Paper Outline

This paper is organised into a business report Air New Zealand Company with the following main parts:

- Introduction. Introduces as to the case at hand and gives an over view of the company.

- Literature review. Shows what different authors have to say in theory about corporate strategy and management.

- Company analysis. Looks at the operations of the company and links them to theories on corporate management and strategies.

- SCA vs Strategic alliances. Looks at the uniqueness of the global airline industry through many mergers and alliance and analyses how effective they are in maintaining business competitiveness.

- Future Prospects. Gives a personal view of where I think the company is headed according to reviewed company information

- Conclusions and recommendations. Finalises the report and offers management tips to the company.

Executive Summary

Converting theoretical business ideologies and principles in to real life action has proved to be an elusive goal for many business executives and directors. For the few that succeed in implementing business management theories into practice, a clear management strategy is adopted that puts information about the consumer needs and wants at the fore front and thus products and service improvement efforts are all directed at satisfying the customer and at the same time maintaining business sense in the involved business processes.

The near collapse of Air New Zealand in 2000/01 was a result of what has been called over expansion. Experts figured out that the company got too engrossed in beating their competitors by expanding into new routes too rapidly without at first considering their prospects in those markets effectively in the long term. As such, the we say that the company thus failed in achieving sustainable competitive advantage which simply means that its competitive advantage then was not long term. After nationalisation and change in management, the company has reversed the downward trend and is looking all spruced up to take the global market by storm.

As we see the company expand, the only question remains whether this will be in the long term or a repeat of the problem that ailed the company some few years back will be witnessed.

Introduction

Air travel has over time developed from just basic transportation and carriage services to encompass a wide variety of supporting services and products thereby broadening the operations of the players and stakeholders involved. Business travel and leisure travel have formed the basic international and domestic market segments in the air travel industry. Industry and market analysts continue to provide different services and products based on the assessment of these two basic segments.

However, market dynamics and corporate strategies have played a great role also in the designing of new products and services for air travel consumers. In the case of New Zealand, we see that the country’s geographical location in relation to the rest of the world places it at a relatively inferior and at the same time relatively superior point to the rest of the world. Benham (2007). The national carrier in the country, Air New Zealand plays a significant role in the New Zealand airline market both domestically and internationally. In its role, we analyse the company’s strategic options in the market relating its identifiable corporate strategies with theoretical strategies learned in this course.

Methodology

This report is structured into subsections each with a subheading indicative of a particular aspect of the company under examination. It views the air travel industry as a whole to give a general understanding of operations in the market and further looks at the New Zealand’s air travel/airline market thus indicating the position occupied and the role played by Air New Zealand.

The report draws information about the company, the market and theories from published secondary sources such as published books, newspapers, reports, journal articles, magazines and relevant websites among them the company’s official website. In the analysis, several business management analysis tools have been put in use such as SWOT, Porters five forces analysis etc. It also looks at the strategic options the company has in future (Johnson and Scholes 2004, p. 12).

Industry overview

The global airline industry has faced a lot of challenges in terms of decreased air travel consumers and in creased fuel process thus limiting the profitability of the players. Since the September 11 attack of 2000 in the US, there has been a philosophical change in the way air travel consumers view flying. Increased terrorism activities have also increased fear over the risk of flying to consumers thus shrinking the market for airline companies. Environmental concerns are also increasing the operating costs of players in the industry as they try to put in place measures to curb environmental degradation resulting directly and indirectly fromm their operations.

As earlier said the geographical positioning of New Zealand in relation to the rest of the world makes for positive and negative impact simultaneously. Its location far away from the other continents makes it a potential market for long haul flights while the same aspect puts it on losing edge in short haul international flights. The domestic market is dominated by Air New Zealand through its pricing strategy though there is competition from other carriers such as Pacific Blue which made its entry early 2007 and Quantas Air among others.

Company background

This is company that is primarily involved in the transportation of cargo and passengers on scheduled airline services. It is based in New Zealand where is also listed in the country’s stock exchange market and also in Australia. The company operates as a group with a subsidiary established in 2008 called Altitude Aerospace Interiors that deals in fitting out or remodelling airline cabins.

The company was established in 1940 Tasman Empire Airways Limited (TEAL) where it operated flying boats. Over the years it changed its name to the current one. In 2001, it faced a very severe fall in operations that threatened its existence. Fortunately, it emerged out of the quagmire after government bail out and a effective management that saw the company back in operations again to reclaim its lost glory.

Air New Zealand or Kiwi airlines as it is fondly known has in the past made headlines in reverting from a path of negative growth that saw industry analysts write off the company to revive miraculously and reinstate her position in the market. Though the recovery was mainly due to government assistance, the sustainability of the growth is mainly attributed to excellent management under former and current CEO Patricke 2008. The airline has grown to be one of the most respected brand names in the region and the world all over. Its low cost fares for travellers a strategy adopted in 2002 has endeared the company to the local people and thus encourages air travel consumption and sees the airline target travellers who use other means of communication such as road.

According to company reports, the first half of the 2007/2008 financial year, the company saw its profit increase by 62% for the same period in the previous financial year. This has been attributed to the high growth in domestic flights and the overall good performance by all its subsidiaries that include Air nelson, Air Eagle, Mount Cook Airline and Vincent Airline.

Vision statement and values

“We will strive to be number one in every market we serve by creating a workplace where teams are committed to our customers in a distinctively New Zealand way, resulting in superior industry returns”.

This vision is pursued under the company’s guiding principles stated as

- We will be the customers’ airline of choice when travelling to, from and within New Zealand.

- We will build competitive advantage in all of our businesses through the creativity and innovation of our people.

- We will champion and promote New Zealand and its people, culture and business at home and overseas.

- We will work together as a great team committed to the growth and vitality of our company and New Zealand.

- Our workplaces will be fun, energising and where everyone can make a difference.

Company profile

The company has embarked on costs cutting measures to enhance its profitability and revenues per customer. This has been marked through staff reduction that saw over thousand employees so far laid off including 600 from their engineering department. The company is also replacing its existing fleet with newer models of Boeing 787-9 Dreamliners and 777-300ERs that can fly further and are viewed to be more to operate in terms of maintenance costs and fuel consumption.

Having dominated the domestic market, despite competition from other players through strategic price reduction the current CEO, Nathan Agnew admits that the future of the company lays in venturing into new international markets and identifying new destinations and competing effectively against established players in the market. As such the company has launched direct flights to Vancouver and Beijing.

Some of these strategies employed have started paying dividends with the company’s 2008 financial year reports showing operating revenue increasing by 9%, net cash position at $1.3bn and revenue per employee up 4%. This has also earned the company a number of awards in merit (2008 Report).

Literature review

Organisations base their business decisions and strategies on extensive market and business environment research that give headway into what to contribute to their competitive advantage and what does not. (Lynch, 2006, pp.98). In addition to this Johnson and Scholes (2004, pp 12) say that the main concern for marketers globally to understand what consumers perceive of their products, their desires and wishes and what they attach most to their money’s worth. This way, marketers will then be only be able to offer what makes business sense and also delivers the wishes and desires of the market and in the long run forge a relationship with the market that will be the basis of brand loyalty.

Lynch (2006) says that the internal environment of an organisation in terms of management and organisational culture and behaviour has an active role to play in determining how business theory and acumen put in place are successful. Lynch (2006) says though the external environment may present a company with growth opportunities, the internal environment may not allow the utilization of that opportunity into growth.

Thompson et al, (2005, pp. 112) also observes that “Consumers react differently to consumption of the product when they had knowledge of the brand”. This gives another perspective that managers and marketing professionals propose as “experience enhancer”. Lynch (2006, pp. 81) adds that research done on consumers taking a certain product brand having a prior experience as compared to a consumer consuming the same brand without prior experience shows that the fist consumer will have a positive attitude even before consuming than the latter consumer who will be a bit apprehensive. This explains why firms are so keen on developing subsidiary brands or deriving versions of a brand from a main brand that has performed well in the market. Lynch (2006, pp. 171) also says that consumers judge a product/service according to their past experience. Therefore product predictability is a key component in the making of decisions by a consumer. He thus adds that product consistence in quality is the key to customer loyalty.

Hill et al, (2002, pp. 320) emphasises on the importance of customer loyalty by saying that it is five times cheaper to market a product to an existing customer than it is to market the same product/service to a new customer. Therefore it would seem that customer loyalty is based on recognition a brand (brand awareness) by the market as facilitated by marketing communication and probably rated according to past experience in consuming the good.

Among the many benefits of branding, different authors (Campbell et al, 2002, pp. 320) agree on these as the main benefits of branding to companies.

- It is a source of competitive advantage.

- Distinguishes products from rivals’ and helps in customer preference and loyalty.

- Sets the basis for legal protection of brand name through trademarks and patents.

- Creates a barrier to market entry for potential competitors.

- Adds value which is utilized in making pricing strategies.

- Facilitates new product development.

- Increase influence in the channels of distribution and advertisements.

- Customers also have their own benefits as a result of branding.

- Customers are able to predict what to expect from a certain brand.

- The utility or satisfaction obtained from consuming a particular brand or service is consistent.

Hill et al, (2002, pp. 320) say that brand consistency and predictability is more relevant in product brands than in service brands. They say that due to the human factor associated with service delivery, services tend to vary as per the human factor.

Company analysis

Strategy

One of the most significant strategies adopted by New Zealand airline which is attributed to the current position occupied by the company especially in the domestic market is the ability of the company to woo conventional non-air travel consumers who viewed the services too expensive for them in to the market through budget charges. Again cost cutting through laying off of excess staff has helped in turning the revenue per employee up from a negative growth

Kiwi airline’s domination of the domestic market is not coincidental but a culmination of an effective marketing strategy. An aggressive marketing campaign that seeks to deliver what the market desires keeps the company ahead of its competitors in the market. Being the national carrier, the company has utilised the patriotism aspect of it for business growth. On the other hand, some of the weaknesses that have been ailing the company for some time are being managed effectively. Unfortunately, as the company expands, new business and environmental challenges are ailing the market the company and as such affecting its competitiveness. Top on the list is high fuel prices and the reduced consumer expenditure following the prevailing global financial crisis and inflation that have seen consumers preferring to save than spend and at the same time experiencing a decrease in real income.

SWOT

Strengths

New Zealand airline offers the most competitive charges for its domestic routes. As such, it has managed to position itself as the market leader offering quality services at consumer friendly prices and still remaining profitable. This strategy was adopted in 2002 and has been responsible fro reviving the company from near collapse in the same period.

New Zealand airline has also managed to establish and maintain its brand as a national heritage of the region and the country. This has been achieved through extensive cultural promotion and domestic tourism promotion through offers and sponsoring of cultural events. This has been essential in aligning the airline to the people’s way of life and not just as a commercial service provider something that Hill et al says is a fundamental principle for service based companies in order to achieve a sustainable competitive advantage.

Consistent quality in service delivery has been crucial in tying loyal customers to the company and helps in service/product expectation. The fact that the company has been consistent in quality is expressed by the manner in which the market absorbs new products or brand extensions.

The company’s customer loyalty programme re-launched in 2004 as Airpoints dollars has been very effective in retaining customers keen on redeeming their points on the company’s flights as they are used the same way as cash anytime anywhere.

Excellent management has seen the company revive from near collapse to astounding performance. Such management capabilities have not common elsewhere and the company’ revival has always been referred to as miraculous.

New Zealand Airline has also managed to maintain a recommendable financial record that has been essential in powering many of the company’s strategies such as the upgrading of their fleet to achieve an average fleet age of 6.5 years as of September 2008 (annual report 2008)

The company is tapping into new markets an developing new product and services. This is indicated by the setting up of a subsidiary company in 2008, Altitude Aerospace Interiors, aimed at tapping into the commercial airline and private jet market by fitting out or remodelling cabins.

Weaknesses

The fact that the company has managed to establish itself as an effective domestic carrier only limits its market size and denies the company the opportunities that come along with a broader market and economies of scale in operating long haul flights.

Drastic measures to cut their personnel to size impacts negatively on the patriotism appeal that the company has worked so hard to cultivate and maintain.

The company has failed to successfully negotiate for strategic mergers with one of its competitors that could have strengthened the company’s position in the industry and help in achieving a competitive advantage that would have been achieved with the pooling together of resources, wider market and corporate ideas.

Expansion into the international market is ill timed when the number of air travellers according to International Air Transport Association (IATA) is on a decline due to the global economic crisis thus growth in this sector is minimal.

Opportunities

The popularity of cultural tourism other than scenery tourism has favoured air travel marketers positioning themselves as cultural ambassadors. Air New Zealand has positioned itself in the market as the ultimate cultural experience of Kiwis.

The attractiveness of the company is selling air travel services at a relatively low price enable the company to compete successfully with other modes of transport thus in creasing the air travel market at large.

Threats

Increased competition from established global players such as British Airways and Emirates that operate international flights from the region and have many destinations than Air New Zealand that is relatively new in the international market.

Growing competition in the domestic and trans Tasman routes as more players enter the market. Eg Pacific Blue

The current and projected decline in air travel consumption. IATA reported a fall in air traffic for the month of September 2008 as having dropped by 2.9% though a slight increase was expected in December due to festive season travels.

Increased terrorism activities that continue o threaten the safety of air travel and increases operations costs through additional measures put in place to avert terrorism.

Environmental concerns have led to enactment of laws that are costly to implement usch as the limiting carbon emissions.

Five forces analysis

Entry of competitors

The airline industry in New Zealand and the world at large can be viewed to have no natural barriers to entry. On the other hand, major players through their financial strength and strong brand names have limited the rate of entry of new players. In addition to this, the prohibitive cost of establishing and running an airline limits the number of players in the industry in New Zealand and the world at large.

Threat of substitutes

The conventional attitude held by many people has worked against the efforts of industry players of position their products as the alternative efficient faster and cheaper means of transport than the conventional rail and road transport. As such, Air New Zealand despite making a commendable effort in creating new markets from non air travel consumers still faces a lot of competition form these modes of transport as they still handle more passengers than airlines as they are more convenient over relatively short distances.

In addition to this, increased cost of living and inflation means that consumers have less and less to consume by the day and thus consumption for travel is also minimised. Therefore, we see a lot of competition for Air New Zealand and the industry at large in terms of resource allocation on the side of the consumers who have to contend with the high cost of living and other goods/services (Colley et al 2004).

Bargaining power of buyers

Market segmentation and product differentiation has proved a cornerstone for players in the airline industry. Air travel has come to be identified using common segmenting names such as business class, economy class, tour class, first class, etc. This has been very effective in capping the bargaining power of buyers/consumers as they are forced to stick to what their financial ability allows them i.e. business class charges cannot be discounted to the level of economy class charges.

Bargaining power of suppliers

The company has to rely on the services of other companies in terms of fleet servicing, manufacturing and hiring where they cannot afford to own theirs. Such companies are few and the two major ones are Boeing and Airbus. This has contributed to the two companies having a lot of control and power over their clients as competition in that market is not perfectly competitive. On the other hand, the high levels of safety concerns in airline industry forces players to stick with established suppliers only and keeping a track record of their products in terms of safety.

The relatively weak brand name in the international market denies Air New Zealand any power that it may yield to its suppliers

Competitive rivalry

Air New Zealand faces a lot of competition both in the international market and the domestic market. Having dominated the domestic market for some period, new players are entering the market with a view to cash in on the increased number of air travel consumers whose increase is attributed to the fact that they can afford the cheap charges offered by Air New Zealand. These competitors are basing their performance in the new market on their past performance in the international market either long haul or short haul.

Sustainable competitive advantage vs. Strategic alliances

Modern corporate strategy experts have coned this name to emphasise on company’s needs to think and make decisions with the long term implications in mind. It is considered as the cornerstone into the profitability and good performance of a company in future Hill et al (2007). Lynch (2006, pp. 144) labels the term as the long-term competitive advantage of a company that cannot be imitated by competitors and if so the level of efficiency in carrying out their processes as enabled by internal environment abilities cannot be matched.

The airline industry is in a big way characterised and affected by the formation of strategic alliances which have according to Thompson et la determined how uniform some of the products offered by the operators are Other authors prefer to view the formation of alliances as a long term approach that help players in achieving sustainable competitive advantage in that there is technology and industry knowledge transfer from experienced players to new players and thus contributing to the long term improvement in quality of service offered. Contrary to this, Hill (2007) views the idea of forming alliances such as Sky Team and Star alliance (Air New Zealand is a member) among others as form of setting up of cartels that will see them controlling air fares and thus denying consumers their bargaining power.

Barlal and Constantatos (2005) argue that firms are better suited by strategic alliances in achieving sustainable competitive advantage than they are by forming mergers and alliances. They that alliances such as Star Alliance allows members to corporate and complement one another in some of the decisions a but allows them to compete on individual capacity thus dispelling the initial fears expressed by Hill et al say they are tantamount to cartels formed to monopolizes markets. Barlal and Constantatos (2005) go a head and say that the need for cooperation by major airlines is driven by the desire to: have an international presence, increase service quality, exploit economies of scale, and gain market power.

Resource allocation

The company is dedicated to expanding and reclaiming it lost destination prior to the company’s decline in 2001. Therefore, a lot of resources have been dedicated to upgrading its fleet so as they can effectively serve the international market through long haul flights such as the one from Auckland to San Francisco route which has been a route well served since it was established in 2004. Wastage of resources is being addressed as evidenced by laying off of excess employees as has earlier been indicated in this paper. This is important in realizing what Lynch (2006, pp.283) says of this management strategy as seeking to achieve 100% utilization of all the resources available to the company.

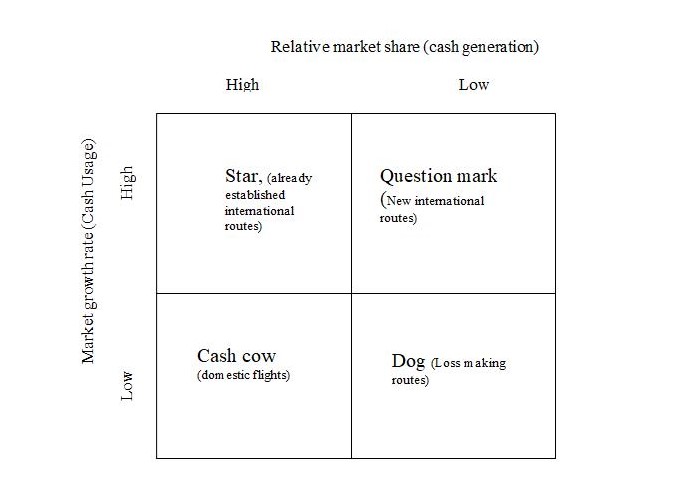

BCG Growth model

This model shows relative resource allocation and relative market share of different categories of a wide portfolio of products and services offered by a particular company in the market and in this case Air new Zealand.

This company can be viewed as having categorised its brands by retaining them as subsidiaries. Operations through subsidiaries earlier mentioned in the paper, position the company into consolidating its new business targets and also come in handy in segmenting the market to handle competition and offer customer satisfaction oriented services in a more efficient manner. For instance the acquisition and retention of Freedom air in April 2008 as a partially independent airline allows Freedom airline consumers to still identify with the brand and enjoy improved services while the parent company (Air New Zealand) enjoys increased market share. Such seemingly minor domestic operations can be viewed to be responsible for providing the financial resources to power investment into new company developments.

Cash cow

Campbell et al (2002, pp. 101) says of this portfolio that as per its name, it’s a portfolio that keeps the company running through its milk and thus being mature should be milked with no major investments surpassing its operations requirements injected into it. For Air New Zealand, domestic flights carried by the company’s brand name or through subsidiaries are the mainstay of the company. Though not much has been directed in investing many new aircrafts, it is open to see that investment in the domestic market is only for maintenance purposes. Resources obtained from the cash cow portfolio are directed into developments of new products portfolio called question marks portfolio.

Question marks

This includes areas of high resource allocation with potential for growth. Unfortunately, the high growth in this category is only projected and yet to be realized. As such, investments in this category are high than returns. Lynch (2006) says that the uncertainty and the risk factor in this category thus make it to be labelled as the question mark category. According to the company’s annual report for 2008, investments have been highest in developing new international routes to compete effectively. This is being done by buying and leasing of larger aircrafts and also increased marketing of such new products.

Star category

This is a product portfolio whereby a lot of resources are invested in developing the product such as marketing. In the process the money invested in developing in portfolio is at the same time resulting into increased market share thus higher revenues. It is usually a development of the question marks portfolio. In the case of Air New Zealand international routes established earlier are beginning to pay dividends and at the same time, the company is investing more in advertising the product driven by the fact that there is more room for growth and in order to increase its market share. Such routes are the direct flights to Beijing from New Zealand, and San Francisco. In addition this increased marketing of this category is seen the use of biofuel on international carriers. Other destinations in this category are short haul international flights in the Oceania.

Dog portfolio

This usually consists of underperforming products and services and is in most cases are ear marked for disinvestment (Hill, et al 2007, pp. 230). Air New Zealand has over time been shaking up its operations to phase out non performing routes either due to high competition or due to decreased traffic volume or other relevant issues.

Future prospects for Air New Zealand

Air New Zealand has made headlines around the world fro Boeing on of the most environmentally conscious air operator by flying one of their Boeing 747 plane on their own developed bio fuel in December last year. As the global population becomes more and more ware of the need to conserve the environment, corporations and many people are deciding to “go green”. As such, with Air New Zealand leading the way for other airlines, it is posed to bag many environmental conscious air travellers. This is in line with the company’s strategy of launching into international operations full swing by establishing more destinations and routes to help it compete effectively with other players in the market.

Conclusions and recommendations

The recognition of the company on the need of consumers and their view on consumption of air travel has been very helpful in the development of new products in the name of budget flying. This service has relied on doing away with unnecessary in-flight services such as audio and video entertainment in order to keep operations costs low which translates into low prices for consumers and thus higher demand as the company generates more brand appeal, increased revenues and customer loyalty (Lynch 2006, pp. 167).

The pioneering of the company in low budget flights has worked very well for the company in the domestic market and short haul international flights. If this kind of strategy was adopted in the international market, the n the company can compete at a higher level than other players. Unfortunately, some of the services excluded in low budget flights cannot be excluded in long haul flight and thus it is upon the company to research on the in-flight services that are luxurious to low budget travellers and increase costs. This would be a very good market entry strategy into new routes. On the other hand the company should tae care not to compromise quality with price. It should therefore still retain its premium services that will match the needs and wishes of luxury travellers.

References

- Ahlstrand, B. Mintzberg, H. & Lampel, J. (2005) Strategy safari: A guided tour through the wilds of strategic management, (New York: Simon & Schuster).

- Barla1, P. and Constantatos, C. On The Choice between Strategic Alliance and Merger in the Airline Sector: The Role of Strategic Effects.

- Boddy. D. (2008) Management: At Introduction 4th ed, (London: Pearson Education Ltd).

- Campbell, D. Stonehouse, G. & Houston B. (2002), Business Strategy 2nd ed., (London, Heinemann).

- Colley, J., Doyle, J., & Hardie R. (2004) Corporate Strategy, (New York: McGraw Hill).

- Hill, L., Jones, R., Galvin, P. & Haidar, A. (2007), Strategic Management: An Integrated Approach, (Sydney: Wiley).

- Johnson, G., and Scholes, K. (2004) Exploring corporate strategy, (London: Prentice Hall).

- Keller, H. (2003), Principles of business management, (London: Penguin).

- Lynch, R (2003) Corporate Strategy, (London: Prentice Hall).

- Palmer, A. and Hartly, B. (2006) The business Enviroment 5th ed (London: McGraw Hill Education).

- Thompson, A., Strickland, J. & Gamble, E. (2005), Crafting and Executing Strategy: The Quest for Competitive Advantage, Concepts and Cases, 14th ed. (New York: McGraw-Hill), Chapter 3.

- Benham, W. (2007) “ The Hospitality and tourism industry in New Zealand” Academy of management review.

- Boeing to test biofuel on Air New Zealand flight. Web.