The report evaluates and compares investments opportunities in three companies, Nissan, Rio Tinto and Vestas. A special attention is given to political and environmental environments. It is recognized that for a new business initiative it is essential to pass, and prepare for the issues and challenges which will be faced. For a business unit within a corporate it is important to recognize that the same development process applies — often with the same challenges! However, these challenges are sometimes eased by the protection of an established corporate parent able to soften the impact of negative cash flow and poor profitability at the relevant stages. Creativity becomes the responsibility of R&D, which is staffed by specialists in visualizing and realizing marginal or major product changes. The reports concludes that Nissan is the best company for investments as a continuum of innovation exists, ranging from very slight modification to radically new, important developments that give rise to new industries

Introduction

Designing the product so that variations can be incorporated to meet local needs is one of the keys to transnational functioning. The use of modules or platforms from which product variety can be launched to satisfy local needs epitomizes the product flexibility/resource efficiency that is the hallmark of transnational firms. While value communication is best left to local discretion, the transfer of design and development information will typically be accompanied by information that can be passed on to customers or, equally important, received from them. The aim of the report is to evaluate financial merits of Nissan, Rio Tinto and Vestas, and give recommendations as for investment opportunities in one of the companies. The decision will be based on technological solutions criteria and future financial benefits if new technology is implemented. The report will be based on PESTEL analysis (for Nissan, Rio Tinto and Vestas). The secondary data (case studies) will be used as the main data collection method. The introduction of absolutely new products, variations of products, extension of new services, new packages, new advertising campaigns, and different pricing arrangements are all innovations.

Discussion Section

PESTEL analysis

Nissan is one of the leading car companies in the world which cares much about new technologies and innovative solutions in production. In Japan, governments exercise control over car production and introduce different programs for such companies. They include increasing state support, additional investments in technology, job opportunities, etc. Governments pass protectionist laws and regulations which define and preserve an industry regulations and laws. Economic Environment: It is known that governments intervene in the operation of all countries’ industries. Economic growth, exchange rates, levels of income, inflation and employment affect company’s ability to improve products and services and hence affect levels and patterns of demand. Social/demographic factor consists of the values, attitudes and beliefs of people of the region and affects the way that they act and behave (Cole, 1998).

Similar to Nissan, Rio Tinto and Vestas are located in countries with positive political climate. Rio Tinto performs in England and Australia while Vestas operates in Denmark. In all countries, the government protects populations living in nearby areas and those affected by the mining production. Production processes in mining and resource industries have been transformed and automated in order to meet the needs of population. Vestas, manufacturer if wind turbines, is supported by the state interested in innovative technologies and environmentally friendly solutions for diverse regions.

The microenvironment involves local relations. Wind power industry is very fragmented in terms of supply operating on a large geographical area. Increasing number of aging population results in fierce competition within the industries, development of new products and services. The strength of Vestas is that their services and products are universal and can be sold in different countries. The opportunities include high potential to growth and profitability caused by increasing number of potential customers. As for Rio Tinto, the international situation suggests the decrease of prices in near future. Also, strict government regulations and control of Rio Tinto will be a threat for small producers unable to compete on the global scale. Population requires new sophisticated products which meet their needs and demands. In this case, the pressure is intense when new products require major investments and long periods of development time. Rio Tinto provides a striking illustration of this driving force (Drejer, 2002).

In contrast to Rio Tinto and Vestas, Nissan attracts huge investments in America. “Nissan aims to use a $1.6 billion U.S. loan to retool a factory in Tennessee so battery-powered cars can be made on the same line that currently produces hybrids and other models” (Ueno and Komatsu 2009). Technological dimension helps Nissan anticipate the firm’s future requirements along an orderly, continuous, systematic, and sequential basis; marketing planning avoids crisis decisions and concentrates on integrated programs of action. Technological and innovative solution can be seen as a rational way of translating experience, research information, and thought into marketing action. It is a pragmatic, organized procedure for analyzing situations and meeting the future. Based on information about ends and means to determine various causal relationships, trends, and patterns of behavior, it is concerned with the selection of alternative strategies. A decision hierarchy is established, and decisions made at the level of the total system are more important than those at any subsystem level. Thus conflicts and tradeoffs among subsystems are considered. What is best for the whole system need not be for any one department or particular element. For example, decisions about the total marketing budget could be unfavorable to any one department, such as advertising or marketing research (De Wit and Meyer, 2004).

The analysis shows that environmental risks affect all areas of Nissan’s performance. They create legal and technological problems and influence strategic direction of the organization. Technological dimension is a dynamic factor which requires constant changes and improvements. It can be seen as an integrated, intelligent, rational process for guiding business change. No marketing decision is properly made without an appraisal of technological changes and innovations. Environmental risks focus attention on broader issues than those usually contained in any one marketing subgroup such as sales or product development. By so doing they add greatly to the formulation of overall corporate and marketing strategy and objectives. Under the environmental approach, the organization is seen as an integrated production process, a coordinated whole. Marketing is coordinated with, rather than confronted with, manufacturing or finance. Environmental issues must be raised about the appropriate structural forms that marketing systems should adopt. Technological effectiveness is the ultimate tests, and those elements and arrangements approved by the marketplace over time are best. Environmental concerns have recently focused on the top level responsibility for product functions. The main tendency identified in the research is that both the state and companies recognize benefits and opportunities of technologies and approaches to water purification. Thus, all stakeholders agree that the high level of organizational placement reflects the critical nature of manufacturing and some of its attendant activities, such as the determination of product aims and the scrutinizing of pollution and environmental risks (Grant, 1998).

Environmental analysis allows to say that Nissan operats on the dynamic market where the main objective is to maintain the high level of service quality and developed strategies to improve products. Auto market is usually affected by the factors in this environment often and it is able to have an influence upon it. In contrast to Nissan, Vestas obtains a very competitive position on the global market. The brand has a hard core of loyal supporters which help the company to.developed lines of services to satisfy the needs of wide audience. Rio Tinto has also maintained high-speed growth through continuous optimization of services and technologic solutions. Today, the mining market shows the average rate of economic growth around the world (Cole, 1998).

Conclusion

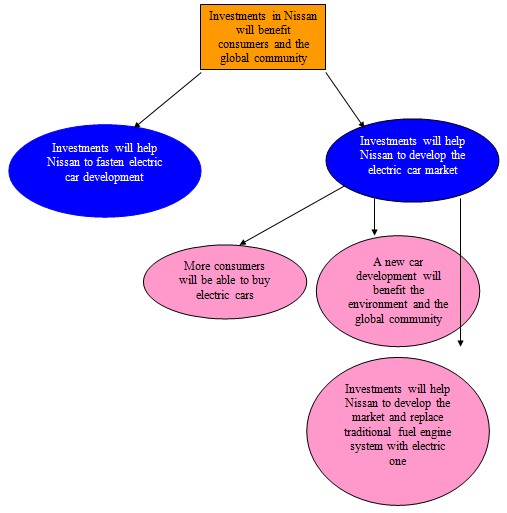

The analysis shows that it will be reasonably to invest in Nissan because, in contrast to two other companies, it has all necessary criteria for further market development and introduction of environmentally friendly technologies (including an electric car solution) The opportunities of Nissan include high potential to growth and profitability of the company; promotion to other divisions; increased revenue from success in the US market, a global expansion and penetration into European markets; safety and high service standards. Neither Vestas nor Rio Trinto have such global and market development opportunities as Nissan.

Recommendation

The strength of Nissan is a strong brand image and past success. The opportunities for investments include favorable economic position, opportunities from the Regional Markets and reduced car prices, online sales. On the other hand, new technologies and automation allow Nissan to decrease prices and improve service quality. A source of customers’ power was the willingness and ability to achieve backward integration. Supplier power in the car industry is the converse of buyer power. Investments are indispensable to achieving high levels of value. After all, whether the firm provides vinyl binders or fast foods, automobiles or software, visualizing how value will be provided, how this will afford the firm a competitive advantage relative to its rivals, and constantly seeking to enhance the value concept, are critical to its continued success. Just as important, however, is making the concept come to life. A painter or sculptor or musician does not touch our sensibilities merely by his or her powers of imagination.

List of References

Cole, G. A. 1998. Strategic Management. Thomson Learning.

De Wit R & Meyer, R. 2004. Strategy: Process, Content, Context. Thompson International Press: London.

Drejer, A. 2002. Strategic Management and Core Competencies: Theory and Application. Quorum Books.

Grant, R. M. 1998. Contemporary Strategy Analysis, (3rd edn.). Oxford: Blackwell.

Appendix