Introduction

Company background

A multinational corporation is an establishment or company that holds its operations beyond a single state or country. Today, the number of functional multinational corporations in the world economy is well above 40,000. We carried out our research at FedEx Corporation which has an operating office in the Kingdom of Saudi Arabia. The “FedEx Corporation” used to be called FDX Corporation.

Since the inception of this Corporation in January 1998, it has continually provided planned and tactical directions as well as managed the financial reports of all its over 280,000 operating associates that compete globally beneath the FedEx brand. According to the FedEx report (2010), these associates include “FedEx Express, FedEx Ground, FedEx Freight, FedEx Office, FedEx Custom Critical, FedEx Trade Networks, and FedEx Services.” All these seven associates are in operation within the Kingdom of Saudi Arabia.

The FedEx Corporation supplies its clients and businesses globally with a wide assortment of transportation. With research carried out, we found that FedEx Express (FedEx), which is a firm under the FedEx Corp. (NYSE: FDX) is the world’s overall biggest rapid transportation company. In addition, FedEx Corporation has an extensive way broadened e-commerce as well as business services in that it has provided digital web familiarity that puts worldwide business awareness and trends in a small society close to any visitor who wants to access it. In the provision of the above-named services, the FedEx Corporation is ranked as the highest revenue earner of the industry and therefore a significant contributor of the gross national income (GNI) per capita.

Many views that multinational corporations prefer their domestic operations more so when dealing with difficult economic rulings. However, this has greatly decreased as a result of increased worldwide competition. The FedEx Corporation is not exempted and unless it is well managed to bear in mind the ever-changing and very competitive nature of this industry, then it may not survive.

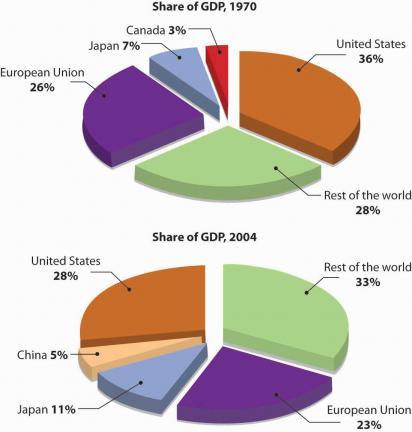

It is worth appreciating that FedEx Corporation faces various challenges in its endeavor in expanding to foreign countries. These challenges are among others cultural, economic, legal, and political dissimilarities between countries. Research has shown that a large fraction of the World’s prosperity is converged in a few areas and this is judged and examined by evaluating the gross national income which acts as an indicator(see Appendix 1)

In this context, one needs to be aware of factors that have an effect on the value of the currency and how those factors affect one’s profit. In our research, we mainly focused on how management accounting, or else in accounting terms known as management accounting poses one of the greatest challenges for FedEx Corporation in Saudi Arabia in its efforts to expand even to other foreign countries. This is accounting which entails the provision of detailed information on how operations in a business should be carried out.

Management accounting has emerged over the years as one effective practice to integrate into any business entity whose vision is to maximize profits and survive the competition of the business environment. Weetman (2003 p. 35) described it as an approach conditioned by the situation because its methods have developed in a variety of ways depending on the decisions and judgments required.

Harris (1990 p. 18) stated that cost and management accounting has developed to meet the demands of management for relevant information in decision making which in turn has been influenced by the economist. In most cases the ordinary management function of planning, decision making, and control go around issues of cost; “is it cost-effective to continue offering this service?”, “will this new investment pay for its self over the next 10 years?” and other similar cases. Each of the three functions, therefore, involves a chain of activities that create cost which must, in turn, be compared with the value-added to the organization.

This makes it necessary for a Multinational Corporation, whose business is to provide a wide range of services to customers, to identify measure, and analyze the costs it incurs in providing each service, and then classify these costs into groups/classes depending on the purpose of the classification. Such a practice would enable International Business management such as FedEx to make decisions bearing in mind past cost implications of a similar decision, estimate the cost of implementing a particular plan, or even gain control over the general operational costs of the facility as a whole. This practice would also enable the firm to compare its performance against those of competitors and therefore make informed judgments.

Problem Statement

Though the management accounting practice of cost classification has existed for a number of years, it has been noted that very few Multinational Corporations have adopted it. Due to this, many are times when management decisions and judgments are made without any considerations of either their implications to the organization or the cost structures of competitors. As a result, many of the existing Multinational Corporations have come to a state of in-competitiveness, liquidation, imp- profitability, mismanagement, and finally closure. It was therefore the purpose of the present study to establish the extent to which the FedEx Corporation has adopted the management accounting practice of cost classification. This study investigated the impacts of adopting this practice and also inquired into the possibility of assimilating the practice in other Multinational Corporations.

Purpose of the Study

The purpose of the study was to yield data and information that would be useful for proper planning, decision making, and control in the operations and management of FedEx Corporation. This would thereby enable internal efficiency in the affiliated associates under different Multinational corporations. The findings and the recommendations of the study should also be useful to the managers and operators of FedEx Corporation. Henceforth, they will not operate their businesses without bearing in mind the implications of costs and the importance of classifying costs for easier management functioning.

It is therefore hoped that the study carried out in this research will form a basis for further research on the practice of cost classification in general. This should lead to the generation of new ideas for the better and more efficient management of the existing International Businesses such as FedEx Corporation and forthcoming Multinational Corporations.

Research Questions

The primary research question in this paper was:

- What are the challenges hindering FedEx Corporation in its expansion to foreign countries?

To aid in widening the scope of the primary research question, further specific questions were adopted for the analysis of this study. The specific questions analyzed were all under the economic environment as one of the challenges identified and were as follows;

- What are the systems of cost classification used by FedEx Corporation?

- What are the impacts of having a cost classification system in FedEx Corporation?

- Will consumers in a foreign country be able to afford the product sold?

- How many units are expected to be sold?

Scope

The study was based on the practice of cost classification at FedEx Company which is one of the many multinational corporations. It was mainly concerned with the implications of cost classification on the performance and operations of the FedEx Corporation in Saudi Arabia. The main respondents for this study were departmental managers of the selected Corporation, the general managers, and the financial controllers. Data were collected by the researchers using questionnaires for the managers and checklists for interviewing the general managers and financial controllers. Specifically, the study sort to determine the impacts of cost classification on the management performance of the FedEx Corporation.

Literature Review

Introduction

This chapter discusses the literature related to the possible challenges to successful International business dealings with a key emphasis on the FedEx Corporation in Saudi Arabia. It will then intensely focus on one of the challenges under the economic environment. This will be on the implications of the practice of cost classification to the FedEx Corporation management and operations which particularly focuses on the various forms/systems of cost classification in existence, the purpose of each classification, and benefits/impacts of classifying costs as well as the challenges of adopting the practice in firms. Literature was collected from textbooks, journals, the internet, and projects.

Challenges to successful business Introduction

Most of the challenges that FedEx Corporation faces and thereby hindering their successes range from culture, economic environment, legal and political dissimilarities between states.

The Cultural Environment

Persons can still have misunderstandings despite hailing from the same country. Different communication styles reveal differences in culture. This varies from values, traditions, and actions. The Cultural dissimilarities give rise to challenges hindering successful relations. This includes;

- Language

The business language used by the European community internationally is English, despite the inborn European countries having their own language and culture; the larger populace in the multicultural Corporation speak English leaving few educated members in the targeted market country speaking English. This has led to “lost in translation”(Appendix 2) which results in a humorous blunder.

- Time and Sociability

An American, Benjamin Franklin, came up with the slogan that “time is money” when holding a meeting to discuss any business issue, it is expected that time should not be wasted and therefore meetings should start and ends on time stipulated. However, in some places, people are not time conscious.

- High- and Low-Context Cultures

In some cultures, before the start of a meeting, people tend to interact to a point of even wanting to know the people’s personal life. This is the high-context culture. To some communities, this is not the case as they perceive it to have no correlation with business life. These are what are termed low-context cultures.

- Intercultural Communication

Different cultures run through Dissimilar communication styles. These communication styles vary from hand gestures, body language, and even highly pitched voices. For some cultures, one has to keep a distance when communicating whereas others prefer a foot or less when communicating.

The Legal and Regulatory Environment

Lack of a specified global legal system, different countries globally have come up with their own specific laws and regulations that should be adhered to when one wishes to start a business within its borders. These are for example in the provision of contract as well as copyright protection. This inconsistent laws and regulations have been a great challenge to FedEx Corporation associates in Saudi Arabia.

The Economic Environment

It is extremely important to know the intensity of economic development as soon as one decides to begin any line of work in another state or country. It is also important to consider all the issues that affect currency as well as the consequence of the same to the expected profits. This varies from exchange rates, currency valuations, and the classification of costs. Our research mainly focused on the classification of cost and how it poses a challenge in Multinational Corporations.

Cost classification systems

Charles and George (1991 p. 7) define cost as a resource sacrificed or foregone to achieve a specific objective. Baggot (1986 p. 12), defines cost as a factor in every business decision which is sometimes the least important but most significant. Weetman (2003 p.42) suggested that the cost of an element of output can be analyzed in terms of two measurements: a physical quantity measurement multiplied by a price measurement. These definitions agree that cost is the most significant monetary resource sacrificed to achieve a specific objective in business and is calculated by multiplying a physical quantity measurement by a price measurement. This was the definition of cost adopted for this study.

The cost of a product is it a service or a manufactured good is made up (consists) of cost elements. These elements are presented by Lucey (2003 p. 18), as labor, material, and overheads.

Labor costs are measured in terms of hours worked multiplied by price expressed as a rate paid per hour, similarly, material costs are made available on the basis of store requisitions (material issued to production) and calculated by multiplying the unit price by the number of materials used. Weetman (2003 p. 46) goes on and defines overheads as comprising indirect material costs, indirect labor costs, and other indirect costs of production.

Various authors have come up with a number of ways in which the costs of a business can be classified. Weetman (2003 p.78) suggested three traditional types of cost classification, which she states as the most appropriate way of looking at costs. These are:-Variable costs and fixed costs, direct costs and indirect costs, and product costs and period costs.

Weetman(2003 p.79) defined variable costs as “costs those that vary directly with changes in the level of activity over a defined period of time and fixed costs as those that are not affected by changes in the level of activity over a defined period of time”. Product cost refers to the costs linked with goods or services bought or manufactured with an aim of selling them to clients while period costs are those costs that are treated as expenses in the period in which they are incurred (Weetman, 2003). Lastly, direct costs refer to the costs that can be traced back to an identified unit like a commodity or a service (or a section of the firm) that affects the determination of the costs in a direct way. Indirect costs on the other hand are the costs that are spread over a number of identified units of the business like a commodity or a service (or a section of the firm) that affects the determination of the costs in a direct way (Weetman, 2003).

Lucey (2003 p.21) on another approach similar to Weetman (2003 p.76), came up with two classifications of costs: variable costs which she stated that changes with production volume e.g. direct materials and power costs. Other costs are fixed costs. These costs do not change with production volume. This includes the majority of overheads. She went ahead on and proposed that overheads costs can further be classified into short term variable costs (which traditionally are known as variable costs), long-term variable costs (which are overheads that do not vary with production volume but do vary with other measures of activity but not immediately) and fixed costs that do not vary for a given time period with any activity indicator.

Purposes of cost classification

Weetman (2003 p.79) suggested that costs can be classified into different groups depending on purposes of classification and with relevance to the three management functions of planning, decision making, and control. She explained that planning involves looking forward and asking questions of what if…? type. For example “what is the impact of a change in levels of production over a period of time?”, “What is the cost effectiveness of planning to expand operations by opening a new outlet?” or “what is the impact of adding a new service to existing client services?”

Decision making on the other hand involves asking questions of the type “should we do…?. For example “should the company produce components in this country or produce them overseas?” or “should the company continue to produce a service when demand is falling?”

Control on another side involves looking back and asking questions of the how and why…? Type. They include questions like “how closely do the costs of each product match the targets set?” or “how closely do the costs of a service department match the budget set for the department?”. This function mostly uses the direct and indirect as well as the product and period cost classifications.

Harris (1992 p.43) proposed that for the purpose of simple profit statement, costs should be classified in terms of the basic cost elements but they also classify costs into direct and indirect for the purpose of management control and fixed and variable costs for the purposes of management planning and decision making.

In order to meet effective planning, control, and decision making requirements, costs can be classified as follows:

- For planning which is an annual and long term budgeting process, costs would be classified according to behavior, to different activity levels, functions into the different responsibility centers within the organization, expense type in terms of different categories, and controllability which involves classifying expenses by responsibility centers to determine individuals accountable for achieving the budget.

- For management function of control which consists of measurements, reporting, and subsequent correlation of performance in order to ensure achievement of firms objectives and plans, costs can be classified by: behavior using flexible budgets, function which involves tracing costs and revenues to responsibility, centers who are responsible for incurring them, expense type, controllability and relevance which involves expense categories with significant deviation from budget.

- For decision making which involves choosing between alternative causes of action, the important cost classifications are: classification by behavior, necessary for predicting future costs for an alternative cause of action, by expense type which shows how cost categories will change as a result of an alternative cause of action

Charles et al (1997 p. 63) suggested a list of purposes for which costs are classified and they include:

- a business function whose cost classification includes research and development, design of products, indirect manufacturing costs, production costs, distribution costs, and customer service costs.

- assignment to a cost object whose classifications are direct costs and indirect costs.

- behavior in relation to changes in levels of a cost driver. The classification for this purpose is variable costs and fixed costs classification.

- Averaging and aggregating whose classifications are total and unit costs

- management function under which costs are classified into manufacturing, marketing costs, and administrative costs.

- Assets or expenses on which costs are classified into inventorial costs and period costs

- time of computing whose classifications are historical budgeted or predicted costs.

- In view of the classification systems suggested by the different authors above, it is clear that a cost classification system is chosen to suit the intended use with each classification playing a role in planning, decision making, and control within an organization. It should however be noted that cost classifications in practice are as varied as the businesses they serve.

Challenges of adopting a cost classification system

Though much has been written on how costs can be classified for the various purposes of a Multinational Corporation, this phenomenon has been described in broad terms and little study has been done addressing the issues of how the various forms of cost classification have been utilized in real-life situations of operations and how the practice relates to the management performance of a business.

In addition, much of what has been written on cost classification has focused on the manufacturing sector and little on the service sector such as the services offered by the FedEx Corporation (Harris 1990 p.58).

Research Design and Methodology

Introduction

This chapter discusses the data collection procedures used in the study. This includes the researchers’ design, data collection instruments, reliability and validity of research instruments, and finally the data analysis method used.

Research design

A thorough study was first conducted to figure out the best method which would comprehensively be used to answer the questions discussed. The method adopted in data collection was one that supplied the most reliable and valid data that can add validity and reliability to the results. This study adopted a survey research design that seeks to conduct a research study without manipulating the research variables.

Since the researchers did not have any control over the effect of the independent variable (cost classification) on the dependent variable (management). Such issues were best investigated through survey design because it enabled the researchers to collect data rapidly and understand the population from a part of it. The survey research design generally entails investigating populations by selecting samples to quantitative and numeric descriptions of some part of the population. For the purposes of this study, the survey research design described and explained the data collected. The design however suffered from limited time.

Sample Size and Sampling Design/ Technique

Paton (1987 p.11) argued that the most important consideration in determining the sample size is the purpose for which the study is being undertaken. The sample had a total of 39 correspondents. The study adopted stratified and purposive sampling techniques.

The purposive sampling technique involved the researchers deciding on whom to include in the sample. In this study, the technique was useful in collecting focused information. It was preferred in this study because it selected typical and useful cases only thus saving time and money. Departments were grouped into strata’s after which the researchers used purposive sampling from each department. The study sampled 69.6% of the target population since Neuman (2000 p. 62) argued that a 30% sample is enough in a survey study.

Data collection Instruments

The study used the multi-method research method (Creswell, J.W. 2003 p.62). This method combines both primary and secondary sources of data. The main research instruments used in this study were questionnaires and interview schedules.

Development of Research Instruments

In developing the items in the questionnaire, the researchers combined open and closed questions. This format was used in all categories of the questionnaires. However, in the fixed choice item, which involves “putting words” in the respondents’ mouth, especially when providing acceptable answers, there is a temptation to avoid serious thinking on the part of the respondent. The respondent will end up choosing the easiest alternative and provide fewer opportunities for self-expression. It is because of these reasons that it will be necessary to combine this format of items with the open-ended response items. The open-ended format allows more spontaneity of response and provides opportunities for self-expression argues Patton (1987, p.39).

Questionnaires and Interview Schedules

The researchers used questionnaires and interviews as the main tools to collect data. The selection of these tools was guided by the type of data that was to be collected, the time that was available well as the study objectives. The overall aim of this study was to establish the challenges and prospects for FedEx Corporation in Saudi Arabia and its expansion to other foreign countries. The researchers were mainly interested in the views, opinions, perceptions, feelings, and attitudes of the respondents. Such information was best covered through the use of questionnaires and interviews. The two instruments helped to balance between the quantity and qualities of data collected and provided more information as well as giving a fuller understanding of the phenomena under investigation.

Both qualitative and quantitative data were collected from the respondents of the operating associates of FedEx. Questionnaires were issued to the departmental heads of the sampled associates and collected after 3 days, while checklists were used to conduct an in-depth interview with the general managers and the chief accountants who were available. These respondents were selected because they are literate and understood the operations of the respective associates more than the other personnel. The respondents did not have problems in responding to the questionnaires and during the interview, the researchers did more clarification.

Secondary data was collected from various literature materials including textbooks manuals and the Internet on the areas related to the topic.

Reliability of Research Instruments

Reliability refers to the degree to which a research instrument yields results through repeated trials. In this study, the researchers will use the piloting method to determine the reliability of the researchers’ instruments. Questionnaires were issued to one of the operating associates after which corrections were made before proceeding to the rest of the associates.

Validity of Research Instruments

Validity refers to the extent to which a research instrument measures what it ought to measure. The researchers discussed the items in the research instruments with the instructor in their department. Suggestions given by the instructor were incorporated in the final copy of the questionnaire to ensure that the instruments were valid.

Administration of Research Instruments

The researchers personally administered the research instruments in October 2010 within a period of one week. The researchers left the questionnaires with the respondents for three days after which they were collected.

Data analysis

Data collected was processed, coded, and analyzed to facilitate answering the research questions. The data was further analyzed using Statistical Package for Social Scientist (SPSS) computer package and MS excel to give descriptive statistics in the form of frequencies. Descriptive methods were employed and data was presented in the form of frequency distribution tables that facilitated description and explanation of the study findings. SPSS was as well used to generate frequency distribution tables for interpretation.

Research limitations

The decision to use associates from one zone in this study could limit the generalization of the findings to other operating associates internationally but could be useful for illustrations and a basis for more research. This is because the study was carried out under constrain of time and therefore the data sample could not be distributed to many operating associates but was only concentrated on five associates which were close together. The time given for filling questionnaire forms could not be extended beyond one week a factor that could have contributed to the low response from the original sample of respondents. However, the information collected from the questionnaire forms received from respondents could be useful for illustrations and a basis for more research.

For future researchers on the same topic, it can be recommended that a wider sample of the respondent be considered and more time for follow-up be provided for the research.

Data Analysis, Presentation, and Interpretation

Introduction

Data obtained was analyzed to determine the implication of adopting Cost Classification Systems in the operating associates. Descriptive statistics such as frequencies and percentages were used to analyze responses to various items in the questionnaire.

The researchers analyzed data in the following sub-topics:

- System of cost classification used by the operating associates.

- Impacts of having a cost classification in the associate’s operations.

- Challenges hindering the associates from fully adopting cost classification practice.

- Pie charts, tables, and bar graphs were used to present data for interpretation.

Demographic Information of the respondents

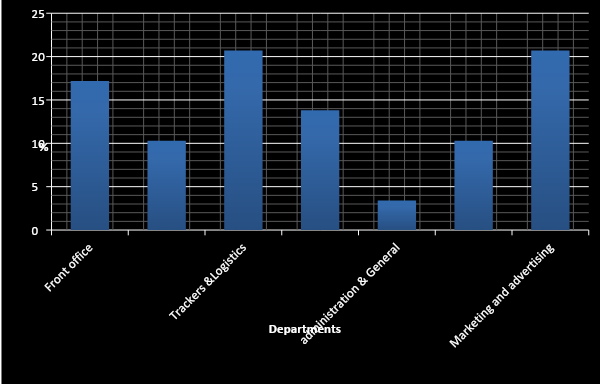

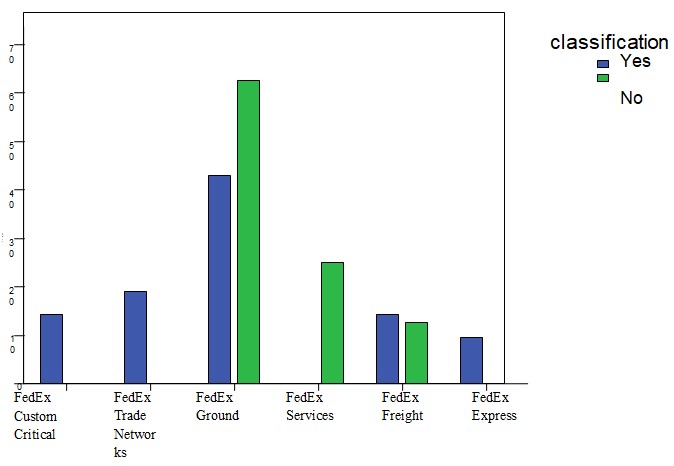

The main objective of this study was to examine the impacts of cost classifications in the management and operations of FedEx. The researchers first began by identifying the various departments of the respondents in the operating associate as summarized in figure 4.1 below.

The departments from which respondents were drawn were; Front Office, Accounts, Trackers & Logistics, Personnel, Administration and general, maintenance, marketing &Advertising departments respectively as shown above.

The results show that 20.7% of the respondents were from the Trackers & Logistics, Marketing & Advertising departments. The researchers interpreted this as being a result of the two departments being the busiest in FedEx Corporation. They are the departments incurring the majority of the associate costs. The results also show that 17.2 % of the respondents were from the front office department and the researchers owe this to the fact that after accounts and maintenance, the front office is another busy department in a corporation. Moreover, only 3.4% of the respondents were from the administration and general departments. This could be because the administration and general department is a department only found in a few associates.

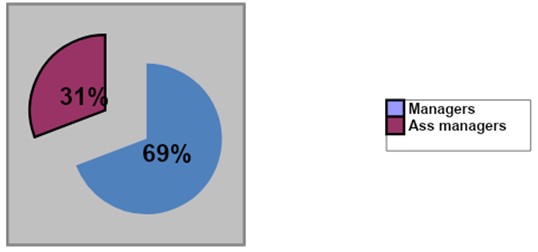

After finding out the various departments from which the respondents came from, the researchers examined the various positions that the respondents occupy in their respective departments as illustrated in figure 4.2 below

The results show that the majority, 69% of the respondents were managers in their departments while, 31 %, were assistant managers.

Cost classification systems

The first objective of this study was to identify the systems of cost classification used by associates under FedEx. In order to achieve the objective, the researchers required the respondents to name the kind of costs incurred in their respective departments and to name the cost classification systems that they use to classify costs in their departments if at all they do classify costs. Data on this objective was analyzed under the questions: what costs do the departments under the associates incur? what forms of classification do they classify their costs in, and in what better ways can cost in these departments be classified?

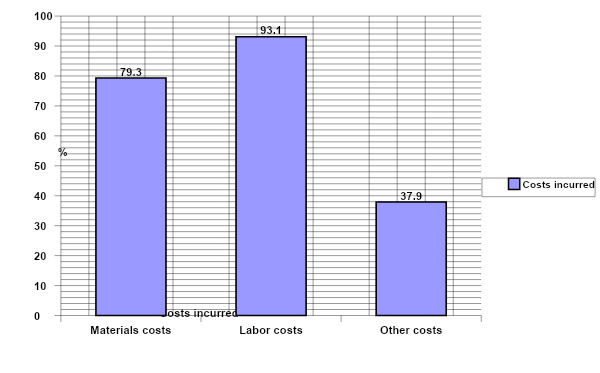

The researchers first wanted to find out the kind of costs incurred in the departments. The results as shown in figure 4.3 below indicate that the majority 27(88.1%) of the managers mostly incur labor costs. This may be because almost all departments have staff working within more so in logistics and Marketing departments and the cost of labor has to be incurred. In addition, 23(70.3%) of the managers incur material costs in form. This percentage can be attributed to the fact that some departments have very little costs in material compared to others while labor costs are relatively equal to all departments.

Systems of cost classification used by FedEx Corporation

The main purpose of this study was to find out the implications of adopting cost classification in operations of the associates under Multinational Corporations. As such, in order to achieve the main purpose, the study sought to find out the systems of cost classification used by different associates under FedEx. The major findings from the study indicate that. FedEx Services does not have any department that classifies costs as shown in figure 4.1. Analyzes from the checklist indicate that the work of cost classification in this particular corporation is mainly done by the financial controller.

After finding out the associates that classify and those that do not, the researchers sought to find out the various types of classifying costs in the respective associates. The results from the study indicate that majority 71.4% of the managers agreed that they use fixed and variable costs as a type of cost classification as shown in table 4.1.

Table 4.1 Types of costs classification in operating associates.

This could be because fixed–variable cost classification is one of the traditional ways of cost classification and is usually necessary for predicting future costs for alternative causes of action and for cost-benefit analysis. In addition, the study findings indicate that 57.1% of the managers use direct and indirect costing methods. The researchers interpret this to mean that every department takes responsibility for the costs that can be directly identified with it. It is also important to note that 10% of the managers argued that they use production costs as a costing method. This implies that the associates rarely use this type of cost classification because it deals mostly with services and not in the production of tangible goods. An analysis of the checklist indicates that the respondents suggested that costs are mainly classified as per department.

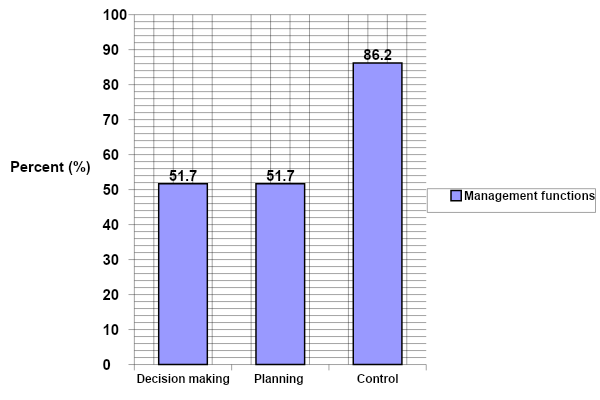

The researchers also sought to find out the management functions performed by the managers. The findings from the study indicate that majority 86.2% of the respondents indicated that managers are involved more in control as a management function as shown in figure 4.1.

The results show that majority 82% of the correspondents are highly involved in control. This can be attributed to the fact that the manager of a department is responsible for any costs incurred in the given department and has to ensure that costs do not deviate much from the given budget. The results also indicate that 51.7% of the correspondents are highly involved in planning and the same number 51.7% is highly involved in decision-making. These results indicate that the management functions of decision making and that of planning are related in some way and they may go hand in hand.

Impacts of cost classification in associative operations

The second objective of this study was to establish the impacts of classifying costs in these departments. To achieve this objective the correspondents were asked to explain how cost classification can improve their performance in the management function that they are highly involved in. They were also asked to give their opinion on how cost classification practice can be of benefit to the performance of a manager, to the entire associate operations, and to the management of any Corporation.

Data on it was analyzed under the questions: “what are the effects of lack of a cost classification system in a Corporation” and “what is the relationship between cost classification and management functions of planning, decision making, and control”? The results are presented in the sub-topics below. The analysis of the study findings indicates that 27.6% of the respondents that improved performance efficiency was one of the benefits of cost classification as shown in table 4.2.

Table 4.2 Benefits of cost classification to managers.

The results show that 27.6 % of the respondents view the improvement of performance efficiency as one of the benefits of classifying costs. 24.1% give effective decision making as the major benefit their departments would accrue by classifying costs while 10.3% state the major benefit of cost classification to their department is enabling the measuring of profitability against departments.

Further, the study sought to find out the benefits of cost classification to the entire associate operations. The findings from the study are tabulated in table 4.3.

Table 4.3 Benefits of cost classification to entire Associate operations.

The results of the benefits of cost classification to the entire Corporation indicate that 34.5% of the respondents state the major benefit of cost classification to the Corporation as enabling cost control in all areas of the departments. 24.1% state enabling the making of sound decisions guided by cost implications as the major benefit. 13.8% state the major benefits as planning and striving to work within the budget another 13.8% state that to minimize costs is by doing away with unnecessary ones as the main benefit of cost classification to the entire Corporation.

The analysis indicates that 44.8% of the respondents argued that improved transparency and accountability was one of the positive impacts of cost classification as shown in table 4.1.

Table 4.1 Positive impacts of cost classification.

In seeking to know the positive impacts of a cost classification system on a Corporation, the researchers found out that 44.8% of the respondents stated that it improves transparency and accountability. 27.6% stated that it minimizes associate’s costs and prevents wastages. 24.1% give an improvement of profits as an impact of cost classification to an associate. While 20.7% state that it increases morale and motivation among staff to work harder. It is also important to note that 17.2% stated that cost classification enhances budgetary controls in a corporation.

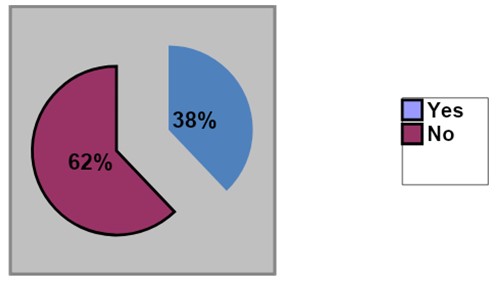

Having established the positive impacts that accrue from adopting cost classification, the researchers sought to find out the negative impacts that accrue from adopting the same. The results from the study findings are as shown in figure 4.1.

The researchers also wanted to find out whether the practice of cost classification has any negative impacts on an associate department or an associate as a whole. The results of the study indicate that 62% of the respondents see no negative impact of cost classification while the rest 37.9% agree that there are some negative impacts of the practice. Research findings regarding the negative impacts of cost classification are tabulated in table 4.1 below.

Table 4.1 Negative impacts of cost classification.

The results show that all 100% of the respondents gave the negative impacts of cost classification as the increase in costs due to needed training and costs of computer systems.

Challenges hindering cost classification practice in Multinational Corporations

The third objective of this study was to determine the challenges hindering associates within FedEx from adopting the practice of cost classification. To achieve this objective, the correspondents were asked to give the reasons for not classifying costs in their departments and the entire associate.

They were also asked to give their opinion on the requirements of adopting a cost classification system and give views on what would hinder its adoption in their respective operating associate and others too. Data on this objective was analyzed under the questions “what are the key requirements of designing a cost classification system in an operating associate”? And “what factors hinder associates within FedEx from practicing cost classification in their operations”? The findings indicate that majority 87.5% of the respondents reported that lack of knowledge and skills was one of the major challenges hindering cost classification in the operating associate as shown in table 4.1.

Table 4.1 Challenges hindering cost classification.

From the findings of figure 4.1, it was seen that not all managers classify costs before reporting them and in the above table the researchers sought to find out the reasons as to why some managers do not classify costs. The results from the study indicate majority 87.5 % of the managers who do not classify costs owe this to their lack of knowledge and skills in that area as shown in the table. This could be because of managers not being trained in that area associate ownership not seeing any importance of training them.

The study also indicates that 85.7% of the managers who do not classify costs owe this to the fact that it is not in their job description. This could be attributed to maybe the lack of clear positions and functions of a management accountant who would coordinate the practice in the departments. It is also important to note that none,0%, of the managers who do not classify costs owe this to the cost associated with the practice. This implies that the issue of cost is not a reason for associates not to adopt the practice of cost classification.

The researchers also wanted to find out what hinders Corporations from adopting a cost classification practice. From the checklists, the major hindrances of adopting a cost classification system in an associate were given as lack of awareness by associate owners as well as their secrecy and that of the accounts office on all matters concerning associate cost, lack of knowledge, transparency, proper records, & proper budgeting and unpredictable industry whose staff are unprofessional and know nothing.

Moreover, the researchers also sort to examine the requirements of adopting a cost classification system in an associate and the interviews yielded the following responses: “a well-defined computer system, professionals, investor knowledge and awareness of the benefits of the practice, transparency, training of managers on what management is all about and start monthly or weekly reports on cost performance of every department’s costs.

Conclusion

The cumulative data was analyzed using quantitative and qualitative analysis and presented in form of tables. Recommendations will be made to employees, employers, and the general FedEx Corporation regarding implications of cost classification systems on operations of Multinational Corporations.

From the research findings, the researcher found out that FedEx Corporation mostly incurs labor costs, material costs, and other costs. The study has shown Labor costs as the highest costs incurred in all departments and this is so because all departments have both permanent and casual staff. Material costs are also incurred in the departments with some departments incurring more material costs than others. This is so because some departments like trackers & logistics, advertising and marketing departments intensively use more materials than others.

Works Cited

Baggot, J. (1986). Cost and Management Accounting made simple, Richard clay Limited; Great Britain p. 6 -18.

Charles, T. H. and George F. (1991). Cost accounting: A managerial emphasis, (7th ed.),Prenticel-Hall international, Inc Englewood Cliffs p.3 – 38.

Charles, T. H. et al. (1997). Cost accounting: A managerial Emphasis, (9th ed.), Prenticel-Hall international,Inc Englewood Cliffs p. 48- 79.

Creswell, J.W. (2003). Research design: qualitative, quantitative, and mixed methods approaches Thousand Oaks, CA: Sage Publications, p.58-68.

FedEx. (2010). Our Company. Web.

Harris, P. J. (1990). Management accountancy. Old Station Drive: Stanley Thornes Publishers ltd p. 16-48.

Lucey, T. (2003). Management accounting, (5th ed.), Book Power; London p.17- 28.

Neuman, W.L (2000). Social Research Methods: Qualitative and Quantitative Approaches. Boston: Allyn and Bacon Publishers p. 51-77.

Patton, M. (1987). Qualitative methods for evaluation. Newbury Park, CA: Sage p. 3-46.

Weetman, P. (2003), Management accounting, Harlow: Person Education Limited p.22- 83.

Appendices

Appendix 1. The World’s Wealth, 1970 and 2004