Executive summary

The report entails an analysis of Zara (Inditex) case study. The firm has been in operation for a number of years in the apparel industry and has managed to attain an optimal market position. Its success has emanated from adoption of an effective business model and incorporation of effective operational strategies. The report centres on a number of issues amongst them an analysis of the business environment by analysing the macro and the micro business environment. The objective of the report is to develop a comprehensive understanding of the internal and external environment within which Zara operates. Consequently, the firm’s management team will be able to implement the best strategies in order to enhance the firm’s probability of succeeding into the future. The report is organised into a number of sections. The first part outlines the purpose of the study. An analysis of the competitive environment and the strategic issues that the firm is facing is outlined in the second part.

A number of models, which include the PEST, Porters five forces and the ILC, are used in evaluating the industry within which Zara operates. The second part entails a comprehensive internal audit of Zara (Inditex). The audit is undertaken by evaluating the firm’s financial and resource capabilities. A number of financial ratios are used to illustrate the firm’s financial strength. The ratios considered include financial strength ratios, profitability ratios, efficiency ratios, and management efficiency ratios. Other components that are taken into account in the audit entails evaluation of the value chain linkages within the firm, the leadership style adopted, power and politics within the firm and the decision making process

An analysis of the public relations crisis and the stakeholder issues faced by Zara and their impact on its corporate reputation and brand equity are evaluated in the third section. Some of the elements taken into account include organisational ethics theory, corporate social responsibility and stakeholder applications, and reputation management concepts. Finally, a summary of the strategic options available to the firm is conducted. The summary is conducted by incorporating the STAIR model, which evaluates the suitability, acceptability, and feasibility of the strategic option selected. Additionally, a number of recommendations that the firm should take into account in its quest to develop competitive advantage in the global apparel industry are outlined. From the analysis conducted, there is high probability of Zara succeeding by incorporating the strategic options suggested. These options include product development, market diversification, and market consolidation. This will improve the probability of the firm succeeding into the long term.

Introduction

Over the years it has been in operation, Zara-Inditex has managed to establish a unique market niche for its fashion brand. In a bid to continue with its growth in 2013, Zara will be required to be cognisant of the prevailing business environment. This report analyzes the prevailing competitive forces and the strategic issues that the firm will face during its 2013 financial year. An internal strategic audit of the firm is conducted using the appropriate organisational and strategic models. The report also identifies the external stakeholder issues that Zara face. A comprehensive analysis of the identified issues on the firm’s corporate reputation and brand equity is conducted. Finally, a summary of the strategic options that Zara should consider are identified and evaluated. Recommendations that the firm should consider in order to sustain its future position in the industry are outlined.

Analysis of competitive forces and strategic issues

PEST analysis

Businesses are affected by changes in the external business environment either directly or indirectly. Consequently, it is vital for organisational managers to ensure that they develop a comprehensive understanding of the industry within which they operate. This goal can be attained by incorporating various models such as the PEST model. The PEST model evaluates a business’ political, economic, social, and technological environment. Firms cannot shield themselves from changes in the external business environment. The following PEST analysis illustrates the political, economic, social, and technological factors affecting the global fashion industry.

Political factors affect business operations both directly and indirectly, which emanates from the fact that governments make legislations and policies that impact business operations in various ways. Firms in the global apparel industry are affected by import and export legislations that are instituted by their respective governments. Examples of such legislations relate to trade restrictions and taxation policies. These legislations and policies may affect the competitiveness of firms in the apparel industry. For example, most firms in the apparel industry rely on importing the necessary raw materials. Institution of such policies may adversely affect the firm’s ability to produce more optimally.

The prevailing political stability around the globe will also affect firms in the fashion industry in their quest to expand into the international market. Despite some countries having high market potential, they are associated with high political risk, which is a threat to firms’ success. Consequently, the political environment will affect firms’ such as Zara in their internationalization efforts.

Moreover, the high rate of climate change being experienced today has motivated governments to institute regulations that are aimed at protecting the environment. An example of such legislation relate to carbon foot-printing policy, which is aimed at minimizing emission of carbon dioxide.

The UK is ranked as one of the developed economies in the European region. Consequently, consumers have a relatively high level of income. However, the prevailing global economic environment is likely to affect the firm’s competitiveness during its 2013 financial year. One of the factors that will affect the apparel industry relates to the recent global economic recession. The global economic environment is characterised by a high level of uncertainty, which has led to a decline in the level of consumer confidence. A study conducted by the Organisation for Economic Cooperation and Development in 2012 revealed that consumer confidence remains low despite the positive signs of countries attaining full economic recovery (Organisation for Economic Cooperation and Development 2012). The apparel industry in the Euro Zone is likely to experience the adverse effects of the Euro Zone debt crisis that is currently being experienced.

Many consumers in the region are considering adjusting their consumption patterns due to high uncertainty regarding the recession. Various governments are instituting policies to deal with the crisis. However, the level of consumer confidence remains low at -23.9 in January 2013 (Spier 2013). Consumers are shifting from consumption of luxuries to necessities. If the situation does not change, there is likelihood that Zara will experience a decline in its sales revenue. In the course of its operation, Zara has adopted a low pricing strategy. This has played a significant role in the firm’s effort to attract consumers. Most consumers within the European Union can afford Zara’s products. As a result, the firm has managed to develop a positive public image within the society. Despite the economic changes being experienced in the EU zone, there is likelihood that Zara will achieve growth in 2013. This arises from the fact that consumers are increasingly appreciating fashion products.

The apparel industry is not technology intensive but labour intensive. However, the industry has experienced an increment in the number of innovative technologies being incorporated. Some of the technologies that have been incorporated relate to development of software (Computer-Aided-Design) that aid in designing and patternmaking. Other technologies that will revolutionize the industry relate to computerization of sewing machines, which is likely to improve the level of productivity. To survive in this industry, Zara has to ensure that it develops competitive advantage by investing in technology in emerging fashion technologies. For example, the firm should ensure that its procurement and other supply chain activities are fully automated. In order to improve its competitiveness with regard to supply chain Zara should take advantage of information technology developments such as online and social networks in its marketing processes (Dasgupta 2013). The firm should also consider improving its production technology by using computer-aided designs and bar coding.

Porter’s five forces

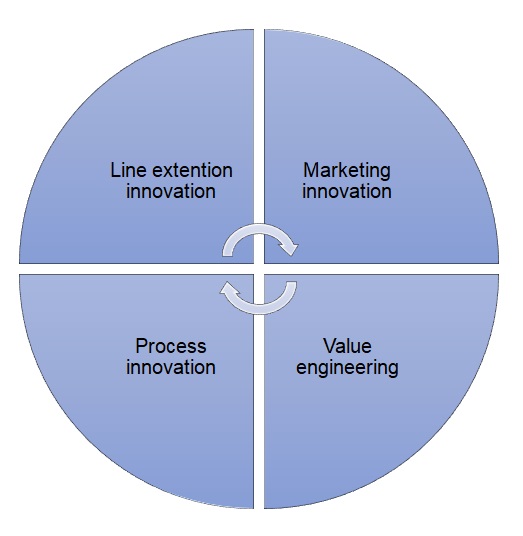

The bargaining power of buyers determines the effect that customers have on a firm’s profitability (Hill & Jones 2010). From 2012, buyer bargaining power in the global apparel industry has remained moderate. In the course of its operation, Zara will be required to deal with possible increment in buyer bargaining power as both domestic and international competition grows (Morrison 2006). In order to survive in an industry that is characterised by intense competition, firms in the apparel industry should consider product line extension, process innovation, value engineering, and marketing innovation as illustrated by appendix 5. Additionally, it is essential for firms to be concerned on how to develop unique and differentiated products in order to develop customer loyalty (Rickman & Robert 2007).

An irregular supply of raw materials is one of the major challenges facing cloth manufacturers in the 21st century (The Manufacturing Institute 2009). The supplier bargaining power in the clothing industry ranges from moderate to high. This presents a major challenge to fashion apparel firms in the course of their operation. This arises from the fact that the firm will experience a reduction in their competitive position.

The industry is characterised by a relatively low supplier bargaining power. This has arisen from the fact that there are a large number of suppliers compared to clients. Despite this, Zara has managed to differentiate itself by outsourcing a significant proportion of its raw materials (40%) in-house thus limiting its dependence on external suppliers.

The fashion market in Europe has continued to be dominated by the major companies, which include Zara, H&M, GAP, and other large departmental stores (Brooks, Weatherston & Wilkinson 2004). This has left a small proportion of the industry’s revenue to new entrants hence reducing the threat of entry significantly. The threat of new entry in the industry is medium. New entrants will be required to develop a robust infrastructure, operational superiority and enhance their strategic market knowledge, which is an enormous task (Salvatore 2006).

Due to the large number of industry players in the global market, the fashion industry is characterised by a high threat of substitute. However, Zara has effectively dealt with the threat of substitute by ensuring that its product are uniquely differentiated, trendy, difficult to imitate and of low-cost fashion.

The competitiveness of the industry is emanating from both domestic and foreign industry players. Some of the firm’s major competitors include GAP, Hennes & Mauritz, Arcadia Group’s Topshop, JTX, Fast Retailing, and Benetton (Cartner-Morley 2013). The large number of industry players has contributed to an increment in the degree of industry concentration (Hitt, Ireland & Hoskisson 2009). In an effort to deal with the competitive rivalry, Zara has instituted an effective business model, which has led to the development of sufficient competitive advantage hence enabling its ability in fulfilling its target market needs (Marchand 2000).

Industry life cycle theory

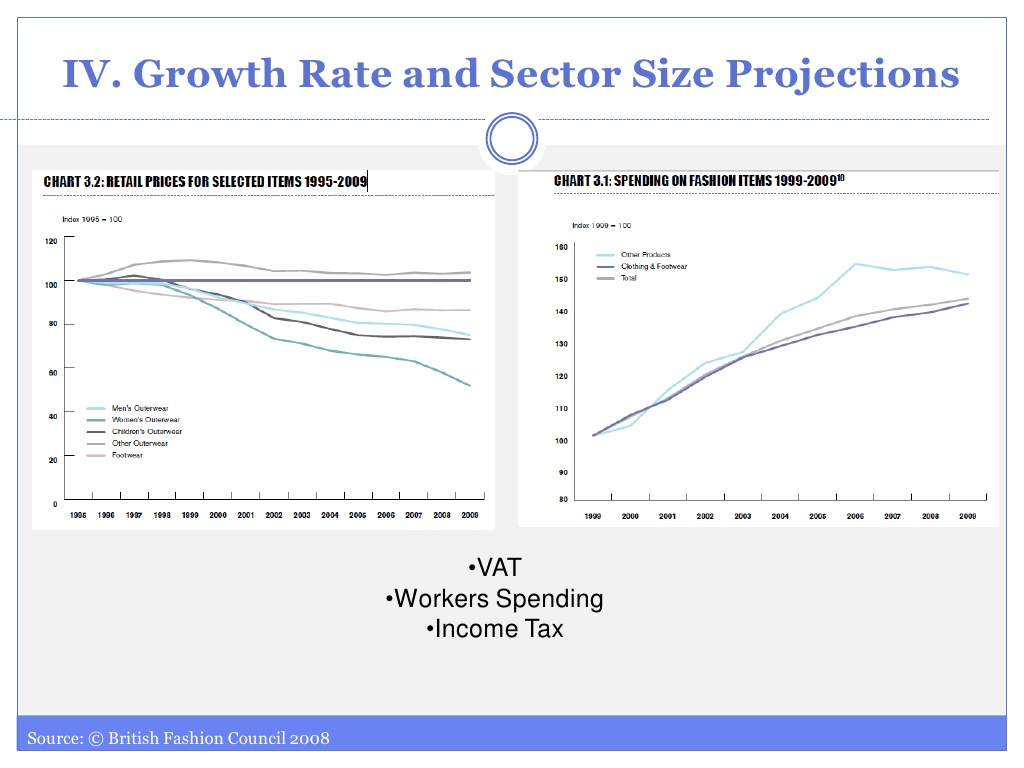

The theory postulates that a number of industry variables such as degree of concentration, number of industry players, level of innovation, price, and performance as the industry ages characterise a particular industry (Cusumano, Kahl & Suarez 2006). With regard to the number of firms, the industry is increasingly continuing to experience an increment in the number of industry players. Due to its fast growth, competition in the industry is well established (Yoo 2000). Consumers’ total spending on fashion items has increased at an average rate of 3.3% annually from 1999 as illustrated by appendix 1 (British Fashion Council 2011).

The three main competitors who include Benetton, The GAP, and H&M have continued to operate on a narrower vertical scope (Campbell & Craig 2005). Additionally, most of the firms have heavily invested in the production processes in order to attain competitiveness.

Conclusion

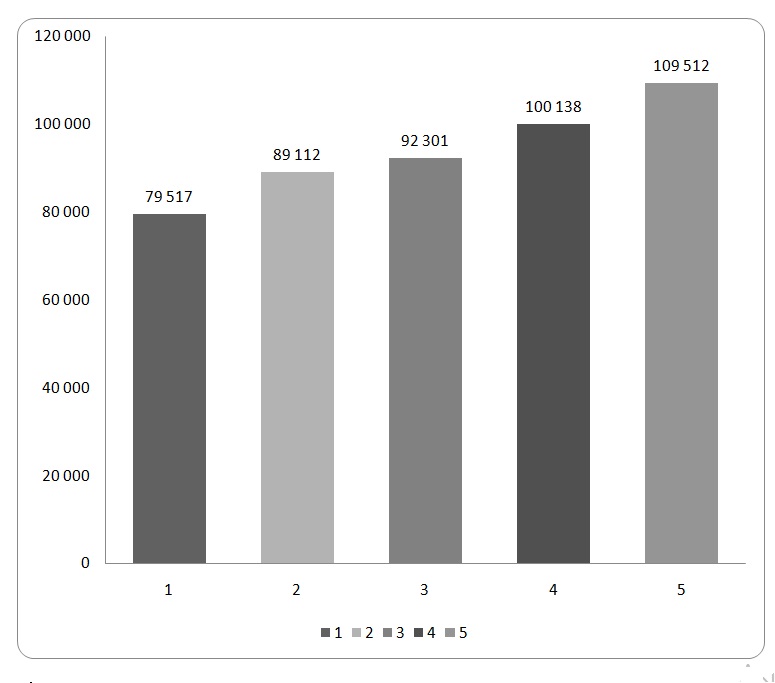

To deal with the high rate of industry concentration, the firm has been committed towards attaining a high competitive edge by expanding into the international market. This has significantly improved the firm’s performance over the past two years as illustrated by appendix 4.

The analysis conducted shows that global fashion industry is dynamic in nature. Consequently, firms in this industry have to incorporate effective operational strategies in order to succeed. To deal with the constant changes occurring in the industry, it is fundamental for firms in the industry to scan the environment continuously in order to determine the most effective way of dealing with industry changes.

Internal Strategic audit of the issues facing Zara

Financial analysis and resources

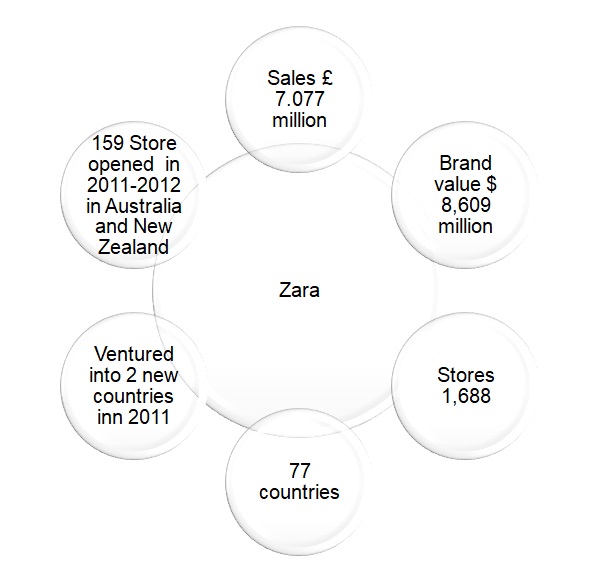

Most businesses were affected by the 2007/2008 financial crisis (Johnson, Scholes & Whittington 2008). Despite this, Zara has attained a high level of operating efficiency compared to its major competitors such as Maximo Dutti, Pull & Bear, and Bershka. During its 2012 financial year, Zara managed to accumulate a considerable amount of profit, which amounted to 1.8 billion Euros. This represents an increment with a margin of 11% compared to its previous financial year. In 2011, the firm established more than 200 new stores across different parts of the world. Europe has continued to be one of the priority regions for Zara. Seventy percent (70%) of the firm’s total sales is generated from the European region (Inditex 2011).

During the first 9 months of 2012, Zara’s net sales increased by a margin of 17% to settle at 11,362 million Euros compared with the net sales in 2011, which amounted to 9,709 million Euros (Gallaugher 2008). On the other hand, the firm’s gross profit margin increased to 6,865 million Euros from 5,784 million Euros, which represents a 19% growth. During the same year, Zara’s Earnings before Interest, Tax, and Depreciation increased by a margin of 25%.

Source: (Inditex 2012).

Appendix 6 illustrates Zara’s financial performance from 2008 to 2010. From the chart, it is evident that Zara’s financial performance in 2011 is relatively lower as compared to its 2010 performance. One of the factors that explain the decline is the current Euro Zone crisis that has made consumers to shift to consumption of necessities. However, the chart above shows Zara’s success despite the challenging economic environment such as the 2007-2008 global economic recessions and the sovereign debt crisis. Therefore, the likelihood of Zara succeeding in the European market is high.

Over the past one year, Zara has portrayed optimal financial performance as in the UK apparel industry. For example, during its 2012 financial year, Zara’s price to earnings ratio averaged 28.4 times which is relatively high as compared to industry averages. On the other hand, the firms’ price to sales ratio was 4.2 times. Improvement in the price to sales ratio emanated from adoption of an optimal business model. Additionally, the firm’s price to cash flow ratio amounted to 3.9 times, which depicts the firm’s effectiveness in generating cash flow (Prezi 2012).

During its 2012 financial year, Zara’s sales grew with a margin of 16% while earnings before interest and tax increased by 24%. On the other hand, net income growth with 22% while return on capital employed was 39%. The firm’s management team increased the dividend proposal to 22% (Inditex 2012). The chart below illustrates the firm’s financial strength in comparison with H&M, which is one of Zara’s key competitors.

From the above chart, it is evident that Zara will be required to improve its competitiveness in order to develop its financial strength. The chart shows that Zara’s financial strength is relatively low as compared to that of H&M. The total debt to equity ratio of Zara compared to that of H&M shows that Zara has not been effective in utilizing its equity finance. The firm will be required to improve its management efficiency in order to guarantee the investors their desired level of return on their investment. On the other hand, the firm’s profitability ratios show that Zara has a relatively lower financial strength the compared to Zara.

Detailed analysis of the firm shows that the Value chain Linkages

Value chain analysis entails an evaluation of the diverse activities undertaken by firms’ in an effort to nurture a high level of customer satisfaction (Ariyawardana & Collins 2013). Effective incorporation of a value chain contributes towards the firm’s developing high competitive advantage (Blythe, Coxhead, Lashwood, Partridge, Reed & Simms 2009). Zara has appreciated the importance of value creation in the firm’s effort to deliver high quality products to customers in addition to supporting the company’s products. Consequently, the firm has incorporated a comprehensive value chain model that is constituted of primary and support activities (Sekhar 2009). The firm has ensured that its primary and support activities are effectively linked as illustrated by the chart below.

Leadership style

Firms in the industry are experiencing an increasing uncertainty with regard to market demand (Worthington & Britton 2006). Consequently, the firm’s management team has to ensure that it has the capability to respond to rapid changes in consumers purchasing behaviour and patterns (Badia 2009). In a bid to be responsive to changes in the external market, Zara has integrated transformational leadership style. Haberberg and Rieple (2006) assert that a strong workforce contributes towards the firm’s employees undertaking their tasks in a superlative manner. Additionally, transformational leadership significantly contributes towards improvement in workers’ engagement hence improving the firm’s productivity (Raynor & Bower 2001).

Power and politics

Zara has ensured an optimal balance of power and politics within the organisation. The firm has been focusing at ensuring effective interaction between stakeholders within and without. Integration of effective communication is one of the strategies that the firm has incorporated to ensure that power and politics are balanced. Effective communication amongst the firm’s employees does not only aid in the firm in its production processes, but also in ensuring effective problem solving. The aspect of power and politics within the firm is also evidenced by the firm’s effort in implementing socio-technical systems (Fairholm 2009). For example, the firm has instituted an environmental policy whose objective is to ensure that its operations do not lead to environmental pollution.

Decision making

Zara’s management team ensures total control of its supply chain, which has significantly contributed towards the attainment of higher degree of operational effectiveness (Badia 2009). Therefore, to ensure effective control of its activities, Zara’s management team is involved in the entire production and marketing processes (Badia 2009). The firm’s decision-making process is not dependent on a small group of decision makers. However, the decision making process incorporates the opinion and intelligence of employees. In a bid to improve the effectiveness and efficiency of the decision making process, Zara has adopted a flat organisation structure (Wallace, Kench & Mihm 2012). This has served in eliminating bureaucratic culture that tends to discourage the employees’ opinions. In the quest to enrich their decision-making effectiveness, Zara has provided store product managers with the discretion to travel extensively in a bid to gather relevant market information for the design team to utilise in their product development process and align the firm with the fast changing customer tastes and preferences (Luthans & Doh 2012).

Conclusion

From the analysis conducted, it is evident that Zara has been very effective in developing its internal strengths as evidenced by the effectiveness with which it has developed its financial stability. The firm’s financial stability enables the firm to be effective in investing in research and development and in its marketing process. Consequently, the firm is able to improve its competitive advantage. The firm has adopted effective leadership and decision-making process in addition to ensuring that power and politics in the organisation do not derail the firm’s operations.

PR Crises

Organisational ethics theory

The firm has been ineffective in implementing organisational ethics theory as evidenced by its ineffective treatment of the internal and external stakeholders. Firstly, most of the firm’s stores across the world are characterised by poor working environment. Additionally, the firm does not ensure equitable employee remuneration, which amounts to exploitation (Belu & Manescu 2013). The firm’s failure to adhere to ethical standards is evident in most stores especially in high-profile organisations (Trevino & Brown 2004). Most authors are of the opinion that the increment in cases of unethical behaviour in the firm has been motivated by organisational leaders’ failure in managing ethical and unethical practices in their organisations (Kurtz, Mackenzie & Snow 2009).

In 2012, a number of campaigns were undertaken by activists to protest against the poor working environment in the firm’s stores in Cambodia (Ethical Consumer 2012). Activists have been committed towards ensuring that the firm improved the working environment in all its stores. It is estimated that over 2,400 employees in Zara stores fainted due to overwork and poor diet. With regard to employee remuneration, Zara is on the spot for failure to adjust its employees’ minimum wage despite the difficult economic environment in Cambodia. Some activists are of the opinion that most fashion firms such as Zara are hiding behind the claim of companies’ code of conduct and the prevailing economic crisis while they continue to oppress their workforce (Ethical Consumer 2012). In addition to the poor working environment, there are reports that Zara is not following ethical standards in procuring its supplies from Morocco, which the firm has cited as one of the most optimal source of its supplies due to its proximity to Spain (Reuters 2007).

In its Brazilian market, Zara was accused of propagating slave labour by purchasing apparels from AHA that were made by Peruvian and Bolivian immigrants who were working under illegal conditions (Gholson & Schloegel 2006). In this case, the Brazilian Labour Ministry rescued over 15 employees. The employees were extensively exploited by earning only $1 for every dress sewn while the retail price for such a dress in Zara’s Brazilian stores was as high as $70 (Moore 2013).

Corporate Social responsibility

In the course of its operation, Zara has instituted a comprehensive Corporate Social Responsibility and environmental protection policy that aims at nurturing a strong collaboration between the firm and the society within which it operates (Kazmi 2008). Chandrasekar (2011) asserts that the workplace environment affects the employees’ productivity, engagement, and morale both negatively and positively. Reuer (2004) further opines that most industries are characterised by unsafe and unhealthy working environments as evidenced by excessive noises, poorly designed workplace, lack or insufficient safety measures in the event of emergencies, and lack of ventilation amongst others. Working in such an environment affects the employees’ performance and productivity negatively (Fombrun, Tichy & Devanna1999).

Stakeholder application

In the course of its operation, Zara is charged with the responsibility of ensuring that it addresses the needs of the various stakeholders. According to Fombrun, Tichy, and Devanna (1999), taking into consideration the needs of customers is vital in firms’ quest to develop sufficient competitiveness. The competitiveness arises from the fact that the firm will gain sufficient market acceptance. Some of the firm’s stakeholders include the employees, customers, suppliers, the government and other regulatory agencies. The firm will be required to evaluate the needs of each stakeholder in order to incorporate strategies on how to address their needs effectively. For example, Zara should evaluate the employees’ needs in order to develop strategies that will contribute towards development of a high level of job satisfaction.

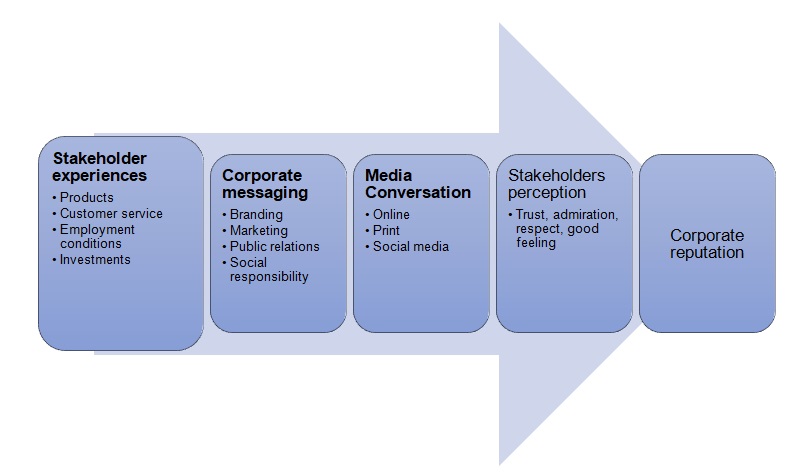

Reputation management and concepts/ metrics

According to Yilmaz and Kucuk (2010), a firm’s corporate reputation is fundamental to its overall performance. Consequently, corporate reputation is one of the most important intangible organisational assets in a business environment that is intensely competitive. Corporate image affects the firm’s brand image and hence its brand equity.

From the analysis conducted, Zara’s corporate reputation and brand equity will continue to be affected if it does not respond to the unethical practices being propagated in some of its stores. Despite the growth in fashion trends, consumers in the western economies and Europe are increasingly becoming concerned of the conditions within which the fashion products were manufactured (Reuters 2007). Taking into account the transformation in consumer purchasing behaviour, the poor working environment in the firm’s stores will negatively affect the firm’s brand equity (Lorange & Contractor 2002).

In a bid to ensure that its corporate reputation and brand equity is not adversely affected, Zara should develop its corporate reputation by investing in Corporate Social Responsibility. This move will enhance the firm’s ability to respond to its internal and external stakeholder needs. Creating a good working environment and faire remuneration are some of the aspects the firm should consider (Mouncey 2007).

Conclusion

The analysis shows that Zara has not been effective in implementing organizational ethics theory as evidenced by the numerous public relations crisis associated with the firm. In some of its stores, Zara propagates unethical conduct by exploiting its work. The firm does not adhere to various labor laws such as employee remuneration. Despite formulating a comprehensive corporate social responsibility policy, Zara does not adhere to the policy. In order to develop a high competitive advantage, the firm will be required to ensure that it addresses the needs of various stakeholders. Moreover, it is fundamental for the firm to respond to the various ethical issues that it is facing in order to improve its corporate reputation. This aspect will contribute towards improvement in the firm’s public image, which is a necessity for its long-term survival.

Summarisation of strategic options

STAIR analysis

Suitability

The PEST and Porters’ five forces analysis conducted shows that Zara is operating in an environment that is characterized by numerous environmental drivers. To survive in such an environment, it is fundamental for Zara to incorporate strategies that will sufficiently address the macro environmental changes. The strategies that adopted by the firm must address industry cycles, major environmental changes and industry convergence.

The competitive nature of the industry requires the firm to incorporate strategies that will minimize the prevailing competitive intensity. Additionally, the firm should also consider incorporating strategies that will bar new entrants. The firm should also focus on improving its weaknesses and developing its capabilities.

Acceptability

The variable is concerned with evaluating the expected performance outcome with regard to a particular strategy (Johnson, Scholes & Whittington 2008). In a bid to determine the degree of acceptability with regard to the selected strategic option, the firm’s management team should evaluate various parameters such as the degree of risk, rate of return and the stakeholder’s reaction. Some of the criterion that should be used in assessing acceptability with regard to return includes the resulting profitability performance, and analyzing the costs and benefits involved. Sensitivity analysis and financial ratio projections should also be incorporated in determining the degree of risk associated with the strategy selected. On the other hand, the firm should also gather stakeholders’ political dimension with regard to the strategy selected.

Feasibility

Upon selecting the strategy, the firm’s management team should evaluate whether it has the necessary resources, capabilities, and competence to implement the strategy. In order to determine the feasibility of the strategy selected, the firm can adopt a number of approaches that include assessing the firm’s financial feasibility and resource deployment. Financial feasibility should be evaluated by analysing and forecasting the firm’s cash flow. On the other hand, the firm should also evaluate whether it has the necessary resources and capabilities in order to implement the strategy fully (Johnson, Scholes & Whittington 2008).

Conclusion on strategic options

In order to survive in an environment that is increasingly becoming competitive, it is paramount for Zara to consider incorporating strategies that will significantly improve its competitiveness. Zara should consider integrating both business and corporate level strategies. One of the strategic options that the firm should consider includes investing in strategic alliances. The firm should conduct a comprehensive market analysis in order to determine the most viable firm to enter into strategic alliance with (Ashton 2013). An example of a strategic alliance that Zara should consider relates to merger and acquisition. The firm should conduct an environmental analysis in order to identify a firm that will result in the development of the desired synergy upon entering into merger and acquisition with. The analysis should entail evaluation of the advantages that it will generate upon forming the merger. For example, Zara’s management team should consider whether the acquisition would result in the firm attaining sufficient organizational and resource requirements such as capital to enhance its competitiveness.

Considering the high degree of rivalry in the UK fashion industry as illustrated by the financial ratios between Zara and H&M, Zara should consider enhancing its competitive edge (Baron 2005). The firm can attain this by integrating the various competitive advantage generic strategies as postulated by Michael Porter. Some of the strategies that the firm should consider include cost leadership strategy and differentiation. Integrating cost leadership strategy will contribute towards the firm attaining a high cost advantage. The firm should focus a number of elements that on in its quest to attain cost leadership. These elements relate to cost drivers and the value chain. Firstly, the firm should consider ensuring that the economies of scale that it has attained is effectively developed and maintained.

Currently, one of the issues that Zara’s management team is grappling with relates to the possibility of experiencing diseconomies of scale. The firm should ensure that it sustains the cost of operation. One consideration that the firm should take into account relates to the incorporation of strategies aimed at controlling overheads and research and development programs. This arises from the fact that these aspects can contribute towards increment in the cost of the final product if not controlled. However, it is of utmost importance for the firm to undertake effective product designing.

Change in consumer tastes and preferences with regard to product quality are one of the issues that consumers are increasingly considering when purchasing fashion products. Therefore, it is essential for the firm’s management team to ensure that it develops a compressive understanding of the consumers’ demands. Designing and implementing an effective customer-relationship management system is one of the aspects that the firm should consider. The instituted CRM software will enable the firm to access accurate market information by developing sufficient contact with customers.

In a bid to deal with the competitive forces, Zara should also consider enhancing its product differentiation strategy. This will ensure that the firm’s products are unique compared to its competitors. Some of the options that the firm should consider in its differentiation strategy include improving its product quality, increasing the effectiveness of its products, increased product innovation, and timely response to customers’ needs. With regard to innovation, Zara should ensure that it selects highly trained and experienced designers. In its differentiation strategy, Zara should identify unique differentiation bases.

Attaining a high level of profitability is one of the core objectives that guide businesses in their operation (Verma & Verma 2013). The financial ratio analaysis conducted shows that Zara is facing intense competition from H&M both in its domestic and international market.Therefore; it is paramount to Zara’s management team to take advantage of the high rate of globalisation. One of the ways through which the firm can achieve this goal is by improving its corporate growth strategy. Currently, the firm relies on vertical integration as its main source of competitive advantage. Integration of other growth strategies will improve Zara’s competitiveness.

Other corporate growth strategies that the firm should focus on include market development, product development, and market penetration. In its market penetration endeavors, Zara should consider attracting its competitor’s customers in order to reposition in the domestic and the international market. The firm should also consider diversifying its product base through product development. The product development strategy should entail three main options, which relate to new product features such as color and designs. The firm should also focus on developing new types of product in terms of quality and models, which will contribute towards the firm increasing its customer base hence maximizing its profitability potential. In its diversification strategy, the firm should be concerned about how to leverage on its brand name. Zara should also combine its resources in order to develop new capabilities and competitive strengths.

Recommendations

In a bid to improve its competitiveness, Zara should consider incorporating the following strategies.

- To improve its profitability, the firm should undertake continuous product development and improvement. This move will contribute towards improvement in the effectiveness with which it meets customers’ fashion needs. Consequently, it is essential for the firm to invest in research and development. This will enable the firm to develop products that will gain sufficient market acceptance.

- Zara should also consider on the most effective strategy on how it should attain a high market share compared to its competitors. Therefore, it is paramount for Zara to consider the most effective strategy to improve its effectiveness in penetrating the new markets. One of the markets that firm should consider entails entering into emerging markets such as China and India, which will enable the firm to tap new market opportunities.

- Considering the intensity of competition in the fashion industry, it is important for Zara to consider on the most effective strategy to attain sufficient market consolidation. One of the strategies that the firm should consider entails forming mergers and acquisition.

Reference List

Ariyawardana, A & Collins, R 2013, ‘Value Chain Analysis across Borders: The Case of Australian Red Lentils to Sri Lanka’, Journal of Asian-Pacific Business, vol. 14 no.1, pp.25-39.

Ashton, R 2013, ‘Corporate social responsibility could swamp social enterprise in 2013’, The Guardian. p.48.

Badia, E 2009, Zara and her sisters: the story of the world’s largest clothing retailer, Palgrave Macmillan, Basingstoke.

Baron, D 2005, Business and its environment, Prentice Hall, New York.

Blythe, J, Coxhead, H, Lashwood, M, Partridge, L, Reed, P & Simms, H 2009, Strategic marketing, Select Knowledge Limited, London.

Belu, C & Manescu, C 2013, ‘Strategic corporate social responsibility and economic performance’, Applied Economics, vol.45 no.19, pp. 2751-64.

British Fashion Council: The value of the UK fashion industry 2011, Web.

Brooks, I, Weatherston, J & Wilkinson, G 2004, The international business environment, Prentice Hall, London.

Campbell, D & Craig, T 2005, Organisations and the business environment, Butterworth – Heinemann, New York.

Cartner-Morley, J 2013, ‘How Zara took over the high street’, The Guardian. p. 46.

Chandrasekar, K 2011, ‘Workplace environment and its impact on organisational performance in public sector organisations’, International Journal of Enterprise Computing and Business Systems, vol. 1 no. 1, pp. 66-86.

Cusumano, M, Kahl, S, Suarez, F 2006, Product, process, and service: a new industry lifecycle model, MIT Sloan School of Management, Cambridge.

Dasgupta, M 2013, ‘Exploring the role of technology strategy in technological innovation through mixed methods research’, International Journal of Business Competition and Growth, vol.3 no.1, pp.67-88.

Fairholm, G 2009, Organisational power politics: tactics in organisational leadership, Praeger, Santa Barbara.

Fombrun, C, Tichy, N & Devanna, M 1999, Strategic human resource management, Wiley, New York.

Gallaugher, J 2008. Zara case: Fast fashion from savvy systems. Web.

Gholson, N & Schloegel, M 2006, Driving growth and shareholder value: The distribution value map, Oxford Press, London.

Hill, C & Jones, G 2010, Strategic management theory: an integrated approach, Houghton Mifflin, Boston.

Ethical Consumer: H &M, Zara, GAP and Levi’s embroiled in poverty pay outrage 2012, Web.

Haberberg, A & Rieple, A 2007, Strategic management; theory and application, Oxford University Press, Oxford.

Hitt, M, Ireland, H & Hoskisson, R 2009, Strategic management: Competitiveness and globalisation; concepts and cases, South-Western, Mason.

Inditex: Annual report 2011. Web.

Inditex: Inditex’s net sales climb by 17% to 11,632 million Euros. 2012. Web.

Inditex: FY2012 results presentation. 2012. Web.

Johnson, G, Scholes, K & Whittington, R 2008. Exploring corporate strategy: Text and cases, Prentice Hall, London.

Kazmi, A 2008, Strategic management and business policy, Tata McGraw Hill Education, New Delhi.

Kurtz, D, Mackenzie, H & Snow, K 2009. Contemporary marketing, Cengage Learning, New York.

Lorange, P & Contractor, F 2002. Cooperative strategies and alliances in international business, Pergamon, New York.

Luthans, F 2011, Organisational behaviour: an evidence-based approach, McGraw-Hill, New York.

Luthans, F & Doh, J 2012. International management: culture, strategy, and behaviour, McGraw-Hill, London.

Marchand, D 2000, Competing with information, John Wiley and Sons, New York.

Moore, M 2013. Zara caught in slave labour scandal. Web.

Morrison, J 2006, International business environment: global and local marketplaces in a changing world: the international business environment, Palgrave Macmillan, London.

Mouncey, P 2007. Market research best practice: 30 vision for the future, Wiley, New York.

Organisation for Economic Cooperation and Development 2012, Economic outlook, OECD, New York.

Prezi: Zara financial statement. 2012. Web.

Raynor, M & Bower, J 2001, ‘Lead from the centre: How to manager diverse businesses’, Harvard Business Review, vol. 80 no. 5, pp: 93-100.

Reuer, J 2004, Strategic alliances: theory and evidence, Oxford University Press, Oxford.

Reuters: Zara owner lays down ethics for Moroccan suppliers. 2007. Web.

Rickman, T & Robert, C 2007, ‘The changing digital dynamics of multichannel marketing: The feasibility of the weblog: Text mining approach for fast fashion trending’, Journal of Fashion Marketing and Management, vol. 11 no. 4, pp. 604-621.

Salvatore, D 2006, Managerial economics in a global economy, Oxford University Press, New York.

Sekhar, S 2009, Business policy and strategic management, IK international Publisher, London.

Spier, B 2013. Forex news: euro breaks a 13-month high following improved consumer confidence. Web.

The Manufacturing Institute: The facts about modern manufacturing. 2009. Web.

Trevino, L & Brown 2004, ‘The role of leaders in influencing unethical behaviour in the workplace’, Journal of Applied Psychology, vol. 85 no.6, pp. 349–360.

Verma, J & Verma, R 2013, ‘The impact of knowledge sharing on firm performance: an empirical investigation of information technology firms’, International Journal of Business Competition and Growth, vol.3 no.1, pp.5 – 22.

Wallace, S & Kench, B & Mihm, B 2012, ‘Coordination costs and firm boundaries: A tale of two supply chain in the apparel industry’, Journal of Management Policy and Practice, vol. 13 no. 3, pp. 47-65.

Worthington, I & Britton, C 2006, The business environment, Prentice Hall, New York.

Yilmaz, A & Kucuk, F 2010, Risk based logical framework to the corporate sustainability, Erciyes University Social Science Institute, Kayseri.

Yoo, J 2000, ‘A theory of industry life cycle’, Journal of Economic Development, vol. 25 no. 1, pp. 155-172.

Appendices

Appendix 1

Appendix 2

Zara is committed at attaining a high level of growth. One of the elements of growth that the firm focuses at includes developing a strong workforce. The firm has integrated an employee policy, which entails continuous and centralised employee attraction, supporting employees through training.

Appendix 3

Appendix 4: Internal Audit of Zara’s performance over during its 2011/2012 financial year

Appendix 5: Figure showing innovative approach fashion apparel firms should adopt