Executive Summary

The Egyptian real estate market is experiencing difficult times due to the pandemic. Nevertheless, this market is of high strategic value, as large tourist flows are constantly attracted to Cairo, Giza, and other attractions of the North African state. For this reason, one startup was invented in 2016 and developed until 2021. It is a REstate real estate agency focusing on improving the customer experience. Specifically, it offers the use of a uniquely designed artificial intelligence platform, REAITM, which gives the user only those options that fully fit the client’s initial requests. This completely eliminates the likelihood of issuing out-of-town garage space for restaurant construction plans. In addition, REstate offers an innovative approach to post-production customer service. Unlike competitors, REstate uses a subscription-based collaboration format where clients pay a commission to the agency for the best interaction experience. This includes 24/7 support, solving any problems related to repairs, and discounts on additional services, whether it is cleaning, remodeling repairs, or other household chores. In this way, REstate solves the acute problem of interacting with agents or realtors since the paramount communication is through the website. This includes forming an individual secure tenant’s personal office and having an online form to fill out bills for water, gas, or electricity. Clients will choose to REstate as an advanced leader in the real estate market: interacting with the company eliminates the risks of fraud and theft of money, which is popular in the Egyptian real estate market from unscrupulous brokers (Lymouna, 2018). After all, investing in REstate is an investment in the complete restructuring of the real estate market in the Republic of Egypt, which has a high strategic value not only for the company but also for the officials.

Company Goals for 2022

- to ensure the REAITM system is up and running

- to enter the Egyptian real estate market successfully.

- to attract as many new clients as possible.

- to get an excellent reputation and achieve 1,000 new clients.

- to get a projected profit of $3,057,330.31.

- to expand staff and increase office space.

- to receive financial support from the state.

Mission

REstate offers the best customer experience by addressing all of the possible fears and risks that people often face when looking for a new home. With REstate, clients will no longer fear losing money or being defrauded. REstate solves the problem of communication with agents by eliminating the human element.

Company Summary

REstate was built by two brothers, Majed Obeid and Nabeel Obeid, who trained as big data analysts and project managers respectively at UAE University. REstate is a comparatively young company that began its journey in 2016, developing machine learning technologies and using artificial intelligence to solve fundamental housing search problems. In four and a half years, the company has not yet entered the Egyptian market, as it was actively developing its own product in the form of a platform for managing client requests and automating the selection of housing options. The main focus of the company, expressed as a business mantra, is represented by the provision of high-quality, advanced, and most optimized services for the residents of Egypt in the search for good housing, the maximum suitable for the needs of the consumer. This includes not only the purchase of the real estate but also rentals, including short-term and long-term. With the help of this business, according to the Obeid brothers, the real estate market in Egypt will undergo a new digital revolution, and matters relating to the search for housing will become much more accessible, more pleasant, and comfortable. Thus, the target audience of REstate, which plans to launch in 2022, is represented by Egyptians, ex-pats, and tourists of the state who want to find housing for their interests and budget.

The Workforce at REstate

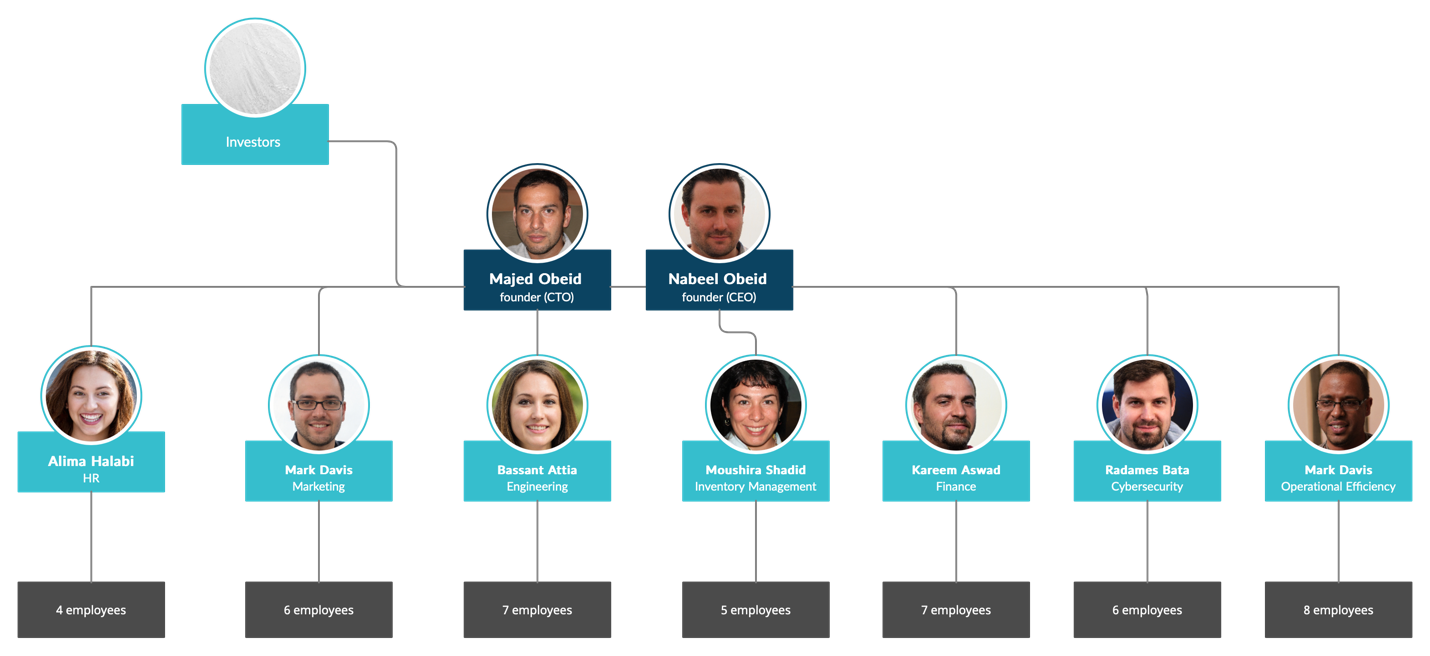

REstate’s small business venture will feature 52 employees, nine of whom hold administrative positions. Specifically, the Obeid brothers are the executive founders and part-time directors of the company: in addition to them, the staff of directors is represented by managers of operational efficiency, finance, HR, inventory management, engineering, cybersecurity management, and marketing management. Each of the seven leaders manages its own accountable, task-focused department. Thus, the overall structure in the company is described in Table 1 below.

Table 1. A number of REstate employees by a line of business

In addition, REstate has several key investors who have invested in the initial stages of business development. These are primarily anonymous funders, although Nabeel Obeid has received recognition from the Egyptian government and promises from the local government to support an enterprising company when it launches in the market. In terms of leadership, REstate has a hierarchical structure in which power is differentiated by levels, as shown in Figure 1. The leadership style within the company is democratic and adaptive: no harsh sanctions or penalties are imposed on employees regardless of misconduct. At the same time, there is a training system that allows new company employees to adapt to the business structure faster and maximize their contribution (Shen & Tang, 2018). In terms of gender cross-section, leadership at REstate will be represented by 67% men and 33% women, and throughout the company, the number of women will be about 46%, with 54% men.

Location

REstate has a single office located in Cairo’s Egyptian capital, at 32 Mohamed Yousef Salim, Heliopolis. It is a small office space of 153 square meters, which is divided into offices for individual departments.

Equipment

By now, REstate has several dozen work computers at its disposal for office tasks, as well as accompanying equipment, including printers, fax machines, coffee machines, and ancillary equipment. Among the company’s most valuable assets are its proprietary REAITM software, on whose action the company’s commercial activities are focused. Most of the equipment in the company is REstate’s personal property, purchased early on with investor funds.

Services

As REstate is a modern real estate agency in the Egyptian market, the company’s critical commercial activity is focused on providing real estate search services to individuals and companies. Thus, REstate operates in both b2c and b2b sectors. REstate focuses on providing the highest quality residential search services, improving the client experience, and significantly optimizing risks and costs. The company currently provides five essential services, each of which is available for use — registration and purchase — on the company’s official website or in its sales offices.

Description of Services

- short-term rental housing. This service is aimed primarily as an alternative to expensive hotels to help tourists. Anyone can find apartments for a period of up to one week in any region of Egypt with the help of REAITM.

- long-term rentals. This service offers individuals assistance in finding and renting long-term accommodation quickly and efficiently. This offer solves the problem of communication between real estate agents and clients and significantly saves time for each of the parties involved.

- commercial space rental. This service is focused on b2b businesses. REstate offers companies of a small, medium, and large businesses a service to find office, warehouse, and other commercial space for specific purposes, any size and location.

- house purchase. In addition to rentals, REstate offers a selection of space to buy property, whether it is a private or commercial building. Unlike rental offers, REAITM has more stringent requirements for real estate sales, and the commission on the transaction is a lump sum (or installment), unlike the subscription format of working with rental properties.

- private residential sales. In addition to outbound flow, REstate supports work with the inbound flow. In particular, one of the company’s services offers individuals and businesses to sublease property under a sublease agreement, thus adding to the REAITM database.

Funding Strategy

Like any other business, REstate is not only focused on providing socially essential services to restructure the local real estate market but also on generating profits. The business will have several funding channels that allow the company to remain competitive, pay salaries and invest in further development. It is worth saying that the housing matching service with REAITM will be entirely free for any client. It works like this: the user enters the official website of the company (or sales office), sets the individual parameters to search for a house for his interests, and the AI from REAITM offers only relevant results. Then the client, if interested, makes a deal with REstate for a particular home and uses it for the duration of the contract. In this scheme, the company only makes a profit at the time of the deal: thus, REAITM is essentially a marketing tool to attract and retain clients. In the case of lease arrangements, REstate signs tenants up for monthly — or quarterly, if the business wants it — subscriptions: the cost of those subscriptions is included in the rent. For example, if the average cost of a one-bedroom apartment in Cairo for October 2021 is $248.84, then for $286.17, the client receives a modern apartment with an excellent renovation, picked up by REAITM to the client’s needs (Numbeo, 2021). Thus, the cost of the monthly subscription, in this case, is $37.33, or 15% of the total monthly payment. Consequently, REstate receives about $447.96 in fees for the year of the contract from this apartment. In contrast, if the client executes a transaction not for rent but for the purchase of the real estate, whether commercial or private, REstate offers a one-time commission payment for the transaction. For example, a 50 square meter apartment in midtown Moscow will cost the client an average of $43,965.58, but when working with REstate, the transaction amount is $48,362.14. This price is formed by a one-time agency commission of 10% of the total transaction amount.

Benefits to Clients and the Company

The scheme described above may seem less favorable to consumers at first glance: why would they pay more than the average market price for the same service. In reality, however, REstate offers a number of accompanying services and full support for the duration of the contract. Thus, for 15% of the monthly payment, the client receives not only a simplified and most targeted search platform for real estate of interest but also assistance in signing the contract, support in case of repairs, as well as a convenient personal account to write off the monthly payment. Among others, the personal office presents a form for registering utility bills, whether they are water bills or electricity bills. On the one hand, the customer receives a streamlined, advanced, and electronic method of interaction in the case of rental properties, and on the other hand, the company receives a commission due to the subscription format. This is important because subscriptions allow the business to raise the average profit significantly, and today’s users are used to using subscriptions for a wide variety of services. The introduction of this format in real estate will significantly change the industry market in Egypt.

Market Analysis

Market Segmentation

The critical segment of the Egyptian industry market is individuals and companies interested in finding real estate. Among individuals, the emphasis is on both tourists and visitors to the state, including expats, as well as locals who will also use REstate’s services. Each of these segments may be characterized by a short or long-term home search, so each of the target audience categories is segmented appropriately. At the same time, the market segmentation analysis identifies customers interested in purchasing, rather than renting, real estate. This is a separate category of clients, which as a rule, does not overlap with those who want to rent a house: the goals of the two requests are entirely different. Clients who purchase a property usually bring more profit to the company. By comparison, renting a typical studio apartment with monthly commissions will bring the company in 9.8 years about the same amount as selling a home with a one-time commission of 10% of the average cost of the same home. In this case, it is much more efficient to separate the management of real estate purchasing clients from the rest since such users require a more thorough plan for dealing with them.

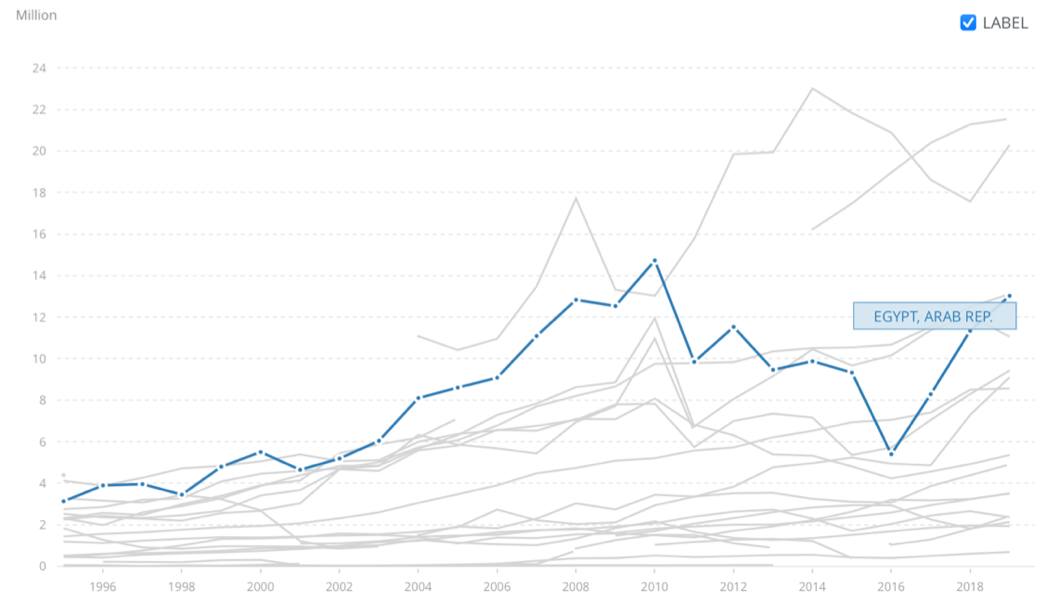

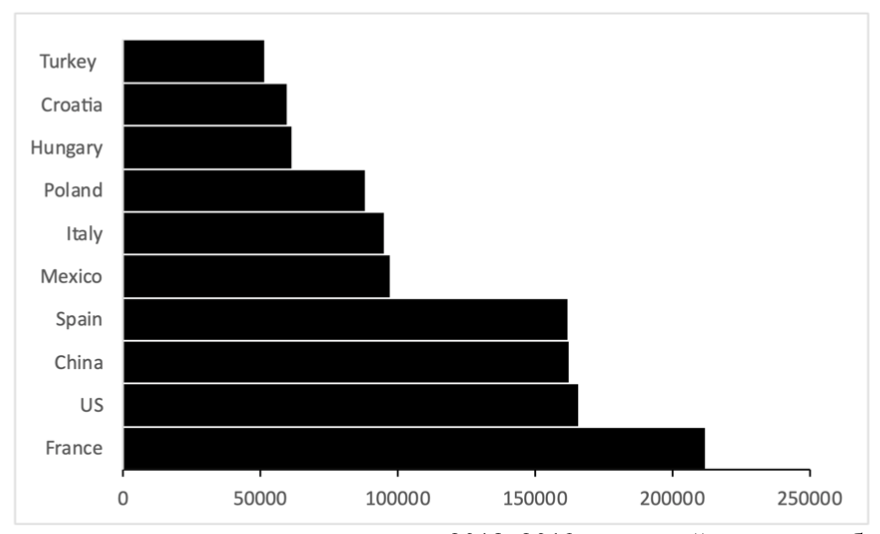

Tourist clients. It is noteworthy that Egypt is an important tourist destination in North Africa. According to data, the average number of foreign visitors to Egypt exceeded 13 million by 2019, as shown in Figure 2. Meanwhile, tourists from France, the United States, China, and Spain make up the bulk of the state’s visitors, as illustrated in Figure 3. Consequently, it is these tourists that should be emphasized when selecting the target audience: optionally, the REstate website should offer language choices based on the user’s IP. At the same time, Russians are an essential category of tourists who could not visit countries because of political decisions between 2015 and 2021 (Magdy, 2021). However, this ban has now been lifted, which means that the Russian tourist flow will resume.

Commercial clients. Another market segment is companies that are interested in finding commercial properties to rent for specific business purposes. These can be retail stores, hotels, restaurants, bars, or any other public places: REstate does not limit commercial clients in the choice of the functional purpose of the premises. On the contrary, at the selection stage, REAITM offers corporate clients housing based on their desires in terms of final functionality so that clients seeking to build a restaurant will not have to study an ad for out-of-town garage sales.

Demographic segmentation. If segmentation analysis is done by demographics, some general conclusions can generally be framed, which are expected to be adjusted in the next few years of customer service. The potential age of clients starts at 20-25 years old when an individual is able to purchase rental or ownership properties. There is no gender differentiation, nor is there a division of clients by the level of education received. According to the local law № 230 of 1996, foreigners on an equal basis with residents of the country can buy real estate for themselves, so the division of citizenship so does not seem relevant (Taxation Researcher, 2020). The focus is on the affluent market segment since renting or buying real estate requires a significant amount of money.

Remaining customers. Finally, a separate segment of the market is clients who wish to sell or rent their properties but cannot find clients. Typically, these people do not want to interact with private brokers or strangers because they fear fraud (Lymouna, 2018). In this sense, REstate will be perceived as a well-known company with government support, which means it can be trusted. Thus, customers themselves will turn to the company, which they will be able to learn about through marketing communications.

Hierarchy of market segments. The overall structure of REstate’s target audience, based on considerations of economic and reputational appeal, is represented by the following hierarchy, depicted in Figure 4. It is important to note that it is not just profitability, as noted earlier, that underlies the choice of short-term rentals as a priority. Although it is the most lucrative customer segment, the efficiencies of focusing on real estate sales are low. Instead, it is suggested to focus on short-term rentals for the first time, as these will tend to be global tourists who are constantly changing places of residence. With this move, it is possible to increase REstate’s brand awareness, which will be great advertising for the first couple of launches and will attract new clients.

Distribution of services. Several channels will allow information about the company’s services to be disseminated. In the first year of launch, the focus is on word of mouth, which will significantly increase the customer base through constantly changing guests who have used the short-term rental services. In this context, it is critical to ensure the best experience using the REAI™ platform so that users are completely satisfied, and their needs are met. However, one cannot make the mistake of competitors — discussed next — and focus only on short-term rentals: REstate is not an aggregator of tourist accommodations but a full-fledged real estate agency. For this reason, interaction with government agencies, lobbying, advertising through significant brands, and a loyalty program for current clients should also be used to spread the service.

Key Competitors

Conglomerate competitors. This is one of the most serious and dangerous competitive segments, as companies in this section have already been able to brand themselves as established players in the industry market. Booking is a widely recognized platform for finding hotels, private homes, or apartments — with the service, customers find accommodation anywhere in the world in minutes. Booking is transparent and convenient, but often customers have problems with customer service. Airbnb is a similar platform, focused not on hotels but on homes rented by owners: with this service, customers can stay with individuals and learn more about the history of the place. However, Airbnb has been accused several times of covering up crimes, and the site itself does not guarantee the complete safety of guests.

Egyptian competitors. Several small industry marketers in Egypt are of significance to REstate. Coldwell Banker Egypt is the most popular local real estate agency and offers similar services to REstate (Badawi, 2020). However, this company’s focus is built on human communication, which means the firm’s clients will have to work closely with Coldwell Banker Egypt agents to find accommodations. Avenue is also a famous company and works with many Egyptian real estate developers, which means it has essential insights and gives clients a good experience (Badawi, 2020). However, among the negative experiences, there is evidence of worse communication from lead agents, which again refers to communication problems (Francour, 2020). In ERA, clients valued transparency and exclusivity in the rights to sell unique properties (Badawi, 2020). An ERA is inferior to the previous two companies, but this company focuses on a broad segment of the market as REstate plans to do. Employees of this company, however, complain of unprofessional management and a brake on competitive development (Glassdoor, 2020). Thus, each of the competitors presented is important to REstate, but the analysis allows us to identify the companies’ weaknesses and cover them with appropriate operational strategies at REstate.

Competitor Strengths. Among the competitors studied, several of their strengths can be identified as follows:

- a great deal of experience in the industry.

- an entire customer base.

- good brand perception.

- having strategic partnerships with real estate developers.

- an established, well-run website.

- availability of customer testimonials and material to improve operational efficiency.

Competitor weaknesses. On the other hand, all of the companies listed above were not completely perfect, but had some of the weaknesses:

- lack of innovation.

- the presence of negative reviews.

- problems with service.

- lack of proper post-production service.

- for some agencies, unreasonably high prices.

A Brief Description of the Strategy

Thus, REstate will focus on clients with short-term rental interests — preferably tourists — in the early years of business but will not stop there. Long-term rentals, building valuable relationships with developers, and building a reputation as a company that can be trusted are additional goals for the next year at REstate.

Pricing Strategy

The company’s pricing policy stems from a study of market segments, the general profitability of the population, and the intensity of tourist flows. The company’s pricing is inconsistent with REstate’s positioning as an agency for rich people: instead, REstate provides quality and enjoyable accommodations at affordable prices, accompanied by an incredible customer post-service experience. The following commissions are fair for the company in the first year of operation, after which they should be refined according to aggregate demand:

- short-term rentals: 20% of the total amount of the entire stay.

- long-term rental: 15% of the monthly payment amount.

- rental of commercial property: 25% of the monthly (or quarterly) payment.

- purchase of real estate: 10% of the value of the dwelling.

- purchase of commercial property: 15% of the value of the premises.

- renting out own home: free of charge for owners.

- sale of own dwelling: 5% of the value of the dwelling.

Sales Strategy

In the first year of REstate’s operation, sales are expected to focus on short-term rentals. The anticipated number of services sold is presented in Table 2. This table shows that the number of sales should increase smoothly by the end of the year (Figure 4), and there are several reasons for this. First, the COVID-19 threat is expected to disappear as a limiting factor for tourism gradually. Secondly, the middle and end of the year are associated with the most intensive tourist seasons due to the summer period and holidays, so an increase in sales for this time will be characteristic.

Table 2: Plans for sales of services by quantity during the first working year

However, the more significant number of short-term rental units sold will not bring the company more profit, as seen earlier. Instead, the main profit will come from the sale service (commissions) for the sale of commercial property, as shown in Figure 5 and Table 3. Such a decision was made deliberately: focusing on short-term rentals as a critical service is more of a marketing move to spread the word about the company, while revenue is generated from other items of incoming finance. Notably, the separate category, “renting out own home,” is selling well and is projected to be 42 units sold. However, no profit is planned from this service in the first year, as this move manages to increase the number of loyal customers willing to rent out their property through REstate. Thus, this action is informative and promotional in nature, allowing to increase the customer base.

Table 3: Forecast sales by quarter for the year 2022, based on service offerings

More detailed sales statistics (in USD) and numbers of units sold are shown in Table 4 and Table 5. At the same time, Figure 6 shows the company’s total projected profit for the first year before expenses.

Table 4: Sales forecast (by number of units sold) by month for the year 2022, depending on the services offered

Table 5: Sales forecast by month for the year 2022, depending on the services offered

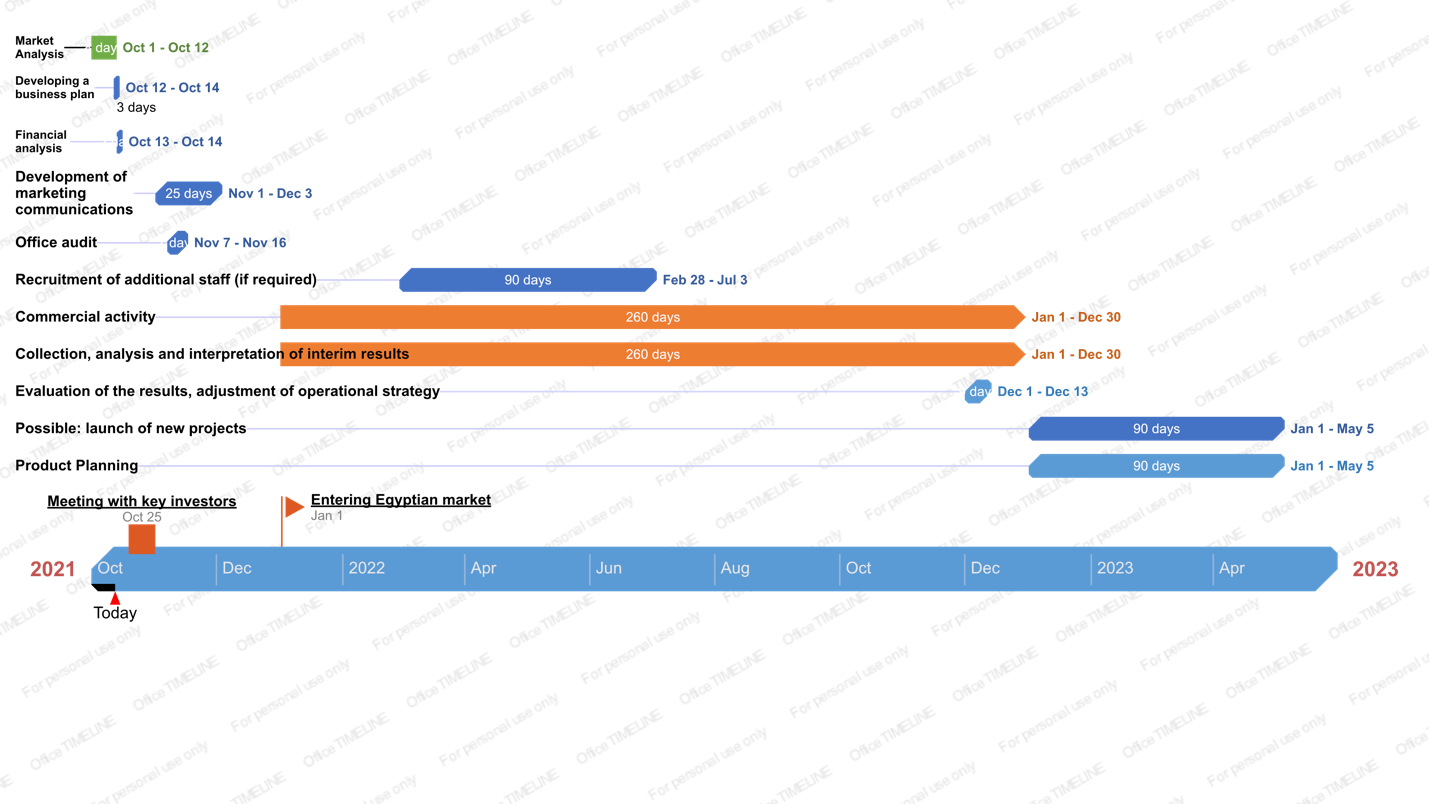

Timeline

For the present project is expected a long time of existence in the industry market, but because of the dynamic and ambiguous environment, primarily because of COVID-19, the leading forecasts are created for the first year of operation. Figure 7 shows the key milestones from the development of the business plan to the launch of new products if the first year proves successful. Any development of further milestones and entry into the Egyptian market is impossible without initial business planning and sponsorship from investors.

Personnel Costs

At the first start, the company will have 52 employees, with a hierarchical organizational structure as depicted in Figure 1. The cost of labor, whether it is a line employee or an administrator, is calculated based on the Egyptian average. Table 6 shows the spending on employee salaries. Thus, it is noticeable that if the projected profit in 2022 is $3,057,330.31, the number of payroll deductions will not exceed 6%. In other words, REstate still has enough cash on hand to pay rent for the space, buy related products and, importantly, run marketing communications. This is normal since marketing spending is known to be 7-8% of the annual budget for start-up companies (Schwinum, 2021). Thus, total marketing spending in the first year will be up to $244,586.43. Since it is marketing that is paramount to guarantee the commercial success of the company in the first year, spending on it should be significant.

Table 6: Expenditures for employee salaries during the first fiscal year

Marketing

To increase the loyalty of new clients — in fact, all company clients will be new in the first year of work — it is recommended to use an incentive system. In particular, the incentive system for customers is represented by sets of souvenir products with REstate brand theme, an example of which is shown below in Figure 8. Such (or similar) gift sets would be given to each REstate customer when they move into a property, whether it is a rental or real estate property. The proposed strategy is expected to have a tremendous impact on the company’s reputation, increase customer engagement and be an additional promotional tool.

Conclusion

To summarize, it is paramount to recognize that the Egyptian real estate market, whether private or commercial property, is in need of modernization. REstate is a promising company with high ambitions, whose intentions just cover the needs of the Egyptian market. REstate is ready to bring new forces to the real estate industry through the use of artificial intelligence tools and big data. REstate’s intentions are clear: the company wants to develop the local market, offer an incredible service experience to private or corporate clients, and generate the desired profits for further development opportunities. If the first fiscal year, 2022, proves to be commercially and reputationally successful for REstate, the company will likely invest in developing further projects.

One of the main operational strategies that will be used during the first fiscal year is to focus on a short-term rental scheme. In this case, Egyptians, visitors, expats, and tourists will use REstate’s unique service based on the REAITM engine, aiming to elevate the experience of similar platforms comparably. REAITM does not produce expected, unnecessary, or complex results, but instead offers only the kind of output that will be useful for each customer. Personalization thus becomes an essential component of customer-centricity. In addition, the subscription-based cooperation format will give clients confidence in the reliability of the company, as well as allow them to use many of the firm’s services either for free or at a good discount. In this way, REstate will build a large client base within a year, necessary for further growth. Once this is achieved, the company will be able to develop the rest of its lines of business confidently. Nevertheless, it is a mistake to think that REstate will only use the short-term rental format for the first year. In order not to become a substitute for Booking or Airbnb, REstate, as an Egyptian real estate agency, offers clients other options for renting or buying housing. Thus, it is predicted that by 2022, REstate will become an excellent alternative to the existing services and agencies and will show a commercially and reputationally successful start.