Introduction

The success of “easyJet” has been focused in this paper on the phase of their company analysis. “EasyJet” has been nominated as the pioneer of the European air network. To evaluate the report, Easyjet’s strategic movement has been compared with Emirates; the main aspirations of key stakeholders, mission, and vision of Easyjet will be discussed. This report will also consider the major points regarding the external and internal environments, business, corporate and global strategies, resources and capabilities, strength, weakness, opportunities and threats, corporate governance programs, organizational structures, PEST analysis, findings, financial condition etc.

Background of EasyJet

The EasyJet Airline Company Limited is a UK based airways started its journey in 1995 with two leased flights from Boeing. Now the company operates almost 100 directions airports in 21 European and American. The easyjet convoy consist of 75 own Boeing 737-700 aircraft including 84 leased crafts with 380 rotes. In 2008, the company has generated pre-tax profits of £123m with a £12.9 million of costs coupled with the amalgamation of GB Airways. It has been evidenced to both the flexibility and quality of the easyJet business model with its human resource has sustained to construct high growth in a tremendously challenging year of 2008 where the others were shocked with recessionary impact.

Developing a strategic vision and business mission

Mission of Easyjet

Easyjet’s objective is to firmly establishing itself as Europe’s leading low-fares scheduled passenger airline through continued improvements and expanded offerings of its low-fares service1.

Vision of Easyjet

Be the leading airline and best in customer service and Easyjet sets the following objectives to implement its strategy:

- Be low cost leadership;

- Cost control;

- Easyjet’s aim to expand its route;

- Build employees to handle multiple job at a time;

- To save the time of passengers by using point-to-point routs;

- Make quick turn around;

- Easyjet is concentrating on quality of services;

- To ensure quality of services with luxuriousness;

- To build up outstanding customer services;

- State of art technology;

- To follow the ETS2 that has settled by the EU. For example, Easyjet is committed to reduce the emission of noxious gas like CO2.

Evaluating Performance & Corrective Adjustments

Easyjet

Easyjet always compare its competitive strengths with other major operations. From the investors presentation the following table has been presented:

The points are representing 1 is worst and 5 is best. Except values for money, Easyjet has ahead in all other sectors. Its management efficiencies have surpassed all other major airlines. While British Airways was receiving fare on an international intra-European route of 180-200, Easyjet was fixed at 130 routs and now it has introduced 91 new routes; therefore, here is no gap between its competitors.

Emirates: A team of service audit manager has been formed to audit at least 500 flights, 8 destinations, 180 audits on call center. This ensures the quality and standards. This audit team also inspects other 6 major competitors to set up the bench mark. A total of 14 stations are audited per year and scrutiny is conducted over the passengers’ satisfaction. Corrective steps are taken always if any mistakes are found of opportunities. The gigantic equipments are relocated to other place, as opportunities are more.

PEST analysis of EasyJet

Political factors

It is well known that political condition changes the business environment, increase or decreases the risk for example oil price for political turmoil, it has adverse impact on the Easyjet’s business. Easyjet is bound to follow the rule sets by the ETS3. Moreover, recently UK has signed-up the in the single European currency which have direct impact on its business such as Easyjet will face the changes of exchange rate.

Economic factors

Now Easyjet in 37 number position among the top fifty EU airlines, which demonstrates its position and market segments. From the annual report 2008 of Easyjet, it can be found that its total revenue is increasing for example- in 2008 Easyjet’s total revenue was £2,362.8 million and in 2007 was £1,797.2 million but for recession it may reduce this year. However, its operating profit has decreasing which may influence take more loans from financial institutions.

Socio-cultural factors

Society, people, friend etc changes the economic conditions as a result, their behaviour, attitude, and demand has a direct relationship with the business. In UK, people are changing their attitude for dieting and health. Therefore, this situation can change the business structure in two ways. Moreover, in Europe, America, there are lived people from different culture, race and religion and among them 40% are minorities of the total population may affect Easyjet’s business.

Technological factor

Easyjet invest largest money to imply the latest technology aircraft at the same time as retiring older aircrafts typically within seven-to-ten years of delivery. Since 2000, it is committed to decrease emissions of CO2 up to 22 percent within 2011.

SWOT analysis EasyJet

Strengths

- Strong brand name image/company reputation as a result Easyjet has strong public image.

- The websites of Easyjet Plc always provide latest information of their company and other flight related issues to travelers and other citizens.

- It provides high quality customer service because besides regular customer, new customer is also important to develop company’s market segments.

- Easyjet has advanced technological support as well as financial capability to save the company from global financial crisis.

- Capable to offset high fuel costs.

- Acquisition with GB Airways.

- Develop euro exchange rate.

- Suitable strategy innovation and implementation.

- Revenue growth amounted £ 123 million that is more than 13.6 % than last year.

- Low fare, No frills has strengthen its position.

- Strong advertisement and promotion.

- Economy of scale and/or learning and experience curve advantages over rivals.

Weaknesses

- EasyJet Plc paid high remuneration to their employees and directors.

- Competitors such as Ryanair, British Airways, Aer Lingus are made high profit therefore it should consider their strategy.

Opportunities

- EasyJet Plc has efficient employees and administration to serve quick customer service with high satisfaction.

- High level of cost efficiencies for further expansion and it will help to face current financial crisis.

- Free flights are offering to increase its profits.

- Employee relationship is better and they always follow the rule of Easyjet.

Threats

- Tourism sector has greatly affected by the Global financial down turns because it creates some uncertainty future expenditure of the citizen as well as tourist. Therefore, the business of EasyJet Plc may adversely effect for financial crisis.

- Likely entry of potent new competitors

- Less expansion in non EU region

- Threats Increasing intensity of competition among industry rivals-may squeeze profit margins

- New industry may become threats for Easyjet.

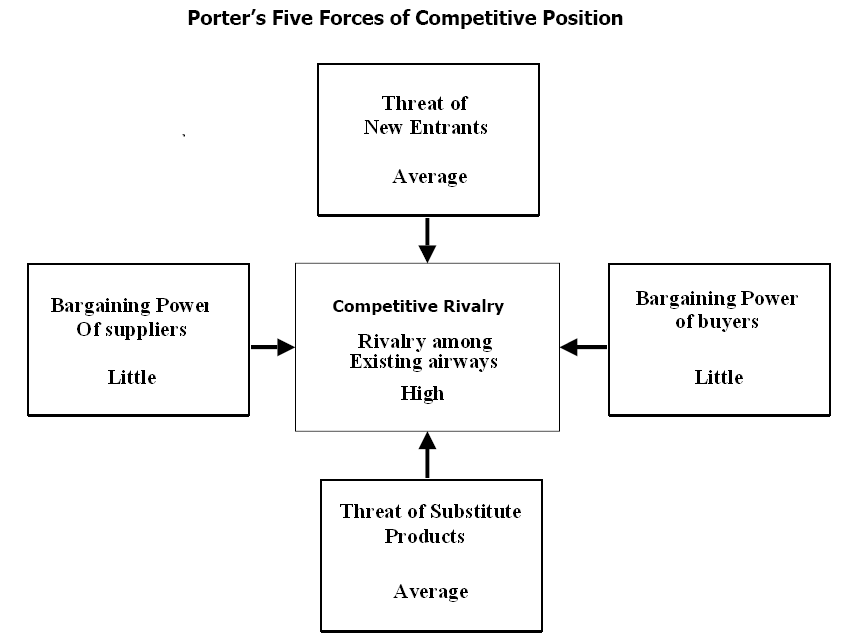

Porter’s five-factor model analyses for EasyJet

The above figure shows the factors are affecting industry competitors. As fare is, low buyers bargaining power is poor, threats of substitute are low as market is saturated. Bargaining power with supplier is poor as they can switch towards in another way any time.

Literature review

In analysing an organization, to facilitate its success several factors need to consider in an aggregate form- strategy, finance, human resources (HR), information system are the essential forces that foster company analysis and their success evaluation. Narrative form of these are presented in bellow

Strategic management

According to Joel Ross and Michael Kami (2001), “Strategy is the game plan of a company’s management that evaluates market position, operation procedure, attract and keep potential and growing consumers, achieve organizational objectives and compete successfully. A company’s heart and soul is managing the tasks of strategy.” A managerial process in which a strategic vision development, setting objectives, strategy designing, strategy implementation and execution and at last performance appraisal, new development supervise and took alternative strategy or correct the existing if requires are accomplished by a manager. Strategic management process is incomplete if these tasks are not properly carried out. In a company analysis, levels of the strategy, both internal and external environment analysis using SWOT analysis is also incorporated. An organization is considered as a rudderless ship that has no strategy.

Financial management

Dess, G., &Lumpkin, G T., (2008), states that monitor and control of monetary activities is involved in financial management. All categories of investment, funding, expenses, earnings, growth rate, share per price, dividend per share, shareholders’ equity etc. are the factors of financial management and financial decision-making. In short, cash inflows and outflows of an organization are supervised in financial management. Success of an organization is mostly depends on the successful management of financial activities.

Human resource management (HRM)

Anthony, W. P., Perrewe and Kacmar (1993) defines that people who work in an organization and directly affected by the organization’s decision making and management practice are under human resource management. Motto of HRM is placed right person in the right place. Other than these planning, recruitment, selection, training and development, compensation structure, safety and security, performance appraisal is the task of HRM department.

Managing information system

As the definition of Loudon and Loudon (1995), information system is a set of inter-related component that act in a cumulative form with the support of technology like-computer, data base management, Internet through a methodical approach. Under this system they- collect, process, store and put in order data, on the topic of decision-making, control, coordination and analysis. Foundation of information system managing is presented in following figure. Information operates cash receipts, deposit, credit decision and payroll decision. Components of the information system are e-mail, tele-conferencing, data conferencing, video conferencing and group ware.

Findings

In this part of the paper, success of “easy Jet” a prominent airlines company is presented here from their various aspects presented as bellow. For their success analysis, here incorporate the issues of-strategic management, financial analysis, human resource management and information system management. Using the source of annual report 2008 of “easy Jet” following finding are grievance.

Strategic analysis

Tools that are used by all stages of the organization in their decision making, policy-making, production, sales and advertising is termed as strategic analysis. In case of “easy Jet”, strategic analysis regard as four levels of the strategy, internal and external environment analysis. A diagnostic form of “easy Jet’s” strategic analysis is as follow

- Their services restrain low cost and highly efficient but have a strong financial existence.

- Build them as a superior air network in Europe.

- Their utmost focus on customer demand and consequently they earned a strong customer position.

- Strengths their financial resources through acquisition with GB Airlines at the begging of year 2008,

- Another point that makes “easy Jet” less defective is their network development.

- Not only build a strong network in aircraft industry nut also holds a efficient network performance.

- In winter, limit margin dilution for margin enhancement. To do this they continuous improve their revenue stream.

- They established more than 60 head office around the world to reach their vision to reserve £ 100 million within 2011.

- Relationship with Airbus makes them efficient in fleet and ownership costs at low level.

- In 2008, they hold their average fuel price at $1,070 and for this when fuel price increase in 50% that had not any impact on per seat revenue at all.

- Through strengthen the euro exchange rate in 2008, “easy Jet” earned 1.32/£ that was 11% greater than in 2007.

Financial analysis

From the annual report 2008 of “easy Jet” findings at financial aspects are shown in following table. In this table, almost all financial factors has been integrated.

Recommendation

- Easyjet Plc can reduce expanses to overcome the global financial crisis and it should not cut the job of their employees.

- Easyjet has large contribution on economy; as a result, it should spend more money for advertising, promotion and R & D.

- Easyjet is powerful and aware safeguarding of brand name to sustain and develop current market share and operation.

- It should fix the wage and price of air ticket considering to the oil price and global economy.

- Easyjet should advertise to increase interest on travel within national and international place.

Conclusion

The report is prepared for depicting the company analysis of Easyjet, Europe’s largest airline in terms of passengers. Easyjet is the pioneered of the low cost provider in Europe in point-to-point routs and it maintains the strategy of administrative efficiency through extensive minimization of costs. The relationship with competitors is antagonistic as it is using head-to-head advertisement and promotional activities. From the analysis, it can be comprehended that in the recent few years Easyjet will be the unreachable market leader for its dynamic and aggressive strategy, financial recourses.

Bibliography

Alacra, Inc., (2009), Thomson Financial Business Description, NY 10005. Web.

Air fleets (2008), Emirates. Web.

Chernev, A., (2007), Strategic Marketing Analysis, 2nd edition, Brightstar Media, ISBN: 978-0979003912

David, F., (2008), Strategic Management: Concepts and Cases, 12th edition, Prentice Hall, ISBN: 978-0136015703

Dess, G., and Lumpkin, G.T. (2008), Strategic Management: Text and Cases, 4th edition, McGraw-Hill, ISBN: 978-0073404981

Doyle P. D, (2004), Adding value to marketing: the role of marketing in today’s profit-driven organization, 2nd Editions, London: Kogan Page, ISBN: 9780749421755

Dibb, S. Simkin, L. Pride, W. M. & Ferrell, O.C. (2001), Marketing Concepts and Strategies, 4th ed., Boston, USA: Houghton Mifflin.

EasyJet airline company ltd. (2008), Charity. Web.

Easyjet Plc (2008), Annual report of Easyjet Plc 2008. Web.

Easyjet Plc (2008), Financial Statement of Easyjet Plc 2008. Web.

Easyjet Plc (2008), Corporate Governance. Web.

Griffin, R. W. (2006), Management, 8th Edition, Houghton Mifflin Company, Boston New York, ISBN: 0-618-35459x

Hitt, M. A. Freeman, R. E., & Harrison, J. S. (2001) The Blackwell Handbook of Strategic Management, Blackwell Publishing, ISBN: 9780631218609

Kotler, P., Armstrong, G. (2006), Principles of Marketing, 11th Edition, Prentice-Hall of IndiaPrivate Limited, New Delhi, ISBN: 81-203-2825-6

Kotler, P. (2006), Marketing Management, 11th edition, Prentice Hall, NJ, ISBN: 0-13-0336297.

Porter, M. E. (2004), Competitive Strategy, Export Edition, New York: The Free Press, ISBN-10: 0743260880

Stoner, J. A. F., Freeman, R. E., Gilbert, D. R. (2006), Management, 6th Edition, Prentice-Hall of India Private Limited, ISBN: 81-203-0981-2

Skinner, S. J., Ivancevich, J. M. (2003), Business for the 21st Century, Homewood, Boston, ISBN: 0-256-09222-2

Thompson, A. et al (2007), Strategic Management, 13th edition, Tata McGraw- Hill Publishing Company limited, New Delhi, India.

Footnotes

- Easyjet Plc (2008) Annual report

- Emissions Trading Scheme

- Emissions Trading Scheme