Executive Summary

In order to compete in the present antagonistic world, many companies are heavily relying on different kinds of strategies. In this report, the Krispy Kreme Company has been taken to analyse as an actual industry. The KK 1 Company has been struggling hard to survive in the marketplace; and by so doing, they gained the capabilities to capture an excellent market share. This consequence led the company from being a simple domestic firm to a multinational one, and thus to enjoy a good profitability in almost every country of its operation. It has almost 560 stores in 18 countries of the world. Ever since 1937 until today, Krispy Kreme has provided good quality doughnuts and coffee. Although it has almost no competitors with the same quality products, even then, it will have to use various sorts of strategies.

As a global expansion strategy, the company is using franchising in almost every countries of its operation. Branding the products of the organisation is the key marketing strategy of KK. In case of corporate level strategy, KK is using Market development approach, and for the business level strategy, it is using focusing approach. It is also undertaking some store opening programs, fundraising and product differentiation programs, and establishing itself in both the coffee and doughnut industry quite strongly.

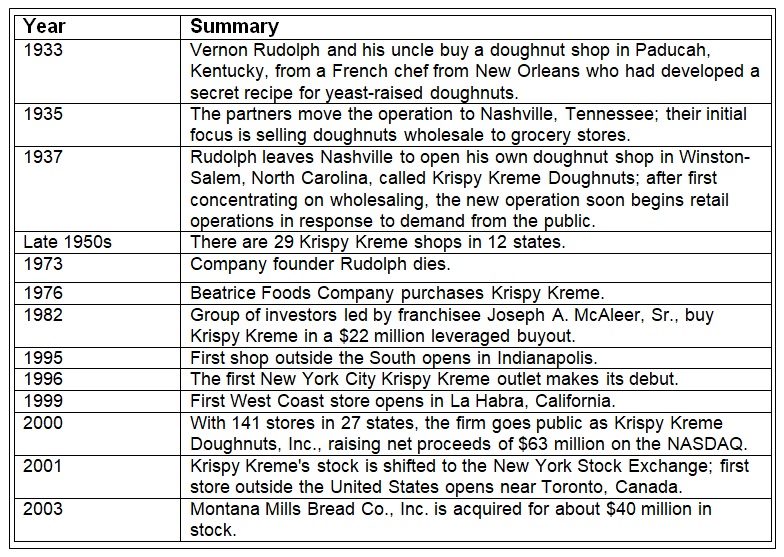

Background and Ownership history

Krispy Kreme asserts that they had been there with the customers at the past and is still serving them at present, and will do so in the future as well. The long history of this company is giving strong evidence for this claim. This company is providing differentiated products for the last 70 years. It was July 13th 1937, when KK started its journey through the founder of the company Vermon Rudolph. Mr. Rudolph learned an effective recipe from a French chef and rented a building in North Carolina, from where the KK started its business. Then he sold his product only to the local grocery shops, which attracted the local people extensively triggering Rudolph to start selling doughnuts directly to the customers. The local families also started to copy the recipe of Rudolph, but as a pioneer, KK always were in a good competitive position. As a result, Rudolph was able to establish a factory of mixing and producing doughnut in 1940-50. In this period, KK established an improved product line for the customers through innovation and established an impressive distribution system along with different branches. Hereafter, the company developed the doughnut-making equipments and this generated more profits.

Throughout the decade, KK put their best efforts to make an easy doughnut making process. After improving this product, the next decade gave KK a steady growth, which was accompanied by its business expansion. Rudolph died in 1973 and thus the impressive business operations hampered. In 1976, Beatrice Food Company bought and reorganised the company, which slowed the growth of the firm.

Then a small group of associates came forward to repurchase of the company from Beatrice Food Company and again the hot doughnut became the key product for KK. As a way of expansion, KK then started to spread within the United States and opened a store at New York in 1996. In 5th April 2000, KK became a public listed company listed in NASDAQ under the symbol “KREM” and since then it is offering common stock for interested investors. It became a multinational company by opening a branch in Canada in December 2001. Presently the production of doughnuts is about 5 millions a day and the sales are 1.8 billion USD a year (Krispy Kreme, 2010).

Evaluation of its current strategy

Strategies for Growth and Development: Franchising Strategy and Joint Venture (Global Expansion)

KK is famous worldwide for its premium quality foods as it is now operating in almost 18 countries globally. It is mainly an international retailer of its products like “Hot Original Glazed Doughnut”. However, it is also offering a great tasted coffee. All over the world, KK has strong brand awareness as a tasty coffee producer and all of its fame came from the global expansion. For the global expansion, KK availed the increased amount of profitability and profit growth, which was not possible in domestic operations. Global expansion helped KK in many ways. These ways are –

- Merging the domestically produced products to the international market,

- Getting the opportunities to realise the location economies, and thus, enabling to get idea where the products can be produced more effectively and efficiently(Hill, 2009, p. 426 and 498)

As a tool of global expansion, KK is using the “Franchising strategy” along with joint ventures in some cases. In 2003 KK has been going to a joint venture with Harrod’s and after that it goes for such a venture with Tesco, which has become the most successful move of KK in UK (Kent, 2008). Franchising is a special type of licensing where the franchiser to the franchisee along with providing the intangible property rights imposes the rules and regulations. The franchiser directs the way of doing business for the franchisee and the franchisee is bound to abide by these restrictions. Using this strategy, KK has reached about 560 locations worldwide including the major countries like United States, United Kingdom, Saudi Arabia, United Arab Emirates, Australia, Canada, Japan, and the republic of Korea, Malaysia, Indonesia, Bahrain, Kuwait, Mexico, Lebanon, Puerto Rico, Philippines, Qatar, and Turkey (Krispy Kreme, 2010).

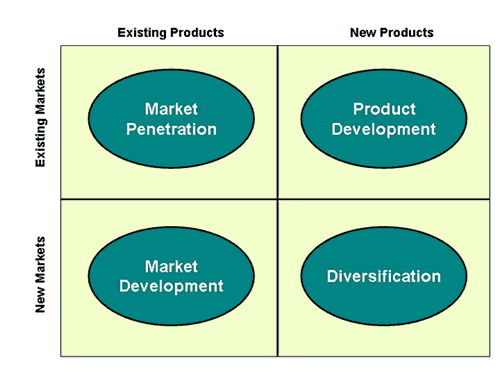

Corporate level strategy – Ansoff Matrix

Johnson, Scholes & Whittington (2008) stated that ansoff matrix is a tool used heavily to identify the appropriate product and market growth strategy. According to this matrix, the business of KK has a task to select its existing products or new products and to offer in a new market or a previous market. Based on this, there can be four types of strategies. These are –

- Market penetration is a strategy where the firm will sell the existing products in the existing markets. The objectives of this strategy is to increase the share of the current product in the current market, ensuring the dominance of growth over the market, restructuring the matured market and increasing the usage among the present customers.

- Thompson & Strickland (2007) said that market development is a strategy where the existing products are sold in a new market. KK can go for this strategy in many ways. It can find a new geographical market, add new product dimensions such as packaging, establish new distribution channels, and differentiate pricing strategies for different customer segments.

- Hitt, Ireland, & Hoskisson (2001) stated that the product development is a strategy where the firm will sell the new products to the existing markets. KK may require the improvement of the new core competencies of the products.

- Diversification is the strategy where the firm is offering the new products in the new markets but it is risky.

Vertical integration and concentration strategy

In case of KK, it is actually using vertical integration as a corporate level strategy. In case of becoming a franchisee of KK, the franchisee must buy the mixing machine for mix doughnut mixing. Again, they must have to invest sufficient amount to market development, which is the base of corporate level strategy we got from ansoff matrix. Along with these, KK has concentration on the doughnut and coffee only, which means it, uses the concentration strategy (Kent, 2008).

Business level strategy: Differentiation

According to Michael Porter’s generic strategies, there are three possible strategies, which a firm can take. According to Kotler & Keller (2006, p. 56), these are low cost leadership, differentiation, and focus. KK is now using the differentiation strategy. In a differentiation strategy, the firm will differentiate the products according to the preferences of the customers for differentiate the products from the competitors. As evidence, it is not spreading the recipe it gets earlier. It has then differentiated the products in many types as it went for capturing international markets like “Sothern Classic”. From April 18, 2010, it is going to differentiate its products furthermore, which is actually Bananas in doughnuts. It always tries to make the doughnut twister than the others. It has differentiated its products also based on many tastes like Banana pudding doughnut and many more. There are about 4 types of doughnuts along with 27 varieties. All these differentiation has been made due to the customer preferences and for a strong desire to differentiate its products. (Krispy Kreme, 2010).

An assessment of its sources of competitive advantage

Krispy Kreme needs the assessment for securing market positioning and creating competitive advantages for current and future presence of competitive rivalry in the industry (Gnau, et. al, 2003). As the industry is operating in standard cycle in competitive market, so they have to take first mover advantages, which would be differentiating themselves based on quality and tastes. Some competitive advantages are analysed according to the source of advantages:

Assumptions on Future Store Openings and Future Sales

According to the annual report 2009 of KK, it is clear that, the expectations and assumptions of future store openings and future sales growths are maintained by this organisation very strictly. Some key issues of this advantage, which are useful for KK, are:

- To open 650 stores within 2013 for capturing maximum market potential.

- To build 200 more stores with the help of franchisees.

- To expand worldwide by 33 stores at minimum (Krispy Kreme, 2009).

Fundraising Programme

Krispy Kreme is also opening fundraising programmes for community for any specific reasons in any locations.

Product Differentiation from Competitors

For analysing competitive advantages, first, it is important to know about the main competitors of KK, which are Dunkin Doughnuts and other coffee chains. However, KK is maintaining differentiation perfectly in its baked products, which are very different from focused group of competitors. It keeps its name as “Doughnuts Theatre” in the very usual market with a competitive advantage.

Having Crowds in Grand Openings

According to KK’s future assumptions, it is successfully opening grand stores in many lucrative locations of UK, which is generating crowds to increase the ability in competitive market. For example, the opening day is started with a ribbon cutting where all the local officials, business leaders of the community and the executives of KK are invited. Thus, the initial awareness has built and the customers came in the stores with pleasure.

Having Numerous Publications

KK is establishing competitive advantages by having numerous publications ((Gnau, 2003)) over other competitors and discount stores for fresh food and bakery delivery in the market. This advantage is a threat to the competitors, which makes differentiation of sales in between KK and Dunkin’ Doughnuts, the major competitor of KK.

Attacking in Coffee Industry

In consumer survey, Krispy Kreme is enlisted as the favourite doughnuts and coffee chain in the market over the competitors of Dunkin’s doughnuts and Starbucks. According to this survey, Krispy Kreme has positioned itself as number one in food and coffee industry with convenience and discount stores with huge market shares and competitive strategy of serving rich products to the consumers at lowest possible prices.

Competitive Dynamics of KK in Doughnuts Industry

The total set of actions and responses taken by all organisations in a specific industry like the doughnuts, can be said as the competitive dynamics of the industry. When KK is taking any competitive step in this industry, immediately the competitors are responding according to the competitive actions of KK. The competitors’ reaction according to KK’s competitive actions is very slow with few players, which is another competitive advantage.

Anticipating Competitors’ Reaction

Krispy Kreme generates competitive dynamics, but it should also anticipate, evaluate, and analyse competitors’ action in the industry. There is a good example of KK to adopt and respond to competitive action of Dunkin’ Doughnuts, which was to open convenience stores at every service station, creating strong competition among two of them. KK emphasised on another action to serve hot and fresh foods to the customers, which was helpful for competitive reaction.

Financial Source-Offering to Increase Sales of Seasonal Products

KK has to increase the small amount of loosing market shares by seasonal products throughout the year. For this reason, it has launched special Christmas, Halloween, and greeting cards for customers and some off seasonal products, which will obviously increase its sales,

Building Brand Name

One of the major competitive advantages of KK is strong brand recognition in consumer market and food & beverages industry over competitors. This brand name is helpful to build KK in very new market with franchises. They are also saving the expenses of media advertising because of its brand name, which cannot be copied by competitors so easily as competitive dynamics.

Being Engaged with Competitors

Competitors are most risky for any organisation but some organisations have to engage with competitors to copy their reactions in the market. This happens when the market commonality is very high with almost same products like KK. It easily can focus on swift attacks and responses according to market as KK is working together with its competitors.

Having Position as Dominant Competitor

According to the model of competitive rivalry, KK is achieving sudden competitive behaviours, like brand name, working process, and serving fresh doughnuts are working as competitive strategies, which is positioning itself as “Dominant Competitor” in the industry.

Strong Reputation

KK is maintaining strong reputation by providing high quality products from 1937, which is a competitive advantage over the market. The KK has some unique brand elements, which reveal the brand as a successful communication tool between the firm and the customers. In case of brand elements, the product characteristics are used by KK, like the doughnuts, which are made from a secret recipe. For this, the doughnuts have a unique taste and the customers become loyal, as they do not have any substitutes. The same can be said for the coffee. Unlike the doughnuts, its coffee is also contributing to the brand portfolio as a purchase generator along with an integral contributor to make strong brand equity. In addition to this, the corporate social responsibility is another way to build brand equity for KK, which will entrust to a strong relationship with the customer (Krispy Kreme, 2010.

Capabilities to Expand in Market

With continuously raising reputation of the company, customers are asking to establish more stores in new locations worldwide. Truly, KK has the capabilities to open stores successfully as customers’ demand in market.

Availability

In some extends, KK is available in 24/7, but certain stores are opening from 9 am – 9 pm to satisfy the need of customers snacks and sugar demand.

Popularity of Doughnuts Chain

All over the world, KK is maintaining quality and cleanliness, which the main reasons for the popularity of chains. These strategies make KK as market leader in the industry and best doughnuts chains worldwide.

Creating Value to Customers

KK is providing value to its customers by its unique products, for which customers are willing to pay to KK. By delivering unique and fresh foods, KK is creating value to its customers.

Core Competency in Market

By providing fresh and unique foods, strong reputation and brand name, KK established core competencies in the market. The brand name, which is consciously misspelled, reminds customers first to this brand. Therefore, the brand name building itself is another competitive advantage of Krispy Kreme

Conclusions on its current strategic and financial performance

Growth Rate Analysis

Foust (2005) reported that the Krispy Kreme’s recent data demonstrates that the investors are deciding to hold or take time to investment in KK, as the growths are being slow in some specific territories. In consideration of longer term, the growth opportunities are higher, as the organisation has 1.2 millions warrants in the share markets of UK and overseas markets. The growths of international franchisees are more than domestic stores of KK, which is determined according to the growth of sales in market, which is fluctuated from 9% to 17% growth rate (Factset Call Street, 2009)

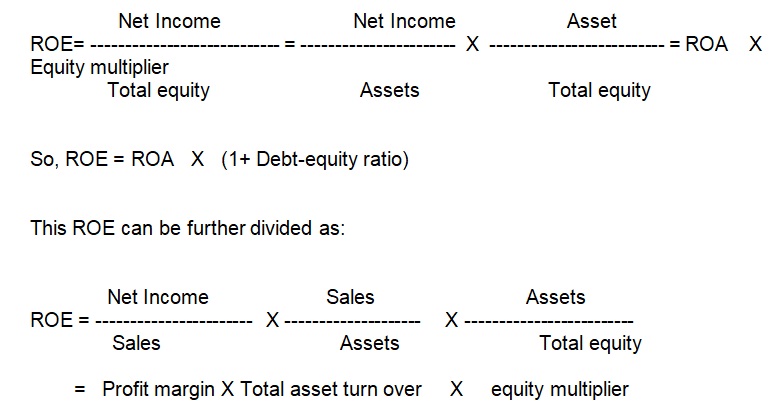

DuPont Analysis

DuPont Analysis is a popular expression of breaking the “Return on Equity (ROE)” in to three parts. These are:

- Operating efficiency.

- Asset Use efficiency.

- Financial leverage.

Here,

Some significant results can be focused from the comparison of DuPont analysis of 2009 with 2005 and these are –

- KK has improved its asset turnover ratio over time, except the current year.

- In previous years, KK was under profit by its operations in the market, but in recent income year, it has improved its gross profit.

- The ROE was in negative position, because of having losses in net profit. However, as KK improved its profit in 2009, so the volume of ROE also reduced, which indicates less leverage from shareholders (Gnau, Lee, Parseval, & Poddar (2003, p.2).

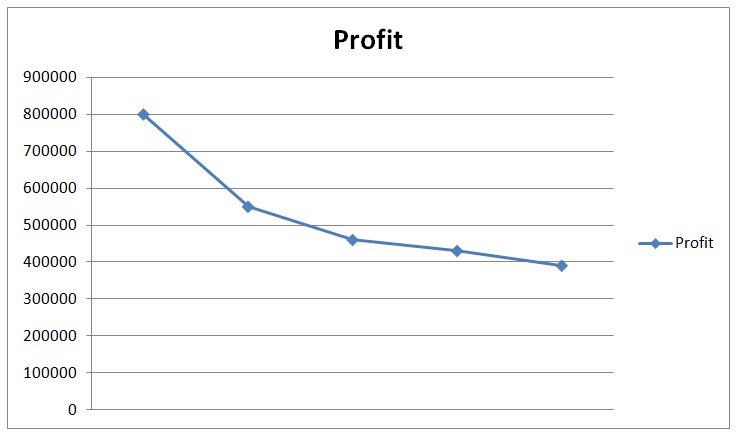

Trend Analysis

From the record of revenues of Krispy Kreme, it is focused that, the revenues are changed in reverse way within time. The chart of revenues shows that in 2009, revenues was in lowest from all years’ revenues. Therefore, trend analysis will show the true image of KK

- Profitability Ratios: the profitability ratios are hardly in positive figures as KK is positioning loss from net profits to revenues. The gross profit margin is only in good position, which is indicating little changes in revenues and costs of goods sold. However, net profit margin indicates that there are huge expenses rather than income from operating margins. With loss on profits, shareholders return cannot be possible to pay for this company.

- Efficiency Ratios: According to sales due to capital employed and sales per employees, it can be measured that, KK is operating its business and maintaining capital expenditures efficiently, which can be shown from efficiency ratios in Exhibit 7.

- Liquidity Ratios: the liquidity ratios demonstrate that KK is highly liquid Company, which is not good for any organisation. Besley & Brigham (2007) stated that unused current assets mean unused property, which is hampering the organisation to income more from investment. Therefore, it is better to keep liquidity ratios more than 1/1.5, not more than this amount.

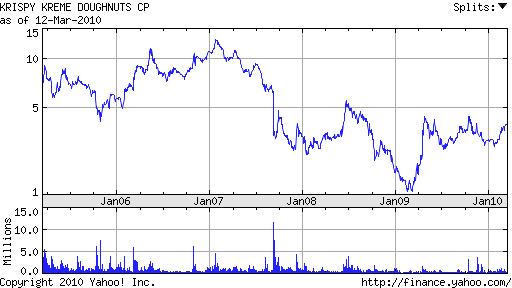

- Investment Ratios: From the investment ratios, it is focused that, earning per share is too low for KK, where the market price of each share was $12.21 for 2009, so the P/E ratio is high with more than 64.

From the above financial analysis, it can be said that the organisation is not so lucrative position in profits or revenues. However, in recent periods, it is trying to improve its revenues with its reputation and brand name worldwide.

Reference List

Anon. (2010). Ansoff’s product / market matrix. Web.

Besley, S., & Brigham, E. F., (2007). Essentials of Managerial Finance. 13th ed. Thomson South-Western.

Factset Call Street. (2009) Krispy Kreme Doughnuts, Inc.: Management Decision Section. Web.

Form 10-Q. (2009) Annual report 2009 of Krispy Kreme Doughnuts Inc. Web.

Foust, D. (2005) Krispy Kreme Has That Glazed Look. Business Week. Web.

Gnau. M, Lee. L, Parseval. Y, D, & Poddar B. (2003) Krispy Kreme Doughnuts. Web.

James, S. (2004) Krispy Kreme Doughnuts, Inc. International Directory of Company Histories, Vol. 61. Web.

Johnson, G., Scholes, K., & Whittington, R., (2005) Exploring Corporate Strategy: Text and cases. 7th ed. Pearson Education Limited.

Johnson, G., Scholes, K., & Whittington, R., (2008) Exploring Corporate Strategy: Text and cases. 8th ed. Pearson Education Limited.

Hill, C. W. L., (2009) International Business. 7th ed. New York: McGraw Hill.

Hitt, M. A., Ireland, R. D., & Hoskisson, R. E. (2001) Strategic Management. 4th ed. South-Western Thomson Learning.

Keller, K. L., (2003) Strategic Brand Management. 2nd ed. New Jersey: Pearson prentice-Hall.

Kent, N. (2008) Krispy Kreme in Brazil. Web.

Kotler, P., & Armstrong, G., (2006) Principles of Marketing. 11th ed. Prentice-Hall of India Private Limited.

Kotler, P & Keller, K. L., (2006) Marketing Management. 12th ed. New Jersey: Pearson prentice-Hall.

Krispy Kreme. (2009) Krispy Kreme Announces First Quarter Fiscal 2009 Results. Web.

Krispy Kreme. (2009) Krispy Kreme Doughnuts, Inc: Management Discussion Section. Web.

Krispy Kreme. (2009) Shareholder Information: Krispy Kreme Doughnuts Inc. Web.

Krispy Kreme. (2010) Company Profile of Krispy Kreme. Web.

Krispy Kreme. (2010) Corporate Fact Sheet. Web.

Krispy Kreme. (2010) Doughnuts & Coffee since 1937. Web.

Krispy Kreme, (2010) Investor Overview. Web.

Krispy Kreme. (2010) Krispy Kreme Goes Bananas and Puts a Flavourful Twist on a Southern Classic. Web.

Krispy Kreme. (2010) Store Locator. Web.

Nevistas. (2010) STR Reports US Performance for Week Ending 6 March 2010. Web.

Pearce II, J. A & Robinson, R. B., (2006) Strategic Management. 10th ed. New York: McGraw Hill.

Ross, A. S. Westerfield, R. W. & Jordan, B. D., (2008) Fundamentals of Corporate Finance. 8th ed. New York: McGraw Hill.

Thompson, A. & Strickland III, A. J., (2007) Strategic Management. 13th ed. Tata McGraw- Hill.

Yahoo Finance. (2010) Basic Chart of Krispy Kreme Doughnuts Inc. (KKD). Web.

Yahoo Finance. (2010) Key Statistics of Krispy Kreme Doughnuts Inc. (KKD). Web.

White, M. M. (2003) Company Analysis of Krispy Kreme. Web.

Appendix

Exhibit 1: Number of Stores of Krispy Kreme in International Market. Source: Krispy Kreme (2010) & Yahoo Finance (2010).

Note: Exhibit 1 shows the stores for international market and the total number of stores in international market is 380.

Exhibit 2: Balanced Geographical Diversification of Krispy Kreme. Source: Krispy Kreme, (2009).

Exhibit 3: Timelines of Krispy Kreme. Source: Krispy Kreme, (2009).

Exhibit 4: DuPont Analysis.

Exhibit 5: Five Years Record of Krispy Kreme. Source: Form 10-Q. (2009).

Exhibit 6: Profitability Ratios.

Exhibit 7: Efficiency Ratios.

Exhibit 8: Liquidity Ratios.

Exhibit 9: Investment Ratios. Source: Self generated from Ross, Westerfield & Jordan (2008).

Exhibit 10: Basic Chart. Source: Yahoo Finance (2010).

Footnotes

- Krispy Kreme.