revenue of $ 35,497 million in the fiscal year 2009, which was an increase of 2.1% over 2007 (FedEx 2009). The three main business divisions of the company are FedEx Express, FedEx Services, FedEx Freight and FedEx Ground. The growth rate the company declined from 7.8% in 2008 to 2.1% in 2009 (FedEx 2009).

FedEx is a known name for its capability to leverage the IT advantage in to express freight logistics business. FedEx received the best Air Cargo Carrier of 2008 award given out during that eighth Annual Supply Chain Asia Logistics Awards in Singapore (Business Times 26 November 2009). The award has been given to the company due to its supply chain and information technology (IT) management excellence. Today FedEx aims at changing its whole business model and moving over to the e-business domain. Thus, FedEx aims at changing the nature of its product and company structure in order to leverage the benefits of information technology.

This company analysis is based on FedEx’s Malaysian subsidiary – FedEx Express Malaysia. The analysis will present a brief background of the company’s operations in the Asia-Pacific market and a brief explanation of the company’s value chain. Then it will do an analysis of the competitive environment of FedEx Malaysia using Porter’s five forces model (Porter 1979; Porter & Miller 1985). The paper will also provide a brief competitor analysis of the company. A SWOT analysis of FedEx Malaysia will be done in order to understand the meaningfulness of the strategy undertaken by the company. Then the paper will discuss FedEx Malaysia using McFarlan’s portfolio framework (McFarlan 1981). In the end the paper will present the recommended strategy that FedEx Malaysia should consider taking in order to sustain competitive advantage.

FedEx Malaysia

FedEx started its international operations two decades earlier after the acquisition of Gelco Express, a courier service operating in Europe and Asia (FedEx Express 2009). In 1989, it acquired Flying Tigers, an all-cargo airline operating in Southeast Asia. With the growth in the Asian economy, the market for FedEx began to grow in the continent.

With increasing market, there arose the need to make a more innovative network in the continent, which it launched in 1995 as FedEx Asia One. So far, FedEx has continually thrived to increase its operations in the continent. Presently it owns its own operating aircrafts – MD-11 and A310 and has employee strength of 10000.

Information technology has been key to the business model of FedEx. It has strategically positioned itself in order to “provide global physical transportation, coupled with information intelligence” (Farhoomand, Ng & Conley 2003, p. 86). The company fosters a culture of business and processes integration through its US, European and Asian operations. FedEx leverages its use of an information system to handle millions of transactions daily. FedEx does this through two strategies –

- continuously improving its internal operations,

- integrating its global supply chain (2003).

It has utilized information technology to increase internal efficiency and its innovative “hub-and-spoke” concept was a source of competitive advantage to the company.

Express Delivery Industry in Asia

The express logistics market in Asia Pacific is growing driven by the high growth rate of countries like China (Biederman 2008). The Asian air cargo market has grown to $30 billion in 2008. According to Global Air Freight Forecast, the intra-Asian airfreight market is expected to grow at 7.5 percent from 2008 to 2017 (28 July 2008). It has been stated that the Asia Pacific market for freight and logistics is “one of the fastest growing in the world, with a current annual growth rate of around 15 percent” (28 July 2008, p. 52).

The Asia growth in the freight industry has also been boosted by the increased export and import from the region especially from countries like Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam. The trade within the ASEAN countries and with China has also resulted in a boost of the market. There has been a rise in the multinational companies operating in the region due to increased drive of outsourcing and global expansion. This has resulted in the growth of the airfreight industry. Regional governments also support express delivery service, as they believe it provides a catalyst to economic growth.

From the above industry background in the Asia-Pacific, it becomes imperative that the market has tremendous growth potential and opportunities. In the next section, we will conduct porter’s five forces analysis for FedEx Malaysia.

Porter’s Five Forces Model

Information systems have changed the way FedEx did business. It has leveraged the power of information technologies to increase its operational efficiency and seamless supply chain management. FedEx was the pioneer in this aspect and thus had created a competitive advantage for itself. Here we will discuss the competitive landscape of FedEx in Malaysia using Porter’s five forces model (Porter 1979).

Supplier Power

FedEx in Malaysia has reduced its supplier power by slowly acquiring cargo airline in Asia and at the present day has its own MD-11 and A310 aircraft (FedEx Express 2009). FedEx has over 400 flights operating over Asia, Europe and the US, connected through its own carriers. The company has the world’s largest number of carriers amounting to 675 aircrafts (Cheng 3 October 2009). Operating its own fleet of flights, an integrated supply chain helps the company reduce the suppliers’ power to the minimum. Further, the other suppliers like the aviation and fuels for aircrafts, and other transportation modes tend to be large companies and therefore have a high degree of power over the market.

Competition

According to Porter, efficient use of information technology can change the competitive landscape for the company. The company invested the hub-and-scope model of freight delivery, which has been replicated by many companies now. The main competitions of FedEx in Malaysia are DHL and UPS (Cheng 3 October 2009). DHL and UPS are both international express delivery services and have large capacity. All of them operate globally and follow the same hub-and-spoke model first developed by FedEx. The industry rivalry is high as all the three competitors have a high degree of information technology capability and operational efficiency.

Substitutes

The threat of substitutes is high. According to Porter and Miller (1985), information technology increased the capability of companies to include minor to major changes in the product offering by simple and cheap alterations in their products. Similar substitution can be observed in case of FedEx. Further, there is always the treat of internet-based substitutes like e-mail, which may become a severe threat.

Buyers Power

The power of the buyers increases with the advancement of information technology. In the express delivery industry, buyers have the power of easy comparison of prices and service offerings of the industry operators. Therefore make or buy decisions are now done by buyers with the aid of more information at hand.

Entry Barriers

Increased use of expensive technology allows companies to get into better positions and forms a barrier for new entrants. The main reason behind this is the initial high investment cost of infrastructure. In case of FedEx, the use of information systems for transportation logistics like Customer, Operations, Service, Master Online System (COSMOS), Microsoft Message Queuing Services, e-Shipping Tools, etc (Farhoomand, Ng & Conley 2003). increases entry barrier. Further, the company has its own fleet of aircrafts, which reduces delivery time, and cost, and remain unrivaled by new entrant. Therefore, a new entrant is blocked with the sheer economies of scale the company enjoys.

The porter’s five forces model for FedEx shows that the company is in a very attractive position. Through industry, competition is high; however, the market structure is oligopolistic with three main players. FedEx derives its competitive advantage through the efficient use of information systems. It helps the company to lower its cost and leveraging the information system to undergo vertical and geographical expansion. Further it has helped the company to differentiate its products substantially from its competitors however, in a highly IT driven environment, replication of the differentiation strategy is commonplace.

Competitor Analysis

The main players in the express logistics market in Malaysia are FedEx, UPS and DHL. DHL started its Malaysian operations in 1973 (DHL 2009). It has more than 1200 staffs in the country and has 25 service centres all over the country. In Malaysia, DHL offers services like “Air Freight, Ocean Freight, Domestic Freight (Cargo consolidation to East Malaysia), Customer Program Management, Cargo Management, Warehousing and Distribution, Project Forwarding and Customs Clearance. Our key target markets include Fast Moving Consumer Goods (FMCG), Electronics, Healthcare, Pharmaceuticals and Automotive Part” (DHL 2009). It too has an integrated IT set-up to ensure real-time updates on inventory levels and provide great flexibility. Their business divisions are DHL Express and DHL Freight.

UPS too has it operations in Malaysia. They specialize in freight, express delivery, and shipments. It operates In Malaysia with the aim of targeting the SMEs in the country (UPS 2009). The company had opened hubs in the regions to compete with that of FedEx (Armbruster 2002).

In global airfreight and express delivery market, DHL, FedEx, and UPS are the three leading companies. In the overall international market, other than the US, the leader in terms of market share is DHL with 23 percent market share, the UPS with 10 percent share, and FedEx has 7 percent share (wikinvest 2009). Therefore, outside the US, FedEx has less strength than the other two companies do. However, in Asia, FedEx is the largest operator with a market share of 22 percent (wikinvest 2009). The strongest competitor of FedEx in the Malaysian market is DHL with a large share in the international market and largest network.

SWOT Analysis

After doing a comprehensive study of the competitive and the competitor landscape of FedEx Malaysia, we now conduct a SWOT analysis of the company. SWOT analysis will provide the internal strengths and weaknesses of the company as well as the opportunities and threats that the external environment has to offer to the company.

Strength

Brand Image: FedEx has been operating in the market for a very long time and has a wide recognition in the market. It has received the best company in logistics and freight services in Asia (Business Times 26 November 2009). It has been ranked as one of the top companies with high corporate reputation (Datamonitor 2008). The company’s four segments of operations – FedEx Express, FedEx Ground, FedEx Freight and FedEx Services – have wide brand presence. The promotional activities of the company are done through print and broadcast advertisements, corporate sponsorships, and organization special events. This brand image has hugely facilitated the company in its international expansion.

Leveraging Information Systems: FedEx has strategically positioned itself in the international freight transportation business leveraging its information intelligence. FedEx’s core business was physical transport of goods, which has been integrated into a supply chain, which handles all its operations together. The strength of the company is deliverance of quality customer service, and top down approach. The unique supply chain solution helps FedEx provide its customers with real time data on the internal process of the transportation system.

Extensive Distribution: FedEx has extensive physical distribution systems, which helps the company to locate their hubs in places, which are close to the market that is essential for serving SMEs who are key growth drivers in the Asian market (Biederman 2008). It has opened hubs in Indonesia and in the Guangzhou in China. Further, it has been acquiring small freight and logistics companies in order to increase their global presence and increase their distribution system.

Their scale of operation is extensive. They provide delivery within 24 hours or 48-hours and interregional less than truckload services. They provide document solution especially for businesses. Their large scale of operations helps FedEx to achieve a broader customer base and improves the revenue generation capacity of the company.

Weaknesses

Declining Growth: FedEx has been experiencing a decline in revenue from $37953 in 2008 to $35497 in 2009 (FedEx 2009). There has been a fall in net income. However, the company’s international operations increased tremendously. There has been a decline in the operating margin of the company, which fell from 9.8 percent to 5.5 percent in 2008 (FedEx 2009).

There had been a decline in profit margin too. The operating profit of the company declined by 36.7 percent from $3,276 million in 2007 to $2,075 million in 2008 (Datamonitor 2008). There was a decline of 44 percent in net profit in 2008 as opposed to the same in 2007.

The company also reported weak returns. Return on asset fell from 2.2 percent in 2006 to 1.1 percent in 2008 and return on equity fell from 4.3 percent in 2006 to 2.1 percent in 2008 (Datamonitor 2008). These figures are indicating of inefficient cost management, which indicated declining operations efficiency.

Dependence on the US Market: FedEx is overly dependent on the US market. That is why the main concentration goes to US while the emerging markets, especially Malaysia get only a slice of the assets. Therefore, in Malaysia the FedEx operations are limited as compared to other countries.

Opportunities

Growing Asian Market: With globalization, there has been an expansion of the market for the company. The emerging market in countries like China provides immense opportunity for FedEx and its operations. According to a report by DuPont, emerging markets sales is expected to grow to $13 billion in 2012 (MarketWatch 2009). The entry into this market provides immense opportunity for the company.

Malaysia has been experiencing growth even when there has been a recession globally. The GDP growth rate of Malaysia was 6.3 percent in 2008 and was 4.6 percent in 2009. Due to recession, there has been a decline in a decline in the growth rate of 26.98 percent (CIA 2009). The growth in the economy is expected to become the driving force for growth for FedEx Malaysia. Another factor would be development of SMEs in the economy, which would drive the growth process.

Apart from the overall market growth, the Asian cargo market has grown to $30 billion in 2008 (Biederman 2008). According to Global Air Freight Forecast, the intra-Asian airfreight market is expected to grow at 7.5 percent from 2008 to 2017 (28 July 2008). It has been stated that the Asia Pacific market for freight and logistics is “one of the fastest growing in the world, with a current annual growth rate of around 15 percent” (28 July 2008, p. 52).

The Asian growth in the freight industry has also been boosted by the increased export and import from the region. The main growth driver in the region is china whose growth rate affects the neighboring countries too (Logistics Today 2004). The trade within the ASEAN countries and with China has also resulted in a boost of the market. There has been a rise in the multinational companies operating in the region due to increased drive of outsourcing and global expansion. This has resulted in the growth of the airfreight industry. Regional governments also support express delivery service, as they believe it provides a catalyst to economic growth.

Internet: Internet provides extensive opportunity for freight forward services (Loong 2009). Online buying will be an increasing trend in Malaysia. In Malaysia, there were 15.9 million internet users by 2008 end (EIU Country Analysis 2009). B2C e-commerce has been though limited solely to travel related purchases, but it is expected to increase drastically.

Threats

Technology: One of the biggest threats that the company faces is due to the growing importance and adoption of internet. Trends in growth of email have progressively substituted the mailing industry largely. Technological advancements like SMS, broadband, email, etc. have had a negative effect on the traditional mail service. This has been worse in urban areas. For instance, earlier banks used to send bank statement to customers through mail, now due to the coming of electronic banking system, the traditional methods have been done away with. Further other electronic devices like fax, telephone, scanners, etc. has reduced the volume of mailing through traditional means. Thus, technological advancement has affected FedEx negatively.

Increase in transportation cost: The prices of fuel have been increasing constantly. The main increases have been seen in gasoline prices, refined fuel, etc. the prices of crude oil are projected to increase prices of all petroleum products (FedEx 2009). Due to the increase in oil prices, there is expected to be a rise in the aviation fuel prices (FedEx 2009). In the past year, fuel costs have increase by 30%, which are expected to affect the company bottom line.

From the SWOT analysis it can be deduced that FedEx Malaysia has to leverage its IT and operational scale advantage to gain greater strength in the Malaysian market. The opportunities in the market must be utilized in order to avoid the threats that the company faces.

McFarlan’s Model

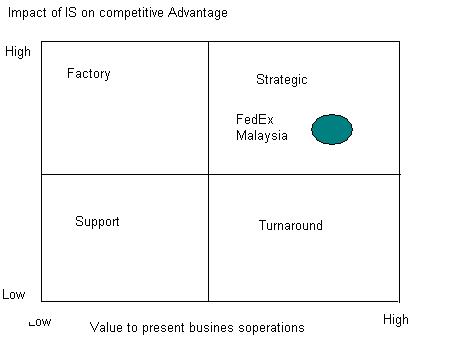

McFarlan developed a two by two matrix to gauge the strategic impact of information systems and as a risk assessment tool for IT implementation (McFarlan 1981). From the point of view of FedEx Malaysia, we will try to understand what strategy it should undertake when it analysed based on this model. Therefore, the main idea was to decide companies based on IT usage of the company i.e. whether it was a defensive stance to use IT or an offensive stance. The matrix was based on high and low IS/IT applications for gain competitiveness and on the vertical side of the matrix was measured the value of business applications. Based on the company’s position it will take following strategy – turnaround, strategic, factory, and support.

FedEx is a highly technology oriented company as there its basic functions too are based on IT. Initially it used IT to increase efficiency, but today IT has been integrated in the overall supply chain of the company to run the operations more smoothly. Therefore, it no longer assumes the function of a support function to boost efficiency. However, the IT that FedEx uses is not its core business, rather it is a way to increase efficiency of the operations and defend the core business i.e. physical transfer of goods.

However, this provides a competitive advantage to the company. Therefore, the company has a high dependence on IS. This makes that value of IS to the company high. Further in terms of reliability of IT, FedEx is highly dependent on it as its whole supply chain is dependent on the IS and its operations. Therefore the IS used by FedEx assumes strategic importance to the company. The position of FedEx Malaysia in the matrix is shown through the McFarlan’s matrix. The matrix shows that the company uses IT as a strategic tool.

Therefore, according to McFarlan, the internal and external integration of this kind of company is high, and planning is medium (McFarlan 1981).

Conclusion

The company analysis shows that FedEx Malaysia has extensive opportunities in the form of market growth and upcoming opportunities. However, there is extensive competition from the market, and the competitive forces in the market are strong. DHL is presently the market leader in the Asian market, however, FedEx too has the advantage of IS and seamless supply chain. The company uses IS as a strategic asset and must continue to do so in order to make it the competitive advantage of the company.

Reference

Armbruster, W 2002, ‘UPS Raises the ante in Asia’, JoC Week, pp. 22-23.

Benjamin, RI, Rockart, JF, Morton, MSS & Wyman, J 1983. ‘Information Technology. A Strategic Opportunity’, Sloan Management Review , vol 25, no. 4, pp. 31-38.

Biederman, D 2008. ‘Express carriers move to take advantage of Asian growth’, The Journal of Commerce, pp. 52-53.

Business Times 2009. FedEx named air cargo carrier of the year. Web.

Cheng, TL 2009. Up close with FedEx Malaysia MD Ramesh Kumar. Web.

CIA 2009. Factbook Malaysia. Web.

Datamonitor 2008. ‘FedEx Corporation’, Company Profile, Datamonitor, New York. Web.

DHL 2009. The new DHL in Malaysia. Web.

EIU Country Analysis 2009. ‘E-Commerce’, Country Analysis , Country Commerce, Malaysia, EIU, 121-129. Web.

Farhoomand, AF, Ng, PSP & Conley, WL 2003, ‘Building a successful e-business: The FedEx Story’, Communications of ACM, vol 46, no. 4, pp. 84-89.

FedEx 2009. ‘FedEx Annual Report’, Annual Report, FedEx. Web.

FedEx Express 2009. FedEx History in APAC. Web.

Logistics Today 2004. ‘Asia draws more logistics capacity’, Logistics Today, p. 50.

Loong, YP 2009, ‘Express Delivery: The e-Commerce Enabler’, Express Delivery Operations, pp. 44-46. Web.

MarketWatch 2009. Updates, advisories and surprises. Web.

McFarlan, FW 1981, ‘Portfolio approach to information system’, Harvard Business Review, pp. 142-150.

Porter, ME 1979, ‘How competitive forces shape strategy’, in PJ Smit (ed.), Strategic Planning: Readings, 2006102117th edn, Juta and Company Limited, Cape Town.

Porter, ME & Miller, VE 1985, ‘How Information gives you competitive advantage’, Harvard Business Review, vol 63, no. 4, pp. 149-160.

UPS 2009. UPS Asia Business Monitor. Web.

Wikinvest. 2009. FedEx (FDX). Web.