Abstract

The marketing audit report presents a comprehensive situational analysis of different strategies that the low-cost Fly Dubai Airline. The PESTLE analysis indicates that the company’s external market factors are positively aligned to guarantee effective market penetration and business profitability. The organizational overview indicates that the Fly Dubai Airline is poised to expand beyond the current market reach due to proper funding from the government and diversified products that are marketed as low cost. The social analysis of the company indicates that it performs well within the limits of sustainable business through a series of CSR activities and general compliance to the requirements of the highly stratified market. The SWOT analysis also suggests that the Fly Dubai Airline is well positioned to survive any competition and improve on the general market catchment. In addition, the analysis has revealed that the Fly Dubai Airline’s brand positioning, brand association, and value proportion are reflective of a successful and stable company. The recommendations suggested to sustain the strong market position include further product diversification and extensive but focused promotional strategies.

Introduction

Also known as the Dubai Aviation Corporation, the Fly Dubai Airline is a low cost airline that is exclusively owned by the Dubai government and currently operates from the second terminal of the Dubai International Airport. The current CEO is Ghaith Al Ghaith. The main product segments are low cost airline tickets, luggage, and charter flights. This paper presents a comprehensive market mix analysis by examining the current situation, PESTLE, SWOT, and organizational overview. In addition, the report examines the value proposition in order to present recommendations for the best line of action for business sustainability.

Environmental Analysis of the Fly Dubai Airline

The market environmental analysis was carried out using the PESTEL matrix to cover economic, social, political, legal, and technological factors interacting with the current Fly Dubai Airline’s business model. In order to grade the environmental factors, a Likert scale was applied to grade each factor in terms of their impacts on the general business environment.

Political Factor (+3.45)

The Dubai government fully owns the Fly Dubai Airline. This means that the business is protected by the government and would be cushioned from extreme political interference to protect the interests of the government. Moreover, the business is destined to benefit directly from a series of government interventions whenever there is a need. The government has even allocated Terminal 2 within the Dubai International Airport to host this business. In addition, the peaceful business environment that is void of political interference is destined to positively position Fly Dubai Airline in a competitive ground within the dynamic Dubai airline market. Thus, the Fly Dubai Airline’s political environment is favorable, which has necessitated the rating of +3.45 on a Likert scale.

Social Factor (+3)

The social business environment reviews the internalized values, general population views, and unique cultural orientation within the Dubai airline market. In Dubai, majority of the population fall within the middle and low income brackets. The growing social trend within the local aviation industry and relatively young workforce are positive social factors within the Dubai aviation sector. Also the low cost appeal and even increasing number of local and international tourists visiting Dubai indicate that many clients are in demand for chartered affordable flight services. The young workforce in the Dubai aviation sector is an indication of reducing cost of pension and other retirement benefits for airlines. However, the current global economic recession has affected the appetite for high cost flights. According to the national forecast, the tourism sector in Dubai will grow by 40% by 2025. These factors are positive skewed to benefit the Fly Dubai Airline because of its low cost product approach, thus a rating of +3.

Economic Factor (+3)

The high inflation rates within the Dubai aviation sector in the last five years had increased the general cost of doing business for the airlines. However, the stable interest rates and relatively friendly tax regime has made most airlines survive the impact of inflation. In the last three years, there has been a rise in the disposable income and GDP within Dubai and the UAE. Moreover, the unemployment rate within the GCC bloc has declined from 12.6% in 2015 to 10.5% in 2018. The friendly tax regime suggests that airlines can borrow at affordable interest rates. Moreover, the rising disposable income and GDP indicate that more local customers are in a position to spend on different aviation services. Therefore, the Fly Dubai Airline is positively positioned to gain from the economic factor by a relatively large margin, thus the rating of +3.

Technological Factor (+2)

Due to improvements in technology, new models of planes are in the local markets. The new plane models have the potential of substantially cutting down the cost of operations, thus, improving on competitiveness. The technological applications also ensure that the airlines are in a position to improve on their quality service charter. However, the high cost of acquiring and operating different applications remain a substantial cost that the Fly Dubai Airline and its competitors have to deal with. Moreover, the constant technological innovations have the potential of rendering the current applications redundant, despite the high vendor cost implications. The technological factor is likely to positively and negatively affect the Fly Dubai Airline, thus, the +2 score.

Legal Factor (+3.5)

Fly Dubai Airline is a government owned airline, which means that it has met all the legal requirements and compliance conditions to operate within the Dubai aviation sector. Thus, the Fly Dubai Airline faces negligible government or legal regulation challenges. Since the Fly Dubai Airline pays taxes to the government and has tax compliance certificates, it is predicted that its legal business environment will remain favorable, thus, the high Likert scale rating of +3.5.

The PESTLE matrix calculation of Fly Dubai Airline is summarized as;

PESTLE = 3.45 + 3 + 3 +2.5+ 3.5/20 = 0.98 >0.45.

The general score of 0.98 >0.45 within the PESTEL index is an indication that the external market environment is favorable for the Fly Dubai Airline.

Organizational Overview of the Fly Dubai Airline

Established by the Government of Dubai in 2008, the Fly Dubai Airline is a low cost airline that operates from Terminal 2 of the Dubai International Airport. The current chairman, CEO, and COO are Ahmed Bin Saeed Al Maktoum, Ghaith Al Ghaith, and Kenneth Gile, respectively.

Mission and Vision Statements

The vision statement of the Fly Dubai Airline is “to strive to make air travel more affordable” (Fly Dubai 2018). Since its inception in 2008, this vision has been the foundation of current success as a low cost airline. The mission statement is “we strive to deliver world class aviation services that guarantee optimal satisfaction with no hustle” (Fly Dubai 2018). The Fly Dubai Airline has cut a unique image as a reliable and affordable airline with a quality service charter.

History of the Fly Dubai Airline

The business has expanded from 12 planes in 2008 to 62 planes by 2018. The destination coverage has equally grown from 7 in 2008 to 104 in 2014 to cover external markets in Africa, Asia, and Russia.

Firm Performance

The financial performance of the Fly Dubai Airline has been impressive from 2012 to present time. The turnover grew from AED 2,778 million in 2012 to AED 5,756 million in 2018. However, the profits declined from AED 151.9 million in 2012 to AE 31.6 million in 2016. However, the trend has taken a positive turn to AED 79 million in 2018. The number of passengers has grown steadily from 5.10 million in 2012 to 10.4 in 2018. The fleet has also expanded from 28 planes in 2012 to 61 planes in 2017. Lastly, the number of destinations has also risen from 52 in 2012 to 104 in 2017 (see table 1).

Table 1: Fly Dubai Airline’s performance. (Source: Fly Dubai 2018).

Over the last five years, the Fly Dubai Airline has created a series of products that appeal to customers due to its low cost strategy. As a result, the company currently enjoys a cult-like following among loyal customers, especially the youthful fashionistas looking for affordable airline services. At present, the quality brand image of the Fly Dubai Airline has made it possible for the airline to capture 7% of the market share. The company has annual market goals angled on its vision and mission statements. The notable goals include the provision of quality and affordable airline services, proactive customer care, and efficiency in the service charter (Balakrishnan 2011). These goals are met through target marketing, promotional discounts, and effective brand awareness campaigns.

Corporate Social Responsibility

The Fly Dubai Airline has a strong policy on environmental sustainability and corporate social responsibility that matches the Pyramid of CSR matrix (Stasch & Ward 1997). The current CSR initiatives are aimed at addressing the legal, ethical, economic, and philanthropic segments of the expansive Dubai market.

Economic Segment

Under the economic pillar, the Fly Dubai Airline is a profitable business that has employed more than 3,000 workers, who earn competitive remuneration in addition to attractive benefits. Therefore, the job opportunities have a multiplier effect in the Dubai economy and effectively address the economic segment.

Legal Segment

The Fly Dubai Airline complies fully with the regulations on environmental business sustainability in terms of carbon trade compliance and effectiveness in technological applications. For instance, the 2017 ISO certification suggested that the Fly Dubai Airline is among the local Dubai airlines that are consistent with suitability reporting.

Ethical Segment

The Fly Dubai Airline practices marketing ethics in terms of advertisement ingenuity. The images presented to represent the Fly Dubai Airline products are truthful and exaggerated with an ill motive. Over the years, this strategy has increased customer confidence and preference to Fly Dubai Airline products as the level of expected and actual satisfaction is predictable from the advertisement messages.

Philanthropic Segment

Despite having been in the market for less than a decade, the Fly Dubai Airline has a successful humanitarian foundation that supports educational, health, and social welfare challenges within the local community. For instance, the Fly Dubai Airline’s Last Mile educational project has provided scholarships to more than 1,000 local and international college students. Moreover, the annual Fly Dubai Airline run has helped raise funds that support women’s healthcare needs.

Key Target Markets: Fly Dubai Airline

The primary target market for the Fly Dubai Airline is the middle and low income customers interested in aviation services within the UAE and other external markets. The company is currently the leading low cost airline in Dubai. This strategy has placed the Fly Dubai Airline as the ideal center for affordable flight and luggage transportation. The products are segmented into economy class for the low income customer bracket and business class for middle income clients. The luggage segment is also segmented into weights and composition. The airline charges for luggage above 20 kilograms when accompanied by a customer who has booked a flight. Transporting any luggage alone is charged according to distance, weight, and nature. Generally, the business model is made for low to middle income customers.

Fly Dubai Airline’s Competitive Analysis

The main competitor of the Fly Dubai Airline is the Air Arabia, which operates on the same low cost product platform. Apparently, the Air Arabia was launched in the Dubai market earlier than Fly Dubai Airline. This means that the Air Arabia was able to build a strong customer following and loyalty for its low cost aviation services before the Fly Dubai Airline could be introduced in the same market. Other notable competitors from outside Dubai are Al Jazeera Airline from Kuwait, Sama and Fly Nas airlines based in Saudi Arabia. However, through product diversification and proactive marketing, the Fly Dubai Airline has been able to penetrate the market and establish a strong brand name.

Fly Dubai Airline’s SWOT Analysis

Strengths

The Government of Dubai owns the Fly Dubai Airline. This means the company has unlimited access to capital and friendly business environment. The company has a strong regional presence serving 104 destinations. The company’s low cost product model appeals to many customers from Dubai and beyond. The Fly Dubai Airline also has diversified its products and services to reach different customer segments.

Weaknesses

The low cost product modeling limits the earnings of the Fly Dubai Airline. Moreover, the company might not survive prolonged inflation since it might not be able to support operations from the low charges for its products and services. However, these weaknesses could be converted to strengths through further product diversification and the introduction of medium cost products. For instance, the Fly Dubai Airline should consider partnering with regional airlines to expand the targeted market and gain from economies of scale.

Opportunities

The Fly Dubai Airline can expand its operations beyond the local and regional markets in Asia and Africa to optimize the economies of scale through expanded market coverage. The company should also expand current products to improve on competitive advantage. For instance, free cargo or luggage delivery within the city of Dubai will enable the Fly Dubai Airline to create a loyal customer base.

Threats

The stiff competition from Air Arabia and other regional low cost airlines might reduce the Fly Dubai Airline’s market coverage. Moreover, modification of the service bundle in each low cost product by a competitor might have diverse effects on the Fly Dubai Airline’s revenues. These threats can be transformed into opportunities through further product diversification to create an environment of own competition. The Fly Dubai Airline could also consider improving its own service bundles for its low cost product to through tailored customer centricity approach to ensure suitable customer loyalty base.

Fly Dubai Airline’s Value Proposition Evaluation

The Fly Dubai Airline does not have a defined value proposition. The analysis will be based on current activities that promote value proposition, which is to provide low cost high quality aviation services. Through focused marketing strategy, the Fly Dubai Airline has been able to stratify its targeted market and appeal to the needs of different market segments. As a result, the Fly Dubai Airline has captured 7% of the Dubai aviation market share. In order to sustain this proposition, the company needs to expand its market coverage beyond the region that is accompanied by relevant marketing strategy. For instance online marketing would easily improve on the Fly Dubai Airline’s product visibility.

Fly Dubai Airline’s Differentiation and Positioning Strategies

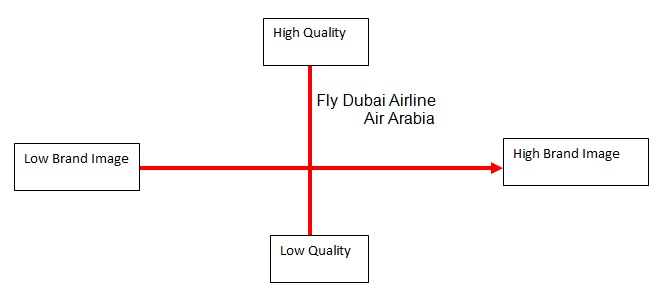

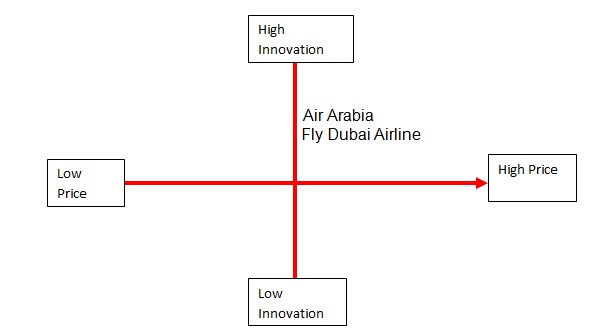

Despite the fact that the Fly Dubai Airline has been in the market for less than a decade, it has a stronger brand association than its competitors. This could be related to its association with the Government of Dubai. Moreover, the Fly Dubai Airline has diverse service bundles for each product. However, there is a need to expand the current product and service diversification module to create a positive service positing map (see figure 1 and 2) in comparison to other airlines such as Air Arabia. Since the Fly Dubai Airline’s image is provision of the quality low cost aviation products, there is a need to improve on product design and general appeal to meet this goal.

Fig. 1. Brand image vs. quality.

Conclusion

The Fly Dubai Airline applies the focused marketing strategy to sell its high quality low cost products to middle and low income clients. The airline has a relatively stable financial and organizational performance in addition to a strong brand image. The PESTEL, SWOT, value preposition, and organizational overview suggest that the Fly Dubai Airline’s current business environment is favorable to its low cost product model.

Recommendations

The Fly Dubai Airline should consider widening its market coverage beyond Dubai to other regions and across the globe to make the low cost product model feasible. This suggestion will ensure that the Fly Dubai Airline increases its earnings from economies of scale (Kotler & Keller 2012). The airline could also consider further product diversification to create an environment of own competition and survive the business activities of its competitors.

Reference List

Balakrishnan, M. 2011. ‘Gain the most from your marketing spend on loyalty’, Business Strategy Series, vol. 12, no. 5, pp. 219-225.

Fly Dubai. 2018. About us. Web.

Kotler, P & Keller, K. 2012. Marketing management, 14 edn, Pearson Education, French Forest, Australia.

Stasch, S & Ward, J. 1997. ‘Characteristics of competing marketing strategies when defending market leadership’, Journal of Strategic Marketing, vol. 5, pp. 23-49.