Executive Summary

Sturm, Ruger & Company is a firearm manufacturing company founded under the partnership of William B. Ruger and Alexander McCormick Sturm in 1949. Its initial establishments were Southport, Connecticut in which the pair rented a small machine shop. Bill Ruger was lucky to have previous knowledge on firearms after he duplicated some pistons from the original that was taken from Nambu as the second world war was about to end. The share capital index of the company has increased progressively. This accounts for the huge investments in firearms around the world. The organization is a member of the New York Stock Exchange and its share count is among the top gainers. The market valuation for the company has improved with time, and this is an edge over major competitors. The company’s capital structure has been stable; this is seen in the sale of shares in 2012.

Pro-forma financial statements

Pro-forma statements provide a summarized balance sheet for Strum Ruger and Co. Since 97% of the company’s revenue is derived from the sale of firearms, it is important to know the market trends. The accuracy in forecasting the growth rate of the firm is an indicator of the performance of the management team. From the financial analysis in part one, it reveals that the growth of the company took a slow leap from the first quarter of 2012 and finally made a remarkable turn by the end of 2012. The Pro-forma statements for 2013 and 2014 would be prepared with direct predictions from our balance sheet.

Let me emphasize that the growth rate of the company increased from 5% in 2012 to 16% in 2013. By our estimates, the company will be the biggest in terms of investments by 2014. This projection has been established using competent analysis. The table below shows the initial Pro-forma statements of Strum Ruger & Co. The net sales of firearms follow a pattern which, reveals that produce sales are higher in the second quarter of the year, the first quarter sales record the lowest. The operating cost will be projected using the quarterly expense records of the company.

The income statement for strum Ruger &Co estimates the growth phase from existing business deals. The year ended 2012 had a significant growth index and the total products sold in the fiscal year was multiplied by the calculated growth rate for 2013. The company decided to present these figures in its annual income statement because of their relevance to the projected income for 2013 and 2014. The growth in net income of the company can be attributed to the demand for firearms and the uncertainty that surrounds the presidential elections. The growth rate was estimated at 13% for 2013 and 18% for 2014 (“Sturm, Ruger & Company, 24”). The net income showed a steady increase in 2012 and the estimated growth will remain constant.

Determination of the cost of debt

An assumed rate at which Sturm Ruger & Co-pays her debt index is referred to as the cost of debt. This estimation occurs either before tax cuts or after-tax deductions. The business market utilizes the after-tax deductions to measure the cost of debt of a firm. The implications of estimating the cost of debt related to the information it produces for the investor or company executives. The cost of debt can be calculated as follows

Step 1: multiply the income before tax deductions by one and subtract it from the marginal tax estimate. Thus, a company with a 5% debt rate would determine its cost of debt using 5%. The firms’ cost of debt is estimated using the cost of bonds.

Determination of the cost of equity

Every business market aims to make a profit; this accounts for the huge investments and aggressive market strategies. The cost of equity of a firm is the return from such investments. This return is called the dividend for the firm. Thus, the estimated returns for shares are known as the cost of equity. The returns consist of the dividend for each share plus any increase in the price of a share due to market fluctuations. Mathematically this is given by Cost of equity = risk-free rate + Beta * Risk premium

Capital Assets Pricing Model

When investments are implemented, every shareholder would expect a rate of return for such investments. The capital asset model can be used to determine the risk involved in such investment and the expected returns. William Sharpe proposed this model using two types of risk: systematic and unsystematic risk. Systematic risks are market risks with one component. Example of systematic risk includes Wars, Earthquakes, and interest rates.

Unsystematic risk is the risk with diversification.

The capital asset pricing model can be calculated using the formula: ri = rRF + (rM – rRF)

Shareholders of the firm expect dividends for their investments based on the value of their investments and risk. The time value of their investments is denoted (rf) while the beta denotes the compensation for taking a risk. The Capital Asset Pricing Model (CAPM) can be determined by the time value of money and the risk for the market Rm-rf. The Capital Asset Pricing Model (CAPM) explains the correlation between the returns for any investments and the risk involved in the investment.

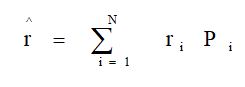

Expected rate of return on a security

The expected rate of return on a security is the profit or loss margin on security which is expressed in percentage. The rate of returns determines how much a shareholder is willing to invest in security. It measures the investments from bonds, stocks, and real estate. The rate of return is an advantage to the company. The rate of returns is significant in assessing the progress or estimating the profit of any security investment. The rate of return for Sturm Ruger & Co stands at 12% and the actual returns after tax will be 9%. Thus, the risk of the investment would be 3% while the premium market value is 9%.

The rate of return is given as

Risk-free return

The risk-free rate of return is the absolute rate of return for an investment or the absolute zero risk of any investment. However, it is not true in practice because every investment carries a degree of risk and this affects the rate of return.

The beta coefficient denotes the risk of an investment and its relationship with market structure. It is used to ascertain the risk in diversified business investments. It is a component of the capital asset pricing model. By assumptions, a firm with a beta coefficient of 1 signifies that the investment security will shift with the market as a whole. When the beta coefficient is less than 1 it means that the investment or stock will not be volatile as compared to the market. When the beta coefficient is higher than 1 it signifies that the stock price will be more volatile than the market as a whole.

Market risk premium

The market risk premium is the change in the expected market returns on security or investment. Graphically, the market risk premium corresponds to the slope of the capital asset pricing model and the security market line. There are three components of the market risk premium. The cost of capital for a firm is the cost of funding a business or security investment. When the capital for an investment increases, the investor will expect gains or returns which are equal to the rate of return or the average rate of return. At this rate, the company would survive the risk involved in the investment. The cost of capital can be expressed as a percentage. The cost of capital can be calculated using three steps:

- The investor must understand the investments and the value of the stocks

- The cost of each fund should be estimated.

- The proportion of the required funds must be determined using the combined cost of the capital.

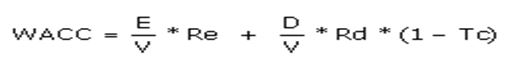

Determination of the Weighted Cost of Capital

The weighted average cost of capital of Sturm Ruger must be weighted proportionately. Raising funds for securities could be in the form of bonds, stocks, or debt. Mathematically, the weighted average cost of capital of Sturm Ruger & Co increases when two variables increase. These variables are the rate of return on equity and the beta coefficient, the increase in the firm’s weighted average cost of capital will cause a reduction in valuation for the asset and an increase in the risk in funding an investment (Osuagwu, 12).

The weighted cost of capital = the cost of equity multiplied by the proportions of each asset raised

Where

Re = the cost equity

Rd= the cost of debt

D = the market value of Sturm Ruger’s debt

E = the market value of Sturm Ruger’s equity

But note that V = E + D

D/V = the percentage estimation of funding the firm’s debt

E/V = the percentage estimation of funding the equity

Tc = the firm’s tax rate

WACC = equity cost * Common equity + Cost of debt *Total debt of the firm

The weighted cost of capital for Sturm Ruger & Co requires the variables

Risk Free Rate = 4.5%

The cost of Debt = 6.7%

Equity Risk Premium = 5%

Beta coefficient = 0.90

Tax rate = 20.0%

Cost of debt after tax = 5.4%

Therefore, by calculation, the weighted average cost of capital for Sturm Ruger & Co is 9.0%. The weighted cost of capital was determined using compared values from different firms. The WACC was determined using the highest value for the risk-free rate because any fundraised on an asset must be lower when compared to the risk-free rate.

Per Share Market Value of the Firm

The value of Sturm Ruger & Co stock price divided by the value per share determines the price ratio of the company. Thus; the Price-earnings ratio = market value per share/ dividends per share the share value of firearms stands at $53 and the earnings per share is 1.14. Therefore, the price-earnings ratio is given by 53/1.14 = 46.50. When the price ratio is high, it indicates that the valuation for the stock will increase. Investors are likely to compare the price ratio of their company with that of other companies to predict the market trend.

Market Value of the firm’s Equity

The market value of a firm is the sum of the shares in monetary value. The market value of equity is not dependent on the growth rate of the company. The market value of equity helps the shareholder in making decisions that will be beneficial to the growth potential of the company.

Market Value of the Firm’s Debt

The market value of the firm’s debt is the total sum of borrowed funds that must be repaid. When the asset of the company is higher than the liabilities the firm is considered to have a stable capital structure. The advantage will bring many investors and shareholders to the organization The company’s debt could be in the form of loans, common stock, or bonds. To calculate the value of debt the company must

- Compile its debts for the year.

- Determine the time to repay the debt.

- Identify the cost of debt

- Sum individual debt of the firm to obtain a face value

- Divide the total face value of debt by the average weighted debt of the company.

The formula indicates that C [(1 – (1/((1 + R) ^T))) /R] + [F/((1 + R) ^T)].

Where C = the annual interest sum

R = the cost of debt

T = the average weighted maturity of the debt

F = the total face value of the company’s debt

The cost of capital for a firm is the cost of funding a business or security investment. When the capital for an investment increases, the investor will expect gains or returns which are equal to the rate of return or the average rate of return. At this rate, the company would survive the risk involved in the investment. The cost of capital can be expressed as a percentage. The cost of capital can be calculated using three steps.

- The investor must understand the investments and the value of the stocks

- The cost for each fund should be estimated.

- The proportion of the required funds must be determined using the combined cost of the capital.

Investment Decision

The pivot for growth in a company’s financial base depends on the decisions for investment. The products and services provided by the company are structured towards maximizing profit. Market demographics are used to analyze market trends and then calculate the growth rate over a period. The information must be updated at a regular interval to produce the desired result. Any investment would be based on the updated information. The first step in an investment plan would be the information phase, and then decisions would be taken based on the market trends. The risk would be analyzed while funds are released to the department that would handle the next phase of the transactions. An investor will expect returns when funds are released for an investment, this would be revealed using the estimated growth pattern of the investment over a period.

Discounted cash flow assumptions

Discounted cash flow is a technique used to understand the growth pattern of investment. The management of Strum Ruger will determine the cash inflow of their investments arrive at an adjusted value of a possible rate of return (Jensen, 13). This technique has its advantages and disadvantages, its advantages include;

- It gives a precise value for the stock; this helps the company to manage business transactions with other firms that have a strong capital base.

- It is a culture medium for investment decisions. The management will input the variables and have a view of the growth pattern for their investments in a quick flash. These projections will save the company for risk associated with any investments before transactions are signed.

Disadvantages

- Due to fluctuations in business, the discounted cash flow model may not give a factual estimate of the rate of returns thus, increasing the risk for the investment.

- The model is only suitable for long-term investment and this makes it have a degree of error on short-term business.

In 2012 strum Ruger considered an investment plan that required $4,400,000. The management used the discounted cash flow to determine the average returns per unit to be $950 while the cost of debt increased. The variable cost of the investment was placed at $200. The operating cost of the investment would be $150,000 while the rate of returns for 4 years was 12%. The information guided the management in releasing funds for the investments. The management predicted that the demand for firearms may drop due to the presidential elections and that would reduce the rate of returns after the election.

Internal rate of return

The table below shows a summarizes internal rate of return of Sturm Ruger & Co

The net present value (at 10%) = 276,271

The net present value (at 20%) = – 397,164

Through interpolation IRR =10% + (10 * 276,271) / 280,893 = 14.7%

The investment decision is a tool for capital budgeting. It helps the investor to forecast market trends even when there are fluctuations. The internal rate of return is the overall value of discounted cash flow from an investment. This rate must equal zero and this rate is used by investors t predict the success of their investment. In 2012 strum Ruger discovered that the internal rate of return for her investment was higher than the required rate of return; a reason for the increase in funding the arms deals over the pacific. Consequently, when the internal rate of returns falls below the adjusted rate of return it will be safe to avoid the investment. Thus, the internal rate of returns enables the investor to arrange possible investments in the order of profit maximization.

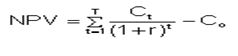

Net present value

The net present value is the difference in the value of cash outflows over cash inflows for an investment. It is another tool used in decision-making. The company will access the inflow for a transaction while estimating the rate of inflow for the investment. The net present VA rule assures an investment. The shareholder will be assured that funds required for the investment will be released for the investment. The rule shows that the investment will be positive only when the net present value of the investment is higher than zero. However, some executives may use this tool to demand funds because it gives the investor a virtual assessment of the investment.

The formula is given by

The table below summarizes the calculations of the net present value.

From the table, the net present value of the project is $516,471. Since the value is positive and relatively large, it implies that the project is viable and worth pursuing. Therefore, the management needs to invest in the project to help in the growth of the forecast sales. Cash flow determination is a technique used by the firm to analyze the flow of funds. It monitors the inflow and outflow of cash for investments. Discounted cash flow assumptions, internal rate of return, net present value, and cash flow determination are the components that give the investor the required information required for investment. These tools help to improve the investment choices of the company. Remember that the wrong choice would deplete the investor’s capital base and must be avoided.

Financial decisions Cash flow determination can be calculated using two methods

- Direct method: it shows a summary of all the investments made by the company. It provides a summary of the total inflow and outflow of annual cash from the company.

- Indirect method: this procedure shows a correlation between the total income and returns from the investment.

Investment choices

The difference between success and failure lies in one brilliant idea or an important decision taken by the management. This probably accounts for the variation in the performance of many organizations. Therefore, investment choices are components of a successful investment. Some variables help the organization to make profitable investment decisions, these include:

Discounted cash flow assumptions, internal rate of return, net present value, and cash flow determination are the components that give the investor the required information for investments. These tools help to improve the investment choices of the company. Remember that wrong choice means that the investment will not profit the company thus affecting the investor‘s capital.

Sensitivity analysis is carried out to determine how the growth index of the company changes when certain variables such as the price of the commodity cost of production or operating cost change. It is important to find the factors that affect the profit index of the business under different conditions. Sensitivity analysis helps in assessing how the rate of returns will change in a worst-case and a best-case scenario. In conducting a sensitivity analysis, sales levels can be up-scaled by increasing product prices. To determine a desired net present value, prices can be adjusted upward. Marketing strategies must be formulated to support the ascertainment of the desired net present value. Thus, sensitivity analysis is a vital tool for analysis in a business cycle. In carrying out sensitivity analysis, it will be assumed the revenue and cost of sales increase. All other variables will be constant. Sensitivity analysis will be carried out for projections of 2013 and 2014. A worst-case and a best-case scenario will be used to carry out sensitivity analysis. A worst-case scenario will assume that sales decline by 9% while the cost of sales increases by 9%. On the other hand, a best-case scenario will assume that sales increase by 15% while the cost of sales remains constant. The results are shown in the table below.

Financial decisions

One of the tools used for financial analysis is ratio analysis. It is used to correlate different financial reports in the company. The financial ratio analysis consists of three variables

- Liquidity: It measures the company’s ability to clear debts in a short term, and also carry out routine maintenance in the organization. The current ratio measures the difference between the firm’s liability and assets. The current ratio is calculated using the formulaCurrent ratio = assets / liabilities

- Solvency: Solvency ratios are used to determine the firm’s risk over the long term. Investors and shareholders benefit from this ratio. It gives them an accurate quantity of any business investments and the risk involved over the long term.

- Profitability: The above ratio shows that strum Ruger has more assets than its liabilities. The liquidity of the company varies with investments and the rate of returns.Profitability ratios measure the firm’s cash flows. This is an important variable used to determine the equity of the company.

Profit margin = net income / total sales

Current capital Structure

A company’s current capital structure measures the fitness of the company in terms of financial strength. The balance sheet describes the firm’s abilities in three different forms

- Capital adequacy

- Performance

- Current capital structure

The current capital structure of the firm evaluates the long-term equity and debt. It is an indicator of the firm’s huge spending, debt profile, and fitness.

The current capital structure of strum Ruger & Co is $9,230,345 which is divided among 2,398 shareholders.

The capital structure of strum Ruger & Co can be determined using the EBIT-EPS. This can be achieved by calculating the earnings before interest taxes assuming the EPS remains constant. It gives the investor an idea of the earnings per share and its impacts on different financial plans. With leverage, the company will increase its earnings per share. The formula for calculating the earnings before income taxes breakeven will be: (EBIT- I) x (1.0- TR) /the number of equity shares

Where EBIT = Earnings before income taxes

I = Interest

TR = tax rate

This formula will be used to calculate the different financing deals.

Preference and Implementation of Financing Method

An investor must consider different ways of financing investment. The approved method will depend on severe factors which include

- Repayments structure: an investor must consider the time of maturity for the payments. Long-term investments would require a long-term financing approach.

- Interest rate: this factor must be considered to maximize profit. The rate of returns should be higher than the interest rate for the investment.

- Mode of purchase: investors should understand the mode of payments before choosing a suitable financing method. The payment method could either be a hire purchase or a direct purchase; this would assist the investor in choosing a financing method.

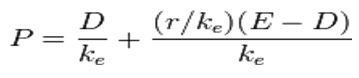

Dividend Policy

Dividend policy deals with the financial repayments for stocks bonds or shares. Investors expect dividends for each share investment and this payment determines the share price for each stock (Gordon, 59). This makes dividend policy an important factor in any business investment.

The model explained the correlation between paying dividends per share and the growth of the investment plans. Shareholders will invest more when the company pays dividends for acquiring stocks.

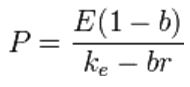

Mathematically Walter’s model is given by

P = market price of the share

D = dividend per share

r = Rate of return on the firm’s investments

Ke = Cost of equity

E = Earnings per share

Gordon’s model emphasizes the payment of dividends regularly.

Where P = Market price of the share

E = Earnings per share

b = Retention ratio

r = Rate of returns

Ke = the cost of equity

br = Growth rate of the firm

The table below shows Sturm Ruger & Co dividends records between 2011 and 2013.

The table above shows the dividends per stock for the company. The share prices showed a strong growth towards the end of 2012. This indicates stability in the company’s financial investments (Miller and Franco, 23).

Sensitivity analysis

Sensitivity analysis is carried out to determine how the growth index of the company changes when certain variables such as the price of the commodity cost of production or operating cost change. It is important to find the factors that affect the profit index of the business under different conditions. Sensitivity analysis helps in assessing how the rate of returns will change in a worst-case and a best-case scenario. In conducting a sensitivity analysis, sales levels can be up-scaled by increasing product prices. To determine a desired net present value, prices can be adjusted upward. Marketing strategies must be formulated to support the ascertainment of the desired net present value. Thus, sensitivity analysis is a vital tool for analysis in a business cycle. In carrying out sensitivity analysis, it will be assumed the revenue and cost of sales increase. All other variables will be constant. Sensitivity analysis will be carried out for projections of 2013 and 2014. A worst-case and a best-case scenario will be used to carry out sensitivity analysis. A worst-case scenario will assume that sales decline by 9% while the cost of sales increases by 9%. On the other hand, a best-case scenario will assume that sales increase by 15% while the cost of sales remains constant. The results are shown in the table below.

Summary and Conclusion

A favorable investment decision defines the strength and weaknesses of a firm. The financial strength of Sturm Ruger is a product of a compressive financial performance over time. Each branch of the company adheres to the principles of the firm in achieving success. Their financial analysis is not a complex one and can be updated. Despite the low returns in 2012, the company continued to push its investments to greater heights. The capital earnings for the first quarter of 2013 have increased with an increase in the share earnings. Investors are reaping their dividends; this indicates strong growth of the firm’s financial base. The company’s asset base exceeds its liabilities in 2012, and the first quarter of 2013. The estimation for the year under review projects an increase in the earnings per share by 4%.

A picture of the profitability ratio indicates a geometric increase in the net earnings of the company in 2012 and 2013. the margin stands at 7%, this indicator will be an advantage for the company’s stock sales. This means that investors and creditors are assured of their investments since the profit margin stands at 56% in 2012. Strum Ruger operates in a competitive market, and this has been the motivating factor for better performance. Although the company faces challenges and investment risks, the performance of the company leaped out of its cage in 2012. The constant low equity rate is an indication of stability in the financial market of the company. It is worthy to mention that the equity ratio has been low since the beginning of 2013 thus, contributing to the balanced capital structure of the firm.

Recommendations

These recommendations will be useful to the company, although their economic and financial strength is relatively strong.

- Acquire recommendation in shares of the company for $1,000,000.

- the organization must have competent management.

- Improve the macroeconomic forecast

- Continuity and succession plan for the management.

- All products must meet market demand.

References

Gordon, Markin. Dividends Earnings and Stock Prices Review of Economics and Statistics. Financial Analysis (1959): 23-59. Print.

Jensen, Micheal. Agency Cost of Free Cash Flow, Corporate Finance, and Takeovers”. American Economic Review Papers and Proceedings (1986): 323-29. Print.

Miller, Merton, and Franco Modigliani. Dividend Policy, Growth, and the Valuation of Shares. Journal of Business (1961): 17-37. Print.

Osuagwu, Linus. Business Research Methodology. Principles and Practices (2006). Print.

“Sturm, Ruger & Company”. Investment Recommendations (2012). Web.