Executive Summary

Business strategy analysis is very important as it enables the company’s executives to make decisive decisions. The Nestlé Company is the business of interest in this case, and the paper scrutinizes its coffee processing unit. Nestlé coffee (Nescafe) has gained popularity over the years, and the product is known globally. Of the many products that Nestlé produces, Nescafe is the most valued as it earns the company massive profits (Nestlé SA 2013).

From the analysis, it is evident that the company has indeed managed to have excellent internal business processes. However, the coffee industry is exposed to some political, economic, social, and technological threats. Nestlé’s executives are struggling to employ strategies that leverage the external factors to their advantage. They are trying to find ways to adhere to the government regulations of the countries in which they operate, and they are finding ways to maintain their competitive position. From the analysis, it is evident that Nescafe’s products have a competitive advantage over their competitors’ products. Indeed, the generic business strategies that Nestlé employs have contributed greatly to its large global market share.

Nestlé Coffee Background Information

Nescafe Ownership

Nescafe is a brand owned by Nestlé Singapore (Pte) Ltd, which is a subsidiary of Nestlé SA. The headquarters of Nestlé Singapore (Pte) Ltd is located in Vevey, Switzerland.

Nescafe History

Nescafe came into existence in 1930 when Nestlé’s coffee experts in Switzerland set out to discover ways of manufacturing quality soluble coffee. After seven years of research, the coffee experts founded a coffee brand, and they named it Nescafe. Nescafe is a name drawn from two words, “Nestle” and “café.” Currently, the Nescafe brand name is valued at about $17.7 billion (Thomson 2013). By 1950, Nescafe was the best beverage in the USA, France, Europe, and Great Britain, among other nations. Nescafe was introduced in Singapore in the later years of the 1950s.The coffee experts continued adding flavor and aroma to the Nescafe product. Currently, Nescafe is selling in all leading retail outlets across the globe.

Nescafe Size

Nescafe is a strategic business unit (SBU) of Nestlé Singapore (Pte) Ltd. Nescafe is Nestlé’s leading products in Singapore, and overall, it is the largest brand of all the products produced by Nestlé (Thomson 2013). In 2012, Nestlé Singapore (Pte) Ltd had a 40% coffee market share in Singapore as it sold about 36 tones of Nescafe. In the entire globe, Nescafe coffee has about 22% of the coffee market share. People around the globe consume about 350 million cups daily, where the number is on the rise as Nescafe continues to gain popularity (Carpenter 2012). Nescafe’s popularity as an energy drink in the military has a significant effect on the massive sales of the product. In the recent past, Nescafe has gained popularity, and its market share increases by about 11% per annum.

Nestlé Coffee Business Scope

Nescafe is a strategic business unit of Nestlé Singapore (Pte) Ltd that manufactures nutritious beverage products. It invests heavily in research and development to find information on how to develop its products to meet the customers’ requirements in the contemporary world.

Nestlé Coffee Major Products and Services

The various Nescafe products comprise of the canned Latte and Mocha, the Ipoh white coffees, and the intense, regular, mild, and rich Nescafe flavors, among others. The Nescafe strategic business unit offers health and wellness solutions as well as nutrition services in Singapore.

Nescafe Major Markets

Nescafe targets all the coffee drinkers who want to enjoy a cup of coffee anywhere, at any time, and without any hassle. Nescafe sells its products to supermarkets, restaurants, cafes, and other convenient outlets that can reach its intended customers.

Nestlé Coffee PESTEL Analysis

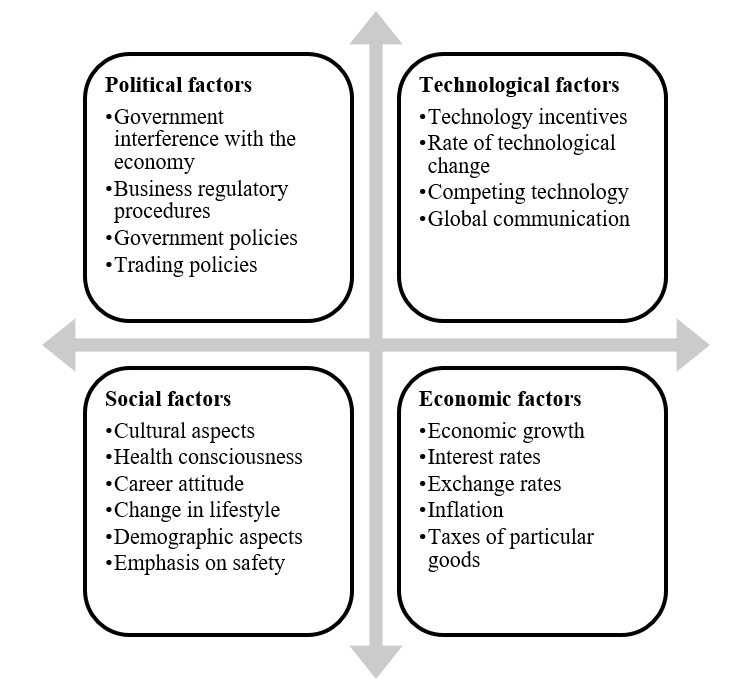

The macro business analysis seeks to take a stringent review of all the factors that the industry is incapable of controlling. The PESTEL analytical framework is the best tool to carry out macro business analysis of the coffee industry in which Nestlé operates. A PESTEL framework analyzes the Political, Economic, Social, Technological, Environmental, and legal factors in the industry in which the company operates. For Nescafe, the opportunities and threats that the factors present will be analyzed to enable the SBU to develop constructive strategic plans. The most critical factors to discuss in the coffee industry in which Nescafe operates are the political, economic, social, and technological factors; therefore, described below is the PEST analysis for the coffee industry.

Nescafe Political Factors

Opportunities

In the recent past, the world has had stable political environments. The trade tariffs in most countries are regulated, and the social welfares amongst countries have favored international businesses. The tax policies have also favored the food industries, which do not have to pay heavy taxes as other industries. Nescafe will have a great opportunity to expand its international sales, where the sales are likely to triple in the near future as the product continues to gain popularity (‘Nestlé’s public-private partnerships’ 2009). Nescafe products are found on shelves of all major outlets across the globe, and they are slowly becoming popular.

In the emerging markets, Nescafe has the upper hand over its competitors. Businesses are struggling to ensure they place Nescafe products on their shelves as the customers have ready information about the product (Miller 2014). Moreover, investors and intermediaries are finding it worthwhile to deal with Nestlé’s products in the emerging markets as the products are selling like hot cake. In the future, Nescafe would be forced to triple its production capacity to meet the rising demand of its products.

Threats

Some countries have imposed laws that disallow the importation of processed food and beverage products. Political changes in this manner may pose a threat to the international companies operating in the coffee industry. Nescafe sells its products globally and it will have to adhere to the laws set by the government of every country in which it operates. If a government decides to impose heavy taxes on imported processed foods, Nescafe would suffer great losses (Smith & Speed 2011). Essentially, if Nescafe fails to meet the set regulations in the nations in which it operates; Nestlé would be forced to pay fines. The healthy and safety act, accounting standards, and tax laws are all threats that affect Nescafe in one way or another.

Nescafe Economic Factors

Opportunities

In the contemporary world, nations are becoming enlightened and the person per capita income is on the rise. This means that the spending power of individuals is rising, and more customers are likely to desire to consume processed foods than before. Essentially, the economic growth rates, especially in the developing nations are rising considerably. The government heads of such nations are striving to strengthen their economic relationship with western companies to access products and services that such nations do not have. This presents a very favorable economic factor that would enhance the sale of processed coffee into such nations. Nescafe would enjoy the new market opportunities that would enable them to increase their sales and increase their profits.

Threats

The processed food industry faces many challenges in the international markets. The economic environment in the third world nations is sluggish as there are high poverty levels. People consider processed foods as expensive and they do not purchase such products. Nescafe may face many challenges in making adequate sales in the developing worlds. Declining sales would result into declined gross profits, where, Nescafe will be unable to meet the transportation, advertising, and taxation costs among other costs. Another economic factor that would affect the coffee industry is the change in interest rates and the unanticipated inflation rates in global markets. Nescafe may experience great losses if the currency in the market in which it sells its products looses value. The economic factors may affect the international coffee industry negatively by lowering the purchasing power of foreign currency. Inflation and the lowered purchasing power of currencies would intricate the normal operations of international business like Nescafe.

Nescafe Social Factors

Opportunities

In the contemporary world, the culture and the lifestyle is changing, as everything is becoming instant (Yüksel 2012). This presents a very favorable opportunity for the processed food industry. Nescafe will enjoy from the increased demand for its instant coffee that dissolves in hot water and maintains its great taste. Moreover, Nescafe is an energy drink that would help various groups like manual laborers and sports players among other individuals whose activities require much energy. People are disregarding the traditional believes that considered Nescafe as a stimulant, as they are finding the product very useful in their busy schedules. Unlike earlier days when some religions would be against the consumption of additive stimulants, people are now becoming enlightened, and they are finding Nestlé coffee to be an important product that replenishes their minds. From this perspective, the demand of instant coffee is likely to rise in future.

Threats

As the lifestyle diseases are on the rise, health institutions are discouraging people from consuming instant foods and beverages. The health advisors state that the tinned products are preserved with chemicals that are harmful to the bodies. Since Nescafe is an SBU that operates in the coffee industry, it is likely to be among other business units to be affected from the negative insights of instant products.

Nescafe Technological Factors

Opportunities

Technology comes to enhance the manner in which people do things (Gobble 2012). Technology presents a great opportunity for the coffee industry to market its products. Nestlé will have the opportunity to make online advertisements of its coffee products. Moreover, the company will have the opportunity to sell its products online as well as learn new product enhancement strategies. Technology enhances the business operations across the globe, and Nescafe can easily manage the records of its infinite number of stakeholders. It may develop new distributive channels, and achieve to convince people to change their lifestyles and like instant product.

Threats

Technology presents a treat to the coffee industry by providing opportunities for new entrants. New companies may find it very easy to penetrate into coffee market, advertise their products, and gain some market share without many hassles (Chiang 2012). Nescafe has existed since the 1930s, and for this reason, it has gained so much popularity. A company that emerges in the contemporary world may not take centuries to become famous. The company will have to invest in advertisement globally to become popular. New entrants into coffee industry will become a threat to the existing business units as they may resolve to sell their products as considerably cheap prices. Essentially, technology is admirable, but it can play a great role in making an existing product outdated.

Conclusions of the Macro-Environment Analysis

From the discussions of the PEST analysis, it is evident that every factor presents some opportunities and threats to Nescafe. It is upon Nescafe to employ strategies that would leverage the external factors to its advantage (Pretorius 2008). Nestlé will have to meet all the standard laws in the nations in which it operates to escape fines. The company will have to take a keen analysis of the political and economic stability of the nations it intends to operate. The following chart presents an outlay of the PEST analysis of the coffee industry in which Nescafe operates.

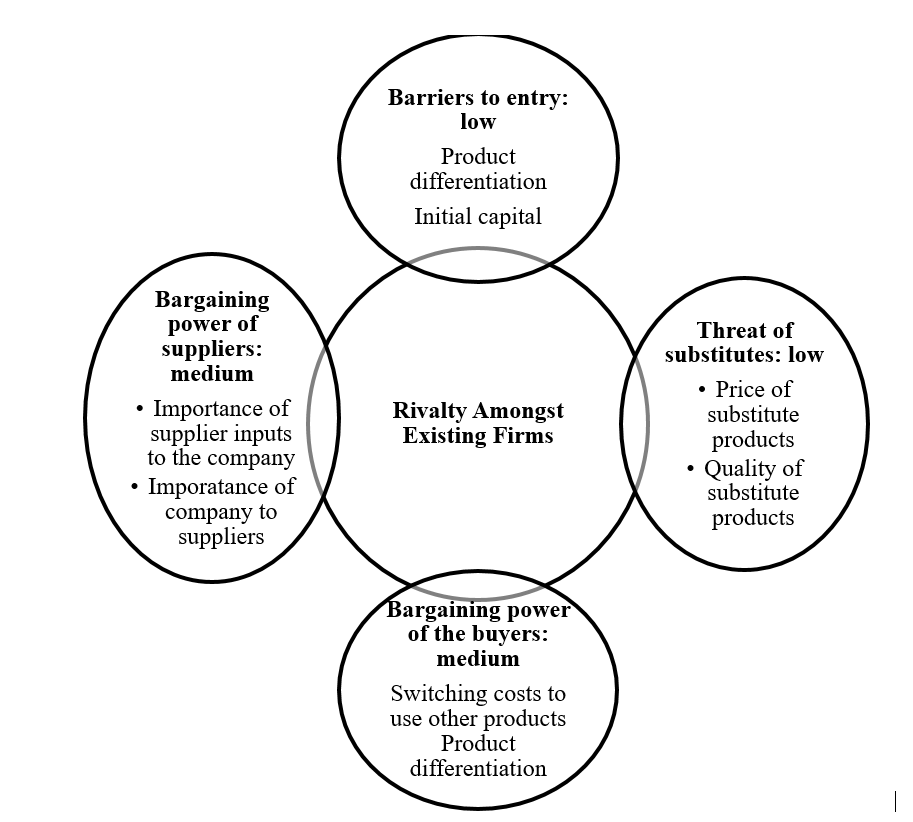

Nestlé Coffee Competitive Analysis: Porters Five Forces

Intensity of Rivalry: High

The coffee industry in which Nestlé coffee operates is very competitive. Nestlé has a market share of about 22% in the coffee industry globally. Mondelez international leads with a market share of 25.7%. Nestlé is not satisfied with its current global market share and it is employing market segmentation strategies, price differentiation strategies and product differentiation strategies (Grundy 2006). In the future Nestlé coffee would be leading in the coffee industry.

Barriers to Entry: Medium

Companies do not find many difficulties in entering into the coffee industry. However, the companies with competent brand names would make it difficult for new entrants to make massive profits (Hankinson 2012). Nestlé coffee has existed since the 1930s and it would be difficult to convince its loyal customers to try out new brands. New entrants can find their way into the market; however, many companies that enter into the coffee industry exit the market after a short period because of the competitiveness. This factor is advantageous to esteemed brand names like Nescafe, which dominates in the markets.

Threat of Substitutes: Low

As mentioned before, it is not easy to sway a Nescafe loyal client into consuming other coffee brands. Therefore, Nescafe enjoys its esteemed brand names to keep its customers and capture new ones. Further, Nescafe has segmented its products into various categories to meet the varying demands of customers. The super premium Nescafe brand, everyday brand, café menu brand, and the decaf brand would serve customers according to their needs. Nestlé’s coffee products are made in such a way that they offer the customers with an opportunity to drink high quality coffee at their convenience. Therefore, the existence of substitutes in the coffee industry does not threaten Nestlé.

Bargaining Power of the Buyers: Medium

Many firms offer the same quality of coffee at considerably cheap prices than Nestlé coffee. Therefore, the buyers have always had a choice of a variety of coffee products on the shelves. Nestlé enjoys its esteemed brand name, where, high class individual who are quality sensitive rather than price sensitive will always purchase Nestlé coffee. Otherwise, the medium class consumers are likely to purchase other products when they do not have sufficient cash (Renko, Sustic & Butigan 2011). This factor has made Nestlé to experience an elastic demand of its products at times.

Bargaining Power of the Suppliers: Medium

Nestlé is a big manufacturing company that requires an enormous quantity of coffee beans. It has to ensure that it maintains a good relationship with its suppliers by buying their products at fair prices. Similarly, the suppliers have to maintain the superb relationship with Nestlé, which assures them of an efficient ready market for their product. Therefore, Nestlé and its suppliers have a mutual relationship and their bargaining powers are equal.

Conclusions of the Industry Analysis

From the discussions, it is evident that Nestlé coffee has a great competitive advantage in the coffee industry. However, the high intensity of rivalry, medium barrier to entry, medium bargaining powers of the supplier and buyers jeopardize Nestlé coffee. The company’s executives have to strive to maintain their current market position.

In the chart that presents the Porter’s five forces analysis of coffee industry in which Nescafe operates, it is evident that Nestle has a competitive advantage over its rivals. Although the barriers to new entrants are low, Nescafe has an advantage over its competitors because of its differentiated products. The medium bargaining power of the suppliers protects Nescafe against supply shortages. The high quality and highly valued Nestlé’s products enables Nescafe to have an upper hand over all its rivals. Although buyers have some bargaining power, they soon become devotees of Nestlé’s products, where, they would rather purchase small quantities of Nescafe rather than purchase large quantities of cheap but sub-standard coffee products.

Nestlé Coffee Resources and Completeness

Nescafe Quality Products

Valuable: Nestlé coffee is one of the most valuable products of Nestlé Company. Nescafe products bring a competitive advantage to the firm, as they are able to serve various needs of the customers. Nescafe enables Nestlé to have a competitive advantage in the coffee industry, and it enables the firm to earn massive profits from its business unit.

Rarity: Nestlé’s coffee products have a rare characteristic of dissolving in water without losing their flavor. The fine blended coffee that comes in different tastes to serve different palettes is very rare.

Inimitability: It is almost impossible for companies to imitate the various Nescafe products or their packages. The 3-in-1 blend, gold blend, or even the fine blend is unique in its way. The competitors would receive a big blow while trying to imitate the instant Nescafe coffee that has various appealing tastes.

Non-substitutable: As mentioned before, Nestlé coffee is unique, and the firm is not threatened by the existence of other coffee products in the market. This is because a loyal client cannot substitute Nescafe with any other coffee brand (Talaja 2012).

Nescafe Branding and Marketing

Valuable: Since Nestlé Company has existed in the market for a long period; its brand name is highly valued, and Nescafe markets its highly valued coffee products across the globe using the highly valued brand name. The highly valuable marketing strategies have enabled the customers to accept Nestlé’s products readily (Köse 2007).

Rarity: Nestlé employs unique marketing strategies in popularizing its products. In addition to the usual newspaper, television, and billboard advertisements, Nestlé invests in rallies to advertise their products, with a special interest on children.

The above named resource and completeness strategies give Nestlé an absolute competitive advantage over its competitors. Essentially, something unique in Nescafe will always draw a customer into trusting Nestlé products.

Nescafe Business Strategy

Nestlé has employed the generic type of business strategy. The firm aims at making a continuous innovation and renovation of its strategies. It emphasizes on enhancing its core competencies to provide high quality products (Markides 2009). The Nestlé coffee business unit employs the marketing segmentation strategies, differentiation strategies and the cost leadership strategies. Moreover, the company employs the market mix strategies that control the price of Nescafe, the quality of the product, availability of the product at the place needed, and the promotion techniques to enhance the familiarity of the product. The mentioned strategic business approaches have all contributed to the current position that Nescafe has in the local and international market.

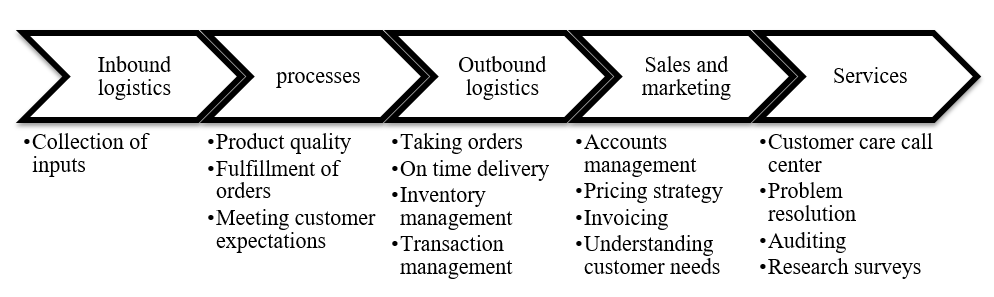

Nestlé employs the porter’s value procedures in its daily processes. Firstly, the company values the Nescafe coffee unit. It has developed esteemed relationships with the suppliers of the coffee beans. The procurement department employs transparency of all the activities that happen in their department. The operations in the coffee processing procedures are done in a very efficient manner. All employees feel motivated to deliver their best in the favorable working environment (Banutu-Gomez et al. 2009).

Once the coffee is ready for dispatch, the products pass through eloquent distributive channels to reach the final consumers. Nestlé has heavily invested in marketing, and by the time its quality products reach at the retail centers, the buyers are already informed. Essentially, Nestlé has outstanding procurement officers, wonderful human resource officers, brilliant technology officers and the best strategic planners. They all work together for the betterment of the Nestlé Company as a whole. The following chart outlays the value chain procedures in the company.

Evaluation of Nestlé Coffee Current Business Strategies

Indeed, the business strategies that Nestlé employs have a significant effect on the current position of Nestlé’s products in the global market. Nestlé coffee has the second largest market share in the global market, and it aims at beating Mondelez international to become the global leader. Nestlé employs the price differentiation strategies that enable the company to reach all classes of consumers. Moreover, the market segmentation strategies based on the geographic area, demographic region, and the behaviors of the customers play a critical role in meeting the needs of the customers (Ormanidhi & Stringa 2008).

The Nescafe ice, for example, is a type of coffee that is consumable with ice. Customers find this product very essential during summer. During winter, people will find warmth by taking a hot cup of Nestlé coffee. The busiest customers would find the instant soluble coffee to be of great use as it contains caffeine to refresh their minds. The 3-in-1 packs of Nescafe have a mixture of coffee, sugar, and milk, and those consumers who want to save on time and money will find it useful. Players will find Nescafe important at it would revive their energy.

In the diagram that presents the porter’s generic strategies that Nescafe employs, the three main strategies described outlaid are the (1) segmentation strategy, (2) differentiation strategy, and (3) cost leadership strategy.

Diagram 4: Nestlé’s generic strategies diagram.

Nestle employs narrow based segmentation strategies that seek to capture the large buyers. As mentioned before, large buyers are quality sensitive, and they purchase Nescafe products because of their high quality. Certainly, a large buyer cannot afford to risk by buying a non-quality coffee product in large volumes. The differentiation strategies that Nescafe employs emphasize on uniqueness competency strategies that target a broad market.

The differentiated Nescafe products are able to win the customers’ loyalty. After consumers have used Nescafe products for a short period, they become devotees of the products. The other strategy that reduces the possibility of going for substitute products is the price differentiation strategy that enables consumers to purchase different quantities of products depending on their financial capability. Finally, the cost leadership is a low cost strategy that seeks to ensure that the customers get value for their money. Moreover, Nestlé’s leaders have ensured that the coffee production process is insulated from the risk of having shortages of coffee beans. This is because of the medium bargaining power that the company has tendered to the powerful suppliers.

Generally, the strategies that Nestlé has employed are so stunning such that companies that are competing with it will have to work extra hard to attain Nestlé’s standards. The strategies are indeed playing a great role in strengthening the business activities of the company. The strategies respond to the opportunities and threats of the firm, and they enable the firm to explore its strengths (Richard & Marilyn 2006). The porter’s generic strategies are among the best strategies that the company should continue employing.

References

Banutu-Gomez, M, Coyle, P, Ebenhoech, S, Fallucca, K, Minetti, C, & Sarin, M 2009, ‘International branding effectiveness: the global image of Nestlé’s brand name and employee perceptions of strategies and brands’, Journal of Global Business Issues, vol. 3, no. 2, pp. 17-24. Web.

Carpenter, C 2012, ‘Nestlé’s global Nescafe coffee sales equal 4000 cups a second’, Bloomberg News, p. 1. Web.

Chiang, S 2012, ‘Shift-share analysis and international trade’, Annals of Regional Science, vol. 49, no. 3, pp. 571-588. Web.

Gobble, M 2012, ‘Innovation and strategy’, Research Technology Management, vol. 55, no. 3, p. 63. Web.

Grundy, T 2006, ‘Rethinking and reinventing Michael Porter’s five forces model’, Strategic Change, vol. 15, no. 5, pp. 213-229. Web.

Hankinson, G 2012, ‘The measurement of brand orientation, its performance impact, and the role of leadership in the context of destination branding: An exploratory study’, Journal of Marketing Management, vol. 28, no. 8, pp. 974-999. Web.

Köse, Y 2007, ‘Nestlé: A brief history of the marketing strategies of the first multinational company in the Ottoman Empire’, Journal of Macro-marketing, vol. 27, no. 1, pp. 74-85. Web.

Markides, CC 2009, ‘A Dynamic View of Strategy’, Sloan Management Review, vol. 40, no. 3, pp. 55-63. Web.

Miller, L 2014, ‘Nestle trails at home as global shares rally: chat of the day’, Bloomberg News, p. 1. Web.

Nestlé SA 2013, Nestlé Annual Report 2012, Nestec Ltd, Vevey, Switzerland. Web.

‘Nestlé’s public-private partnerships in agricultural sourcing’ 2009, International Trade Forum Review, vol. 4, pp. 16-17. Web.

Ormanidhi, O, & Stringa, O 2008, ‘Porter’s model of generic competitive strategies’, Business Economics, vol. 43, no. 3, pp. 55-64. Web.

Pretorius, M 2008, ‘When Porter’s generic strategies are not enough: complementary strategies for turnaround situations’, Journal of Business Strategy, vol. 29, no. 6, pp. 19-28. Web.

Renko, N, Sustic, Butigan, & R 2011,, I ‘Designing marketing strategy using the five competitive forces model by Michael E. Porter: case of small bakery in Croatia’, International Journal of Management Cases, vol. 13, no. 3, pp. 376-385. Web.

Richard S., A, & Marilyn M., H 2006, ‘Linking strategic practices and organizational performance to Porter’s generic strategies’, Business Process Management Journal, vol. 12, no. 4, pp. 433-454. Web.

Smith, G, & Speed, R 2011, ‘Cultural branding and political marketing: an exploratory analysis’, Journal of Marketing Management, vol. 27, no. 14, pp. 1304-132. Web.

Talaja, A 2012, ‘Testing VRIN framework: resource value and rareness as sources of competitive advantage and above average performance’, Management: Journal of Contemporary Management Issues, vol. 17, no. 2, pp. 51-64. Web.

Thomson, R 2013, ‘World’s most valuable brands: Nescafe’, Forbes Magazine, p. 1. Web.

Yüksel, I 2012, ‘Developing a multi-criteria decision making model for PESTEL analysis’, International Journal of Business & Management, vol. 7, no. 24, pp. 52-66. Web.