Introduction

This report analyses the market and financial positions of Du and Etisalat telecom companies by comparing the main financial and market strengths, weaknesses, opportunities, and threats. A review of financial statements of the companies for the years 2015-2019 and relevant data are used to show the trend analysis of the companies. The United Arab Emirates has Du and Etisalat as the major telecommunication companies.

Overview of Du

Du which is also known as “Emirates Integrated Telecommunications Company”, is a company that operates in telecommunication in the United Arab Emirates (Alghawi and Abdullah 112). Osman Sultan the Chief Executive Officer and founder of the company since 2006 established its headquarters in Dubai. The services of the company include mobile communication, fixed-line, digital television, and internet services.

An approximate 100,000 UAE companies are affiliated to the ICT and managing services offered by Du. In addition, it formed an MoU that recognizes it as the official partner of strategic planning for the Smart Dubai Platform Provider (Du 2016). Media companies are also a market for the company since it has services of carrier and satellite linking. In 2019, Du was recognized as the nation’s preferred Telecommunication network at the fifth chapter of the yearly Filipino Times Awards. Since its inception, the company has gradually developed and improved the quality and range of its network coverage. Because of the active development, it is now a major competitor of Etisalat. Today, Du has opened up retail shops of mobile communication in more than 30 locations. It has also formed a partnership with Emirates links, Axiom technology, and Jumbo.

Overview of Etisalat

Etisalat is ranked 13 among the largest mobile telecom operators globally and is also the giant in telecommunication services in the United Arab Emirates (Alghawi and Abdullah 11). Before 2006, Etisalat was the only mobile operator and had more than 149 million subscribers to its mobile operations in the UAE. The company has opened outlets in London, New York, Singapore, Frankfurt, Paris, and Amsterdam that represent its outsourced services and headquarter in Abu Dhabi.

The company’s logo is an easy spot because of the unique giant ball that is often put on rooftops of buildings. The range of products offered by the company includes voice and bundled services in fixed and mobile networks. Etisalat has established its presence in 18 countries in Asia, the Middle East, and Africa. The mission of the company is to widen the reach of its services to people.

As mentioned earlier, the stiff competitor is Du a mobile operator that has a market share of 37%. The year ended 2015; Etisalat had total revenue of $14.08 billion and a net profit of $2.26 billion.

Economic and Market Overview

Du Market and Economic Overview

According to Osman Sultan, Du had a positive 2015 and subsequent years. The company has focused on rejuvenating the company’s business and prioritizing innovation as the basis of the mission and vision. He highlighted that 2015 was a profitable year for the company.

The strategic objectives and planning brought positive results through the main indicator for another successful year in the nine years positive run. The company registered a growth of AED 12.34 billion in 2015 which was a positive deviation of 0.8%. The company had a sum of AED 13.0 billion in 2017 which was an increase from the previous AED 12.7 billion of 2016. The net profit stabilized at recurring levels for the year ended 2018 and 2019 respectively. The demand for connectivity by customers in 2015 increased which transformed to a high margin of growth in the mobile data income to AED 2.96 billion by an index of 7.3%. Through the years, mobile data has represented the highest percentage of revenue at a deviation of averages 4% each year from the 32% of 2015.

The demand of the customers translated to more digital-oriented service delivery, and since this gives development is dominating the market and increasing the monetary advantages, Du implemented the strategy that put the business in the best competitive position to establish the company as the sole integrated digital operator (Abdulla, 2016).

Etisalat Market and Economic Overview

The total subscribers of Etisalat have increased over the years and recorded an addition of 7.9 million in one year to reach 149 million mobile subscribers in 2019. The number of mobile subscribers increased every year by 1% and reached 10.8 million customers subscribing to the post-pay service. The increase in post-pay subscribers led to a decrease of prepaying subscribers by 1%.

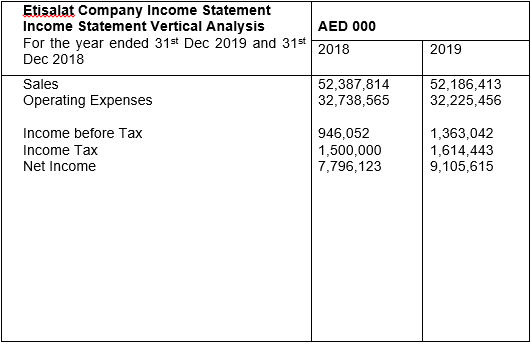

The implemented services of Etisalat caused the growth of 2% every year to a population of more than 1 million. The revenue of Etisalat telecom stabilized in 2019 at AED 52.2 billion which was affected by inconsistency in the exchange rates. The exchange rates similarly increased yearly by 1%. The unstable behavior of the exchange rates did not affect the revenue in the UAE which was balanced at AED 31.5 billion. This balance was because of the increased subscription to the premium services and data plans with higher speed. The currency exchange rate in Pakistan rupee and Moroccan Dirham impacted the negative 1% yearly revenue to AED 20.4 billion.

Services offered in Egypt registered a positive deviation of 22% which presented revenue of AED 3.4 billion (Alshebli 2016). The revenue in Pakistan fell by 17% in the previous years and increased by 2% in local currency due to the good behavior of the premium subscription packages and fixed broadband. The year ended 2019 had a debt amounting to AED 23.9 billion which had increased from 23.5 billion of the previous year.

SWOT Analysis

Du SWOT Analysis

Strengths

Improved Services in the ICT Department

The UAE government has made information and communication Technology its main priority to develop and improve smart services in the UAE. The 2019 financial year was the year that ICT development was made the main agenda in satisfying the digital needs of the customers. Du formed partnerships with digital technology firms and sealed lucrative contracts. For the ICT department to meet its target, it launched a high-level megawatt data center which is projected to operate soon.

Wide Range of Innovative Ideas and Initiatives

Since 2016, Du has prioritized digitalizing the business and confirmed that innovation is at the center of the company’s activities. The company committed itself to the UAE’s government agenda of improving the experience of the people in the digital era (Alshebli 65). A project launched by the government ‘Smart Government’ and ‘Smart City’ were initiatives that were launched to enhance life experiences. As a result, Du built a basis for the Smart City with Wi-Fi UAE and presented in the summit of the internet of things network in the Middle East.

Stable Financial Statements

The evolving business tactics that consider subscription needs are at the core which has to enable Du to maintain strong financial statements. Over the years, Du has kept a constant improvement in annual revenues and an increase in the income from mobile data services. In addition, the fixed-line program contributed positively to the deviation in revenue each year. The investors also got a better share of the dividends every year because of the growth in net profit annually before royalty.

Effective strategic planning from the launching of the Virgin Mobile Brand

Cheaper Package Costs: Du offers a wide range of services and has cheaper pricing when compared to Etisalat the main competitor, the subscribers believe that the prices are fair and pick Du. This plan has enabled them to get a loyal customer base in the UAE.

The Digital TV Service: The DU TV+ has been customized with quick access features like rewinding, pausing, and recording live programs on TV. The subscribers get a wide option of the latest programs to watch that are in HD and 3D.

Efficient Customer Service with Multiple Languages

Du has a customer service that offers multiple languages like English, Bengali, Hindi, and Arabic which represents the different communities living in the UAE.

Weaknesses

Poor Connectivity Issues

The subscribers to the Du services often report complaints that the Du’s signal is available in some locations in the UAE, and this causes calls to end or poor voice quality when they make calls.

Emerging Company

Since it was just formed less than two decades ago, Du found Etisalat operating on the market for many years (Agwu 81). For this reason, it is hard to get customers to shift from the other company because of the trust they have built with them. Customers are therefore not yet familiar with the services that Du offers.

Opportunities

Improvement in its Technology

Du has wide technological resources that can enable the widening of the signal and improving the speed of the internet to be at the level of international quality standards. This will serve the demand for internet service that has increased largely over the years.

Invest in the International Market

As a plan to further the growth of the company, Du can open its services in the neighboring countries. The increasing number of subscribers in the UAE has made substantial profits for Du which can satisfy the growing demand for cheaper internet services globally.

Introduce New Products and Services

Du has wide options of services that have won against its main competitor; this has been considered a good reputation. For a better competing position, they should be more innovative in order to maintain the good qualities that they offer.

Threats

The emergence of New Competition

The telecom market is constantly growing in Saudi Arabia, and Du might have a problem if new companies enter the market and offer better services than they do (Alarjani 42). In order to remain at its level, Du has to come up with new tactics every time to cushion against new competitors.

Influence on the Pricing of Services

Du has introduced an approach of paying per second because of the increase in the demand for low prices. If a competitor comes with the same approach at a cheaper cost, Du will be compelled to make the same changes to stay in the competition which will cause a decrease in their prices and revenue.

Constant Shift in the Subscriber’s Number

The problems of poor signal and call connectivity issues may cause customers to shift back to competitors that have a better service if the problems are not addressed by Du.

Etisalat SWOT Analysis

Strengths

Biggest Network

Etisalat is the largest telecom company in the Middle East and Asia and ranks at position 12 in the whole world. This geographical coverage gives it access to different market segments and a large customer base.

Market Share

The current market share value of Etisalat is at AED 156 billion. This is because of the high profiting telecom groups that make a net income of about AED 52.4 billion and a net profit of 8.4 billion.

International Data Company

Etisalat provides innovative services across 15 countries and about 149 million customers. As a result, it had a competitive advantage in terms of the ease with which it can market its products to a global audience and penetrate foreign markets.

Proper Customer Experience

Etisalat provides the best customer experience locally and in an external territory. It gives an attractive dividend share to the shareholders and manages to invest in the long-term goals of the company.

Weaknesses

Poor Maintenance of Connectivity Levels

The Company has its services in a large territory which could lead to relaying poor quality services that will not be easy to maintain. A 2020 report by Open Signal indicated that although signal strengths, and by extension connectivity had improved within the UAE, the same could not be said in other markets (Khatri 2020). Weak signal strengths in non-UAE markets are a major challenge for Etisalat, especially in the context of the global efforts to upgrade to the faster 5G network. Accordingly, the large geographical area, while presenting Etisalat with the opportunity to globalize more easily, also presents the challenge of straining the company’s resources to maintain reliably strong signals. One possible outcome of this situation is the company risking losing customers in low-signal areas to its market rivals.

Difficulty in Managing International Operations

The global presence of the company is a problem to the management in terms of streamlining functions and maintaining similar standards across all of its markets. Granted, this is a challenge that all multinationals struggle with on a routine basis. However, Etisalat’s challenge is compounded by the fact that the company provides services that cannot easily be segmented to target various market niches. For instance, all mobile users want strong signals and fast video download speeds. Satisfying this need for all of its customers is a big challenge, compared to its main rival Su. The implication of this situation is that the company must come up with a way to streamline managerial functions across all market regions to ensure that provides consistent and reliable network signals.

Unaffordable Calling Rates

Customers usually have second thoughts when deciding to use the Etisalat network due to the high calling rates. In May 2020, the company was forced to adjust its international calling rates to keep up with the packages offered by Du (National Business 2020). This fact suggests that Etisalat may in the future lose customers if it fails to keep with the pricing wars with its competitor Du.

Opportunities

Improved Services to Customers

Etisalat offers a wide range of products, which and can help the company to maintain its market control and minimize risks through diversification. For instance, the company’s position as a provider of bundled packages places it in a better position to diversity into video calling services, which are becoming popular as a result of the uptake of new technologies like WhatsApp.

Stable Financial Position

Etisalat’s success and profitability are sustained by its strong financial position. For instance, the company has a high liquidity ratio, which enables it to invest in new technologies quickly, for example, the ongoing upgrades to 5G networks. At t the same time, the company’s heavy presence within the UAE has allowed it to take advantage of the country’s high GDP and consumer purchasing power.

Mobile Number Portability

The customers can change from one network operator to another and still retain their numbers if they feel that one operator is not giving them the best services. Etisalat can use this opportunity to offer better services to gain a bigger share of the market.

Threats

Emergence Of New Competition

The telecom market is constantly growing because many companies come up with better services that are more affordable (Ameen and Willis 13). Considering the expensive nature of Etisalat services, this can be a serious threat.

Stiff Competition From Du

Etisalat has been facing continuing competition from Du which keeps on getting an increase in the market share. If Etisalat does not innovate to provide superior services and offer customers competitive prices, it risks losing some of its market share to Du.

Services Offered by other Telecom Companies

The services offered by parallel companies attract many customers which grab most from the Etisalat Company.

Financial Analysis

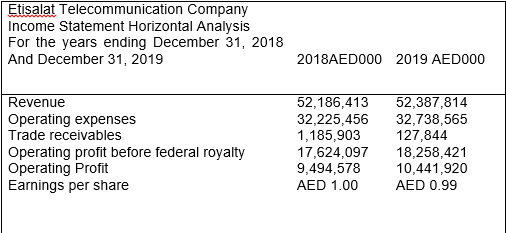

Horizontal Analysis

Trend Analysis

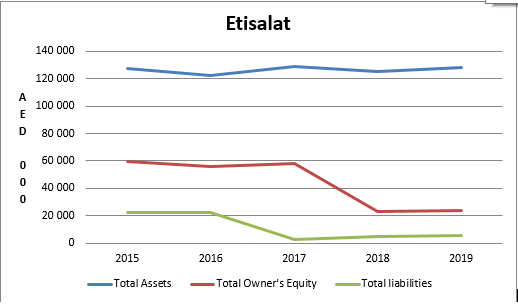

In between 2015 and 2019, Etisalat has experienced a drop of more than half in the Assets and Liabilities of the company while owners’ equity has seen a substantial rise which means that they liquidated their assets to meet the investors’ expectations. This behavior is similar to Du’s figures as they had a drop in the assets and liabilities but maintained the owner’s equity to keep the investors happy.

Etisalat has heavily invested in 2019 as compared to the previous years and it looks like they had a setback when they did not invest in 2018. Their financing cash flows have been rising since 2017 to keep the operating cash flow stable through time. While Du financed their cash flows and abandoned their investments which still kept their operating cash flow above AED 5 million through the years.

Etisalat has had a hard time realizing shooting profits despite changing its operating cash flow strategies. Even when they reduced the operating cash flow the profit margin maintained at the same level and increased in 2018 when the operating cash flow was reduced. Du has failed to improve the operating profit of the company despite increasing its operating cash flow.

Vertical Analysis

Financial Ratios

Liquidity Analysis

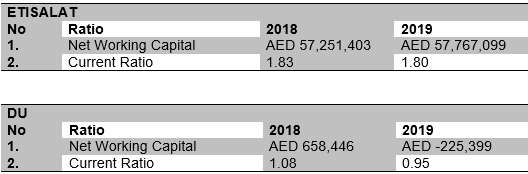

Liquidity analysis measures the ability of a company to cater to expenses that are in a short period of time. It, therefore, shows the capability of quickly converting the available resources into money (Linares-Mustarós et al. 5). It is able to save a business from going into unnecessary debts and also means that a company is able to carry out its daily activities when the liquidity ratio is high.

The Networking capital and Current Ratio of both the companies have been reduced. However, Du has a big drop showing that it’s liquid and therefore making debts. Etisalat maintained the gap to a small difference-making good use of the assets to generate income.

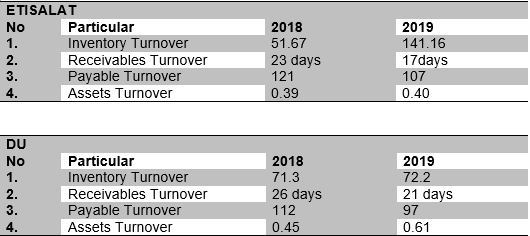

Activity Analysis

Activity ratios determine the company’s ability to convert available resources into cash. It gives figures on how the management uses its assets to generate income.

The inventory turnover of Etisalat has gradually increased in 2019 and the payable turnover means that it takes the company fewer days in 365 days to be able to pay its creditors. The trend is similar to that of Du as the distribution of days come related.

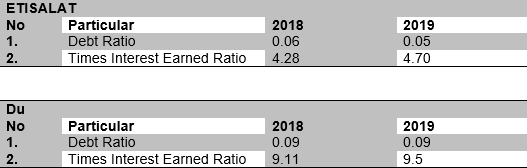

Solvency and Debt Management

Solvency measures the company’s ability to be able to compensate its long-term debts.

The Debt ratio of Etisalat is relatively low which means that they have had fewer debt amounts in 2019 when compared to 2018 and also fewer when compared to that of Du.

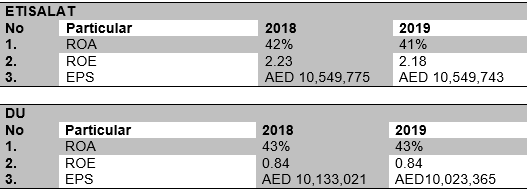

Profitability Analysis

This is commonly used as the tool for measuring the significance of a company. It gives the figures of how the shareholders and the company benefit through dividends and extra profit.

The Return on Assets for both companies is averaging 42 for the two years meaning the company is not using debts unnecessary to finance its operations. The Return on equity is also high which means that the shareholders are motivated to invest in the companies.

Conclusion and Suggestions

Liquidity Analysis

The current ratio of both companies is very low. They depend on debt to achieve their strategic plans which makes them be dependent. The companies should introduce tactics that they can use to utilize the assets to make revenue.

Activity Analysis

The two companies have maintained a good balance in the days they take to compensate for what they owe. This also applied to the customer turnover and that of their creditors.

Solvency and Debt Management

Both Etisalat and Du do not rely on Debt to finance their operations, which means they utilize their assets to create revenue and can be independent. However, their number dropped from 2018 and if they don’t take the necessary actions, it means that their debt ratio will rise.

Profitability Analysis

The Return on Assets for both of the companies was below average but at a good index. An improvement to the converting of assets into cash will improve their ROA and ROE which will also encourage more investors to stake in the companies.

Works Cited

Agwu, Mba, O. “Corporate Social Responsibility and Non-Financial Organizational Performance in Etisalat Telecommunication Company United Arab Emirate.” Journal of Business School, vol. 2 no. 1, 2019, 80-98.

Alarjani, Hasan, M. An Analysis of the Role of Competitive Intelligence (Knowledge Management and Business Intelligence) in Globalisation of Saudi Arabia ICT firms. University of KwaZulu-Natal, Westville, 2019.

Alghawi, Ali, and Mahra, Abdullah. “Telecommunications Regulation in the UAE: The Interconnectedness of Better Governance and Regulatory Performance.” Political Science Theses, vol. 10, 2019, pp. 1-132. Web.

Alshebli, Abdulla. Improving Capabilities and Strategic Fit in Governmental Agencies: The Case of Abu Dhabi Government Infrastructure Sector. University of Wolverhampton, 2016.

Ameen, Nisreen, and Robert, Willis. “An Investigation of the Challenges Facing the Mobile Telecommunications Industry in United Arab Emirates from the Young Consumers’ Perspective.” Econstor. International Telecommunications Society, 2016.

Du. Smart Dubai Announces the Smart Dubai Platform with Strategic Partner, du. EITC, 2016, Web.

Khatri, Hardik. “United Arab Emirates Mobile Network Experience Report 2020. Open Signal, Web.

Linares-Mustarós, Salvador, Germà Coenders, and Marina Vives-Mestres. “Financial Performance and Distress Profiles: From Classification According to Financial Ratios to Compositional Classification.” Advances in Accounting, vol. 40, 2018, pp. 1-10. Elsevier. Web.

The National Business. “Etisalat Cuts International Call Rates.” The National Business, 2020, Web.