Introduction

The latest financial crisis made it clear that the way how decisions are taken and implemented in a company can make the difference between success and failure in the market (Gomez-Mejia et al., 2008). Since the first problems were ‘spotted’ at the beginning of the century with governance failures at Enron, WorldCom, Tyco, Adelphia, Global Crossing, there has been a lot of reaction by the academic and legislative world. Many authors have criticized dubious and ethically discussable corporate governance decisions. As Kaplan and Holmstrom point out:

“Besides spurring productivity improvements, the rise of equity-based pay—particularly the explosion of stock options—and the run-up in stock prices in the late ’90s created incentives for the shortsighted and at times illegal managerial behavior that has attracted so much criticism” (2004, p. 71)

The new regulations enacted, even by federal law, reshaped the relationships between stakeholders in a company. They also reshaped the duties and, especially, responsibilities, of a management team. The case we are going to discuss is about the reshaping of these relations between the various stakeholders at McBride Financial Services. The new regulations oblige companies to form new institutional components and have all parties interested take part in the process. In our case, the formation of the new Board of Directors and the functions and role it will play in the company’s future are a matter of divergence between the management team and the major investor, Beltway Investments.

This paper will try to assess the situation at McBride Financial by assessing the problems between the two interest groups, the stakeholders of the situation and the possible solutions to the problem. All this will be done in order to deliver an optimal solution that will satisfy all parties and fulfill law obligations. This will ensure a positive corporate governance model and will surely positively influence the market future for McBride Financial Services.

Situation Analysis

Issue and Opportunity Identification

Corporate governance has been one of the major topics since the Enron scandal at the beginning of the decade. There have been many discussions and studies on this topic. There have been also many legislative actions during this time. Such is the Sarbanes-Oxley Act of 2002 which opened the door to other regulatory changes as those implemented on NASDAQ and NYSE. Sound management and corporate governance have become important issues for investors and management teams also (Brown and Caylor, 2004).

This is certainly the case with McBride Financial Services. Due to the industry turmoil and subsequent situation with the new laws and regulations, investors have become increasingly concerned with the performance of the companies they have invested their money. Beltway Investment has been showing these concerns over the last period. Even though by the email exchange with McBride’s management team a sense of confidence is shown, they would like to see more concrete plans for future actions. On the other hand, the management team at McBride would like to have less pressure and control over their decisions and operations. This is an issue of compliance control. This is done in order to ensure the safety of an investment.

On the other side, Hughes, CEO of McBride Financial Services, is trying to avoid Beltway’s control by making some moves that would seem to be in accordance with investor requisitions. By the emails, we can understand that he is instructing his management team to find some justifications to ‘get rid of’ Beltway Investments. The issue here is that of the role that management teams have on corporate governance.

The actions of these two actors raise the issue of distributive negotiations since they are both trying to achieve what they want by using different techniques. This is an ambiguous situation since it can both harm and benefit the company depending on how they will interact with each other. The opportunity for the company is that key players in corporate governance can come together to work under a common plan and objectives. If both parties manage to synchronize their ideas and efforts then they will transmit a positive message to the market. This positive message will not pass unnoticed by customers and will reinforce brand recognition and ensure a positive perception for the company.

Sound corporate governance is the key to protecting the company (in fact every company) from market crashes and external threats (Glossman and Steward, 2004). Yet, sound corporate governance cannot be achieved without the synchronization of efforts from every party involved. All stakeholders’ perspectives should be taken into account and the interest of a stakeholder group should not be favored over the other. For this reason, we need to identify who are the stakeholders of McBride Financial Services and what are their perspectives and dilemmas.

Stakeholder Perspectives/Ethical Dilemmas

From what we wrote above it can be understood that both parties are stakeholders of the company. Its labor force, its staff, is a stakeholder for a company. In our case, it is represented by the management team of McBride Financial Services, but all the other level staff can be considered stakeholders too. They earn their living with this company and their interest is certainly to have a prosperous company. They also have the right to be properly rewarded for their work. From the views diverge between the management board and the investor, the labor force is the primary stakeholder which suffers the consequences. They have much to lose from company failure. This is why their involvement in the decision-making process is crucial and important.

Another stakeholder is Beltway Investment. As an investment company Beltway has put its financial assets along with its trust and brand reputation at stake. As the major investor, the primary source of financial assets, for McBride Financial Services, it is concerned with the future of the company. Every investor has the right to safeguard the future of his investment. In fact, the new laws and regulations that were introduced starting in 2002 take a clear stance on the rights of investors (Kaplan and Holmstrom, 2004). As the sole investor Beltway tries to ensure that the management board of McBride does not take decisions that may harm their investment. The dilemma here is whether the fact that you invest your money in a company gives you authority to control the decisions of the management team. After all, Beltway decided to become McBride’s investor because they trusted the way the company was managed. We will discuss in alternative solutions whether more control over the management team is the answer to prevent problems at McBride.

And a final stakeholder would be the consumers. To be correct, stakeholders would be those categories of consumers which McBride Financial Services targets. As the company states in its mission statement they target certain categories of consumers like professionals who wish to have a second or a first house or retirees who wish to buy a property. These people are the ones who benefit from or suffer from the services offered by the company; they benefit if the company offers excellent financial services, especially mortgage services, and suffer from financial loss if the company fails to deliver them the necessary help and the best solution for their situation. This is why the correct function of the company is a matter of great interest for them. Corporate governance is the ‘driving force’ which enables the company to serve its customers in the best way possible. The Oxley-Sarbanes Act of 2002 takes a strong position positioning on customer defense. Thus, these groups of consumers are directly interested that the divergences between the McBride management team and Beltway Investments be removed and full collaboration is established.

Problem Statement

McBride Financial Services is committed to becoming a leading business company in the real estate financial market by providing state-of-the-art services in home and property buying. McBride will try to accomplish this goal in the five states area it operates and gradually expand to new markets.

McBride Financial Services will achieve this goal by providing sound corporate governance by developing tools for successful negotiations among its stakeholders. Furthermore, it will accomplish the desired goals by enforcing a management system that will consider all stakeholder’s perspectives and ensure the efficiency and efficacy of the company in the market.

For these reasons, it needs to develop a solution to the divergences among its various stakeholders and implement a corporate culture that will encourage efficiency and responsibility.

End-State Vision

The end-state vision for this company is to make McBride the leading financial services company in the real estate market of house and property buying in the five states it is actually operating.

The end-state vision is to have McBride become an attractive company for investors by having a strong corporate culture of stakeholders’ perspective consideration combined with efficient management.

The end-state vision is to have McBride become a solid brand in the market with high positive customer perception as a company delivering excellent financial services.

Alternative Solutions

One of the first issues that need to be addressed is the incomprehension between Beltway Investment and the management team at McBride financial Services. There are various options for how the situation can develop.

One solution option would be to have a sort of ‘round table’ with Beltway and share the viewpoints on what they expect from the company and what is their perspective; a sort of agreement between the management team of McBride and Beltway Investments where the management team would be more considerate of the viewpoints of Beltway. As a consequence, they would design an action plan that will completely include shareholders’ perspectives.

Another solution would be that the management team will completely disregard Beltway’s viewpoints and perspectives for the business. They can continue conducting activities as they wish disregarding the Board of Directors and the recommendations of Beltway. This is certainly the way that Hughes is currently responding to the situation. The reaction he showed his management team relating to the concerns expressed from Beltway demonstrated total disregard of others’ viewpoints. The role of the Board of Directors and of the external auditing company is perceived as formal and superficial. We will discuss later what this view can bring to the firm.

A third solution to the situation would be that the Board of Directors plays an important role in the company’s direction and policies but still it does not interfere with the managerial autonomy of conducting everyday business that the management team of McBride should have. The auditing company also plays a controlling role in assessing the limits inside which the management team should ‘play its game’.

Analysis of Alternative Solutions

To begin with the first, the option of the shareholders’ viewpoints is fully incorporated into the managements’ team action plan. As a matter of fact, taking into consideration stakeholders’ viewpoints is part of the shift in power from the management team to all the stakeholders involved. This situation is evaluated to be one of the key factors of sound corporate governance and an incentive to a company’s performance (Edwards and Hubbard, 2003). But here we are talking about a total, or major, shifting toward shareholder’s viewpoints. That would immediately create a problem; it will restrain creativity and innovation. There are various key players in corporate governance, and the CEO and his management team are important ones. Their inputs and ideas are essential to succeeding in business. If things are done as the shareholder likes, the Beltway way, then these players will turn into executing mechanisms that will lack motivation and incentives for innovation. If things go wrong they are the least to be blamed since they will have followed shareholders’ plan but yet, the primary ‘looser’ if the situation will be the shareholder itself. A shareholder needs the creativity and innovative ideas of the CEO and his management team. It would be a mistake to implement this alternative as a solution.

The second alternative can be considered to be the opposite of the first. It is what the CEO and management team seem (from the emails) to view as the solution. The vision of the CEO of McBride, Hughes, is that of an inactive Board of Directors that meets twice a year and has a secondary role in the way business is conducted for the company. The same can be said of the messages sent to the management team by the CEO in which he openly states that the shareholder should not interfere in how business is conducted. This raises the problem of ethics in corporate management.

It seems like the management team and CEO of McBride tries to bypass the concerns of the primary shareholder, Beltway, by forming a ‘façade’, an illusion, that they are considering their remarks. This dubious ethical conduct can tension the relationship between the players and ultimately damage the image of the company. An ethical and correct relationship would be at the core of increasing performance and efficiency for McBride along with helping in creating positive brand recognition. This behavior of trying to surpass the laws by and shareholder perspectives certainly is not the solution.

Risk Assessment and Mitigation Techniques

Many of the risks associated with the two optional solutions have been already mentioned. The major risk is that of creating a relationship based on mistrust. Both, McBride’s management team and CEO and Beltway will tend to separate from each other. The reason is that they will not trust the other. That poses a major threat to the health of the company. The image transmitted to the market would be negative and customers would notice. Being McBride a company that impacts directly on the financials of an individual, it should show compactness and solid corporate culture that is built on trust and security. The problem between the management team and the shareholder poses the risk of damaging the corporate culture.

Optimal Solution

The third mentioned alternative would be the optimal solution for this situation. This would be the solution that would help build a solid relationship based on trust between the parties. As the law requires the Board of Directors shall be formed and an auditing committee will be formed to monitor the financial health of McBride. They can decide even to outsource and select an external auditing company. These two organs will serve as controlling institutions for the management team of McBride. Nevertheless, this does not mean that the management team should conduct business strictly as the shareholder requires. Part of the solution would be that the management board shall have full autonomy in conducting daily business. They will follow the general principles and guidelines, but they will be in charge not only of the implementation the way they evaluate it to be more appropriate. The external auditing company will serve as a whistleblower for the actions of the management team. The role of the whistleblower is essential for the financial health of a company. It sets the limits within which the company should conduct business (Millstein and MacAvoy, 2004).

The Board of Directors will take into consideration the evaluation of this auditing agency and adequately adjust policies if necessary. The management team will use the reports of this audit committee, or external agency, in assessing the necessary steps they can make.

Implementation Plan

The first step would be to form a negotiating group that will decide the appointments in the Board of Directors. This negotiating group will also decide whether to outsource auditing to an external evaluation agency or to form an auditing committee within McBride. This negotiating group shall be composed of representatives of Beltway, as the primary shareholder, and representatives of the management team of McBride and its CEO.

The second step would be to appoint the Board members. Both parts will have the ability to propose 50% of the Board members. Each member appointed should have the support of both parties in order to form a Board that has full support from all the players. This Board of Directors shall not have only a formal appearance and role for McBride but will be the one who will approve the guidelines and vision upon which the company will conduct business in the market. Then this negotiating team, group, will decide whether to outsource auditing or select an auditing committee and select its members.

The third step would be to determine the duties and rights of the Board and auditing agency along with those of the management team of McBride. Full autonomy should be given to the management team and CEO in conducting daily business. This autonomy will serve as an incentive and will ensure creativity and innovation.

A fourth step would be that the Board of Directors will approve the guidelines and policy based upon which the management team will conduct business. Yet, as mentioned, the way it will be implemented will be let free to choose from the management team.

The Board will time after time conduct analyses and evaluations of the management team. They will have to report to the Board for their activities. Keeping an eye on the management team, without inappropriate interference, will benefit the company (Bogle, 2003).

The audit company, the whistleblower, will ensure that the management team does not take decisions that will harm the financial health f McBride.

Evaluation of Results

For a business company, there is nothing more important than customer satisfaction (Mullins et al, 2008). Of course, that would be the most important indicator showing that McBride Financials is functioning quite well. Nevertheless, there are also other indicators that should be considered when evaluating results. Functionality and efficiency are two important indicators that show how a firm is performing or will perform in the future. If the process of decision-making is fast and accurate that is a positive sign that things are going well. Also, if the audit company reports show that the firm has retained financial stability and decreased risk that is also a positive indicator. A final indicator would be that the management team and company staff give positive feedback for the situation. If the staff of a company is motivated and happy at what it is doing, their performance is likely to boost (Mullins et al, 2008).

The Board of Directors can make quarterly checks on the above-mentioned issues and instruct the management board to be careful or adjust actions if necessary.

Conclusion

Corporate governance is one of the key issues that arose at the beginning of the century. The business world is now convinced that without proper collaboration from all actors involved a company will have fewer chances to succeed.

This is certainly the case for McBride Financial Services. In these difficult times of financial turmoil, the answer would be sound corporate governance. This can be achieved only through collaboration and by taking into account the perspectives of every player involved.

References

Brown, L. and Caylor, M. (2004) Corporate governance and firm performance. Georgia State University doctoral working papers.

Bogle, J. (2003) “Somebody got to keep an eye on these geniuses”.

Bogle Financial Center Keynote Speeches. 2010. Web.

Edwards, F & Hubbard, G. (2004) “The growth of institutional stock ownership: a promise unfulfilled”, in Chew, M. and Gillian, S. Corporate governance at the crossroad. The McGraw Hill Companies.

Glossman, D. and Steward, S. (2004) “Twelve ways to improve your incentive plan.” in Chew, M. and Gillian, S. Corporate governance at the crossroad. The McGraw Hill Companies.

Kaplan, S. and Holmstrom, B. (2004) “The state of U.S. corporate governance: what’s right and what’s wrong?” in Chew, M. and Gillian, S. Corporate governance at the crossroad. The McGraw Hill Companies.

MacAvoy, P. and Millstein, I. (2004) “The active board of directors and its effect on the performance of the large publicly traded corporation.” in Chew, M. and Gillian, S. Corporate governance at the crossroad. The McGraw Hill Companies.

Kinicki, A., & Kreitner, R. (2003) Organizational Behavior: Key Concepts, Skills & Best Practices. Burr Ridge, ILL: Irwin/McGraw-Hill.

Mullins, J. W., Walker, Jr., O. C., & Boyd, H. W. (2008). Marketing management: A strategic decision-making approach (6h ed.). Boston: McGraw-Hill Irwin.

Table 1:Issue and Opportunity Identification

Table 2: Stakeholder Perspectives

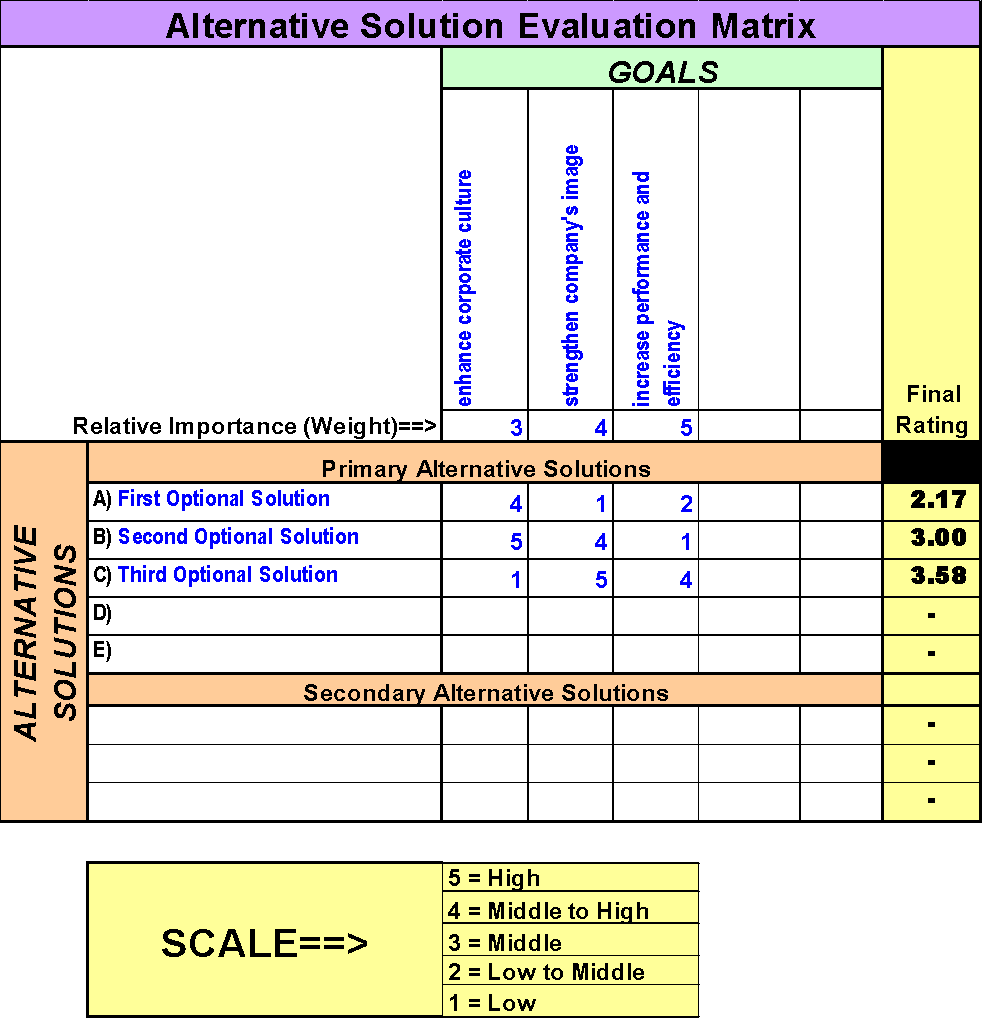

Table 3: Analysis of Alternative Solutions

Table 4: Risk Assessment and Mitigation Techniques

Table 5: Optimal Solution Implementation Plan

Table 6: Evaluation of Results