Introduction

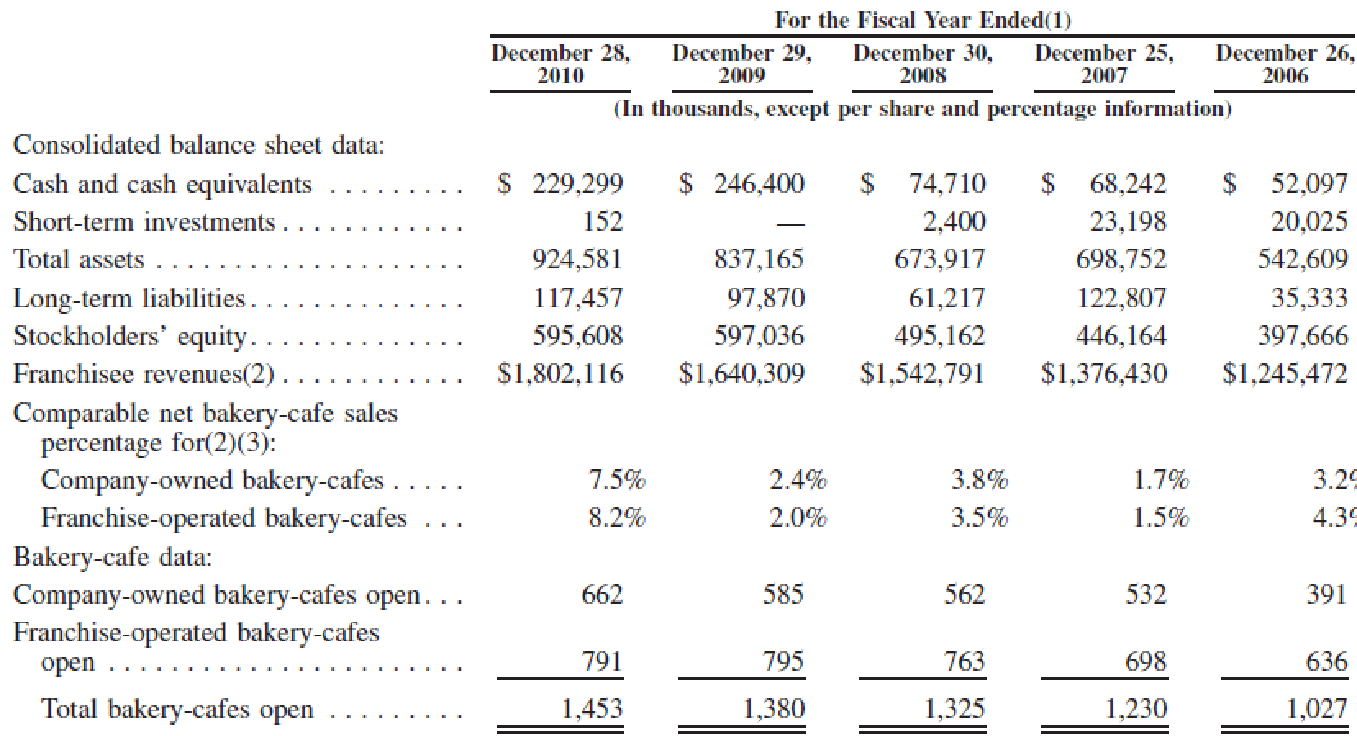

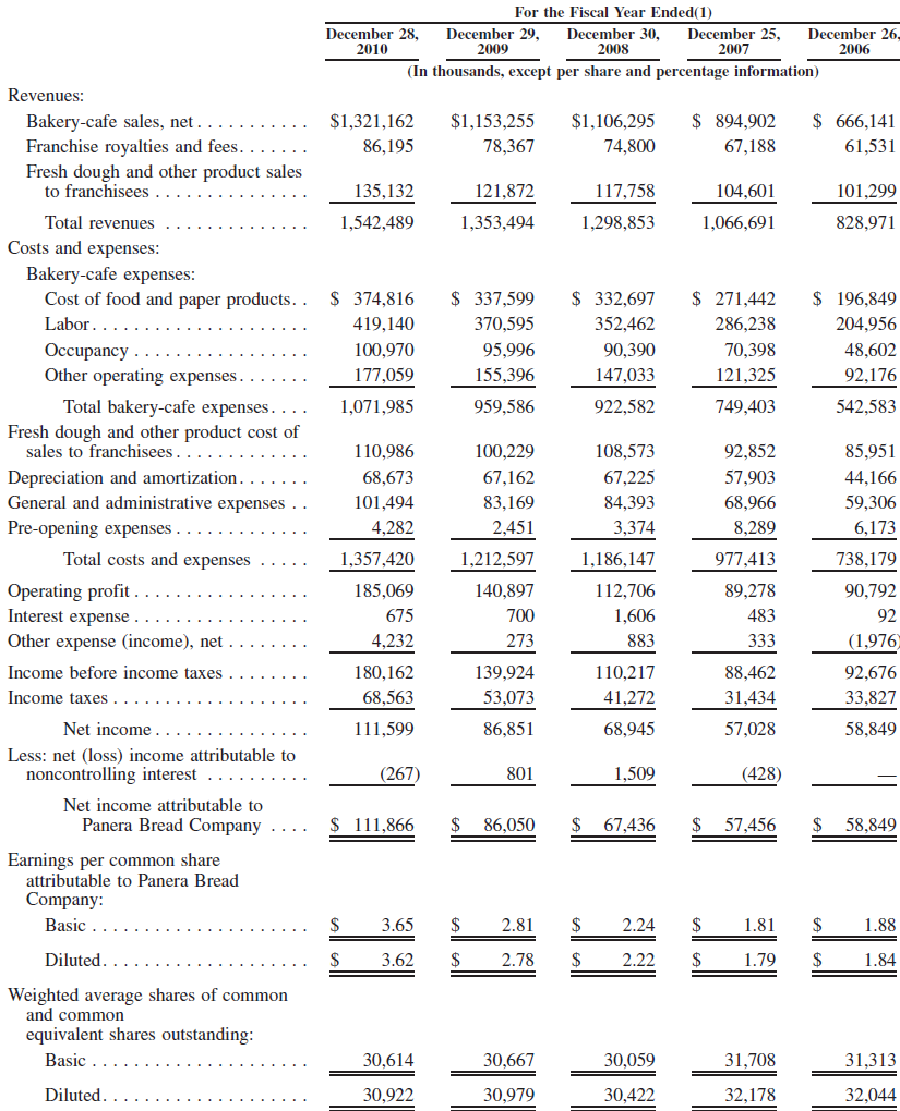

With its headquarters in Sunset Hills in the United States (U.S.), Panera Bread Company was recently reported by Financial Times as one of the fastest growing companies in the restaurant industry. Panera operates as a Bakery café chain that specializes in producing a number of brands including salads, bagels, sandwiches, hot Panini and soups. Founded on the eve of 1980s by Louis Kane, Ken Rosenthal and Ronald Shaich at Missouri, the company has grown rampantly to own 1493 units spread out in different locations both in the U.S. and Canada. The high numbers of business units currently employ over 5,000 employees who work on full time basis. Led by Ronald Shaich as the executive chairman and William Moreton, president and chief executive officer, Panera recorded a promising net income of U.S. dollar 67,400,000 as of 2008 end of financial period. The year 2008 closed with a total assets of U.S. dollar 674,000,000 and total equity of U.S. dollar 495,000,000. A couple of years back in 2005 BusinessWeek ranked Panera Bread number 37 among the “hot growth companies”. In particular, it was reported that Panera had remarkably earned U.S. dollar $38,600,000, which represented 42.9 percent increase in profits. Since its foundation, Panera has been employing expansion strategy to considerably increase its market share as well as improve its profitability performance. Panera merely trades its shares at NASDAQ using the trade name PNRA (NASDAQ, 2011).

Management Team

A knowledgeable and experienced team manages Panera. At the top, executive Chairman, Mr. Ronald Shaich, manages the company. Mr. Ronald shares almost equal responsibility with President and Chief Executive Officer, Mr. William Moreton. Panera Company has as well ensured that its units located in different locations are supervised and monitored by experts who understand the market environment as well as Panera production processes. To ensure Panera’s entire operations are set towards achieving the company’s goals and objectives, Panera Bread Company chose to set three committees that would oversee its operations.

The committees comprise of audit committee, which prepares and audits financial statements to ensure all requirements and regulations governing the financial reports are followed as per GAAP. Compensation and stock option committee, which determines the compensation of the executive officers as well as the cash and equity incentives. Finally, we have nominations and corporate governance committee, which is concerned with selection of individuals to the Board of Directors. Having a strong believe in good corporate governance, Panera management team has streamlined its human and financial resources towards improving its financial position through expansion strategies that aim in diversifying its business to new regions among other measures (Graves & Moran, 1995).

The Company’s Products and its Strategy

Panera Bread specializes in producing different types of bread products such as salads, bagels, sandwiches, hot Panini and soups. The products are sold in over 40 locations in both Canada and the U.S. The company’s strategy is to provide a special bakery and café to dwellers of town and suburban areas. Particularly, the firm pursues broad differentiation strategy, which denotes that Panera Bread is attempting to appeal to a variety of customers with its high quality products. For the Panera’s product to penetrate well in both the U.S.’s and Canada’s market, it had to conduct a comprehensive and broad research after which the company realized that customers would enjoy having fast and excellent dining experience. According to Doherty (1993), to gain competitive advantage, the firm ensures its scrumptious bread arrives fresh on a daily basis in addition to serving the customers in a welcoming and friendly environment.

Financial Ratios

Net Profit Margin

The net profit margin has been increasing significantly for the last five years. Except for the slight drop of 0.0007% witnessed in the year 2008, the firm saw its net profit margin increase progressively for the remaining 4 years. This trend is expected to continue in future thereby making Panera Bread Company an attractive investment for many potential investors (NASDAQ, 2011).

Return on Stockholder’s Equity

Panera Bread Company’s return on stockholder’s equity showed steady increase apart from the slight drop in the year 2008. The ROE dropped to 14.9% from the previous 15.1% experienced in the year 2007. However, for the rest of other financial periods the company indicated a positive increase. The trend is projected to move in the same direction in the near future making the investment attractive for both preferred and common shareholders (NASDAQ, 2011).

Debt to Equity

The company as well indicated a positive increase in D/E for the last five years apart from the year 2008 where there was a slight drop of 0.002. The trend indicates that Panera Bread Company is increasing its level of dependency on debt, which is quite risky for companies because heavy debts have high likelihood of disposing a company into bankruptcy situations. Increase in debt means that the company is facing huge obligations payable to the debtor. Failure to pay the interest rate and principal amount on time may result to such hard times for Panera Bread Company. However, the company is able to gain from the reduction in levels of equity holders. In particular, the company is able to reduce level of dilution associated with the stockholders’ shares. Reduction in the dilution level will make Panera Bread an attractive investment decision for prospective investors (NASDAQ, 2011).

Current Ratio

The increase in the current ratio denotes that a firm is having a reduction in its level of current liabilities relative to the current assets. In the year 2006, the firm had a current ratio of 1.16, which sharply rose to 1.31 in 2007 indicating a substantial increase in current assets and a reduction in the level of current liabilities, an indication of good performance. However, the ratio dropped to 1.24 and 1.12 in the subsequent years indicating poor performance in terms of fewer current assets and more liabilities that are current. In the final year of 2010, Panera remarkably experienced an increase of 0.47 an indicator of good management of short-term assets and liabilities associated with the firm. The excellent management is expected to continue in the next years for the firm to compete effectively with other firms. This consequently makes Panera Bread Company an attractive investment (NASDAQ, 2011).

Return on Sales-by Business Segment

Company stores

The company stores’ return on sales increased steadily throughout from the year 2007 to the year 2010. At no point did the company indicate a decrease. With return on sales standing at 15.3% in the year 2007, the company stores saw its return on sales move to 16.59% in the year 2010. The steady increase is an indicator that the firm has the capacity to move to new heights hence becoming an attractive company for both debt and equity holders (NASDAQ, 2011).

Franchises

Panera Bread Company has perhaps used its franchising strategy to gain recognition in new markets. The firm has been adequately utilizing franchisees business units to distribute its fast, fresh and quality products. The franchisees return on sales has been decreasing for the last five years apart from the increase of 0.6% experienced in the year 2008. This is an indication of the company’s effort to buy and fully own most of the units. This will give the company an opportunity to have full control of diverse locations. This will consequently mean that Panera Bread Company will earn 100% of profit reaped from various locations (NASDAQ, 2011).

Dough Segment

The Dough Segment has been one of the segments that have considerably contributed to strong performance of Panera Bread Company. Over the last five years, Panera Bread Company saw a progressive and stable increase in the returns associated with its sales. The company had a return of 10.1% on sales at the end of financial year 2006 while at the end of financial year 2010, the company returns on sales rose to 13.4%. The company’s increase in returns on sales pertaining to its Dough segment is an indication of excellent performance. As a result, the company becomes one of the attractive firms in the industry (NASDAQ, 2011).

Combined

The combined return on sales indicated a non-decreasing trend throughout the five years period. The company had a return of 23.4% on sales at the end of the year 2007, 24.3% in 2008, 24.7% in 2009 and 25.65 in the year 2010. The increasing rate is representative of the excellent performance experienced by the firm for the last five years. Such growth rates become attractive grounds for most investors. The high rate of growth emanating from the company’s sales can be attributed to the company’s strategy and efforts streamlined towards expansion of the company’s size through acquisition as well as franchising (NASDAQ, 2011).

The External Business Environment

Interest Rates

Panera Bread Company is exposed to market risk particularly the volatile interest rate. The company owns a credit facility, which issues about $250,000,000 secured property under which the company selects an interest rate basing on the “Base Rate” mostly indicated by Bank of America prime rate as well as Federal Funds. At the end of the financial year 2010, the company did not have outstanding balance at the credit facility. However, the firm will be exposed to difficulties in the near future if interest rates for borrowings increase to higher levels. It is projected that Panera Bread will most likely borrow in future to continue with its expansion strategy in the market. In simple terms, if the market for borrowings experiences high interest rates, Panera is likely to suffer from the heavy costs of borrowing. On the other hand, if interest rates go down, Chandra (2005) argues that Panera is likely to have enjoyed happy moments at the market due to the cheap cost of borrowing.

Foreign Currency Exchange Rate Risk

In the recent past, Panera expanded its market to the neighboring country Canada. It has opened up new units through franchising as well fully owning bakery-cafes. The Panera’s income and expenses are subject to changes in the exchange rate between Canadian dollar and the U.S. dollar. While opening new units in Canada, Panera will prefer U.S. dollar to be much stronger. However, when repatriating income earned in Canadian’s business units to U.S., Panera will perhaps require the Canadian dollar to strengthen to earn maximum profit. In the last five years, the exchange rate between the two countries has been seen to stabilize and only indicating slight drops and increases. On the contrary, the company is exposed to high risk bearing in mind that it has not entered into hedging contract. This might particularly affect Panera’s business units outside U.S. market. To encounter the problem, Panera need to hedge its income against the exchange rate risk (Chandra, 2005).

Risks associated with the Inflation Rates

The company frequently faces hard times during inflations. In particular, the company faces difficulties in raising the menu prices after prices of fuel, wheat and protein, which include chicken, and turkey hikes. During inflation, the company as well faces pressure from the increases in the wages and salaries of workers. Taking into consideration that increasing menu prices instantly is likely to dampen Panera’s sales as competition continue to stiffen due low cost strategy embraced by a number of rivalries, Panera’s slight increase in menu prices will not reflect the increase in inflation rates. Nevertheless, Panera Bread Company can be able to position itself in the market by employing broad different ion strategy, which focuses on producing superior products that will attract premium prices (Haines, 1995).

Conclusion

Panera Bread Company is among the few companies that offer superior products in the restaurant and bakery industry. The firm’s superb strategy in expanding to new markets through franchising as well as purchase of new business units in new locations has seen its growth stabilize. Since the company operates outside the U.S. border, the firm’s operations are likely to face problems related to exchange rates as well as hostile foreign governments. During inflation times, the company faces pressures of commodity prices in addition to increases in costs related to labor. Panera Bread Company may find it difficult to retaliate by instantly increasing the menu prices by considerable amounts. However, Panera’s strategy on expansion has seen the company increase its level of sales. The increase in sales might be attributed to the increase in market share which made the company perform significantly well for the last five years. This, as a result, has enabled most investors to choose Panera Bread Company as the company of choice in their investment strategy (Graves & Moran, 1995).

References

Chandra, P. (2005). Fundamentals of financial management. New York, NY: Tata McGraw Hill.

Doherty, M. (1993). ‘Strategic management: The future is now’. Paper presented at the Total Quality Government Conference, Washington, DC.

Graves, S. & Moran, J. (1995). Developing an organizations strategic intent and operational plan. The Quality Management Forum, 21(1), 1-4.

Haines, S. (1995). Successful strategic planning. California, CA: Crisp Publications Inc.

NASDAQ. (2011). Stock market today. Web.

Appendix

Panera Bread Consolidated Income Statement

Consolidated Balance Sheet

As at the end of Financial Year