Historical Background of the Industry in the UAE

The Period Between 1970 and 1989

The UAE Airline Industry was established in the year 1971 under the stewardship of Sheikh Zayed following the unity between Dubai and Abu Dhabi. By the end of the year 1971, the industry had more than 9 airlines serving more than 20 destinations. To fast track expansion and growth in the industry, Ras Al Khaimah International Airport was commissioned in the year 1976. In the 1980s, the local government launched a series of high ambitions and marketing the industry as the gateway to a different destination in the west and east. In 1984, the government established a national carrier at an initial outlay of US $10 million. In 1986 more airports were commissioned and fleets by different airlines expanded as a high number of travelers was being recorded (Khan, 2015).

The Period between 1990 and 2009

The UAE Airline Industry was transformed into a global air travel contender following the high revenues. In 1996, the General Civil Aviation Authority became the sole civil aviation regulatory authority as a strategy for strengthening the pace of growth in the industry. Series of bigger and better aircraft were purchased by players in this industry during the 1990s. These expansionary policies resulted in more destinations served by the industry across the globe such as Paris, London, and Manchester. By the end of the year 1995, Emirates was serving more than 34 destinations across the globe. In the year 1998, Emirates carrier recorded more than 4 million passengers and 200,000 tons of cargo.

As the number of passengers increased, the government launched a second terminal with a capacity of serving more than 7 million clients. Despite the September 11th attack in the US, “Emirates continued to post an increase in passenger figures, rising to 6.8 million in 2002 with cargo up to 400,000 tons” (Khan, 2015, par. 7). This prompted Abu Dhabi to launch Etihad Airways at an initial capital outlay of US $ 136 million in the year 2003. By the end of the year 2009, Etihad had 56 planes and served 66 destinations. Several low-budget private carriers were also launched during this period such as Air Arabia, Flydubai, and RAK Airways (Khan, 2015).

The Period Between 2010 and Now

The industry continued to expand in the year 2010 and Dubai International Airport marked its 50th anniversary “as one of the busiest airports in the world, a couple of years after Emirates’ own terminal 3 had started operations in 2008” (Khan, 2015, par. 5). In a bid to maintain dominance, Al Maktoum International Airport was commissioned in the year 2010 with a capacity of serving 160 million passengers, four runways, and 18 cargo terminals. In the year 2014, Emirates Airline “placed the largest dollar order in Boeing’s 95-year history, valued at a staggering US$26 billion. Its nearest rival, Etihad also reported an increase in revenue of 39% to US$1.1 billion in the third quarter of this year, its highest quarterly result ever with passenger numbers rising 18% to 2.25 million” (Khan, 2015, par. 9). In the last 5 decades, UAE has managed to establish a stable airline industry that has a global appeal. The future seems bright for this industry since the expansionary strategies of the late 2000s have not reached their full capacity. In fact, “IATA (International Air Transport Association) has predicted that the UAE will be the second fastest growth market for international passenger traffic from 2013 to 2019” (Khan, 2015, par. 14).

PESTLE Analysis

Political Analysis

In the UAE, the government’s regulations, taxation strategies, directives, norms of leadership, and employment regulations are highly flexible for business. The UAE is one of the most promising business places with remarkable expansion in the corporate world. Etihad has taken advantage of the favorable UAE economic condition to expand its market niche. The stable economy of the UAE has been a pull factor for the company’s airline-related products since the purchasing power of many of its potential customers is high, especially for its cargo and passenger services.

Economic Analysis

UAE is amongst the leading oil producers in the world. Bearing this in mind, the recent rise in oil price has increased government spending. An increase in government expenditure implies that there is more money in circulation and people can afford to buy more air tickets and related services. By combining the increase in government expenditure with vibrant tourism, transport, and trade, the outcome is a favorable environment to conduct business for the players in the UAE Airline Industry. For 12 months to May 2014, inflation rose by an average of 0.7% (Etihad Airways, 2015). It is expected that the exchange rate will remain stable and so the players in the airline industry will not be affected.

Socio-Cultural Analysis

Heritage and culture are valued by UAE and that is why the Emirate has taken steps to establish the Saadiyat Island, which paints Abu Dhabi as the center of art. The United Arab Emirates further comes out as a diverse, multi-ethnic, and multicultural society, which makes it a perfect destination for tourism (Etihad Airways, 2015). Besides Urdu, Arabic, English, and Hindi are spoken in UAE. This makes it easier to tailor marketing language for different players that target clients within and without the UAE.

Technological Analysis

Social media such as Twitter and Facebook are currently the most utilized platforms and can be exploited positively to reach more customers in the UAE. Etihad and other industry players have successfully incorporated online activities within their operations. As one of the leading airline carriers in the UAE, the company has launched the Etihad credit card, online ticket portal, and live consumer support center. Since most of its operations rely on the availability and usability of information technology, the business has applied available technology to develop and maintain the market leader status. All aspects of the firm such as sales, purchases, marketing, management, and operations have been aligned to appropriate and sustainable technology (Sarin, Challagalla, & Kohli, 2012).

Legal Analysis

The legal system in the UAE is very stable and functions on the pillars of serving the interest of everybody equally. As a legal requirement, companies in the UAE are expected by the regulatory authorities to be tax compliant. The taxes are remitted directly to the government of Abu Dhabi. In the UAE laws on commerce, a certificate of compliance to taxes is issued to a business that remits their returns accurately from which taxes are deducted. They will have to comply with the above laws. This has created an easy environment for its business activities.

Environmental Analysis

The government of the UAE has established stringent environmental rules that all companies must respect. These rules control environmental pollution and sustainability in doing business. Since the airline industry operates within the transport regulations, the UAE environmental regulation authority has laws that control air and land pollution for the airlines. Besides, the disposal of wastes by the airline carriers in the industry is often monitored by the authority. The above PESTLE analysis is summarized in the table below.

Recommended Actions for Each Environmental Variable

Political Analysis

The players in the airline industry should avoid active participation in political processes in the country to avoid conflict of interest.

Economic Analysis

The players in the industry maintain high consumer confidence and adopt ethical business practices to avoid economic fines by the UAE government.

Socio-Cultural Analysis

Players in the industry must align their products and services to the UAE cultural norms such as Islamic religion and language to penetrate the local market.

Technological Analysis

Players in the industry should invest in the latest technology and apportion large investments in changing technology frequently to remain relevant in the industry.

Legal Analysis

The players in the industry must observe tax compliance employment laws to avoid conflict with the local authority.

Environmental Analysis

The players in the industry must adhere to environmental pollution and sustainability policies to guarantee business existence for a long time in the region.

Company’s Current Situation

The Company

A Brief History

Etihad Airways is a national airline company in the United Arab Emirates that was established by a royal decree as the national carrier of UAE and first started commercial operations in 2003. Etihad Airways is considered as one of the most rapidly growing airlines around the world, with a fleet of 57 aircraft operating about 1000 flights a week to 66 destinations in 44 countries from its hub in Abu Dhabi. With less than 12 years in operations, Etihad Airways received many global awards reflecting their position as the leading premium airline brand in the world such as “World’s Leading Airline” at the World Travel Awards in 2009 and 2010 and World’s Best First Class in Skytrax’s 2011 World Airline Awards. The services of the airline are classified as Business Class, First Class, Economy Class, high-end lounges, and limousine pick-up services in more than 20 destinations across the globe (Etihad Airways 2015). The company has an effective business excellence model as evident in its efficiency in services that have guaranteed continuous growth, in terms of market, profits, and physical expansion.

Company Size (Number of Employees)

The executive management of Etihad Airways is made up of five senior personnel. The total number of employees of the organization is more than 17,000 direct personnel and more than 5,000 personnel in its subsidiaries. All the employees of the incorporation work in the departments of cargo, passenger travel, marketing, human resource, logistics, and research and development. This team offers services in air travel, consultation, service delivery, and inspection services. Indicated below is the list of the top management team at Etihad Airways.

(Source: Etihad Airways, 2015).

The other committee members of the board are Khalifa Sultan Al Suwaidi, Hamad Abdullah Al Shamsi, and George Cheaib.

Products/Services

The main products offered by the company are air travel and cargo handling for clients across the globe. The air travel product is further divided into three types such as the “Diamond First Class, Pearl Business Class and Coral Economy Class” (Etihad Airways, 2015, par. 6). The services offered by Etihad Airways are entertainment, catering, and free information guide to all customers among others. The company has partnered with other players such as Air Berlin, Virgin Australia, Darwin Airline, Alitalia, Air Serbia, Aer Lingus, and Jet Airways to ensure that the above products and services are delivered to more than 50 million customers.

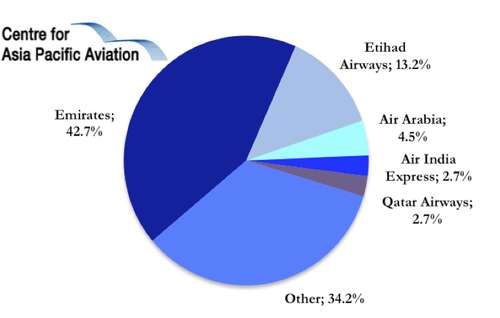

Market Share

Etihad Airways sells its products both in the UAE market and across the world. The foreign markets include Asia, United States, Europe, and Africa among others. A large amount of net sales emanates from the UAE market. This was followed by sales in Asia and Africa. The largest users of its products are individual customers and incorporations in the air travel industry. The market share is an indication of the current position of Etihad Airways against competitors in the UAE market. This is summarized in the table below.

From the above pie chart, it is apparent that Etihad Airways control 13.2% of the market after Emirates which controls 42.7%. For Etihad, the number of passengers it serves in a year grew from 1.01 million in 2005 to 39.3% in the year 14.5 million which is equivalent to a 39.3% rise. This is summarized in the table below.

Company’s Competitive Position in the Industry

Main Competitors in the Industry

As a leading airline company based in UAE, other airline companies are competitors as they offer similar products and services. Several airlines are operating in the same industry with virtually all of them dealing in a variety of flight products and services. For instance, the Emirates and Qatar Airways provide the biggest competition to Etihad due to their big market share and expanded network. All the players in the industry are putting measures in place to ensure they attract more customers and therefore expand their market share. Other competitors are Abu Dhabi Amiri Flight, Abu Dhabi Aviation, Air Arabia, Aerovista, and Dolphin Air among others (Sarin et al. 2012).

Competitive Forces in the Industry

A threat to new entrant

It is difficult for any aspiring airline to enter into the flight industry in the Persian Gulf market and manage to break even easier. In the Persian Gulf, Etihad’s business magnitude together with that of its main competitors such as the Emirates of Dubai and Qatar Airways are well established and would easily enjoy economies of scale to the disadvantage of a new entrant. The Etihad airline is well-positioned to survive in the competitive market through gaining from economies of scale, competitive price tags, and a strong customer base in the Persian Gulf region.

Threat of substitutes

Emirates and Qatar Airways pose the greatest threat to Etihad’s existence and business performance. These airlines have been in the industry for a longer period and are more established than Etihad. Besides, Emirates and Qatar Airways can offer an alternative perfect substitute to customers who may be unsatisfied with the services offered by the Etihad Company. However, to remain relevant, Etihad has established a unique market for its customer through tailored optometry flight services.

Competitive rivalry

Several airlines are operating in the same industry with virtually all of them dealing in a variety of flight products and services. For instance, the Emirates and Qatar Airways provide the biggest competition to Etihad due to their big market share and expanded networks. All the players in the industry are putting measures in place to ensure they attract more customers and therefore expand their market share. In line with this, the Etihad of Abu Dhabi has the highest passenger traffic.

Suppliers’ bargaining power

In the airline industry, the influence of the suppliers is highest when large volumes of products are in the trade. When the influence is high, the profitability of airlines is low. Since suppliers within the airline industry operate and local and international levels, their influence differs. For instance, China, India, and Europe supply the largest volume of business to airlines in the UAE. The partnerships between independent ticket vendors and the airlines reduce the power of the suppliers in this industry. Etihad has endeavored to use its deep reservoirs as a strategy for balancing the supply forces in the fragile airline market of the UAE and across the globe.

Buyers’ bargaining power

There is a strong power in the fragmented ticketing segments which are indirect and direct to customers. Although these airlines have very strong brand names, the buyers in this sector have the power to influence the prices for the premium tickets and other services. The power of the buyers is high since this industry is characterized by high competition. Therefore, each airline considers the perception of its customers before setting prices to survive the competition. Fortunately, Etihad has been consistent in maintaining their competitive prices.

Market Position of Etihad and Competitors

Etihad is in position three after Emirates and Qatar airlines. It was important to note that the airlines ahead Etihad have operated in the UAE market for a longer time. However, Etihad is moving towards closing the market position gap as discussed in the previous section.

Key Success Factors in the Industry

Strong brand

Etihad has established a brand image that enables it to attract customers with less effort as opposed to most of its less established rivals. The entrants have to invest heavily in promotion and advertising for them to attract new customers and maintain their customers.

Steady commitment to quality

Strong commitment to quality and product innovation enables the company to get the right experience for their customers. This has been possible through the recruitment of employees with the right skills and knowledge. These employees are further trained to understand company production strategies. Moreover, the company conducts more market research to ascertain customer thoughts and changing demands.

Expanded market

Etihad has an active presence in UAE with an expanding presence in emerging markets including China, Africa, and Europe. In the past five years, revenues from sales doubled annually and the company expanded steadily.

Market experience

Having been in the fashion industry for over 10 years, Etihad has acquired enough experience to compete favorably in the industry. It has had sufficient time to learn from its weaknesses and develop long-term strategies that will anchor it through the future of the market. As a way of adopting the emergent technological changes, Etihad has invested in technological creativity to suit its consumer changing needs.

Degree of Product Differentiation in the Industry

The UAE Airline Industry has experienced steady growth as more customers embrace renowned airlines such as Etihad, Emirates, and Qatar among others. The products in the industry are divided into the economy, business class, and first-class with different services attached to these products. The products are differentiated based on prices, luxury, and other accompanying benefits attached to each option. These products are argued by the industry players to increase their competitiveness. For instance, the airlines offer cab services, twenty-four hours departure facilities, and flexible booking options.

Discussion

From the above outlook, the UAE Airline Industry is very stable and this stability is expected to continue for more than two decades. The competitive forces, success factors, and competition are positively skewed to the advantage of the current and future expansionary strategies of Etihad Airways.

Recommended Actions Based on the Analysis

Etihad must establish a strong brand image to enable the company to cut on its cost and get increased levels of profitability. Besides, the company has the potential of winning more customers with its strategically-placed and ambient airline services with conspicuous features, especially through rolling out low budget subsidiary to get a competitive edge above other players in the local destinations. Lastly, Etihad Airways should integrate and differentiate its current products based on pricing to remain competitive in the UAE Airline Industry.

Company’s Current Strategic Factors

Growth Thrush Strategies

Generally, the quality operations management system at Etihad Airways is that which satisfies requirements within the budget and schedule without disintegrating initial goal projections (Etihad Airways, 2015). Since its inception, the company has maintained positive growth and expansion of profits as a result of the efficiency maintenance strategies. Besides, the company has invested in the expansion of its services and products by forming partnerships and establishing subsidiaries to support the actual and projected growth. As a result, this venture has developed a cumulative experience, optimal performance, quality assurance, and full control of the operational chains and subsidiaries across the globe.

Market Position Strategies

In the overcrowded UAE market for flights, product position is directly linked to the success in the short and long term, especially for Etihad products. To achieve the desired goals, Etihad has positioned itself to emphasize the difference between its products and those of its competitors. As a strategy for diversifying market operations, Etihad Company has created multiple brands through its numerous airline partners such as Jet Airways of India and Aer Lingus of Ireland. This has created an environment of their own competition and blocked other competitors from encroaching into the company’s local and global market. This strategy has been successful and has led to its dominance over other local airlines.

Market Differentiation Strategies

The unique brand of the organization makes it stand out and lead in the provision of products and services to different market segments such as corporations and individual customers within and without the UAE. The company has entered into a partnership with dealerships rather than engaging its resources in selling to its customers. These partnerships have boosted growth in the company in Europe where Air Berlin has been active in expanding its strategic operations in that region.

Product Differentiation Strategies

The company has adopted the product proliferation strategy to penetrate the UAE Airline Industry within the Gulf region. Etihad is a leading airline in the global flight arena and offers some of the safest and most affordable flights to passengers. Every household within and beyond the Persian Gulf consists of potential customers of Etihad. With the need to be ahead of its competitors, Etihad adopted the strategy of maximum comfort in the first-class cabin, spacious airplanes, and a variety of meals served on flights at Etihad. This has enabled the company to create multiple products that are very unique to its line of business.

The rationale for Selecting the Strategic Components

Product development entails the innovation process aimed at modeling the existing product or improving on it to balance with the changing preferences of the customers. For instance, the first-class services come with free cab for this class of customers. Etihad is associated with innovations and attractive designs that appeal to the vast customers across, especially the spacious and high-end comfort in flight. The company will benefit from this strategy in terms of market expansion. Specifically, through product development, the business is in a position to optimally exploit opportunities available in the individual and corporate market segments and has gained a significant share in the customized air services market in the Gulf region. For instance, the expansion into India and Africa through its subsidiaries has boosted growth and capacity from 7 million passengers in the year 2009 to 14 million passengers in the year 2014. Cost leadership strategy is vital in business management especially in an industry with stiff competition, such as in the UAE Airline Industry. Through cost leadership, Etihad has been able to double cargo handling by offering the most competitive prices to customers.

Company’s Vision, Mission, Objectives, and Goals

Analysis and Critique of the Vision Statement

The vision of Etihad Airways is to “reflect the best of Arabian hospitality – cultured, considerate, warm and generous – as well as enhance the prestige of Abu Dhabi as a centre of hospitality between East and West” (Etihad Airways, 2015, par. 3). The vision of the business is to be a leading reliable air travel and cargo handling carrier that offers cultured and comfortable services to clients across the globe. The company had achieved this vision since its operations have been expanded beyond the UAE, despite having been in the market for less than 15 years.

Analysis and Critique of the Mission Statement

The mission of Etihad Airways is to “forge long-term partnerships with key customers as an integral part of their strategy. This achieved by development of a strong base of share partnerships, and minority investments in strategically important airlines, which combined; provide access to hundreds of destinations we do not serve with our own aircraft” (Etihad Airways, 2015, par. 3). The mission of the business is to grow the airline business platform to cover specific demands for clients by rolling out an easy to access, use, and personalize products and services through partnering with all the stakeholders. This mission is strategic since it acts as a guideline in the current and future expansionary policies within and without the UAE. Besides, the mission statement is ideal for guiding the management and other personnel on the growth strategies and the need to guarantee efficiency when meeting customer desires.

For the implementation of the strategy, the management balances both the short-term and long-term considerations towards decisions making. Management that ensures long-term obligations is fulfilled. They consider the role played by planning for resources in technology, continued innovations in the production of new products, and conducting researches in the market to identify market niches within the customers (Etihad Airways 2015). For instance, the long-term expansion and further market penetration have been integrated through a series of beneficial partnerships, performance evaluation, and proactive innovation in the services to meet the demands of its diverse customers.

Analysis and Critique of the Goals and Objectives

Mission: Platform for easy to access, use, and personalize products and services through partnering with all the stakeholders The goal of Etihad Airways is to “is to be a truly 21st century, global airline, challenging and changing the established conventions of airline hospitality” (Etihad Airways, 2015, par 4). The strategic goal of the business is to be the market leader in the UAE Airline Industry. The business also aims to build a successful customer-business model by ensuring that the level of customer satisfaction at any time is maximized to ensure that the annual expansion by 20% is maintained. The business also strives to increase its profits by 20% each year through the expansion of market coverage. The objective of this goal is to operate on the pillars of transparency, accountability, leadership, and strong standards of corporate management by maximizing the value attached to each product and service offered by Etihad. Through strategic and operational planning, the company has been in a position to increase the scope of operations through strategic and innovative ideas of air transport service delivery to customers and provide efficient, cost-effective, and comprehensive transport logistics services to customers while maximizing profits in the process.

Alignment Table

Recommended Actions

The company has a relatively unstable functionality within a competitive advantage parameter in serving the goal of being a global airline due to swings in the global airline industry. To reverse this, its existing forms of system monitoring should be periodically upgraded to introduce multiple operating system models, such as ratio analysis in operation management, which is compatible with tracking and analysis within and without the company. For the implementation of the strategy, the management should balance both the short term and long term strategic goals. Business efficiency is critical in the product management line since it is characterized by optimal utilization of allocated factors of production within the least possible cost. From the above refection, it is apparent that the Etihad Airline will gain in the long run if it adopts the Flexible Monitoring System (FMS) in executing the business goals (Escrig-Tena, Bou-Llusar, Beltran, & Roca-Puig, 2011). Despite lower returns on investment below the projection, the overall effect of adopting this proposal will have benefits that will outweigh its limitations. For instance, when the FMS is fully adopted as proposed, the reduction in the cost of factors of operations such as labor and reduced actual operation costs will result in accumulated gains as a result of controlled costs that are recurring.

Moreover, the aspect of efficiency as a result of FMS will push the operation frontier curve towards sustainability in the long run. The immediate adaptation of the proposed FMS will contribute towards sustainability in the aspect of cost, dependability, speed, quality, and flexibility. Due to increased output, the market will eventually expand and the company will get more revenues. At the UAE location, the quality system is certain. Thus, when the system is quality-oriented, the entire chain coordinating these segments would result in optimal operations at the airline.

Environmental Scanning Analysis

Issues Table

(Source: Khan, 2015).

SWOT/TWOS Tables

SWOT/TWOS Analysis

Strengths

Etihad Airways has been able to increase its level of sales and profits through increased consumer proximities, clear differentiation, and segmentation of its brands. Etihad Airways has increased its own air travel and cargo business in the last few years, particularly in UAE and Asia. The other strength of Etihad Airways is its efficient customer relationship management strategy through its loyalty services, comfort, and competitive services. For instance, Etihad Airways has customized services for a customer interested in specific air travel plus destination facilitation. The company has excellent marketing, advertisement, and promotional strategies to win the confidence and loyalty of the customers. Besides, the good scope for scalability of the operations of the company has enhanced the brand image and holds more market share. Besides, technically efficient and well-trained staff, extensive transportation network, state of art infrastructure, and wide market niche has improved the company’s performance.

Weaknesses

Etihad Airways has more presence in the UAE than in other parts of the globe. Specifically, unlike its main competitors, the company has subsidiaries outside the UAE. Besides, the focus of Etihad Airways is more on the economy and high-class travel services. This is counterproductive in terms of revenue generation since the majority of its potential customers are small businesses and private individuals who cannot afford high end traveling cost. The current customer value delivery methodology has not been fully developed since the regions of operation have demands that are not universal.

Opportunities

Etihad Airways has an opportunity to expand its opportunity to cater for expanded client growth since its asset base is strong enough to sustain this market. This opportunity will help in boosting the company’s revenues and leadership position in the UAE Airline Industry. There is also the opportunity of incorporating new features into the existing air transportation service to cater to the changing demands and needs of the targeted customers. This may be achieved through complete transport chain automation. Besides, globalization of the transport services by opening operating offices in different countries would enhance the growth of the business. Also, the adaptation of new technology to be in synchronization with the latest transport visibility parameters such as live tracking, proactive freight management system and proper communication equipment will increase the company’s visibility and competitive advantage.

Threats

The main threat to the survival of Etihad Airways is the competition from products offered by another competitors such as Emirates and Qatar that may act as a direct substitute to its brands. Thus, the expansion and market penetration strategies that Etihad Airways may adopt are likely to face opposition if these substitute products are expanding their market share. Etihad Airways is faced with fierce competition from its rivals, which requires the adoption of more vigilant strategies. The company operates in the sensitive air transport logistics industry where customer preference determines business sustainability. Any negative experience or perception among the customers may not auger well with the current business model of the company.

A possible conglomerate diversification would be a threat to the company should the business decision environment conspire against its goals. For instance, mergers and acquisitions from major competitors such as Emirates and Qatar may reduce the current market share by a substantial percentage.

Recommended Actions

The company should increase its product development strategies to ensure that the low customer segment is well serviced. The company should improve its current focus on product proliferation to quality to successfully compete with companies that have specialized in a single product. The company may also improve its financial structure through a series of strategic investments in the expansive UAE airline market. The company should consider further product differentiation to improve its competitive advantage as the most reliable air travel and cargo services provider. The company should create pricing strategies that match competitors to guarantee the sustainability of the current position of a market leader. The company may entertain the idea of managing its pricing strategies to ensure that clients in the high-end and low-end segments are served. The company may also introduce friendly service terms and conditions for different segments of customers, especially frequent travelers and the business community, to create an environment of its own competition (Escrig-Tena et al. 2011).

Strategic Readiness Analysis: Based on Ansoff’s Strategic Success

Strategic Segmentation

The Etihad business model targets individual consumers who form the majority of its market catchment. Since this target group frequent Etihad Airways, the company is in a position to conveniently direct the customers to their designated customer support points and cargo depots without having to directly deliver.

Strategic Business Area: Introduction of low-cost flight and cargo products

The introduction of low-cost travel and cargo handling will expand the catchment area of the company and increase the revenues of the company by almost 20% within the first year of implementation.

The rationale for the SBA

Current competitive advantage

Escrig-Tena et al. (2011) noted that the segmentation process is informed by the need to serve a specific group of customers falling in similar preference characteristics on a brand. Therefore, the introduction of low-cost travel and cargo handling product will improve the company’s brand visibility. This will improve the current competitive advantage since the company will widen its catchment area.

Critical success factors

The company has merged the strategy with advertisements since this group of consumers has access to social media and other forms of media. Due to exposure to information sources such as newspapers, television, radio, and magazines, product announcement through these avenues has enabled the company to double its market base from 5 million in the year 2008 to 12 million in the year 2014 (Etihad Airways, 2015). The decision on the best product relies on information feedback after multiple exposures to different competing products. As forecasted in the market research, this strategy has been successful towards dominance as it offers a variety of options to consumers, while at the same time, maximizing benefits of economies of scale to the company (Etihad Airways, 2015). Etihad’s innovative products in air travel and cargo handling are among the most visible airline transport services across the globe.

Etihad Airways has a partner that medium businesses offering airline products similar to those of its competitors, such as Jet Airways of India and Aer Lingus of Ireland among others. This strategy has enabled the company to expand its market and besides making it easy for customers to access the products. To attract this segment, the company offers free delivery of cargo to high volume cargo customers and a series of discounts based on the frequency of air travel by individual or corporate organizations. Since it is properly implemented, the company is well-positioned to counter the Emirates strategy of reaching the customers through proxy agents in air ticket booking and cargo handling (Khan, 2015). This strategy will ensure company sustainability amidst competition.

Future attractiveness

In shading more light to the above segmentation approaches, the case of Etihad Airways is an ideal example of a company that has perfected segmentation to properly sell its airline products to different customer and market segments. For instance, low-cost travel and cargo handling products will increase the current competitive ability of the company. The strategy to offer series of sub-brands from a single product is aimed at serving different interests within different customer segments. There are different price tags for high-end and low-end customers within different social and economic classes (Griffin & Moorhead, 2013).

Recommended Actions

Marketing strategy

Potential problems

The first challenge deals with the stiff competition that Etihad is likely to face upon entry into this customer segment market. The segment is highly competitive and Etihad is likely to face stiff competition from other indigenous airlines such as Air Arabia, which specializes in low-cost travel and cargo handling products. The competition challenge is further compounded by the patronage issue, whereby local customers may prefer to shop for cheap air travel/cargo products at a familiar airline. The second challenge deals with building a local brand for the new product that Etihad intends to expand to. Available literature demonstrates that Etihad is already a global brand, but this may not translate into performance and competitiveness in the hugely untapped African and Asian markets as customers may not readily identify with the brand as compared to other indigenous airlines in such regions.

Actions

In its market entry program, the company must hence undertake to develop ways and strategies that could be used to obtain a substantial market share in the low-cost air travel and cargo handling product. Besides, Etihad must fully appreciate the sustained investment required for brand building and management, and make huge investments while expanding globally to ensure that the targeted clients readily identify with the low-cost product brand as is the case with other local and international airlines operating within this segment.

Entities to execute the actions

Etihad may organize an in-house marketing team or contract a marketing agency to manage this process.

Innovation strategy

Potential problems

Although the creation of a product as a result of innovation is through research, every member of an organizational team is always anxious about the expected response once the product hits the market. Besides, the organizational environment may not have a supportive organizational culture that integrates creativity in performance. Besides, innovators face the challenge of anxiety on the forecasted response to their innovation within an organizational setting. Despite proper management, thorough research, pre-contemplation, contemplation, and action, there is always an element of uncertainty as a result of a possible rejection of a particular innovative strategy in incorporating the new low-cost product for Etihad Airways.

Actions

Basically, product innovation architecture is “responsible for the success of an organization in getting its innovations in the market include continuous polices aimed at building trust with ideas considered as low-risk” (Dewhurst, Harris, Heywood, & Aquila, 2012, p. 28). From the possible challenges, it is necessary to develop a proactive system of balancing and tracking different innovation strategies within the goals of Etihad to ensure that the final product agreed upon is well designed to survive market turbulences. Therefore, through the engagement of an elaborate innovation promotion culture, it is easy for Etihad to create a sustainable system of balancing foresight, corporate culture, product development, and product proliferation as dependent elements of an innovation architecture. Therefore, “foresight is very crucial since it gives a company rough perspective and an overview of the future concerning the expected and unexpected changes” (Khan, 2015, par. 14). If the company enrolls critical foresight strategy, the innovative idea will be the password for solving its current customer segment expansion puzzle.

Entities to execute the actions

The success of an innovation is largely dependent on vital intelligence which when incorporated into the open innovation process, may produce what the innovators call technical thrust. Reflectively, when properly planned and executed, intelligence is the main force behind successful and accelerated innovation. On the boundary spanners, innovations should be fairly fast and inclusive of all the stakeholders. The innovation-decision process is inclusive of knowledge, persuasion, implementation, and confirmation among the employees. Therefore, the company should create a new department to manage the innovative aspects of the proposal to ensure that the final product is aligned with the current goals and missions of Etihad Airways.

Development of key managers and managerial capacity

Potential problems

Skills required in supporting business strategy plans are found in operation management models, which functions as an implementer and driver of business decisions. Sustainable companies have operations management systems that incorporate planning, development, implementation, and discovery through consultative decision science. These variables are critical in ensuring organizational survival in the volatile market, irrespective of the line of production or size. Since the total quality management unit is objective, it focuses on benchmarking of efficiency in the operations and service delivery initiative, accreditation initiative, staff performance, and skills assessment initiative. Although the scope might be different, the strategy and components of a total quality management system might not be sufficient at Etihad to support the proposed low-cost product.

Actions

Apparently, the benchmarking initiative involves streamlining service delivery to ensure efficiency via a proactive quality mitigation channel, which reports the progress of the intended quality improvement system. Since Etihad aspires to achieve efficiency in the chain of command between output and customer satisfaction, there is a need to make the scope of quality universal across different departments to ensure that the proposal is modified to fit within different expansion goals of the airline. Expansion of capacity as a managerial strategy demands that the design system matches implementation efficiency while assuring the quality of the final product outcome. Sharing decision sub-system facilitates direct transactions and the generation of reports that rate product performance. Due to its dynamic reporting, anomalies in the managerial strategies are communicated instantaneously to the stakeholders to initiate corrective action.

Entities to execute the actions

Implementation of the managerial capacity standards at Etihad is proactive in safeguarding assets and resources, sustaining efficiency in operations, and ensuring completeness in the management strategies. Thus, Etihad must have standard supplementary measurement variables. Monitoring product performance relies on managerial opportunism besides a well-organized system that quickly identifies sources of challenges and creating counterproductive strategies. This is applicable at Etihad as long as there is an effective progress monitoring system. As an element of the managerial capacity development, Etihad must incorporate a corporate disclosure and system of litigation variables which are connected at a central point by strategic planning. The planning encompasses costing, speed, quality, flexibility, and dependability to create a smooth continuous managerial capacity tracking model (Dewhurst et al. 2012).

Development of culture

Potential problems

The physical structures of Etihad’s organizational culture may not promote a positive relationship between favorable and effective job performance and work environment as attributes of motivation and congenital conditions since the proposed product will be viewed by the implementation agents as new. Therefore, the current structure may not encourage security, comfort and safety, and prevailing physical convenience to implementation agents. Therefore, measuring factors such as interpersonal relations, working conditions, support and trust, welfare provisions, and work environment may be difficult.

Actions

Etihad should roll out a continuous training program for the implementation agents to guarantee the successful introduction of the low-cost air travel and cargo handling product. The program will have a proactive behavior control system provides that functions within a structured system of utilitarian ethics. When the system functions within accepted parameters, employees will eventually develop a self-consciousness to deliver quality services and defend the organization as part of a family unit. Among the motivation enhancing practices within this program will include incentives, promotions, rewards, and recognition.

Entities to execute the actions

The human resource department of Etihad Airways would be ideal since the program is expected to be continuous for the next 2 years.

Structural, technological, and decision system changes

Potential problems

The challenge concerns efforts needed to understand local consumer patterns. Available literature demonstrates that “companies must take the time to understand the values, needs, and behavior patterns of local consumers” (Sarin et al. 2012, p. 34). Undoubtedly, therefore, Etihad must assess and understand the values and buying habits of consumers in predominantly low-income markets. An immediate complexity related to this challenge is that customers in the targeted segment have unreliable sources of income and unreliable cash flow, hence tend to settle for low-cost products. Such consumer patterns are likely to affect Etihad’s operations and strategic direction as it expands to the proposed customer segment. Besides, technology in the airline industry becomes obsolete within a short period.

Actions

The continuum of increasing the value of quality in operations for all organizations lies in data, information, and knowledge. The value system for the company should be supported by a decentralized decision support system. Due to the need for an efficient operations management system, Etihad should have a mechanism for monitoring progress at micro and macro levels of decision making. In terms of technology, the company should invest in the latest technology and recruit qualified technical experts to support the development of the new product.

Entities to execute the actions

The information technology department in the company should be in charge of the modeling and rolling out technological support for the proposed product.

Measures for Effective Implementation

The sub-gaps identified are balancing the marketing plan, integrating innovation into the proposed product, integrating organization culture and product marketing, managing the aspect of efficiency and strategic implementation process, and creating stable personnel capacity to perform optimally. These sub-gaps are discussed below.

Balancing the marketing plan

Potential Problem Anticipated While Closing the Gap

As a prerequisite for sustainable product performance, the strategic issues that Etihad Airways is currently facing pivot around the most appropriate market that the company should focus on or neglect for the new low-cost air travel and cargo handling product to survive the competition. Under this strategic issue, the company currently faces the dilemmas of critical focus on the most reachable market, the potential of entering the stratified local market, the potential of re-branding the other existing brands, and the best strategies of increasing ambiance without appearing as a copy cat of the main competitors.

Remedies for Expected Problems

Etihad Airways may use an expanded marketing mix to improve the performance of the low-cost product through the creation of a need in the mind of customers to ensure customer loyalty and market expansion. The company’s product multi-branding as a positioning strategy may enable it to integrate the expanded marketing mix by balancing the elements of intangibility, inseparability, and heterogeneity in the 7Ps of its market mix as a result of improved product visibility for the target segment. The company can use a strategic brand equity model to integrate the advertisement approach to its market penetration strategies for the new product. To achieve this, the company should segment and differentiate its market along with consumer-based market segmentation procedures. Specifically, the company may apply the online kiosk model promoted through the local media channels to keep in touch with the target segment. To increase credibility and maintain the Etihad brand visibility, the corporation’s website and social media channels should be modified to encompass processes and features that flawlessly facilitate a healthy lifetime relationship between the product and its clients across the globe (Sarin et al. 2012).

Personnel to Execute the Remedies

The personnel from the marketing department within Etihad Airways may be assisted by the public relations team to ensure that the marketing plan is sustainable and realistic.

The Role of the Human Resource Department

The human resource department at Etihad Airways may use the online traffic results to draw a growth calendar for the social media marketing strategies after every six months to fast track the initial objectives against the realities of market swings for the low-cost air travel and cargo handling product. Besides, the department may be in a position to locate the regions with the highest and the lowest traffic to improve its social media marketing strategy. Besides, the department may be in a position to accurately determine the average duration of access to these sites to track the success of its social media marketing channels before and after implementing the marketing plan.

Integrating innovation into the proposed product

Potential Problem Anticipated While Closing the Gap

Among other issues that might affect the success of Etihad in getting its innovations in the market include lack of continuous policies aimed at building trust with ideas considered as low-risk. Besides, the company may not be in a position to develop a system for tracking and balancing the portfolio options. Besides, the company does not have an elaborate formula for managing the evaluation methodology choice to remain relevant in the market. This means that Etihad can not be on the frontline in addressing customers’ concerns, improvement of previous versions, and creation its innovation signature. Therefore, the proactive research and innovation team has to be modified to ensure that the company’s products are among the best in the market.

Remedies for Expected Problems

A quality innovation integration management system performs optimally via integration of appropriate scientific methods and techniques, to ensure that Etihad derives maximum benefits. To enrich artistic managerial talents, the scientific techniques come in handy to not only magnify the margins of success but also to ensure a smooth transition of ideas or events after another. Besides, to avoid an imminent failure, it is vital for the integrated management system for Etihad to focus on innovation and consumer centricity strategies. Therefore, Etihad Airways should adopt the strategies of product proliferation, corporate culture, foresight, and product development to not only achieves the goal of internationalization but also to maintain its competitiveness in the UAE Aviation Industry.

Personnel to Execute the Remedies

The research and development department may offer the ideal services to integrate innovation to product relevance and acceptance in the local and international markets served by Etihad Airways.

The Role of the Human Resource Department

The human resource department has the role of tracking the performance and activities of the research and development department to ensure that the set target is achieved within a specific timeline.

Integrating organization culture and product marketing

Potential Problem Anticipated While Closing the Gap

The primary structure of a stable organizational culture consists of elements such as work specialization, formalization, centralization, chain of command, and work specialization. It is very difficult to balance the above factors since Etihad operates in different markets with different cultural orientations and marketing approaches.

Remedies for Expected Problems

It is critical to balance the feedback with the goals of Etihad as a remedy towards inclusiveness and active participation, which translate into desirable performance. The policies adopted should be aligned to the basic building blocks of performance and scope of the organization. These policies should incorporate the employee-employer relationship model, performance review, and organizational social culture. Operational efficiency and market niche provide an indication of how well the company manages its resources, that is, how well it employs assets to generate sales and income. It also shows the level of activity of the corporation as indicated by the turnover ratios. The level of activity for the company should be modified to remain relatively stable despite the threat of competition, constant change of taste, and varying preferences. To stay afloat, the company should streamline its operational costs by outsourcing marketers.

Personnel to Execute the Remedies

The top management of Etihad since this gap is very sensitive, and the success of the company will depend on how it is integrated with the current business model.

The Role of the Human Resource Department

For the organization’s culture quotient of Etihad to become an effective tool for performance maximization, it is necessary to create an environment of mutual trust between the employees and the management team. This is achievable when the human resource department balances the three building blocks of organization learning such “as a supportive learning environment, concrete learning processes, and practices leadership are balanced to reinforce innovation” (Griffin & Moorhead, 2013, p. 25).

Managing the aspect of efficiency and strategic implementation process

Potential Problem Anticipated While Closing the Gap

The main challenge expected when closing the gap for managing the aspect of efficiency and strategic implementation process is the competing interests against limited resources. It is very difficult to maintain sustainability in the implementation process while ensuring that the process is managed at the optimal efficiency level. Therefore, Etihad Airways has to manage its distribution channel within the parameters of sustainability and efficiency.

Remedies for Expected Problems

Properly designed product distribution management facilitates the success and sustainability of Etihad Airways. To increase credibility and maintain professionalism, the current channels of reaching the consumers should be tailored to encompass processes and features that flawlessly facilitate a healthy and lifetime relationship between the business and its clients. Among the new development elements that the company should incorporate include trust, liability acceptance, distribution, fair retribution process, and passing accurate information to a target audience to restore confidence within these networks. This strategy will ensure that the business is sustainable.

Essentially, the success of any business depends on the proper alignment of a functional team that is responsible for the creation of flexible and quantifiable measurement tracking tools for tracking performance results. Reflectively, Etihad Airways should introduce a functional team with the essential knowledge in sustainable performance skills. This will guarantee sustainable human resource practices and a stable labor force.

Personnel to Execute the Remedies

Top management since this group has the skills for managing efficient processes without having to interfere with the current operations model.

The Role of the Human Resource Department

The human resource department may generate reports for benchmarking the efficiency processes to outcomes recorded over a specified period. The department may also facilitate any training program designed to support efficiency strategies proposed by the top management of Etihad Airways.

Major Recommended Actions of the Strategic Audit

Actions Needed for Responsiveness to General Environment

Etihad Airways should focus on supplying its consumers with premium products that suit their needs and experiences. The premises should be furnished in a luxurious manner that attracts potential consumers from all categories in the market. The company’s commitment to high ethical values should be integrated through the value network and chain to ensure business sustainability. As a global company, the Etihad Airways management should consider a standardized system supporting logistics and operations processes as success factors. As opposed to its competitors, which market their products from central points, the strategy to spread production points around the world would consolidate Etihad’s networks and strengthens its long-term partnerships. Moreover, the spread of the sourcing volume across the global network of subsidiaries will spread its risks and make the company independent of any single-sourcing location within and without the UAE. From the supply point, Etihad Airways’ products should be distributed either through the company’s agent or through independent agencies, especially in markets outside the UAE.

Actions Needed for Competitive Responses to the Industry

The company should improve its current focus on product proliferation to quality to successfully compete with companies that have specialized in a single product. The company may entertain the idea of managing its pricing strategies to ensure that clients in the high-end and low-end segments are served. The company should improve its current logistics support system to ensure that the overhead costs of running its operations are sustainable. The company should create pricing strategies that match competitors to guarantee the sustainability of the current position of a market leader. The company should increase its product development strategies to ensure that the low customer segment is well serviced. The company should increase its marketing strategies to improve product visibility in the dynamic airline industry in Dubai. The company should consider further product differentiation to improve its competitive advantage as the most reliable airline services provider.

Actions Needed for Vision Alignment

Etihad Airways may partner which medium airline businesses retailing products similar to those of its competitors. The objective of this recommendation is to expand Etihad’s market and make it easy for customers to access the products. The above objective can be achieved by creating an in-house supply chain and marketing strategies. The choice of vertical integration is driven by the need to create that perception of reduced inventory costs. The key performance indicator will be reduced inventory cost by 10% in the first year of application since costs related to running the business are expected to drop. This strategy takes some initial costs to develop the integration concept but the advantages are the ability to legally protect the product, creation of some barriers to competition, and general promotion of customer loyalty.

Actions Needed for Responsiveness to the Industry Environment

The airline should ponder concentration to its products in countries that do not have strict laws that protect the business when expanding further to other foreign markets. Countries like China do not have strict rules which protect business entities from being copied by competitors. This will help in safeguarding its products’ brands and making sure that it targets specific market segments. The objective of this recommendation is to ensure that Etihad introduces measures in its operative process that would make it distinct in the market from any firm, despite any turbulence that might prevail in the market. The introduction of product concentration should be applied while ensuring that the targeted markets, especially in Europe, have customized services that are unique to that region. The key performance indicator will be increased revenue in the European market by 6% in the first year of implementation and 10% thereafter. Therefore, product concentration will position Etihad as a strong incumbent brand in the UAE airline industry.

Actions Needed for Alignment with Future Turbulence

New product launches should be executed within two years to minimize the negative impact of the sub gaps identified. The company can improve the current investments in logistics flow by 20% to guarantee good and sustainable returns in the short and long terms. The company should introduce a strategic customer relationship management to ensure that the satisfaction level is above 95% since the entire business platform for the company is dependent on the perceptions of customers.

References

Dewhurst, M., Harris, J., Heywood, S., & Aquila, K. (2012). The global company’s challenge. McKinsey Quarterly, 3(1), 76-80.

Escrig-Tena, A., Bou-Llusar, C., Beltran, M., & Roca-Puig, V. (2011). Modeling the implications of quality management elements on strategic flexibility. Advances in Decision Sciences, 1(1), 1-27.

Etihad Airways. (2015). About us. Web.

Griffin, R., & Moorhead, G. (2013). Organizational behavior: Managing people and organizations. New York, NY: Cengage Learning.

Khan, N. (2015). Historical overview: The 40-year rise of UAE aviation. Web.

Sarin, S., Challagalla, G., & Kohli, A. (2012). Implementing changes in marketing strategy: The role of perceived outcome and process-oriented supervisory actions, Journal of Marketing Research, 3(12), 564-580.