Introduction

A bank is an institution – whose debts are commonly accepted in the final settlement of others people’s debts. (R. S. Sayers) Nowadays, the banking business has created a great revolution in the world economy. Every country’s banking business creates a great impact on the economy. Here we have taken mainly two banks to analyze the banking financial, comparative strategy Saudi Arabian SABB (Saudi British Bank) and is Audi Bank. We made some comparisons between these two banks.

Corporate Information

Bank Audi sal – Audi Saradar Group (the Bank) is a Lebanese joint-stock company registered since 1962 in Lebanon under No 11347 at the Register of Commerce and under No 56 on the Banks’ list at the Bank of Lebanon. The Bank’s head office is located in Bank Audi Plaza, Omar Daouk Street, Beirut, Lebanon. The Bank, together with its affiliated banks and subsidiaries, provides a full range of commercial, investment, and private banking activities through its headquarters as well as its 78 branches in Lebanon and its presence in France, Switzerland, Jordan, Syria, Sudan, Egypt, and Saudi Arabia. (Audi bank Annual Report 2006).

SABB is one of the members of the Saudi Kingdom’s financial sector. In the recent past, they have created beneficiary growth in the Saudi economy. SABB is a Saudi Joint Stock Company with a strong track record and a heritage that stretches back almost 30 years. The Bank was Established on 12 Safar 1398(H) (21 January 1978). SABB formally commenced activities on 26 Rajab 1398(H) (01 July 1978) when it took over the operations of The British Bank of the Middle East in the Kingdom of Saudi Arabia. (SABB bank Annual report- 2006).

The operating structure of the financial institution, board powers, management structure

For every financial institution, the operating management and its structure, broad members, and the structure of management is very important. The management is operating the business; the board members take the decision. And, the structure of the management should be very strong for doing sound business. If it is the banking business, the operating management should be strong and active.

SABB has a strong operating structure, uses broad powers, and has strong management. In accordance with the Articles of the Association, the company has an independent board of directors appointed by SABB and a chairman.

- Abdullah Mohamed Al Hugail (Chairman)

- John Edward Coverdale (Managing Director)

- Khalid Sulaiman Olayan

- Fouad Abdulwahab Bahrawi

- Khalid Abdullah Al Molhem

- David Howard Hodgkinson

- Niall Booker

- John Lowood Richards, OBE

- Sulaiman Abdulkader Al Muhaidib

- Ahmed Sulaiman Banaja

Audi Bank also poses a strong and well-structured management system. The structure is given below.

The board of directors has the power to make the decision about the policy and strategy of the Bank. They have the power to recruit employees who are managed and operate the banking activities.

Bank risk management processes and internal controls

In the banking business, the banks have to control their internal environment as well as cope up with the external environment to minimize the risk. The management always has to face some risks and, they recover them by controlling the internal environment and management.

Both of the banks, Audi and SABB, are committed to the people for better banking services and provide safety and security, which allows managing customer’s money, no matter where the customers are. Available by phone all day, every day, many of their facilities are completely free of charge.

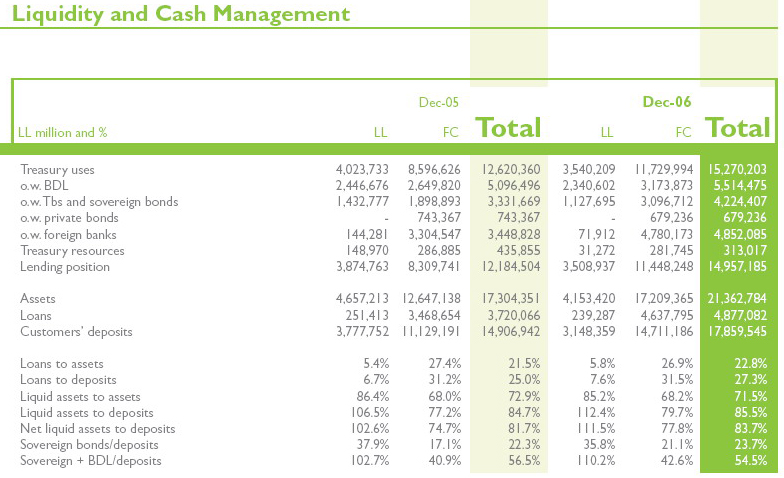

Besides this, to ensure harmonious banking activity, both of these banks are concern about their liquidity which is mandatory to continue the regular banking activity. Here the chart of Audi bank shows the condition of liquidity of the Bank to avoid liquidity risk.

Regulatory supervision and reporting

Regulatory supervision is the fact which ensures the proper management of an organization. As the financial condition is updating day today, it is very much important to any financial organization like a bank.

The consolidated financial statements comprise the financial statements of Bank Audi sal – Audi Saradar Group and its controlled subsidiaries drawn up to 31 December each year. The financial statements of subsidiaries are prepared for the same reporting year as the Bank, using consistent accounting policies.

Market penetration/segmentation/strategy/product mix

Market penetration is the act or the process of the business to making a way or performs something at a lower cost into the market to gaining market share.

Market segmentation is the process of dividing the market into some groups according to the characteristics of the markets. An organization or a company segments its market to find its target customers.

The product mix is the set of all tactical tools offered in the market to sell products and to get a competitive advantage from the market.

Technological advantage

SABB is well represented globally through its association with HSBC Group, and their regional leadership allows them to provide expert solutions across Saudi Arabia and the Middle East. And because they invest heavily in people, their highly prof Asset Management introduced two new funds and retained its nearly 16% market share of the mutual funds market whilst earning 26 awards for fund performance during the year. In Corporate Finance SABB and HSBC Saudi Arabia Ltd were together the most active providers of financial advisory, lead management and placing agent services for equity issues, and advising on and lead arranging Islamic finance transactions. Professional staff will look after the customer as customer needs and requirements grow.

Competitive analysis, technology usage / branching-domestic and international, strategic alliances

Now the Bank SABB uses various technologies in all its branches, domestics and international.

At SABB, they are proud that their technologically advanced business gives the solution to the customers who are very advanced in their banking territory. And, they feel very proud that they have the market-leading reputation.

Their Payments and Cash Management Division is a specialist unit that delivers cost-effective transaction, liquidity, and information solutions. Their state-of-the-art technology means that they can meet and exceed customer’s requirements for efficient, fast, and reliable services. From simple payment solutions to complicated account structures, their expert teams have the vision to engineer and deliver creative solutions to customer’s local, regional and international needs while minimizing costs and maximizing returns.

Sabbnet

The customer can Sit back and take control of their finances in the comfort of their own home or office with SABBNET. SABB offers an online banking solution, a wide range of online services round the clock, every day in the week. SABBNET operates using the highest levels of data encryption.

Via SABBNET, the customer can access the following online services:

- General Banking and Credit Card Services

- Check your SABB account balances and transaction details

- View portfolio balance and contents

- Open additional account current/saving

- ATM card request once opening the additional account

- Opening Amanah commodity investment

- ATM card reissue online

- Get an e-Statement

- Order a checkbook

- Update your personal information

- Check your Credit Card balance and current transactions

- Set up a mobile or SABBNET alert service

Payment Services

- Transfer funds between SABB bank accounts

- Make payments to your SABB Credit Card

- Pay STC and SEC bills

- Pay SADAD Billers

- Make SARIE transfers

- Make overseas transfers (including DirectPay)

- Easy Buy payments

Mutual Funds services

- Subscribe to a new Mutual Fund

- Add additional units to current Fund

- Redeem units in any mutual fund to which you have already subscribed (partially or fully)

Initial Public Offering (IPO) / Rights Issue (RI)

- Subscribe to the available company

- Inquiry to view the details of an IPO/RI subscribed to through SABB

- Allocation Inquiry to view the allocation details of an IPO/RI you subscribed to through SABB

Help and Advice

- Full online help

- Secure two-way e-mail service

Operating at the forefront of technology, SABBNET is a continuously evolving system, and we aim to ensure that it grows with your needs.

The prime Bank also uses technologies.

Online Banking Operation

The Bank has set up a wide area network across the country to provide online branch banking facilities to its valued clients. Under the scheme, clients of any branch shall be able to do banking transactions at other branches of the Bank. Under this system, a client will do the following type of transaction:

- Cash withdrawal from their account at any branch of the Bank, irrespective of location.

- Cash deposits in other accounts at any of the Bank irrespective of location.

- Cash deposits in their account at any branch of the Bank, irrespective of location.

- Transfer of money from their account with any branch of the Bank.

Any amount can be deposited or transferred under the Prime line. In the system, however, at present, there is a limit for cash withdrawal through the bearer or by the account holder himself.

The function and roles of this institution have been expanded day by day. The Bank has been introduced Credit Card both Domestic and International as a principal member of Master Card International. As the Bank’s business has continued to diversify and grow, so has the demand for premises from which to operate.

During 2006 new premises constructed, leased or under construction at the year-end included:

- A purpose-designed branch in Najran;

- Nine new branches Kingdom-wide, five of which are relocations;

- Three new Ladies Lounges;

- Three new Investment Centers and expansion of a fourth;

- A new Premier Lounge;

- Three new Central Cash Centers in each of the main centers;

- Four new premises for Direct Sales Teams, one in each main center and a fourth in AlHasa; In addition, a new site has been secured for the Head Office of HSBC Saudi Arabia Limited; designs have been completed for a new fully-fledged Central Processing Centre; and a further 52 ATM machines and five Cash Deposit

Machines have been installed. In the light of this considerable activity, SABB had at the end of the year a network of 73 branches, including 12 sections or branches for ladies; a total of 278 ATM machines; 4,983 point-of-sale (POS) machines; and 30 cash deposit machines.

Loan/loss provisions and policies

SABB has some provisions and policies in case of loan and loss. Their policies are as follows:

Loans and advances are non-derivative financial assets originated or acquired by the Bank with fixed or determinable payments. All loans and advances are initially measured at fair value, including acquisition charges associated with the loans and advances except for loans held as FVIS. Following the initial recognition, subsequent transfers between the various classes of loans and advances are not ordinarily permissible. The subsequent period-end reporting values for various classes of loans and advances are determined on the basis as set out in the following paragraphs. The Bank’s loans and advances are classified as held at amortized cost. Loans and advances originated or acquired by the Bank that are not quoted in an active market and for which fair value has not been hedged, and those that are to be held to maturity, are stated at cost less any amount written off and provisions for impairment.

For loans and advances, which are hedged, the related portion of the hedged fair value is adjusted against the carrying amount.

Provision for Risks and Charges

Provisions are recognized when the Group has a present obligation (legal or constructive) arising from a past event, and the costs to settle the obligation are both probable and can be reliably measured. (Annual Report of Audi bank 2006)

Provisions are recognized when a reliable estimate can be made by the Bank to a present legal or constructive obligation as a result of past events. It is more likely than not that an outflow of resources will be required to settle the obligation.

Asset/liability diversification

Property and equipment

Property and equipment are stated at cost and presented net of accumulated depreciation and amortization. Freehold land is not depreciated.

The cost of other property and equipment is depreciated and amortized on the straight-line method over the estimated useful lives of the assets as follows:

- Buildings 20 years.

- Leasehold improvements over the period of the lease contract.

- Furniture, equipment, and vehicles 3 to 4 years.

- Gains and losses on disposals are included in the statement of income.

The assets’ residual values and useful lives are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. Any carrying amount is written down immediately to its recoverable amount if the asset’s carrying amount is greater than its estimated recoverable amount.

Liabilities

All money market deposits, customer deposits, borrowing, and debt securities in issue are initially recognized at fair value. Subsequently, all commissions bearing financial liabilities, or where fair values have been hedged, are measured at amortized cost. Amortized cost is calculated by taking into account any discount or premium. Premiums are amortized, and discounts are accreted on an effective yield basis to maturity and taken to special commission expense. Financial liabilities in a fair value hedge relationship are adjusted for fair value changes to the extent of the risk being hedged. The resultant gain or loss is recognized in the statement of income. For deposits and money market placements carried at amortized cost, any gain or loss is recognized in the statement of income when derecognized or impaired.

Derivative product risk management

In the case of product risk management, SABB has a security service, which provides tailored services suitable for all needs and creates a good relationship with the customers. For this, SABB has a dedicated team of experienced and professional staff.

Securities Services

2006 has been a very successful year for Securities Services (SCS), with business growth in excess of 100% over the previous year. Such an achievement results in large part from the increased size and diversity of SCS’s core business offerings, which now include custody and clearing, IPO/rights issue management, institutional fund services, escrow agent services, and non-bank financial institution services – the latter two of which were introduced for the first time during the year. Of particular note is the recognition of SABB in the local marketplace as a key provider of IPO.

Management Services due to its innovative approach in introducing direct subscription channels.

Off-balance sheet management

For the Bank, cash is the most important and volatile asset. And the management’s first step is to manage or handle it effectively and efficiently so that they allow funds to flow where and when needed.

SABB provides fast and electronic banking services by which the customer can get cash payments locally or globally. And, for this, the customer needs a business banking relationship. which means less cost and efficient communication and administration.

The management of SABB also perform some off-balance-sheet activities, which are as follows:

Payments Management Service

SABB’s leading-edge Payments Management Service is designed to allow you to control routine payments from one integrated point of contact, maximizing your cash flow and minimizing your workload.

Collection Management Service

As well as helping you to make payments, SABB can also provide the tools you need to collect funds from creditors with maximum efficiency. Our electronic banking system will ensure that funds are collected on time, allowing you to forecast your cash flow with greater accuracy. We can also provide secure cash and cheque handling services as part of our integrated cash management solution.

Delivery Management Services

Rapid access to clear and concise information is the key to competitive advantage. With SABB’s electronic banking services, you can be assured of just that – and a whole lot more.

Remittance Management Service

In line with our commitment to providing you and your staff with the solutions that best meet your Payment and Cash Management needs, our Remittance Management Service is extremely convenient, totally secure, and fully automated. It can be accessed from anywhere, at any time, and your staff can even use it to make payments to pre-designated beneficiaries from the comfort of their own homes.

Dividend Distribution

SABB’s specialist Dividend Distribution system can help you optimize the way in which your company pays dividends to its shareholders. Our unique, purpose-built system exists with the sole purpose of paying dividends, which we can distribute in the following ways:

- SARIE (to SABB and non-SABB account holders)

- Tick up

- Cheque

Conclusion

General Banking development performs the core functions of the Bank, operated the day-to-day transactions, all other department is linked with these departments. They take the deposit from the customers and meet their demand for cash, honoring their cheques. The department is very rush, and the employees here are too upgrade to their duty.

References

www.sabb.com