Efficient information systems have become an integral part of the successful functioning of any banking firm. Use of well-designed information systems and reporting tools enhance the reliability of the information which respond to the requirements of complex information needs of the clients as well as the information exchange between different departments of a bank branch. A real-time reporting mechanism has a decisive influence on the relationship which a bank can develop with its clients.

The optimization of the efficiency of the client-related processes and an increased array of banking services are the current criteria for any client to choose a specific bank. Even though, the differences in the monetary involvement in the form of charges of different banks do play a role in retaining the customers, the bank-client relationship also needs to be considered as a significant factor in the success and growth of any progressive bank.

The quality of such relationship is greatly enhanced by meeting the information requirements of the customers accurately and within the minimum time possible. The information exchange among different departments in the branch of a bank also facilitates the passing on of reliable information speedily to the clients. However, in order to meet the external information needs of the clients as well as the internal needs of the departments, it is vitally important that the bank employs well-designed information tools to speed up the process of gathering and disseminating the vital information.

This study analyses the engagement of different software applications in the major branch of a bank for improving the performance of the branch with respect to the interdepartmental information dissemination as well as meeting the information requirements of the clients of the bank. The research reported in the study forms an exploratory study which examined the suitability of different software applications for improving the branch performance. The study undertook a pluralist approach with the backing of a detailed review of the relevant literature and a case research. The focal industry was the financial services industry with specific reference to BNP PARIBAS Securities Services (BPSS).

Background of the Study

Even though, the aim of the earlier research was to investigate the business value of information technology (IT) there have been lack of consistent definitions more specifically with respect to Information Systems (IS) and IT (Weill & Olson, 1989). However it can be argued that the due to rapid and dynamic changes experienced in the realm of IS and IT, it was not possible to evolve definitions which were consistent in nature (Banker & Kauffman, 1988).

To complicate the issue further the earlier studies have used differing measures for assessing the organizational performance. Cron & Sobol, (1983) used generic profitability measures to assess the effect of computer usage on the performance of different types of organizations. The research reported in the current thesis was deemed to be specifically looking in to the utility of certain types of software in improving the information capabilities of the financial institutions.

The study attempts to address the issues relating to the implementation of specific reporting-informational tool and the use of such tool in enhancing the working of the branch/subsidiary of a major bank through the development and analysis of a conceptual model which is meant to improve the reporting abilities available with the branch.

Objectives

The objectives of the research reported in this thesis were:

- To examine and report on the necessity of the existence of an efficient information system at the bank branch level to improve the organizational performance

- To make a review of the functioning of the different departments with a view to assess the requirements of the IS for efficient reporting

- To examine and report on the impact of the investment on reporting-informational tool on the organizational performance

- To add to the existing knowledge through the review of the relevant literature and thereby identifying the further areas for research

- To review some of the available software tools for reporting-informational and to recommend the best suited one to the branch under study.

It is expected that while achieving the above objectives, the current study would make significant contributions to the existing body of knowledge by analysing the IS capabilities of the bank branch under study and the capabilities that can be added to the information reporting by the branch thorough the use of the recommended tool.

Significance

With the increased expectations of service delivery from the customers, it becomes vitally important that the banks equip themselves with the latest IS and IT tools so that they can become more competitive. In this context, this study increases the understanding of the impact of the utilization of an improved information reporting tool on the organizational performance. This research is unique in nature as it brings new insight and knowledge into the employment of new application software for meeting the information requirements of the clients as well as the several departments within the branch of the bank.

This research extends the knowledge based on the existing theoretical base on the topic available from earlier research. Harris and Katz (1988) are of the view that it is important to measure the organizational performance within a single economic sector in order that useful information and data can be generated, the analysis of which would make meaningful contribution to the growth of knowledge in the specific area being studied. In this respect, the research under this study focuses on the single economic sector of financial services and analyzes the scope for improvement in the sector. As shall be demonstrated later, this study yielded several other conceptual and practical benefits.

Research Design

This study is based on derivation of a conceptual model evolved over a detailed review of the relevant literature, designed to address the research question. The model is derived by reviewing some of the existing software applications designed to meet the specific information needs of the branch of the bank. The review covers the merits and demerits of the systems considered. The study of the impact of the implementation of the software on the performance of the branch both with respect to the internal (interdepartmentally), and to the external needs (client-based) form part of the research. The study also considers the application of Strategic Information System Planning as suggested by Weill and Olson (1989) and Earl, (1993).

Research Question

In order to achieve the objectives set out for the research the following research question has been framed for lending theoretical support to the research issue.

How is the implementation of software applications related to the improvements in organizational performance at the branch level of a banking institution?

The research also extends to provide theoretical support to the following research sub questions.

Do some areas in the IT portfolio of a banking institution contribute more to the organizational performance as a whole?

How does the organizational performance influence the investments in improved IS software tools?

Can any limit be fixed on the investment threshold in the IS for a banking institution?

The research design has been framed taking into account the number of propositions derived from the research questions (Yin, 1994; Miles & Huberman, 1994). Considering the complexity of the research issue and the development of a conceptual model, the case study method of research is being employed to find the answers for the research questions.

Layout of the Thesis

With the outline of the research laid out in the foregoing sections, this section details the layout of the research. To make the study more comprehensive, the thesis is structured to have different chapters. Chapter one while introducing the subject matter of the study, also details the objectives and significance of the study. This chapter also provides a brief outline of the research. Chapter two presents a review of the relevant literature on the topic to enhance the knowledge on the subject of study.

Chapter three briefly introduces the research method and presents the case study. Chapter four presents the findings of the research followed by a discussion on the findings. Chapter five concludes the study and makes few recommendations for an effective implementation of software applications for improving the working of the branch of the bank.

The objective of this chapter is to present a review of the relevant literature on the introduction of Information Systems/Information Technology in the financial service sector and their impact on the organizational performance. Despite the proliferation of the technology and the associated tools, there is no consensus in the literature as to what constitutes information system (IS) and information technology (IT) (Boaden & Lockett, 1991).

McKeown, (2001, p376) has defined information technology as “all forms of technology used to create, store, exchange and use data, information and knowledge”. He defined the information system to mean “a system that converts raw data into information that is useful to managers and other interested parties”. To be more specific, IT can be considered as a collective term that represents the means which are used to capture, process, communicate and store data, information and knowledge. In major organizations, investments in infrastructure, core processing systems and decision support or management information systems are considered as investments in information technology.

The IS in any organization on the other hand can be found in a combination of resources which comprises of information technology, human and organizational factors organized in a manner to achieve a given set of objectives relating to the collection and dissemination of information efficiently and at lesser cost. Organizational performance can be arrived at as the extent to which an organization is able to marshal its resources with a view to create products and services in an efficient manner and at a reasonable cost to the consumers.

The issue of the business value of the IS/IT has been subjected to continuous study by various IS researchers and professionals (Banker et al., 1993). When it comes to the question of deciding the impact of the IS/IT with respect to a particular context as in the case of branch of a bank, the issue becomes decidedly more complex involving a detailed analysis of all relevant factors. There have been many instances to study the relationship between the investments in the IS/IT and improvement in the organizational performance. In many of the instances only a casual link could be established between the two aspects (Harris & Katz, 1991).

The results of the studies conducted have been mostly equivocal which made the generalizability of the results little difficult. Kauffman & Weill, (1989) observe that the measures employed for conducting the research, differences in the research methods and even the time periods during which the studies were conducted were mainly responsible for the limited success of the studies in establishing a general pattern over the issues studied.

Value of Information

Ahituv & Neumann, (1990) relate the value of information used to the context in which the information is used and the time at which the information is being used. The authors argue that there is no absolute universal value attached to the information. Therefore, any attempt to determine the value of information should be linked to the decisions which are based on the use of information supplied.

According to Glazer, (1993) the value of information can be equated to the sum of profits from the enhanced revenues and reduced costs of the transactions to be entered into in the future which are the results of the information collected and passed on to the concerned people and departments. Information can best be described as a valuable resource having considerable financial significance. Based on these wide ranging views on the use of information the following definition of information can be arrived at:

The value of information is the sum of profits from increased revenues and reduced costs of present and future transactions as a result of information collected and used during transactions while effectively employing IT; and the profits from the sale of the information.

Business Value of Information Technology

One of the major concerns for the present day managers is to obtain the maximum value from the IT investments (Butler-CoxFoundation, 1990). However it is not possible to establish one single measure that could provide a conclusive proof to the business value of IT. Nevertheless, it is possible to assess the value of IT investments by relating the costs to a range of business performance measures and compare them with that of other forms of investments.

According to Glazer (1993) firms which integrate the IT strategies with the overall corporate strategies successfully are able to achieve success, by focusing on the information an s a valuable resource and one of significant competitive advantage. This is especially true in the context of banking environment where the information flow among different departments as well as clients is at the root of success of any banking institution. Successful organizations recognize information as their primary asset. In addition, they use IT as the mechanism through which they are able to align the IT strategy to the overall strategies of the business.

However a contrary view is expressed by Mukhopadhyay et al., (1995). According to Mukhopadhyay et al., (1995) there exists a controversy of great magnitude with respect to the impact of IT on the improvements in the organizational performance. While some researchers have found a positive impact of IT on organizational performance others have found a negative impact or no impacts at all. It is true that the large investments in IT apply greater pressure on the business managers to justify the investment by quantifying the business value of IT. The argument here is that large investments in IT call for a cost-benefit analysis and other strategic considerations in the light of higher expectations of the top management in improving the organizational performance.

Justifications for IT investments

Any investment in IT should be considered as an investment for the future, which can contribute to the growth of the business largely. However, business managers often find it difficult to evolve and present a proper justification for new investments in IT because; it is not quite possible to value the investments in IT using the traditional capital-budgeting techniques.

Deitz & Renkema, (1995) observe the businesses find it difficult to value the IT investments in the context of determining the associated costs, benefits and risks which make the decision making process complex. The authors point out that the existing methods of investment evaluations which consider formal rational arguments are not in a position to recognize the complexity and diversity of investments in IT in the organizational context.

These methods also cannot consider the several layers of investment decision-making process and their interdependencies. Deitz & Renkema, (1995) observe in addition to the financial cost benefit analysis, there are other non-quantitative and non-rational aspects which also have a major role to play in important IT investment decisions.

Clemons & Weber, (1990) argue that strategic IT programs often are devoid of formal economic justification. They further argue that in the case of investments in IT programs it is not possible to quantify the benefits as it is not possible to precisely make an estimation of user adoption, future benefits of the programs, and competitive impact which are subjective issues. Findings from the studies conducted by Tam, (1992) indicate that the capital budgeting techniques when used for the evaluation of IS/IT projects have only a small impact on the decisions regarding the evaluation, termination and post-audit of the different IS/IT projects.

Normally the decisions to make investments in the IT projects involve only simple budgeting techniques as against complex capital budgeting evaluation techniques involving discounted cash flow and other methods. The strategic value of the IT programs is an important criterion in the consideration for adoption of any new IT programs. The studies by Tam (1992) provide empirical evidence that the sophisticated capital budgeting techniques do not find any place in the decision making process of IS/IT investments.

IT and Business Change

In order to achieve substantial business success it is necessary that the managers constantly look for business changes and cater to the changing needs of the business. Earl, (1992) points out that it is vitally important that the firms should identify change business needs first. It is for the businesses that they recognize the need for additional capabilities and actions including IT which are to be initiated to achieve the change and manage the business as a whole. Earl, (1992) opines justification for IT investment becomes simplified when the investment becomes an integral part of the vision of the future expansion and growth of the organization.

This gives a clear idea to the organization as to the purpose for which the IT investments are made and commitments are made by the organization. It is also equally important that there is the integration of the IT strategies with the overall organizational strategies for justifying the investments in different IT programs. Any well-considered investment in IT would turn out to be a tool for change in the organization expected to take place in the future and it is critically essential that all these considerations are kept in mind while making any investments in IT programs.

IT Investment and Organizational Performance

Harker & Zenios, (2000) observe that the financial services sector has been the pioneer in the use of IS/IT for improvements in the organizational performance. Financial institutions have put IS/IT into use for a variety of purposes. These purposes include the basic infrastructural needs on normal day to day communication in the form of emails and other automated communication methods. The use of IT extends to other processes like transaction processing on core banking systems, Automated Teller Machines (ATMs), internet banking, voucher processing systems and other management information systems.

Image storage system is one of the improvements in the use of sophisticated technologies. Such exposure to different IT mechanisms has enabled the financial institutions to enlarge the number of products/services they could offer to the customers. They have been able to develop new and improved delivery channels which are unique in nature and above all the institutions are in a position to handle the extremely high volume of transactions with ease employing the new and improved delivery channels (Krishnan et al., 1999; Harker & Zenios, 2000). Substitution of labor to enhance operational efficiencies and to contain the operating costs are some of the other benefits resulting from the increased investments in IS/IT by the banking institutions (Dewan & Min, 1997).

In the context of enlarged investments in IS/IT the question of relationship between the investments in IT and improvements in organizational performance assumes significance. Falling prices of the hardware combined with increases technological capabilities of both hardware and software components of IT programs have contributed largely to the proliferation of the number of IS/IT applications within the firms (Brynjolfsson & Hitt, 1996).

This has also given rise to the issue of enhancement in the productivity of the information systems. The review of the relevant literature has revealed an apparent lack of consensus on the contribution of investment in IS/IT towards improvement in the organizational performance. The studies have attempted to assess the contribution of the investments and have produced mixed results (Kauffman & Weill, 1989).

One of the shortcomings identified by the earlier studies was the focus on technology which limits the scope in terms of understanding the broader impact of other factors on organizational performance.

Comparison of Investments in IT and Other Areas

Powell, (1992) studied the difference between the investments in IT and investments in other areas. The investments in IT have different purposes envisaged by the firms. Organizations in their effort to gain competitive advantage and to improve productivity invest in various IT programs. Investments in IT also enable them to manage and organize the organizations in new ways and to develop new businesses.

However, each IT investment is bestowed with economic underpinning and therefore makes it difficult to quantify benefits and problems from the IT investments. Powell (1992) is of the view that there are few investments where it may not be possible to make a proper evaluation. Powell (1992) also hypothesises that it is not true that the investments in IT are different from other investments. The IT investments resemble other normal investments and therefore they face the same problems as that of other investments. This also implies that the solutions to the issues connected with the IT investments are also same as that of other investments.

Cost-Benefit Analysis Covering IT Investment

Peters, (1990) has developed an evaluation methodology that can be used for evaluating investment in specific IT investments. The methodology developed by Peters (1990) uses variables which are measurable indicators having physical or cost performance characteristics. These variables have a special characteristic of being capable of getting measured. Examples in this respect are the stock turnover or customer queuing time.

Peters (1990) divides the components of costs and benefits from the IT investments into two different streams as is being done with any balance sheet. The methodology suggested by Peters (1990) is considered to have the advantage of covering the complete range of evaluation stages from the stage of conceiving the idea of investments to the last stage of management of benefits. The method identifies and deals with all the intermediate stages. While the method defines an early evaluation process it also contains the measures for the likely benefits and orientation. The method does not consider the internal rate of return as an important criterion for evaluating an appraisal.

Quantification of Business Value of IT Programs

The risks of continuing to use an obsolete technical platform can be evaluated by the functional managers by a review of the complete portfolio of IT applications. It will also enable the managers to take a decision as to the way in which they can deal with the systems which do not meet the needs of the customers. Carlson & McNurlin, (1992) highlighted to the demands of top managers for quantifying the measurements of the value of their organizations which have been realized from the IT investments.

The authors claim that almost all large organizations have adopted some way of measuring the business value of their IT programs developed internally through home home-grown methodology. However it is a fact that most of the measurements so developed are linked to the knowledge and expertise of the managers of the IS operations.

The organizations follow some guiding principles. These principles include

- the proven efficiency of the information systems department,

- integration of business and technology factors,

- measurement of business performance and quality of service,

- lack of single measure, and

- education of executives.

The quantification of business value of IT programs also requires the existence of a strong IT department and a proper benchmarking of the efficiency of the systems. The existence of poor quality of the systems hurts the performance of the business organization. Carlson & McNurlin, (1992) also contribute to the view that there is no correlation between the effectiveness of IS and the organizational performance.

While the organizations treat the amount spent on hardware as investments, the software and people have not been regarded as investments, despite the fact that these are most valuable assets. Keen cited by Carlson & McNurlin, (1992) has observed that the entire expenditure incurred for creating IS infrastructure including hardware, software or people should be characterized as investments and classifying them as expenses would result in an unrealistic expectation of the immediate payoffs from the investments in IT programs.

Information Systems in the Financial Services Sector

De Lucia & Peters, (1998) classify the products and services provided by the financial institutions into

- accepting deposits,

- providing loans, and

- other services covering the processing of financial transactions.

In the present day context, almost all of these services are provided by the financial institutions through the use of technology. This makes the financial institutions significant users of IT. Trewin, (2000) therefore concludes that because of the interrelationship between IT and the services of financial institutions, the institutions are largely dependent on the information technology and telecommunication sectors for their growth and profitability.

In the last decade there have been remarkable changes in the service delivery by the financial institutions where the use of IT has increasingly been found. This resulted in a significant shift from the traditional methods of banking through the brick and mortar model and face-to-face contact.

Increased use of IT has also benefited the financial institutions largely to increase the number of products and services and introduced new delivery channels. Some financial institutions have made large investments for introducing new IT systems or to make improvements in the existing systems and thereby have replaced the labor with capital investments by investing in flexible and extendable IT platforms. With the introduction of new products and services the customers have become more sophisticated. With the sophistication the customers start demanding more better services from the financial service providers.

Therefore the customers can also be found responsible for pushing the financial service providers to enlarge the range of services being provided by them. The customers also expect to receive a round clock access to a multitude of financial services and information (Harker & Zenios, 2000).

With higher spending on the IS/IT the financial institutions have introduced several innovations in their products and services which in turn have resulted in numerous changes in the approaches of the customers’ banking habits (Holland & Westwood, 2001). In the past the financial institutions were dependent mainly on their brick and mortar branch network for the delivery of their services which has undergone tremendous changes in the recent past.

Most of the improved delivery channels are dependent on IT in conjunction with the traditional network of bank branches (Seivewright, 2002). As a consequence there has been a significant shift in the processing of the transactions. Most of the paper-based transactions have been shifted to the use of semi-automated to full electronic tools. This practice has been facilitated largely by the falling prices of hardware and software which have made the investments in IT more affordable and financially viable (Harker & Zenios, 2000). Investing in IS can provide enlarged benefits to the financial institutions in two ways (Carrington et al., 1997).

While the increased investments in the IS/IT enable the financial institutions to create more opportunities for a healthy competition among the existing players in the industry, it also prevents the entry of new players to the market. Increase use of technology also changes the customer behaviour. With the increased sophistication the expectations of the customers also go up with more demand for better and efficient services (Earl & Khan, 2001).

With the increased customer base, the financial institutions also are forced to resort to increased automation of the processes so that they would be able to achieve higher level of efficiency. The enlarged use of IT/IS would also enable the financial institutions to cope up with the increased volume of business without any corresponding increase in the administrative costs (Harker & Zenios, 2000).

In addition, the continued presence of dynamism in the financial services sector caused by the changes in the regulatory measures, entry of new players, increased customer demand for specialized products and services have provided the required motivation for the financial institutions to remain innovative and competitive through the use of innovative of IS/IT tools (Horvitz and White 2000). However, Chong (2002) observes that it is the common complaint of the CEOs of financial services institutions that, despite spending too much on IS, the resultant benefits do not match with the investments.

This view may have relevance based on factors like difficulty in providing justifications for new investments in IT, costs incurred in training technical and other administrative staff for the use of sophisticated IT tools, frequent changes in the architecture making the application software obsolete and obsolescence in the existing IT (Crane and Bode 1996). According to Harker & Zenios, (2000) there are three important performance drivers which drive the functioning of the banks and other financial institutions. They are

- formulating strategies,

- execution of strategies and

- banking environment.

Interestingly IS plays a dominant role in all these three areas. It can therefore reasonably be concluded that investments in IS play a significant role in the performance of the financial service institutions in general.

The discussion under this chapter provide strong support to the argument that the financial services industry is the ideal one for the introduction of any improvements in the IT/IS because of the continued increase in the demand for improved and quality service from the customers.

Summary

The question regarding the nexus between investments in IT and organizational performance has continued to be the central focus of many researchers. The subject has been studied from the angles of causality, positive and negative impacts of IT and the potential benefits that an organization can realize from the investments in IT.

The existing literature has produced more inconsistencies with respect to identifying the nature and extent of this relationship and is divided even from arriving at a consensus on the definitions of key concepts till to precisely detailing the relationship itself. This chapter provided ideas on some basic concepts relating to information systems, information technology and organizational performance. Literature on business value of IT and the quantification of the value of IT has also been the subject of study under this chapter.

The issue of investment in IT and its impact on the organizational performance was also discussed. Financial services sector being one of the largest users of IT has been selected for research on the introduction of new and improved IT tools for information reporting and the its impact on the performance of the branch of the financial institutions. Finally the chapter presented a review of the importance of the investments in IS to demonstrate the suitability of the financial services sector to be the central focus of this research. The picture emerging from the current review of the relevant literature is that the financial services sector is the one which invests heavily on IT not only to improve its production processes but also for providing an efficient information service to the clients.

Research Methodology

Social science research follows several research methods to collect information and data relating to the issue under study. Ontology and epistemology enables the formation of the basic framework for many of the social research methods. The term ontology is defined as “a branch of philosophy concerned with articulating the nature and structure of the world.” (Wand & Weber, 1993). Ontology thus is concerned with what is said to be in existence in the real world. The ontological questions always try to find the form and nature of worldly reality and the things that need to be known about the real things in the world.

On the other hand, epistemology talks about the nature of human knowledge and understanding (Hireschheim et al., 1995). This philosophy advocates that such knowledge and understanding can be acquired by employing various types of inquiry and alternative methods of investigation (Hireschheim et al., 1995). Both ontological and epistemological issues become interrelated in the sense the epistemology is concerned about the ways in which the human actors would act to inquire and acquire knowledge on things, which really exist in the world, which is the domain of ontology. The epistemological questions define and explore the nature of relationship between the inquirer and would-be inquirer and the ways in which different things can be known.

According to Guba & Lincoln, (1994) the inquiry paradigms can be considered in ontological, epistemological and methodological questions. It is through the methodological questions that the researcher is able to find out the means that he/she can use to establish the truth behind his/her beliefs about the existing things in the world. The research methods generally follow

- experimental,

- correlation,

- natural observation,

- survey and

- case study methods.

The researcher must evolve a suitable research design specifying the research method the researcher intends to follow for completing the study. In choosing the particular research method to be followed, the researcher has to take into account a number of factors like the subject matter under study, research and theoretical interests of the researcher, constraints of time and resources and funding issues. The major classification of the research methods takes the form of qualitative and quantitative research methods.

In the current study, the focus is on the effectiveness of the implementation of an improved IT mechanism for improving the efficiency of organizational performance of a branch of a financial institution. More specifically this study attempts to evaluate the introduction of a software tool for improving the information exchange among the departments within the branch of the bank and with the clients of the branch to meet the changed demands of the clients with respect to their information needs.

During the process of this evaluation, the research will also extend to analyzing the cost and benefits of the new IT tool proposed to be introduced to improve the organizational performance. For this purpose, the research has taken up the case study of recommended techniques/programs to better serve the operational sectors of BNP PARIBAS SECURITIES SERVICES so that the research can lend theoretical support to the research question. The current study also examines the effectiveness of the IT tool in meeting the information needs of the departments within the branch.

Research Design

For any research in the realm of social science, research design provides the bondage that keeps the research project together (Webcenter for Research Methods, n.d.). The primary purpose of research design is to provide a basic structure to the research. This is accomplished by establishing the ways in which all of the major components of the research project like the “samples or groups, measures, treatments or programs, and methods of assignment” are made to perform in coalition to make any attempt to address the central research question.

The research design may take the form of a randomized or true experiment, quasi experiment or non-experiment (Webcenter for Research Methods, n.d.). It is necessary to have this three-fold classification for describing the research design with respect to internal validity. In general, the randomized experimental basis is the strongest for establishing a cause and effect relationship. Therefore, this study adopts the randomized true experiment research design for conducting the research.

Quantitative Research Methods

Quantitative research methods find their origin in natural sciences where they are used to diagnose and analyze natural phenomena. Certain commonly adopted quantitative methods include survey methods, laboratory experiments, econometrics and mathematical modelling. According to White (2000), the quantitative research method consists of investigative process that leads to research conclusions expressed in numerical values.

The numerical values represent the findings of the study and they are subjected to statistical analysis for presenting the results of the study. Quantitative research is rooted on positivism supporting measurements made in researches considered attaining precision and exactness (White 2000). A quantitative research is said to be well conducted when objectivity in the treatment of results and the process used to generate the results is attained (Cavana et al., 2001).

Qualitative Research Methods

The main objective of developing qualitative research methods is to enable the researchers to make an in-depth study into the social and cultural phenomena. Action research, case study, ethnography are some of the techniques employed for conducting qualitative research. Creswell (1994) defines qualitative research as a process of enquiry that involves the understanding any problem connected with the social or human behavior. The qualitative research process according to Creswell, (1994) is based on the views and perceptions of various informants being the participants to the study that are expressed in a natural setting.

The data sources for supplementing qualitative research methods include observation and participant observation (fieldwork), structured and semi structured interviews, focus groups and questionnaires, documents and texts. The data may also be provided by the impressions and reactions of the researcher himself/herself. Byrne, (2001) believes that defining qualitative research using a single definition is not at all practical because the term qualitative itself a broad term. In addition, inferential statistics that is usually applied to data that are generated from quantitative researches is not used for qualitative research.

Case Study

Several research studies have used case study as a research methodology. “Case study is an ideal methodology when a holistic, in-depth investigation is needed” (Feagin et al., 1991). Various investigations particularly in sociological studies have used the case study as a prominent research method to gather pertinent knowledge about the subjects studied. When the case study procedure is followed, the researcher will naturally be following the methods, which were well developed and tested for any kind of investigation. “Whether the study is experimental or quasi-experimental, the data collection and analysis methods are known to hide some details” (Stake, 1995).

However, the case studies on the other hand are capable of bringing out more details from different viewpoints based on a multiple source of data. The selection of the cases is of crucial importance so that the maximum information can be gathered for completion of the study within the time available. For the purpose of completion of the research this study adopts the research method of a case study of the recommended techniques/programs to better serve the operational sectors of BNP PARIBAS SECURITIES SERVICES.

Research Methodology

The methodology process of this study entails the collection, organization and integration of the collected data. Data collection will be the most important step in the success of this paper since it will lead to viable and credible findings. This study will be based on a qualitative study on the evaluation of the role of the improved software tool in improving the efficiency of the branch performance. Since the primary data through sponsored study by contacting, various subjects through personal interviews and/or questionnaires will be a time consuming process, this study resorts to the case study method for conducting the research.

The subject matter of study as such can invariably be supported by primary data collected through the qualitative research method of case study. The researcher considered the secondary research through a detailed review of the relevant literature as a supplement to the case study method since there is abundance of literature on the subject matter of IT/IS management within the financial services sector.

The secondary data can be expected to enhance the validity and reliability of the study. Further, since the topic of IS performance being a subjective one where the perceptions and view points of the population cannot be assessed precisely, it was considered better to use the case study method which would add value to the findings.

This chapter presents a descriptive account of the research design, research process and the data collection techniques followed for completing this research. The chapter also contained a discussion on the survey method followed for gathering the information and data from the chosen samples. A detailed analysis of the findings of this study and an analysis of the findings is presented in the next chapter.

Findings and Analysis

Based on a review of the case of BNP PARIBAS SECURITIES SERVICES, this chapter presents a detailed account of the findings from the research. The chapter also presents a descriptive analysis of the findings from the research which would find the necessary theoretical support to the research questions and sub questions.

BNP Paribas Securities Services – a Background

The central focus of this research is the organization and the information systems of BNP PARIBAS Securities Services (BPSS). This section provides a brief background on the structure and functioning of the organization.

BNP Paribas Securities Services is a leading provider of securities services and investment operations solutions to issuers, financial institutions and institutional investors worldwide.

Combining a unique European heritage with global ambition, it delivers a comprehensive range of services to its clients – all backed by the resources of BNP Paribas, one of Europe’s largest financial groups.

With a solid client base made up of 900 institutional clients across the world, it has presence across the investment markets of continental Europe and a historically strong presence in the United Kingdom in Australia and Asia. Presently the organization is having staff strength of approximately 5,400 people. BPSS is a subsidiary of the group of BNP Paribas.

BNP PARIBAS group in Greece

Specifically in Greece, its presence starts on 1982 as a full Branch of BNP Paribas and one of the largest foreign banks in the country. Local network is based on one large implementation in the centre of Athens. BNP Paribas is also represented in Greece through the following subsidiaries specialized in various services.

- BNP Paribas Securities Services, which is in charge of settlement of securities

- Citole, the European leader in consumer finance

- UCI, which provides housing loans to individuals

- Arval, which is specialized in vehicle management

- Ségécé, the first Shopping Centers Manager in Europe.

BPSS Athens

Amongst the best locations in terms of quality of services globally, is the subsidiary of Athens, which ranks 8th between the most sophisticated buyers of securities services of all subsidiaries and all companies that provide this kind of services. The table below exhibits the leading clients of the BPSS.

Table: The Top Providers 2008: Leading Clients.

The BNP Paribas Securities Services Athens branch has been awarded a ‘Top Rated’ status in Global Custodian’s Agent Bank surveys every year since 1999 and is consistently rated in the GSCS Benchmarks’ review of sub-custodians. It has also contributed to BNP Paribas Securities Services being named as ‘Best Regional Custodian Europe’ by Global Investor four years running (2000-2003).

Functions/Operations of BPSS Athens

Due to high level of expertise and automations the Athens branch is working more than satisfactory, with personnel of around 40 people including 2 to 5 temporary hands. There is a clear structure defining the roles and responsibilities of each individual.

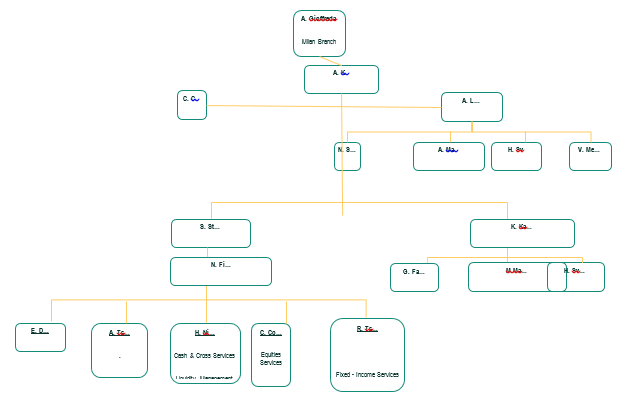

The organisational chart is shown below.

The organization chart shows the departments and the persons responsible for each department.

Three are fundamentally three functions – Finance & Administration, Operations and Client Relations.

Information and communication between departments is a very important task that is being accomplished with success. However due to the lack of a central data ware house and a central database under the same system, there are processes that are performed manually, calculations and formatting with the use of spreadsheets, historical information (of 2-3 years ago) retrieval from live systems with additional actions which normally slows down the process of capturing and processing of information.

It is vitally important for the banks to also comply with a growing array of national and international legislation and recommendations. However, it has to be understood that compliance is about more than just meeting the letter of the law. It is more about ensuring transparency, mitigating risk, maintaining customer confidence, and enabling profitable growth. It is for the bank to support these requirements to manage risk across the enterprise, increase business performance, and drive competitive advantage. To meet these objectives and ensure corporate sustainability, unify corporate strategy, risk management, and control initiatives across the extended enterprise the bank needs the appropriate tools.

This case study attempts to describe in brief how each main function works, how each one communicates with other departments and how thinks can change with the implementation of central reporting tools on a first step and second depending on the selected solution to a catholic data ware house with additional capabilities in financial control, projections and formatting functions.

It is important to explain the ways in which each department communicates with the other, before starting to explain the functions of each department. The basic systems include two main systems. They are CATS and ABS. The first one is the Cash Applications that all payments are received and sent (cash, commissions, fees etc). It is the back office main tool.

ABS is the application in which the set up of customers account is done. Receipt and Settlement of instructions, delivery of swift messages related with the change of status etc.

Except these two, another application is also used which is called PB-link connected with Swift that contains the information of all received and delivered messages from/to our bank. Secondary functions and applications are used having connected partially with each other.

Finance and Administration

The finance and administration department is responsible for all relationships with money with the ‘outside’ world. Payments for staff, suppliers, equipment are done by them. All kinds of business with authorities, tax calculations, labour issues are handled by the finance and administration department. Reporting of revenues to our central offices in Paris and financial management predictions as the monitoring of sensitive accounts or practices followed also form part of the responsibilities of the functions of finance and administration department.

As it is understandable, the capturing and processing of all this variety of information need very powerful and efficient tools in order to have an accurate and quick result. Even though there are supporting software tools that create a part of needed figures, important information is also needed to be included to help the processing by a different part of the system.

The billing system itself is based in a relatively outdated accounting tool but very accurate and stable which is being used by almost all the branches of the bank. Therefore there is no chance of changing this established system. Moreover the issue under discussion is not to change the information input or the movements of the input but only to report, formatting and calculation pertaining to the information received from various sources.

Efforts to implement a reporting tool specifically designed for this department have been done. A year now a contract has been signed with Singular to install the software Objects. This is the creation a database which can create static reports calculating data from two different sources and creating them by will. However, despite the amount of over 40.000€ spent, the system is not able to deliver the desired results due to hardware incompatibilities. According to the professionals from the software company involved in the implementation, the problem has been resolved and any time it would be solved.

However, even after the lapse of one year period there seems to be no salvation allowing the potentials of this software to be tested according to the needs of the rest departments of the bank. It is not out of place to mention that the IT department is functioning under Finance & Administration department which implies that this department can make significant contribution to ensure the smooth operation of the bank.

Operations

This is the front line of the bank. The operations of this department are divided in to five different divisions.

- Cash & Cross Services

- Equities/Bonds

- Corporate Actions

- Project Manager.

Cash & Cross Services

This is the department which functions as the back office of the bank. Keeping record of all positions in terms of money exposures of clients is the primary responsibility of this division. In addition this department looks after disbursing and receiving payments, commissions, fees and other forms of revenues. This section uses mainly the CATS system described above. However, due to difficulties to extract combined information from their system this section has created and maintained a manual ‘excel’ file which contains all accounts of the clients of the branch, with information that covers almost any issue.

This file is used from all departments of the bank and is an important tool. This ‘excel’ file serves as a reference for all the departments and is used to provide information to the clients. This file is also used to create any other reports from the information that is contained in the file. This system suffers from two disadvantages. First the file is being created and amended manually. This carries the risk of error in inputs and is vulnerable to alterations in information done intentionally without any control to secure the correctness of information. Secondly, with the high volume of information contained in the file the excel file has reached its limits. This causes at least half a minute delay in accessing to any information contained in the file for further processing.

Equities/Bonds

The first two are the connection between our clients and from the other side the brokers the stock exchange and market counterparties. Because of the number of parties involved, there is a continuous flow of information and exchange of files. Clients are always in need of various kind of information regarding their instructions and the details of the booked trades in market. Present status of instructions, historical transactions, End of Day reports are the most common kind of files sent.

From the brokers’ side, the bank receives information every day in the form of files with all transactions that our clients book in market. The bank then matches the information received manually with the actual instructions received from clients. Typically the matching process with counterparty should be done through phone. Every instruction in order to be settled needs to be matched first in all of its details with the instructions from the counterparty.

Therefore, the process to match instruction per instruction means wasting a lot of time and the possibilities of getting mismatches due to human errors cannot be eliminated. In order to reduce the time and errors and to ensure an accurate matching process, the counterparties accepted, not very long ago, a common format of exchanging files in agreed periods of time. From this point, the matching process is done automatically through bank’s system.

In general there is no need for processing information. However, there is the extended need for reporting of information in various formats to various recipients. Reports can be time scheduled or by clients’ request and the included information can also vary.

This kind of job up to now is performed in two different ways.

- First is the direct extraction from the main system/application in ‘excel’ files. The file is created very easily, however the information is specific with standard columns that cover most of the reporting needs of different departments. Therefore, if client wants further information (or less) the staff have to add/remove columns manually.

- Second is through the reporting system of the bank. This system is again linked with the live system of the bank. This system is found to be a very useful tool which follows the procedure of crating ‘excel’ files with information that was previously set. This system works as an extension and a supporting application of the bank’s live system. This system can pull information from every part of a client’s instruction and create reports either by a time schedule or by command. However, these reports need time to set them up. Therefore, in case a client needs information which is a bit different from what is available, the staff has to go back to the setup screen and create a new report from start. Another disadvantage is that the information is related only with instructions and cannot be combined with other kind of information related to the customer i.e. tolerance levels, cash levels, and other customer-specific information

Necessary information is also extracted by SAT (The electronic system of Central Security Depository). Information like the trades allocated to our Bank, account information, account’s position in shares etc is uploaded with txt files that are uploaded to the main system of the bank.

Corporate Actions

The ‘Corporate Actions’ department collects information from all kind of sources and informs clients about anything that might interest them. CA department has its own system that created in an easy way the necessary messages to clients. However, there are a lot of issues that need an update from Equities and Bonds departments and also uses a lot the excel file created by the Cash & Reference Dpt. This makes the job of this department time consuming and complex.

Client Solutions (Sales & Relationship)

The functions of this department among other things include responding to the customer’s queries about market updates and to send monthly reports with the statistical information on the clients’ transactions including executed instructions, rates of failure, short analysis with economical figures. This section prepares the reports they send automatically each month and the need of manual intervention is low. However, the format in which the information is generated is fixed and it cannot be changed easily. Therefore, it is not possible to accept any possible demand from clients’ side as it requires extra effort and time to create the information.

Analysis

From the findings of the information needs of each department and based on the need for centralized information, it can be observed that there is the need for a common database with all available information accessible by every department in a way that can be processed and combined in such a way in order to have a clear image of the present status of an account, client set up, instruction status. The common data base should also provide the ability to create from the centralized information, quick and accurate reports for both internal and external use.

This is one step further to the total quality that this company can offer to the existing and prospective clients.

To arrive at a concrete proposal in this direction, there is the first question that needs to be answered. The question here is to identify the need to create an internal database system from IT in the central offices of the bank in Paris or is it better to have some system developed from an external source. Finding an answer to this question can be attempted relatively easily.

Even though there are high skilled personnel in technology available externally who can be used to focus on supporting and finding solutions in the existing programs, there is also the point of security of information. Since the bank in general is traditional in its approach, it avoids the intervention by people external to the organization. However, when the project is really large there are good and trustful software companies in market which can be engaged to provide the necessary services. However, this kind of unification of information and the creation of this database would kept also a large number of personnel busy with this issue and would cost many man hours. Finally it would cost more than an already created solution from an external agency and with no guaranteed results.

The second question that needs to be answered is to decide on the idea of going in for tailored software just for the bank or as a readily available commercial package. Although some system specifically designed for the branch would be ideal, there is the cost element which needs to be considered. The disadvantage here is that the costs would be exorbitantly high and also the results even with specialised companies in the field cannot be guaranteed, at least in relation with the implementation time. Therefore, the decision centres round identifying and investing in a ready commercial software package. In fact there are a few solutions which meet with the needs of the branch more than satisfactory.

Even though there are not so many alternatives available after a thorough market search, the following commercial products having different capabilities available in different price ranges have been identified for consideration. The review of these readymade software forms part of the analysis section of this chapter. The prices of the software solutions vary from 200€ per user for ‘Crystal Reporting’ software of SAP up to 1.200€ for “Business Intelligence’ of Oracle. Between them is another solution from SAP the product ‘Business Objects’ with around 600€.

Each software applications provide a volume of details about the installation and usage of each of them. However the pros and cons of each system is discussed below for the sake of brevity.

Crystal Reporting (C.R.)

An inexpensive and easy to implement solution is found in this software application. A ‘universe’ with the available data fields is created and then it is possible to prepare any report that is required. A central database is created but all reports that are created are static. The report takes the form of something like a pdf file. It is not possible to change them easily. This is a distinct disadvantage of this system.

Another drawback of the system is that the creation is not very user friendly and there is almost the continuous need for external support. This makes the system expensive and out of range. This system may be considered as an effective solution for the accounting department, which needs specific and periodic reports but not for operations, where there are new requests and combination of information required in every few days. Therefore, this system cannot be considered as a complete solution and it also does not provide so much added value (except the unification of information) that the present system the bank has.

Business Intelligence (B.I.)

Business Intelligence is a total solution for data integration, reporting, analytics and data mining. This system provides more than what a company requires. However, the cost is also proportionately high. At 1.200€ per user, it is a huge investment even for a bank of the size of BNP, especially when there are other tools available to do the job, as they did it up to now. Moreover the investment of this magnitude cannot be justified at times of this difficult economic turbulence. Except the characteristics which are excellent like fully dynamic reports, predictive information, the system appears to be very user friendly.

The other most important factor is that there is no need for external support as indicated by the company representative. The whole system can be supported from within the branch internally and only in exceptional cases information requirements an outside support would become necessary. Another possibility is building the system piece by piece and not at once, so that the cost can be reduced to the minimum. The number of users could be less than the total needs of the bank.

Business Objects (B.O.)

Business Objects is the solution that lies in between the CR and BI. This system has characteristics between the other two systems with a price range which is close to the middle of the other two systems. This system seems to be the appropriate solution for the size and the needs of the bank, since it combines the features of the other systems and the price is at an affordable level. This system also covers all the present needs of the branch. At the same time, the system is not as user friendly as B.I is, but a lot more than C.I.

Although B.I system can be preferred by comparing the features available with the price, it is not advisable to opt for the system with the present information needs and infrastructural facilities the branch has. The system can be considered superior as it covers the needs of all the departments satisfactorily and will be a perfectly useful tool considering the future business of the branch. However, the use of this system needs sophisticated knowledge and skill among the staff in the various departments, without which the system would be a failure. It needs a stronger and faster base for using the system effectively.

Therefore, the bank cannot make the full use of the BI system presently. This leaves the option of the Business Objects as the obvious choice for the bank to consider as B.O of Oracle could handle the present needs of the bank effectively. Even for meeting the future needs the systems can be used with proper upgrades. When the management of the bank is inclined to implement a system step by step and with no large investments the BO is the perfect tool for the needs of the bank to further its business.

Conclusion and Recommendations

This chapter presents some concluding remarks on the research conducted to find out the suitability of the implementation of an improved software solution to make the reporting information easily accessible to all concerned in the branch of a bank. This study by using the case of BNP Paribas Securities Services attempted to establish the utility of different IS/IT solutions to solve the problem of information sharing and service delivery to the clients. In the process of analyzing the case, the research was extended to a review of the available literature on the subject of information systems, information technology and their impact on the organizational performance. The review lent adequate theoretical support to the research question. This chapter presents a summary of the issues dealt with in the text of this report.

In the review of the literature, it emerged that there is no consensus among the earlier research on the definition of the terms information system (IS) and information technology (IT). It also emerged that there are mixed opinions on the impact of investment in IS on improvement of organizational performance. Some of the researchers have reported positive impact while others have reported no or negative impact.

It was also found that there is a substantial degree of agreement among the models which have been used to assess the value of IT. It was also demonstrated that the measure of organizational performance employed may have a significant impact on the perceived value of IT. It is learnt that the IT can have a multiple effect on the performance of an organization. There is a wide range of evaluation methods suggested by theory for evaluating the investments on IT projects. There have been numerous research conducted on the evaluation of investments in IT and most of them conclude that the normal capital budgeting techniques cannot be adopted to evaluate the investments in IT.

In business managers are still faced with the problem of applying the IT to various functional areas and they also are facing the problem of finding the ways to manage the information IT is generating. Therefore, the central challenge relating to the use of IT is the lack of ability of the managers to cope up with the information capturing and processing to make meaningful use of the tools and systems provided by IT.

In fact the current research attempted to find out the suitability of the readymade software applications for information sharing among different departments of the branch of a bank. There were several factors that go into the consideration of the adoption of particular solution including the cost and adaptability of personnel. This challenge of proper use of IT is therefore to be considered as a business challenge and this challenge is not the one just for the CIO or the IT department. It is to be construed as a business challenge to be faced by all the organizational members starting from the CEO.

It is for the business managers to recognize the fact that the responsibility for the successful management of investments in various IT projects lies with them. It is only with this recognition by the managers that the organizations would be able to face the challenges relating to information gathering, retrieval and dissemination. There is the need to have a new approach to the IT management. Especially in the case of financial services institutions being the largest user of IT, this phenomenon becomes critically important to consider the investment in IT from various perspectives to maximize the benefits from the IT programs and tools being put to use by the organizations.

With regard to the research question “How is the implementation of software applications related to the improvements in organizational performance at the branch level of a banking institution?” this research concludes that there is validity in the premise that by installing a suitable software application which can supplement the information requirements of different departments within the branch of a bank as well as the information needs of the clients can be well managed and to this extent the organization can expect improvement in its performance. This is evident from the fact that the software application of ‘Business Intelligence’ and ‘Business Objects’ both could be considered to provide for the information processing needs of the BNP Paribas Securities Services Athens.

The consideration of creating a common data base to centralize the information to be shared by different departments answers the research sub question of “Do some areas in the IT portfolio of a banking institution contribute more to the organizational performance as a whole?” It is quite clear that by creating a common data base several departments needing the information can draw from the central pool and make adjustments to the information to make it presentable to the clients or to their own processing of further information. The case study also answers the research sub question in affirmative by providing that the investments in improved IS software tools largely influence the organizational performance.

While interpreting the results of the current study, it is important to consider that the case studied is a single one from a large industry and the study is very preliminary. However, there are number of other researches conducted in the area of value of IT to the financial services institutions which may provide a comparative evaluation of the results from this study. Despite the limitation the study has provided a deeper insight into the realm of investment in IS and the relationship of such investments and the organizational performance in general.

There are different areas available for further research in the field of IT investment. One of the areas that may be of interest is to identify different IT investments or to make a prediction of the specific outcome that could stem from any specific IT investment. There are other opportunities for research in the action program and implementation of different methodologies in an organization covering investments in different IT projects. The impact of IT investment in the performance of a matrix organization may be another interesting area of study.

References

Ahituv, N. & Neumann, S., 1990. Principles of information systems for management. Dubuque IA: Wm C Brown Publishers.

Banker, R.D. & Kauffman, R.J., 1988. Strategic Contributions of Information Technology: An Empirical Study of ATM Networks. Minneapolis: Proceedings of the Ninth International Conference on Information Systems.

Banker, R.D., Kauffman, R.J. & Mahmood, M.A., 1993. Strategic Information Technology Management: Perspectives On Organisational Growth and Competitive Advantage. Harrisburg PA: Idea Group Publishing.

Boaden, R. & Lockett, G., 1991. Information technology, information systems and information management: definition and development. European Journal of Information Systems, 1, pp.23-32.

Brynjolfsson, E. & Hitt, L., 1996. Paradox Lost? Firm Level evidence On The Returns To Information Systems Spending. Management Science, 42, pp.1143-59.

Butler-CoxFoundation, 1990. Getting value from Information Technology. Research Report 75. London.

Byrne, M., 2001. Linking philosophy, methodology, and methods in qualitative research. AORN Journal, 73(1), pp.209-10.

Carlson, W. & McNurlin, B., 1992. Basic Principles For Measuring IT value. I/S Analyzer.

Carrington, M., Llanguth, P. & Steiner, T.D., 1997. The Cost of Technology. The Banker, 147(861), pp.49-50.

Cavana, R.Y., Delahaye, B.l. & Sekaran, U., 2001. Applied business research: qualitative and quantitative methods. Brisbane Australia: John Weiley & Sons.

Clemons, E.K. & Weber, B.W., 1990. Strategic Information Technology Investments: Guidelines for Decision Making. Journal of Management Information Systems, 7(2).

Creswell, J.W., 1994. ). Research Design: Qualitative and Quantitative Approaches. Thousand Oaks: Sage.

Cron, W.L. & Sobol, M.G., 1983. The Relationship Between Computerization and Performance: A Strategy for Maximizing the Benefits of Computerization. Information and Management, 6, pp.171-81.

Deitz, R.M.H. & Renkema, T.J.W., 1995. Planning and justifying investments in Information Technology: A framework with case study illustrations. Proceedings of the 2nd Henley Conference on the Evaluation of IT Investments. Henley UK: Henley Management College.

DeLucia, R. & Peters, J., 1998. Commercial Bank Management 4th Edn. North Ryde NSW: LBC Information Services.

Dewan, S. & Min, C.K., 1997. The Substitution Of Information Technology For OtherFactors Of Production: A Firm Level Analysis. Management Science, 43(12), pp.1660-75.

Earl, M.J., 1992. Putting IT in its place: a polemic for the nineties. Journal of lnformation Technology, (7), pp.100-08.

Earl, M.J., 1993. Experiences In Strategic Information Systems planning. MIS Quarterly, 17(1), p.1.

Earl, M.J. & Khan, B., 2001. E-Commerce is Changing the Face of IT. Sloan Management Review, 43(1).

Feagin, J., Orum, A. & Sjoberg, G., 1991. A case for case study. Chapel Hill NC: North Carolina University Press.

Glazer, R., 1993. Measuring the value of information: The Information intensive organization. IBM Systems Journal, 32(1), pp.99-110.

Guba, E.G. & Lincoln, Y.S., 1994. Competing paradigms in qualitative research. In N. K. Denzin & Y. S. Lincoln (Eds.), Handbook of qualitative research (pp. 105-117). Thousand Oaks CA: Sage.

Harker, P.T. & Zenios, S.A., 2000. Performance Of Financial Institutions. New York: Cambridge University Press.

Harris, S.E. & Katz, J.L., 1991. Firm Size And The Information Technology Investment Intensity Of Life Insurers. MIS Quarterly, pp.332-51.

Hireschheim, R., Klein, H. & lyytinen, K., 1995. Information Systems Development and Data Modeling. Cambridge: Cambridge University Press.

Holland, C.P. & Westwood, J.B., 2001. Product Market and Technology Strategies in Banking. Communicatrions of the ACM, 44(6), pp.53-57.

Kauffman, R.J. & Weill, P., 1989. An Evaluative Framework For Research On The Performance Effects Of Information Technology Investment. Proceedings Of TheTenth International Conference On Information Systems, Boston MA. Newton MA: Butterworth-Heinemann.

Krishnan, M.S., Ramaswamy, V., Meyer, M.C. & Damien, P., 1999. Customer SatisfactionFor Finacial Services: The Role Of Products, Services and Information Technology. Management Science, 45(9), pp. 1194-209.

McKeown, P.G., 2001. Information Technology and the Networked Economy. Texas: Harcourt College Publihsers.

Miles, M.B. & Huberman, A.M., 1994. Qualitative Data Analysis: An Expanded Source Book 2nd Edn. Thousand Oaks CA: Sage Publications.

MUkhopadhyay, T., Kere, S. & Kalathur, S., 1995. Business Value of Information Technology: A Study of Electronic Data Interchange. MIS Quarterly, pp. 137-56.

Peters, G., 1990. Beyond strategy – benefits identification and management of specific IT investments. Journal of Information Technology, 5, pp. 205-14.

Powell, P., 1992. Information Technology Evaluation: Is it different. Journal of Operational Research Society, 43(1), pp.29-42.

Seivewright, M., 2002. Traditional vs Virual service. Credit Union Magazine, p.26.

Stake, R., 1995. The art of case research. Thousand Oaks: Sage Publications.

Tam, K.Y., 1992. Capital Budgeting in Information Systems Development. Information and Management, 23, pp.345-57.

Trewin, D., 2000. Finance Australia: 1999-2000. Australian Bureau of Statistics.

Wand, Y. & Weber, R., 1993. On the ontological expressiveness of information systems analysis and design grammars. European Journal of Information Systems, 3, pp.217-37.

Weill, P. & Olson, M.H., 1989. Managing Investment In Information Technology: Mini Case Examples And Implications’. MIS Quarterly, 13(1), pp.3-17.

Yin, R.K., 1994. Case Study Research: Design and Methods, 2nd edn. Thousand Oaks CA: Sage Publications.