Executive Summary

This paper is a research report analyzing British Airways (BA). Several aspects of the company’s performance and external environment are analyzed. Consequently, this paper explains that, BA’s external environment is unattractive. Technology stands out as the only favourable factor in the industry because it improves the level of competitiveness and efficiency in the industry. However, other aspects of the industry seem unfavourable to airline companies.

The company’s financial performance assessment shows that, it is too early to plot BA’s financial future because an imminent European financial crisis looms. In this regard, the company’s financial strength is still shaky. Weighing the findings of BA’s competitive environment, this paper establishes that, BA has concentrated its competitor strategy on differentiation. Comprehensively, this paper paints a shaky future for BA because the company operates in an environment characterized by much uncertainity.

Introduction

British Airways is a member of the royal family of European airlines and among the largest airlines in Europe. For a long time, British Airways has been the national flag bearer of the United Kingdom (UK). It operates in 160 destinations around the globe and has a market presence in more than 70 countries (Ganesh 1999, p. 269). BA’s inception occurred after four small and large airline companies (BOAC, BEA, Cambrian airways, and Northeast airlines) merged (Meyer 2007).

Before 1987, the government ran British Airways, but in the same year, it was privatized as part of the British government’s efforts to seize control of most of its national corporations (McGowan 2011, p. 3). After the privatization, British Airways was able to expand its operations to new locations and new market segments. Currently, the airline is part of the one world alliance, which is an association of several airline companies including American airlines, Cathay pacific, Qantas and Canadian airlines (Meyer 2007). British Airways also operates under the International Airlines Group (IAG) and its association with this business outfit marks its participation in the London Stock exchange.

BA offers several passengers and cargo transport services. Most of these services are offered by the airline’s subsidiaries including British Airway’s city flyer, open skies and British Airways World Cargo (Plunkett 2009).

In 1980, BA’s vision was designed along the principles of safety and excellence (JY&A Consulting 2011). During this period, BA marketed itself as one of the safest airlines. Due to the changing aviation market, the company reviewed its marketing strategy and branded itself as the world’s favorite airline. From this development, BA has shown its commitment towards redefining its mission to ensure it achieves high levels of corporate success. Service has therefore become one of the company’s main preoccupations. BA currently works towards rebranding itself as the world’s undisputed leader in travel (JY&A Consulting 2011). This corporate mission is wider than the original branding of the company as an airline with good customer relations and service.

The reinvention of the company’s mission is part of the aftermaths of a competitive aviation market that has forced many airline companies to be more innovative and creative in finding new market niches (and maintaining their existing customers through loyalty programs). The company’s mission to be the undisputed king of world travel gives the company’s management a new mandate that stretches beyond being just an ordinary airline.

In an effort to rebrand itself to be more than a profit-making entity, BA has ventured into several corporate social responsibility programs. However, the company has mainly focused on climate change concerns as an important area of concern for the company (JY&A Consulting 2011). The focus on climate change has seen British Airways take part in government initiatives aimed at reducing UK’s carbon blue print. As a result, the company joined UK Emission trading scheme, which has seen the company offset most of its carbon emission.

The climate change concern is one among many CSR projects that BA has participated. It is a strong conviction among the company’s management that they also need to support community projects in the countries BA operates (JY&A Consulting 2011). As a result, BA finances more than 100 community-based projects in different countries where it operates. For example, in 2010, the company invested more than 5,000,000 pounds in community projects (JY&A Consulting 2011).

This paper is a report summarizing different aspects of BA’s operating environment. To do this, an external analysis of BA’s operating environment will be undertaken. This analysis constitutes the industry’s attractiveness and the environmental stability of the aviation industry. Secondly, this paper analyzes BA’s financial performance. Several factors will be analyzed in this analysis including the company’s financial trend, historical ratios and the likes. This analysis is aimed at assessing BA’s financial strength. A competitive assessment of the company’s environment will also be undertaken to assess the company’s competitive strategies.

Several tools of analysis will be included in this analysis including porter’s strategic generic framework and the resource based view framework. The competitor analysis will expose the company’s strategic direction of development. This will be an exclusive segment of the study, which incorporates ansoff’s growth vector to determine BA’s strategic direction of growth. The methodologies adopted by the company to drive the strategic direction of the company will also be assessed. Finally, a conclusion summarizing the main points of the study will be provided.

External Environment Assessment

To come up with a comprehensive analysis of BA’s external environment, this paper incorporates the PEST analysis framework.

PEST Analysis

Political Factors

Political instability always has a negative effect on businesses. The airline industry is no exception to this rule because airline companies often shun travel destinations that are characterized by wars or political instability. For instance, many airline companies cancelled their flights to Iraq when the US and the UK were at war with the middle-eastern country (Acumen 2011, p. 14). Currently, the political instability in the Middle East has caused a significant rise in crude oil prices and airline companies are suffering from an increase in fuel costs.

The war on terror has also had a profound effect on the aviation industry because it has caused a significant rise in operation costs. This rise in costs has been occasioned by increased security checks and increased insurance costs that airline companies have to incur to protect themselves against terrorist attacks.

The changing policy environment also affects the aviation industry because airline companies have to orient themselves with different policies and laws governing their operations. Furthermore, considering the airline industry is predominantly a customer-service sector, there are different legislations that govern the industry. Such varied legislations include consumer protection laws, environmental protection laws, consumer health and safety laws, passenger security laws and similar legislations (Acumen 2011, p. 14). Cumulatively, political developments significantly affect the operations of airline companies.

Currently, the dynamism of the political environment and the political uncertainties in the Middle East has done little to decrease the cost of doing business for airline companies. BA suffers as a result.

Economic

The world has recently experienced repeated episodes of economic depression. The 2007/2008 global economic recession is one such disaster. As countries still grapple with the aftermath of the recession, more fears are registered in the European Union because it is feared that many European countries (such as Greece and Italy) may default on their credit obligations. Due to this economic gloom, unemployment rates have soared in most European nations.

This trend has a negative impact on the airline industry because decreased economic performance decreases consumer purchasing power. For instance, world tourism has significantly reduced with increased economic problems. Most travelers have chosen to hold their travel arrangements, pending the economic performance of their countries. The slowdown in economic growth among many countries has also affected the share price performance of airline companies. For instance, BA’s share price has consistently declined over the past decade (since 2001). The economic environment therefore paints a gloomy picture for the aviation market

Social/ Cultural

Most global airline companies operate across different racial, religious and ethnic environments. In addition, social or cultural influences are often observed before providing in-house services. For example, Indian passengers would not appreciate to be served pork while on transit. Consequently, airline companies have to understand their markets by tailoring their products and services according to the appropriate culture. This situation complicates the operations of the aviation market.

Technology

In the spirit of outdoing one another, most airline companies have invested a lot of money in incorporating new technology in their product and service offing. BA is not an exception to this trend because it has invested a lot of money in new technology such as lotus and associated technology (Acumen 2011, p. 14). The rapid advancement of technology has forced many companies to adopt new technology in their in-flight services. The provision of internet services as an in-flight service is one initiative taken by BA to improve its in-flight services. Internet booking is also another service adopted from the implementation of new technology by most airline companies. The adoption of new technology therefore improves the competitive position of many airlines.

Company Financial Performance

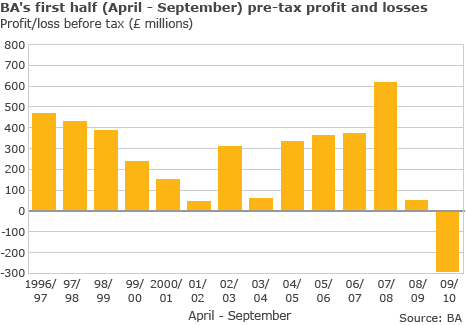

In 2009, BA posted its worst financial loss in years (Milmo 2010, p. 3). An increase in fuel cost and a collapse of the business travel segment occasioned the loss. The increase in fuel cost alone was estimated to cost the company a loss of three billion pounds (Milmo 2010, p. 3). Partly, the loss was also attributed to the collapse of the world economy and the consequent decline in business and leisure travel. A decline of the value of the pound was also cited as a possible cause of the company’s loss. During the same year (2009), BA posted a loss of 401 million pounds. This loss saw the company wipe off the dividend payments for the same year. The company’s share price also plunged by about 6.6% (Milmo 2010, p. 3).

In 2010, the company posted another loss of 290 million pounds (net), but this loss was an improvement from the projected pretax loss of 500 million pounds. The following diagram shows BA’s untaxed profit and loss for the last five years.

Urgent cost-cutting measures were adopted in 2010 to save BA from further losses (like it posted in 2009). The cost cutting measures saw a fall of operating costs of more than 10% (BBC 2009). However, the poor financial performances for 2009 and 2010 have been reversed by several operational changes of the company. For instance, the company’s alliance with Spain’s Iberia airlines has increased the company’s profitability because of the advantages of economies of scale. Consequently, International Airlines Group (formed after the Spain alliance) posted a pretax profit of 39 million pounds (BBC 2009).

This profit was realized during the alliance’s half-year performance for the year 2011. This profit was a dramatic turn of events for BA because Iberia and BA both suffered a loss of 419 million pound loss for the year 2010 after there was a volcanic eruption in Iceland that paralyzed the companies’ operations (Milmo 2010, p. 3).

IAG’s strong profit performance for 2011 narrowed to BA’s profitability for the year because Iberia posted a loss of 78 million pounds while BA posted an operating profit of 210 million pounds. BA also carried more passengers (at 32 million passengers a year) while Spain’s Iberia Airline carried only 25 million passengers a year.

Assessing BA’s financial ratios, we see that, the company’s financial ratios reflect the above analysis of company profits and losses. The net debt/total capital ratio for the years 2010, 2009 and 2008 were 52%, 56.3% and 28.7% (Milmo 2010, p. 3). The high net debt/total capital ratio significantly increased in 2009 because of the poor financial performance of the company during the same year. The declining net debt/capital ratio for the year 2010 shows the recovery in financial performance.

Competitive Strategy

Competition in the airline market is very intense because traditional airline companies have been losing their customers to newer airline companies. The worsening economic environment and the fall in passenger numbers have also done little to improve the situation. As a result, many airline companies have resorted to adopt different cost-cutting measures to prevent the realization of company losses.

This strategy informs BA decision to cut its employee costs by nearly 20% (Acumen 2011, p. 14). Conversely, this has led to threats of employee strikes and employee go-slows. BA’s competition can however be analyzed from two levels. The first level is the short distance travel and the second level is the long distance travel. The short distance travel is very competitive because low-cost airlines have emerged; thereby further tightening the competitive environment. In the short distance travel segment, British Airways has witnessed immense competition from Ryanair and Easy Jet.

In comparison to the short-route airline sector, BA experiences a stiffer competition in the long-route market segment. The main competitor is Virgin Atlantic (UK). The competition has mainly been witnessed in the business class category because the two airlines have been head-to-head in the past five years (UMA 2011, p. 1). Qantas airline also poses a stiff competition to BA especially because it has an excellent safety record.

American airline was also a strong competitor for BA but its vulnerability to terrorists turned the competition in favor of BA. Other airline companies such as Air France, Lufthansa airlines, and Swiss airlines have also posed a strong competition for BA because of their strategic locations (operating in the middle of Europe). To assess BA’s competitive position, viz-a-viz its competitors, we will use Porter’s generic Competitive Analysis.

Porter’s generic analysis explains that the competitive performance of a company represents a company’s profitability if analyzed according to the industry’s average (Acumen 2011, p. 14). The model also proposes that competitive advantages may be attained through the low-cost adoption and differentiation strategies. These strategies are estimated to lead to three outcomes: focus, differentiation and leadership. BA will therefore be analyzed within this framework.

Cost Leadership

BA has had a good record in service delivery. Through its online marketing platform, BA has strived to satisfy its customers by offering quality services to beat the competition that low-cost airlines pose (Acumen 2011, p. 14). In alignment with this strategy, BA has reduced the number of cabin seats and security check requirements to reduce the cost of operations. The proliferation of low cost airlines saw BA reduce its fares and cut most of its long flights to the Middle East and the US. More so, most of the concord flights were reduced because of the increased threat of terrorism.

Differentiation

Companies are often known to overlook pricing issues and focus on value addition factors to enable them charge a premium for their products (Acumen 2011, p. 14). For instance, British Airways has consistently differentiated its services to suit its different market segments. This action has been a strong commitment for British Airways because it believes that; by offering high quality services, the company can be able to charge high prices for its products.

BA’s differentiation strategy has been witnessed in several aspects of the company’s operations. For instance, it is a strong company conviction that BA should listen to what its most trusted customers want, and tailor their products and services in line with these needs. This conviction has seen BA develop small focus groups, which are designed to generate ideas regarding how to improve the services of different customer groups. Such initiatives have led to increased service quality and innovation (Acumen 2011, p. 14).

Focus

The entire concept of “focus” lies in the concentration of a small aspect of the aviation industry to emphasize a company’s niche. Companies that adopt this strategy often overlook other segments of the market and tailor their products and services to suit the needs of customers found within the focus market (Acumen 2011, p. 14). British Airways has however not subscribed to such a competitor strategy. Though some of its product and service innovation strategies are focused on its premium customers, the company still maintains a strong business presence in other sectors of the aviation market including cargo business and economy travel.

Resource-Based View

The resource-based view analysis of BA shows that the company recognizes the importance of engaging the right resources for excellent organizational performance. This emphasis has mainly been witnessed in the company’s human resource strategy which has been designed to align with the company’s differentiation strategy. The company’s human resource strategy is that of attracting the best quality human power, which provides the best human resource for the organization (Acumen 2011, p. 15). Weighing the findings of Porter’s generic forces, we can establish that, BA has concentrated its competitor strategy on differentiation.

To support this argument, we have seen that the company’s reliance on the focus strategy is almost non-existent because there is little evidence to suggest that BA has a niche market focus. The emphasis on low-cost competitor strategy is also weak because BA has strived to uphold most of its customer excellence service strategies at the expense of pricing strategies. BA therefore has a strong inclination towards differentiating itself from its competitors through improved customer service.

Strategic Direction of Development

To evaluate BA’s strategic direction of development, the ansoff growth vector will be used. Ansoff matrix proposes that, there are four main ways that companies can effectively grow their product and service offing. These four alternatives are market penetration, product development, market development and diversification (Acumen 2011, p. 15). BA has mainly adopted a blend of the market penetration strategy and the market development strategies.

The market penetration strategy explains the company’s competitive strategy. This analogy is true because BA has done a lot to achieve growth by increasing its market share to provide new services and products. This strategy informs the company’s competitive strategy because BA has developed new products and services to increase its market shares. For instance, evidence has been given of the new service offing provided to premium customers.

BA’s market development strategy explains the company’s resolve to forge airline alliances with one world alliance and Iberia airline. These alliances are tailored to improve the company’s regional presence (Goh 2002, p. 2). For instance, the company’s alliance with Iberia was intended to improve BA’s market presence in Europe. One world alliance was also used to increase the company’s market presence in America and other parts of the world.

Methods of Development

To grow BA’s market presence, the company embarked on forging alliances with existing airlines. This method of development poses several advantages and disadvantages to BA. BA customers may enjoy improved networks of operations, thereby increasing their loyalty towards the company, but this advantage is complemented by other pros, including transferable priority status, extended lounge access, seamless travel and enhanced frequent flyer program benefits (Goh 2002, p. 2). Airline companies are also known to benefit from such alliances because they can be able to transcend travel or route restrictions, enjoy economies of scale emanating from increased economies of scale, coordinated schedules and prices, and the opportunities to reshape the industry’s structure.

One major disadvantage of airline alliances is the sharing of losses. In the past, airline companies that have been part of an alliance have suffered the risk of being in the alliance in the first palace. For instance, Ansett airlines had to shut down after it was bankrupt, thereby locking other members of the star alliance out of the Australian market. A similar situation was witnessed when Air Canada bought Canadian airline out of the One World Alliance (Goh 2002, p. 2). A risk of reputation “carry over” also looms in airline alliances. For instance, if Iberia Airline were to be involved in a plane crash, such an event would have a negative impact on the reputation of BA because both airlines are part of one alliance.

Conclusion and Recommendations

Based on the above analogy of BA, the strategic position and action evaluation matrix (SPACE analysis) recommends an aggressive strategy for BA. This strategy is supported by the intense competition existing in the airline market. Moreover, BA has a strong strategic position in the aviation industry because it is a veteran in this regard and it can experience rapid growth. BA therefore needs to develop its internal expertise to realize a stronger market penetration strategy.

This strategy also needs to be complemented by a strong market development strategy. So far, the alliance strategy, which has been adopted by the company, seems to work, but this strategy needs to be complemented by a stronger product development strategy and a stronger integration with other airline companies (preferably those that complement BA’s operations). It would also be a good move for BA to acquire some of the competition so that it can improve its competitive position and eliminate existing competition, (especially in its primary markets). This SPACE strategy is supported by the elimination of the defensive, competitive and conservative strategic approaches because of the growth in the aviation sector and the increase in competition within the industry.

Reflection Assignment

Team Development/Peer Support

Throughout the course of the presentation, the commitment of the team was commendable. Every team member understood that it was important to contribute towards the overall team exercise because it was crucial to incorporate the dynamic views of every team member in the whole exercise. Team cohesion was realized during late stages of team development. During the initial stages of interaction, team members were orienting themselves with one another. At first, members were not open with one another. Team members clustered in small groups and partly, there was a sense of hesitation to talk and interact with one another.

As time went by, the team leader was identified, but there was a sudden reluctance among team members to engage in team activities. This situation led to a strong reliance on the team leader. It is also at this stage of team development that the first team conflicts arose. Due to the constant negativity and conflicts surrounding team activities, it was almost impossible to highlight one advantage of our teamwork. Our team cohesion was greatly threatened at this point. This conflict was especially witnessed during meetings.

However, after constant deliberation among team members, team cohesion was realized during the day of presentation. All team members emphasized incremental performance improvements during the presentations, and comprehensively, there was a strong sense of resilience among team members to overcome any obstacles that prevented the realization of team objectives.

Every team member had a different role to play within the team. I was a team player. My task was to support other team members in the resolution of cross-functional team problems. My task was also to report project team expectations and performances to the team leader. My colleagues performed other team roles. For instance, our team leader’s role was to provide project guidance and oversight to other team members. Other team members undertook a variety of responsibilities such as searching for input to improve team ideas, attending all team meetings (among other duties).

Though we coordinated well during the entire project task, several measures could be implemented to improve our team performance. For instance, weak team members should have been given the same level of attention that strong team members were accorded. This action would have greatly improved team cohesion. In addition, since the entire team project was demanding, performance pressures should have been reviewed by adding different perspectives and fun to the team project. There was also a strong inclination for some team members to ignore inevitable performance setbacks. This action led to several team setbacks. If all team members accepted inevitable team setbacks, it would have been easier to overcome such setbacks.

The main challenges experienced during the peer assessment process were the strong inter-personal relationships developed among team members that prevented an honest assessment of team members. The varying difficulties and variances in team tasks and responsibilities was also another area of conflict for team members because these variances led to varied outcomes. It was therefore easy to rate a team member poorly because of the difficulty of the task assigned. Equally, it was easy to positively rate a team members because of the relative ease in performing team tasks.

Presentation Strengths and Weaknesses

Excellent strategic management presentations are made from the inclusion of several elements. Simplicity is one main component of a good presentation because the audience can easily understand what message is conveyed in the presentation. It is especially important that one concept be explained at a time. The inclusion of graphics during the presentation is also another attractive ingredient of good presentations because it summarizes the main points of the presentation in an “eye-friendly” manner. In a snapshot, somebody can easily understand what message is conveyed in the presentation.

The main strengths of our team presentation were the focus on details and the proper research of information to support the project arguments. Our clarity of purpose and development of content were also some of our major strengths because we were able to convey information that was well suited for our target audience. However, the main areas of weaknesses for our presentation were the intense reliance on data. Too much information overwhelms the audience. Compared to other team presentations, our presentation lacked a strong sense of enthusiasm, energy and excitement.

The main strength of our presentation’s visual flow was the clarity of the diagrams and the integration of the visual aids and the theoretical information. The theoretical information perfectly matched the visual aid presentation, thereby creating a seamless integration of data. There were no main weaknesses for our presentation in this regard.

Self Evaluation

There were several skills learned from participating in the team project. The main skills learned from the entire exercise were analytical and creative skills. These skills developed from the role of analyzing information and coming up with workable solutions for the project purpose. I also developed strong communication and negotiation skills because during the course of the team building process, we were able to learn that it was important to communicate individual ideas by respecting our dynamism. This skill also enabled us to resolve team conflicts in a non-confrontational manner. Finally, I was able to learn organizational skills because, as a team, we were required to organize our activities in an organized manner so that we could meet team deadlines.

While undertaking the research investigation, I used different skills and techniques to accomplish the research goals. The main skills applied were the ability to undertake problem identification, formulation and solution; the capacity to undertake independent critical thought; and the open regard for truth and intellectual integrity of information. From the entire presentational experience, I also learned that, it was important to undertake a thorough research before any presentation.

This was my main strength. Though my report is mainly detailed and thorough, its main weakness is the future relevance of information because of dynamic changes in the company’s internal and external environments. After identifying my major weaknesses in the overall presentation of the report, I will strive to consult more with my supervisors to get recommendations regarding how I can overcome such weaknesses.

References

Acumen, P. (2011). British Airways Case Study. Web.

BBC. (2009). British Airways Cabin Crew Vote For Christmas Strike. Web.

Ganesh, G. (1999). Privatization Competition and Regulation in The United Kingdom: Case Studies. London, Mittal Publications.

Goh, K. (2002). The Benefits of Airline Global Alliances: An Empirical Assessment of the Perceptions of Business Travelers. Web.

JY & A Consulting. (2011). Identity Heralds a New Vision at British Airways. Web.

McGowan, R. (2011). Privatize This?: Assessing the Opportunities and Costs of Privatization. London, ABC-CLIO.

Meyer, S. (2007). Acquisition of EasyJet Plc. by British Airways Plc. London, GRIN Verlag.

Milmo, D. (2010). British Airways Makes Worst Ever Loss. Web.

Plunkett, J. (2009) Plunkett’s Transportation, Supply Chain and Logistics Industry Almanac 2009 (E-Book): Transportation, Supply Chain and Logistics Industry Market Research, Statistics, Trends and Leading Companies. London, Plunkett Research, Ltd.

UMA. (2011) British Airways’ Bases for Differentiation. Web.