Executive Summary

Dividends are considered to be the most important mechanism of distribution. Most companies make a specific type of distribution. For instance, while some companies pay 94 percent dividends, others pay 39 percent of the firms that buy back the shares. In most cases, when a company decides to use a specific mechanism of distribution, it considers a number of factors. These factors include the implications of accounting, alternatives of tax efficiencies, the attractiveness of the investors as well as the flexibility offered by the distribution mechanisms. From the above factors, accounting is considered to have the strongest theoretical support. Despite the challenges presented by distribution policies, business executives should always understand that these are long-term decisions. For this reason, it is important to create not only consistency but also a long coherence to gain a competitive advantage in the marketplace. Constant changes in distribution policies set back the brand reputation as well as customer experience. This paper will examine various aspects of change in distribution policies at the Harris Mineral Resource (HRM).

Assumptions

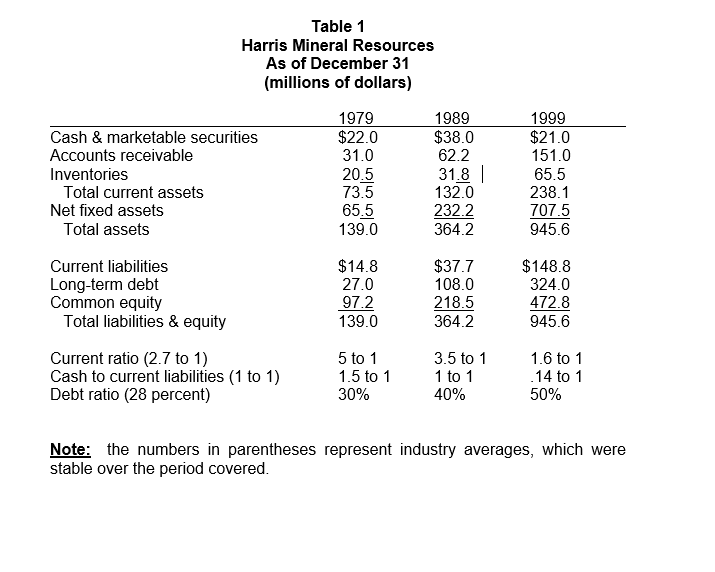

As far as Harris Mineral Resources’ current financial situation is concerned, the company has consistently operated in an aggressive manner. As established in the case study, the company’s policy has benefited in the rapid growth of assets as well as sales. However, the company’s growth has resulted in a broad range of challenges as evident in the company’s balance sheets of 1999, 1989 and 1972. The company’s debt ratio increased from 30 percent to 50 percent between the years 1972 and 1999. Besides, the company’s current ratio weakened from 5:1 to 1.6-1 while the cash to current liability ratio declined from 1.5:1 to 0.14:1. An assumption made from the company’s present situation is that the hostile takeover has significantly affected the company’s profitability.

Analysis

As a marketing tool, distribution policy acts as a link between consumers and producers. This policy also serves as a determinant of where and how products and information are distributed within and outside the organization. In most cases, Distribution Policies are created by executives. These officials are required to consider the company’s needs and goals carefully when determining how dividends are released to the shareholders. It is critical for these officials to ensure that the products and data are made available to employees as they manage risks such as leaks to the outside. In a distribution policy, external distribution follows numerous chains to bring services, information, as well as products to the consumers. However, these chains need to be prudently examined when determining how organizational interests are protected. With respect to the importance of distribution policy at the Harris Mineral Resource, it is important to conduct an evaluation of the advantages and disadvantages of having an announced distribution policy to a company. Although it is necessary to have an appealing announced distribution policy, there is a need to have an understanding of the different mechanics behind this kind of payout. Therefore, when investors overlook a distribution policy, they might end up facing not only tax but also economic consequences. Although an announced distribution policy has many advantages, it also has some disadvantages.

Advantages of Announced Distribution Policy

The benefits of announced distribution policies are enticing. To begin with, in the announced policies, the CEFs will have high rates of distribution. For instance, announced distribution policies at Harris Mineral Resource led to the increased net asset. As of December 31, HMR’s average distribution rate was 40 percent at the net asset value, and 50 percent at the share prices, equated to 30 percent when the distribution policies were not announced. Secondly, the increased interest of the investors made possible by the announced distribution policy at the HMR led to smaller bits of discounts for the funds that utilized such strategies. As of December 31, the average equity funds that did not use such an approach were sold at a 7 percent discount when compared to the 4 percent for the equity funds that used and announced the distribution policies at HRM.

The Disadvantages of Announced Distribution Policy

When investors earn more dividends, they consider it good news. However, the downside of announcing distribution policies is that the likelihood of investors having an overestimated organizational performance is increased. At some point, an organization board might assume the decision to announce a dividend payout that might act as a savior to the investor at the end of the year. Overestimations brought by announced policies are considered a greater challenge when the excessive forecast is followed by a sudden deterioration associated with the market conditions. Another negative attribute associated with the declared distribution policies is that it is characterized by complex issues in investing in the CEF. Most investors may tend to avoid returns for the investor’s capital as well as the funds that trade at the premium. From the total return point of view, the resources traded at the capital gain may have a serious effect on the long-term shareholders.

The Implications of Recent Hostile Takeovers

A hostile takeover usually refers to the corporate merger or acquisition that typically takes place against the wish of the other company’s management. There is a broad range of research work on the implications associated with hostile takeovers as well as the different approaches that companies take to address issues related to these practices. While most studies view the effects related to hostile investors from cooperating officers’ and investors’ perspectives, little information focuses on implications from a shareholder’s perspective. The importance of studying these effects from a shareholder’s perspective is that contributions of these shareholders pose significant financial consequences when the target company’s board creates a defensive strategy to address the hostile takeover. The three key implications associated with hostile takeover include increasing debt, shareholder’s rights plan and staggered board of directors.

- The first implication related to the hostile takeover is the growing debt. There are high chances that companies that acquire prospect companies will operate under increasing debt. For the longest time in history, forcefully acquired companies have used the growing debt factor as a defensive strategy. When these companies increase the related debts, there are high chances that they will deter similar payments after the acquisition. Besides, the increasing debt to the acquiring company can significantly affect the stock prices.

- A staggered board of directors is another implication of a hostile takeover. A hostile takeover is characterized by a staggered board of trustees. In the case study, both companies elected a staggered board of trustees. Since the board of directors is elected for varied terms, they can be challenging problems to the new corporation after the acquisition. To deal with their succeeding shareholders, riders are mandated to win most proxy fights. With respect to this view, there is the need to note the fact that a hostile takeover does not offer the shareholders a direct benefit.

- Lastly, the shareholder’s rights plan is another major imprecation of a hostile takeover. The shareholder’s rights plan is considered the most common defense approach. The shareholder’s rights plan is activated when the acquired company announces its interest. Through such schemes, the acquiring company has an opportunity to buy extra company stock at a pleasantly discounted price. When investors buy stocks at discounted prices, the company might experience control challenges

Recommendation

A hostile takeover is the kind of acquisition that takes place through a proxy fight or tender wars. An essential characteristic of a hostile takeover is that the target company is usually not willing to participate in the success of the deal. Mostly, one company will act in defense of the hostile takeover by using strategies that are controversial to poison the deal. There is a need to understand the implications of hostile takeovers of companies by other firms including several in the oil and mineral industries and the vulnerability of Harris Mineral Recourse to such a takeover. With respect to the issues current issues faced at the Harris Mineral Resource, there is a need to adopt the most appropriate distribution policy.

The most suitable distribution policy for HMR is one that outlines all the approaches the company will use incorrectly distributing dividends to its members. This distribution system will guarantee that all the royalty distributions are precise, affordable and fair. Besides, all the significant characteristics should be readily understood by members and transparent. The first recommendation is to allow the company to choose a compliance officer as well as an investor service center. The aim of this approach will be to ensure that the investors comply with the buy-back regulations as well as address the investor’s grievances. The second recommendation will be to ensure that each buy-back completes within a year for the day exceptional resolution is passed at the general meeting when approving a buyback.

Exhibits and Tables