Publicly traded companies have to pay out dividends to their shareholders as a form of compensation for their investments. These dividends are issued according a company’s rewards policy, which may be dictated by various factors affecting performance. However, broadly, the term “dividends” refers to the amount of financial compensation shareholders would receive from a company and the frequency of the receipt (Labhane, 2019). These decisions have to be made by a company’s board of directors and management because whenever they make a profit, they should know what to do with it. Typically, they have two options of either remaining with the profit or re-investing it by financing its operations or issuing it out to its investors as dividends. Most companies offer their shareholders two types of dividends: cash dividend and bonus payments (Pathan, Faff, Méndez, & Masters, 2016). The type of remuneration accorded to customers depends on the nature of business involved and a firm’s internal management policies and agreements.

Ascertaining factors that cause managers to choose their dividend polices is an important step for investors to determine which kind of companies they want to invest in. From an organizational perspective, dividends help firms to maintain a positive image in the eyes of their investors and from an investor’s perspective, they help to improve their profitability (Dhamija & Arora, 2019). Since dividends payments are often part of a company’s overall management strategy, the lack of obligation to offer them at the end of every financial period presents a difficult scenario of understanding when companies decide to issue dividends and when they do not wish to do so. Furthermore, even though it is not mandatory for listed companies to issue dividends, many shareholders consider its absence an indicator of poor financial performance

Although there is evidence that suggests the irrelevancy of dividend payments to company operations, a majority of researchers believe that dividends remain a key source of income for shareholders and are largely predictive of market performance and the financial health of firms (Arora & Srivastava, 2019). Considering dividend payments remains a key part of management decision-making plans, the biggest beneficiaries are usually company heads who are typically the largest shareholders in a business. However, managers must decide on the amount of money to issue as dividends to this group of stakeholders and still keep others satisfied.

Therefore, timing, amount of money to be paid and expediency are some variables that are in play when determining a company’s dividend payout plan. Owing to the complexity of such factors in influencing management decisions, this paper seeks to understand the determinants of payout policies for commercial banks and technological firms. Data will be sourced from companies located in the two sectors and listed in two Chinese stock markets and analyzed using a regression model. In detail, information from major financial companies, such as HSBC and Standard Chartered will be analyzed in this study and the findings contrasted with data emerging from giant tech companies, such as Alibaba and Tencent.

Research Problem

Payout policy can be divided into three types: cash dividend, stock dividend and stock repurchase. To the firm, we can compute the firm value with discounted free cash flows. But to shareholders, the equity value is the sum of discounted cash dividend according to Discount Dividend Model. Therefore, payout policy plays a critical role in pricing a company for shareholders. Different from cash dividend and stock repurchase, although stock dividend does not generate real cash flows to shareholders, stock dividend still has a positive effect in boosting share price.

Firms are financed with either debt or equity, then firms will invest the fund in various projects to generate operating cash flows. Later on, firms need to decide the proportion of operating cash flows as reinvestment, and the proportion of operating cash flows as divided payment. In other words, payout policy is the last decision of the firm after a series of decisions, such as debt repayment, reinvestment and cash balance. Therefore, payout policy is affected by all the previous decisions. To stabilize cash dividend, firms need to keep the capability of generating operating cash flows and the capability of stable growth.

Bank stocks, as a demonstration of market prudency, have kept constant cash dividend. However, on 1st April 2020, HSBC and Standard Chartered decided to suspend their cash dividends for the first time in record. After their announcements, stock price of HSBC plummeted more than 9% and stock price of Standard Chartered dropped more than 7% (Yahoo Finance, 2020). The influence of the pandemic is undoubted, but more determinants of the dividend suspension is worth of further analysis. Therefore, this paper intends to take the listed commercial banks in China as the research object to analyze the decision-making process of dividend payment policy.

In terms of non-financial enterprises, I chose listed companies of Internet and technology enterprises in China, such as Alibaba and Tencent, as the research objects. Due to the different industry characteristics of commercial banks and technology-based enterprises, the logic of dividend distribution policy of technology-based enterprises will be different from commercial banks.

Based on related dividend policy theories, and from the angle of supervision, firm characteristics and ownership structure, multi-regression will be applied to analyze the determinants of dividend payout policies from three perspectives, namely, the willingness of dividend payment, paying level of stock dividend and paying level of cash dividend.

Research Aim

To find out the determinants of payout policies of financial and non-financial firms

Research Objectives

- To determine the impact of corporate characteristics on the payout policies of financial and non-financial firms

- To establish the effect of ownership structure on the payout policies of financial and non-financial firms

- To estimate the effects of macro-regulatory factors on the payout policies of financial and non-financial firms

Research Questions

- What is the impact of corporate characteristics on the dividend payout policies of financial and non-financial firms?

- What factors affect the weighting of dividend distribution policies of financial and non-financial firms?

- How do macro-regulatory factors affect the payout policies of financial and non-financial firms?

Importance of the Study

The findings highlighted in this study may be useful to policymakers and market researchers who are involved in the fields of investor relations and corporate management. From a policy level, the evidence presented in the report may be relevant in developing better policy management regulations governing managers’ actions and their responsibility to shareholders. This relationship needs to be further demystified from a policy perspective as a matter of urgency because there is a lack of trust between managers and shareholders, which fuels speculative activities and increases investor risks. As will be seen from the evidence gathered in this research paper, when markets are stable, investor risk increases, thereby limiting a company’s ability to issue dividends.

Regulations will also find the information highlighted in this document to be relevant to their quest to align government and corporate policies for better company management. The evidence gathered in this document will also contribute towards improving the consistency of regulations and policies between government and companies. Therefore, it is a concerted effort among key stakeholders and all parties that they should abide by this principle. The information presented in this document will also be useful to managers and company shareholders in determining the kind of dividend policy they will be issuing to their shareholders.

The type of policy chosen by a company’s board of directors will also influence decisions on whether shareholders get regular, irregular or stable dividends, subject to the identification of a number of factors that will be weighted to influence decisions on whether dividends will be paid out, or not. Therefore, the determination of a criterion of factors, such as company ownership structure or profitability, is important in influencing decisions on whether dividends will be paid out, or not. As will be demonstrated in this paper, a company’s profitability emerges as one of the most significant or impactful factors influencing company decisions to issue dividends, or not.

Literature Review

This second chapter of this dissertation contains a review of what other researchers have said about the study topic. To recap, the aim of this study is to find out the determinants of payout policies of financial and non-financial firms. In line with this goal, three research questions were formulated. The first one was to establish the impact of corporate characteristics on the dividend payout policies of financial and non-financial firms and the second one was to determine factors affecting the weighting of dividend distribution policies of financial and non-financial firms. The last research question was designed to find out how macro-regulatory factors affect the payout policies of financial and non-financial firms. In this chapter, the literature underpinning the study topic will be explored, including a comparison of traditional and contemporary theories on dividend issuing. Empirical studies on the payout of policies will also be investigated to compare how the theoretical literature merges with real-life experiences influencing policy determination among commercial and technology firms.

Dividend Theories

Lintner (1956) studies dividend policy for the first time, and after that, the academic world has been researching the topic for more than 60 years. Generally speaking, dividend policy theories can be divided into traditional dividend theories and modern dividend theories.

Traditional Dividend Theories

‘Bird in Hand’ is supported by Williams (1938), Lintner (1956) and Gordon (1959). This theory claims that most investor are risk averse. When stock prices are not stable, investors prefer to receive lower dividends than keeping profits in firms and receiving more capital gains and dividends from reinvestment. Therefore, paying higher dividend to shareholders decreases shareholders’ risk, required return of shareholders decreases, and stock prices will increase. On the other hand, paying lower or no dividend to shareholders increases shareholders’ risk, required return of shareholders increases to compensate for higher risk, and stock price will decrease.

To sum up, ‘Bird in Hand’ stands for higher dividend payment because dividend policy is closely related with firm value – higher dividend means higher stock price and higher firm value. However, one disadvantage of ‘Bird in Hand’ is the assumption of this theory. This theory assumes that firms always adopt ‘low return and high risk’ investment strategies, and investors could find better investment target after receiving dividends. Hess (1981) claims that, ‘when the discount rate of capital gains is higher than the discount rate of dividends, ‘Bird in Hand’ is established on the relations between high-risk investment policy and low market value, rather than on the intrinsic value of dividends.

‘Dividend Irrelevance’ is supported by Modigliani and Miller. They argue that investors do not care about firms’ dividend policy under some assumptions, and dividend policies have no effect on stock price and firm value. Firm value is only determined by its capability of generating profits and total risks. ‘Dividend Irrelevance’ is based on several strict assumptions: firstly, there is no corporate tax or individual tax; secondly, there is no transaction cost or agency cost; thirdly, no financing cost when firms raise funds; fourthly, information is symmetric and investment policy and dividend policy are dependent to each other; fifthly, investment policy is certain and can be understood by investors. Once each of these assumptions fails, dividend policies will have effect on firms’ value.

‘Tax Difference Theory’ is supported by Farrar, Selwyn and Brennan. This theory introduces tax into dividend policies and explains the effect of dividend policy from two dimensions, tax rate and time. From the angle of tax rate, to guide investors to actively participate in the capital market, tax rate on capital gains is normally lower than tax rate on dividends, this difference encourages investors to gravitate toward capital gains. From the angle of time, if tax rate on capital gains and tax rate on dividends are the same, the time to pay capital gain taxes and dividend taxes differs. The time to pay dividend tax is constant, and the time to pay capital gain tax is more flexible. Therefore, investors can enjoy the benefits of deferring capital gain taxes. According to ‘Tax Difference Theory’, if transaction cost does exist and dividend tax rate is higher than capital gain tax rate, investors will prefer lower dividend policies. In another word, firm value will increase if firm choose to decrease dividend payment.

Follower Effect

Follower effect is also called customer effect, which is put forward by Modigliani and Miller in 1961. Follower effect theory discusses the effect of tax on dividend policies in more detail and analyze investors’ attitude toward dividend policies under different tax rates. Generally speaking, high-income groups tend to have higher marginal tax rate, who prefer lower dividend payment and expect firms to keep higher retained earnings for reinvestment and receive profits from higher stock prices. On the other hand, low-income groups and pension agencies could enjoy lower tax rate and prefer stable and high dividend payments. From this point of view, firms will make dividend policies bases on investors’ preference. At the same time, according to the dividend policy of a firm, investors who are attracted by the firm’ dividend policy will present corresponding characteristics.

Signal Transmission Theory

Signal Transmission Theory can trace back to Lintner (1956), who claims that when firms adopt stable dividend policies, investors will regard dividend change as a signal of firms’ development potentials. Signal Transmission Theory introduce the information asymmetry between management and investors into the analysis of dividend policies. Management has comprehensive information about current operating situation and financial situation of a firm and has information advantage against investors. Therefore, management use dividend policy as a signal channel to investors, and investors can analyze status quo of firms with dividend policies.

Nevertheless, whether dividend increase deliver positive messages of firms is still in doubt in the academic world. One side argues that dividend increase means that firms have a better expectation of future development, and with the enhancement of profitability, management will deliver bull news to outside investors by increasing dividend. However, another voice deems that dividend increase does not necessarily delivers good news of firms. When firms are at mature stage, profitability and growth potential become stable, paying high dividends may indicate that firms do not have potential investment plans in the future and firms do not have sustainable development capacity as well. In this situation, high dividend may lead to stock price decline.

Agency Cost Theory

Separation of ownership and management will lead interest conflicts between principals and agents. Compared to shareholders, management has better information about firms, and the information asymmetry will lead additional benefit to management and losses to shareholders. Rozeff (1982) introduces Agency Cost into the analysis of dividend polices and argues that agency cost will decrease with the increase to transaction cost. The optimal solution is adjusting dividend to minimize the sum of agency cost and transaction cost.

The ownership of management is negatively related with dividend payout ratio, and ownership concentration is also negatively related with dividend payout ratio. ‘Agency Cost Theory’ also combines with ‘free cash flow theory’, indicating that when ownership concentration is low, because of the existence of information asymmetry between management and shareholders, paying dividends could decrease cash flow to firms and decrease agency costs. Management have to conduct exogenous financing, which enhance supervision on management further.

Life Cycle Theory

Life Cycle Theory is supported by DeAngelo (2006), Fama & French (2001) and Denis & Osobov (2007). This theory claims that operating status and investment environment of firms will differ given different growth stages, as the result, applicable dividend policies will differ. In the start-up stage, firms have good development environments and more investment projects, but have less disposable fund. Firms will choose low dividend policies in this scenario. In the mature stage, profit is stable, investment opportunities decrease, and firms have more disposable fund. In this scenario, firms tend to choose high dividend policies. On the basis of Agency Cost Theory and Signal Transmission Theory, Life Cycle Theory considers the effect of operating status, investment opportunities and growth stage on dividend policies comprehensively, and provides a new angle to research on dividend policies.

Empirical Studies on Determinants of Payout Policy

The Effect of Firm Characteristics on Payout Policy

With the development of dividend theories, pioneer scholars have conducted extensive empirical studies on determinants of payout policies, and most of them concentrate on the effect of firms’ characteristics on dividend policies. Linter (1956) conducts empirical analysis on American listed companies between 1946 and 1954 and interviewed financial executives with questionnaire. He concludes that firms’ payout policy decision-making process is positively related with growing net income. Continuous and stable profitability at high level will lead firms to choose high dividend payout policies.

Crutchley and Hansen (1989) study the effect of ownership and financial status on dividend payment on the basis of Agency Cost Theory. They find that with the increase of firm scale and debt, dividend payout ratio will be higher and management’s control on firms’ resources will be lower. Eije and Megginson (2006) draw a contrary conclusion on the sample of listed companies of European countries between 1980 and 2003.

They find that large scale firms have higher willingness to pay cash dividends and pay higher dividends as a matter of fact. Linter (1956) also studied the relation between growth ability and payout policy decision-making process, concluding that because of the investment prospect difference between high growth potential firms and low growth potential firms, high growth potential firms tend to pay less cash dividends. Crutchley and Hansen (1989) further measured investment opportunities of firms with Tobin Q and studies stock price reaction to dividend payments. They find that when firms have more investment opportunities, stock price reaction will be smaller. DeAngelo (2006), used the same methodology and draws a completely different conclusion, that is investment opportunities is not related with stock price reactions.

Fama and French (2001) studied dividend payments on the sample of American listed companies between 1926 and 1999. In the long-term observation window, dividends payment increased in the early stage, reached the peak level in 1978, and began to decrease afterwards. They conduct regression models during empirical analysis, concluding that the determinants of dividend payments include retained earnings, scale and external investment opportunities. When firm scale is large, retained earnings are high and external investment opportunities are less, firms tend to pay high dividends. DeAngelo (2006) compares the relation between growth potential and dividend policies in developed and developing countries.

In developing countries, capital market are immature and minority shareholders are at the weak position, leading that profitability does not have effect on dividend policies, firms in developing countries do not have continuous dividends, and dividend payout ratio is relatively low. However, in developed countries, capital market has complete mechanism and minority shareholders are protected more comprehensively.

Under the circumstance, high growth potential firms tend to pay lower dividend than low growth potential firms. Gordon (1959) used firms of OECD countries as samples from 1994-2005 and use free cash flow as the main factor in the research of dividend policy. The conclusion is that the uncertainty of future cash flow is an important factor when enterprises make dividend policy, which is negatively related to cash dividend. Denis and Osobov (2008) find that there are similarities in dividend policy among different countries.

The Effect of Ownership Structure on Payout Policy

Pathan et al. (2016) take American listed companies as a sample and finds that firms with low equity concentration tend to have high dividend payout policy, while firms with high equity concentration prefer low dividend policy. The conclusion is that the level of dividend payment is negatively related with the equity concentration. Research by Denis and Osobov (2008) indicate that the greater the controlling shareholders’ power, the more cash freedom it has, and the less profit it can get. The higher concentration of ownership, the controlling shareholders tend to high dividend policy to obtain benefits.

Fama and French (2001) selected Japanese and American listed companies as samples, by comparing the dividend policy of the two countries, the conclusion is that the concentration of ownership structure of American listed companies is lower, and its cash dividend payout ratio is higher. The dividend policy of the listed companies in the two countries is different because of the difference of equity concentration degree. DeAngelo (2006) took American listed companies as a sample from 1982 to 1995 and conclude that there is a positive correlation between the dividend payout level of listed companies and the proportion of institutional investors.

Other determinants of Payout Policy of Financial and Non-financial Firms

Historical Performance

The historical performance of a company has been used as a predictor of many other aspects of company performance besides it stock payout policies. For example, investors have used it to predict trends in share prices, while governments have used the same data to compute corporate tax rates (Pathan et al., 2016). The same methodology has been used to predict dividend payout policy decisions among listed firms. Thus, a company’s historical performance on dividend payout may also be a predictor of their current and future payout policies because managers are known to stay consistent to their past policy guidelines even as their companies undergo different stages of development. Nonetheless, this measure of pay policy determination is only applicable to companies that have a rich history of data that can be analyzed and used to make deductions about future performance.

Investors may experience a difficult time using the above-mentioned methodology to predict determinants of payout policy decisions in small enterprises. The same challenge may be experienced by enterprises that do not utilize effective data generation and storage techniques because the use of historical data to compute future organizational behavior demands the availability of sufficient data. If an organization uses manual methods of data management, or fails to keep track of its policy decisions, it becomes increasingly difficult for investors to reliably ascertain past performance to make decisions about future results.

Company’s Growth Needs

At different stages of a company’s lifecycle, it experiences different needs requirements based on its market expectations and performance. This is why mature firms tend to have different types of resources and goals from those that are in their inception stages. Similarly, firm’s that are in the middle of their growth stages may require a different set of resources compared to those that are only starting up. For example, a firm that has difficulty fulfilling its order requirements due to limited finances may have a different set of needs from that which needs to make customers aware of its presence. Research evidence shows that varied growth needs experienced by a company at different stages of lifecycle development have an impact on dividend payout decisions (Pathan et al., 2016). Particularly, those that are within their early stages of development tend to have a lower propensity to offer high dividend payouts compared to those that are in their latter stages of growth.

The effects of a company’s growth needs on its dividend payment plans is not only reflective of the future direction or performance of a firm but also of its quest to meet its future obligations to its customers. Hover, as they grow, they need to realize that their shareholders still expect a return on their investments and they have to balance such needs with the company’s internal resource requirements for growth. Again, firm characteristics are applicable in determining the extent that managers will prioritize their growth needs against their shareholder demands. This is why most young companies are associated with lower dividend payments compared to older firms that have already experienced the growth stage and are in their maturity phase.

Legal Requirements

The legal environment governing a company’s operations have a profound impact on different aspects of its performance. For example, corporate profitability is a direct function of the tax rate imposed on a company because the lower the tax rate, the higher the profitability and vice versa, where high tax rates attract lower profitability. The relationship between a country’s legal requirements and a firm’s dividend payout ratio also exists in the same manner because existing legal statutes often prevent companies from issuing dividends beyond certain limits (Labhane, 2019). Similarly, different legal regimes have diverse rules on how companies can declare their dividends and most managers strive to abide by such regulations to avoid conflicts with authorities. Particularly, this issue is relevant to multinational companies that could have operations in different jurisdictions.

Additionally, those that participate in overseas business, but have their headquarters domiciled in their host nations, may find that they have to address the legal requirements of multiple countries with respect to their dividend payout plans. However, the type and nature of stock exchange market listing largely determines the legal requirements, which have to be followed when formulating or implementing dividend policy payout policies.

Summary

This section of the paper has shown that different issues have been identified to affect dividend payout policies. Most of the factors highlighted in the literature stem from the need to understand a company’s characteristics as the main source of influence for making decisions that influence payout policies. This is the main motivation for the development of the first research question, which seeks to understand the impact of company characteristics on a firm’s dividend payout policies. The multiplicity of determinants of dividend payout options further led to the development of the second research question, which seeks to find out how companies weigh the multiplicity of options influencing their dividend payout plans.

The information gathered in this analysis shows that evidence has been generalized without a specific focus on national, industry or firm differences that affect dividend payout decisions. The current study seeks to fill this research gap by investigating factors that determine dividend payout policies for firms that are listed on different stock exchange markets in China. In this regard, the study will have a Chinese focus, thereby providing a regulatory framework for understanding issues influencing policy directions on dividend payments. The multiplicity of industries from which the sampled companies will come from will also help to highlight differences or similarities in motivations for developing dividend payout options relating to companies operating in the tech and financial sectors. Therefore, the current study will have a localized focus of the research issue.

Methodology/Hypotheses

This chapter explains the techniques used to answer the research questions. Key sections of the analysis will contain a broad analysis of factors affecting dividend distribution without a specific emphasis on the firm involved or industry selected. Subsequent sections of the study will demonstrate how an independent scholarly review of data was used to identify the main determinants of payout policies of commercial banks and technology firms.

Factors Influencing Dividend Policy

What factors influence the dividend policy of commercial banks and technology firms. Through the literature review on dividend theories and empirical studies, this paper combines the macro characteristics of financial and technology industries and micro characteristics of these companies. I project to study the impact of corporate characteristics, ownership structure and macro-regulatory factors on payout policy of financial and non-financial firms.

Company Size

The size of a firm would affects its agency costs. Company size generally refers to the total amount of capital or accumulated surplus and controllable assets since the establishment of the enterprise. Managers often do not want to pay dividends to shareholders, but invest the money in other projects, thereby expanding the corporate model. The larger the company size, managers can get more control benefits.

Therefore, from the perspective of agency costs, shareholders tend to force managers to pay dividends in order to reduce agency costs. Crutchley and Hansen (1989) studied the effect of ownership and financial condition on dividend payment based on agency cost theory. The larger the company size and the more debt, the higher the dividend payout rate and the lower the control of resources. Eije and Megginson (2006), on the other hand, came to the opposite conclusion. The sample they selected is listed companies in EU countries from 1980 to 2003.

The results show that large scale enterprises have high willingness to pay high level cash dividends. This conclusion can be explained by the life cycle theory. When the listed companies are in mature stage, the company scale is large, the disposable resources are more, the reinvestment project is less, then the enterprise will tend to pay high dividends. In addition, the larger the company, the lower the risk of creditors, so the creditors’ restriction of the company’s financial policy is less, and interest rate is low, which provides a relatively large financial space for large companies to pay dividends. Therefore, it can be concluded that the size of listed companies and cash dividend payout ratio are positively correlated. This paper argues that investors have more confidence in large-scale companies because their external financing is relatively easy, and financing cost is lower.

Profitability

Fama and French (2001) have shown that corporate profitability has a positive impact on dividend payments. The profitability of a company represents its ability to create profits. The stronger the company’s profitability is, the more secure the capital source for creditors to collect principal and interest, the more profits available for distribution, the more likely the company is to pay dividends, and the more dividends it will pay to shareholders. Usually, managers transmit the information of the company’s strong profitability to the outside world through cash dividends, but it does not rule out that the management manipulates the dividend policy in order to achieve a certain purpose. In this paper, earnings per share (net profit after tax / total share capital), net assets per share (total net assets / total share capital) and rate of return on net assets (net profit after tax / total net assets) are used to measure the company’s profitability.

Corporate Solvency

Crutchley and Hansen (1989) studied the effect of ownership and financial condition on dividend payout, based on Agency Cost Theory. Solvency is an important index to measure the financial status of companies. The board of directors should consider the company’s financial status, whether it has the ability to repay corporate debt, whether there is a strong ability to raise funds to borrow new debt when making dividend policy.

The solvency of a company is generally divided into long-term solvency and short-term solvency, which are measured by the current ratio and asset-liability ratio. When the debt level is high and solvency is weak, the enterprise will retain more funds to guarantee debt repayment, and weak solvency will increase the external financial costs. The funds needed for enterprise development rely more on their own retention. These two factors make these companies adopt lower dividend policy.

Growth Capability

Previous studies on the relationship between firm growth capability and dividend policy came from the perspective of life cycle theory. The theory of dividend life cycle argues that the operating condition and investment environment of firms are different in different growth stages, and the dividend policy is different. In the early stage of the firm, the enterprise has a better development environment, but the disposable capital is limited. So firms will choose low dividend payment strategy. But in the later period of firm development, the profitability tends to be stable, the investment opportunity is less, the firm has more disposable capital, then the firm will choose the high dividend payment policy.

Investment Opportunities

Fama and French (2001) and DeAngelo (2006) draw similar conclusions, who argue that investment opportunities and dividend payout rate are negatively correlated. This paper argues that when firms face better investment opportunities and the more demand for funds, the greater proportion of profits will be used in investment, and they will tend to pay less cash dividend and pay more stock dividends. When firms face fewer investment opportunities and have abundant funds, they will use the idle funds to pay cash dividend and tend to pay less stock dividends. Based on the analysis above, I propose the following hypothesis:

Cash Flow Adequacy

Cash flow is the guarantee of firms’ continuous operation and the need of daily production and operation, expansion of scale and reinvestment. When we study the relationship between cash flow and dividend policy from the perspective of agency cost, it can be conclude that when the cash flow of the company is sufficient, the company’s decision-makers will choose a higher cash dividend policy in order to reduce agency cost. This paper considers that the abundant cash flow is the guarantee of cash dividend. When firms have stable and abundant cash flow, they tend to pay cash dividends with higher payout ratios. When firm’s cash flow is insufficient, it cannot pay cash dividends even though the firm wants to pay cash dividend. In order to attract investors with lower stock price, the firm may pay stock dividends.

Ownership Concentration

Most Scholars’ research on the impact of ownership concentration on dividend policy derived from the perspective of agency cost. When the concentration of equity is high, controlling shareholders have more control over the company’s resources, and often make use of the decision-making power to develop self-interest dividend policy, which hurts the interests of minority shareholder. Labhane (2019) points out that when companies are highly concentrated, controller will choose to pay high dividends to corrupt the firm. When the concentration of ownership is low, high cash dividend will send good news to external investors. In this paper, I argue that the higher the ownership concentration, large shareholders are inclined to pay high cash dividend in order to gain profits. Major shareholders tend to distribute stock dividends and realize their own interests through equity transfer.

Institutional Investor Shareholding

With empirical studies, most scholars conclude that institutional investors and cash dividend payment level is positive correlated, which is attributed to customer effect. Dhamija and Arora (2019) conducted an empirical study of American listed companies. They conclude that the customer effect does not exist in the impact of institutional investors on dividend policy.

However, it is believed that these institutional investors (especially pension funds, insurance, and trust funds) will not choose to invest in companies that do not distribute dividends. According to the follower effect theory, firms will decide their dividend policy on the basis of considering the investors’ preference. According to the different dividend preference of investors, when firms want to attract dividend preferred investors, they will make high and stable dividend distribution policy. Therefore, this paper argues that mechanism investors are relatively rational, who pay more attention to the investment value of firms and prefer stable cash dividend policy. With the increase of the proportion of institutional investors, firms tend to pay more cash dividends in order to cater to the interest of institutional investors.

Research Hypotheses

Assumption about whether to Distribute Dividend

Hypothesis 1: the proportion of non-tradable shares, such as state shares and corporate shares in the total share capital is positively correlated with the possibility of dividend distribution.

The higher the proportion of non-tradable shares in the total share capital, that is, the higher the degree of ownership concentration, the greater the degree of control of major shareholders over the company. In order to meet the needs of major shareholders for annual investment returns, the more likely the company is to distribute dividends.

Hypothesis 2: the quality of the company’s assets is positively correlated with the possibility of dividend distribution.

The better the quality of the company’s assets and the higher the liquidity ratio, the stronger the liquidity of the company’s assets, and the more likely the company is to distribute dividends.

Hypothesis 3: there is a positive correlation between the size of the company and the probability of dividend distribution.

The larger the size of the company, the more total assets it has, which indicates that the company is in the mature stage, so in order to maintain its market reputation and stabilize the stock price, the greater the possibility of dividend distribution.

Hypothesis 4: there is a negative correlation between the level of debt and the probability of dividend distribution.

The lower the debt level of the company, the better the financial situation of the company, the smaller the financial risk, and the greater the possibility of dividend distribution.

Hypothesis 5: there is a positive correlation between the company’s profitability and the probability of dividend distribution.

The stronger the company’s profitability, the stronger the ability to create profits, the more secure the source of dividend distribution, and the greater the possibility of dividend distribution.

Hypothesis 6: there is a positive correlation between the strength of the company’s operating ability and the possibility of dividend distribution.

The stronger the company’s operating ability is, the better the future will be. Similar to profitability, the stronger the ability to create profits and the greater the possibility of dividend distribution will be.

Hypothesis 7: the company’s cash flow is positively correlated with the probability of dividend distribution.

The better the company’s cash flow, the more cash available for dividend distribution, the greater the possibility of dividend distribution.

Assumptions about Dividend Distribution

Hypothesis 8: the proportion of non tradable shares such as state shares and corporate shares in the total share capital is directly proportional to the distribution of cash dividends and inversely proportional to the distribution of stock dividends.

State shares and corporate shares are non tradable shares, that is, they can not make profits or cash out through stock trading in the secondary market. Therefore, non tradable shareholders who hold most of the shares and have a greater degree of control over the company are more inclined to cash dividends, which is the direct source of their return on investment. Therefore, the more concentrated the share capital is, the more likely it is to distribute cash dividends.

Hypothesis 9: the quality of a company’s assets is directly proportional to the distribution of cash dividends and inversely proportional to the distribution of stock dividends.

The stronger the liquidity of the company’s assets, the better its financial flexibility, and the more it can meet the demand of capital at any time. Therefore, the more cash the company can draw out for cash dividends.

Hypothesis 10: the size of the company is directly proportional to the distribution of cash dividends and inversely proportional to the distribution of stock dividends.

The larger the company’s scale is, the more stable the company is. At this time, the company’s external expansion capacity is not strong, and it does not need more capital for investment. Therefore, the more likely the company is to pay cash dividends: the smaller the company’s scale is, the greater the demand for external expansion is, and the more capital is needed, the company will not have enough cash to distribute, on the contrary, it will need more cash In this case, the company will tend to increase capital with the stock dividend.

Hypothesis 11: the company’s debt level is proportional to the distribution of cash dividends and the distribution of stock dividends.

The lower the debt level of the company, the less the pressure to repay the debt, the more profits available for distribution, and the greater the possibility of cash distribution; when the company has a lot of debt, in order to reduce the financial risk, it is necessary to retain more profits to repay the debt. In this way, the company prefers stock dividends, because it not only retains more cash, but also reduces the pressure of debt repayment.

Hypothesis 12: the company’s profitability is directly proportional to the distribution of cash dividends and stock dividends.

The stronger the company’s profitability is, the more cash can be used for dividend distribution. At the same time, the greater the chance of profit created by refinancing capital investment. In this way, the more likely the company is to distribute cash dividends and stock dividends.

Hypothesis 13: the strength of the company’s operating capacity is directly proportional to the distribution of cash dividends and stock dividends.

The stronger the company’s profitability is, the higher the profit of its main business, which means that the company has more cash available for dividend distribution. When more funds are invested in its main business, the more room for profit will be, and the more likely it is to distribute cash dividends or stock dividends.

Hypothesis 14: the quality of the company’s cash flow is directly proportional to the distribution of cash dividends and inversely proportional to the distribution of stock dividends.

The better the company’s cash flow, the more profits available for distribution, the smaller the possibility of refinancing stock dividend distribution, and the greater the possibility of cash dividend distribution.

Data and Sample

This paper selects 30 listed technology companies of listed commercial banks in Shanghai and Shenzhen stock markets in 2017, 2018 and 2019, which have not distributed dividends, distributed cash dividends and distributed stock dividends, and collates their annual report data to obtain the original data required in this paper. Before the empirical analysis, the sample and data should be explained as follows:

- The data in this paper are obtained from the annual reports of listed companies

- On the issue of conversion and allotment of shares, due to the diversity of the forms of dividend distribution in China, that is, in addition to cash dividend and stock dividend, there are other forms of converted share capital, and our listed companies are used to include converted share capital into the distribution plan. Although it does not belong to dividend distribution in essence, its characteristics are very similar to stock dividend, so the converted share capital is regarded as stock dividend in the following study. In this way, the distribution can be simplified into three types: no dividend, cash dividend and stock dividend.

- On sample selection, in this paper, when we study whether to distribute dividends, the sample of dividend distribution is a mixture of cash dividend and stock dividend. In the study of cash dividends and stock dividends, the samples only come from the companies that distribute cash dividends and stock dividends.

- On data processing – In this paper, the data processing is mainly carried out with the help of Stata and excel.

Results

Variable Design

According to the previous factor analysis and hypotheses mentioned, the explained variables and explanatory variables are designed as follows:

Table 1. Variable Design (Source: Developed by Author).

Model Design

Research on Factors Influencing Whether to Distribute Dividends

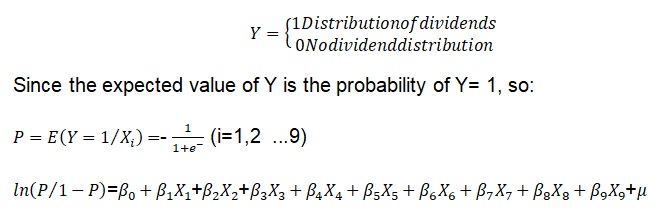

Since the problem studied is a binary choice, distribution or not, and it is assumed that each individual is faced with the choice of one of the two, the purpose of the classification selection model is to determine the probability of individuals with given characteristics to make this choice rather than that choice. The logistic model uses the logical probability distribution function, and the dependent variable will be expressed in the form of probability. Therefore, this model is selected and established as follows

Among them, P is the probability of dividend distribution, β0 is the constant term independent of each factor, β1 – β9 is the regression coefficient, which indicates the influence degree of each factor on LN (P/1-P), and μ is the random error term.

Research on the Influencing Factors Affecting Dividend Distribution

As the explanatory variable is in the form of natural logarithm or ratio of the amount, the multiple linear regression model is used to estimate the parameters with the least square method. In this paper, cash dividend per share and stock dividend per share are used as explanatory variables, and the above designed indicators are used as explanatory variables to conduct multiple linear regression to find the explanatory variables of dividend policy. In the model, the variables that did not pass the t-test were eliminated step by step, and the goodness of fit of the model was tested by R2, then heteroscedasticity, sequence correlation and multicollinearity were tested and revised. Finally, find out the explanatory variable, which has the greatest influence on the explained variable.

At 95% significant level, the model was established as follows:

![]()

Where Yi is the dividend per share of the i-th dividend distribution method, β0 is the constant term β1 – β9 is the regression coefficient, which indicates the influence degree of each factor on Yi, and μ is the random error term.

Empirical Analysis

An Analysis of the Influencing Factors of Whether to Distribute Dividends or Not

According to the nine explanatory variables designed above, logit stepwise regression in Stata was used to estimate and test the parameters. At the 95% significance level, the following test results of influencing factors were obtained:

Table of factors affecting whether to distribute dividends

Figure 1. Regression Analysis (Source: Developed by Author).

It can be seen from the above table that the factors influencing the dividend distribution of listed companies are different in different years. In 2017, the significant variables influencing the dividend distribution of listed companies are X2, X3, X6 and X8; in 2018, the significant variables influencing the dividend distribution of listed companies are X3 and X8; in 2019, the significant variables influencing the dividend distribution of listed companies are X3, x4, X7 and X8. From 2017 to 2019, the significant variables influencing the dividend distribution of listed companies are X3, x4, X7 and X8.

Overall, whether the dividend distribution of Listed Companies in Shenzhen stock market is significant or not, whether the dividend distribution of Listed Companies in Shenzhen stock market is significant or not and whether the dividend distribution of Listed Companies in Shenzhen stock market is significant or not. At the same time, the effect is not significant. Through the summary table above, the variables that affect the dividend distribution of listed companies are x1, X2, X3, x4, X6, X7, X8. Among them, X3 and X8 have the most significant impact, which have passed 5 times in each of the six model estimation tests; X4 and X7 have passed 2 times in each of the six model estimation tests; and x1, X2 and X6 have passed 1 time in each of the six model estimation tests.

Therefore, it can be said that the ownership structure, asset quality, company size, debt status, profitability and operating capacity of listed companies are the main factors that affect their decision whether to distribute dividends. Therefore, we accept hypothesis two, three, four, five and six and reject hypothesis one. That is to say, the higher the asset quality, the larger the scale, the lower the debt level, the stronger the profitability and operation ability of the company, the greater the possibility of dividend distribution; the stronger the concentration of share capital, the smaller the possibility of dividend distribution

Analysis of Influencing Factors of Cash Dividend Distribution

As stated in the model design in the previous section, the analysis of influencing factors of dividend distribution forms adopts multiple linear regression method, with nine indicators X1-X9 as explanatory variables. The non-significant variables are eliminated by t-test in turn, and the overall goodness of fit of the model is tested by R2, then heteroscedasticity, sequence correlation and multicollinearity are tested and modified respectively. Finally, the results are summarized at the significant level of 95%, the following regression models were obtained under different sample conditions

It can be seen from the above regression results that:

- In equation 5, the cash dividend distribution of listed companies is mainly affected by three factors: ownership structure, asset quality and profitability. We accept Hypothesis 8 and 9 and reject hypothesis 12.

- In the equation 6, the cash dividend distribution of listed companies is mainly affected by the size of the company, debt situation, profitability and operating ability. Hypothesis 10, 11, 12 and 13 are accepted. ‘

- In equation 7, the distribution of cash dividends of listed companies is mainly affected by three factors: ownership structure, asset quality and profitability. Hypothesis 8, 9 and 12 are accepted.

- In equation 8, the cash dividend distribution of listed companies is mainly affected by three factors: ownership structure, profitability and cash flow status. We accept Hypothesis 8 and 14, and reject hypothesis 12.

- In equation 9, the cash dividend distribution of listed companies is mainly affected by the ownership structure, asset quality, company size and profitability of the company, and the hypothesis 8, 9, 10 and 12 is accepted.

- In equation 10, the cash dividend distribution of listed companies is mainly affected by the company’s ownership structure, asset quality, company size and profitability. Hypothesis eight, nine, ten and twelve are accepted.

Table 2. Model Analysis (Source: Developed by Author).

From the table 2 above, we can clearly see the number of times that the factors represented by each variable have passed the test. From this, we can conclude that the factors that affect the cash dividend distribution of listed companies, in order of influence degree, are company profitability, ownership structure, asset quality, company size, debt situation, operating ability and cash flow situation.

Analysis of Influencing Factors of Stock Dividend Distribution

We also used multiple linear regression method to analyze the influencing factors of stock dividend distribution, and get the following regression models

- In equation (4.11), the stock dividend distribution of listed companies is mainly affected by the quality of the company’s assets, profitability and cash flow. Accept hypothesis 14 and reject hypotheses 9 and 12.

- In equation (4.12), the dividend distribution of listed companies is mainly affected by the company’s debt status, profitability and operating ability. We accept hypothesis 12 and reject hypothesis 11 and 13.

- In equation (4.13), the dividend distribution of listed companies is mainly affected by the company’s profitability and operating ability. Hypothesis 12 and 13 are accepted.

- In equation (4.14), the distribution of stock dividends of listed companies is mainly affected by three factors: profitability, operating capacity and cash flow status. Hypothesis 13 and 14 are accepted, and hypothesis 12 is rejected.

- In equation (4.15), the dividend distribution of listed companies is mainly affected by the quality of the company’s assets, the size of the company, liabilities, profitability and cash flow. We accept hypotheses 9, 11 and 14 and reject hypotheses 10 and 12

- In equation (4.16), the stock dividend distribution of listed companies is mainly affected by the size of the company, debt situation, profitability and operating capacity. Hypothesis 11 and 13 are accepted, and hypothesis 10 and 12 are rejected.

Table 3. Summary of factors affecting dividend distribution (Source: Developed by Author).

Like the research on the influencing factors of cash dividend distribution, we can see clearly from table 3 above that the number of times that the factors represented by each variable pass the test. From this, we can conclude that the influencing factors of stock dividend distribution of listed companies are listed in the order of influence degree: company profitability, operating ability, debt situation, cash flow situation, asset quality and company size.

By contrasting the above findings with the theoretical evidence highlighted in the literature review section, we find that traditional dividend theories largely explain the main determinants of payout policies of commercial banks and technological firms. This is because the order of degree of influence of the above-mentioned factors impacting dividend pay polices, such as company profitability, operating ability, debt situation, cash flow, asset quality and company size all point to customers being risk averse.

In other words, investor actions is often influenced by their perception of loss of money based on a company’s internal management policies or external market situation. For example, in this research paper, it has been stablished that companies with strong asset qualities have a higher likelihood of issuing dividends compared to those with lower quality assets. This means that investor actions is dictated by their attachment of risk to the quality of asset involved. The higher the risk, the lower their likelihood of investing in such firms, thereby decreasing the likelihood that the same firms would issue dividends.

From the above statement, investors seem to be largely motivated by the need for stability and predictability as key drivers of their investment decisions. This viewpoint is largely supported by the signal transmission theory, which demonstrated that investors perceived the pursuit of stables dividend payout polices as a positive indicator for better returns on investments. This is why the theory presupposes that dividend payouts are largely seen as welcome move by investors because they deem it part of their developmental plans. However, the ease of implementation depends on whether a firm remains liquid, or not, because this factor has been identified as one of the most important determinants of dividend policy payment decisions. Therefore, coupled with profitability, they form powerful forces for determining whether a company will issue dividends, or not.

The agency-cost theory also explains the rationale for investor actions highlighted in this paper because it mentions the conflict of interest between companies and their shareholders. On one hand, investors want to maximize their returns but do not have as much information as managers do about the company’s operations to make an informed choice about it. Therefore, some level of mistrust occurs between managers and investors that force them to be risk-averse. However, as opined in this report, investors are naturally risk-averse and the company’s policies on dividend payouts reflects as much.

Summary

The summary of actors affecting dividend payouts highlighted in table 3 above reflects the range of factors that contribute to company’s overall dividend distribution policy because managers often deploy different tools to meet stakeholder concerns, in light of their primary goal – to maximize returns. Ownership structure, asset quality, company size, debt position, profitability and operating capacity are all frameworks that managers use to formulate their dividend distribution plans. The six models highlighted in this research paper outline the impact that such determinants would have on a company’s distribution policies. Profitability emerges as the main consideration for managers to dictate their dividend distribution policies as it appears in all the six models mentioned. Stated differently, not all other dividend policy considerations appear in the same sequence as profitability does. This makes it one of the most impactful considerations of business quality performance and, by extension, the most reliable predictor of dividend payout polices.

The findings presented in this analysis are consistent with the empirical literature highlighted in chapter 2 of this research paper. For example, the evidence gathered in the study showed that firm characteristics influenced dividend payout policies for both financial and non-financial firms. This finding is consistent with similar findings highlighted on the same research relationship because historical evidence showed that the basic characteristics of a firm significantly affected its stock payout policies.

The findings highlighted in this area of research are also consistent with additional evidence presented in section 2 of this report, which showed that the ownership structure of a company had a significant impact on stock payout polices. In other words, the models predicted the same outcome because they equally suggested that ownership structures had an impact on stock payout policies. The consistency in findings between the current and past literature means that the management considerations for financial and nonfinancial firms regarding stock payout policies do not differ much from historical data on investor relationships and stock market performance sampled in the past. The consistency of findings also implies that factors influencing dividend payout decisions among Chinese firms are similar with those adopted in other countries.

Conclusion

The aim of this study was to find out the determinants of payout policies of financial and non-financial firms. In line with this goal, three research questions were formulated. The first one was to establish the impact of corporate characteristics on the dividend payout policies of financial and non-financial firms and the second one was to determine factors affecting the weighting of dividend distribution policies of financial and non-financial firms.

The last research question was formulated to find out how macro-regulatory factors affect the payout policies of financial and non-financial firms. Based on the nature of the three research questions highlighted above, the investigation was mainly focused on financial and non-financial firms. Commercial banks were used as examples of financial firms, while technological firms represented non-financial enterprises.

The information obtained in this document was collected over a three-year period that stretches between 2017 and 2019. Within this time of analysis, the companies did not distribute dividends in cash or stock forms. Their annual report data were also collated to obtain the original evidence required for analysis in this paper.

The data used in the analysis was obtained from the annual reports of listed companies. HSBC, Standard Chartered, Citi Bank, ICBC and Barclays, were selected as financial firms and an analysis on their dividend payout policies and decision-making processes carried out. The largest Internet and Technology firms dominating the industry today, such as FAANG (Facebook, Apple, Alphabet, Amazon and Netflix), Alibaba and Tencent were equally selected as non-financial firms.

Data relating to the firms were obtained from Chinese databases and extrapolated using the Stata software to get a holistic understanding of major trends in the data that helped to ascertain or reject the hypotheses advanced in this paper. Evidence was also gathered from the literature review section in chapter 2 on dividend theories and empirical studies by combining the macro characteristics of financial and technology industries and micro characteristics of these companies to ascertain factors that affect dividend polices.

The evidence captured in the analysis, showed that corporate characteristics affected the dividend payouts of financial and on-financial firms. This finding addressed the first research question of this study. In this context of analysis, corporate characteristics refer to identifying features associated with a company’s unique characteristics. For example, its ownership structure and stage in corporate lifecycle are unique identifiable features that are likely to influence how managers make decisions on dividend payouts.

The evidence presented in this study also demonstrated that corporate features significantly affected dividend payout policies because the six models used to undertake the regression analysis showed that profitability, ownership structure, asset quality, company size and other features that represent a firm’s characteristics were linked to dividend payout decisions. This finding is linked to the first objective of the study, which is to determine the impact of corporate characteristics on the payout policies of financial and non-financial firms. Thus, corporate characteristics play a significant role in determining the kind of dividend payout policies a firm is likely to pursue.

The second research question, which sought to determine factors affecting the weighting of dividend distribution policies of financial and non-financial firms, was also addressed in the study. The evidenced gathered showed that certain factors appeared to have more weight on company decision-making policies than others. Several factors could be responsible for this outcome but they are rooted in a company’s core characteristics and industry dynamics. However, there are certain overriding factors that cut across different sectors, which generally affect dividend payout decisions. For example, company size affects such decisions, regardless of firm or industry characteristics.

This statement is supported by the current empirical evidence developed in this study and the historical data obtained in the literature review section. Indeed, smaller corporations tend to be perceived by investors to be of high risk and therefore less deserving of their attention compared to those that have a large size and have been operational for years. This statement contributes to the first research question, which sought to find out whether a firm’s characteristics influences their dividend payout policies.

A company’s size is only one characteristic that affects payout policy decisions because other factors, such as ownership structure, asset quality and profitability equally have a significant impact. These determinants of policy outcomes cut across different industries and firms because most investors are aware of the same factors. For example, profitability is a strong motivator for investment actions regardless of whether it is a firm operating in a tech or financial industry. This statement is based on the findings of the six models used to analyze the data collected because each factor influencing dividend payouts appeared in different sequences across the model analysis framework. For example, the profitability of a firm had more weight on a company’s dividend payout decisions compared to asset quality.

The second research question sought to find out which considerations influence how companies attach weight to different factors influencing dividend payout decisions. The overriding interests of a firm emerged as the main underlying factor affecting dividend payout decisions. Particularly, the interests of the true owners of the company seem to influence most dividend payout decisions formulated by these companies because managers always want to keep their employers happy. In most cases, they happen to be their shareholders, whose main interest is profitability.

The third research question, which sought to find out how macro-regulatory factors affected the payout policies of financial and non-financial firms, was also addressed in the study through the investigation of government policy decisions on firm dividend payout policies. In other words, the need for maintaining consistency in policy approach between governments and companies is paramount if payout policy decisions are to be accepted by employees and at an industry level. The role of government cannot be ignored in this analysis because it is the arbiter and custodian of the interest of different players involved in business relations. For example, the government enforces corporate laws on their shareholders and, equally, shareholders have an obligation to make sure that they abide by policy guidelines that safeguard corporate operations.

In this kind of arrangement, macro-regulator factors have an impact on the payout policies of many companies. Particularly, this is true for the companies selected in this analysis because they were Chinese-based and listed on its stock markets. China has a long history of government control and its polices have been felt not only at industry level but also at firm level as well. Therefore, it is typical for a company to formulate its payout policy decisions, within the regulatory framework set out by the Chinese government. However, there a lot of similarities can be drawn between how macro-regulatory factors affect dividend payout decisions in China and western counties because most of the evidence gathered in the literature review section was drawn from American and European companies. At the same time, it is established that most of the findings highlighted in this research paper are consistent with those presented in the literature review section. Thus, it means that the Chinese based findings are reflective of western-based studies.

Overall, it is difficult to ignore the role of profitability in influencing the decision on whether a company should issue dividends or not. This is because it emerged as the most commonly identifiable denominators in the six models developed in this port. This finding only goes to emphasize the role of economics in influencing business decisions. In other words, the will of shareholders is deemed superior to all others and until this criterion is fulfilled, it becomes difficult to conceptualize any other use for a company’s resources.

Recommendations

The findings highlighted in this paper have been developed after developing six models that strived to predict factors that influenced the decision of firms to issue dividends, or not. Future research should use different variables to develop alternative models for achieving the same goal. Variations in methodology would contribute towards further understanding the findings of the study because they will provide greater depth to comprehending factors impacting a company’s decisions to issue dividends, or not. Additionally, this strategy would improve the integrity of the findings because it will be possible to detect consistencies or inconsistency of findings between the two sets of models discussed above.

Future research should also use a different sample of companies because the ones selected for this investigation only included those that offer either cash or stock dividends. This means that the factors identified to affect their dividend policies are largely confined to the two types of rewards – cash and stock dividends. Therefore, other researchers should investigate whether the factors identified to affect policy decisions are also consistent with those that affect the dividend payout policies of firms that do not offer cash and stock dividends.

This recommendation means that the findings highlighted in this document should be adopted cautiously and within the context of factors for which they were formulated. Stated differently, it should be noted that the factors identified to affect dividend payouts are only reflective of firms that offer cash and stock dividends.

The type of dividend offered is an important factor to consider in this analysis because ownership interests that influence payout policies are dependent on the kind of dividends offered by a company. Since ownership was identified as one of the factors impacting pay policies in this study, by extension, it means that the type of dividend offered should affect the payout policies as well. Therefore, it is important for future researches to consider this issue when investigating factors that influence payout policies because the type of dividend issues represents the main interests driving company performance and management decisions.

The findings of this study should also be conceptualized within the Chinese financial and technology sectors. This is because the sample of data selected for analysis in this study came from corporations that are within the sector. Additionally, the statistics analyzed in the process was related to recent financial data obtained from the year 2017. This means that the information used to generate the finding are representative of current investor and market activities. This statement shows that the validity and reliability of the findings are rooted in the methodology selected. However, future studies should expand the period of data collected for analysis beyond the year 2017 to get a broader understanding of issues that affect dividend payout policies in companies.

Doing so would make it possible to identify patterns in stock market performance that would explain investor sentiments and actions based on company performance. It will also enrich the data available for analysis because a broader analytical period would mean that more factors influencing investor activities and management decisions would be included in the model analyzed. Similarities can also be drawn to the need to expand the number of sectors for which the sample of companies was drawn from because the findings presented above are only indicative of two sectors – technology and finance. Granted, these industries play a significant role in spurring the global economy, but other industries can be driven by a different set of factors when determining their stock payout policies.

References

Arora, R. K., & Srivastava, A. (2019). Ownership concentration and dividend payout in emerging markets: Evidence from India. Global Business Review, 4(1), 1-10.

Crutchley, C. E., & Hansen, R.S. (1989). A test of the agency theory of managerial ownership, corporate leverage, and corporate dividends. Financial Management, 18(1), 36–46.

DeAngelo, H. (2006). Dividend policy and the earned/contributed capital mix: A test of the lifecycle theory. Journal of Financial Economics 81(2), 227–254.

Denis, D. J., & Osobov, I. (2007). Why do firms pay dividends? International evidence on the determinants of dividend policy. Journal of Financial Economics, 9(2), 1–10.

Dhamija, S., & Arora, R. K. (2019). Impact of dividend tax change on the payout policy of Indian companies. Global Business Review, 20(5), 1282–1291.

Eije, H., & Megginson, W. (2006). Dividend policy in the European Union. Web.

Fama, E., & French, K. (2005). Financing decisions: Who issues stock? Journal of Financial Economics, 76(1), 549–582.

Gordon, M. J. (1959). Optimal investment and financing policy. Journal of Finance, 18(1), 264–272.

Hess, P. (1981). Dividend yields and stock returns: a test for tax effects. Web.

Labhane, N. B. (2019). Dividend policy decisions in India: standalone versus business group-affiliated firms. Global Business Review, 20(1), 133–150.

Lintner, J. (1956). Distribution of incomes of corporations among dividends, retained earnings, and taxes. The American Economic Review, 2(1), 97–113.

Pathan, S., Faff, R., Méndez, C. F., & Masters, N. (2016). Financial constraints and dividend policy. Australian Journal of Management, 41(3), 484–507.

Rozeff, M.S. (1982). Growth, beta and agency costs as determinants of dividend payout ratios, Journal of Financial Research, 5(3), 249–259.

Williams, J. B. (1938). The theory of investment value. Harvard University Press.

Yahoo Finance. (2020). Standard Chartered PLC. Web.