Executive Summary

This paper documents an analysis of the UAE’s airline industry by evaluating a number of elements that determine the industry’s competitiveness. However, the paper mainly focuses on Emirates Airlines and its close competitor, Etihad Airways. A number of indicators used in determining the attractiveness of industry are evaluated. These indicators include the industry’s size, growth rate, market size, level of profitability, capital requirements, entry and exit barriers, level of consolidation, customer characteristics, and capacity utilisation. Furthermore, the essay analyses the major driving forces and the industry structure using the Porters’ five forces. The competitiveness of the two companies is evaluated using the SWOT model. Moreover, the paper also assesses the industry’s attractiveness, the current position and the industry’s future outlook.

Introduction

The aviation industry in the United Arabs Emirates (UAE) comprises one of the most important economic sectors in the country’s economic growth. The industry’s contribution to the country’s Gross Domestic Product [GDP] is estimated to be $ 22 billion, which represents 15% of the total GDP. It is estimated that the industry will account for 32% of the country’s GDP by 2020. Thus, the UAE government is focused on sustaining the industry’s growth and contribution to the country’s economy (Sophia par.2). Emirates Airlines and Etihad Airways are the most dominant carriers in the UAE’s aviation industry. Emirates Airlines was founded in 1985, and its headquarters are based at Garhoud, Dubai. The company has established operations in 142 destinations and a fleet size of 221 carriers. On the other hand, Etihad Airways was founded in 2003, and its headquarters are located at Khalifa City, Abu Dhabi. The airline has a fleet size of 105 carriers, and it serves 120 destinations.

Aviation Industry Indicators

Size and growth rate

The aviation industry in the UAE has emerged as one of the leaders in the global aviation industry. One of the factors stimulating the industry’s growth relates to an increment in demand for air travel. For example, between 2005 and 2010, the number of passengers in the industry increased from 24.8 million to 47.2 million. It is projected that the number of passengers will increase to 98.5 million by 2020 (Mouawad par.5).

The growth of the industry will further be harnessed by the high rate at which passengers and international airline companies are considering the country’s airports as a global hub. Subsequently, the country is experiencing remarkable growth in the number of inbound and outbound flights (Sophia par.1). The growth of the industry will further be enhanced by the government’s investment in constructing and expanding the existing airports. In 2011, the UAE government launched to boost the industry’s performance by investing US$ 136.12 billion [AED 500 billion] by 2021 (Clark par. 7).

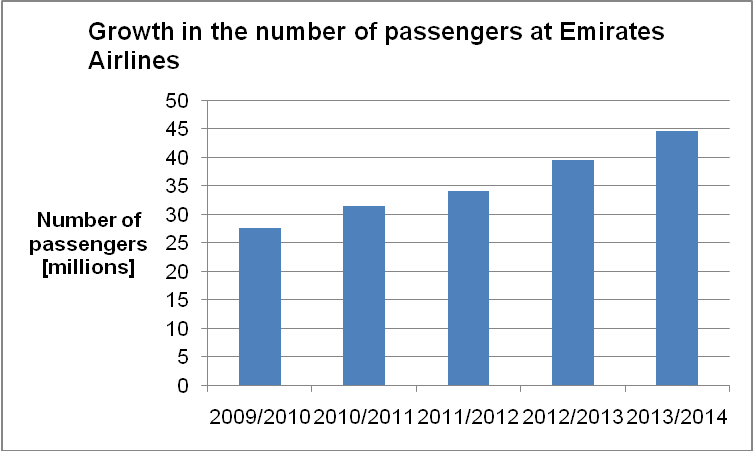

Emirates and Etihad Airways account for a significant number of passengers. In 2013/2014, Emirates Airline passengers increased to 44.5 million passengers as opposed to 16.4 million passengers at Etihad Airlines (Emirates par.12). The chart below illustrates the growth in the number of passengers at Emirates Airlines

Table 1.

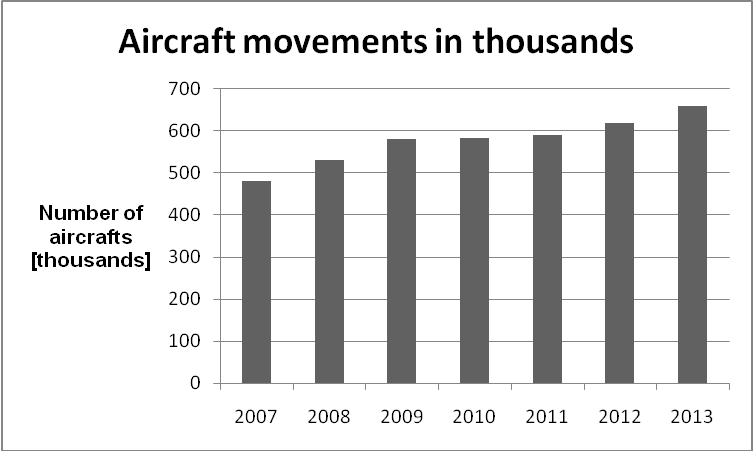

Furthermore, the number of aircraft movements within the country [general aviation, foreign airlines, local airlines, and private operators] has increased substantially over the past decade, as illustrated by the graph below.

Table 2.

Market size and profitability

The industry’s level of profitability is expected to grow owing to the high demand for air transport. It is expected that over 3.9 billion people will travel by air by 2017, which represents a 17% growth from the 2012 level. Furthermore, it is expected that the UAE air cargo market will grow by 17%, hence making it the third-largest international air cargo market by 2018 (Sambidge par. 6). This presents an opportunity for the company to maximise its profits.

Entry and exit barriers

The UAE government has not restricted entry into the market, as evidenced by the allocation of operation licences to diverse airlines. The low cost of entry has been enhanced by the adoption of the open-skies policy. Furthermore, the exit barriers are relatively low because it is easy for industry players to adopt different exit strategies such as an acquisition.

Capital requirements

The industry is capital-intensive. Thus, entry into the industry requires potential entrants to have huge financial outlay in order to establish an extensive fleet size and other airline services such as catering services in order to attain a high competitive edge compared to other good companies.

Products and services

Firms in the airline industry specialise in the provision of diverse products and services. However, the major services offered include cabin, cargo, and ground services. The cabin services vary depending on the diverse target customer groups. However, the core cabin services include economy class, business class, and first-class. On the other hand, the cargo service category specialises in carrying diverse cargos.

Emirates Airlines offers cargo services through its Emirates SkyCargo division while Etihad Airways offers the service through the Etihad Cargo division. However, Emirates has attained a relatively high competitive advantage with reference to cargo solutions having been established in 1985 as opposed to Etihad Cargo, which commenced operations in 2004.

Customer characteristics

The industry is mainly characterised by individuals. The customers are categorised into different classes such as economy class, middle class, and luxury class depending on their purchasing power. Generally, the individual customers are increasingly consuming air transport services, hence a high potential for maximising profitability.

Capacity utilisation

The UAE airline industry is characterised by a relatively high rate of capacity utilisation, which might limit the industry players’ ability to exploit the market potential. For example, the industry players are increasingly introducing new technologies in an effort to remain competitive. The high capacity utilisation is evidenced by the ousting of the Heathrow Airport as the busiest airport in the world by Dubai International Airport. Furthermore, the government intends to align operations within the airline industry with the capacity demands of the Air Transport Management (Mediaquest par. 3).

Level of consolidation

The industry is experiencing a relative increment in the degree of consolidation due to the high rate at which companies are adopting the concept of strategic partnership and alliance in order to improve their competitiveness. Most industry players are members of the three major global alliances, which include SkyTeam, Oneworld, and Star Alliance.

UAE Aviation Industry Driving Forces – Liberalization & Globalization

One of the core driving forces that have stimulated growth and development within the UAE aviation industry relates to the liberalisation of air transport. The UAE government has entered a number of open-skies agreements with different countries such as the US, Spain, Eretria, Egypt, Luxembourg, and Singapore. Liberalisation of the country’s airline industry has led to a considerable decline in the price of flight ticket and increase in the number of passengers.

The growth of the UAE’s airline industry has also been stimulated by the high rate of globalisation. Airline companies are increasingly exploiting the opportunities presented by the high rate of economic integration and world trade by adopting new airline models. For example, Etihad Airways and Emirates Airlines have based their business models on the geo-centricity of the Gulf region. The two airlines are focused on exploiting the market opportunity presented by the 4 billion people residing within an 8-hour flying zone (General Civil Aviation Authority par.20).

- Tourism

- The UAE tourism industry has experienced a significant growth over the past four decades. The large numbers of tourists visiting the UAE have led to an increment in the number of airlines that have established their operations in the country. A study conducted by the Dubai Chamber of Commerce shows that the country’s tourism industry would experience an annual growth rate of 6.5% between 2011 and 2021 (Algethami par. 2).

UAE Airlines PEST Analysis

Political factors

The degree of political risk in the UAE is relatively lower as compared to other Middle East countries. The high level of political stability has led to the creation of an enabling environment for business operations within the airline industry. Furthermore, the UAE government is extensively committed to improving the country’s airline industry. The adoption of the open-sky policy by the UAE government has created an opportunity for Emirates Airlines to venture into new markets, hence increasing its profitability.

The open-sky policy has made the UAE the most connected country. Moreover, the government is also focused on improving the country’s airport infrastructure in an effort to cope with the rising demand from air travel. Emirates Airlines is likely to benefit from the governments’ airport expansion plan due to its strong relationship with the UAE government. However, the airline’s international operations might be affected by the existence of a high degree of political risk especially in the Middle East region.

Economic factors

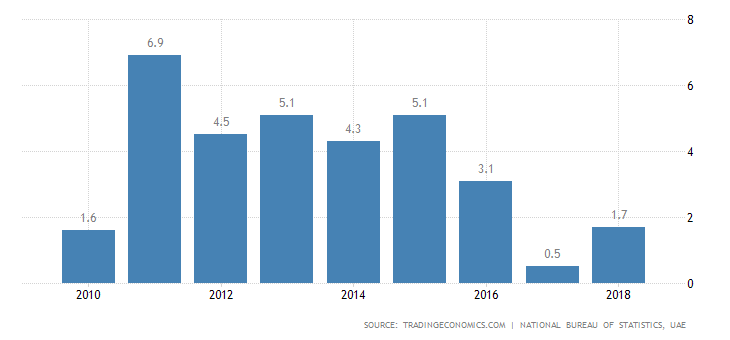

The UAE has experienced a positive economic growth over the past decade. However, the country’s economy was affected by the 2007 economic recession, which led to a decline in the rate of GDP growth from a high of 9.8% in 2007 to a low of -4.8% in 2010 as illustrated in the graph below. However, the adoption of effective economic policies has stimulated the country’s rate of economic growth to 5.2% in 2013. Subsequently, the consumers’ purchasing power is expected to recover in the future. Therefore, Emirates Airlines expects to benefit from the economic growth through an increment in the number of passengers.

Social factors

The continued increase in the consumers’ disposable income over the past decade has led to a general improvement in the population’s living standards. Thus, the consumption of necessities and luxury products has increased significantly. The global aviation industry including the UAE has experienced tremendous social transformation. Currently, consumers increasingly prefer air travel to short and long distances (The Emirates Group Annual Report 6).

Technological factors

The global airline industry is undergoing a high rate of transformation due to increased investments in innovation. Thus, the UAE airline industry will not be shielded from the technological changes currently being experienced in the industry. For example, aircraft manufacturers such as Boeing are investing in research and development continuously in an effort to cope with the market needs and improve the efficiency of their aircrafts. Similarly, Emirates Airlines will be required to update its fleet with new and improved aircrafts in order to remain competitive. In 2013, Emirates Airline ordered 50 Airbus A380 aircrafts and 150 Boeing 777. The aircrafts will be delivered from 2018 and they are expected to replace the existing aircrafts in line with its strategy to modernise its fleet with efficient and wide-body aircrafts (The Emirates Group Annual Report 12).

UAE Airlines SWOT Analysis [Emirates & Etihad]

Emirates Airlines’ SWOT analysis

Etihad Airways’ SWOT analysis

Porter’s Five Forces

The operations of Emirates Airlines are greatly influenced by changes in the macro business environment. The Porters five forces below illustrate the degree of competition within the industry.

Threat of entry

The UAE industry is characterised by a relatively high threat of entry due to its attractiveness to local and international investors. The country’s airports are considered as entry points to other parts of the world such as Asia, Africa, and Europe. However, Emirates Airlines is considered as a national carrier, and thus it enjoys protection by the government through patenting. Additionally, the airline has been in operations for nearly three decades, which has led to the the development of global market recognition. Furthermore, Emirates Airlines has attained a relatively higher brand value as compared to Etihad Airways. Another aspect that has enabled the firm to establish barriers to entry relates to its financial stability.

Buyer power

The bargaining power amongst buyers in the industry is relatively high due to the existence of diverse categories of industry players such as budget airlines, cargo flights, and luxury flights. Consequently, customers are in a position to bargain the price of tickets. Furthermore, the buyers’ bargaining power increases due to the low switching cost within the industry. Consumers can easily shift amongst airlines depending on the competitiveness of the airlines’ schemes and offers.

Despite the high buyer bargaining power, Emirates Airlines has attained an optimal market position by adopting effective strategic management practices. The airline is characterised by a relatively high differential advantage within the airline industry, which has arisen from the integration of excellent services. For example, the airline offers non-stop direct flights in some of its routes. Additionally, the airline has been in a position to cope with the intense competition posed by budget airlines by incorporating unique in-flight services such as in-flight entertainment, comfort, food, and services. Moreover, the firm has integrated the concept of backwards integration by operating its own in-flight catering services.

Supplier power

The industry is characterised by high supplier power because two main suppliers, viz. Boeing and Airbus, dominate it. The two companies [Boeing and Airbus] are the main suppliers of airline carriers in the global market. Consequently, the degree of supplier concentration is relatively high. Furthermore, the cost of switching to another supplier is greatly increased by the existence of long-term contracts between the supplier and the airline companies.

Threat of substitute

The propensity of consumers shifting to another carrier is relatively high due to the existence of numerous industry players. The industry is dominated by diverse categories of carriers such as luxury and budget airlines. The high degree of price sensitivity amongst customers makes it easy for passengers to shift to another airline. Most passengers prefer budget airlines for short distance flights, which affects Emirates Airlines’ competitiveness due to the luxurious in-flight services. This aspect shows that price is one of the key determinants in attaining competitiveness within the industry.

Rivalry

The large numbers of domestic and international carriers operating in the industry have led to a substantial increment in the degree of competitive rivalry. Over 150 airlines operate from and to Dubai. Furthermore, the high rate of industry growth has led to an increment in the number of airlines operating in the UAE. The degree of rivalry is likely to grow in the future due to the high rate of consolidation. Airline companies are increasingly entering strategic alliances in an effort to enhance their market dominance and sustainability. The airline is likely to face intense competition from the three major alliances, viz. Star Alliance, Oneworld, and SkyTeam.

UAE Aviation Industry Attractivenes

The attractiveness of the UAE’s airline industry has increased considerably due to the adoption of effective airline policies such as the open-skies policy. The government’s commitment to improve airport infrastructure such as the construction of new airports and expansion of existing airports across the country will enhance the industry’s attractiveness. Moreover, the UAE is considered as the most connected economies in the world.

Current Position of the UAE Airlines

Most aviation industries around the world were adversely affected by the recent global economic recession. However, the UAE aviation industry has remained resilient due to the continuous investments in modern infrastructure. The country has entered open- skies agreement with over 120 countries, which is the second highest in the world after the US. Thus, the country’s overall connectivity has improved tremendously.

Future Outlook of the Industry

The global airline industry is expected to sustain a growth due to the high demand for air travel (IATA par. 5). The UAE will be in a position to exploit the high market potential due to the adoption of open-skies policy and improvement of the current Air Services Agreements [ASAs]. The industry’s future success will further be improved by the decision by the UAE government to “expand its capacity with regard to aircraft manufacturing and maintenance plants” (United Arab Emirates par. 6). Currently, the UAE government has established Strata, which refers to an advanced aerostructure manufacturing facility situated at Al Ain. Thus, the industry players such as Emirates and Etihad will be in a position to improve their operational efficiency. The industry’s future outlook is bright due to the projected increment in the number of passengers and volume of cargo. Subsequently, there is a high probability of Emirates and Etihad sustaining their success by adopting effective strategies.

Works Cited

Algethami, Sarah. Why the UAE is a leading tourism destination in the region. 2014. Web.

Clark, Nicola. Reaping benefits of expansion, Emirates’ profit rises 43% 2014. Web.

Emirates: Emirates Airline; building a global network 2014. Web.

Etihad Airways: Etihad Cargo overview 2014. Web.

General Civil Aviation Authority: The impact of international air service liberalisation on the United Arab Emirates 2009. Web.

IATA: Airline financial outlook strengthens; $12.9 billion global net profit in 2013. Web.

Mediaquest: GCAA to tackle airspace capacity issues with traffic expected to double by 2030. 2014. Web.

Mouawad, Jad. A growth spurt for Middle Eastern carriers, led by Emirates 2013. Web.

Sambidge, Andy. UAE to have world’s third largest air cargo market 2014. Web.

Sophia, Mary. UAE air passenger numbers to grow 5.6% by 2034-IATA. 2014. Web.

The Emirates Group Annual Report: Going further. 2013. Web.

Trading Economics: UAE GDP growth rate. 2014. Web.

United Arab Emirates: Aviation in UAE 2013. Web.