Introduction

Almarai Company is a business in Saudi Arabia with the biggest vertically integrated business in the Middle East. The business was based on a venture agreement between two family members in 1979. The title of the company ‘Almarai’ signifies green pastures from Arabic. From the early 1990s, the business changed from a centralized arrangement during restructuring and reinvesting to more decentralized management. Almarai is the major firm in the GCC that sells dairy products in the Gulf Area. Almarai has a robust logistics system run by experienced Directors in marketing, sales, and distribution chain that integrate, chilled supply network, and technology installed within the farms and processing plants. Almarai Company produces and distributes meals and drinks. The organization’s product portfolio comprises fresh milk, yogurts, cheeses, fresh poultry components, hamburgers, sandwich rolls, puffs, croissants, wafer and cake pubs, and baby formulas.

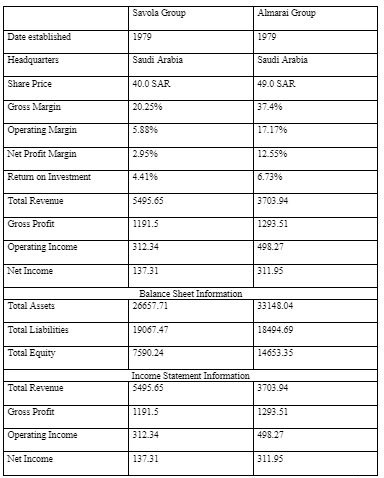

As of January 2020, the firm’s total assets were 38148.004 million, the firm’s total liability was 20494.69 million, while the total equity of Almarai Company was 18653.35 million. The share price was 47.50 SAR as of 31 March 2020, and the company traded 639,185 million in volumes. As part of its expansion strategy, the management announced the acquisition of 21.3 million worth of stake from Pure Breed and other shareholders. By implication, the Almarai currently controls 56.9 percent of the share capital of Pure Breed. Pure Breed organization concentrates on poultry farming, and its purchase will allow Almarai Group to streamline, integrate, and fortify its own poultry distribution chain.

Data Discovery Details

Financial Information about Almarai Group

Almarai Company ownership is divided into corporate and individual investors. As a result, its corporate investors control 67.1% of its management, while individual investors control 32.99% of its shares. The investors include Savola group, government institutions, mutual funds, swap agreements, and individuals. The company announced its net profit of SAR 1.9bn in 2019 compared to SAR 2.01bn in 2018. Despite recoding 9.7 percent in earnings, the decrease in the corporation’s profitability was largely related to reducing gross margins caused by the increase in manufacturing price. Furthermore, an increase in operating costs by approximately 16 percent YoY (year over year) places an extra burden on the organization’s operating margin, which was listed at 37.7percent in 2019 compared to 38.5 percent in 2018.

The company witnessed a moderate growth of 3.4 percent and 9.5percent in value of operating and gross levels, respectively. However, the recognition of impairment reduction, amounting to SAR180.2 million with an increase in fiscal expenditure by 11.9%, affected the positive impact on gross profit and operating gains on the bottom line. The firm announced a net income of 10.16% in the first quarter of 2019 as against 15.5% in 2018. The corresponding analysis indicates a YoY decline of 9.7 percent. The decrease is based on a noticeable drop of 8.7percent in 3Q-2018, which was orchestrated by the consolidation of IDJ operations.

Almarai’s dairy products continue to serve the people of the Gulf region. The organization’s earnings are generated from milk performance since it offers a notable position in the market demand. The firm’s products remain stable to reinforce its dominance in regional and local markets throughout the induction of numerous new types of goods. The division’s earnings increased by a CAGR of 13.7 percent between 2015- 2019 in which the earnings contribution from this section was 53.3percent in 2019 compared to its value of 60.7% listed in 2018.

Investment Strategy

Signaling that the Organization’s Expansion Philosophy

The board declared its 5-year funding investment program amounting to SAR18.7bn, throughout 2016-19. In accordance with the specified information, the dairy company used the budget to expand Almarai’s company in all sections, such as farming, development, and research. Each unit received a boost in new product creation and business growth. The campaign was the largest investment strategy for the organization. Although the board did not reveal detailed information about its implementation and success rate, the signs showed the fiscal effect on the firm’s valuation as of December 31, 2019.

Almarai’s Net Profitability Growth and Inventory Valuation

According to the shareholders’ demonstration and presentation in the 2Q-2017, Almarai is focusing on growth in the GCC supply system, new product, gross profit, cash flow administration, and improving operational incorporation. The implications of cash flow administration are associated with price control measures for its capitalization projects. Generally, the cost is measured on weighted scales, which covers production, packaging, and delivery expenses. Consequently, based on manufacturing goods, the cost of operations includes all direct investment depends on the implementation of standards. The board is aware of these standards, has enforced, and integrates effective organizational reforms to improve its financial position in the competitive market. Investments in securities have been quantified from the consolidated balance sheet at fair value with unrealized profits or losses documented in equity. When Almarai products are disposed of, the consolidated profit or loss announced in the equity is accepted as the interim record of income. However, when the firm fails to record any investment price is regarded as the most appropriate, reliable, and objective measurement of the fair value of these securities.

Organization Structure

Almarai has an operational structure comprising three functional and four service branches. The operational branches are directly accountable for the different phases of distribution and production. The operational unit includes revenue sales, operations, farming department, marketing, and HR, administration, information, and support divisions. Almarai’s integrated method of food manufacturing and supply is one of its competitive advantages. Consistency of strategy and coordination of operational decisions is vital to the accomplishment of overall company targets. Strategic functions are built on supplying practical support to working units and on ensuring the management of operational goals and objectives. The senior management of each branch comprises a group of seasoned and competent professionals led by the DGM (Divisional General Manager). The organization is run by effective policies and processes tailored by a centrally controlled government. Almarai’s supervisors focus on agreed financial and nonfinancial aims at the business unit level and therefore are independent to handle within these restrictions. Annual and fiscal budgets are introduced for acceptance with capital expenditure programs and related improvements. The Almarai strategy may be regarded as a mix of consolidated and decentralized structures with an emphasis on collaboration and integration.

Supply and Earnings

Almarai’s marketing and sales department oversees the organization’s relationship with its clients and is tasked with meeting customer support requirements while creating Almarai’s quality dairy products. As goods are distributed on a sale-or-return arrangement, the firm must optimize to optimize its point distribution and logistics to maximize earnings while minimizing product returns and other losses. The climate and topography of the Arabian Peninsula pose certain issues for the chilled distribution system as demanded by p fresh milk products. To guarantee that goods are readily available, it is important that each link in the distribution chain from moving cows to retail outlets operate efficiently to provide raw milk and products at an acceptable chilled temperature.

The organization established a distribution system covering all GCC regions. The distribution infrastructure incorporates cold shops, retail units, and regional workplaces with 25 depots in Saudi Arabia. The depots distribute fresh diaries and foods to nearly 27,000 clients with over 150,000 orders per week. The company sells only Almarai branded products to expand its competitive edge. As a result, the firm has a league of committed staff working in excess of 750 sales units employing a fleet of over 1050 delivery trucks to manage its sales and supply activities. The investment in supply depots and fleet ensures that fresh dairies are supplied at chilled temperatures and reach stores and customers in excellent condition. This implies that the merchant will get complete credit for unsold merchandise returned to Almarai.

In retail stock shelves, Almarai negotiates a balance between the threat of returns and earnings. Almarai management invested in modern and innovative technologies to secure the precise and trustworthy information crucial to guarantee the effective running of the process. The installation of handheld stations signifies that Almarai knows accurate sales volumes and substitute amounts of goods and daily retail returns. The investment in technology and advanced systems enables Almarai to respond efficiently to market changes and predict market demand.

Economics Literature of Almarai Company

The company’s core industry is milk products and other production lines such as poultry and sugar nectars. The firm’s vision aligns with its goals and dedication to service quality. As a result, the management enforces standard procedures in animal feed, employing global occupational health criteria. In accordance with global practices, the management is expanding its earning based on quality operations, introducing new goods, and launching new markets. Besides attaining development through technological advancement, the firm seeks to diversify its market hub along geographical lines. Another crucial measurement of Almarai’s economic strategy is the focus on research, education, and skill acquisition training. The management employs workers based on their demands and qualifications. As a result, the management invests in high-end technological training to boost employee performance and productivity.

In development and research, the company participates in analyzing experimental foods by measuring and assessing customer demand and exploring possible options to guarantee customer satisfaction for fresh and quality products. Almarai’s alignment of high-end training and additional research is proof of its strategic positioning. The strategy involves both organizational preparation and management. The business empire recognizes the significance of spirited efforts to harness its competitive advantage in a complex market. With the acquired knowledge, the workers are motivated to provide high-quality performance and job specialization to meet customer demands and provide informed decisions in the production, distribution, and supply units (Kripa and Dorina 359).

Data Analysis and Valuation Conclusion

SWOT Analysis of Almarai Group

Strengths

Almarai is a major competitive firm in the GCC that specializes in fresh dairy products. Almarai is operated by a well-orchestrated experience in sales, network marketing, and supply chain. The strategy allows the organization to integrate and collaborate its efficiencies in delivery logistics for a chilled supply system and advanced innovation integrated with its distribution plan.

Weakness

The company depends on its trademark ‘Almarai’ and cannot switch its production lines if an unanticipated incident occurs. The company has a comparatively limited share within the Gulf region (Kaya 510).

Opportunities

Almarai will appreciate the gains attached to the removal of currency exchange prices in GCC countries. As a result, the organization will apply reduced import duties, which could lower the cost of operations and increase its earnings and net profit (Maerkle and Afsina 33). The business will grow in its earnings because of the growing population in the Arabian Peninsula. Such growth will benefit the business as it establishes a new product to create opportunities for expansion (Kaya 511). Based on this assumption, the organization scaled-up its deliveries in fresh dairies, fruit juices, Laban because of its health awareness proportions and fitness standards.

Threats

Macro and microeconomic forces pose challenges to the organization. Political stability in the gulf regions is a significant variable in the growth of the Almarai group (Maerkle and Afsina 33). The changes in fuel price create market volatility and affect business performance in the Gulf region.

Summarized SWOT Analysis for Almarai Group

Strength

- Brand awareness

- Quality merchandise perception

- Strategic partnership with retail outlets

- Transparent measurement of product shelf life

- A market share of percent 65 percent in 2018

- Effective distribution of chilled supply network.

- Distribution criteria

Weakness

- Extended distance from the manufacturing location to sale outlets

- Border manufacturing farm location

- The extended and complicated supply station

- The high price of supply channel than other challenges

- A high proportion of delivery damage

- The negative impact of short shelf life

- Single brand and product trademark

Opportunities

- In the long run, the integration of a single GCC currency will remove the expense of money exchange

- Expansion channels of diversification

- In the long run, the import and export duties will be lowered or removed thereby improving business earnings

- The growing population will influence the earnings of dairy foods by expanding product demands.

- New product lines in line with customer demands and market analysis

- Improved awareness of health standards and requirements from customers

- Low price support investments from the organization’s business lines

Threats

- Oil subsidies affect market dynamics of dairy products

- Any threat to government stimulus packages due to oil volatility will affect the cost of production.

- The regional expansion could pose financial burdens such as cost of operations, procurement, insurance, and lawsuits.

- The short shelf life of products influences sales and product quality

Competitive Advantage and Disadvantages

Almarai has a number of strategic features, which interpret sustainable competitive benefits and superiority relative to its rivals. Almarai dairy products are instantly recognizable because of their brand differentiation. Consumers see the brand as a mark of excellent quality and value within the market environment. As a result, the company guarantees its expertise for dairy quality, technical excellence, efficiency, and brand responsiveness. The management mandated Conquest AMRB to run research on the comparative strength, its products, and notable substitutes. The study showed that Almarai dominated its niches with large scores in brand consciousness, relevance, operation, and communication. Almarai is the recognized market leader for fresh milk products and sugar mix in GCC markets. In cheese and margarine production, its market share is increasing as it competes with recognized brands such as Savola, NADEC, Al Rawabi, Agthia Group, and Adecoagro. Conquest AMRB is a brand agency that specializes in running market research to value the advantages of products employing a methodology called BRANDZTM. Almarai has prevented dependence on different facets of its company, such as regional market, retail group, and client category or supply channel.

The experienced and seasoned senior group with strength in depth controls Almarai Group across the organization. Department heads are chosen from various backgrounds and nationalities with combined capability, proficiency, and local knowledge. As a result, the company has deployed key changes in market trends and implemented change approaches to market fluctuations. This change management experience allows the company to maintain growth, sustain its brand differentiation and quality.

Strategic attributes of Almarai’s management experience include:

- Adept planning in balancing product requirements with the supply chain distribution of dairy products and materials.

- The control of chilled deliveries and their effect on product quality.

- An effective analysis of market trends, sales direction, and delivery technicalities.

- Strategic and accurate earnings forecast.

- Robust financial data, planning, and administration systems

Reflections of Suitable Strategy for the Organization

Approaches to Sustain Profits

Companies regularly access their competitive Advantage based on market dynamics and demand. Thus, Almarai should employ these strategies to maximize gains from the SAR 12.5billion investment program. The advantage in-depth of its administration capabilities, expertise, and technical support in most disciplines ensures the effective use of those capacities and positions Almarai Group among successful food businesses in the Gulf region.

Price Direction

This approach allows firms to provide products of identical quality as other rivals on the current market at much-reduced prices. Presently, Almarai implements a pricing plan by considering the expense of its production lines and distribution expenditures. Therefore, the company could deploy the cost-based pricing to support its products. Another approach used is merchandise based pricing, whereby products within a comparable product scope are sold differently. If the company adopts this pricing plan, the management could lower the cost of operations by effective resource allocation.

Product Differentiation and Forming Alliance

The firm must integrate product differentiation among its competitive edge. Such a strategy will create customer satisfaction and stabilize its product demand. Almarai stumbled on introducing new juice products with the goal of complementing its existing sales earnings. The business added bakery foods and poultry products to boost its presence in the Gulf region. However, with the injection of SAR 12.5billion, the firm must study its production lines to determine consumer needs by creating aggressive strategies to sustain its quality, sales delivery time, and efficiency. To sustain its competitive edge as a leading investor in dairy foods in GCC countries, Almarai must look for strategic alliances. These alliances can aid the enterprise to pull resources with strategic investors in the constitution of joint ventures (Maerkle and Afsina 33). Thus, Almarai will acquire exposure while fostering its income with a commanding market share.

Micro and Macroeconomic Factors

The market dynamic is a business term that describes forces and variables that affect a firm’s capability to construct and maintain effective relationships with clients. Micro and macroeconomics have their pull on Almarai business growth and profitability. Macroeconomic factors are external variables that influence its capacity to serve the client’s requirements, such as supplier network providers, advertising intermediaries, the client markets, and demand. Macroeconomic factors describe external variables such as demography, economy, natural powers, engineering, politics, and civilization.

Macroeconomic Factors

Culture, Demographics, and Economy

In the GCC market environment, there is no tendency to utilize raw dairy milk products from its production farms. The region’s civilization does not encourage such a mode of consumption. Therefore, the forces of culture influence the firm’s decision mechanic to support the finished processing of dairy products. Demographic variables in GCC countries favor dairy investments, and the demand is influenced by the product quality and brand differentiation. Dairy and milk products are substantially demanding in UAE merchandise. Dairy products are a healthier means to sustain energy and thirst; thus, demographic trends support the production of Almarai milk solutions. Many people in the UAE, no matter the ages, household architecture, geography, or qualifications, purchase Almarai dairy solutions. The UAE is a consumer market and a tax-free economy. Individuals have a higher disposable income in the UAE. Thus, the economy favors the production and distribution of dairy products.

Innovation and Digitalization

With the introduction of digital architectures in agriculture, farm mechanization is gaining attention with huge investments in high-tech equipment and production components. Therefore, innovation and digitalization support the firm’s supply network of chilled dairy products. Consequently, the use of mobile refrigerators could reduce spoilage during service interruptions such as roadblocks, riots, or natural disasters.

Political

The UAE government is built on strong political strategy, resonated with the economic system. As a result, the region’s economic and political structure promotes the ease of doing business. However, the rising political instability in the Gulf region poses significant challenges to business growth and expansion. Thus, the political structure in GCC countries creates business uncertainties and market volatility.

Microeconomics Factor

Customer Need

Diary merchandise is essential for healthy living. As a result, Almarai merchandise is a standard demand for high and low-income earners. Therefore, the market demand cannot be altered by income, but quality and service delivery.

Conclusions

Almarai Company is among the largest integrated firm in the Middle East. As a result, the firm can apply numerous approaches to fortify its footprints for long-term demands. By adapting to the future, changing consumer needs, and sustaining the right to perform, Almarai could sustain its market requirement and maximize profit. The SAR 12.5 billion-projected investment will expand its shareholding, new product lines and improve its manufacturing volumes. By altering its resource capabilities, improving the transport and distribution solutions in addition to the advancement of manufacturing capacities, Almarai would have a competitive edge over its rivals on customer demand. By forming alliances, embracing differentiation, and price leadership, Almarai could become a multinational giant in dairy products and benefit for its SAR 12.5 billion investment.

Defining the Company

Savola Company

Savola Group (SG) is among Saudi Arabia’s major firms, having a strong presence across the GCC countries. The company’s ownership is shared among investors and was founded in 1979. The organization produces and markets olive oil in Saudi Arabia. Its market stocks for olive oils and glucose have been 69% and 72 percent, respectively. Savola is presently among the most effective multinational food groups from the Gulf and the Middle East, with a presence in North African and Central Asian nations. It has developed into retail and food conglomerates to boost its supply distribution. The food branch incorporates edible fats, oils, and sugar. The retail branch contains supermarkets, retails units, and branches that incorporate plastic production. With a market capitalization of SR19billion, the company has over 25,000 workers, 200,000 investors, and is recorded at the top 20 firms in Saudi Arabia. Its earnings stood at were SR221Millionin 2019, which is a 70 percent increase from 2018. Savola Group is attempting to maximize its market share in Saudi Arabia and internationally by following a strategic and geometric growth plan. The company’s assets, liabilities, and equity standings on December 31, 2019, is shown below.

Total Assets: 36657.71 million

Total Liabilities 20067.47 million

Total Equity 8490.24 million

Data Discovery

The Savola Group is among the fastest-growing business venture on dairy products. The Group markets a wide range of products, which include a portfolio of companies and activities such as olive oils, sugar, retail and pasta stores, and fresh milk. The Group business history is built on many years of diversifying, construction, and consolidating manufacturers and jobs under the umbrella of a holding company located in the Kingdom of Saudi Arabia. The Savola Group is a joint venture any with the aim of producing and marketing olive oil and vegetable oil in the Arab Emirates. The business started its operations with 40 million SAR funding and 200 workers, importing, and optimizing raw vegetable oils.

The foundation of the business has been unique since most businesses from the Kingdom originated as household controlled entities. The simple fact that the business was established as a joint venture for public subscription was unique in its governance structure. The organization’s early success was built on the integration of its manufacturing process in its value string, which helped to significantly minimize operational cost accounting for over 73% of merchandise prices. The acquisition of an investment in businesses in its industry was the basis of its growth strategy. Savola obtained a stake in Swicorp when equity was nonexistent in the UAE. This acquisition led to a long-term partnership between both firms. Almarai was launched at precisely the exact same period as Savola with the notion of altering the standard of dairy food supply Saudi Arabia via industrial technology.

Business Structure

As of today, Savola Group functions as a holding of the stock market (Tadawul) using a variety of food manufacturers and portfolio investments not directly linked to its core enterprise. Though many of its property investments and non-core relevant companies have been divested, the Group still keeps numerous portfolio investments. The management of this Group does not think there is a solid rationale to terminate its investments; the value of that is projected at 25 billion SAR.

Ownership Structure

The ownership architecture of the company has evolved over time, though some founding investors still exist, their shares investments are diluted. Only two investors have a stake in the business exceeding 10 percent, along with the majority of other big shareholders in the business. The company’s major owners in January 2020 include Aseelah Investment Company, Abdul Qadir Al-Muhaidib Company, Abdullah Mohammed Abdullah Al-Rabi’a, and The General Organization for Social Insurance, and Al-Muhaidib Holding Company. Shareholders like Al Muhaidib Holding Company and Assila Investment Company with contemplating understanding of the financing market are called institutional actors. Ownership by overseas investors has evolved gradually; for instance, between 2015 and 2016, it climbed from roughly 2.3percent to 3.3 percent.

The Business is still a top manufacturer, especially in the Edible oils section, in most markets it works and contributes to other dairy products. The company is grounded in pasta, oils, and sugar products. Its merchandise supply is based on the business-to-consumer framework and B2B sales. The majority of business earnings (over 70 percent) derive from the sale of edible oils. Following 30 Decades of success and expertise across varied business industries, the Savola Group has set itself for a fresh period of natural development via its subsidiaries based under the holding firm. The business is pursuing both natural growth and acquisition opportunities, funding them via a mixture of customer’s equity, debt, and equity.

Micro and Macroeconomic Improvements on Market Valuations

The board wants to show investors whose current share price performance is a temporary occurrence and one which the organization is well placed to improve pursuing its own core competencies and identifying strategic prospects, which may improve the present footprint in sectors where Savola has a competitive advantage. In the center of its strategic leadership is the notion of leveraging strengths in retail and food. Despite current uncertainty, the executive staff and the board are not seeking to alter the Group plan, always moving towards a tactical investment model focused on food and retail components. Therefore, the direction has grown, and the management has accepted specific instructions for implementation. Divestments in center subsidiaries or investment businesses have not been considered. Even though the firm has not diluted its management in subsidiaries in favor of some other investors, it has sought to increase funding for its actions from external sources to bolster its balance sheet and its subsidiaries

The ‘defend’ standard applies to shield vital companies and developing faster in the marketplace. A vital initiative in 2015 has been merging the Group’s sugar companies in Saudi under a single management group. The ‘extend’ strategy requires the core products, which include oil and wheat, to adjoining regions of merchandise, searching better margins, according to existing strengths and capabilities. The ‘incubate’ strategy identifies classes with expansion potential, assessing market trends, and creating innovative goods using its business strengths and opportunities.

SWOT Analysis of Savola Group

Strengths

- The Savola Group has a strong presence in GCC countries

- It is now among the most populous multinational food groups from the Middle East

- Strong business and financial performance

- Continued revenue growth

- Diversified business investments and portfolios

- Effective and agile market analysis and evaluation

- Strong workforce with specialized qualifications

Weakness

- Weak international presence

- Under local pressure from oil uncertainties

Opportunities

- Retail presence in UAE and other regions

- Strategic alliance, mergers, and acquisitions

Threats

- Competition from international competitors

- Volatile economic requirements and market conditions

- Poor government funding and policies

- Financial crisis impacts client earnings

Data Analysis and Valuation

Grand Plan Matrix

The Grand Strategy Matrix relies on two evaluative measurements, which include aggressive standing and market growth. A firm whose annual earnings exceed 5% records accelerated expansion. Based on these assumptions, Savola Group (SG) earnings are exceptional at 45% in 2019 and 34% in 2018. The CMP identifies a firm’s competitor(s), its strengths, and its weaknesses regarding its strategic alliance. SG’s comparative strengths and weaknesses are represented in the weighted values. SG is among the leading venture from the MENA, having a searchable portfolio of flagship companies with branded goods. The GCC rivals include Almarai Company, Waitrose, and Carrefour. As explicit statistics for these opponents are inaccessible, their marginal scores are based on perceived strengths and flaws relative to SG.

Consequently, its success stories are represented by the circumstance. SG can improve on its own cost competitiveness since foreign competitors have a competitive edge. SG could face competition from rivals, particularly in the areas of pricing, product lines, and merchandise quality. An EFE Matrix allows managers to outline and assess economic, cultural, social, demographic, ecological, political, legal, technical, and competitive analysis. SG is at a comfortable place with its aggressive position across the Gulf region when compared with the Almarai group. However, the SG must evaluate its external opportunities and threats by constructing potential core competencies. Since the online penetration remains in its bud state, SG could capitalize its adaptive product lines to maximize profits.

Comparing the Business Valuation of Almarai and Savola Group

The business valuation between the Almarai group and Savola group evaluates each core competency based on key measurement sales. The paper assessed the company’s ownership structure, financial information, balance sheet, governance structure, economics, literature, industry information, quantitative and qualitative analysis, macroeconomic, and microeconomic analysis. Both organizations dominate in each product line, as they tend to utilize various core competencies to establish a presence in Saudi Arabia. Based on the exhaustive research, this paper highlight specific areas of the analysis.

The quantitative data analysis shows comparable differences between SG and AG investments. Each organization showed its areas of strength and weakness based on the recorded values from its financial statements. Findings on the net income showed that SG has a better standing than the AG. It is important to know that SG acquired a stake in AG, which explains its relative strength based on business diversification. The SG board believes in business diversification to mitigate market uncertainties and brand collapse. The macro and microeconomic factors affect both organizations since there are located in the same gulf region. However, business diversification provides a springboard for business expansion as it equips shareholders with informed decisions on market dynamics.

Overall, the analysis showed that both management adopts similar market variables to improve their standing in the stock market. By adapting to the future, changing consumer needs, and sustaining the right to perform, both companies could sustain its market requirement and maximize profit (Alomari and Islam 2745). Consequently, by altering its resource capabilities, improving the transport and distribution solutions in addition to the advancement of manufacturing capacities, both companies would have a competitive edge on customer demand. Adopting strategic alliances, embracing differentiation and price leadership, would position both companies to become a multinational giant in dairy products, and benefit from its investment.

Works Cited

Alomari, Mohammad, and Islam Azzam. “Effect of the Micro and Macro Factors on the Performance of the Listed Jordanian Insurance Companies” Journal of Emerging Issues in Economics, Finance and Banking (JEIEFB), vol. 8, no. 1, 2019, pp. 2743-2755.

Kaya, Emine. “The Effects of Firm-Specific Factors on the Profitability of Non-Life Insurance Companies in Turkey.” International Journal of Financial Studies, vol. 3, no. 1, 2015, pp. 510-529.

Kripa, Dorina, and Dorina Ajasllari. Factors Affecting the Profitability of Insurance Companies in Albania.” European Journal of Multidisciplinary Studies, vol. 1, no. 1, 2016, pp. 352-360.

Maerkle, Rae, and Afsina Abbasi. “Assessing the market for motion graphics in Jeddah, Saudi Arabia.” Journal of Media and Communication Studies, vol. 9, no. 5, 2017, pp. 32-41.