Company back ground: overview

The organization that has been chosen for the purpose of research is Emaar, Dubai. The chosen company – Emaar – is a company which is into real estate development and which has its presence in more than 4 countries across the Middle East. The main purpose of the company’s existence is to provide new infrastructure across the countries which can be helpful to various people to attain affordable living. The company continuously and consistently applies new ideas in order to develop simple housing units. The company has over 200 workers and subordinate in Jeddah, Abu Dhabi, Ram Allah, Riyadh and Oman offering the same products.Emaar Dubai has been in operation in the Middle East since 1980’s and in 1990’s it’s established its earliest regional office. Emaar Dubai in the Middle East is the market organizer for venture, small and average trade and customer commodities and offers a great product portfolio of services.

The company always laid great emphasis on servicing all its stakeholders with high levels of integrity and utmost fairness. The founders of the company always stressed upon the fact that the company is always inclined towards sharing its success with all its employees, and in this process recognizing their achievements on an individual basis, and also treat all of its employees with great respect and trust. In addition to this, the company was always focused on ensuring customer satisfaction and shareholder satisfaction through its continuous innovative product development and service.

The aim of every business is maximization of profit and minimization of operation cost. This has been the focus of most multi-global corporations as they seek to expand their market through the identification of new marketing points. An employer or executive top manager working with global corporation, cannot rely on basic knowledge and skill learnt from limited work experiences in ensuring profit maximization and in launching offices, stores, or products in different locations around the world. Globalization is taking root and every business person has to move with the current while ensuring improved business strategies to withstand the stiff competition

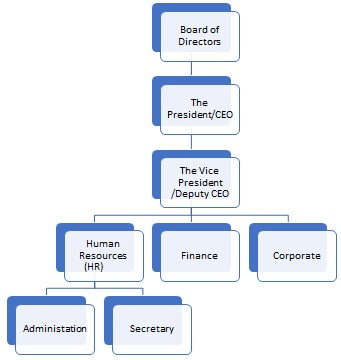

Organizational structure

The organizational structure of Emmar is as follows:

Corporate Objectives of Emmar: The corporate objectives of the company have the guiding force behind the company’s success since its inception. Customer Loyalty, Profit, Growth, commitment to employees, Market Leadership, Leadership Capabilities and Global Citizenship are the Corporate Objectives of the Company (Emmar, 2009). The company is successful in earning high amount of customer value because of its consistent and high quality of service levels. The company continuously explores the available opportunities in the market and grows which in turn makes the company more competent in the market. The company has got the advantage of market leadership as it strives continuously to design and deliver innovative products and solutions to its customers across the globe. The company is dedicated and committed towards economic, intellectual and social growth of the each and every country in which it has got its presence.

The most important value that the company gives is for its customers in everything it does. Uncompromising integrity, Results through team work, achievement and contribution, trust and respect for individuals etc, are some other values that the company shares.

The company believes that diversity as a crucial factor behind its success. The company has put in a lot of time and effort and dedicated itself to finding meaning behind the words like Diversity, Inclusion and Work/Life Navigation. This proves the commitment of the management and the leadership team towards human resources and developing an extremely positive organizational culture. These kinds of efforts on part of the management and the leadership team always proves to be a catalyst in performance because these kind of initiatives touch people at an extremely emotional level – in other words – they reach out to the hearts of the people and not just the minds. Further, whenever there is a commitment from the heart, one need not put efforts form the mind. Productivity, Passion, Performance and Dedication to the customer is by default and not just by design.

Organizational Behavior at Emmar: – The HR department acts as a bridge between the employees and the management. It is the responsibility of the HR department to advise the management on various issues that involves the human resources of the organization. As part of their jog, the HR personnel need to convey the decisions made by the management to the employees of the organization and also conveying the demands and wishes of the employees to the top management. The HR department also has the responsibility of designing and implementing various initiatives and acts that are aimed at the well-being and betterment of the employees of the organization.

Many developmental activities like training, management development, employee performance appraisals etc, are designed and implemented by the HR department, as discussed earlier. They actually facilitate these kinds of tasks. One of the major initiatives that need to be taken by the HR department of an organization is to prepare the organization and all its employees to successfully face the new and upcoming market challenges. This way, the HR department takes the role of a change agent and in order to do so, the people of the HR department need to be well-equipped.

Cultural Issues at Emmar

Organizational culture refers to a pattern of learned behaviors that is shared and passed on among the members of organization. It comprises of the various assumptions, values, beliefs, norms, rituals, language etc. that the employees in an organization share among themselves. The differences in values and beliefs held by people all over the world make adjustments and interaction with people belonging to other cultures very difficult for some. To be successful in the global economy, it is important for all managers to be sensitive to the differences between them. However, this became one of the major issues and challenges that the organization faced since its inception. According to analysts, the company’s culture that emphasizes on teamwork and mutual respect transformed into a consensus-style culture as the years passed and proved to be a major disadvantage to the company in the fast growing era of internet and technology which business oriented.

Business strategy: motives for expansion in international arena

International diversification helps in reducing risks that may affect business at home. If there is a slump in the economic environment international market gives an opportunity to reduce risks. To reduce international risks the diversification in adopted. It is healthy for business to concentrate on the most profitable opportunities and to leave risk diversification to the shareholders at the portfolio level. This is because share holders can eliminate nearly all specific risk from their portfolios by holding a reasonable large number (20 or so) of holding of shares in businesses across a range of industries within the country or across stock exchanges. The holding shares in different countries, risks that are systematic within one country, yet which are specific to that country, can be eliminated by diversifying into international securities. International portfolio diversification leads to a relationship between portfolio risk, on the one hand, and number of different holdings in the portfolio. The standard deviation which is a measure or risk for portfolios of increasing levels of diversification. The risk of the portfolio decrease significantly as the number of securities making up the portfolio is increased. This decrease is significantly more pronounced when international securities are included in the portfolio. There is a relatively low degree of co-relation between the returns from equity investment in one country and those from others.

Most companies go international because of the past and future of Competitive Advantage. This primarily deals with the marketing strategies prevailed in the past and present markets and discussed the competitive advantages as perceived by different business segments and their actual applicability in the competitive markets. Emaar faced changing scenarios of the competitive advantages as viewed in different point of time by different strategists and different companies. Therefore these issues contributed to their going international;

- The economies of scale, which can be defined as the reduction in cost per unit as a result of increased production, realized through operational efficiencies.

- The economies of scope, i.e., the benefits received through the production of a wide variety of products using the same available technology.

- Vertical integration, i.e., the sharing of single ownership by the integrated companies producing different products and combining the same for a common need.

- Competence in terms of new thoughts and action orientation in the organizational processes.

These key issues have been developed in the article using examples from the past and present successful companies in order to generate an insight about the competitive advantage that can be achieved through proper analysis of the market conditions related to each of these factors.

The company concentrated on the market conditions and situations specific to each company in order to gain competitive advantage with each of the separate factors affecting the performance, production and costs of the company (Christensen, 2001). According to the author for the purpose of forming a successful business strategy the strategists must analyze the conditions, which contributed in making a factor the competitive advantage for a company and how the factors applied to such conditions rather than just blindly following the existing strategies used by other companies.

The first factor discussed in the article was the economies of scale where steep scale economies with tools like growth share matrices, experience curves and industry supply curves have been exemplified. In this section the author focused on the linear relationship of the market share and profitability of the companies using economies of scale strategy as found in case of General Motors and IBM previously. According to the author steep economies of scale exist with high fixed versus variable costs in the business model enabling the large companies to amortize the fixed cost over greater volumes. But in contrast with the previous conditions, in the present day market with reduced in-process inventories, set up times for machineries and batch manufacturing process the scale economies have been flattened. Thus the linear relationship between market share and profitability of the companies has been removed completely (Christensen, 2001). The advantages were also seen to be transitory in the newer context rather than previous sustainable ones. In the present scenario, the competitive advantage in terms of economies of scale can change significantly with innovative technologies and huge mergers to get benefited from the larger economies of scale are not viable anymore for present scenario.

In terms of economies of scope a huge variety of product lines are manufactured to cover all the customer requirements. The companies with all the necessary equipments and huge stock base could easily overcome the competitions in the market in this case. But again with changing market conditions and invention of newer strategies like reduction of fixed costs and development of overnight air delivery systems smaller companies were also able to manufacture wide ranges of products without depending on the stock base and thus reduced the competitive advantage of the economies of scope. The author also considered the case of retail industry in this regard. The four distinct situations experienced by the sector as described in the article were the downtown department stores, mail order catalogues, discount department stores and finally the online retailing. These disruptive technologies removed one after another through the increased ability to offer the consumers the knowledge of the products and the place of their availability. With the increased amount of product specification in each retail outlet the competitive advantage of the departmental stores offering all products, i.e., the economies of scope lost their advantage (Christensen, 2001).

The third issue in relation to competitive advantage as discussed in the article was the vertical integration or non-integration by the companies. Previously it was seen that the ability to cover all the necessary activities of a company under single roof had significant advantage in competitive market. But under the present circumstances this strategy is proved to be disadvantageous making the company slow in production. Under present context with the availability of sufficient information regarding the requirements of the company, measurable technologies to assess the proper supply of the requirements by the suppliers and the required adjustments for any variation in the supply the non-integration or outsourcing was found to be more beneficial except for the specific new technologies developed at manufacturers’ level (Christensen, 2001). Under present situation when the newer variety of products may be less helpful for the consumers than the availability of products at a faster pace, non-integration rather than vertical integration has been found to be more suitable as a business strategy. In short it can be said that the market looking for improved performance of the products prefers integrated business strategies whereas the non-integrated approach is suitable for the companies targeting less performance oriented consumers (Christensen, 2001).

The final approach of the paper related to the core competence of any company in relation to the competitive advantage. The competence of technologies of any company is thought to be more enduring due to the inability of the market to copy the same (Christensen, 2001). But as a result of cost reduction efforts sometimes it is seen that the companies produce technologies much easier to be copied that thus lose the competitive advantage. Thus the entire discussion depicted in the article clearly explained with proper examples the conditions attached with each factor related to competitive advantage and indicated the requirement of deeper understanding of the market conditions in order to choose the most suitable strategy for the company.

Relevance to Marketing Strategy

All the factors discussed in the article are found to have significant relevance to the studies of marketing strategies. The economies of scale as a marketing strategy help big companies to access larger markets in terms of greater geographical limits. In the present context joint venture is used as a beneficial tool to use economies of scale and the small companies are also able to compete in the bigger markets. The joint venture helps small companies to use the existing resources without hampering the needs of the consumers, the big players of the market as well as themselves and thus the economies of scale find relevance to the study of marketing strategies in the present context with newer available tools.

The economies of scope are the comparatively new factor in the study of marketing strategies depending on the development of technologies. Batch flow or the group technology processes with the help of computer aided technologies not only reduce set up time and requirement of tuning between the products and processes but significantly increase the economic efficiency of the products. Thus the strategy not only helps in cost reduction but also in the production of newer variety of products providing the companies competitive advantage through product customization and customer focus and earns relevance with the study of marketing strategy.

The vertical integration as a factor of competitive advantage gets relevance to the study of marketing strategy due to the focus of the present market towards the non-integration. The study of vertical integration in terms of backward, forward or balanced integration techniques helps to understand the conditions under which the strategy is applicable. It also helps understand the conditions when non-integration or outsourcing may cause problems. Application of the strategies according to the customer needs is the most challenging part of the vertical integration process.

Finally the study of competence as the marketing strategy helps to identify the needs of the company to improve in terms of new thought and actions. This study helps to relate management and marketing more closely so that the internal processing of the company is reflected as its competitive advantage at the market level. The study of competence is also suitable to keep pace with the dynamic market conditions prevailing in the present day markets. Thus as a whole all the four factors of competitive advantage as described by Christensen (2001) have relevance to the marketing strategies in the present context and are helpful for future managers and strategists to improve their skills.

There are very many challenges that befall companies that want to expand and do business internationally. Companies have to make very important decisions before they begin to offer their goods and services in the global market place. They will also face various challenges that require vital decision making. They will also have to make some adjustments or changes in order to fit into the new country where they wish to operate. A company has to decide carefully on which country to enter, how to enter each country and here the country has various ways in which it can begin business in a foreign country. The first way is by beginning as an exported of its products to a new country. It can also begin joint ventures with other countries in the country where it wishes to begin its operations. It can also solicit contracts or decide to enter as a solo company. All these ways pose serious challenges that the company has to overcome in order to survive. The company has also a challenge of ensuring that people will adapt to its products easily and the pricing methods they will use to attract customers. Other challenge that will face the company include political legal systems of foreign countries, different negotiation styles of people who have different consumer buying behaviors, good or poor political climate and strength of the currency of foreign countries. Some of the major challenges that the country will face will be political factor and social cultural factors. Other factors are technological, economic and demographic.

As far as political environment of the country is concerned, in recent times the rule of the Al Saud family experienced significant threats from the opposition which enhances political risk, particularly for those who were planning to make investments on this land. Foreign investments have a crucial place in the development process of the economy of Saudi. Hence, the political challenges that the ruling government has recently faced raised significant fears amongst the potential investors as well as the established industrialists of the country. However, it is now being forecasted that in the up coming years the Al Saud Family’s rule in Saudi Arabia will not be threatened by the oppositions as opposition parties have lost their strength owing to their fragmentation. Thus the strong opposition that has been experienced in recent times against the current ruling party has suppressed by some extent and will be fully suppressed in near future.

As far as the economic goals of the present government of Saudi is concerned, it is expected that the government will place its emphasis more on economic development and will put huge efforts to speed up the rate of growth in GDP in the face of ongoing global recession. Government has prioritized its economic goals than its political aspirations. Hence it is forecasted that the municipal election that has been scheduled to take place in 2009, will now be delayed in order to accomplish the economic goals on a priority basis in order to protect the nation from the global economic down turn. As far as the investments in oil sector is concerned, it is forecasted that global economic slow down will not place huge obstacles for making investments in the oil sector of the country. Favorable political situation might be the factor for encouraging investments in oil sector for the up-coming years. Irrespective of the level of investment by the private companies, the oil company of the state will continue its investment in the production of oil for attaining expansion in the production of oil and natural gas by large scale in near future. However, some refinery projects are expected to experience some delay

Political factors will affect the company because it will have to adjust and fit into the political situation of the foreign country. Some of the political barriers will be vastable governments which have bad officials who award businesses with corruption to highest bribers instead of lowest bidders. Other government will impose high tariffs to protect their home industries. Poor political environment will make the countries to place many regulations on the entering country to scare it off. Political environment is also inclusive of laws, government agencies and pressure groups that will form a barrier to entry into a particular country. There is however hope because some political factors can also create some opportunity to countries. The company must therefore know all the major laws protecting competition, consumers and the society of the country that it wants to enter, before they decide to expand into the country.

The cultures of people in different countries can affect the marketing strategies that a company will use as it enters new international markets. The company has to consider vary many factors of the new international, market place, some of these are political factors, social factors, economic and technological factors. Looking at the social cultural factors ethnocentricity is a major factor especially if the new marketplace is in a country with diverse cultures. This is a major challenge because most of these people hold so much to these cultures that it is very difficult to make them adopt your product and your marketing strategies.

To enter a market like the Japanese market one must understand that they do not consume other products like pork as an example because that’s some of their cultural beliefs This means that in order to enter such markets one has to understand the practices of the people in these regions, their cultures and other influences like customs ethnic differences attitudes towards the products or services e.t.c. The cultural activities of these people desires and their likes and preferences, these equip the individuals of the communities with certain value systems and on the other hand compel individuals and the community to comply with certain demands and participate in certain activities.

Other factors to consider are the economic factors of the new country. How the people spend their money, their power to purchase products and the income distribution among the people I the foreign country. Some people also have different patterns of savings and borrowings. This should be taken to serious consideration also. Some countries also have huge foreign debts, high inflation and high unemployment of its people. This leads to foreign exchange problems that will lead to foreign economic instability and the decrease of the currency of the country in value, hence the country should focus on these factors in order to make decisions whether to go international or not. Some of these factors may lead to threats or opportunities.

Emaar situation in Dubai

Faced with diminishing growth prospects, the company is chasing one of the few demographics still walking the streets largely without using their services. This will give an impetus to the rather docile market trend of the present. With demands going up, there will be scope for expansionism, leading to more employment opportunities. Competition is getting hotter, and so too will production. Introduction of new technology opens the doors for new avenues of employment and greater GDP growth.

With its marketing machinery, Emaar is poised to become the poster child for the new breed of companies in the market with good products and services. However, they will not be alone, for they will have their share of rivals. The government can play a major role in the development of the industry to generate further employment opportunities and GDP. To exemplify this, the Saudi industry has contributed substantial money to the country’s GDP.

Globalization marked the entry of many competitors into Dubai to enjoy Capital incentives and other liberalized services from the government. Factories were set up to take advantage of the existing cheap labor force. Many Immigrants also contributed to the assembly line and this gave the foreign companies scope to multiply their sales and profits. Because of this, a large number of Dubai companies have developed under the government’s protection, and now compete with foreign corporations not only in the Dubai market but also in third-countries. This invariably increase foreign exchange earnings, and at the same time increases employment opportunities in the country.

Expectant Revenue Generation

Technological advances will help boost revenue and increase employment opportunities in the industry. A lot of innovativeness were seen and discussed along the way. One such feature that led to enhanced sales and production of products and services was the introduction of other services such as healthcare. Global revenues will take the company skywards. It is projected that there will be an accelerated growth of users, expanding was the best option.

Competitive advantages and mode of entry strategies and why they enter in Saudi market

Investment encompasses the transfer of physical capital and intangible assets such as technology. Corporations go abroad to invest capital and knowledge, to source goods and services from areas that offer such specialization, and to improve competitiveness driven by the availability of cheaper labour, specialized skills, inputs, logistics etc in an internationalisation process for firms to have cross-border multi-facility operations (Alfaro et al, 2005).

Investment abroad can take several forms. One way is investment in the stocks of promising companies for a profit motive – this is not the intention of our company. Investment can occur through mergers and acquisitions (M&A) of domestic companies or through green-field investments. While takeover of a company provides advantages of a quick start and lower investment, it severely compromises our ability to set up production facilities to meet our standards. Despite these observations, most mergers and acquisitions do not yield long-term benefit for the acquiring company or for the one taken over. For example, studies by Ravenscraft (1991), reveal that efforts to enhance market position through mergers yield no better performance, and sometimes worse. Statistics show the failure rate of most mergers and acquisitions lies somewhere between 40 and 80%. The layoff of employees and closing of some production or functional activities that accompany acquisitions are harmful to the economic development of the host country (UNCTAD, 2005). Therefore, the Saudi authorities will not appreciate acquisition of existing industry.

The most appropriate for Emmar is to make foreign direct investment (FDI). This is because it plays a pivotal role in global business. It can provide a country with marketing channels, access to new technology, cheaper production facilities as well as financing. The host country can get new technology and management skills as well as capital. Balance of payments refers to the transactions that a given country makes with the world. Balance of payments gives an indicator on the impact of FDI in a country. This paper aims to critically analyze the impacts of FDI on the balance of payments in developing countries. It starts by a discussion of FDI and balance of payments in relation to developing countries and ends with an analysis of a case study of Bangladesh as a developing country.

Foreign direct investment has currently taken many forms for example it could be an investment in a strategic alliance or a joint venture with a local firm which has licensing of intellectual property. High technology is the new entrant in FDI and capital investments and it does not require huge outlay for machinery, fixtures and plants. The high technology ventures tend to have a longer incubation period than other types of ventures. FDI plays a big role in making a business operate on a global level. The reduction of global communication costs has made FDI easier than it was in the past. Foreign direct investment benefits both the host country and the beneficiary country.

Foreign direct investment is important since it helps companies to achieve many benefits. Some of the benefits that companies get as a result of FDI are; increasing the total production capacity, circumventing of trade barriers, avoiding the pressure for local production which emanates from the local government, providing opportunities for joint marketing arrangements, licensing and joint ventures with local partners.

The balance of payments is a list of the transactions that a certain country has with other economies in the world. It is composed of three main elements. The elements are; the current account, capital account and financial account. Capital account refers to international capital transfers for example non financial assets such as patents. Current account involves international transactions in income, goods, current transfers and services. Financial account refers to transactions that have financial liabilities or claims to the rest of the world. This includes international purchases of securities such as stocks and bonds. The receipts and payments that arise from a country’s transaction with the rest of the world are recorded in that country’s balance of payments account. When the receipts of particular country exceed the payment, the balance of payments account is said to be in surplus. When the receipts are less than the payments from all transactions, then the account is said to being in deficit.

Balance of payments

Most of the developing countries have very complex trade regimes. The simplification of these regimes would be of great benefit to the developing countries since it would improve efficiency of resource use as well as promote the economic integration between developing and developed countries. The constraints in balance of payments in developing countries have influenced trade policies to a great extent. The payment restrictions in developing countries make it hard to identify the effects of trade policies in these countries. The difficulties faced by developing countries in the context of the balance of payments can be seen through a research that was carried out in 35 developing countries. Most of the countries have increased their reliance on restrictions while some have liberalized their restrictive systems. The efforts made to adjust the balance of payments in developing countries have not only been focused on lining up aggregate demand with supply, but also at the encouragement of improved supply of resources throughout the economy over the medium term (Morton & Tulloch,1997 pp. 246-250).

The developing countries usually have a deficit on their merchandise and invisible trade. The deficit of invisible trade in developing countries characterizes all the external payments of these countries and this is closely related to their underdevelopment. Large debit items in developing countries are marked in terms of insurance and freight. Some of the developing countries that export oil have surplus on goods and services like Saudi Arabia. The net factor services form a negative item in most of the developing countries’ balance of payment accounts. This is a reflection of the fact that developing countries are net importers of foreign capital in their pursuit of economic development (Shailendra, Kirmani & Petersen 1985, pp. 8-12).

In most of the developing countries the transfer of payments item is in surplus as a result of the grants that are offered to these countries. The oil exporting countries are however excluded from this surplus. Developing countries need to run an import surplus that is financed by long term capital inflows and grants because they lack savings and foreign exchange. If the grants, export earnings and inflows are enough to finance export requirements as well as debt from past capital inflows, then an import surplus does not cause any payment difficulties. If the balance between the payments and the receipts is upset and hence leading to a deficit, it is most likely that the developing country’s development efforts will be adversely affected unless it can draw on its reserves. The prevailing balance of payments pressures, the scope of corrective domestic policies and the extent of distortions are some of the factors that have led to a variation of the steps that the developing countries are taking towards liberalization (Morton & Tulloch 1997, pp. 246-250).

Foreign direct investment has had major impacts on developing countries. The impact that FDI has on a given developing country is influenced by many factors and polices that exist in the country. The most important form of measurement is through an assessment of how policies in the host country favor the expansion of exports and import substituting production.

Positive impacts of foreign direct investment

FDI inflows to developing countries improves the balance of payments adjustment processes in countries that have more open trade policies since this encourages sectoral composition of foreign direct investment flows. The magnitude depends on some factors in the host country. A review of major studies that were conducted to analyze the impact of FDI on developing countries balance of payments revealed that it has a positive impact in the long run. The research was conducted through an analysis of payback periods and also took into consideration all the possible cash flows including the components of subsidiaries to exports, remittance of earnings from subsidiaries and initial capital and equipment exports. The most important factor in this study is the relevance of export in the absence of investment. A similar study also arrived at the same conclusion and this was based on calculations of related dividend, fee payments and royalty. The results of the study also indicate that industries that have low FDI also have own export levels and vice versa. It was further concluded that performance of exports tends to improve as FDI increases up to a certain point, but beyond this point, additional FDI does not promote exports. (Lee 2002, pp. 104-115).

Negative impacts of foreign direct investment

FDI can have a negative impact enveloping countries. This is because the fiscal and financial incentives that are given to foreign investors may do more harm than good if the incentives tend to discriminate against small local investors and local firms. This therefore means that domestic firms can be harmed by high FDI inflows, for example in Morocco. This therefore implies that the domination of the effects of negative competition by the positive technology effect may lead to a fall in the productivity in the domestic market (Lipsey 2000, pp 67-95).

A research that analyzed the effects of FDI on national income revealed that about 25% of the projects had a negative impact on the national income. The main reason of this negative impact can be attributed to the protectionist measures that are granted to the firms that undertake FDI projects in foreign countries (Lee 2002, pp. 104-115). Although FDI does have an overall positive impact on the economy of a developing country, it is important to note that this positive effect is determined by several factors such as human capital as well as other institutions that are put in place to attract FDI. A research on the effects of FDI on economic growth revealed that the host country’s human capital limits the absorptive capability of a developing country. FDI can also contribute to the worsening of the environment in the host country as well as increase interregional inequality (Lee 2002, pp. 104-115).

Impact of foreign direct investment on Bangladesh balance of payments

Foreign direct investment in a developing country like Saudi Arabia can be a very important tool to create employment, build up the physical capital, and to enhance the skills of local labor through advancement in technology. FDI generally has a positive impact on the Saudi Arabia economy. FDI inflows in Saudi Arabia have increased tremendously over the last few years. There are various factors that have contributed to this such as; the liberalization of trade and exchange, the emphasis on the development of foreign and domestic private sector, investment regime liberalization, the opening up private sectored infrastructure and current account convertibility. The main factor that has led to the increase in FDI inflows is the interest that foreign investors have shown in the telecommunications and energy sectors in Saudi Arabia.

The FDI inflows in the energy and telecommunications sector in Saudi Arabia has very little impact on foreign exchange reserve accumulation due to the heavy import content that is associated with it. Saudi Arabia is therefore not able to generate adequate foreign exchange that would finance remittance of income originating from foreign investment and profits. The outstanding stock of private sector debt in Saudi Arabia has reached alarming levels.

The result of a research done on the impacts of FDI on developing countries showed that the inflow of FDI can crowd out or crowd in domestic investment in the company and this would depend on specific circumstances. Looking at the issue of FDI in Saudi Arabia in an overall manner, it can be noted that FDI has a major positive impact on economic growth. It is however important to note that the magnitude of the impact is highly dependent on complementary resources especially in terms of human capital. The FDI inflows in Saudi Arabia are usually reported under the financial and capital account of the country’s balance of payments statement which clearly shows the direct effect that FDI has on the balance of payments.

FDI inflows play a key role in the determination of deficit or surplus in the financial and capital account of the balance of payments statement. It can therefore be concluded from the above facts that the initial impact of an inflow of FDI on Saudi Arabia balance of payment is positive but the medium term effect could turn out to be negative or positive as the investors increase the import of their intermediate services and goods and begin to repatriate profit. In most occasions the FDI inflows tends to have a great positive magnitude by augmenting imports other than having a negative impact by increasing imports.

Another positive impact is the fact that initial inflow of FDI increases the host countries imports. This can be explained by the fact that the FDI companies have high propensity to import intermediate services and goods as well as capital that is not readily available in the host country. FDI can also negatively affect imports when it is concentrated in import substituting industries. This is because the goods that had been previously imported would be produced by foreign investors in the host country. Foreign direct investment has many benefits to a developing country’s economy and this would explain why the inflow of FDI in developing countries is continuously increasing. FDI can also have negative impacts such as the neglect of domestic firms and pollution.

Challenges, issue, and prospects

Saudi Arabia is the place where Islam was born. The culture of Saudi Arabia is very conservative. The nation’s economy is oil based. American geologists tracked oil fields in the year 1930. The wealth of oil is such that it has caused an economic development in Saudi Arabia. The largest reserves of oil are found in Saudi Arabia. Saudi Arabia has become the leading oil producer. Along with that it has also become the leading oil exporter. More than 90% of the country’s export is accounted to oil. It contributes approximately 75% of the government revenues. Oil reserves of the nation accounts for 25% of the world oil reserves. Saudi Arabian government produces 95% of the oil. During 1960’s the growth was modest but it was stupendous during the 1970’s. Now the question is why it had such a success during the 70’s? The answer lies in the Arab Israeli war during 1974. It contributed heavily to the overall rise in the petroleum revenues of Saudi Arabia. It became one of the quickest growing economies. It enjoyed an abundant surplus in its overall trade with other countries.

Rapid rise was there in the imports and this helped the government with excess revenues. The largest reserves of oil are found in Saudi Arabia. But now due to the higher oil prices the global consumption has taken a toll. This is the reason why most oil fields in the world are developed. This also created a deficit in the overall budget of Saudi Arabia. During the early 80’s the production of Saudi oil was 10 millions barrels per day (b/d). However it dropped to around 2 millions barrels per day (b/d) during 1985. This caused the budget deficit in the Saudi Arabian economy and the government had to sell off their foreign assets. This disaster also forced them to accept production quota. In relation to the dependence on petroleum there has been a considerable growth in agriculture and industry. The five-year development plans were very impressive in building up the economy as a whole. In their first two five-year plans focus was mainly given on the development in the building highways, power generation and seaports. The results were excellent. The numbers of paved highways were tripled. A big rise was seen in the generation of power. In addition to that capacity of seaports had grown tenfold. Third five year plan focused mainly on the education, health & social services. During this period there was no expansion in the productive sectors. However two cities Jubail, and Yanbu had other ideas. Country’s oil and gas was used for the production of ‘steel’, ‘petrochemicals’, ‘fertilizers’ and other ‘refined oil products’.

During the fourth five-year plan the focus shifted to the foreign investments plans

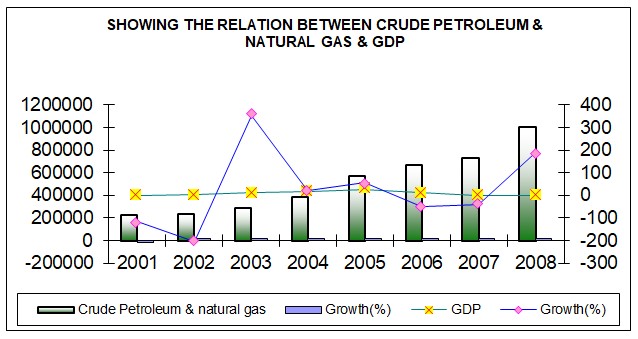

Encouragement was given to the private enterprises. Foreign investors were encouraged to come and invest in Saudi Arabia. Public and private organizations formed joint ventures with the foreign entities. The fifth plan focused mainly on the improvement of the country’s defenses. The sixth plan tried to reduce the cost of government jobs without creating job losses for the people of Saudi Arabia. (“Country fact sheet: Saudi Arabia”, 1994). A graph can be presented to show the recent trend between the growth of ‘GDP’ & ‘crude petroleum & natural gas’.( CDSI, 2007)

In relation to the above mentioned point the World Bank has also approved of the strong position of Saudi Arabia in their annual business report. Saudi Arabia has got the 13th rank in the world. The World Bank has also ranked Saudi Arabia ahead of developing nations such as Japan, Germany, France & Switzerland. The main reason for which Saudi Arabia has improved their business is due to the reforms they have undertaken. The reforms have made it easier for foreign companies to start business in kingdom due to the reduction of time, cost and complexity. The significant improvement which has been seen in case of Saudi Arabia is due to the vision undertaken by “His Majesty King Abdullah”. Encouragement has been shown in the established “SAGIA” (foreign investment law) which gave confidence to the foreign participators. Achieving membership in the WTO as well as privatizing public companies has only yielded benefits for the nation. Economic growth can only be achieved if there is competitiveness. Saudi Arabia has encouraged entrepreneurship and has created new jobs for their people. In addition to the business report of the World Bank another key component has shown the development in the business of Saudi Arabia. “United Nations conference on Trade and Development World Investment Report” have also shown that the foreign direct investment(FDI) have been on the upsurge for Saudi Arabia. During this hour of financial crisis FDI inflows have kept on increasing for the nation. In 2006 the total FDI totaled around USD18.3 billion but the regulatory reforms and improved business conditions have only taken that figure to USD 4 billion in 2007. (“World Bank Recognizes Saudi Arabia as the 13th Most Competitive Economy, 2009).

However the Saudi government is taking some strategic steps to reduce the dependence of oil in the national economy. Around 30 years ago oil contributed around 60% to the overall GDP of the nation which has dipped now. At present it has fallen to 45%. Government is stressing on other sectors and hoping that the percentage will keep on declining. The government believes that any economy cannot stand on one commodity. The reason is that it believes that the income from this commodity is subject to major fluctuations. An example can be provided in this light which shows that in the recent past the production of oil has increased from 7.5 to 9.5 MMBD. On the other hand it was seen too that the prices have increased to a record high level of $100 per barrel but less than a decade ago the price was reeling at around $10 per barrel. The kingdom is hence focusing on the growth and development of the other economic sectors. Reforms and restructuring have been seen in the sectors such as water, electricity, commerce and industry. The kingdom’s economic growth and prosperity have a direct impact on the other countries of this region. The people of other countries are affected by the trade exchange, movements of capital, investment and recruitment of citizens. The kingdom has a workforce of around 6 million and these people are transferring whopping money of $18 billion. This transferring of money is directly related not only to the financial and economical sides of the nation but it also affects the social side. (“Saudi Arabia’s Petroleum Policy and Its Economy, 2009).

Analyzing SWOT of Saudi Arabia’s economy

Strengths

While discussing the strengths of Saudi Arabia’s economy the factor of oil and petroleum industry comes as the major component. The factors that are integral in the development of the oil industry are high oil reserves, ability to produce them at a lower cost, huge spare capacity in terms of production and the close linkage between oil industry and the national economy. In the past years it has been seen that global oil reserves have increased by 400 billion barrels and Saudi Arabia itself is contributing to one quarter of that total reserves. In relation to this it has been determined that Saudi Arabia is able to generate one barrel of oil from three barrels of oil production. An example can be illustrated in relation to this. In the rest of the world (if global average are considered) the cost of production comes around $5 per barrel while in Saudi Arabia it takes less than $1.5 per barrel. Another advantage that can be stated is the cost related to the adding of new reserves. Globally it costs $4 to discover a new area whereas in Saudi Arabia it costs around less than ten cents per barrel. An example can be related to this. Shaybah in Saudi Arabia is the most remote area but from there an oil field has been discovered. Being so far from the city the government had to build a 240-mile road and a 400-mile pipeline to connect the oil field. The field contributed to around 50000 barrels of oil & the cost associated with that was $2.5 billion. The production of spare capacity and maintaining it do incur a cost. Saudi Arabia’s ability to manage these costs gives a strong idea about the financial strength of the nation. Oil is very essential in developing the sectors.

Investments in the natural resources of hydrocarbons and energy by the foreign participators show the dynamic growth potential of the economy. (“Saudi oil policy: stability with strength, 1999). In 2008 the Saudi Arabia’s economy has gone for a booming growth in spite of the tricky global economic outlook. Global financial turbulence did not have any impact in the overall Saudi Arabia’s economy. In that same year the real oil GDP grew by 5.6%. This has also built up the net foreign asset position thereby showing a positive result on current account and fiscal account. Due to this the economy has able to come out from the susceptibility of trade shocks and fiscal deficits. The crude oil output is expected to increase. The oil sector remains as the core economic activity in Saudi Arabia. The growth in the GDP has ranged from 3.1% to 3.4% in 2007 when compared with the previous year. It is determined that the income from the oil exports will rise by 26% in the year 2008. When total exports are compared it is seen that the figure is determined at around $289 billion in which oil exports are contributing at around $259 billion. In comparison to the exports the imports have also grown at a pace of 11%. In case of current account surpluses the economy is expected to touch a figure of an all time high of $138 billion. The growth in the economy is due to the booming external position of net foreign assets. The increase in the oil income has only raised the surplus of the budget. Facts and figures can be provided in relation to the above-mentioned point. The budget of Saudi Arabia is expected to have a surplus of SR565 billion in 2008. The growth is stupendous from the last budget where the surplus was in the region of SR40 billion. Due to this effect the money supply of Saudi Arabia has also increased to 19.6%.

The FDI flows of the kingdom are on the rise and the rise is expected to continue in the following years too. Saudi Arabia is enjoying the role of the top oil exporter and most importantly the boom is led by the private sectors of the economy. Judicious macroeconomic management coupled with proper use of oil revenues has stimulated the development of the private sector. This has certainly helped the government to reduce the burden of debt. Structural reforms, diversification in the economy and the coming of age of the private sector has all combined to help the economy grow. This has also combated the economy from oil price shocks. Standard & Poor, “the global rating agency” have determined that the foreign reserves of Saudi Arabia will be around $220 billion by the year end of 2006. The growth in the foreign reserves is expected to be around 55% from the year2004.

As in the report of 2009 it has been found that Saudi Arabia has reduced the import of gasoline. The reduction rate is approximated at around 29% and this decision has arrived after Saudi Arabia has successfully managed to increase its capacity. In addition to these it needs to be said that the performance in maintenance work has gone up. At present the country is importing gasoline at a rate of 57000 barrels a day while previously it used to import 80000 barrels a day.

Weakness

The over dependence on the natural resource can proved to be fatal for the Saudi Arabian nation. In addition to that the prices of oil tend to fluctuate more, which can have a direct impact on the overall earnings of the nation. Another cause of concern can be the starting of oil futures market in the early 80’s. This causes volatility in the market. This is the one biggest factor of concern as it is affecting the oil prices directly. Too much fluctuation is a cause of concern for the producers, customers and investors. The unstable oil prices hit the Saudi Arabian economy in the early years of the 21st century. In addition to these the economy was also weakened by the stiff competition from the international trade blocs’ unemployment and huge budget deficit. The country’s one of the biggest problems lies in the huge budget deficit and balance of payments. Joining WTO has not helped the economy in a big way as the deficits are still there. Joining WTO means that it has to integrate its economy internationally but in doing so it must remember that it should not falter in its overall budget deficit and the balance of payments. This proves to be the competitive disadvantage for the nation.

Rise in inflation can be the other main cause of concern for the nation, as it will drastically reduce the cost advantage of petrochemical industry in Saudi Arabia. Also another disadvantage that the company might face is in the availability of the feedstock. The biggest factor in providing petroleum at a lower rate is because of the cheap availability of the feedstock. This gave the industry a big cost advantage. However it seems that the countries have outpaced the production of feedstock. In addition to these the rise can be expected in the prices of feedstock in the near future. The rise will obviously hurt the petrochemical industry of the nation. Spare capacity can sometimes prove to be fatal for the nation itself hence producing must be checked in for the betterment of the petrochemical industry. (Al-Mady, 2007)

Opportunities

Investments in the energy sector clearly remains in the economy. Producing oil and gas are the main areas that Saudi Arabia is focusing on in the future years. As in 2000, the foreign companies in Saudi Arabia invested around $100 billion in the next 20 years. The sectors they are focusing on mainly are oil and gas. “ARMCO” which is a national oil company will participate in the implementation of the projects. Investment in the Saudi energy sector is the need of the hour at this point. However the move will totally depend upon the regional, national and international developments. IOC has made an investment in the Saudi Arabia’s energy sector. This investment in the energy sector can be viewed up in an analytical manner. Saudis are mainly interested in stimulating their economy. They want that newer jobs should be created and at the same time expansion must occur in their petrochemical industry. In addition to these they want free oil for the purpose of exporting. However IOC’s have different viewing on the investments that they have made in Saudi Arabia. They want to maximize their profit and create a base in Saudi Arabia.

The main reason behind this establishment is to create an opening for them in the country’s most profitable oil sector. As in the report of 2004 it has been found that Saudi’s proven gas consists of 60% associated and 40% non associated. Crude oil reservoirs are the main means of producing associated gases while for the non associated gases it is not obtained from the considerable volume of crude oil. Non associated gas development can be beneficial as it is utilized independently. Also it does not consider the volatility in the output of oil and its prices. The nation’s gas consumption is determined at a growth of 3.7% per year from 2004-2025. The growth in the natural gas is very useful as it helps in the generation of power and water desalination. As on 2003 a report showed that Saudi Arabia wants to join the WTO. The reason is definitely economic, as the country wants to enjoy the removal of trade barriers against its petro chemical exports. In addition to these overall business in Saudi Arabia can gain strong competitiveness and enhance their productivity in the future years. (“Saudi Arabia eyeing early accession to WTO, 2003)

Threats

Shortage of oil supply can hamper the overall economic growth of the nation. This can only happen if there is a decline in the investments. This will shut the doors of development of newer oil fields and the search of new deposits. This can also stop the steady growth in the production and the production capacity. Oil prices will also be affected by the wrong investment strategies. Rise of the terrorist attacks in the nation is not a good sign as the foreign investors may pull out their investments from the country. An e.g. can be related to this where in 2004 militants attacked an office of foreign petroleum. In that same month the militants attacked a complex housing of oil.

The attacks are not able to stop the production as well as the export made to the other countries. But the biggest problem may lie in the psyche of these foreign investors. That’s why it becomes more important on the part of the nation to provide security to the energy installations and to the foreign workers. Russia also possesses a threat for the Saudi Arabian economy in terms of oil exporting to the European Union and the Unites States. As in 2004, it has been found that Russia holds the top position in the exporting of natural gas. In addition o these they also hold the second largest position in terms of oil exporting. It has been found that Russia’s production is on the rising spree and it is asking the EU and the US to reduce over dependence on the oil production of the Middle East. Both the EU and US have responded positively to the calling of Russia and it seems that the over dependence of oil from Middle East may shift. This is an early sign for the Saudi Arabian nation to quickly realize the situation as it may cause them the foreign investment in their sectors of oil and gas.

Recommendations

Business capabilities of Saudi Arabia only look bright as far as the future goes for them. Recently they were placed as the 13th most competitive country among the rest of the world. They are at present eyeing the 10th spot in terms of overall business. This has only made the government realize that more reforms can be undertaken to achieve its target. Various positive as well as negative views may come in when reforms are spoken about. Regarding the privatization of the nation the country has been immensely benefited. There are several other areas where the country needs to focus on. Firstly speaking about the immense mineral resources it possesses. The minerals are in such abundance that the economy can be immensely benefited by it. Through crude oil to petroleum products it has been able to deliver great business for the economy. However some places it still need some resurrection.

The government must remember that producing excessive oil in spare can prove fatal for their sake. Yes it’s a fact that oil is one substance that everyone will have to take but sometimes over producing it may hamper the demand and supply for the overall global economy. Newer field extracting is a good sign and for that relevant cost associated with it in terms of having proper technology is acceptable. However too much dependence on a particular commodity is not a good sign. Every country’s economy initially started off with a particular commodity but later on it shifted to some other products. It’s not that the Saudi Arabian nation is not thinking on those lines and that’s why other sectors are now given priority. To emerge as the best business nation in the world only dependence on a particular commodity will not help the cause. One of the major sectors that Saudi Arabia is focusing on is the generation of gas for which newer technology is implanted. Also the fact is proper investment has to be made in proper places. Just for the sake of having a particular industry does not mean that the overall objectivity of diversifying into another sector has been achieved. That’s why investing into natural gas can prove to be a corner stone for the country. In addition to these, another thing that needs attention is the rising terrorism in the Middle East nation.

Foreign investors when come to any particular country they expect safety from the government of another nation. But if the safety factor does not meet its requirements the foreign participators may shift out of their country. This may cause a dent not only to their current projects but might also cause a concern for the future. Finally the rising volatility is the biggest threat to the pricing of oil. Since the rise of oil futures in the early 80’s the price have kept on fluctuating. Controlling can be done if the financial tools such as options, futures and derivatives can be properly applied. In case of business, the oil exports as well as the non-oil exports has to be compared with the overall GDP of the economy. This needs to be done to find out the exact growth of the oil and non-oil products.

Though Emaar limited is able to compete effectively in the market with strong competitors, it has not achieved in meeting the right managerial economic practice which is desirable for achieving maximum profits in the company. One such area is advertising and promotion of its products across the Saudi Arabia which is the potential market. Promotion is a very important factor in managerial economical which has to be organized and financed well. A well organized promotional strategy will make the company sell more of its products and thus achieve the set goal of getting profits. It’s a strong recommendation that Emaar Company should review its promotional strategies and adopt the best which will make it outstand in the market. Such strategy should not be biased to a few countries only but should cut across all the nations.

Another recommendation that will allow it to create more profits is doing a thorough research in the market. Research will help to find out what the consumer requires and at what time. It will therefore make the company provide all the products that are demanded by the consumers without bias or favor. The several growing needs of people and knowledge demands that the company needs to do a research that bases on the customer needs and not what the stakeholders or the management says.

There is a great need for the company to be able to embrace the use of various technologies in development of its products and in promotion strategies. Advertising today in the media takes several forms, the advent of Computer networking making it even easier for promotion of products to occur.

Managing International Business

In order to manage international businesses in an effective manner, adopting a competitive strategy is the best method. Effective formulation of strategy needs clear understanding competition. Competition in an industry is determined not only by existing competitors but also by other market forces such as customers, suppliers, potential entrants and substitute products.

Strategic Management

A mature market poses the biggest challenge from the stand point of strategic management. This is because the mature market is already saturated. Strategic alliances are formed to maintain the leadership of the companies and also to protect their core business. Strategic alliances would make more sense in emerging markets because emerging markets go through a continuous phase of development. While forming a strategic alliance it is important that the companies look at mutually beneficial goals instead of individualizing them.

Organizations should evaluate several dimensions of international environmental uncertainty before choosing an entry mode. Organization design changes when entering different types of markets. Upstream activities like R & D, manufacturing etc would remain the same but when it comes to downstream activities like marketing, distribution etc. changes may be required according to the market that has been entered. The local infrastructure of the particular market is also one reason for this. The markets are likely to influence the behaviors of the employees. Inadequate infrastructure and insufficient resources are the most important challenges posed by emerging markets.

Managing Business Operations

Managing business operations is indeed a great challenge that many organizations today are facing. International management of business operations requires organizations to carefully match and monitor many aspects like the market demographics, the growth potential of the particular market and also potential competition. If an organization successfully plans and maps all the above mentioned aspects, managing business operations at an international level would definitely be easy.

Marketing Management

Emerging markets have a certain amount of unexploited markets with a little amount of unexplored resources. This is not the case with mature markets. So, marketing management activities in emerging markets will be profitable and beneficial to firms. Both the markets need to understand the tastes and preferences of the market. However, marketers in emerging countries, by doing so, can design and develop products for them exclusively.

Operations Management

In order to operate in emerging markets, firms need to identify, investigate and manage te various business operations of the market. the business environment in emerging markets is traveling at a fast pace towards mature or advanced markets. The variations that need to be addressed between emerging and mature markets would be the macroeconomic structure, the currency exposure and the exchange rate system and also certain issues of business ethics.

Human Resource Management

In an international environment, the work force of a form has to interact with people from different countries. The complex organizational structure of multinational firms tests the manger’s interpersonal skills to the limit. The leadership styles of people in different countries vary greatly. The work culture in emerging markets like Japan is totally different. People in such markets are not used to privacy at work place. They rather prefer to mingle with everybody and they also have an unhindered flow of communication. These kind of situations does not seem to be present in mature markets. There are a lot of differences in terms of culture, perceptions, behavior and participation etc, among the workforce of different kinds of markets. Firms need to know the host country culture and try and get information about the perceptions and cultural difference of the people and design their policies accordingly.

Conclusions

In the year 1930 when an American geologist’s discovered oil from the fields of Saudi Arabia it was never anticipated that the foundation will lead Saudi Arabia to become one of the super powers in the economy. The economy has seen the highs and at certain points it has faced some lows. The highs were mostly contributed by the overall production of the oil in these years. But just like any other economy Saudi Arabia too cannot survive in only the production of oil. Yes it can keep on producing it but to become the superpower in the world it has to shift into other sectors too. The petrochemical industry needs various competitive advantages in its costing so that it can contribute immensely in the overall economy. Newer investment in the energy sector has to be greeted with positivism. Privatization is also a new concept that the ministry of petroleum has executed and this kind of reforms only look better as it takes the overall economy in a new direction. Allowing foreign companies to take part in the overall business of the nation through joint ventures with public and private companies is another major step taken by the government. The biggest advantage that Saudi Arabia has is the low cost of production of oil in comparison with the other countries. However some precautions the government has to undertake so that excessive production may not provide the competitive cost disadvantage to Saudi Arabia. Rising prices of oil is the biggest problem for any nation hence this has to deal with immediate seriousness. Demand and supply interaction demands the production capacities to be kept at a tighter level.

Rapid growth and transformation of the Saudi Arabia economy since beginning of economic reforms, driven by trade in the international and domestic arenas as well as the massive injections of foreign direct investments that came into the country primarily to establish new industry, have underscored its transformation since 1979.

The problem of its artificially pegged currency rates remains. Despite pressure from all quarters, the Saudi Arabia government has so far resisted floating its currency in international money markets. If, and when this happens, the currency is likely to appreciate through a huge margin making Saudi Arabia export less competitive in world markets.

As the situation stands today, and in the near future, the advantages of establishing a new facility in Saudi Arabia far outweigh the probable disadvantages. It is earnestly recommended that Emaar consider this option and take substantive action to begin putting up a facility in one of Saudi Arabia cities to take advantage of the concessions, facilities, and infrastructure they provide.

Works Cited

Alfaro, Laura., Ozcan, Sebnem and Volosovych Vadym. Why Doesn’t Capital Flow from Rich to Poor Countries? An Empirical Investigation, The Review of Economics and Statistics, 2008, 90: pp. 347–368.

Al-Mady, Muhammad. “Putting the Middle East at the centre of the petrochemical industry: Strategies for long-term success.” Speech during the Gulf Petrochemicals and Chemical Association Conference in 2007 Dubai, UAE: GPAC.

Christensen, Clayton. The past and future of competitive advantage. Strategies for E-business Success, 2001.

Lipsey, Robert. Inward FDI and Economic Growth in Developing Countries. Transnational Corporations,2000 vol. 9 (1) pp. 67–95.

Morton, Kathryn & Tulloch, Peter. Trade and developing countries, Croom helm ltd, London, 1997.

Shailendra Anjaria, Kirmani, Naheed. & Petersen, Arne.Trade policy issues and developments.IMF, Washington D.C., 1985.

Ravenscraft, David. (1991): Gains and Losses from Mergers: The Evidence, Managerial Finance, 17, 8-13.

UNCTAD (2005): World Investment Report 2005, New York: United Nations.