Introduction

The concept of e-business has evolved with the development of networking and the Internet. The concept is not so much of a deviation from the conventional mode of business transactions, except that the internet is used primarily as the medium for transactions. There are several e-business models that have emerged to characterize e-business transactions as either business-to-customer (b2c), business-to-business (b2b), customer-to-customer (c2c), or person-to-person (p2), and so on. This report examines westlaw.com within the United States online legal research market to show how a company can develop its business-to-business (b2b) relationships. It uses the five porter’s forces to explain the company’s position and compare its ranking on alexa.com (Alexa n.d.). It also highlights various options available for westlaw.com to develop value-added service and improve its market position and give a financial appraisal of the business.

The choice of the company and its competitors

The choice of Westlaw and its competitor was strategic. Westlaw and LexisNexis are companies that both provide online legal research services and are specialized. This makes it easy to compare the performance and various aspects of the two companies and their websites. Since the two companies have a similar model of operation – that is they use the internet as a medium of the transaction – the aspects to be compared are similar. Better still the companies have a similar customer base. These aspects increase the reliability of the results of the comparison of the two business situations. It would be unrealistic to compare companies having different target markets or customer bases, different business models and platform for doing business, and dealing with different products.

The market structure for online legal research services

The market for online legal research services or legal information is large and spans over the entire globe. The users of this information are both individuals and corporate. They are mainly law students, lawyers, legal professionals as well as firms offering legal services. The millions of individuals and firms providing legal services to people over the globe are potential users of legal information. The fact that these legal research services are provided through the Internet means that almost anyone in the world can access them. It is also an advantage that the number of users of these online services is not limited merely by geographical boundaries.

The market structure for online legal research is characterized by oligopoly. The industry is concentrated with only a few large firms controlling more than 40% of the market. There are several companies, both large and smaller, providing online legal research services. Competition in the market has been characterized by companies trying to develop product differentiation since the concentration of the industry’s by only a few large firms has wiped out significant sources of rivalry.

Most of these companies offering online legal research services charge people a certain amount of money to access their services through the internet, while others offer these services at absolutely no charge. The players offering free services are mainly smaller companies that are funded by governments or non-profit-oriented organizations. The companies are small in the sense that their information resources are not as comprehensive as those for the major players. Large companies such as weslaw.com and lexisnexis.com have large databases of informational resources to support their huge user base. On the other hand, the smaller companies have a relatively smaller number of users.

The competitive position of the company

Market share and relative position of B2B services

Westlaw has a 39% share of the global legal information market (Emory Law School 2007). The company commands the largest market share in the online legal research services in both the United States and globally (Svengalis 2007). It provides legal information to approximately 83% of users interested in constitutional law, to 63% of users interested in tax information, and to 63% to the user searching for bankruptcy treatise globally. On the other hand, its greatest rival in the provision of legal research services is LexisNexis, which has a market share of 31% in the global legal information market (Emory Law School 2007). All the other companies have less than 35% share of the legal information market. The online legal research industry is highly concentrated with the three largest companies controlling about 85% of the legal information market (Svengalis 2007).

The control of a large market share is also an indication that Westlaw B2B services have a strong standing in relation to its competitors (Donahue & Nye 2002, p.133). Most of the legal information sought out online by lawyers, law students and other professionals comes from westlaw.com.

Porter’s forces

Competitive rivalry

The online legal research service industry leans towards monopolistic characteristics. It is less competitive with only a few companies serving a very large market share. The high percentage of the legal information sold globally is accounted for by only a few large firms. The 2007 data shows that 85% of the legal information sold is provided by the four largest firms in the world; these are Westlaw (39%), Lexisnexis (31%), Wolters Kluwer (14%), and the Bureau of National Affairs (Emory Law School 2007). The online legal research service industry is somewhat disciplined, and rivalry attempts by the smaller firms has been weak.

There have been various strategies by firms offering online legal research services to gain advantage over Westlaw. LexisNexis, for instance, has been striving to improve its product differentiation through innovations such as enhanced web-based electronic access and electronic filing system (LexisNexis 2008). This innovation has given their clients more control and allows them to reduce cost, paper and time involved in delivery and management of their court Affairs (McKnight 1997). Firms have also been devising their pricing schemes to capture the market. LexisNexis has used monthly flat rates, hourly rates, and per source rate schemes to provide its services to their customer (Bates & Basch 2003, p. 357). Moreover, it has often provided its services at discounted rates to various clients such as law school and other learning institutions.

The proliferation of freely available legal information on the Internet provided by various firms is also a threat to westlaw.com. Some firms, especially those sponsored by governments or by non-profit-oriented organizations, have been providing some legal information to their clients at absolutely no cost. An example of such companies is LexisOne. Various electronic publishers also including Westlaw and LexisNexis have branched out into allowing open but limited access to some of their legal information through subsidiary companies such as LexisOne, Findlaw and casemaker (Boston College 2008; Thomsom Reuters 2007). Furthermore, primary legal information such as caselaw, regulations, and statutes as well as many United States and state government publications are generally available on the Internet and to the public at no cost. In additional, numerous new websites are providing free information that is relevant to legal research or is part of the legal research business products such as historical information, Federal Court of Appeal and District Courts and state courts materials.

Threats of substitute

The threat of substitutes on the online legal research industry comes not from alternatives to the legal information itself, but from the mode of providing this information. People can opt to get legal research services through conventional means, whereby a client visits firms physically to get information. However, the online medium has numerous advantages over the conventional approach such as limitless geographical boundaries, cost advantage, and availability of search engines. The consumers for legal information do not have an alternative industry to switch to if they are not satisfied with the legal information. Therefore, westlaw.com is not so much threatened by this aspect.

Buyer power

In the online legal research industry, buyers do not posses much power to control the providers of the legal information. They lack alternative products to legal information. Moreover, although these buyers are not fragmented, they are many and no single buyer has the power to influence prices (Emory Law School 2007). The businesses have also the power over forward integration and they control the distribution of their products. These factors have weakened the buyers’ bargaining leverage against the legal information providers. Westlaw as a brand has managed to create an impression of a strong brand to the buyers of legal information. Its main competitor, LexisNexis has also developed a strong brand that has worked further to weaken the buyers.

Supplier power

The suppliers in the online legal research industry have some level of control over the businesses offering legal information. Suppliers substantially threaten the forward integration in the industry. For instance, several businesses including the biggest companies, Westlaw and LexisNexis, have been acquired by the corresponding publishers of legal information. The suppliers are also somewhat concentrated and the cost of switching suppliers is high. However, customers are not very powerful and the legal information is rather standardized.

Barrier to entry and exit

The online legal research industry has various barriers that place Westlaw at an advantaged position over companies wishing to enter the business. The business requires huge capital investments to establish the large volume of informational resources required among other requirements. Therefore, the ability to raise huge financial resources is one of the prerequisite of operating an online legal research business. Westlaw has developed its huge database that contains both present and historical information.

Informational and technology patenting is another entry barrier to new firms. For instance, most of the commentary information is copyrighted and any business selling such information has to have publishing rights. The business is also highly dependent on technology, especially the search technology, and some companies have patented their search systems. Westlaw, for instance, has patented its “star pagination” system used to efficiently search information from its database (U.S. Department of Labor n.d.). While new entrants would benefit from such a technology if it was freely available, Westlaw has made it difficult for other firms to access it. Note that search technology is vital in online research services and provides a company with a competitive edge. Westlaw has continued to take advantage of its superior search system over its rivals.

The specificity nature of some assets necessary in the legal research business is also a hindrance to new players into this market. The informational resources required to operate online legal research services are specific to the legal field. There are no much opportunities available outside the legal research industry for such resources. This aspect discourages investors from venturing into the industry, while the already existing firms engage their spirited efforts to protect their market share. Westlaw has continuously engaged in mergers and acquisition (Emory Law School 2007) to guard its market share.

The economy of scale in the online legal research industry also creates barriers to new entrants. New entrants have to get a minimum share of the market to become competitive. In this industry, a few large firms have dominantly controlled a large market share, and the large difference between the minimum efficient scale (MES) and unit costs of entry have further made it difficult for businesses to enter this market. Small and start-up companies are deterred from entering the online research business.

The increasing administrative decisions and regulations towards commercial provision of legal information is also a barrier to new entrants. While Westlaw and other existing companies have the advantage of having complied with the existing regulatory requirements, new entrant would have to invest both time and money in meeting these requirements.

Competitive analysis

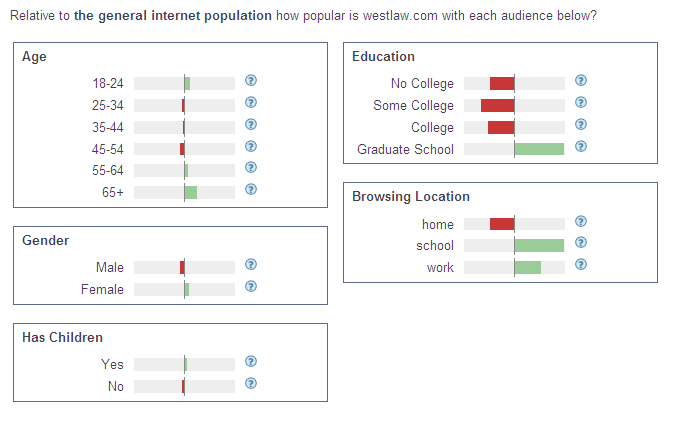

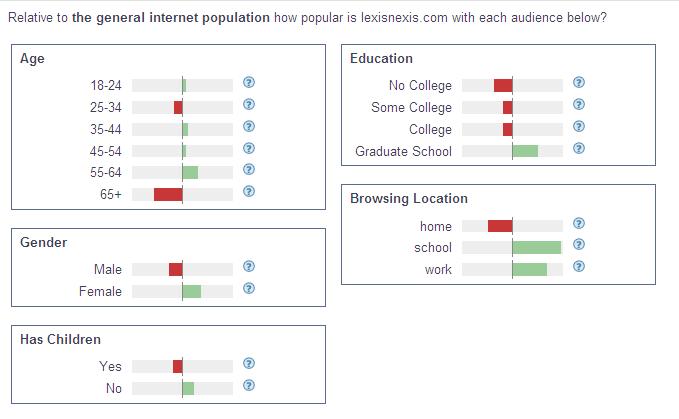

According to Alexa statistics, westlaw.com ranks well on the Internet. It is ranked as the 12,320th most visited website on the Internet globally, and 3,732 most visited website in the United States (Alexa n.d). This is poor in relation to its main competitor, LexisNexis.com, which ranks at 10,566th position globally on alexa.com. However, westlaw.com ranks far much better in the United States compared to its main competitor. The charts below show the performance of Westlaw against its rival LexisNexis.

- Green colour – towards over-representation

- Red colour – towards under-representation

- Green colour – towards over-representation

- Red colour – towards under-representation

Options to develop value added services and potential to apply more recent techniques

The development of the Internet technology provides westlaw.com and other online legal research companies opportunities to develop various value added services. The options available are mainly in the emerging technologies and concepts such as the web 2.0 technology, social networks platforms, online payment systems, and web services.

The company can make use of web services or other applications to add value to its main products offerings. To start with, Westlaw has already developed various web services that assist its clients in legal research. These web services and applications include Find and Print, Brief-it, WestCheck, WestCiteLink, and KeyCite Alert. Find and Print facilitates printing of the researched information through the Internet, while Brief-it makes a summary of the information being researched to guide the user into retrieving relevant information quickly. WestCheck and WestCiteLink are useful in retrieving information from the company’s database by linking citation from a word processing file to the database, while KeyCite Alert allows real-time tracking of administrative materials, statutes and cases. These services are unique to westlaw.com, but other firms offering online legal research services can emulate these innovations to enhance their products offerings.

On the other hand, westlaw.com has more options to develop value added services. Since its clients are mainly interested in information, the company could develop applications to provide its clients with news clippings of relevant information in various credible newspapers, magazines, journals, and other source of news. The company can make use of the web service technologies to create an interface that would facilitate the processing of payments for its purchased products by its clients through its website. Since many of its customers purchase the company’s products through subscriptions, this web service would be useful in alerting the customers about the expiry of their subscriptions, and how best to manage their subscriptions. The company has also the option and potential to make use of the web 2.0 technology.

Westlaw.com can use the Web 2.0 technology to enhance its search function and retrieval of data in its database. With the Web 2.0 technology, it is possible to create web applications that allow interactive sharing of information, collaboration, interoperability, and user-friendliness on the World Wide Web (Solomon & Schrum 2007, p. 2). The Web 2.0 can therefore greatly enhance the search service of websites providing online legal research services. Westlaw.com, for instance, could exploit this technology to allow name suggestion of data stored in its database to facilitate the search of legal information. The service can also be utilized to offer clients online support through chats and instant messaging. This technology also supports the several social networks that have spawned on the Internet.

Westlaw can also utilize social networks to enhance its product offerings. Social networks have been gaining popularity as indicated on the recent Internet trends, and companies providing legal research services can utilize these platforms to promote their products. Facebook.com, for instance, allows other websites to link to it as well as to create a special page of information about their offerings. Developers can also create independent applications to run on top of Facebook.com platform. Westlaw.com can utilize these opportunities to promote itself and its products. Other social platforms that westlaw.com and other online legal research companies can utilize for promotional purposes include Twitter.com, Digg.com, Myspace.com, friendster.com, orkut.com, and linkedin.com, among others. These platforms can also be utilized in authenticating westlaw.com users into their websites. Forgetting usernames and passwords is a common phenomenon in online authentication and allowing users to utilize information that they regularly use in their social activities would be helpful. However, choice of using the social platforms must be dependent on the level of security guaranteed by these platforms.

Options for the company to improve its market position

Westlaw.com has several options to improve its market position further. The company can use various strategies such as advertising, globalization, partnership and symbiotic relationships, acquisition and mergers, and creation of new market segments to improve its business. There are various forms of advertising available to westlaw.com. These include search engine optimization (SEO), contextual ads, e-mail marketing, affiliate marketing, and social media advertising. SEO allows indexing of websites by the search engines such that they are displayed on search results depending on their popularity and relevance of its information to the keywords searched. Contextual advertising involves display of textual or graphical ads that relate to keywords searched on the Internet or the information of the web page on which the advertisement is displayed. Banners are an example of graphical contextual advertising. Keyword hyperlinks can also be used to direct an audience to the sponsoring advertiser’s website. Elsewhere, e-mail advertising should be legitimate to differentiate it from spam e-mails. Affiliate marketing could allow Westlaw to place advertisements with other online publishers, whom it would pay upon generation of traffic as measured by a sale, a form, or a sign up. This could be achieved by contracting an affiliate company. Social media advertising involves placing ads on social network websites.

These online advertising options offer various benefits. One is the instantaneous publishing of content and information that becomes available without limitation by time or geographical boundaries. The other benefit is that it guarantees the efficiency of the investment; that is, it is possible to customize advertisements, and the payment is often relative to the response of the audience. It is also worth to note that online advertising is less expensive than conventional advertising (Brown 2006).

Weslaw.com can also utilize the opportunities presented by globalization to improve its market position. The company can expand its scope of operation so that it offers similar services to other countries. It could also provide online legal research services to countries in Asia, Europe, and Africa, although that would mean publishing more information that is specific to each administrative boundary.

Westlaw has also the option of creating new market segments to improve its market position. The company could diversify its services and include in its database information that is useful to other professionals in accounting, risk management, government, academic, and corporate market. The company could opt to offer these extended services under a different brand name that relate to the particular services. This is because the branding westlaw.com may not reflect the additional offerings by the company. Nonetheless, the new brands should be linked to the original brand to take advantage of the credibility associated with the company.

The company could also strengthen its symbiotic relationships and partnerships strategically. The company, for instance, could partner with governments and other non-profit oriented organizations to provide some of its services to a targeted market at discounted rates. While the role of Westlaw would be to provide legal information, the governments or the organizations would participate as sponsors. The firm could also partner with other companies to capture some new market segments such that the partner firms provides specific services while it benefits from the reputation of Westlaw. Westlaw could also seek alliances with organizations that differ to its values, perceptions, mission, and evolution, but have a significant effect on a strategic market (Lee 2008, p.176). Strategic symbiotic relationships can provide huge benefits to an organization including strengthening its market position (Weiss 1998, p.10; Lee 2008, p.176).

Acquisition and mergers is also another option available to westlaw.com to enhance its market positioning. Westlaw could also strategically acquire smaller companies that offer unique services related to its products. For instance, the company target companies offering online research services to different market segments that it has not yet captured. Such market segments could include those in need of accounting information, corporate information, academic information, and so on. The company could also seek mergers with its main rivals such as LexisNexis to expand its market share. While mergers are not always successful (Cowen & Moorhead 2006, p.316), they often result in an increased market share (Bruner 2004, P.26; Bakker & Helmink 2000, p.127). It is likely that the credibility of the two major companies in legal information market would provide a ground for positive results. Furthermore, given the fact that Westlaw has a very large share in the legal information market, acquisitions and mergers would drive it towards being a monopoly.

Financial appraisal

The potential for businesses to generate acceptable returns from investment in the online legal research industry is guaranteed. There is huge demand and market for legal information that business can tap into to generate more revenues. The legal information publishing is the largest sector in professional publishing with total global annual revenue of more than $9.93 billion. Westlaw.com and lexisnexis.com, as examples, further provide proof of the potential for business in this industry to generate substantial returns. These companies have been experiencing growth both in size and returns since their establishment. Westlaw and LexisNexis, for instance, had both revenue growths of 8% in 2007, while Wolters Kluwer whose 50% of its revenue comes from its online products had profit margin of 18 % in 2007 (Emory Law School 2007).

The two major providers of legal research services have been getting substantial returns. The estimated revenue for Westlaw was $3.3 billion in 2007, while that of LexisNexis was $2.4 billion in the same year. Furthermore, in the same year, Wolters Kluwer income was $823 million. While these statistics are indications of the market share that these companies command, they also highlight the profitability of online legal research business.

The utilization of the Internet as a medium for transaction by Westlaw affords it some cost-cuttings that serve to raise the companies’ profit margins. By using the Internet, the company eliminates some processes involved in conventional legal research businesses (Li 2007, p. 114). The distribution of legal information published conventionally is more costly than it is to distribute online legal information. Organisation for Economic Co-operation and Development (2001, p.183) has revealed that utilizing the Internet in publishing can reduce the cost incurred in conventional publishing by about 20%.

Conclusion and recommendations

This report has taken westlaw.com as an example of a business-to-business (b2b) e-business model, and examined its operation and performance in relation to the industry and its competitor, LexisNexis. These choices were strategic in that both companies have similar customer base and offer similar products. The industry is characterised by an oligopolistic market structure with a market that spans over the globe. Westlaw has a large market share, and together with LexisNexis, controls almost 85% of the market. There is less competitive rivalry in this industry to threaten Westlaw’s position, as there are less threat of substitute, and weak supplier power. There are also several barriers to new entrant that makes Westlaw unworried of competition. Moreover, there several options available for Westlaw to develop value added service and for the company to increase its market position. This business is worth and can give substantial returns to the investment.

Reference List

Alexa, n.d. Westlaw.com. [online]. Web.

Alexa, n.d. LexisNexis. [online]. Web.

Alexa, n.d. Westlaw. [online]. Web.

Bakker, H.J.C. & Helmink, J.W.A., 2000. Successfully integrating two businesses. Gower Publishing, Ltd., United Kingdom.

Bates, M.E. & Basch, R., 2003. Building & running a successful research business: a guide for the independent information professional. Information Today, Inc., New York.

Boston College, 2008. Newsletter spring/summer. [online]. Web.

Brown, B.C., 2006. How to use the Internet to advertise, promote and market your business or Web site with little or no money. Atlantic Publishing Company, United States.

Bruner, R.F., 2004. Applied mergers and acquisitions. John Wiley and Sons, Australia.

Cowen, S.C. & Moorhead, S., 2006. Current issues in nursing. Elsevier Health Sciences, Australia.

Donahue, J.D. & Nye, J.S., 2002. Market-based governance: supply side, demand side, upside, and downside. Brookings Institution Press, United States.

Emory Law School, 2007. Mergers and acquisitions, [online]. Web.

Emory Law School, 2007. Price Increases. [online]. Web.

Lee, I., 2008. Emergent Strategies for e-business processes, services and implications: advancing corporate frameworks. Idea Group Inc, New York.

LexisNexis, 2008. LexisNexis® File & Serve Passes Milestone of “E-Filing” Equivalent of 1 Billion Pieces of Paper. [online]. Web.

Li, F., 2007. What is e-business? how the internet transforms organisations. Wiley-Blackwell, Australia.

McKnight, J., 1997. Wexis versus the net, Illinois Bar Journal. Vol. 85, No. 4, Pp. 189-190.

Organisation for Economic Co-operation and Development, 2001. Enhancing SME competitiveness: the OECD Bologna Ministerial Conference. OECD Publishing, United Kingdom.

Solomon, G. & Schrum, L., 2007. Web 2.0: new tools, new schools. International Social Technology Education, New York.

Svengalis, K.F., 2007. Legal information: globalization, conglomerate and competition – monopoly or free market. Rhode Island LawPress, Rhode Island.

Thomsom Reuters, 2007. Westlaw services. [Online]. Web.

U.S. Department of Labor, n.d. Star Pagination. [Online]. Web.

Weiss, L.M., 1998. Structuring the field for business-nonprofit collaboration that produces symbiotic and community benefits. Harvard Business School, Harvard.