Introduction and Objective

Founded in 1994, Amazon has made a name for itself as a successful global e-commerce company with vast operations in the online retail sector. Having most of its operational activities centered in Seattle, Washington, which is the company’s headquarters, Amazon sells different types of products, including consumer electronics, digital content, and groceries (Hinterwimmer, 2018). The firm has a global market presence in more than 50 countries and provides goods and services that span across various industries, including cloud computing, e-commerce, artificial intelligence, consumer electronics, digital distribution, and retail (Rossman, 2016).

The objective of this report is to review Amazon’s financial performance by analyzing its key financial statements developed in the last five years, from 2015 to 2019, and comparing the findings with those of other players in the industry. The information provided in this review will be useful in helping businesspersons to understand the viability of the company as an investment option and assist creditors to understand the firm’s creditworthiness.

Summary of Findings

This report suggests that Amazon should focus on highlighting its core competencies to stay ahead of the competition and leverage its immense skills and experiences to improve the quality of services and goods offered on its online retail platform. This recommendation was developed after investigating the impact of the company’s performance on key operational areas and by assessing the firm’s financial position through a review of its income statements, balance sheet report, cash flow, and key financial ratios.

The insights provided in this document are linked to the overarching recommendations highlighted in this study, which emphasize the need to pay attention to the quality of services offered on the company’s e-commerce platform. This attribute of corporate performance remains one of the most distinguishable factors influencing Amazon’s financial position through the positive market reception it continues to enjoy in 2020 and beyond. Collectively, if well implemented, the recommendations highlighted in this paper may play a key role in cementing Amazon’s dominance in the market and elevating the profile of its stock as a “good buy.”

Firm, Industry, and Environment

Company’s Management Structure

Amazon’s management has played a key role in steering the firm to be one of the key players in the global retail space. Today, the firm is among the best performing entities in the industry with revenues over $280 billion annually (Clement, 2020). This strong financial position has been built on an elaborate global strategy that is characterized by the identification of fast-rising markets that have a high rate of e-commerce adoption, as a percentage of their overall global sales, and exploiting them as frontier markets (Rossman, 2016). This strategy has been characterized by an aggressive internationalization plan whereby Amazon takes control of the entire value chain of a business, as opposed to collaborating with local businesses to gain traction in new countries (Rossman, 2016). This strategy has largely proved to be successful for the business, even contributing to its acceptance as one of the world’s most valuable brands.

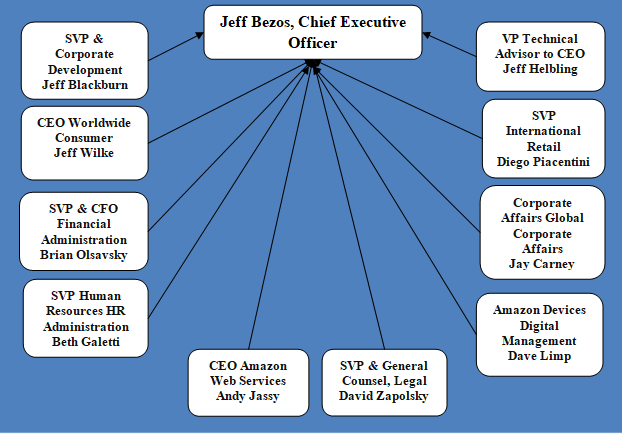

Amazon’s directors have direct control over the activities of the company’s managers and, by extension, all other employees in the organization. The retail giant has a functional management structure whereby key duties relating to the company’s operations are assigned to workers according to specified core functions (Amazon Inc., 2018). Stated differently, departments are created based on the functions they perform. These entities are comprised of a team that is headed by a manager (Rutakirwa, 2018). The major functions underpinning the company’s management structure are divided into eight key divisions in the organization that include the Office of The Chief Executive Officer (CEO), the business development sector, Amazon web services, finance, international consumer business operations, accounting, and legal services (Amazon Inc., 2018). These functions have been spread across 10 key subdivisions of management control that report directly to the CEO, as demonstrated in figure 1 below.

According to the diagram above, finance, human resources, web services, legal, digital operations management, international retail, corporate global affairs, and worldwide consumer divisions of the company undertake the company’s core functions. The managers mentioned above play a key role in influencing the company’s activities at local and global levels (Amazon Inc., 2018). They are also responsible for coordinating the company’s activities across several markets. Nonetheless, their efficacy in the organization is subject to competitors’ actions.

Description of Competitive Environment

Amazon’s main competitors are Alibaba, Otto, and eBay. In some markets, such as North America, the company also experiences stiff competition from brick-and-mortar retail outlets that transitioned into the digital space, like Walmart. In Asia, and other emerging markets around the world, the retail giant experiences competition from local e-commerce retailers, such as Alibaba and its affiliates (Gupta, 2019). Nonetheless, Amazon’s main market presence is in the United States (US), where it commands a 47.7% market share of the total online retail sales (Gupta, 2019). Figure 2 below compares its market share with its main rivals in the industry, including eBay, Walmart, Home Depot, and Best Buy.

Economic Climate and Outlook

Porter’s five-force analysis will aid in understanding Amazon’s external business environment and provide useful insights regarding how the company can overcome competition from rivals to remain the world’s leading e-retail company. In this analysis, the five forces that will be mentioned include competitive rivalry, bargaining power of suppliers, consumer bargaining power, the threat of substitute products, and the threat of new entrants in the market. These forces will be analyzed below, relative to how they influence Amazon’s business.

- Competitive Rivalry: Amazon operates in a fiercely competitive business environment characterized by high forms of aggressiveness from rival firms, the availability of multiple substitutes, and low switching costs. The growth and market presence of known rivals, such as eBay and Walmart’s e-commerce business, have further increased the competitive profile of the firm’s business environment, as it has to constantly come up with new strategies to outwit the competition (Hinterwimmer, 2018). In this regard, competitive rivalry is a strong force in Amazon’s business environment.

- Bargaining Power of Suppliers: There is a moderate bargaining power of suppliers in Amazon’s business environment, characterized by the presence of a small number of suppliers in the market, half-embraced forward integration strategies adopted by some market players, and the small influence of suppliers in the market. Broadly, the effects of these factors on Amazon’s business is modest because a slight increase in the price of its products could have a significant impact on the retailer’s business (Rossman, 2016). However, the moderate forward integration plans adopted by Amazon’s suppliers minimize such an effect on the business. Therefore, there is moderate bargaining power of suppliers.

- Bargaining Power of Consumers: Consumers who buy goods on online retail platforms, such as Amazon, exert strong bargaining power on linked businesses because they have access to high-quality information relating to their purchases, enjoy the presence of low switching costs, and benefit from the easy availability of substitutes. These data empower customers to think critically about their purchases and enable them to shop for alternatives whenever they are displeased with one company (Hinterwimmer, 2018). Therefore, there is a strong consumer bargaining power in the online retail industry.

- The Threat of Substitute Products: Similar to the consumer bargaining power highlighted above, Amazon also experiences a strong threat of substitute products in the market. This is occasioned by low switching costs, high availability of substitutes, and the obtainability of affordable products from rivals (Hinterwimmer, 2018). Collectively, these insights suggest that there is a strong threat of substitute products in the market.

- The threat of New Entrants in the Market: There is a low threat of new entrants in the online retail industry because of a high cost of brand development, low switching costs, and the high economies of scale enjoyed by major players in the sector. These market dynamics mean that a new company would require billions of dollars and a lot of time to match the same level of brand appeal that Amazon, or other multinational companies of its stature, enjoy in the market (Rossman, 2016). Therefore, there is a low threat of new entrants in the market. A summary of the impact of the five forces discussed above on Amazon’s performance is highlighted in table 1 below.

Table 1. Porter’s Five-Force Analysis of Amazon (Source: Developed by Author).

Other Factors

Being an e-commerce company, Amazon has to abide by the same regulations as any other company. However, the global nature of the company’s operations means that it has to operate in a multi-framework legal environment characterized by the presence of different laws in several markets where the firm operates. Amazon’s human resource practices are also governed by the same nature of variable laws because it has to respect local and state guidelines on how to treat employees (Amazon Inc., 2018). As of 2019, Amazon reported that it has a staff of about 798,000 people who work on a full-time or part-time basis (Clement, 2020).

Lastly, in the US, Amazon’s litigation procedures are subject to state and federal laws with most legal problems stemming from the sale of defective products (Hinterwimmer, 2018). Globally, the firm also abides by international and state laws governing the sale and distribution of its products and services. These environmental market dynamics have influenced the company’s financial performance as highlighted through a review of its balance sheet, cash flow, income statement, and key financial ratios below. The data used to undertake this review have been prepared by following the Generally Accepted Accounting Principles (GAAP) governing Amazon’s financial operations.

Balance Sheet Analysis

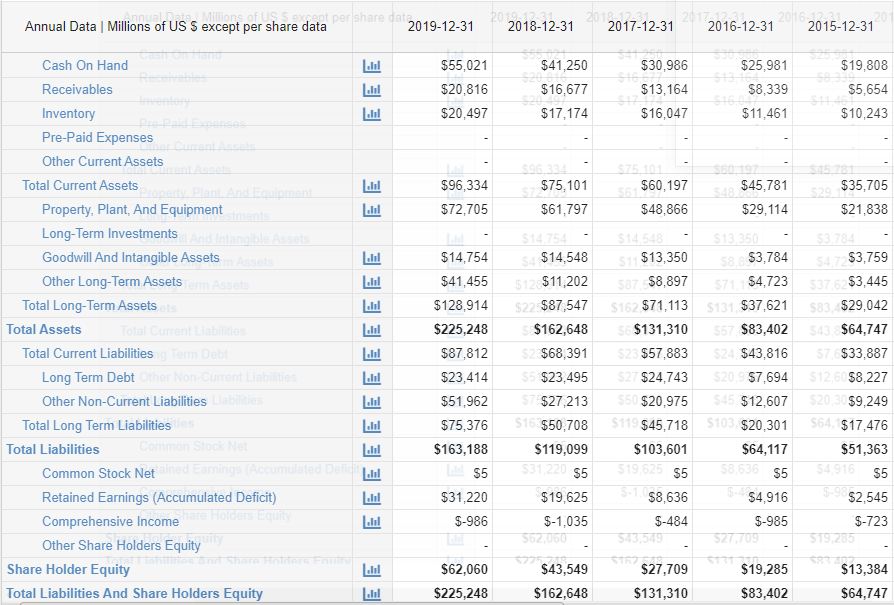

An analysis of Amazon’s balance sheet explains key indices affecting the company’s financial position, including its total assets, total liabilities, and shareholder’s equity. According to the statistics highlighted in appendix 1, from 2015 to 2019, the company’s current assets increased from $64 billion to $225 billion in the five years under review (Macrotrends, 2020). This change represents an improvement of its financial position, which has been occasioned by a surge in cash on hand and receivables.

Amazon’s total liabilities have also increased from $51 billion to $163 billion in the same period but this $112 billion increase is smaller compared to the total escalation in the value of current assets of $161 billion. This difference has improved the company’s financial position throughout the five years under review. The favorable standing has also been reflected in improved shareholder equity, which surged from $13 billion in 2015 to $62 billion in 2019 (Amazon Inc., 2018). Collectively, these data suggest that Amazon has a favorable financial position, relative to its peers.

Income Statement Analysis

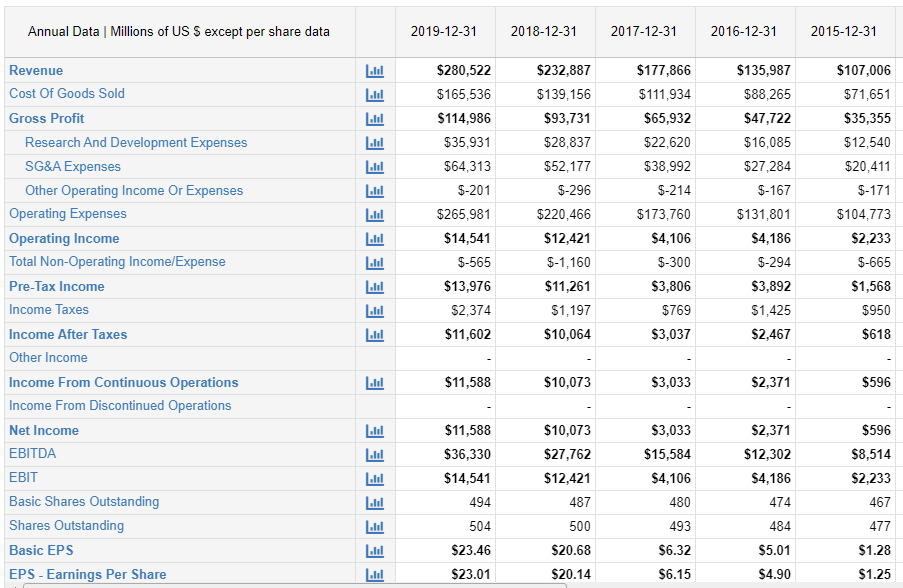

This income statement analysis highlights Amazon’s financial standing within the period in review. Key financial indices that are pivotal to this analysis include revenue performance, net income, and earnings per share. Relative to these financial indices, Amazon’s revenue has increased from $107 billion in 2015 to $280 billion in 2019 (Macrotrends, 2020). These statistics mean that the retail giant has managed to double its revenues within the past five years. This strategy has been further supported by a decline in the company’s operating expenses because its net income surged from $596 million in 2015 to $11 billion in 2019 (Macrotrends, 2020).

These changes mean that Amazon has largely remained profitable between 2015 and 2019. The firm’s good performance has been supported by a significant increase in revenue and a reduction in expenses and losses (Amazon Inc., 2018). Its earnings per share have also improved within the same period of analysis from a low of $1.25 per share in 2015 to $23.01 in 2019 (Macrotrends, 2020). A more comprehensive review of data relating to the income statement is provided in appendix 2.

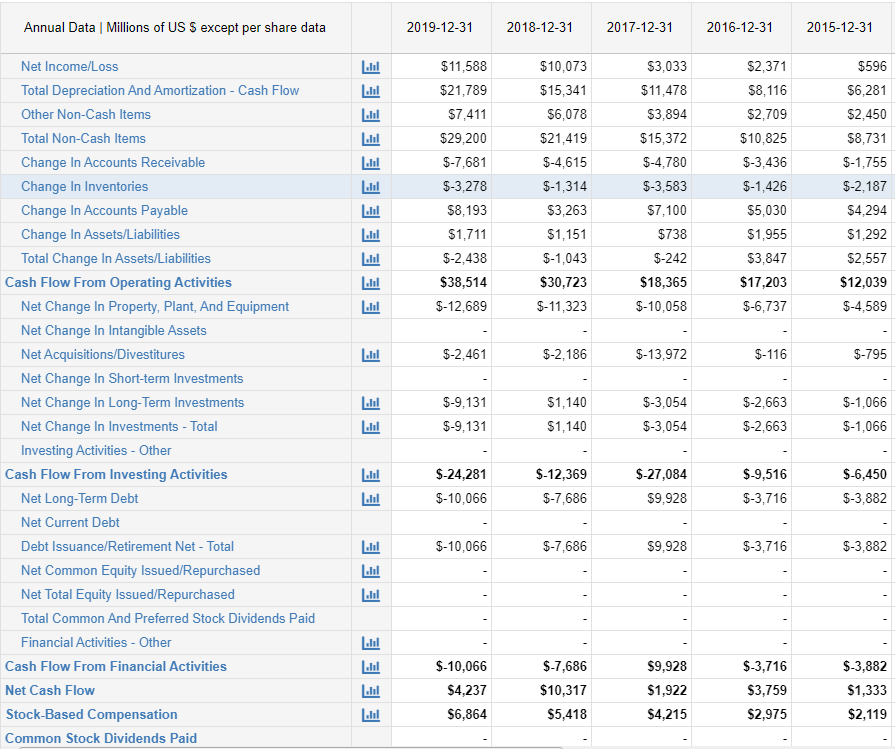

Cash Flow Analysis

This cash flow analysis highlights Amazon’s financial position throughout the five years under review by analyzing patterns in financial flow throughout the organization. Key financial indices that are pertinent to this analysis include cash flow from operating activities, investing strategies, and financial investments. The cash flow from operating activities has increased by 300% between 2015 and 2019 from $12 billion to $38 billion, respectively (Amazon Inc., 2018; Macrotrends, 2020). Although this increase largely shows that its operational plans have been profitable throughout the five years under review, the same cannot be said for its investment activities because they have led to a surge in losses from $6 billion in 2015 to $24 billion in 2019.

The same poor performance has been registered in its investments in financial activities, which has led to an increase in losses from $3 billion in 2015 to $10 billion in 2019 (Macrotrends, 2020). These financial indices mean that Amazon has had a poor cash flow within the five years under review. However, the effects of its poor financial and investment decisions have been offset by its overall net cash flow, which increased from $1.3 billion in 2015 to $4.2 billion in 2019 (Macrotrends, 2020). A more comprehensive report of Amazon’s cash flow statement appears in appendix 3.

A Review of Financial Ratios

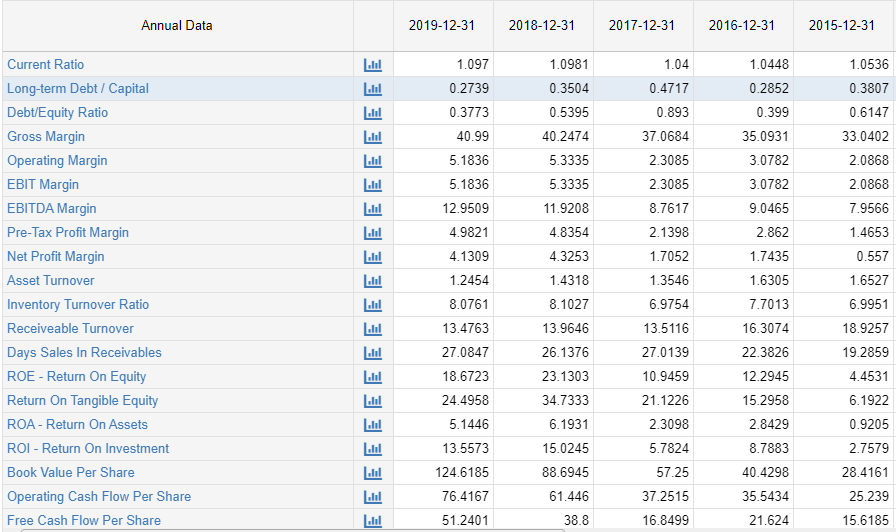

Key financial indices that will be explained in this report include the debt to equity ratio, return on investment (ROI), and current ratio. According to appendix 4, Amazon’s current ratio has remained steady at 1.0536, 1.0448, 1.04, 1.0981, and 1.097, in the years 2015, 2016, 2017, 2018, and 2019, respectively (Macrotrends, 2020). These statistics mean that the company’s assets can cover its liabilities. Its debt to equity ratio also reflects the same positive financial position because, in the years 2015, 2016, 2017, 2018, and 2019, it posted figures of 0.6147, 0.399, 0.893, 0.5395, and 0.3773, respectively (Macrotrends, 2020).

These numbers suggest that the American-based firm has high financial leverage in the market. The outcome is consistent with the average debt to equity ratio in the online retail market, which is 0.5 (Hinterwimmer, 2018). Therefore, Amazon’s performance is consistent with that of other players in the industry. Lastly, the company’s increase in ROI from 2.7579 in 2015 to 13.5573 in 2019 suggests that shareholders have benefitted from an increased return on their investments. Broadly, these financial ratios suggest that Amazon has been in good financial health, relative to its competitors. A more comprehensive analysis of the company’s key financial ratios appears in appendix 4.

Summary, Conclusion, and Recommendations

Amazon has grown from a small retail company to one of the world’s most formidable and recognizable brands. Its growth has been spurred by surging interest in e-commerce activities among American and international consumers. As the firm continues to expand its global operations to more countries around the world, it needs to maintain a favorable financial performance by periodically evaluating its capital requirements and operating cash flows, which are key performance indicators for the e-commerce behemoth. By doing so, the company can exploit some of the emerging opportunities in electronic retail services through the expansion of its market share in new and emerging regions, such as the Middle East and Africa. However, to reinvigorate such a plan, the company needs to pay close attention to the results of Porter’s five-force analysis described in this report because they highlight weaknesses in its relationship with its competitors, consumers, and suppliers, who have the biggest impact on the firm’s future operations. Therefore, the following recommendations should be considered:

- There is a need to address the strong competitive force that exists in the market as a primary threat to Amazon’s global operations by highlighting unique aspects of the company that, for many years, have made it stand out in the e-commerce industry. This approach to strategic development means that the firm should allocate more resources towards strengthening its brand, which is one of the world’s most recognizable.

- Amazon should dedicate more resources to improve the quality of its services to meet the changing needs of customers in the market. For example, the minimized use of counterfeit products could improve the overall user experience of its customers by safeguarding the integrity of the products sold on the online platform.

- Address the threat of substitution and new entrants by looking for innovative ways to stay relevant and more integrated into the future design and markets of e-commerce. By doing so, its online platform may become more appealing to customers.

Collectively, if well implemented, the recommendations highlighted in this paper may play a key role in cementing Amazon’s dominance in the market and elevating the profile of its stock as a good investment. Nonetheless, the above-mentioned recommendations need to be implemented through extensive consultations with all major stakeholders. To support this plan, Amazon’s expansion plans should be covered by its strong financial position, which supports the creditworthiness of the Seattle-based Corporation. Therefore, Amazon is a viable investment.

References

Amazon Inc. (2018). Annual report. Web.

Clement, J. (2020). Amazon – statistics & facts. Web.

Gupta, N. (2019). Amazon’s share of America’s online retail market. Web.

Hinterwimmer, T. (2018). International marketing. analysis & decision-making. New York, NY:GRIN Verlag.

Macrotrends. (2020). Amazon financial ratios for analysis 2005-2020. Web.

Rossman, J. (2016). The Amazon way on IoT: 10 principles for every leader from the world’s leading internet of things strategies. New York, NY: Clyde Hill Publishing.

Rutakirwa, T. (2018). Amazon organizational structure. Web.

Appendix

Appendix 1: Amazon’s Balance Sheet (2015-2019)

Appendix 2: Amazon’s Income Statement (2015-2019)

Appendix 3: Amazon’s Cash Flow Statement (2015-2019)

Appendix 4: Amazon’s Key Financial Ratios (2015-2019)