Executive Summary

Google Incorporation is currently the leading player within the expansive global Internet Information Providers Industry. Established less than two decades ago, the company has created a strong brand name in its traditional US market and across the globe. The notable internationalization marketing strategies used by Google over the years are vertical integration, continuous research and development for product improvement, market enlargement, simultaneous regional concentration, online distribution, and market penetration to improve visibility of its product and service charters. The scope of this report is to examine the company’s internationalization marketing strategic capabilities to present recommendations for improvement. The report aims to carry out internal and external market analysis from a marketing perspective. Data was collected from the company’s annual performance report. The findings indicated that Google Incorporation is facing the challenges of stiff competition, counterfeiting, and the inability to integrate an ideal marketing mix in the international markets.

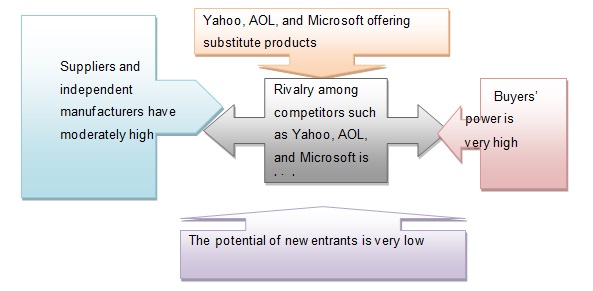

Moreover, Google’s increasing the cost of production is threatening profitability. Also, the volatile nature of some international markets due to political instability, corruption, and unfair business practices have impeded Google’s internationalization marketing strategies. To establish the surrounding business environment for Google Corporation, a comprehensive Porter’s Five Forces analysis was performed to comprehend its weaknesses and strengths. Despite having a household name in the local market, several players are consistently penetrating this market and eating into Google’s share to limit its competitive advantage. From the internal and external market analysis, it is apparent that Google is facing setbacks in its internationalization marketing strategic capabilities due to competition, counterfeits, inexperience in foreign markets, and increasing cost of production. There is a need for the company to create a more focused approach to survive the impacts of these challenges. To sustain its market leadership position and competitiveness, Google Incorporation should consider implementing product concentration, vertical integration, and innovation. These recommendations will improve the company’s internationalization marketing strategic capabilities.

Introduction

Google Incorporation is currently among the top Internet-based companies across the globe. Headquartered in California, the company has a variety of products and services such as search engines, internet marketing, and software vending among others. In the last five years, the company integrated cloud computing in its product charter. At present, the primary competitors of Google Incorporation are Linkedln, Microsoft, AOL, and Yahoo (Vanhala & Stavrou 2013). These companies offer perfect substitute services and products at relatively competitive prices. To survive the impact of competition, the company has internalized marketing strategies such as retail distribution, focused product differentiation, and flexible sourcing simultaneously.

By the end of the 2016-2017 financial year, Google Incorporation was the US leading Internet-based company with a market share of 63%, which is an improvement by 5% in the previous year (Google Incorporation 2018). The notable internationalization marketing strategies employed by Google Incorporation are used to expand the local and international markets, especially in Africa, Europe, China, Japan, and other parts of the world. For instance, retail distribution strategy (internet marketing and software vending) has been successfully used by the company to expand its market coverage to areas such as China, Asia, and parts of Europe (Vecchi & Brennan 2014). Moreover, renowned brands have emerged from Google’s software vending product charter (Wilkinson & Redman 2013). The research paper examines the successes, challenges, and potential improvements to Google’s internationalization marketing strategic capabilities.

Strategic Issue

Analysis of Google Incorporation Strategic Capabilities

Google Incorporation has consistently used several strategic resources to penetrate and uphold operations in the local and international markets. To guarantee sustainability, the company has focused on premeditated marketing alignment through specific market segment targeting and definition of customer segments, especially for the online-based services and products. These strategies are accomplished through effective distribution, provision of unique and high-quality products, and secure networks for corporate and individual customers (Suma & Lesha 2013). Despite the extensive successes of these marketing strategies, the company faces the threat of competition from other established brands using the same approaches or platforms within the sensitive Internet Information Providers Industry. For example, Linkedln, Microsoft, and Yahoo’s successful internationalization marketing strategies are threatening to reverse or slow down the gains realized by Google Incorporation over the years.

Strategic Issue Identification

As a requirement for effective and sustainable internationalization marketing performance, the primary strategic challenges Google is facing are pivoted on competition, and the best ways of curving a unique market niche in the local and international markets. This means that the company should mold an ideal strategic marketing mix to survive the impact of competition. For instance, Google is facing the dilemmas of threats and potentials of penetrating the currently stratified market for software, critical focusing on the most profitable and reachable market, potentials of continuous product re-branding, and creation of new brands and the ideal strategy for guaranteeing increase viability (Zhang 2015). Google Incorporation has to accomplish these strategic issues without presenting itself as the copy cat of competitors’ marketing tactics. Therefore, what is the ideal internationalization marketing strategic capabilities that Google Incorporation should internalize to improve performance in the local and international markets and survive the competition? The following sub-questions were generated to answer this question;

- What strategies should Google Incorporation use to effectively differentiate its multiple brands in the local and international markets?

- Should Google Incorporation launch more brands or re-brand its existing product line?

External Environmental Analysis

Industry Competitiveness Analysis Using Porter’s 5 Forces Model

The threat of market entry: It is difficult for a new business to effectively enter and penetrate the Internet Information Providers Industry and create a stable brand that might challenge the dominance of main players such as Yahoo, Google, and Microsoft among others. Starting a venture in this industry is capital intensive and massive investment must be availed for a new entrant to outperform the current players (Simha 2014). This means that a new entrant has to face difficulty in any attempt to increase its brand visibility and gain a substantial share of the market. Since this industry accommodates much high quality and globally recognized brands, any new entrant has to painstakingly build its brand from the scratch (chart 1). Therefore, Google is not threatened by a new entrant or activities of established businesses expanding their product sector to include Internet-based services (Singh & Singh 2014).

The threat of substitutes: The software vending and internet marketing segments in the Information Provider Industry are characterized by many companies offering more or less similar products. This means that products and services retailed by Google and its competitors are perfect substitutes, that is, they serve the same purpose and target similar customer and business segments. For instance, Microsoft and Yahoo have comparable product and service charters as Google Incorporation (Solomon 2013). Therefore, customers who are not satisfied with the services of Google have alternatives for gaining similar benefits. Moreover, the surge in imitation and software counterfeiting is threatening all the players within this industry (chart 1). Since these counterfeits are cheaper, an increase in their purchase would translate to reduced revenue streams of the main players such as Google and Microsoft. As a strategy for countering counterfeiting and perfect substitute nature of its product charter, Google Incorporation has put in place a unique marketing approach through tailed optometry to provide customized versions to its clients.

Bargaining power of the suppliers: The influence of suppliers within the Internet Information Providers Industry is high since the corporate customer segment tend to purchase large volumes of the products and services vended by the main players. Due to high influence, the profitability of these players is relatively low due to the high cost of licensing and the creation of these products. Since most players in this industry operate at local and international markets, the degree of influence varies. For example, Japan, China, and India are the largest suppliers of software used by Google to develop or improve its product charter, especially within the search engine service (chart 1). Moreover, other players such as Microsoft and Yahoo have more than 2,000 suppliers each to be able to create or improve the efficiency of their services. However, over the years, most players in this industry have come up with partnerships between vendors and manufacturers of most software to curtail the suppliers’ power. For instance, Google Incorporation has consistently used its deep financial and resource reservoirs to get competitive offers from suppliers. As a result, the company has been able to control the power of suppliers through a competitive bidding process and partnerships with major software creators.

Bargaining power of the buyers: There is generally a strong buyers’ power to bargain within the Internet Information Providers Industry, especially at individual and corporate customer levels. Although most players have created strong brand images, buyers within this industry have direct and indirect power to influence the pricing of these products and services due to the existence of many alternatives at any given time (chart 1). The high competition gives the buyers an upper hand in selecting the most competitive and efficient product from other versions available in the market. Therefore, the major players such as Google, Yahoo, and Microsoft must integrate their customer perception on quality, reliability, and affordability in setting product prices to remain competitive. Fortunately, Google Incorporation has remained consistent in offering the most affordable and negotiated prices within different customer segments to accommodate the premium and ordinary clients.

Rivalry: There are many customized and stratified product and service brands within the Internet Information Providers Industry. Most of these players deal with many sub-brands and types of search engines and internet marketing services. This means that businesses in this industry have to be strategic to remain viable amid aggressive competition through the creation of a flexible product brand and continuous diversification (chart 1). For example, at present, Yahoo is the greatest competitor of Google due to its equally large market catchment and relatively expanded marketing networks across the globe. Since customers in this industry are keen on technological development and value traits in their preferred products, quality is the primary determinant of any purchasing decision. Due to volatility in the customer decision process amid many alternatives, players have over the years put in place measures aimed at attracting customers. For instance, Google Incorporation has institutionalized strategies such as diversification, smooth supply chain management, and focused brand positioning (Strom, Sears & Kelly 2013). As a result, the company has been able to create multiple brands of its current product and service charters to appeal to different categories of clients.

Key Success Factors Within the External Environment

Strong brand image: From the external environmental analysis, it is apparent that Google Incorporation has an established brand image, which has enabled this company to effectively attract and retain repeat customers with relatively fewer efforts as compared to its rivals such as Yahoo and Microsoft. This means that any venture planning to enter the Internet Information Providers Industry has to invest heavy capital and human resource in addition to advertising to attempt to compete with Google (Sostrin 2013). The established brand image has given Google an upper hand in terms of product visibility.

A focused commitment to quality charter: Google Incorporation has consistently remained committed to building innovative and quality service charter to give customers a desirable experience with its products. The company has managed to accomplish this goal by mixing the right human resource skills, technological development, and continuous market research to capture customer expectations (Rashid & Naeem 2017). Specifically, employees at Google Incorporation are frequently offered relevant training on the software development strategies in the market. Moreover, the development of the latest version of existing products is a continuous process carried out in a dedicated department called the Research and Development division.

Expanded market coverage: Google Incorporation has managed to expand its market presence to cover all the continents. From its local market in the US, the company has steadily increased its market visibility as a top internet-based service provider, despite having been in the market for less than two decades. In the last ten years, the company has managed to consistently record positive growth in its revenues (Google Incorporation 2018). In the last five years, Google Incorporation has doubled its annual sales to almost 100 billion dollars (Shende 2014). The trend is projected to continue in the foreseeable future as the world embrace technology.

Market experience: Google Incorporation has been in the Internet Information Providers Industry for close to two decades. It is one of the pioneers of Internet-based service providers. The elongated duration in the market has given the company adequate experience and established its current position among the top five leading global ventures (Fill 2013). Moreover, the company has had sufficient time to test the market and correct its mistakes, thus, developing stable, tested, and long-term marketing strategies that are anchored on specific targeted customer and business segments.

Industry Analysis

Industry Profile and Attractiveness

The Internet Information Providers Industry has had a positive trend in terms of growth as many businesses and individual customers embrace the technology-based services offered by Google and its competitors. This industry is estimated to be worth more than $500 billion (Rashid & Naeem 2017). At present, Europe, the US, and Asia markets control more than 79% of the industry market share (Rashid & Naeem 2017). Despite the downward financial environment following 2007-2008 global economic downshift, many players in the Internet Information Providers Industry managed to quickly recover since their businesses are based on the internet platform. In the last ten years, these companies have experienced an average growth of 25% every year (Shende 2014).

As at the end of 2016-2017 financial years, the Internet Information Providers Industry was estimated to constitute more than 21% of the total consumer internet purchases value. At present, the anticipated growth in this market value is expected to surpass 27% by 2022 (Rashid & Naeem 2017). The Internet Information Providers Industry is dominated by Linkedln, Microsoft, Yahoo, and Google. These players have established strong brand names and recognition across the globe. Moreover, the companies have integrated reliable and efficient technology in product development and marketing to their advantage (Searcy & Buslovich 2014). Based on their annual growth rates, anticipated industry expansion, and increasing market share, these incumbents are properly positioned to reap optimal benefits at present and in the future if all other factors are held constant (Sampson 2016). For instance, the emerging markets in Africa and Asia might catalyze positive growth.

Industry Structure

The expansive Internet Information Providers Industry is fragmented due to the nonexistence of a single company with a relatively large market share that can influence the direction of the business environment. At present, the main players consist of 15 companies of which four firms control almost 81% of the combined market share. The other companies are mostly privately-owned and operate at regional levels (Obeidat, Masadeh & Abdallah 2014). The currently largest player in the Internet Information Providers Industry is Google Incorporation, which has managed to hold 57% of the total market share followed by Microsoft at 16% and Yahoo at 12% (Nisula & Kianto 2016). Generally, the Internet Information Providers Industry is very competitive because these players offer perfect substitute products and have similar Internet-based business platforms. Therefore, pricing and product design are the key determinants of competitiveness (Fill 2013). The main success factors associated with the Internet Information Providers Industry are consistency in supply of significant inputs, stable contact with primary markets, the capacity to modify services in line with favorable market conditions, efficient and properly trained workforce, and creation of services demanded by the market (Osterwalder & Pigneur 2013).

The main players in the Internet Information Providers industry have adopted the oligopolistic market structure due to the existence of a few dominant companies. These players command a share of internet marketing, search engine, and software vending sectors (Oakland 2014). Because these players have a similar customer and market catchment, their alternatives to multiple pricing are limited (Nasrinsulthana & Hyder 2015). This means that most of the players such as Google, Microsoft, and Yahoo tend to use self-advertisement to differentiate their products and appeal to each customer segment. According to Muthuraman and Mohandoss (2016, p. 221), “the self-advertisement is possible due to their global brand image and active presence in the major markets”.

This industry structure has affected the internationalization marketing strategies used by Google, especially in terms of customer segmentation and product pricing. Since most of its competitors have perfect substitute products, Google has to come up with competitive pricing to ensure that its customers do not switch to products offered by competitors. Moreover, the company has to consistently and constantly integrate and remodel its sub-brands to sustain global dominance (Myerson 2015). Although the company has benefited from the oligopolistic market structure by earning massive profits, Google has to ensure stability in its operational framework. If this is not achieved, Microsoft and Yahoo might gain a sizable share of Google Incorporation’s market and reduce its revenues.

Company Situation

Financial Performance

The financial performance of Google Incorporation has been steady in the last ten years. Specifically, the total assets increased from $2.467 billion in 2012 to $7.663 billion in 2016. The liabilities also increased from $961.82 million to $1.242 billion between 2012 and 2016. Moreover, the equity value experienced positive growth from $1.505 billion to $3.456 billion from 2012 to 2016 (Google Incorporation 2018). In the last six years, the least growth rate was recorded in 2013 with a slight decrease in the sale by 1.4%. However, from 2014, the trend has been positive with the highest growth recorded in 2016 at 15.2% (Google Incorporation 2018). In terms of profitability, the return on assets increased by 6% between 2012 and 2016 (Google Incorporation 2018). This is an indication that Google Incorporation has been realizing steady profits over the years. At the same time, the return on equity experienced positive growth from 48.52% in 2012 to 57.67% in 2016 (Google Incorporation 2018).

The high return to equity value is an indication that the company has been generating high returns for its investors. Since the ability of a company to effectively roll out promotional strategies is pegged on its liquidity, an examination of Google’s current ratio and working capital indicated stability and strong capitalization. For instance, the current fluctuated between 2.56 and 2.59, which is a clue that Google can comfortably service its loans with its current assets while remaining financially sound. The working capital increased from $1.042 billion in 2012 to $5.674 billion in 2016 (Google Incorporation 2018). This implies that the company’s current assets value is bigger than the current liabilities. Moreover, it signifies that Google has remained consistent and effective in the management of working capital and liquidity. Generally, the positive ratios suggest that the company has low debt about working capital configuration (Fill 2013). Moreover, the company is yet to fully exploit its potentials (Martelo, Barroso & Cepeda 2013). These growth prospects indicate that Google is projected to record even better performance in the foreseeable future. At the same time, the company has enough resources for promotional and advertisement strategies as part of its internationalization strategic capacity.

SWOT

Strengths: The focused and stable management approach consisting of different layers of control has been instrumental towards propelling Google Incorporation towards the provision of customized, quality, and efficient services such as Internet marketing, software vending, and other search engine products (Monks & Minow 2014). The management approach has been proactive in reviewing and tracking the current operational strategies against past performance and future forecasts (Table 1). As a result, the company has been able to not only meet the demands of its customers but also set trends in the Internet Information Providers Industry.

For example, Google’s management team was the first to introduce the Internet marketing service, which became a trend and has been copied by its competitors (Mangan, Lalwani & Lalwani 2016). The innovative management strategy has enabled the company to generate enough revenues to fund its research and development initiatives. Another strength is an expansive market network and a series of subsidiaries across the US and other regions (Lohdi & Naz 2016). These networks have enabled Google to attract and retain millions of customers across the globe, especially in regions where the company is yet to optimize its potential. Moreover, the subsidiaries spread evenly across the continents have improved the company’s product accessibility and visibility.

Over the years, Google Incorporation has managed to increase its internet marketing and software vending in North America and most parts of Europe and Asia. These two product segments have become the backbone of Google’s growth drivers. Moreover, the software vending has been turned into a strategic distribution point in regions previously uncovered by the company. As noted by Kotler and Keller (2016, p. 28), “the vivid presentation of Google brands supports differentiated perception by customers beyond their product experiences, further strengthening the brand image”. Notwithstanding, the internalization of reliable and strong internet marketing services has improved positive customer perception towards the company. Google Incorporation has one of the most reliable and fully functional 24/7 customer relationship management strategies (Fill 2013). At present, a customer can contact the support and get feedback within 10 minutes. This customer management strategy has been extended to include special rewards such as discounts for every purchase made.

Weaknesses: Google’s subsidiaries are more concentrated in the US and Europe than in other regions across the globe. Unlike its major competitors such as Yahoo and Microsoft, Google has a weak market presence in Africa and Asia. As a result, the company has not been able to reap benefits from substantive global market demand since its customer catchment is still restrictive in the expansive Africa and Asia markets (Kotler et al. 2013). Moreover, Google has excessively focused on customized service charter, especially for its Internet marketing and software vending products (Kraft 2013). In reality, this strategy is counterproductive in generating revenues since most of the customers are individuals and small businesses that cannot optimally operate in a customized service platform (table 1).

Another weakness is the high cost of inventory since the process of software development and maintenance is expensive due to ever changing technological advancement and security concerns (Kajalo & Lindblom 2015). For instance, some of the research and development projects are abandoned after investing millions of dollars if a competitor has successfully come up with a better version. This means that some product improvement research projects are not viable or sustainable in the event of reduced annual turnover (Kiran 2016). These weaknesses have made it difficult for Google Incorporation to efficiently and proactively enter and penetrate the small business segment in the international markets. For instance, the company’s Business-to-Business (B2B) model remains largely unexploited since the focus on product quality has become an impediment in incorporating the recommendations of software users in the creation of better versions (Hyland, Lee & Mills 2015). Google is still lagging in the integration of search engines than accommodate all languages.

Opportunities: Several opportunities exist for Google Incorporation to strategically expand its product charter and market coverage due to a strong and stable capital base. The company has deep financial reservoirs that are adequate in sustaining growth within the local and international markets. This means that Google is capable of rolling out continuous and focused marketing strategies across the globe without compromising its financial standing (Homburg, Jozic & Kuehnl 2017). This opportunity is instrumental in boosting the company’s revenues and current market leadership position as the top player within the Internet Information Providers industry. When properly exploited, Google might be in a position to substantially expand its annual revenue stream due to expanded market coverage and increased client base (Harrison & Wicks 2013).

Over the years, the company’s strong financial performance and global brand image is a demonstration of a focused management approach. This means that the company has an opportunity to further improve its management approaches to integrate the latest strategic planning modules that guarantee optimal utilization of inputs to produce the desired level of outputs (Guiso, Sapienza & Zingales 2015). For instance, the company may decide to decentralize management in the international markets to ensure that marketing and other strategies are aligned to the regional cultures and customer preferences (table 1). This opportunity has inspired Google to expand and enter new markets every year, especially in regions that are not fully served by its product and service charters (Eman, Ayman & El-Nahas 2013). At the same time, Google Incorporation might gain through smooth entry into the international market if it collaborates with other subsidiary companies that are already operational (Elder & Krishna 2013). This opportunity will cushion the company from market swings and negative reactions from the targeted customers since these subsidiary companies understand the local markets.

Threats: Competition from companies producing counterfeit services is the main threat facing Google Incorporation. These fake product and service charters have penetrated the global Internet Information Providers industry and currently acts as direct and cheaper substitutes to its quality brands (Harrison 2017). For instance, much counterfeit software from Asia is readily available in the market and some are sold as Google products to unsuspecting customers. This means that the current internationalization strategies proposed by Google might face a challenge as these fake products flood their market (Fill 2013). Moreover, Google has to deal with stiff competition from other established software vendors and internet marketers such as Yahoo, Microsoft, and Facebook among others since these companies have equally strong capital-based and stable internationalization capabilities (Dasgupta, Suar & Singh 2013).

This means that the company must integrate more focused strategies to retain its market leadership position (table 1). Another threat is the possibility of increased prices of inputs or support services that Google uses to create its products. The ever-rising global demand to integrate Internet-based marketing and software applications may force independent producers and traditional suppliers to increase their prices (Daft & Marcic 2016). As a result, Google might have to deal with the increasing cost of production, which lowers its profitability. Moreover, an unfriendly business environment in the international markets might curtail Google’s expansionary internationalization marketing capabilities, especially in the Middle East and some parts of Africa. High taxation regime, complex business permit process, corruption, and limited government protection might result in losses and slowed growth (Cravens & Piercy 2013). For instance, the continuing political instability in several countries in the Middle East makes it difficult for Google to establish regional offices or smoothly run its businesses in these regions. Also, excessive political interference in China as a result of control accessibility of the Internet is a threat to Google’s profitability and market penetration objectives in this region (Clow & Baack 2014).

Table 1. Summary of Google Incorporation’s SWOT. Source: Developed by the Author for this work.

Generic and Grand Strategy Recommendations

Product Concentration

Google should focus its internationalization marketing strategies on regions with flexible laws and a favorable business environment when executing its market expansionary plans (Battor & Battour 2013). The objectives of this recommendation are to safeguard the company’s products and general brand, optimize the ease of market penetration and expansion of customer base and ensure that the company monitors its operative measures to improve visibility. This proposal should be integrated to customize management and marketing strategies in the international markets for ease of acceptance (Baxter 2014). When properly implemented, this recommendation is expected to strategically position Google Incorporation as a stable incumbent brand expanding to other regions.

Vertical Integration

Google Incorporation should consider partnering with local businesses in the international markets that retail similar products to increase the success of entry and penetration in the foreign regions (Bloom 2014). For example, the company may form strategic alliances with software developers and private programmers to create products that have local appeal. The same should be replicated in the marketing strategies to boost the probability of Google brand acceptance in the foreign markets (Chaffey & Smith 2013). The objective of this proposal is to increase product coverage for Google and cushion the company from uncertainties associated with entering a new market (Ang 2014). To achieve this objective, the company should create a hybrid in-house software development and marketing strategies that are flexible and can be integrated into the platforms of local partners. When this plan is effectively implemented, Google is expected to properly counter the competitors’ strategy of retailing to final clients via proxy businesses (Bloom, Draca & Reenen 2016).

Innovation

Although innovation has been the backbone of Google’s operational strategies in the local market, there is a need for the company to consider expanding its cost leadership strategy to quickly penetrate any international market it intends to enter (Cottrell 2013). The objective of this proposal is to ensure that Google sustains its market leadership position in the local and international markets as a result of improved product visibility and affordability. Over time, Google will be able to fuse optimal performance, product availability, and cumulative experience to turn the existing brands into new and attractive localized products (Cole 2015).

Conclusion

Google Incorporation has managed to sustain its global market leadership position through focused internationalization marketing strategic capabilities. The internal and external environment analysis indicates that the company has innovative products and a strong capital base, which has enabled it to survive the competition. However, Google is grappling with challenges in its internationalization marketing strategies due to changing customer preference, counterfeiting, and increasing competition. To address these challenges, the company should consider product concentration, innovation, and vertical integration.

Reference List

Ang, L 2014, Integrated marketing communications: a focus on new technologies and advanced theories, Cambridge University Press, Cambridge.

Battor, M & Battour, M 2013, ‘Can organizational learning foster customer relationships? Implications for performance’, The Learning Organization, vol. 20, no. 5, pp. 279-290.

Baxter, J 2014, ‘Who wants to be the leader? The linguistic construction of emerging leadership in differently gendered teams’, International Journal of Business Communication, vol. 52, no. 4, pp. 427-451.

Bloom, N 2014, ‘Fluctuations in uncertainty’, Journal of Economic Perspectives, vol. 28, no. 2, pp. 153–76.

Bloom, N, Draca, M & Reenen, J 2016, ‘Trade induced technical change? The impact of Chinese imports on innovation, IT and productivity’, Review of Economic Studies, vol. 83, no. 1, pp. 87–117.

Chaffey, D & Smith, P 2013, Digital marketing excellence, planning, optimizing and integrating online marketing, 5th edn, Routledge, London.

Clow, E & Baack D 2014, Integrated advertising, promotion, and marketing communications, 6th edn, Pearson Higher Education, New York, NY.

Cole A 2015, The implications of consumer behaviour for marketing, Anchor academic publishing, London.

Cottrell, S 2013, The study skills handbook, 4th edn, Palgrave Macmillan, Basingstoke.

Cravens, D & Piercy, N 2013, Strategic marketing, 10th edn, McGraw-Hill, New York, NY.

Daft, R & Marcic, D 2016, Understanding management, 10th edn, Cengage Learning, London. Dasgupta, A, Suar, D & Singh, S 2013, ‘Impact of managerial communication styles on employees’ attitudes and behaviours’, Employee Relations, vol. 35, no. 2, pp. 173-199.

Elder, R & Krishna, A 2013, ‘The visual depiction effect in advertising: Facilitating embodied mental simulation through product orientation’, Journal of Consumer Research, vol. 38, no. 6, pp. 988-1003.

Eman, M, Ayman, Y & El-Nahas, T 2013, ‘The impact of corporate image and reputation on service quality, customer satisfaction and customer loyalty: testing the mediating role: case analysis in an international service company’, Journal of Business and Retail Management Research, vol. 8, no. 1, pp. 12-33.

Fill, C 2013, Marketing communications: brands, experiences and participation, 6th edn, Pearson Higher Education, New York, NY.

Google Incorporation 2018, About us, Web.

Guiso, L, Sapienza, P & Zingales, L 2015, ‘The value of corporate culture’, Journal of Financial Economics, vol. 117, no. 1, pp. 60-76.

Harrison, C 2017, Leadership theory and research: a critical approach to new and existing paradigms, Springer, New York, NY.

Harrison, J & Wicks, A 2013, ‘Stakeholder theory, value, and firm performance’, Business Ethics Quarterly, vol. 23, no. 1, pp. 97-124.

Homburg, C, Jozic, D & Kuehnl, C 2017, ‘Customer experience management: toward implementing an evolving marketing concept’, Journal of the Academy of Marketing Science, vol. 45, no. 3, pp. 377-401.

Hyland, P, Lee, A & Mills, M 2015, ‘Mindfulness at work: a new approach to improving individual and organizational performance’, Industrial and Organizational Psychology, vol. 8, no. 4, pp. 576-602.

Kajalo, S & Lindblom, A 2015,’Market orientation, entrepreneurial orientation and business performance among small retailers’, International Journal of Retail & Distribution Management, vol. 43, no. 7, pp. 580-596.

Kiran, D 2016, Total quality management: key concepts and case studies, Elsevier Science, New York, NY.

Kotler, P & Keller, K 2016, Marketing management, 15th edn, Pearson Prentice Hall, New York, NY.

Kotler, P, Keller, L, Koshy, A & Jha, M 2013, Marketing management: a South Asian perspective, 14th edn, Imprint Pearson Education, New York, NY.

Kraft, ME 2013, Public policy: politics, analysis, and alternatives, SAGE, New York, NY.

Lohdi, S & Naz, U 2016, ‘Impact of customer self concept and life style on luxury goods purchases: a case of females of Karachi’, Arabian Journal of Business Management Review, vol. 6, no. 192, pp. 56-67.

Mangan, J, Lalwani, C & Lalwani, C 2016, Global logistics and supply chain management, John Wiley & Sons, New York, NY.

Martelo, S, Barroso, C & Cepeda, G 2013, ‘The use of organizational capabilities to increase customer value’, Journal of Business Research, vol. 66, no.10, pp. 2042-2050.

Monks, R & Minow, N 2014, Corporate governance, John Wiley & Sons, New York, NY.

Muthuraman, B & Mohandoss, K 2016, ‘Impact of customer based brand equity of Toyota cars in Oman’, International Journal of Applied Sciences and Management, vol. 2, no. 1, pp. 219-225.

Myerson, P 2015, Supply chain and logistics management made easy: methods and applications for planning, operations, integration, control and improvement, and network design, FT Press, New York, NY.

Nasrinsulthana, M & Hyder, S 2015, ‘Brand preference among customer using Toyota car in Oman’, Intercontinental Journal of Marketing Research Review, vol. 3, no. 10, pp. 62-67.

Nisula, A & Kianto, A 2016, ‘The role of knowledge management practices in supporting employee capacity for improvisation’, The International Journal of Human Resource Management, vol. 27, no. 17, pp. 1920-1937.

Oakland, JS 2014, Total quality management and operational excellence: text with cases, 4th edn, Routledge, London.

Obeidat, Y, Masadeh, R & Abdallah, B 2014, ‘The relationships among human resource management practices, organisational commitment, and knowledge management processes: a structural equation modelling approach’, International Journal of Business and Management, vol. 9, no. 3, pp. 9-26.

Osterwalder, A & Pigneur, Y 2013, Business model generation: a handbook for visionaries, game changers, and challengers, John Wiley & Sons, New York, NY.

Rashid, A & Naeem, N 2017, ‘Effects of mergers on corporate performance: an empirical evaluation using OLC and the empirical Bayesian method’, Borsa Istanbul Review, vol. 17, no. 1, pp. 10-24.

Sampson, T 2016, ‘Dynamic selection: an idea flows theory of entry, trade, and growth’, Quarterly Journal of Economics, vol. 131, no. 1, pp. 315–80.

Searcy, C & Buslovich, R 2014, ‘Corporate perspectives on the development and use of sustainability reports’, Journal of Business Ethics, vol. 121, no. 2, pp. 149-169.

Shende, W 2014, ‘Analysis of research in consumer behaviour of automobile passenger car customer’, International Journal of Scientific and research Publications, vol. 4, no. 2, pp.1-8.

Simha, S 2014, ‘Identifying the preferences and brand choices of female customers for cars: A study conducted in Muscat region, of Sultanate of Oman’, International Journal of Science and Research, vol. 9, no. 2, pp. 312-320.

Singh, H & Singh, B 2014, ‘Total quality management: today’s business excellence strategy’, International Letters of Social and Humanistic Sciences, vol. 12, no. 32, pp. 188-196.

Solomon, M 2013, Consumer behaviour: Buying, having, and being, 10th edn, Pearson Education, London.

Sostrin, J 2013, Beyond the job description: how managers and employees can navigate the true demands of the job, Palgrave Macmillan, New York, NY.

Strom, D, Sears, K & Kelly, K 2013, ‘Work engagement: the role of organizational justice and leadership style in predicting engagement among employees’, Journal of Leadership & Organizational Studies, vol. 2, no. 1, pp. 71-82.

Suma, S & Lesha, J 2013, ‘Job satisfaction and organisational commitment: the case of Shkodra municipality’, European Scientific Journal, vol. 9, no. 17, pp. 41–52.

Vanhala, S & Stavrou, E 2013, ‘Human resource management practices and the HRM-performance link in public and private sector organisations in three Western societal clusters’, Baltic Journal of Management, vol. 8, no. 4, pp. 416–437.

Vecchi, A & Brennan, L 2014, ‘Quality management: a cross-cultural perspective’, Cross Cultural Management: An International Journal, vol. 16, no. 2, pp. 149-164.

Wilkinson, A & Redman, T 2013, Contemporary human resource management: text and cases, 4th edn, Pearson Education, London.

Zhang, Y 2015, ‘The impact of brand image on consumer behaviour: A literature review’, Open Journal of Business and Management, vol. 2, no. 3, pp. 58-62.