The success of CEMEX Company can be attributed to the waves of acquisition that the firm started undertaking in the late 1980s shortly after Lorenzo Zambrano reversed the firm’s long-term diversification plans. This change in the Company’s long-term strategic plan is what enabled CEMEX to become one of the largest global giants and a key player in the cement industry business. By the start of the year 2000, CEMEX had edged several global firms to become the third-largest worldwide with sales revenues that surpassed the $4.8 billion mark annually (Bartlett and Beamish, 2011). By this time CEMEX appeared to have reached the peak of its rise with a global business presence in all the major continents as well as countries that had high market potential.

Between 1985 and 1999, CEMEX has hugely increased its global business operations by undertaking acquisitions in very strategic geographical locations such as Latin America, the US, Eastern Europe, Africa Asia and the Mediterranean. Despite this exponential growth by CEMEX over the last one and half-decade, the firm was still faced with stiff competition from two of the largest cement firms which currently surpasses its global business operations i.e. Holderbank and Lafarge (Bartlett and Beamish, 2011). Both of these Companies have dominated the cement industry for decades and have business operations that supersede CEMEX both in sales revenues as well as in capital investment and therefore presents the most challenging obstacle to CEMEX’s quest for global dominance at the moment. This is because both Lafarge and Holderbank have the capacity to compete directly with CEMEX especially as far as the acquisition of strategic businesses is concerned. In the backdrop of this heightened competition that CEMEX must now anticipate and counteract is another complication that arises because of the high rate of saturation of cement companies in the industry which will also ultimately increase the level of competition among all key players. These are the challenges that CEMEX has to grapple with as it considers expanding its business operations globally a notch higher notably in Africa, Asia and the Middle East.

The kind of vision that Lorenzo Zambrano has for CEMEX is evident in the way that he had strived to mold the Company since the late 1980s shortly after he took the reins of the firm. There is no doubt that what CEMEX has achieved so far is a result of calculated long-term strategic plans aimed towards securing a considerable global market niche in an increasingly competitive industry. From an early stage since the moment that Lorenzo Zambrano decided to shift the strategic business plan of CEMEX, the Company’s expansion and competitive advantage took new forms of what appears to be a centralized hub pattern that is also very similar to the coordinated federation pattern. The centralized hub is a pattern of organizational configuration that is aimed at providing a global firm with a competitive advantage over its rivals in a global setting (Johnson and Scholes, 2005). This organizational Configurational strategy is evident in the way that CEMEX has set out and targeted cement companies that it was interested in acquiring which it ensured were dispersed across key geographical locations with high potential markets.

Initially, it can be seen that Zambrano first set out to solidify and secure a large market share of Mexico’s cement market with two key acquisition deals of Cementos Anahuac and Cementos Tolteca. These early acquisitions are seen to have provided CEMEX with a stable base from which to operate as it set out to concur the global market and claim its dominance in the cement industry. It is for this reason that CEMEX’s organizational setup can also be described to be similar to a Coordinated Federation pattern where the management’s motives are largely driven by a need to seek and obtain a sizable world market share. In both methods of organizational configuration, that of Centralized hub and Coordinated federation a Company operates from a centralized location which functions as its headquarters very similar to what CEMEX operates at the moment. This type of expansion plan appears to be what Zambrano is likely to pursue in the coming years as he positions CEMEX to become a global leader through more acquisition strategies in key regions such as Asia, Africa and the Middle East.

The chances of success that CEMEX has as it strives to further expand its business operations beyond the geographical areas that it is already operating on is dependent on several factors most critical of which include the location of the country, cost of business operations, rate of competition in that region and suitability of the Company that it targets to acquire. Indeed, the current choices of location that include Africa, Asia and the Middle East which Zambrano has picked to expand the Company indicate consideration of all these factors. A fundamental principle in profit maximization states that “a Company should be incorporated where it is financially appropriate rather than operationally appropriate” (Bartlett and Beamish, 2011). Because this has been the position that CEMEX management has always adopted it would seem that future decisions will also be dependent on this factor. Another strength that CEMEX has in its bid for expansion has to with due diligence and standardized process of assessing target Companies for acquisition which enables it to identify the most viable firms that it desires to buy out. The challenge for CEMEX will be overcoming the set of factors that hinder the establishment of any large firm in foreign new markets which have been aptly summarized by Bartlett and Beamish i.e. understanding new environments, coping with global uncertainties and management of local-level risk (2011).

Under each of these three categories is another range of specific factors that will impact a firm that is eager to expand globally; thus CEMEX success rate is dependent on how best it can weather these challenges. Perhaps the greatest risk that CEMEX is likely to encounter as it seeks to expand its markets to these three regions is increased competition from the two of its greatest rivals, Lafarge and Holderbank which must also be structuring their business operations along these regions. Overall, I would say that CEMEX’s chances of success are pretty high based on several ranges of factors more so since it presently has a large capital base that it can effectively invest in high return business ventures at about the same level as its competitors.

Throughout the 1990s CEMEX was going through some of its greatest challenges that threatened its very existence; in the early 1990 the Company’s business operations in the US were hampered by trade sanctions that had been instituted against thereby making it unable to access the US market. It was also during this period that Zambrano restructured the Company’s long-term strategies from a diversified business entity to one that was mainstreamed in cement production only. The turnaround of CEMEX Company at a time when the firm was relatively young meant that the Company’s strategic plans and objectives needed to be realigned with the new vision that Zambrano had for the Company. The importance of strategic management in a business is one of great importance that organizational management cannot afford to overlook. It refers to plans, decisions and actions that an organization must implement in the course of business operations in order to chart the organization towards the most desirable level that the management desires as envisioned in the mission statement (Pearce and Robinson, 2008). The single most important aspect of strategic management in the running of an organization is its ability to provide the management with contingencies at every level of difficulty that a business will encounter during its operation (Pearce and Robinson, 2008).

More importantly, it enables the direction of the business to be informed by the use of best practices that utilize a range of information sources as opposed to decisions that are not based on any strategic management models as was traditionally the case. It is this approach of strategic management that enables Zambrano to anticipate and “plan for volatility” that is inherent in all business environments. For instance, in early 1990 after CEMEX adopted a new long-term strategic plan it started by strengthening its Mexican business operations which would later come to be the base of its global business subsidiaries. Over the next few years between 1992 and 1999, CEMEX finalized most of its Company acquisitions projects that were dispersed all over the world; these early achievements were very key in enabling CEMEX to sail through the Peso crisis of 1994/95 and through the political instability that took place in Mexico within the same year. This was possible because of strategic management in business operations which involves various activities that are seen to occur at three levels within an organization namely: functional level, business level and corporate level (Pearce and Robinson, 2008).

At each of these levels of business operations, the concept of strategic management requires it to be incorporated in a way that contributes to the overall strategic plans of the organization. At functional and business levels CEMEX explored cost-effective ways of producing cement and related products in order to gain a competitive edge and increase its profitability. It should also be noted that the Company was at the forefront of utilizing the concept of information technology which would later become integral to its business operations globally. Corporate level strategic management is essential in charting the future of a Company by deciding on short-term as well as long-term goals to pursue in the murky environment of globalization which is exactly what Zambrano has achieved by the start of 2000. This is necessary because each of these levels provides different insight regarding the business operations at that level which is necessary since it informs executive level management on the best decisions to undertake (Pearce and Robinson, 2008).

Therefore a critical role of strategic management in the management of a business is its ability to provide the management with tools and capability to effectively respond to the range of challenges that might hamper or run down a business, in what is usually referred to as internal and external threats (Pearce and Robinson, 2008). The external threats or environments refer to factors that adversely affect a business that is beyond its scope of control, such as government compliance requirements that increases the cost of doing business or marketing competition that requires a company to spend more in order to keep up. The internal environment incorporates all issues that limit the performance of the organization from within and which can effectively be addressed through proper management skills such as employee motivation and so on.

Our focus, in this case, shall briefly be on external factors that faced CEMEX in the late 1990s. The immediate threat that CEMEX had to grapple with during this period was an increasing level of competition from several of its major rivals which had business operations in the same regions that the firm was opening its subsidiaries. In Colombia for instance CEMEX encountered stiff competition in 1996 that sparked a price war shortly after it has acquired Cementos Diamante which controlled about 1/3 of the market. In the aftermath of this price war, the CEMEX subsidiary in Colombia suffered a drastic drop in operating margin from “more than 20% at the beginning of 1998 to 3% by late in the year” (Bartlett and Beamish, 2011). To address this challenge of increased competition CEMEX adopted two approaches to competing with its rivals; what Bartlett et al refer to as Triad giants and domestic defenders. This approaches enabled the firm to secure an established local base while also spreading out to capture the global market in key strategic positions.

Another factor that faced CEMEX during this period was price uncertainty in the industry which could be triggered by a range of factors such as political instability and economic recession as happened in Spain and Indonesia. Because these were factors beyond the control of the firm it had no way that it could effectively hope to insulate itself against such external factors. Finally, CEMEX was faced with unfair trade legislation that sabotaged its efforts of entering new markets as it happened in the United States where the ITC body imposed a 58% duty on all cement being imported from Mexico thereby effectively limiting the capacity at which the firm could have operated in the United States.

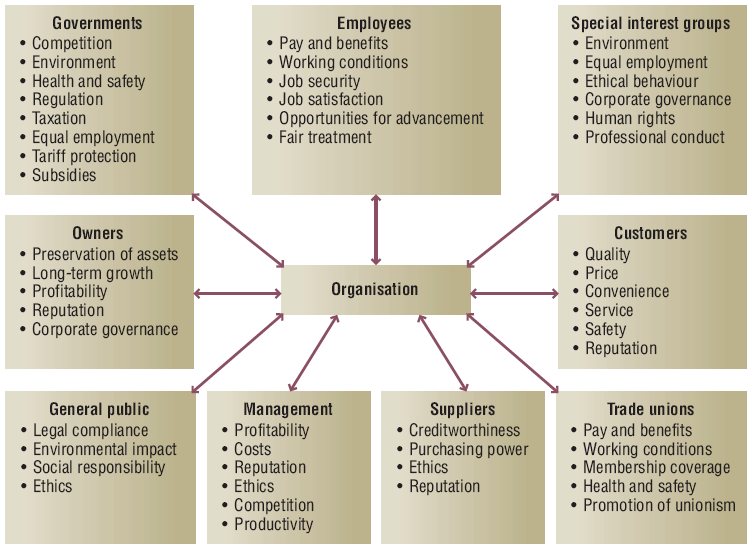

Ideally, the stakeholder’s interest of a company normally goes beyond the immediate investors of a firm to include a range of several players that directly or indirectly interact with the business. According to Stone, there are a total of nine stakeholders who can be listed for most types of large-scale business establishments. These are government, employees, special interest groups, investors, customers, suppliers, the general public, management and trade unions as depicted below in this framework (Stone, 2008).

Among the most important stakeholders of CEMEX are the Company’s employees who are the driving force of the firm global success. Indeed, CEMEX CEO Lorenzo Zambrano who can be viewed in this context as an employee of the firm together with his top management committee has been very crucial in shaping the firm’s business operations globally. The crucial role that CEMEX employees play in the global expansion bid of the firm is very apparent in acquisition processes that involve due diligence, opportunity identification and post-merger integration which are all crucial stages in an acquisition that requires maximum employee input. Like all successful Company’s, CEMEX owes its business success to the way that it engages with its business employees which is very similar to the concept of Strategic Human Resource Management (SHRM).

Strategic Human resource management is a concept that had been advanced more recently by human resource specialists that recognize employees as a key factor to the success of the organization (Pinnington and Edwards, 2000). SHRM is different from traditional personnel management in that it recognizes the need to incorporate and align employee work procedures with the organization’s long-term business operations strategic objectives (Simmonds, 2007). Unlike ordinary personnel management strategies, SHRM goes beyond the routine activities of human resources that involve recruitment, training, personnel development, and salary processing. The key concept of an SHRM is to achieve an efficient human resource that complements the organizational business goals and visions that also build on a framework that integrates the external factors of the organization as well (Pinnington and Edwards, 2000).

To attain the kind of success that CEMEX has been able to achieve in just a few spans of years in which it has risen to be a major global leader in the cement production industry, then SHRM is the only option that can enable the firm to attain the kind of commitment that is required from the employee which is aligned with the organization’s strategic plans. The stakeholder interest of employees from an SHRM perspective also incorporates issues of trade unions and management which are listed separately on the list of organizational stakeholders by Stone.

A slightly different framework of Stakeholder interest of a firm has also been advanced by Harrison which summarizes all the type of stakeholder interests that exists in a Company in three categories; the broad environment, the operating environment and finally the organization itself (Harrison, 2003).

Based on this concept the broad environment encompass issues such as technological influences and socio-cultural factors that impacts on the success of the firm within a given industry. For CEMEX Company the information technology that it undertook during it early years of global expansion was part of the stakeholder interest that existed in the firm. The Socio-cultural influences aspect is evident in countries of operations where CEMEX has business operations since the cultural context of each region is different from the cultural orientation of CEMEX base of operations which is predominantly Mexican. The largest groups of stakeholders are categorized in operating environment which encompasses players such as local communities, labor unions, activist groups, the media, international community, and competitors among others. Among the most notable stakeholders in this case are CEMEX competitors, activist groups and unions which are integral to the business operations of the firm especially as far as corporate social responsibility is concerned. In a recent corporate environment, there has been a shift from business as usual which involved profit maximization to enterprises’ inclusion of social aspects and environmental conservation issues. This comprises of corporate social responsibility that goes beyond normal business regulation to voluntary services of corporate in the areas of operation is evident in the way that CEMEX undertakes its business operations in all the regions of its operations. CSR refers to a voluntary process that enables organizations to integrate their business operations with, environmental sustainability and the social responsibilities of the community in which their business is based at every level. From the above definition, it is clear that companies move beyond the regal requirement and add more value to social welfare in their human capital.

Corporate social responsibility has revolutionized and is now a boardroom issue in the management of corporate or firms. In the current business environment corporate social responsibility is no longer an option that firms can choose to undertake but rather an integral component of an organization that is clearly articulated in many Companies’ mission and vision statement.

Firms use CSR agenda so that they can be described as socially responsible by both adopting new business practices and contributions either monetary or non-monetary which ultimately contribute to their competitive advantage. Kotler applies the term corporate social initiatives under the CSR umbrella to describe major activities undertaken by a corporation to support social causes, utilize the environment in a sustainable way and fulfill the commitment of CSR. CSR transcend national boundaries; the international major conferences such as the world summit on Sustainable Development in Johannesburg and the world summit on the Information Society in Geneva have recognized the crucial part that CSR can play in tackling the many social and environmental challenges we face currently which makes it an integral component for any company that is keen on becoming a global business leader on any field such as is the case with CEMEX Company.

References

Bartlett, C & Beamish, P. 2011. Transnational management: text, cases, and readings in cross-border management. New York and London: McGraw-Hill/Irwin.

Harrison, J. 2003. Identifying Stakeholders. Chichester: Wiley Publishers.

Johnson, G. & Scholes, K. 2005. Exploring corporate strategy. 7th ed. Harlow: Pearson Education / Prentice Hall:

Kotler, P. 2005. Corporate Social responsibility. New Jersey. John Wiley & Sons Inc

Pinnington, A., and Edwards, T. 2000. Introduction to Human Resource Management. Washington, DC: Oxford University Press.

Pearce, J. A., & Robinson, B. 2008. Strategic Management. (11th ed.). Boston: McGraw-Hill.

Stone, J. 2008. Human Resource Management. Sydney: John Wiley & Sons Australia.

Simmonds, D., Porter, C., & Bingham C. 2007. Exploring Human Management. Washington, DC: MacGraw Hill Higher Education.