Introduction

The seafood dining experience is a luxury in Singapore and most Asian states. Despite this, JUMBO Seafood operates in a tight market, with competitors offering comparable expertise and prices. This part of the report will focus on analyzing the internal and external environments and value chain items that can provide a competitive advantage to JUMBO’s management. At the end of this report, some recommendations for improving the current strategy, such as focusing on differentiation, are presented. This part of the report will address the competitors, customers, and collaborators, SWOT, VRIN, and Value Chain analysis and detail the plan for establishing a new takeout and delivery service for this restaurant.

Jumbo’s Environment Analysis: External Environment: Competitors and Customers

The opportunities and threats are derived from the external environment, hence customers and the industry’s dynamics influence this criterion. Competitors of Jumbo in Singapore are Long Beach Seafood, Uncle Leong Seafood, and No Signboard Seafood. The price range in these restaurants is similar, making the competition even more intense. Hence, the differentiation between these competitors through price is not possible, and JUMBO has to use other resources to distinguish itself from the competition.

The competition in the market is intensified due to the need to account for the revenue losses that restaurants have had as a result of the pandemic. According to Singapore’s Department of Statistics (2021), the total sales of all foods and beverages in the state decreased by 24% when compared to 2020, and sales of restaurants fell by 30.4%. Evidently, the sharp decline is linked to COVID-19 and the restrictions regarding people’s access to retail locations and restaurants. However, this also means that the competition within the industry will intensify as restaurants will try to compensate for the lost revenue. Notably, online sales accounted for 22% of total food and beverage sales based on month-to-month data (Singapore’s Department of Statistics, 2021). The decline in sales shows that all restaurants in Singapore were affected negatively, and the competitor for clients will intensify.

Customers

The consumers in Singapore do not perceive seafood such as crabs as exotic. Typically, these individuals have experience traveling to other states and are well-versed in their food choices. Hence, even award-winning seafood dishes do not provide a strong competitive advantage for JUMBO. However, it is a popular food option, both among locals and foreign visitors. According to the USDA (2019), “Singaporeans love seafood, not to mention a fair share of 16.4 million visitors in 2016 who together rang up sales valued US$1.07 billion for imports” (p. 1). Hence, the customers in Singapore enjoy seafood, but they are difficult to impress with regular dishes.

Consumer eating habits, patterns, and attitudes towards seafood have changed in recent years. Supartini et al. (2018) state that the increase in income and rapid population growth result in greater consumption of seafood by a nation. Moreover, Supartini et al. (2018) report that citizens of Singapore report a five times higher desire to purchase seafood when compared to data from 10 years ago. This suggests that the demand for seafood products, including dining experiences that incorporate seafood, is increasing in Singapore. Additionally, the data by Statista (2021) shows that the seafood consumption in Singapore between 2010 and 2019 remained stable, with a person consuming on average between 21 to 23 kilograms per year. Hence, the demand for the main product that JUMBO uses to create its luxury dining service is stable.

Consumer patterns and preferences have changed due to social distancing measures. Another major external threat is the coronavirus and the Singapore government’s restrictions that concern restaurants. Moreover, it is currently unclear what specific disruptions COVID-19 will cause, but it is certain that it will affect customer’s preferences for the types of foods and dining experiences they have. According to Nguyen and Vu (2020), social distancing measures made delivery food applications in Singapore more popular.

However, there were cases of infections through food delivery in Vietnam, which raise concern. One way of addressing this is through contactless delivery and online payments. However, these infection cases may prompt users to avoid any unnecessary contacts at all. Still, food delivery has become a norm after the pandemic, which affected consumer behavior patterns.

As for collaborators, Jumbo has to work in partnership with distributors and importers to receive supplies of crab since local producers cannot provide them. For example, JUMBO relies on the supplies of seafood from abroad. The estimations by USDA (2017) indicate that 1.8% of the imports come from the United States. However, JUMBO mostly uses seafood supplied from the United States and suppliers from other countries for specific types of crab.

Internal Environment

JUMBO Seafood is a well-renowned restaurant with a reputation for high quality and luxury dining. According to JUMBO’s 2020 annual report, they are “one of Singapore’s leading multi-dining concept F&B establishments” (JUMBO GROUP, 2020, p. 1). Moreover, this restaurant has its signature dishes—chili crab and black pepper crab. The portfolio of restaurants includes 39 locations in 15 cities across Asia, and the brand also owns outlets and catering businesses (JUMBO Group, 2020). This diversity allows the company to create a unified supply chain management and quality control systems, which in turn reduce costs for individual restaurants.

Since the establishment, Jumbo has collaborated with the Singapore Tourism Board to promote local foods to tourists visiting Singapore. Moreover, there were several other corporations with the local government to promote the seafood dining experience to tourists (JUMBO Group, 2020). The collaboration with government officials is effective because it allows JUMBO to receive insights about the number of tourists that arrive in Singapore, their place of origin, as well as receive guidance from the officials. Additionally, the Singaporean government has programs directed at fishing and seafood (The Fish Site, 2021). However, they were ineffective because they promoted overfishing and unethical business practices instead of aiding fish and seafood-related businesses during the pandemic.

SWOT and TOWS

When using TOWS to define who JUMBO will be collaborating with, one can conclude that cooperation with the government of Singapore and food delivery applications is essential. This is a necessity since the coronavirus has affected the revenues and consumer behavior patterns, and JUMBO had little time to adjust its operations. Table 1 is a summary of the internal and external factors that impact JUMBO’s operations in a SWOT format.

The TOWS Matrix displayed in Table 2 shows how JUMBO can use its strengths and leverage the industry’s opportunities to overcome challenges. For example, the industry analysis shows that the consumption of seafood in Singapore is projected to grow as the population and its income increase, providing more potential market share for JUMBO. Additionally, despite the restrictions of the pandemic that caused a decline in JUMBO’s revenue, as was discussed in Part A, the popularity of food delivery applications is increasing. Hence, people are willing to order seafood to their homes to have a luxury dining experience. The downside of this is, however, the lack of JUMBO’s unique luxury dining atmosphere that one can get when visiting one of the restaurant’s locations.

Table 1. JUMBO Seafood’s SWOT (created by the authors).

Table 2. TOWS for JUMBO (created by the authors).

Analysis of JUMBO’s Business Level Strategy

Based on how JUMBO approaches the management of its restaurants, one can argue that their management uses a Defender strategy. According to the Miles & Snow organizational strategies, businesses have to match their goals to the plans and strategic actions (Daft, 2020). The Defender strategy means that JUMBO tries to maintain its position in the market without being at the forefront of innovation. According to Daft (2020), these companies “seek to hold on to current customers,” and focus on “internal efficiency and control” (p. 50). Hence, they try to maintain the quality of their foods at a high level and the positive experience of their visitors. JUMBO offers the same signature foods they have had since their first location was opened. However, no company can operate without making some changes, even with a Defender strategy (Daft, 2020). For JUMBO, this includes opening new locations, launching their website, and selling their signature sauce as a retail item. This strategy is appropriate for stable or declining industries. However, with COVID-19 challenges, JUMBO will have to adjust.

VRIN

Table 3 is an assessment of JUMBO based on the VRIN framework. Based on this assessment, JUMBO’s approach to managing its operations in terms of quality, supplier management, human resources (HR) policies, and know-how are the organization’s primary resources. Focus on quality is another factor since JUMBO has established a Central Kitchen facility in Singapore to “maintain stringent quality standards and consistency in the taste of its signature dishes, increase productivity and lower costs” (JUMBO Group, 2020, p. 1). Most importantly, other restaurants cannot copy JUMBO’s atmosphere and their approach to creating a luxurious yet comfortable experience for their guests, as well as the unique recipes that JUMBO has.

Table 3. The assessment of VRIN for Jumbo (created by the authors).

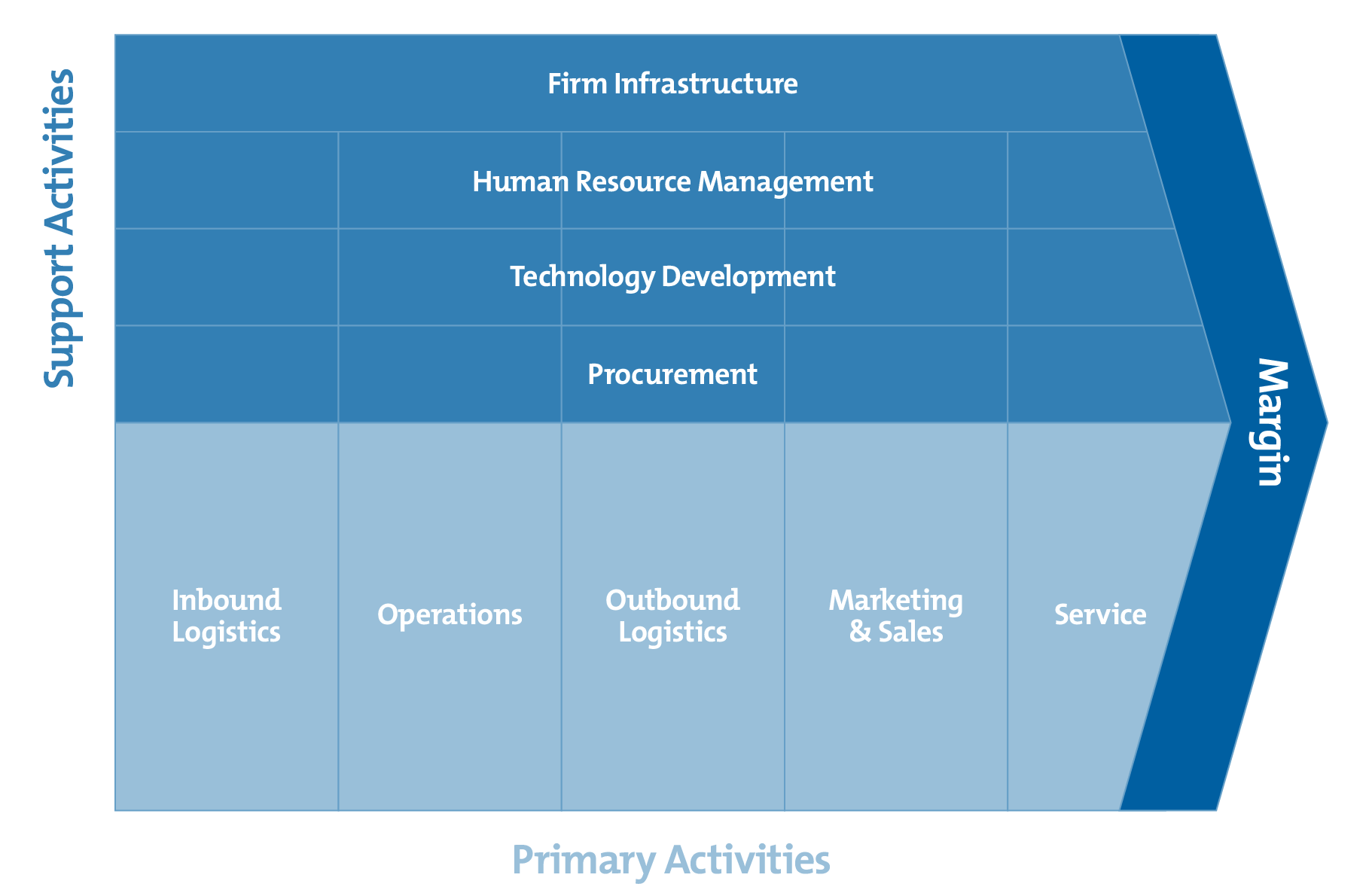

Porter’S Value Chain

Porter’s value chain analysis is a framework that allows to analyze the processes that contribute to the businesses’ offer. JUMBO Seafood creates value by taking seafood, creating their signature dishes, using skilled and trained personnel to hold the guests, and creating an excellent atmosphere for its visitors. The bigger the value that a company creates and the lower the costs, the more profit margin the organization receives (Daft, 2020). Figure 1 shows elements of Porter’s value chain that will be analyzed for JUMBO.

Primary Activities

- Inbound Logistics: JUMBO relies on the supplies of seafood from foreign companies and has to collaborate with distributors rather than having a direct contract with producers. In addition, the seafood safety standards require JUMBO to pay close attention to how the product is transported, received, and stored. The Singapore Food Agency (n.d.) had a set of standards for handling these products. For example, most chilled seafood and fish can be stored only for one to two days. Moreover, JUMBO Group (2020) states that the organization’s restaurants use fresh produce, which requires special attention to avoid contamination and poisoning.

- Operations: The atmosphere that a restaurant creates is one of the elements crucial for the business’ success since food and types of dishes can be imitated by the competitors (Liu et al., 2018). According to JUMBO’s website, this restaurant chain aims to bind people through food (“JUMBO Seafood,” n.d.). The operations of the firm influence the atmosphere and the experience, and JUMBO manages this by having a JUMBO Group, which is responsible for all the brands in this network. The group has unified marketing, supply chain, and quality units that help all restaurants.

- Outbound logistics: typically, JUMBO would provide their foods to the customers at their restaurant locations. However, with the pandemic and social distancing restrictions, the group had to change its approach to outbound logistics (JUMBO GROUP, 2020). Currently, JUMBO offers deliveries through its website, and the launch of the HACK IT brand that is focused solely on takeaway foods and deliveries shows the organization’s commitment to works towards creating cohesive delivery and takeaway systems. In the annual report for 2020, the company’s management declares their commitment to focusing on food delivery. Hence, JUMBO was forced to change their outbound logistics strategy from an on-site provision of dishes and luxury restaurant atmosphere to takeaways and deliveries.

- Marketing and sales: JUMBO uses social media as one of the tools to promote its restaurants. According to JUMBO Group (2020), this company has spent over $1.7 million on marketing activities in 2020. Although this is an accumulative number for an entire group, the data shows that JUMBO dedicates substantial budgets to the management of its marketing activities. Next, the company also uses traditional advertisements such as billboard ads to attract visitors to its locations. The promotions often include deals, for example, 20% of the bill (“JUMBO Group promotion,” n.d.). Hence, JUMBO has a strong focus on marketing and advertisement of its seafood restaurants. Apart from this, to maintain a connection with the customers, JUMBO uses a third-party vendor to send text message notifications after the customers leave JUMBO’s locations. These messages ask for a rating and feedback, which allows monitoring the satisfaction with the services and foods (JUMBO Group, 2018). Additionally, visitors are welcomed to leave feedback on JUMBO’s webpage or social media account. Arguably, this attention towards monitoring the experiences of customers allows JUMBO to add value to the experience and build relationships with the consumers.

- Service: In terms of service, the personnel that JUMBO Seafood has is the determining element of success. According to Bos et al. (n.d.), JUMBO uses the 7 Driver framework to train and develop its human resources. Moreover, JUMBO continuously creates new programs that will motivate the staff members and encourage them to work better. To maintain a connection with the visitors, JUMBO sends out text messages after guests leave their restaurants to ask them about the experience (JUMBO Group, 2018). Hence, JUMBO’s service is linked both with on-site interactions with the consumers and the maintenance of communication with guests after they leave.

Support Activities

- Procurement: JUMBO partners with suppliers and distributors to receive their fresh seafood. JUMBO Group (2018) states that the company has a set of quality standards that each of its suppliers has to adhere to if they want to deliver products to any of JUMBO’s restaurants. Next, JUMBO uses only high-quality products and cooperates with reliable vendors. With seafood, this is especially important because this group of produce is dangerous if it was transported and cooked incorrectly. Hence, JUMBO’s supply chain management is designed to ensure that the restaurants receive good quality food. Apart from this, the cost of the food is considered before supplier agreements are made. JUMBO Group (2018) states that each supplier is evaluated based on their prices, licenses, and quality assurance programs. However, the quality and compliance with regulations is the main factor that JUMBO’s management considers with procurement. Each month, quality assurance managers select two suppliers and visit their facilities to evaluate their compliance with standards, hygiene, maintenance of facilities, and other factors (JUMBO Group, 2018). Moreover, upon handling the seafood, the team performs lab tests for the bacterial count, and the delivery can be rejected if the standards are not met. Hence, JUMBO has a strong

- HRM: According to JUMBO GROUP (2020), the company has accreditations from the Singapore Workforce Development Agency and Singapore’s Institute of Technical Education. This means that they are qualified to hire and train personnel in accordance with the local laws. However, for a restaurant business, the employees that interact with the visitors are a factor that impacts the latter’s experience. Uslu (2020) argues that the friendliness and attitudes of waiters impact the customer’s satisfaction with their visits to a location. Hence, for a restaurant business training, the personnel to be friendly and welcoming is vital and creates additional value from the perspective of the visitors.

- Technological development: The development of technology had become important for the restaurant businesses when the pandemic began since many establishments reverted to delivering food to customers while their facilities were closed for visitors. Gunden et al. (2020) argue that technology will continue to play a role for restaurants, and food delivery will become a vital distribution channel for them in the nearest future. JUMBO has a platform for implementing online sales and delivery since it recently launched its HACK IT brand.

- Infrastructure: In terms of infrastructure, JOMBO’s main advantage is the number of restaurant facilities and their variety. The group currently operates in 15 cities and had 39 locations under its management (JUMBO Group, 2020). This allows JUMBO Seafood to leverage the benefits of lower costs since the central management is in charge of activities such as quality assurance or marketing. Hence, the fact that JUMBO Seafood’s administrative management is handled by the Group and not the individual restaurant, this location benefits from lower costs.

Final Recommendations, Strategies, and Implementation

Based on SWOT and Value Chain, the recommendation for JUMBO is to establish its JUMBO delivery service, which will focus specifically on takeouts and deliveries. Considering the information from SWOT and TOWS, JUMBO’s management should consider reverting to a Prospector strategy under Miles & Snow’s typology. The pandemic, its social and economic consequences will require changes in the way customers perceive dining experiences and more focus on at-home dining, deliveries, and takeouts.

For the Prospector strategy, a company has to invest in the research and development of new products or services (Daft, 2017). Moreover, this applies to not merely opening locations in new cities but to changing how JUMBO sells its seafood experience to the consumers. By choosing food delivery as a strategic focus JUMBO will be address the disruptions that arise from coronavirus and account for the 30% decline in sales while leveraging the resources that the company already has.

Marketing Mix

- Product: The main recommendation of this report is to launch a separate service JUMBO Delivery that will focus specifically on takeaways and deliveries, offering customers to experience JUMBO’s signature dishes at home.

- Price: JUMBO Seafood is a luxury seafood dining place with an average cost per dish at $68 (“JUMBO Seafood Menus,” n.d.). This price is higher when compared to other seafood locations in Singapore. Hence, one recommendation is to develop dishes that can be sold at a lower price to tailor to the customers who are wary of the economic problems globally. This can be done by partnering with local producers and suppliers and using their fish and sea products instead of importing from the United States or other countries. However, as for the price of the dishes that JUMBO already has, the recommendation is to retain the current prices since seafood is potentially dangerous if the quality of raw materials is impaired (“Seafood safety overview,” 2020). Hence, by maintaining the price, JUMBO will be able to cook from high-quality seafood as before.

- Place: JUMBO’s management has already acknowledged that the restaurant’s strategy will have to change from the focus on the in-restaurant experience to deliveries (JUMBO Group, 2020). Hence, although the restaurants will continue to operate as usual, JUMBO has to develop a way to deliver the same luxury seafood experience to the customer’s homes. Additionally, this will require a change in how the internal logistics are managed and approached. Preparing the food for the delivery service can be managed through JUMBO Group’s Central Kitchen.

- Promotion: Social media advertisement is the best selection for the post-pandemic advertising and promotion of food delivery services since people leave their homes less often. JUMBO can offer discounts to people who will download its food delivery application and to those who recommend it to others.

- Process: In the process sector, JUMBO has to address two issues: lowering costs and providing deliveries to customers. The first option is linked to the losses that JUMBO had during 2021. The second is associated with COVID-19 restrictions and the changing consumer behavior since more people choose to dine at home. Some examples that arise from this report include collaborating with local seafood producers, who currently receive government support and overfish Singapore’s resources (The Fish Site, 2021). This can help lower JUMBO’s costs since Supartini et al. (2018) found that higher demand among young people is associated with lower prices for seafood.

- Physical Evidence: In terms of physical evidence, JUMBO has an established brand image and consumer trust. However, if JUMBO wanted to separate its main restaurant business from the new strategy, it should create “JUMBO Virtual,” which will focus exclusively on deliveries or takeouts. The inclusion of “JUMBO” in the title will help customers recognize this brand.

- People: Finally, it is evident that JUMBO will have to transfer to the Prospector strategy to address the COVID-19 disruption. The revenue decrease that the restaurant chain has had is associated with the decline in tourists, who were a large portion of JUMBO’s customers, and local restrictions for restaurants and public spaces. The Prospector strategy will stimulate JUMBO’s recovery because the company will have to look for ways to adjust. However, the Prospector strategy requires an environment and people capable of creative thinking, which is why JUMBO needs to adapt its training practices. Hence, apart from the current training and development practices, JUMBO should invest in fostering innovation. This measure will help the restaurant with creative ideas for the delivery and new menus.

Implementation

Since COVID-19 has already affected Singapore’s restaurant industry, JUMBO has to use the resources it has to speed the implementation of its takeout and delivery service. JUMBO can use HACK IT’s a platform as a blueprint for its service and partner with local delivery services. JUMBO Group’s central kitchen can serve as a location for preparing and distributing food across Singapore. The biggest changes that JUMBO will have to make are in the human resources field since the restaurant will have to hire couriers and train them. Social media and online marketing will be used instead of traditional marketing since the delivery platform will be available online through JUMBO’s website or smartphone application.

Conclusion

In conclusion, JUMBO has had a great position in Singapore’s fine dining and seafood restaurant industry prior to COVID-19. The disruption caused a substantial decline in sales and the need to revert to the Prospector strategy. The recommendation for JUMBO is to mimic HACK IT’s a strategy and focus on food delivery and takeout through its Central Kitchen and promote this new service titled “JUMBO Delivery” through social media.

References

Bos, P., Chow, L., & Choo, C. (n.d.) How JUMBO Seafood is paving the way to international growth. EY. Web.

Daft, R. L. (2020). Organization theory & design.

The Fish Cite. (2020). Singapore sets up $50 million aquaculture, agriculture innovation fund. The Fish Cite. Web.

Gunden, N., Morosan, C. & DeFranco, A. (2020). Consumers’ intentions to use online food delivery systems in the USA. International Journal of Contemporary Hospitality Management, 32(3), 1325-1345. Web.

JUMBO Group. (2020). A fresh approach. 2020 annual report. JUMBO Group.

JUMBO Group. (2018). Sustainability report. JUMBO Group.

Jumbo Group promotion. (n.d.). Web.

JUMBO Seafood. (n.d.). Web.

JUMBO Seafood Menus. (n.d.). Web.

Liu, P. & Tse, E.C.-Y. (2018). Exploring factors on customers’ restaurant choice: An analysis of restaurant attributes. British Food Journal, 120(10), 2289-2303. Web.

Mind Tools. (n.d.). Porter’s Value Chain. Web.

Nguyen, T., & Vu, D. (2020). Food delivery service during social distancing: Proactively preventing or potentially spreading coronavirus disease–2019? Disaster Medicine And Public Health Preparedness, 14(3), e9-e10.

Online food delivery. (2021). Web.

Seafood safety overview. (2020). Web.

Singapore’s Department of Statistics. (2021). Retail sales index. Web.

The Singapore Food Agency. (n.d.). Seafood. Web.

Statista. (2021). Per capita seafood consumption in Singapore from 2010 to 2019. Web.

Supartini, A., Oishi, T., & Yagi, N. (2018). Changes in fish consumption desire and its factors: A comparison between the United Kingdom and Singapore. Foods, 7(7), 97. Web.

USDA. (2017). Singapore. Seafood report 2017. Web.

Uslu, A. (2020). The relationship of service quality dimensions of restaurant enterprises with satisfaction, behavioural intention, eWOM, and the moderating effect of atmosphere. Tourism & Management Studies, 16(3), 23-35. Web.