Introduction

Tesla is an American multinational company that produces electronic cars and spare parts. From the annual report’s assessment, the organization had positive stocks, which made it record positive net income. At the same time, Tesla’s revenue generation outweighs its expenses, and the entity has a favorable cash position, indicating it can pay its costs and remain with accessible capital. Notably, the company’s financial ratios are positive, indicating that short-term and long-haul obligations can be met.

The automotive market segment has historically been essential to economic growth and development. According to Saberi (2018), it represents almost 4% of the world GDP, and, in the context of developed economies, 1% of automotive industry growth triggers respective 1,5% growth in the country’s GDP. Such a relationship is caused by the automotive sector’s strategic position in the middle of other market segments, which results in a multiplier effect. However, the industry nowadays has to face serious environmental concerns and anticipate energy crises. In this context, electric cars and the companies producing them, including Tesla Inc. (Tesla), receive much attention.

Tesla is a relatively new electric vehicle company that dedicated itself to researching, developing, and selling electric vehicles and their spare parts. It was founded in 2003 by people willing to prove that electric vehicles present a reasonable alternative to their fuel counterparts (Shao et al., 2021). Due to the specificity of Tesla’s chosen course, the company has a long history of enthusiastic research and development activity (Flehantova&Redka, 2021). However, this activity yielded little profit, and Tesla required substantial external investments to sustain itself in the first seven years (Shao et al., 2021). Eventually, the company decided to transition from being privately held to a public state.

Tesla made an Initial Public Offer (IPO), listing its shares on the NASDAQ stock exchange. The stock then grew gradually and eventually tripled its IPO value in three years (Shao et al., 2021). In 2014, the stock rose even more with the presentation of the auto-pilot function (Shao et al., 2021).

During the years that followed, the price of the stock remained approximately constant until 2020, when the share increased 4,5x more, overcoming the expectations. Thus, for the first time, Tesla managed to close a year with a positive net income.

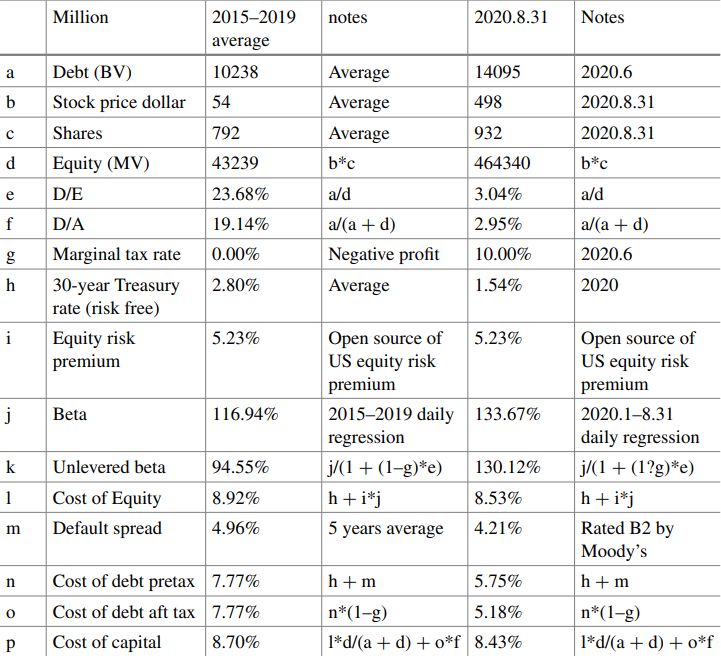

Tesla presents an interesting case in terms of its capital structure. Being in a high growth stage, it does not generate enough revenue to pay dividends. However, paying dividends is more commonly attributed to more mature companies, while recent profits can be considered promising. According to Zhao (2021), in 2020, the company had a negative EBIT due to not having profit for the previous five years. Consequently, Tesla’s interest coverage ratio can not be greater than 0, which indicates that an optimal debt ratio should theoretically be 0 (Zhao, 2021). In addition, it implies the company does not have enough profit to pay all its debts; therefore, issuing any debt in this state would not be a good idea. Table 1 presents the respective calculations of a company’s capital structure.

The fact that Tesla finally started to earn money in 2020 does not have a significant influence on the overall state. Despite the company being able to pay the interest in the first half of the year, even the lowest 5% debt ratio would not allow it to pay for the total interest (Zhao, 2021). The displayed capital structure of Tesla can be considered reasonable only due to the sharp drop in the debt ratio from approximately 19% to 3%, which caused the company’s stock price to increase (Table 1). Another implication of the presented calculations highlights a higher cost of capital sensitivity in 2020 than in the previous years. Ultimately, it means Tesla has to be more attentive to its debt ratio fluctuations than it used to be.

To conclude, Tesla’s future seems promising even despite its rather volatile stock standings. It operates in a new, fast-growing, and unpredictable market; consequently, Tesla cannot rely on possible high expected future returns. Nevertheless, the external factors affecting the industry are greatly in Tesla’s favor. Natural resource depletion resembles a time bomb that will eventually cause significant disruption. Therefore, a focus on an alternative to fuel means of transportation slowly rises in value.

The company is listed on USA NASDAQ, with an IPO in June 29, 2010 and its headquarters is located in Austin, Texas, United States. The company was founded on July 1 2003 by Elon Musk, Martin Eberhard, JB Straubel, Marc Tarpenning and Ian Wright (Dzialo, 2018). Tesla is better described as a battery manufacturer, even if its name is most commonly associated with electric vehicles. The firm operates within the automotive sector where it is well-known for its expertise in solar panels and Lithium-ion battery energy storage.

According to the past three years’ worth of stock activity at Tesla Inc., the average share price for the company was about $205.39 as per the data provided by Yahoo Finance. Based on the data on the site, the stock price for 2020 was 29.53 USD, 2021 was 235.22 USD and as of December 31 2021 it was 352.26 USD (Microsoft Corp., 2022). The previous three years have seen a tremendous increasing trend in the price of Tesla Inc. shares with the December 2021 share prices being the highest.

The highest stock price as on October 3rd4:00 p.m. was $414.50 while the lowest was $206.86. Tesla’s 52-week high was at $414.50 on November 5, 2021.Today, this trend has reduced to $242.40 (Microsoft Corp., 2022). Over a span of three years, the prices of Tesla shares have increased in overall by about 4.8 percent and this is expected to rise over time at a similar rate. Similarly, the previous three years have witnessed the company’s revenue increase tremendously due to improved client base and sales.

When a company decides to split its stock into several shares, it is typically to reduce the price for investors and broadening the availability of the stock within the market. For example, when stocks are split, their value is divided up into smaller shares with a lessened buy-in value. However, the number of shares increases, and an existing investor owns a higher number of shares with the same value prior to the split.

With the company stock split having been rumoured for many months, the company ended up approving the 3-for-1 stock split during its annual general meeting held on August, 4, 2022. As research on the outstanding share of stock for Tesla has revealed that as per the quarter that was ending on June 30, 2022, there was about 3.465 billion outstanding share of stock (Microsoft Corp., 2022). This represents nearly 3.22% increase as compared to the previous financial year (Microsoft Corp., 2022). As of June, 30, 2021, Tesla’s shares outstanding were 3.387 billion representing an increase of 4.25% from the 2020 financial year.

Considering the variety of companies that are listed and are available for investment on the NASDAQ, I believe it would be prudent to invest into a company with a NASDAQ basis such as Tesla Inc. In addition, NASDAQ is such a well-known and trustworthy exchange, investors may be certain that they are receiving a fair return on their investment. To reiterate, NASDAQ companies are verified, legitimate investment opportunities due to the exchange’s history, stability, and reputation in addition to the level of vetting that occurs prior to inclusion with NASDAQ.

The New York Stock Exchange and the NASDAQ both operate within the same industry. An example of a company listed on the New York Stock Exchange include Forward Industries, Inc. (FORD). On comparison between the two companies, it is evident that the stocks are traded more often and are more costly on the NASDAQ stock exchange as they are on the New York Stock Exchange (Dzialo, 2018). This finding clearly depicts that an investor who purchases a single share on the NASDAQ stock exchange platform does so at a more expensive cost than on the New York Stock Exchange. This cost is probably high due to greater demands of stocks on the NASDAQ stock exchange.

Regardless, Tesla’s standing within the market has been fairly consistent and consistently sought after. Tesla’s ability to be on the cutting edge of technology, renewable resource investment, and futuristic endeavors make it appealing to individual investors and firms as well. With the level of innovation, excitement, and opportunity continuing to rise, Tesla will be a forerunner in the international market for years to come.

Financial Analysis of Tesla Inc.

To a great extent, Tesla is an automotive company mainly focused on researching, designing, and selling electric vehicles and their spare parts. The key areas of Tesla’s balance sheet include liabilities and assets, which stood at $30,584,000 and $62,131,000, respectively (Jonathan & Siegfried, 2021). Therefore, it indicates that the company has no debts and can sell its properties to cater for its expenses, indicating a positive and healthy status. In addition, Tesla’s income statement’s main areas involve the total expenses of $56,289,000, the entire revenue is $67,166,000, and the net income stands at $9,160,000 (Jonathan & Siegfried, 2021). It indicates that the company makes a profit and the revenue gathered can cater to its expenses without borrowing.

Ratios Reflection

For a firm to thrive, it must conduct a detailed ratio analysis, which assists in evaluating its books and obtaining an overview of its financial health. The liquidity (cash ratio and current ratio), profitability (return on equity and rotational of assets), and solvency (debts-to-assets ratio and the equity ratio) ratios selected help Tesla’s shareholders whether to continue investing. The current ratio quantifies an entity’s prowess to pay short-haul obligations. Tesla’s current analysis for 2021 was 1.37, indicating good financial stability as the firm can refund its debts sufficiently (Macrotrends, 2022). Notably, the cash ratio is a liquidity measure showcasing the organization’s short-term charges using cash and money equivalent. Tesla’s cash ratio is 1.59, thus the reason why it is preferred by creditors, analysts, and investors, as the firm can cover its current liabilities and have some remaining earnings (Macrotrends, 2022). Therefore, the liquidity ratio analysis of Tesla Inc. indicates that the company has pragmatic financial health.

Rotational of Assets (ROA) is evaluated by dividing actual earnings by the entire properties, and the more the sales and profits are generated by Tesla, the more it amasses its assets. Currently, Tesla’s ROA stands at 9.08, showcasing positive monetary fitness (Macrotrends, 2022). The return on equity (ROE) calculates the capability of a firm to earn profits from its speculations. Tesla’s ROE is 18.19, manifesting it remains effective in manufacturing and outperforming other entities in the same market (Macrotrends, 2022). The debt-to-asset ratio measures how much of the venture is owned by creditors contrasted to the shareholder’s possessed properties. For Tesla, it is 0.53, indicating that for every $1 debt, Tesla assets are worth $2 (Macrotrends, 2022). Lastly, Tesla’s equity ratio is 0.9177, and since it is zero, the company has good financial health (Macrotrends, 2022). The solvency and profitability ratios are positive, showcasing that the company management is making good decisions to ensure the entity has more assets.

Healthy Status of Tesla Inc. and Comparison

Significantly, Tesla Inc. is heading in the right direction as the solvency, profitability, and liquidity ratios are all positive, indicating good financial health to meet its short-haul and long-term obligations without bankruptcy. In addition, from the balance sheet, the company’s assets outweigh its liabilities, indicating no financial distress as it can pay short-term debts and still have substantial earnings.

By comparing Tesla and Volkswagen entities based on the ratio categories, it is clear that Tesla is more efficient than its competitor as its ratio analysis is extensively valuable and stable. Regarding the solvency ratio, Tesla’s cash flows are high, and con covers its long-term debt compared to Volkswagen, which has a high chance of defaulting on its bills. Tesla’s profitability ratios metrics show that analysts, shareholders, and investors would prefer the company to Volkswagen due to its high capability of generating more income (Jonathan & Siegfried, 2021). Contrasted to Volkswagen, Tesla has positive solvency ratios, whereby the company can meet its long-haul debt obligations and pay its lenders. Therefore, it shows Tesla has sufficient cash flow to meet its long-term liabilities, indicating good financial health.

Cash Position and Reflection

Tesla’s annual report offers data and analysis concerning its operations and financial performance. The assessment of the key financial statements enables the entity to summarize its achievements over the past year. To a great extent, the cash position represents the amount of money that Tesla has on its books of accounts at a given period. Tesla’s cash on hand for 2022 was $18 billion, a 17% increase contrasted to 2021. In 2021, its accessible capital was $17 billion, an 8% decline from 2020 (Macrotrends, 2022). Therefore, Tesla’s cash position is positive, as the decline witnessed in 2021 was due to low sales of electronic cars due to the COVID-19 impact (Macrotrends, 2022). At the same time, for the last three years’ annual report examination, Tesla reflects positive cash balances. After paying its costs, Tesla has some accessible money, including assets that can be liquidated into cash within 90 days (Laws, 2019). The firm can meet its short-term obligations successfully without facing financial obstacles.

Cash Flow Sustenance Methods

Tesla’s management uses various approaches to ensure the enterprise maintains pragmatic cash flows. At first, they charge a deposit, invest in bitcoin, and establish milestones for the long-haul projects, making the customers purchase more commodities from the company (The Fly, 2022). Secondly, Tesla’s high product prices target wealthy people, making them record more profits and keep a positive net income. In addition, the firm’s management negotiates terms with vendors to reduce expenses. The leveraging of the costs makes the company record improved revenue (Laws, 2019). Finally, Tesla’s executives implement systems, including streamlining workflow, enhancing customer communication, and processing returns to ensure they save costs by improving productivity, thus maintaining positive cash flow.

Financing Methods

The trade credit is Tesla’s first short-term financing method, whereby the company’s management buys materials and supplies on solvency from other entities, recording the debt as an account payable. Due to prompt payments, Tesla receives extensive discounts from the sellers, enabling the executives to fund its operations successfully. From the firm’s annual report balance sheet, it is evident that commercial bank lending is another monetary approach, which is recorded as notes payable (Zhu et al., 2021).

Tesla requires extra capital to meet its growing needs, including investing in research and development to manufacture eco-friendly cars. Lastly, commercial paper is used to finance key operational activities at Tesla. The organization’s well-established promissory notes are sold to other core ventures, banks, and insurance enterprises. Tesla has a high credit rating, enabling most investors to support tasks undertaken at the company (Jonathan & Siegfried, 2021). Commercial papers have substantial liquidity value and an elaborate maturity range that is flexible. Therefore, Tesla can save more money and earn a good return from the investments made.

Conclusion and Recommendations

Tesla is a multinational company that manufactures electronic cars and spare parts. The final recommendation is that Tesla Inc. would be a good investment for potential investors. Based on the financial performance, the company has a positive generation of revenue to cater to the expenses and has a positive net income indicating it makes more profits. In addition, the company has more assets compared to its assets. To a great extent, Tesla’s financial performance has been sustainable within the last three years with no liquidation uncertainties despite reduced sales due to the COVID-19 pandemic. The financial analysis regarding profitability, liquidity, and solvency ratios is positive, showcasing Tesla’s positive monetary health, and the investors should fund the company operations as they will receive substantial dividends.

References

Dzialo, B. (2018). Charging down the road: A historical analysis of the American auto industry and Tesla. (Publication No. 144578) [Master’s thesis, the University of Vermont]. Sage.

Flehantova, A., &Redka, O. (2021). Innovation as the main driver for the future economic growth of the company (on Tesla, Inc. example). In Economy and Human-Centrism: The Modern Foundation for Human Development: V International Scientific Conference (pp. 89-92).

Jonathan, H. U. K. E., & Siegfried, P. (2021). Finance methods in the automotive sector-business agility in the age of digital disruption. International Journal of Automotive Science and Technology, 5(3), 281-288. Web.

Laws, Jason. (2019). Essentials of financial management. Liverpool University Press.

Macrotrends. (2022). Tesla financial ratios for analysis 2009-2022. Macrotrends. Web.

Microsoft Corp. (2022). Profile, business summary, and analysis. Yahoo Finance. Web.

Saberi, B. (2018). The role of the automobile industry in the economy of developed countries. International Robotics & Automation Journal, 4(3), 179-180. Web.

Shao, X., Wang, Q., & Yang, H. (2021). Business analysis and future development of an electric vehicle company – Tesla. In 2021 International Conference on Public Relations and Social Sciences (ICPRSS 2021) (pp. 395-402). Atlantis Press. Web.

The Fly. (2022). Tesla ceo says bitcoin conversion intended to ‘maximize cash position.’ The Fly. Web.

Zhao, L. (2021). Capital structure of new energy automobile industry. In Proceedings of the 4th International Conference on Economic Management and Green Development (pp. 236-246). Web.

Zhu, E., Zhang, Q., & Sun, L. (2021). Enterprise financing mode and technological innovation behavior selection: An empirical analysis based on the data of the world bank’s survey of Chinese private enterprises. Discrete Dynamics in Nature & Society, 26(4), 1–11. Web.