Read this essay to explore external environment of tesla and its strategy analysis. This paper also provides information about Tesla internal environment, its resources, capabilities, threats, and opportunities

Tesla’s Background

Founded in 2003, Tesla Motors is an American automobile manufacturing company. Its main offices are based in Palo Alto in California (Tesla Motors 2014). The company developed its first model, Roadster, with the objective of setting the way for the development of an electric car as an alternative to gasoline-propelled automobiles. As this paper reveals, its ability to overcome weaknesses and threats by utilising its key internal resources and capabilities while taking advantage of the opportunities in its external environment has made it acquire a competitive advantage in the EVs market in the U.S., Europe, and Asia.

Tesla External Environment Analysis

An organisation can manipulate some of its external environmental factors through its marketing efforts. In some others, it can only adjust such elements in line with its requirements (Trifu, Girneata & Potcovaru 2014). In its operation, Tesla Motors copes with issues such as the prevailing economy, market, industry dynamics, government regulations, and socio-cultural forces that constitute its external environment. The PESTEL/PESTLE analysis constitutes one of the well-known approaches to analysing these issues (Roper, Pitt, & Zakrzewska 2012).

Tesla Motors operates in an automotive industry that is exposed to political instabilities in major markets, although government incentives have helped in the development of EVs (Karamitsios 2013). The U.S. government offers direct tax subsidies on purchasing an Electric Vehicle (EV). For example, in the U.S., the federal government offers $7,500 tax credit on purchasing an EV, for instance, Model S or Nissan Leaf (Van & Steen 2015). The case also reveals that California expanded this offer to include an additional $2,500 buying discount. It also allowed zero-emission vehicles such as Model S a free use of HOV lanes until 2015. This political atmosphere indicates the U.S. government’s commitment to encouraging the production of EVs and hence a crucial opportunity for the company’s growth and profitability.

The global financial crisis of 2007-2009 resulted in a massive struggle for three leading automobile manufacturers in the U.S., some of which reached a near-collapse situation. However, the economic problems faced by the car manufacturers were beneficial to Tesla Motors. For example, the company successfully moved the entire manufacturing of Model S back home after purchasing a plant that lay idle in Fremont, California, owned jointly by the General Motors (GM) and Toyota companies (Van & Steen 2015). This deal resulted in a capital injection of $50 million from the Toyota Company into Tesla. Economically struggling car manufacturers disposed their production equipment at discounted prices to Tesla. For instance, a Detroit-based company sold a hydraulic stamping press to Tesla worth $50 million at only $6million (Van & Steen 2015). In the wake of the economic crisis, Tesla spent only 33% of the total amount it would spend in making the acquired plant operational.

Economic factors also influenced the demand for fuel-efficient vehicles. For example, in the U.S., the cost of gasoline has been rising since 1995 (Healey 2016; Statista 2017). Consequently, an opportunity for more sales has been available, owing to the rising demand for EVs after 2014 and beyond as consumers look for long-term cheaper alternative cars compared to ICs or hybrid vehicles. The observed reduction in battery costs presents an opportunity for Tesla.

Social factors that influence Tesla Motors’ operations include the rising preference for low-carbon lifestyle and renewable energy. For instance, Tesla Motors’ marketing efforts based on low emission focus on responding to customers’ preferences of low-carbon lifestyles. The U.S. government also supports this lifestyle through subsidies upon purchasing EVs. Hence, social factors that affect the external environment for Tesla and other EV manufacturers, including Nissan, present an opportunity for the company’s growth.

Tesla operates in an industry that experiences a high rate of technology changes, which present both threats and opportunities. For instance, when Nissan Leaf developed the Li-ion battery with 192 cells, Van and Steen (2015) reveal how Tesla had to improve its Roadster battery for use in Model S by incorporating 7000 cells. This move guaranteed a higher-energy density that led to a reduction of the total weight of the car coupled with the corresponding amount of materials (Van & Steen 2015). This accomplishment presented an opportunity for ensuring that the organisation remained competitive compared to the Nissan Leaf. Through the technology, Tesla’s Model S improved its ability to pick speed, thus possibly explaining its 2013 selection as the car of the year (Tesla Motors 2014). However, the changing technology presents threats. For instance, with a 7000 cells battery, a high-energy density increases the risk of catching fire (Motavalli 2013). Therefore, more investments are made in the design of a cooling system.

Ecological factors affect Tesla Motors’ external environment due to the rising standards on waste disposal and the increasing concern over climatic changes. The zero-emission capability of EVs increases their reception in the market. Indeed, the state of California requires automobile traders to have their total sales volume capturing a specific minimum percentage of zero-emission vehicles. Van and Steen (2015, p. 5) posit that those who fall short of the requirement “can buy ZEV credits from those above the mandated minimum”. The move has directly affected the external environment of Tesla as it encourages buying EVs in response to the increased climatic changes.

Dealership regulations in the U.S., the U.K., and other markets constitute legal factors that threaten Tesla’s operations. Dealerships lobby pushed states into enacting laws that only allowed car manufacturers to sell through independent recognised dealers but not directly through company-owned stores. In such states, Tesla opted to sell online, although Texas had already passed a law prohibiting such a move (Van & Steen 2015). North Carolina almost enacted a similar law. Consequently, Tesla had no option apart from complying while fully aware that dealers could educate customers on the advantages of the EVs. They had to balance their interest in selling IC vehicles.

Tesla’s Internal Resources and Capabilities

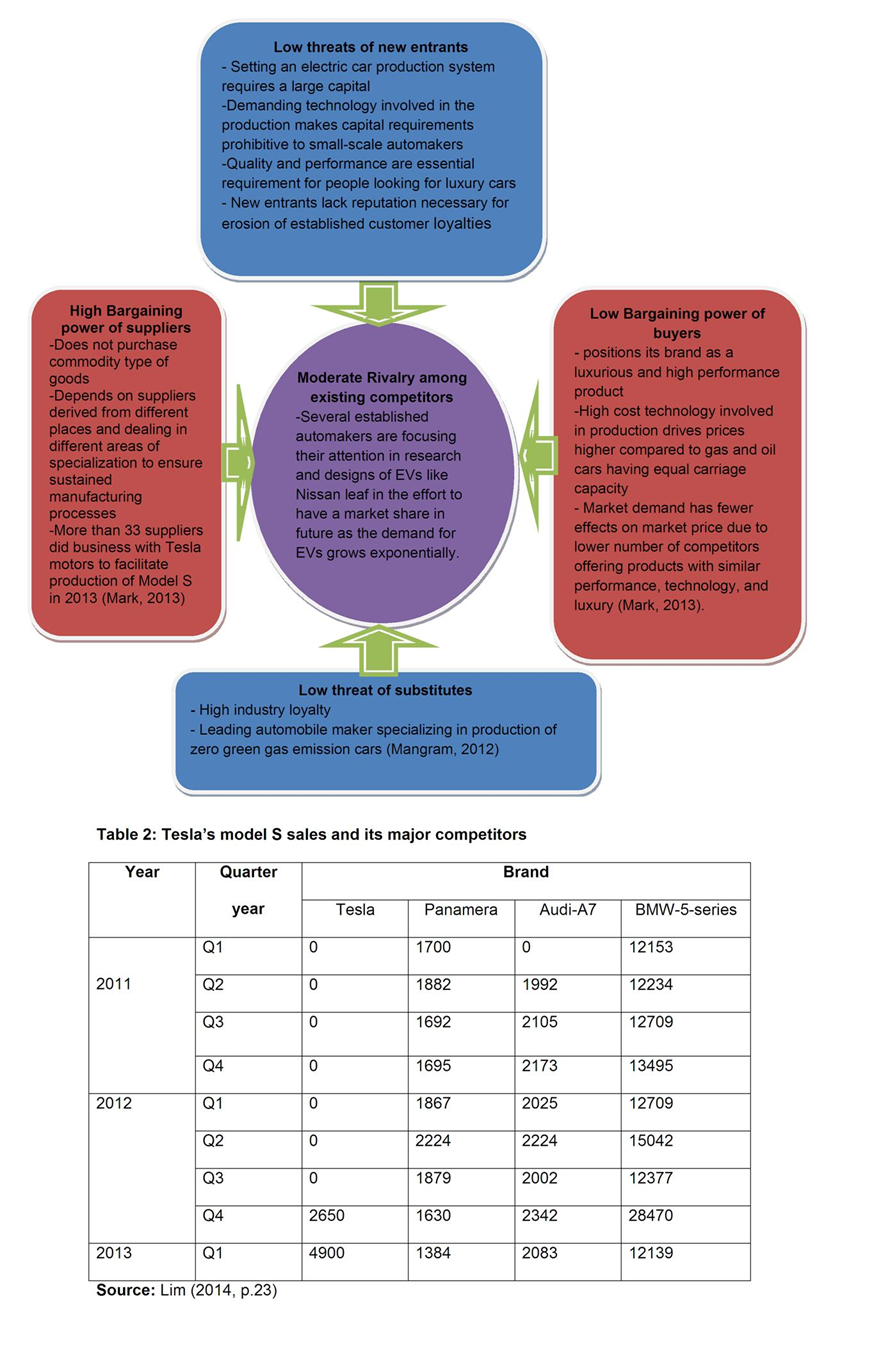

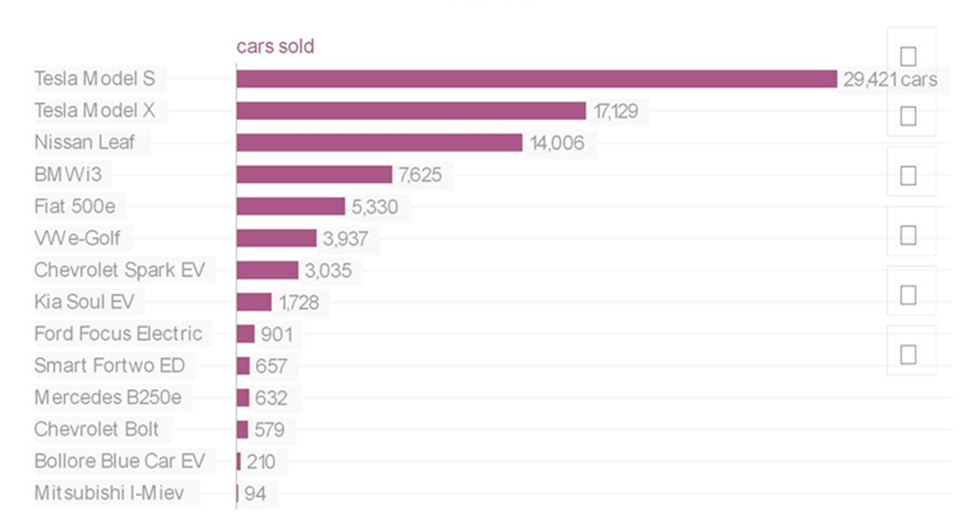

An internal analysis of an organisation facilitates the identification of core competencies and resources in various functions of an organisation, including operations, finance, and marketing. Approaches such as SWOT, competitor analysis, and value chain tools help in accomplishing this goal (Anbu & Mavuso 2012; Shaw 2012). The identification of resources involves an analysis of sales, profitability, employees’ capability, product portfolios, brand association, and cost relativity of a new product among others. Capabilities imply the strategic strengths, weaknesses, uncertainties, and all emerging coupled with existing problems (Saxena 2012; Yoo 2013; Luxton, Reid & Mavondo 2015). Table1 shows Tesla’s SWOT analysis while Figure 1 represents the company’s competitive examination of its internal resources and capabilities. Table 2 evidences Tesla Motors’ capability to create strong product portfolios that it can successfully push to the market when compared to competitors such as Audi-A7 and Panamera.

Table 1: Tesla Motors’ SWOT Analysis.

Sales and Marketing Capabilities

Table 2 shows that Tesla began making the sales of Model S from the last quarter of 2012. BMW 5-series and Panamera had been selling since the first quarter of 2011. Audi-7 began selling during the second quarter of 2011. Hence, Tesla successfully introduced Model S in the market after it ceased taking Roadster orders. By the end of 2012, it surpassed Audi-7 and Panamera in terms of the units sold. Although Tesla could not surpass BMW 5-series’ sales, it sold 10500 units compared to Nissan Leaf’s 9,839 components by July 2013 (Van & Steen 2015). This achievement evidences its high selling capability. In terms of marketing, Tesla emphasises “speed, comfort, and handling, before taking low emissions” (Van & Steen 2015, p. 8), hence indicating a marketing capability in the analysis of product attributes that are most important to buyers. This strategy influences the corporation’s car-purchasing decision. Arguably, a buyer will be interested in buying an EV due to its low emission if it offers equal levels of utilities such as speed, comfort, and handling that are likely to be found in a luxurious IC engine car.

Operations

Tesla’s design teams display how a company can build a competitive advantage around innovation. For instance, they developed a battery pack rated at 60kWh costing between $250 and $300, which was “less than half the estimated cost per kWh for the Nissan Leaf” (Van & Steen 2015, p. 7). The decision to bring almost all its manufacturing operations in-house created cost-saving advantages. It also set a way for the development of new business lines. Tesla sells in-house-produced powertrains to other EVs manufacturers such as Mercedes. Model S customers have a range of alternatives when in need of repairs. They can call Tesla Rangers, visit an authorised service centre, or exchange a malfunctioned car for a loner via the company’s valet service.

Finance

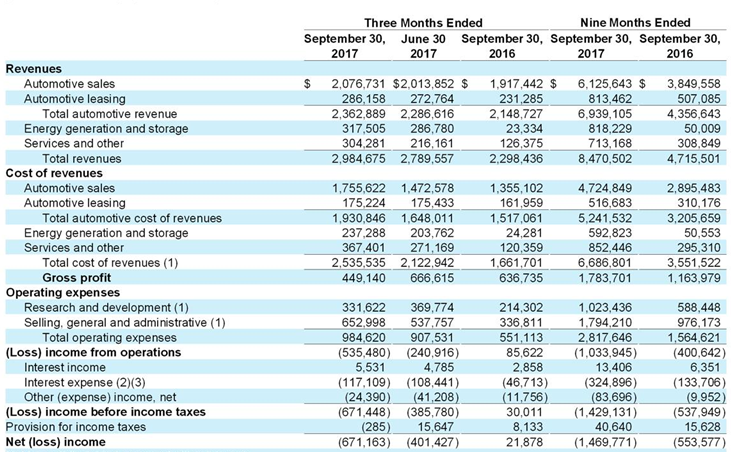

From the 2010 to 2013 income statement provided by Van and Steen (2015), Tesla reported negative net profits from 2010 to 2012, although the gross profit remained in the positive region. In 2013, Tesla doubled its revenue from the sales of cars and powertrains (based on 2012 figures), resulting in a positive net profit. However, total operating expenses reduced by over 50% (Van & Steen 2015). Thus, high operating expenses, especially investments in research, design, and marketing, explain the negative net profits reported by Tesla from 2010 to 2013 (Tesla Motors 2015). BMW Group reported a positive gross and net profit from 2011 to 2012 (Van & Steen 2015). However, considering the percentage of operating expenses against revenues for the two companies, BMW Group did not invest heavily in research, development, and marketing compared to Tesla. Hence, despite reporting negative gross profits, Tesla’s future financial capability remains indisputable.

Technology

Technology forms an important resource and capability that helps Tesla Motors to drive its competitive advantage. For example, when Model S developed windscreen wipers and handle problems, technology permitted an immediate wireless software update (Van & Steen 2015). This accomplishment was possible since Tesla possessed the technological prowess to integrate such software to control its vehicles’ behaviours. The software can be upgraded through cellular connections.

Tesla’s Additional Resources after 2014

Figure 2 evidences Tesla Motors’ increased selling and marketing capability after 2014. Elon Musk’s idea of building a sports car, using the money generated to build an affordable car, and developing an even more affordable future car has succeeded (Van & Steen 2015).

From Figure 2, in 2016, Tesla led in the sale of EVs in the U.S. market compared to its competitors such as Nissan Leaf, BMW i3, Mercedes B250e, Fiat 500e, and VW e-Golf. For instance, in the same year, Tesla sold 29421 Model S units and 17129 Model X units while the closest competitor, Nissan Leaf, sold 14006 units (Coren 2017). In 2016, the sale of Tesla’s Models S and X accounted for more than 50% of the total EVs sold in the U.S. (Coren 2017). Hence, it stands as the most valuable electric carmaker across the globe. The fact that it sells many vehicles compared to any other EVs maker implies that returns on sales are higher. Therefore, Tesla can utilise economies of scale to acquire more cost leadership. Nevertheless, for the financial year ending September 2015, its operating margin stood at negative 14.02%, with the expectation to turn positive over a period of 5 to 10 years (Blokhin 2016).

Figure 3 shows that in 2016 and 2017, Tesla continues to report negative net profits. However, this situation does not indicate its poor financial capability. Tesla is a young company. It invests heavily in marketing to promote sales. Its approach to research and design also contributes to the negative operating margins and net profits, which will increase its comparative and competitive advantage in the end.

Conclusion

Following the expertise of Lotus Elise, the UK-based co-designer of Roadster model’s chassis, Tesla Motors stopped taking orders for the Roadster model. The rumours of introducing another contractor by 2014 or 2015 were unfulfilled. Rather, it focused its efforts on Model S and X and later Model 3. As evidenced by the analysis of its internal and external environment, for the three models, the company has displayed an incredible technological innovation and resilience to operational dynamics, thus evidencing its ability to remain profitable after 2014 and beyond.

References

Anbu, J & Mavuso, M. 2012. ‘Old wine in new wine skin: marketing library services through sms-based alert services’. Library Hi Tech, vol. 30, no. 2, pp. 310-320.

Blokhin, A. 2016. Tesla’s 3 key financial ratios (TSLA). Web.

Coren, M. 2017. Tesla’s biggest competition for the model 3 will not come from other electric vehicles. Web.

Healey, R 2016, ‘Under-enumeration, inconsistency, and bias in the U.S. manufacturing census 1860–1880: case studies from the American manufacturing belt’, Historical Methods, vol. 49, no. 1, pp. 11-33.

Karamitsios, A 2013, ‘Open innovation in EVs: a case study of Tesla Motors’, Master of Science thesis, KTH Industrial Engineering and Management, Stockholm.

Lim, T. 2014. Model s: revolution for the masses. Web.

Luxton, S, Reid, M & Mavondo, F. 2015. ‘Integrated marketing communication capability and brand performance’, Journal of Advertising, vol. 44, no. 1, pp. 37-46.

Mangram, M. 2012. ‘The globalisation of Tesla motors. a strategic marketing plan analysis’, Journal Of Communication Management, vol. 20, no. 4, pp. 289-312.

Motavalli, J. 2013. ‘As it increases production, Tesla worried about battery supply’. The New York Times. Web.

Roper, K, Pitt, M & Zakrzewska, P. 2012. BIM implementation: PESTEL drivers and barriers: cross-national analysis. Web.

Saxena, S. 2012. ‘Challenges and strategies for global branding’, Journal of Business and Management, vol. 4, no. 4, pp. 38-43.

Shaw, E. 2012. ‘Marketing strategy: from the origin of the concept to the development of a conceptual framework’, Journal of Historical Research in Marketing, vol. 4, no. 1, pp. 30-55.

Statista. 2017. Average annual OPEC crude oil price from 1960 to 2017 (in U.S. dollars per barrel). Web.

Stringham, E, Miller, J & Clark, J. 2015. ‘Overcoming barriers to entry in an established industry: Tesla Motors’, California Management Review, vol. 57, no. 4, pp. 85-103.

Tesla Motors 2014. About Tesla. Web.

Tesla Motors 2015. Annual report. Web.

Tesla Motors 2017. Tesla third quarter 2017 update. Web.

Trifu, A, Girneata, A & Potcovaru, M. 2014. ‘Influence of natural factors upon the organisational activities’, Review of International Comparative Management, vol. 15, no. 4, pp. 487-496.

Van, E & Steen, D. 2015. Tesla Motors, Harvard Business School, Boston.

Yoo, Y. 2013. ‘A tool for evaluating advertising concepts: desirable characteristics as viewed by creative practitioners’, Journal of Marketing Communications, vol. 19, no. 2, pp. 81-97.