Introduction

The purpose of this paper is to study the case of O’ Higgins named ‘’Ryanair – the low-fares airline’’. This paper will consider the environmental issues of the European airline industry with implications for the budget sector and it will assess how Ryanair has been successful in this industry. To do so, it is essential to discuss political, economical, technological, and environmental factors, porter’s five forces, and competitive advantages of Ryanair. The paper also incorporates the history and description of Ryanair, resources, and capabilities of the company, operation, and challenges as a budget airline, and the sustainability of Ryanair’s strategy.

Background of Ryanair

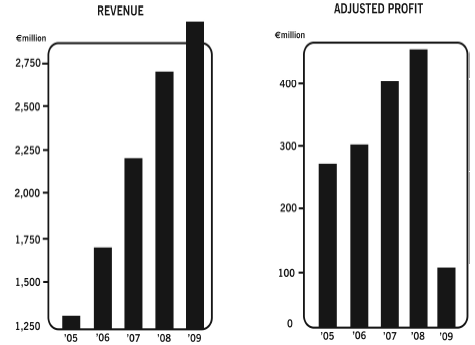

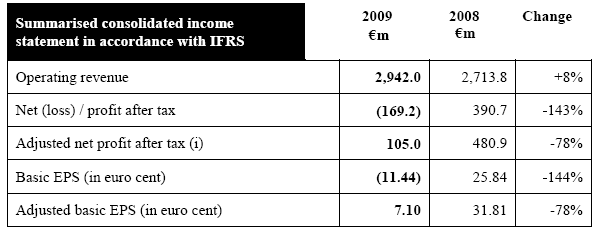

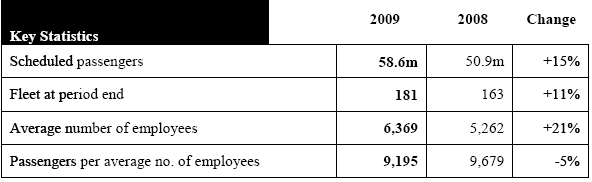

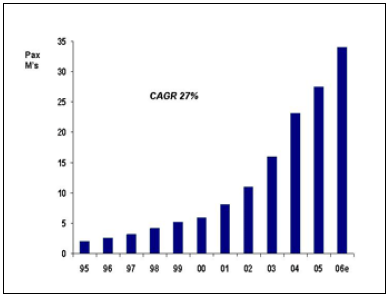

The Ryan family established Ryanair in 1985 and initially it was a full-service conventional airline with 2 classes seating, leasing 3 different types of aircraft, and 5,000 passengers carried in a long route of Waterford Airport and London Gatwick. Despite growth in passenger volumes, by the end of 1990, it had flown through a great deal of turbulence, disposing of 5 chief executives, and accumulating losses IR£20 million, so, the management team (lead by O’ Leary) of Ryanair was sorting some major changes during 1990 to 1991 and the annual revenue of Ryanair has increased from 1995. In 1998, Ryanair ordered 45 new Boeing 737- 800 aircraft (189-seat capacity) worth $2b, and in 2002, the company was admitted to the NASDAQ-100, in 2006, an Air Transport World magazine announced that Ryanair was the most profitable airline in the world despite 42% higher fuel costs of €337m.

Objectives

Ryanair sets the following objectives to implement its strategy:

- achieve low-cost leadership in the European budget airline industry;

- Cost control by implementing its own strategy;

- Build employees to handle multiple jobs at a time;

- Increase the productivity of the employees;

- save the time of passengers by using and increasing short-haul point-to-point routs;

- Make a quick turn around;

- Measuring risks, technological development, and environmental awareness;

- Starting new domestic routes within EU countries.

Major Competitors in the European airline industry

- Easyjet: The business model of EasyJet is somewhat different from Ryanair as it uses more centrally located airports, thus incurring higher airport charges, for instance, Schiphol in Amsterdam and Orly Airport in Paris are hubs, while the airline also flies into Charles de Gaulle Airport in the French capital;

- Virgin Express: As EasyJet Virgin Express flies into main airports in a major city and its inception as a budget airline, it has struggled to make a profit but its performance has been deteriorating, with losses of €6m and €60m in 1999 and 2000 respectively;

- Bmibaby: It’s a subsidiary of BMI, which was the UK’s second-largest scheduled service operator serving domestic, European, and American routes;

- MyTraveLite: Birmingham based MyTraveLite began operations in October 2002 as a budget airline subsidiary of MyTravel, the loss-making tour operator;

- Aer Lingus: Aer Lingus is the national state-owned airline of Ireland, operating domestic and international market, with a fleet of 30 aircraft.

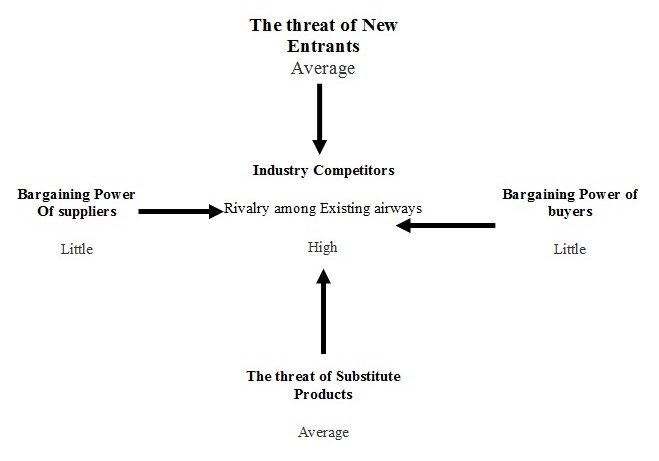

Porter’s Five Forces Analysis

Bargaining Power of Suppliers: The key providers of aircraft in the industry are Boeing and Airbus, where merely Boeing is Ryanair’s potential supplier. The switching cost of one provider to another is enormous here, as the technicalities and pilots will need to be trained again. The provincial airports possess low bargaining capacity because they deeply rely upon just one airline; however, the larger airports, where Ryanair’s rivals run, boast better bargaining power.

Bargaining Power of Customers: The consumers, in this industry, are very much responsive to high prices as the switching costs at other airlines are rather cheap; most importantly, the consumers have a greater knowledge about the rate of the services provided, and there is no loyalty at all.

New Entrants: The obstacles to entrance include huge capital investment and constrained slot accessibility, making it far complicated for the new competitors to find apposite airports. Besides this, the established companies could participate instantly in price wars in the existing LCC route and gain a competitive advantage; this would make it tough for the novices to sustain. Restricted Flight Authorisations add up more complicacies to these.

The threat of Substitutes: Lack of ‘close consumer relationships’, absence of brand loyalties, and the presence of numerous competitors like Easy Jet, Virgin Express, Lufthansa, British Airways, Air France, coupled with other modes of transport, e.g. Eurostar, TGV, Eurolines, Ferries, Cars, etc. lowers switching costs exceedingly. However, the low-priced segment possesses a few rivals, making it easier for Ryanair to carry on.

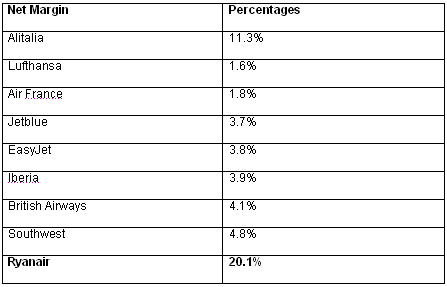

Competitive Rivalry: The European airline industry consists of the flag carriers, independent airlines, franchises of chief airlines, and charter operators, whereas, the independent carriers (the budget sector) comprise low priced transporters, for instance, Ryanair and Easy Jet Plc, and transporters offering “frills” services. In this budget sector, the majority of cost advantages can be copied instantaneously; however, here, the competition is comparatively low since the two major inexpensive airlines have chosen altered routes to serve passengers. Nevertheless, if new businesses enter the sector, high pressures would be imposed on prices, margins, and consequently on profitability (Ryanair, 2009).

PESTEL – Analysis

Political factors: Starting from the terror attacks of 9/11 till the War of Iraq, all those that contributed to the global financial crisis have also led the airline industry to suffer major loss; Ryanair, in particular, was also adversely affected. The possibilities of War, the prospect of the Euro to gain strength against the Dollar, EU regulations on pollution, fluctuations in the fuel costs each year, for example, can cause airline businesses to vacillate.

Economical factors: Changes in the interest rate can directly influence the businesses in the industry; unlike Ryanair, other airways will obtain more loans from financial institutions and invest it in their specific concern. Therefore, alterations in the financial situation, would affects their investment strategies.

Socio-cultural factors: The EU requires the airline industry to remain devoted in upholding equal opportunities to the employees of all airlines regardless of ethnic group, race, gender, and disability, religious or political belief. Ryanair, in this context, recruits people in the basis of merit and potential; its staff newsletter “The Limited Release” is dispersed to the workers ensuring that employees are kept up-to-the-minute on the plans. In 2004 and 2005, Ryanair invested 10,512000 and 9,660000 respectively on Social welfare.

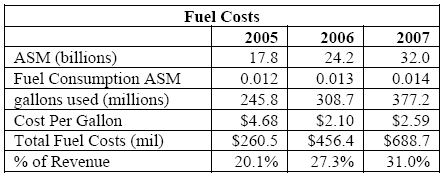

Technological factors: The low-priced sector offers a recent technology that reduces fuel consumption to some extent (the Boeing 737-800 aircraft) because of the motors and winglets and prolonged flight destinations; this would help whilst the oil cost’s growth would be doubtful and unpredicted. Therefore, Ryanair is prevaricating for ninety per cent of its oil charge that will show the alteration in petroleum price insignificant.

Environmental factors: The CFC gases and carbon discharge persist to ascend in European airline industry, creating an even bigger panic to the environment from aviation. The industry contributes a 2.6 % CFC secretion in the EU. The EU and Irish policies require all aeroplanes to run by Stage 3 noise requirements; Ryanair lessens emission and noise by avoiding late night departures, lowering per traveller CFC discharge by higher load factors, using fuel efficient Boeing 737-800 “next generation” airliners and dropping petroleum wastage per traveller by 45 per cent, and well utilising the existing infrastructures (Ryanair, 2008).

Legal factors: The European airline industry is burdened with both domestic and EU regulations; prior to 1980’s, there were serious restrictions on rivalry in the industry, afterwards, a liberalised mutual contract among Ireland and the United Kingdom relaxed the legal boundaries. In 1980’s the E.U. began deregulating the industry by a range of liberalisation methods, resulting in the proposal that any E.U. airline can run anywhere within the E.U. free from regulations. The rules of the EU competition law and some other specified rules of the Irish government (from regulators like the Department of Transport, the Irish Aviation Authority, and the Joint Aviation Authority) also bind Ryanair.

Risks & Challenges for Ryanair

There are some challenges encircling Ryanair, which must be encountered by the airlines to success in the market. The challenges are as follows:

- The first challenge for Ryanair is the acquisition of the Aer Lingus, an Irish public Airline controlled by the government, ready to float in the stock market. Aer Lingus is a national airline that operates in the Ireland with a high profit margin and serves maximum passengers to the different destination in Europe with low budget (Massey, 2008).

- The suspicions and fear of the investors of Ryanair presents another challenge for the airline, as the investors did not want to support the merge as because Aer Lingus is a big airline company with its long route and a huge number of passengers, which opposed to the business model followed by the Ryanair.

- Another challenge is the extreme opposition by the stakeholders including the board of directors of Aer Lingus for the merge of the Ryanair and Aer Lingus. They even highlight the initiative of merging as an attempt to wash out competition and rivalry from the market, which would ultimately affect the passengers.

- Continuous price hike of fuel of the airbus presents actual challenge for Ryanair as it directly affects the customers through the increment of the fares for the being of budget airline in Europe. Since many airlines add surcharge in the fare for the high price of fuel, Ryanair could not increase its fare due to their own policy and it creates a dilemma for the company.

- Expanding the operation of Ryanair through the reserve fund is also a challenge for the company, as the investors want the fund distributed among them. Ryanair invests record 2 billion Euros for its business expansion, which was generated from its reserve and it would be a riskier decision on the part of the CEO of the company.

- The twenty million Irish pound losses in 1990 made the company difficult to survive with the low budget operations and it showed a challenge for the company.

- The turbulence of the five executives and experienced a huge loss was a big challenge for Ryanair and the potentiality and success of the new CEO Michael O’Leary was representing a question mark for the company.

- The negative impression on the ancillary operations, especially mobile phone facilities in the flights was criticized by the passengers, which was a big sources of income for Ryanair; this created challenges for the company and on the decision of whether it continue the ancillary operation or not.

Reasons behind the success of Ryanair

- Ryanair is a budget airline based on Ireland that operates its flight in whole Europe and decides to merge the local government airline Aer Lingus through the acquisition of the majority share of the company. It was hardly opposed by the investors of Ryanair as well as the various stakeholders of Aer Lingus and so the deal did not worked well. However, this decision reflects positive impacts on Ryanair as the passengers and other stakeholders are convinced about its ability and in affect, the profit margin of the company increased as well.

- Another reason behind the success of Ryanair is the executives of the company led by the CEO Michael O’Leary who is the pioneer in its success. Most of the decisions for Ryanair are made by Michael O’Leary proving successful for the company.

- The main competitive advantage of Ryanair is its low fare compared to other airlines that operates in Europe. Ryanair offers lowest fare for their passengers in various destinations in Europe and it make the airline capable to generate more revenues for itself.

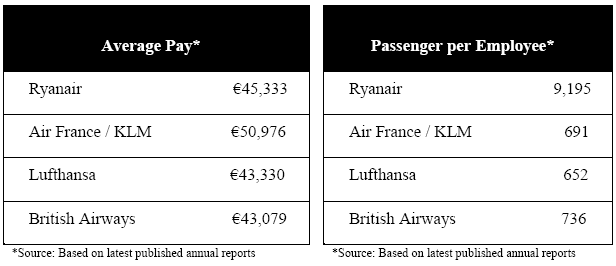

- The business model followed by Ryanair is another reason for the success of the company as it follows organic model; while, in 1990, the company experienced a huge loss, it followed the model of Southwest Airlines. According to the statement of the CEO of the company, Ryanair tries there level best to minimize its cost in every sphere of operation, which enables them to charge low from their customers and even they minimize the staff size and the volume of training in the organization. Ryanair uses new airbuses, which consume fuel lower than the traditional airbus and require small numbers of crew during the flight.

- There is no additional charge for high fuel price in the international market, so, it brings success for the company. The price of the fuel has increased frequently these days to approximately seventy percents in the world market, which raised the cost of the airline companies in Europe and almost every one of them increased their fare to cover the additional cost. Nevertheless, Ryanair do not make any surcharge in the fare and the CEO of the company declared that they would not increase the fare at present and in future due to the high fuel price.

- High quality service and airbus plays a great role in the success of Ryanair as it generates new airbus for their customers with high capacity and big sized seats inside the bus. The average life span of the airbus of Ryanair is 2.4 years, which is the youngest life of fleet in Europe. The airbuses are more environment-friendly, produce lower level of sound, and fume during operation.

- The ancillary operations of Ryanair contributed thirty-six percent increases in the revenues, which show a faster growth in revenue, than the revenue received from the passengers. The ancillary service includes the scheduled service like hotel, insurance services, additional charge of excess bagging etc. The credit card interest from customers, the website advertisement income, mobile phone services during travel, on boarding sales and so on. This ancillary service generates a good volume of profit for Ryanair which is used by the company to subsidize the cost of flight operation and it enabling it to charge low fare from their passenger for traveling in various destinations.

Sustainability of Ryanair’s Strategy

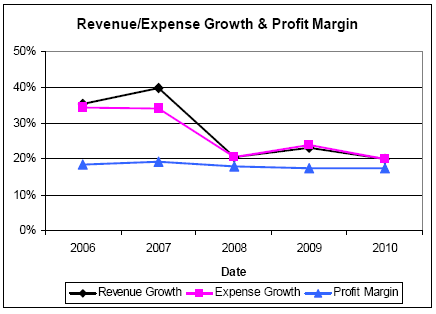

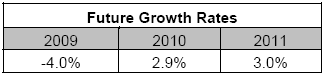

Low Fares: O’Cuilleanain et al (2004) argued that Ryanair pursues low cost strategy, so, it is targeting fare-conscious leisure and business travelers and using the secondary airports rather than majors. The CEO of Ryanair O’Leary said that Ryanair sets fares on the basis of the demand for particular flights (with fares ranging from 0.99 euro to 199.99 euro) and offers one-way pricing policy because they want to be the Wal-Mart of the Airline business. However, its operating costs have been increasing at least 35% from 2007 due to high price of fuel, which is a big challenge for this company to offer low cost strategy in future (Barrett, 2004).

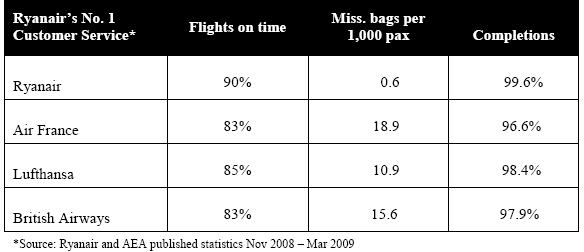

Customer Service: Ryanair (2008) reported that its strategy is to provide the best client service performance (such as, better punctuality, less lost bags and smaller amount cancellations) because the competition is very high in this industry; beside of that, in 2005, a new EU regulation came into effect to reduce the inconvenience of passengers.

Frequent Point-to-Point Flights on Short-Haul Routes: Though Ryanair was more concerned about UK to Ireland flights, now it is the pioneer of the low cost provider in the entire Europe in point-to-point short-haul routes.

Low Operating Costs: Johnson, Scholes & Whittington (2005, p. 840) argued that the main competitive advantage of this company is that its operating costs are among the lowest of any European scheduled passenger airline as it has decreased its expenses from several sectors. These sectors are:

- Aircraft equipment costs: In order to reduce the aircraft acquisition costs, it would like to purchase used Boeing 737-200A aircraft from Boeing, as it is one of the major aircraft supplier companies in the world. However, it is operating 74 aircrafts in 127 routes and has a confirmed order of B7C7 and it operated a single fleet type of “next generation” Boeing 737-800s from 2006. Increase in aircraft equipment costs would discourage the sustainability strategy for the company, though management believes that purchasing contracts are very favorable to Ryanair to increase the size of its fleet.

- Staff costs and productivity: Ryanair tries to reduce its labour costs by constantly developing the efficiency of its employees and O’Leary stated that most of the employees are already highly-productive to sustain in this industry

Customer service costs: According to the annual report 2003, Ryanair declared itself number one for customer service, in terms of punctuality, fewest cancellations, and fewest lost bags and less complaints per 1,000 passengers flown. Johnson, Scholes and Whittington (2005, p. 839) argued that to ensure quality service, it offers low fare than competitors, allows flight changes with low fee, provide information to passenger, provide prompt refunds, and so on.

Airport access fees and route policy: Ryanair decreases Airport charges such as landing fees, passenger fees, and aircraft fees by avoiding congested main airports, choosing secondary and regional airport destination; for instance, Ryanair uses Frankfurt Hahn 123 kilometers from Frankfurt, Torp 100km from Oslo etc.

Taking Advantage of the Internet

Commitment to Safety and Quality Maintenance: Johnson, Scholes and Whittington (2008, p. 703) argued that safety is taken very seriously by the company, with extensive safety training and protocols because a serious accident is threat for budget airliner as experts questioned on human safety issues. However, Johnson, Scholes & Whittington (2005, p. 840) argued that in 2006, UK television Channel 4 broadcast a documentary ‘Ryanair caught napping’ and criticised Ryanair’s training policies, aircraft hygiene and highlighted poor staff morale but the management committee of the company denied all allegations against them and published its correspondence with Channel 4 on its website.

Marketing costs and focused criteria for growth

Choice of routes: The major routs include, Dublin Airport, London Stansted Airport, Orio al serio Airport, Rome Ciampino Airport, Shannon Airport, Pisa Galilieo Galilei Airport, Brussels South Charleroi, Frankfurt-Hahn Airport, Cork, and Liverpool John Lennon;

Ancillary Services: the company will not provide refreshment or meals or accommodation to passengers facing delay (if customer asked these services they had to pay) and Ryanair will not supply free wheelchair for disable passengers, but it provides non-flight scheduled services, the in-flight sale of beverages, food and merchandise and internet-related services.

Reference

Barrett, S. D., (2004) The sustainability of the Ryanair model. Web.

Beppegrillo, (2005) Ryanair – Industry leading margins. Web.

Johnson, G., Scholes, K., & Whittington, R., (2005) Exploring Corporate Strategy: Text and cases. 7th ed. Pearson Education Limited.

Johnson, G., Scholes, K., & Whittington, R., (2008) Exploring Corporate Strategy: Text and cases. 8th ed. Pearson Education Limited.

Liolios, A., (2007) Ryanair Holdings plc (RYAAY). Web.

Massey, P., (2008) Commission’s Economic Analysis Shoots down Ryanair’s Proposed Acquisition of Aer Lingus. Web.

O’Cuilleanain, E. S. et al., (2004) Séminaire d’elaboration d’un Business Plan: Ryanair Plc. Web.

Porter, M. E., (2004). Competitive Strategy. Export Edition, New York: The Free Press.

Ryanair, Annual report 2009 of Ryanair. Web.

Ryanair, (2008) Ryanair: Europe’s Greenest Airline.Web.

Ryanair, (2009) Ryanair Reports Record Profits Of €481M up 20%, Fares Fall 1%, Traffic Grows 20% to 51M. Web.

Ryanair, (2008) Strategy. Web.

Snell, J. D., (2007) Ryanair Holdings PLC (RYAAY). Web.

Timoteo, B., Valeriu, F. D. & Gianluca, M., (2005) Ryanair: Low cost or Low Ethics? Web.