Introduction

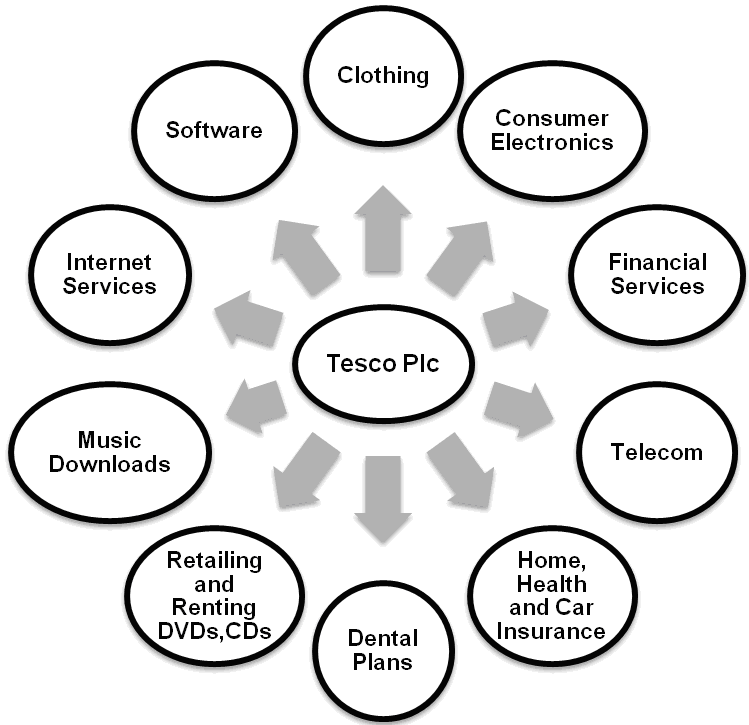

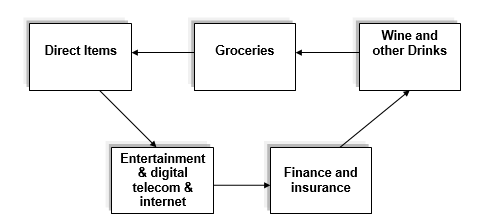

Tesco Plc is the largest grocery and general retail chain merchandising business in British with International priorities, which has about 2,318 stores worldwide. Every year its profits arises about £2 billion and become the fourth-largest retail business in 2008. It also provides the following services-

Overview of Tesco Personal Finance

From different types of Tesco’s services, it has also provided banking and insurance services, which is called Tesco Personal Finance. It is mainly a telephone and internet-based commercial bank situated in UK. Before 2008, Tesco and Royal Bank of Scotland are owners of Tesco with 50:50 joint ventures.

There are various types of products and services offered by TPF in the banking and insurance sectors, which are shown in the following graph:

Task 1:

Introduction

This management report has discussed Tesco’s strategy, the current position in recession, and justification of their strategy. This task will consider the strengths, weaknesses, threats, and opportunities of Tesco Personal Finance and this report will analyze its environmental position. To discuss competitive force, it should discuss Porter’s five forces and the board trends of this company would be considered.

Offer of Commercial Banking without RBS

On July 28, 2008, Tesco was determined to buy 50% of the ownership of Royal Bank of Scotland with £950 million, to hold individual ownership and offer consumer-banking services from Tesco Personal Finance only.

Tesco’s Strategic Decision on Consumer Banking

In the strategic decisions of Tesco, they are planning to open 30 branches of the store with Tesco Bank, which they are targeting only to capture the market. In order to do this, they are going to use promotional tools like posters and leaflets, which can be very low-cost advertisements, can be used as competitive advantages for the company. On the other hand, direct customers are conducted through posting, phoning, or internet within 2010.

According to Kotler (2006), strategic decision can be three types, which are:

- To do more with less: In this type of decision, organizations are being more efficient in growing any sectors, like product development, or welfare of budget.

- To drive new business development: When any business or organization is taking decisions on new business development, they have to consider new markets, new distribution channels, new lines of business rather than only launching new products in the market.

- To be full business partner: When the partner of a joint venture organization is taking the decision of being a central business partner, which helps to drive more profits and market share.

Strategic decision of Tesco is like the third type of decision, where, Tesco is going to be fully owned business without any ventured of Royal Bank. As TPF was taking advantage of present recession by improving themselves and their profits without any sharing of joint ventures, the strategic decision is taken by them for business success and profit.

In the corporate strategic planning decisions, there are some statements that have to be prepared by the company, Tesco is no different from it. In the planning activities of strategic decisions, there are four steps to be considered:

- The main mission of Tesco is to create value for customers to earn lifetime loyalty by implementing some social and environmental challenges.

- Any Strategic business unit has three major characteristics, which are:

- To operate a single business or collection of business is planned to separate from other companies.

- To set of competitors

- Responsibility for strategic planning is implied to the business manager.

For Tesco Plc, to be separate business as personal finance without joint venture of Royal Bank is an important strategic business unit for the company.

- For new strategic business unit, Tesco has been promoted to new branches of store banking in Blackpool, Coventry, and Bristol with existing offers of insurance, credit cards, loans and savings accounts and with new offers of current accounts.

- As Tesco is divided from Royal Bank by expensing huge amounts of money, they have a greater chance to decrease its business in the competition of other financial service businesses.

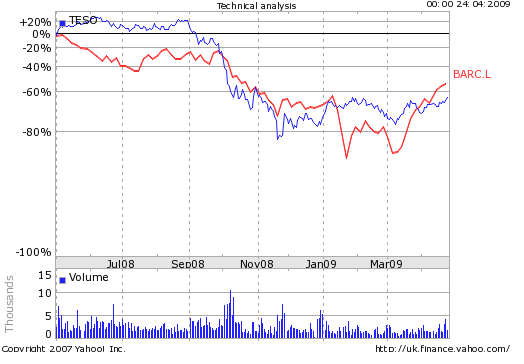

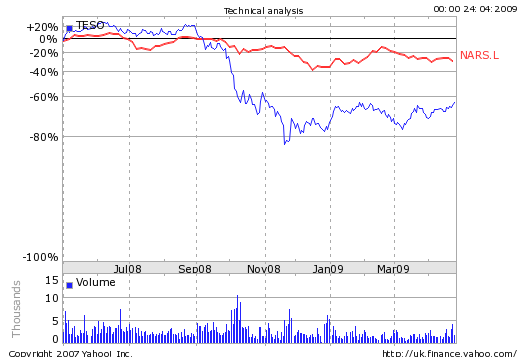

The chart has demonstrated that from the end of the financial year 2008 its market position is decreasing; therefore, the changes of strategy were opportunistic decisions for Tesco.

SWOT Analysis of TPF

The total evaluation of TPF is determined as SWOT analysis, which is:

Strengths: The strengths of TPF services are mainly focused on the internal strengths of Tesco as a banking and financing organization, which are:

- Brand Awareness among Customers: The value of the brand is successfully aware by customers, because of operating its financial service since 1997 in the market.

- Strong Financial Position of TPF: TPF is in very good financial health in the market, as considered one of the top levels brands in providing financial services.

- Increasing Market Share: TPF has a tremendous market share of 23%, with the help of Tesco Plc. Regional support is the main reason for increasing market share.

- Tesco Online Services: TPF provides online services of financial, banking and insurance services for capturing market.

- UK Market Leadership Resistant: TPF has successfully captured the domestic market of UK with the help of resistant leadership.

- Flexibility: TPF has to build itself in such a way that, it can adopt any environment of market situation both globally and local way.

- Develop Capability: TPF has to consider skilled employees, proper process in business and holding brand in market can develop capabilities of doing business properly.

- Significant Contribution to Perceived Customer Benefits: TPF has to provide such products and services, which are perceived different from competitors’ products and services, and also seems to be beneficiaries for the customers.

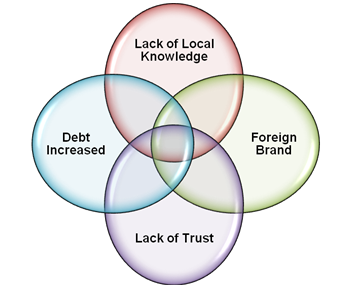

Weakness: As TPF recently released from a joint venture with Royal Bank of Scotland, some weakness arises which are:

- Lack of Local Knowledge: TPF is not known to the local market, although it runs its business for more than 10 years.

- Debt Increased: as TPF is being separated from Royal Bank, to meet up £950 million dollars will increase debt.

- Lack of Trust: With the trust of Royal Bank, many customers make transactions with TPF. However, after the joint venture between them is no longer exists, the previous customers were in lack of trust in TPF.

- Foreign Brand: As a foreign brand in global market, TPF is unable to capture the international market.

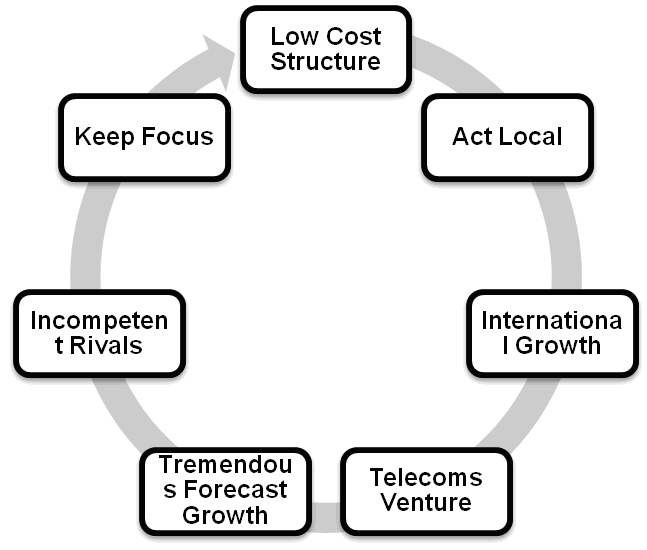

Opportunities: There are some useful opportunities for TPF, which are:

- Low-Cost Structure: The low-cost structure of financial services in time of taking banking services, loan facilities and insurance facilities is one of the major opportunities in TPF.

- International Growth: As the local market is being aware of TPF, in the mid-time, the scope of international growth is also available to it.

- Telecoms Venture: Telecom services are used in financial and insurance services. For this reason, it can be used as good opportunity for TPF.

- Tremendous Forecast Growth: By entering large economic market, like China, Tesco Personal Finance can build so fast forecast growth in the market.

- Incompetent Rivals: TPF can choose such products and services in banking and insurance companies, competitors are unable to imitate such products and services for their customers.

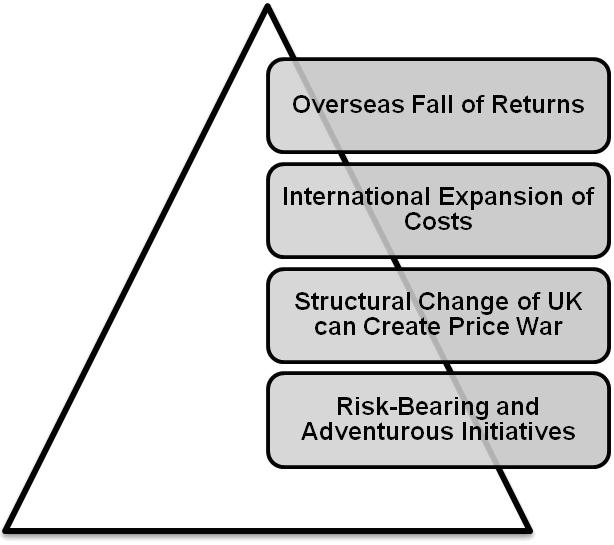

Threats: Threats are the external dimensions faced by Tesco Personal Finance, which is given below:

- Risk Bearing and Adventurous Initiatives: Initiatives for new market development could be risk-associated and adventurous, which could be harmful to TPF.

- Structural Change of UK can Create Price War: The competitors can become hostile investors in price. For TPF as a price leadership, it could create a step down from profitability of the business.

- International Expansion of Costs: The costs of doing business in international market can incur costs or expenses of the business, which may create fall down on the company’s profits.

- Overseas fall of Returns: The profit or return from the international market may not be suitable for local business operations for inflation, global change in pricing system etc.

Strategic Formulation of TPF

Tesco is continuing its financial operations without the help of other banks; it is difficult for maintaining the traditional roles of lenders by TPF. The announcement of expanding business is coming from 56% of financial services. The finance results in only 9% business growth in market.

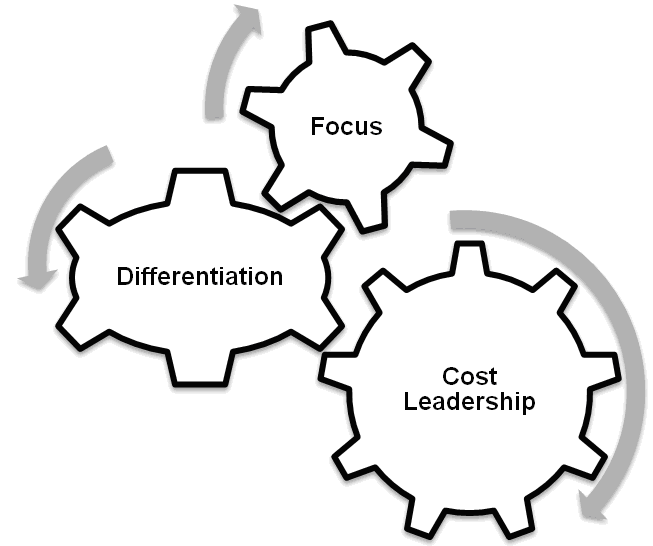

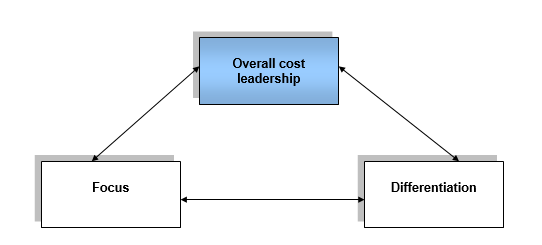

Tesco’s strategy formulation can be created through three steps, developed by Porter, which are:

- Cost Leadership: In the first strategy, TPF can control costs and provide low-cost costs services to the customers. Cost leadership can be maintained by reducing operating costs.

- Differentiation: TPF can be different from its competitors in providing unique features to the product and services, which can increase customer value, customer loyalty and price elasticity.

- Focus: In the focus strategy, first TPF has to focus on the internal market rather than the global. Specific markets for choosing in delivery of products can pursue also cost and differentiation.

Strategic Implications of TPF

The strategies discussed above can be implemented effectively in two ways:

- Development of Market: Market can be developed by using growth drivers of the company’s revenue and expansion strategy with the level of consumer spending on products and services. For TPF, three factors are considered in the development of market, which is, sustainability, acceptability and feasibility.

- Diversification of Product Development: The changes in business environment create opportunities to create new products and services for the market. The changes of new product lines, developing R&D, and additional spending can create diversification in product development in TPF.

Whether Taking Advantages of the 2008 turmoil

The current recession is defined as turmoil. The reason is the unintentional disorder of the economic condition of the industrialized countries in the world. This recession was firstly started in USA, but after that, it spreads out in almost all parts of the world. The effect of the recession will vary from industry to industry. The key issue was the credit market. Thus, most the financial organizations are affected by this.

Tesco took this situation as a way to promote their retail-banking image. They tried to advertise the failure of general-level street banks. As because, people do not want to perceive the risk to lose their money, Tesco advertised that, retail banks are much safer than street banks. The street banks created the credit-related problem and many banks failed to return the money invested by the people. For this, Tesco takes the turmoil as an opportunity and to expand their business and profit, they have bought the total share of Tesco’s Personal finance.

Assessment of Broad Trends and Competitive Forces of Tesco Personal Finance

To analysis the competitive forces of TPF, there are some frameworks to assess properly, which are discussed below.

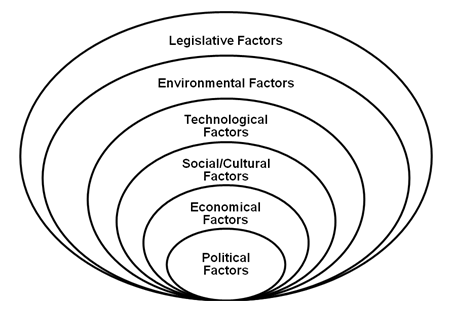

PESTEL Analysis of Tesco Personal Finance

- Political Factors: To operate in the local market, Tesco Personal Finance has to consider the political factors of the UK, including the European Union. In the international market, the operating environment considering political factors, is totally different from one country to another country. The performance of TPF can be increased when the support of political factors can be gathered.

- Economical Factors: The influential economical factors for Tesco Personal Finance are demand, costs, price and profits of the products or services. Some other important economic conditions are unemployment levels, inflation rate, recession situation, which can affect TPF’s profits and business.

- Social/Cultural Factors: Social changes and cultural trends also affect Tesco’s Personal Finance business. The demographic changes like increasing female workers, developing supply chain, focusing on value-added products and services have impact on the business of TPF. The demand for products and services is also demanded based on social factors.

- Technological Factors: Technological factors are influencing and great opportunity for the development of Tesco Personal Finance products and services. There are some technologies developed by TPF:

- Environmental Factors: The responsibilities toward societies and environments are more focused in today’s world. TPF has to maintain corporate social responsibilities and governance of stakeholders with the obligations to operate the business in the market.

- Legislative Factors: Governmental legislations and policies are driving Tesco’s Personal Financing business to the customers. Some products can be banned by Government. The political implementations influences on correct pricing policies of products and services offered by TPF.

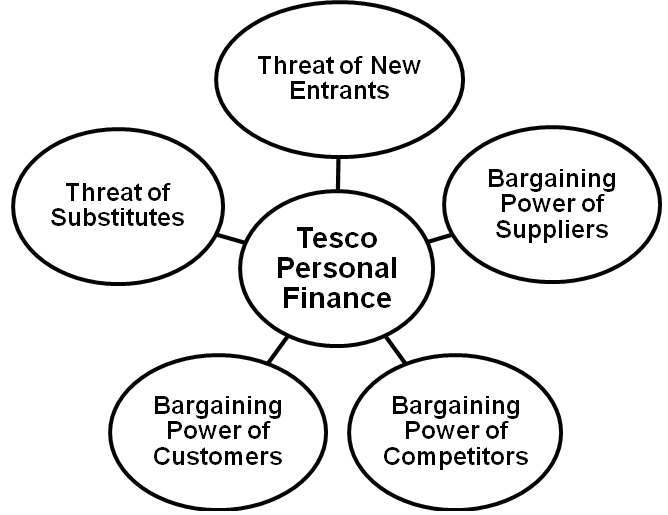

Porter’s Five Forces Model Analysis in Tesco Personal Finance

- Threat of New Entrants: Primarily, there are few competitors existing in the market for TPF. The development of large supply chain and huge marketing mix expansion is one of the major strategies of entering into the market of banking and financial services. Products and services can also be imitated easily by new competitors, who have large fixed costs and developed value chain. The economy of scales and in different products and services bring the scope of new entrants in the market.

- Bargaining Power of Suppliers: The powers of suppliers mainly depend on the value chain from Tesco Personal Finance to the potential customers. If TPF cannot capture the supply chain in the market, competitors can take the advantage of supply chain and reduce the profit margins of TPF.

- Bargaining Power of Customers: When Tesco Personal Finance can provide standardized and different products and services to the customers, the power of handling them is stable. Otherwise, the switching costs to other competitors can arise. TPF has to have the ability to capture global and local markets by meeting up the expectations and aspirations of customers about TPF.

- Threat of Substitutes: General substitution can reduce the demand of Tesco Personal Finance, which is almost working as threat to competitors. If the substitute products or services provide better results than TPF, then customers are choosing substitute products as an alternative.

- Bargaining Power of Competitors: The growth of banking and financial services is going very rapidly these days. For this reason, large competitors with the concentration on customers’ value, utilization of opportunities and strengths, and meet the increasing demand of customers, can easily capture the place of Tesco Personal Finance business. For focusing on the market, TPF has to respond to the changing consumer behavior, price and value of its services

Broad Trends of Tesco Personal Finance

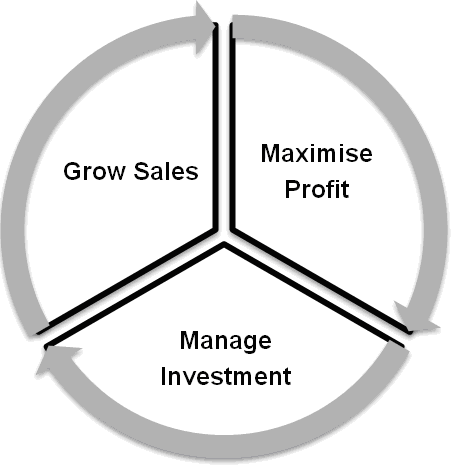

- Corporate Social Responsibilities of TPF. The corporate social responsibilities are determined by sales growth, profit maximization and investment management of TPF. The growth of sales is confirmed with the offering of different services, and is obviously, sales growth will bring profits more. The proper way of management is also the responsibility of investors in TPF services.

- Corporate Governance of TPF. TPF has developed high standards of corporate governance, which is considered as Combined Code Principles of Good Governance and Code of Best Practices in 2008. The approaches of Corporate Governance are:

- Financial Trends of TPF in 2008 and 2007. The trends of profit of TPF, when it is joint ventured with Royal Bank of Scotland are shown:

Table: Profits of TPF and Royal Bank of Scotland

The portion of profits got by TPF was shown below:

Table: Profits of TPF

As seen by the above two tables, although the profits are increased 28.7% in 2008, the profits of TPF are decreased.

Conclusion

Tesco Personal Finance is a faster rate of growth providing new products and 20% rise of price on online sales with 5 million customers with the range of 26 products and services. Although TPF is in position of difficult financial services market with bad debts and credit cards, the insurance facilities can have the possibility of strong profit growth. It also provides internet savings and child trust fund accounts, Tesco Finest Health Insurance and Dental Insurance. With the strong identity of the branding and service delivery, Tesco Personal Finance has met up cultural sponsorship, political controversy, and consumer experience and brand extensions.

Task 2

Introduction

In order to discuss the resources and capabilities of Tesco, it will consider the strengths and weaknesses of Tesco and consumer banking system and level of competition. Every week it is serving millions of customers through different types of products and services. It provides varieties of services such as:

Its financial services are also accepted perfectly by the customers. Mainly, in UK, its financial services served the UK customer with dignity and effectiveness. The financial services offered by Tesco are:

Recently Tesco has taken a new strategy to expand its operation internationally and in many sectors. It has divided its operation in mainly two criteria- food items and non-food items. It has strategically taken the innovative offerings in retailing of non-food services. Their ultimate target was to create the value of offerings to attain the lifetime loyalty of the consumers. It has some strategies to fulfill some goals and these goals are:

Last year the TPF got 1.7 million new customers. Introduction of new services and products were the reason behind this. Health insurance, dental insurance and internet savings accounts got new services. The total profit earned by Tesco personal finance was 128 million pounds last year. Tesco got 64 million as per 50%. But the expense was almost 31 million pounds because of the flood-related insurance compensation. Tesco beard 11 million pounds of the total claims. From this discussion, it becomes enlightened that, Tesco’s personal finance is now achieving a little profit. This small profit is not enough to do better operation in this sector.

Analysis of Tesco’s UK strengths and weaknesses

Before attempting to discuss the strength and weaknesses of Tesco’s competitor, it should consider Tesco’s own performance and resource capabilities and the following figures are shown the sales performance and Number of stores of Tesco PLC –

Strengths

- Tesco personal finance is achieving more and more milestones. For example, in 2003 the insurance service achieved 1 million motor insurance policies. All its sectors like Credit cards, savings, deposit schemes, pet insurance, travel insurance & life insurance are continuously increasing its capability to launch a fully operated bank. The key strengths are:

- International Market: Tesco is the largest grocer in the UK and the third-largest grocery retailer in the world. Its operation includes both domestic and international markets and it has almost 440000 employees worldwide including 12 international markets. Therefore, it has strong financial capabilities to expand its business all over the world.

- A widely established brand: As Tesco has a widely popular brand-awareness among the people of UK, its banking operation can also get the brand equity. Presently, Tesco has a banking service. But it has only 50% share. After the acquisition of 100% share, it can use its present brand value to promote the new undertaking.

- New collections of services: Tesco is going to introduce various types of services along with the existing services. These new collections of services will attract new customers.

- Knowledge and experience: Tesco has the proper and appropriate knowledge and expertise to do banking operations because it has almost all banking services now. Knowledge regarding doing the business can be effective to do the business on a large scale.

- Good planning and timing: Tesco planned to enter the market at a time when the banking sector is just trying to do better after a downsizing. This is strength for Tesco in a sense that customers are now becoming more sensitive to evaluate the strategy of every bank for their investment. If they do so, Tesco can have good reconciliation, because they have good recognition and brand image.

- Acquisitions: Tesco is going to purchase the 50% stake of its finance from Royal Bank of Scotland. This acquisition will help to get an autonomous power over the operation. Now, Tesco can enjoy the total profit without sharing it with RBS.

- Shareholder: Shareholders are a key strength of Tesco. They are generating the ultimate investment capacity for it. Thus, shareholders can be a major strength for establishing a new banking service.

- Technologically: Technologically Tesco is very advanced. It is using online technology fully in its personal finance operation. Various types of Tesco services are available online and many different types of technologies are used in every stage of service offerings. This is strength in a manner that, this technological orientation can smooth and quick the service delivery and increase the service quality.

- Service quality: From time to time Tesco achieved a great fame for its ultimate customer-oriented service quality. It always offers the best things in whatever service or product. Thus, this fame will help it to run a new bank with the same fame.

Weaknesses

- Cut off financial resource: To buy the 50% stake from the RBS, Tesco needs to invest a huge amount of money. This extra investment can create pressure on its other business sector and it may make the financial condition of Tesco fragile. Besides, to run the total bank, it must bear the total expense, which will result in a possible cut down in financial resources.

- Limited market: Now, initially Tesco is going to operate in the local market. Thus, its market segment becomes limited and thus the profit opportunity also remains limited.

- Lack of complete knowledge: Though, Tesco has previous experience in doing operations in financial sector and banking operations, it may become insufficient in many cases. It does not have the complete knowledge of doing the business, designing and delivering the service and arranging the total banking systems. For this, they may hire people of great skills and thus may pay a high amount of currency.

Analysis of the UK consumer banking system and level of competition

The consumer-based baking system is a most recent idea. It means to become customer-oriented and drive to achieve customer satisfaction. It is closely related to retail banking. In the UK, the banking system compiles and practices these two ideas. The UK banking system is a unique one. The four or five largest European banks are UK-based.

The credit condition is an important part of the UK banking system. Since 1970s, the far-reaching liberalization of the customer-based credit condition was happened, mainly in mortgage market. Housing market and purchasing pattern of the customers designed the implication for the liberalization. These markets worked as a medium for the economic boom in 1980s. In 1990s, these markets helped the banking sector to retrieve from the recession. The conditions of UK banking sector were thus affected in 1980s and 1990s because the credit availability was changed and reduction of expenditure in the consumption

The credit condition index (CCI) measures the availability of non-price-related credits. This CCI is a key indicator of the banking system’s consistency. The UK banking system is consistently changing of different contingent consumer-related factors. These are:

Recently, the global banking system has faced instability. This instability is the most effective one since the First World War. The UK banking system is also affected by this change. The root cause is the global tendency of banking to become mass credit-oriented sector. The extended credit boom weakens the total banking system for the time being. Another cause is to become dependable to the extensive balance sheet development. These conditions are followed by the exclusive operation of technologies. Then, the less liquid assets and uncertain quality of credit is the ascending cause. The funding structures of the banks were becoming vulnerable from time to time. Thus, the key causes of present fragile banking system are:

These condition forces globally the destruction of many established bank. Thus, the consumer-banking sector is now in a vulnerable position globally.

The key issues of the present UK banking system can be analyzed through its vulnerabilities and the recommended or taken solutions. The vulnerabilities are of different types. Firstly, the high uncertainty involving the portfolio of the assets resulted in the risk of both macroeconomic and counterparty.

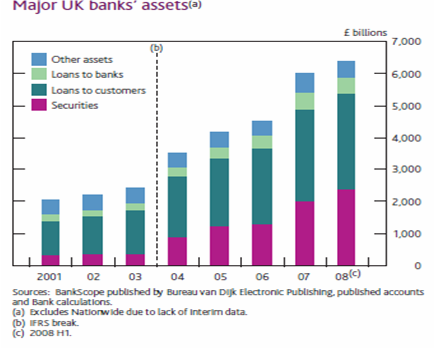

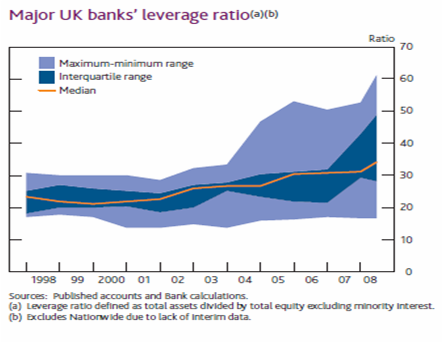

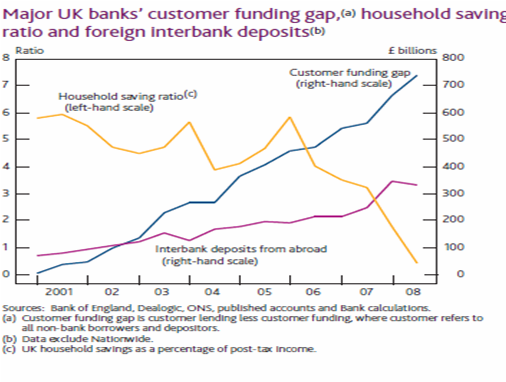

This chart above shows that the major banks of UK have greater credit against their asset. Then, Risk underpricing and the extension of financial statements in the means of under capitalization of the banks for a longer period of time. These decrease the level of confidence in the banking system. This condition is clarified by the chart below:

After that, the total UK banking market becomes dependant on the funding market. This results in rising in rollover risk. The chart below illustrates this fact by drawing relationship between the consumer-funding gap, household savings ratio and foreign bank deposits.

Finally, globalization of financial materials and variations among different funding models in different countries is affecting the banking system of UK and discourages the interconnections with foreign banks.

The government is now trying to create a friendly and helpful environment for the banking sector. By supporting recapitalization of both the banking system and the public funds, the government is trying to overcome the situation. Through various operations of the central bank the government inserts extra liquid assets directly. However, the government should consider using the regulatory framework and recently accepted counter cycling policies to deafen against the systematic risk. The regulatory process is designed and imposed by the FSA. It makes the transparent market condition, which shapes the competition. This competition among the banks mainly depends on some key factors. These are:

- Globalization: The banking sector like other business sectors, is becoming globalized day by day. Now, a bank of UK is not far away from a bank of Australia. Besides a Bank of South Africa, for example- the standard chartered bank, operating in Asia and other regions. Thus, the global level of competition among different banks shapes the UK banking sector more competitive.

- Favorable economic environment: The economic climate is now becoming friendly for the banks. For the competition among the banks to generate best profit is a common dimension in UK banking sector. In past years, the banks were continuously transformed into a capitalized mood and the reservation and collection of assets were strong.

- Risk management: The bank that is able to manage its risk more efficiently and effectively, is termed as the most successful one. This dimension creates a new level of competition in the banking system. In past years, almost all banks have developed the management of their market and credit-related risks effectively. This level makes the banking market more competitive.

- Elevated profile regulation: The regulators of the banking sector keep pressure to manage the reputation of the banks lawfully. To do so, the banks become more sensitive to regulatory factors. These factors force the banks to operate in a strict way, which makes the market more competitive.

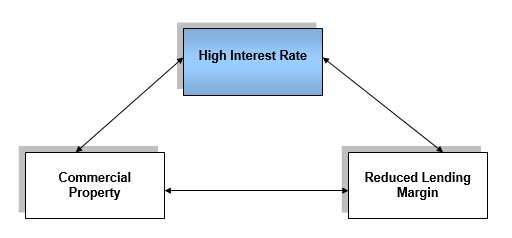

The UK banking sector is facing some macroeconomic competition. Firstly, the banks are practicing now high-interest rates. This night’s interest rates reduce the customer’s participation. Secondly, the a reduced margin of lending. The strong competition in this sector declined the margins to a lower level. Thus, there arise two major types of risk downsizing. One is the excessive growth of volume and underpriced risk holdings. Thirdly, the property is owned and managed by commercial entities. Commercial properties are used as a lending instrument for time being. This practice is becoming high in recent times.

The key challenges faced by the banks in the completion of the UK banking sector are strategic ones. The growth of the earnings of the banks can be compromised and the cost-cutting implies better essence. But the hard part is to achieve efficiency over the service offerings. Besides, the greater deliberation within the market has shaped the competition in a restricted manner of the aspect of the merger or joint venture. Thus, the competition includes some challenges. These are:

Challenges to Risk Management: The management of risk is a challenge to compete effectively in the market. Whether to reserve good current assets or to maintain a good asset turnover ratio are such types of challenges.

Regulatory developments: The regulation designs the each bank’s deposit system, lending and debt arrangements, reservation of currencies and the serving techniques of the customers.

Prudential challenges: this is a type of regulatory challenge that indicates the challenges regarding implementing a process effectively and efficiently. This challenge shapes the entire market in a manner that, each bank is now allowing to improve their operation by any means.

Wholesale challenges: the UK is a suitable place to do any kind of business. Thus the wholesale challenges are related to the banking sector are review works, hedge funds, growth of potential leverage and portfolio management.

Retail challenges: The main challenge in case of retail is to ensure the fair price of the service. Customers may turnout if the dispersion of service price is huge than others.

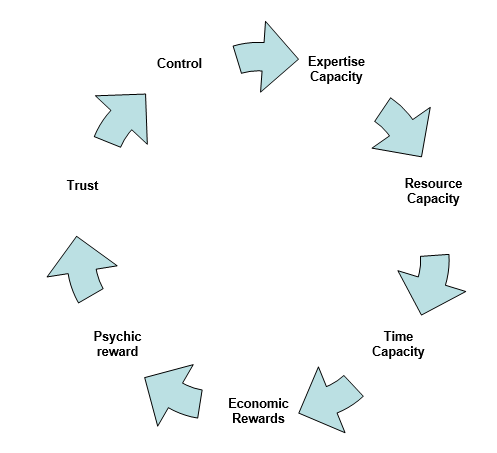

The present condition indicates that, the need for caution in case of prudential risk, because it remains low. For these, the competition level is basically decision-related. According to Zeithaml and Bitner, the main levels of competition as service perspective depending on decision are:

- Expertise capacity: The capacity to exercise required skills and knowledge’s in operation and delivering service.

- Resource capacity: The capacity to maximum use of the limited resource,

- Economic rewards: The profit earned by the service.

- Psychic reward: the mental satisfaction after a good transaction,

- Trust: The confidence over the process and the techniques,

- Control: Maintaining practice power of the control.

Assessment of whether Tesco can compete effectively

According to Michael Porter, there are three generic strategies to start a business for getting a good competitive advantage. These are:

- Overall cost leadership.

- Differentiation.

- Focus.

To offer a lower price than the competitors is a key step to becoming successful. Tesco’s primary objective should be to minimize the production and distribution costs. Thus, it can offer a lower price and can give the customer a greater interest. Tesco differentiated its products and services to satisfy needs of its customers all the way to a sustainable competitive advantage. This allows Tesco to desensitize prices as well as spotlight on value with the intention of generating a reasonably advanced price with a better margin. The reimbursements of differentiation necessitate Tesco to segment markets to target products and services at precise subdivisions engendering an elevated price than average. The differentiating Tesco would acquire supplementary costs in producing their competitive advantage.

To compete in a competitive market, service differentiation is an important factor. When, customers will find the service offering is differentiated from the others they will be motivated to go with it.

To compete effectively, Tesco should be focus on its market segments. If it fails to read the mindset of the customer segment, it cannot be able to design its service and thus fails to achieve customer satisfaction.

The major competitors of Tesco in the banking sector can be The Royal Bank of Scotland, Barclay’s bank, Halifax (Lloyds banking group), Lloyds TSB, Abbey, Standard Chartered Bank, Bank of Scotland, HSBC bank UK, National Westminster bank and so on. All of these banks are well established in their operation for long time.

The competitive advantage held by Tesco is its present acceptance of the customers. This acceptance may offer the bank to increase its customer and thus get good revenue. The growth rate of the Tesco group was 11.1% last year. Group profit before taxes was 5.7%, 14.2% was the diluted EPS and 13.1% was the dividend per share. These growths can give the competitive advantage for Tesco.

The above table shows the ultimate batter financial condition of Tesco. The group revenue was 47,298 million pounds. This is enough to start a new bank with a good investment. Its knowledge and expertise in banking service delivery is also a good competitive advantage. Tesco can use its Brand as completive advantage.

Conclusion

In a present UK banking sector, there is a significant chance for Tesco to exercise its banking operation fully. In its past 50% share of related business, now it can use its unique competitive advantages to manage the 100%. The strength is mainly the present condition of business of the Total group. However, it has some weaknesses also, which can be recovered by the timely planning and strategy.

Task 3

Introduction

In task of this management, report considers whether it can compete successfully by using its resources and capabilities and to do this it will discuss the presence of Tesco in my country, market positioning and competitive strategy and the strength and weakness of the competitors of TESCO.

Presence of TESCO Personal Finance (TPF) in the United Kingdom

TESCO Personal Finance (TPF), a subsidiary of TESCO plc, was founded in 1997. It was founded as a joint venture of TESCO and Royal Bank of Scotland (RBS). The TPF from its inception is operating in United Kingdom. The subsidiary of the giant supermarket chain is operating as a supermarket bank in UK. From its inception, it is offering general insurance, ATMs, online banking services, online insurance comparison service, credit cards, and saving products in UK. The TESCO’s store network is used in the banking operations throughout the UK. These stores serve as points of sale of the TPF’s financial products and services.

Market Positioning & Competitive Strategy of Tesco

Market Positioning

The word ‘market positioning’ means the placement of products and services in specific market segment. The market segment that is targeted by TPF is based on demographic segmentation. The TPF is targeting its consumers according to demographic variables such as income, the density of population etc. The notion is clear because TESCO’s placement of its stores is based on the same basis.

The basic marketing positioning of TPF is positioning itself as a supermarket bank. The supermarket bank means operating banking operations in the supermarket. This is done for several purposes such as giving convenience to the consumers, lower costs in operations, lower promotional costs etc. The TPF uses the store network throughout the UK for these purposes and therefore can cut unnecessary costs of operations.

The points of parity (POPs), the similarity with other similar operators to make a service fall in a specific service category, include offering of financial services and being a subsidiary of a supermarket. To fall under the supermarket bank category TPF uses TESCO’s store network and it offers wide range of financial products and services. According to tescofinance.com TPF was offering 26 financial products and services in 2008.

The points of difference (PODs), the point where TPF differentiates itself from other financial products and services operators, include large customer base, strong store network, high street brand image, etc. The TPF has almost a 5.5 million-customer base. The achievement of such an enormous customer base has been possible due to the large customer base of its parent company. The TESCO has the largest supermarket chain in UK and therefore has a large customer base. The TPF also uses TESCO’s strong store network throughout the UK as point of sale of financial services and products. According to tesco.com, the TESCO has over 2,100 stores throughout the UK. This base became POD because of TESCO’s brand awareness as the largest supermarket in UK. Moreover, the supermarket chain of TESCO falls under the high street brand category and so does the TPF. Therefore, the TESCO’s brand awareness plays as the ground for building TPF’s brand image.

The TPF has monolithic positioning too. To lessen consumers’ confusion about the organization and its offerings, the bank uses its parent name in its operation. According to Harris, G., (2008), it is the least cost and least risk option in market positioning to lessen consumers’ confusion. As a defensive strategy, it is used in TPF’s market positioning to gain advantage over its parent’s supermarket chain. Therefore, TPF uses TESCO’s name as an endorsement in both its online and offline operations.

Competitive Strategy

According to Dobson, P., et al. (2004) the competitive strategies have been used to gain competitive advantage over competitors i.e., having superior customer relations. They further stated that such superior value comes from either from offering customers generic products at lower costs than that of the competitors or from somehow differentiating the firm. According to Porter, M., (1985) to create competitive advantages a firm has to rely on generic competitive strategies. These strategies together are known as generic competitive strategies. He further argued that a firm could only rely on any one of the three strategies and these are cost leadership, differentiation and focus strategy.

If TPF is analyzed, the analysis will result that the competitive strategy, which is followed by TPF, is the differentiation strategy. According to Porter, M., (1985) differentiation strategy means the firm’s approach to differentiate itself from its competitors so that it can raise price for its products more than that of the differentiating costs to become profitable. To differentiate its offer, TPF uses several sub-strategies such as tailored promotions, integration of corporate social responsibility in the core business, that is giving consumers the most value, online presence with a completely unequal service (having Tesco Comparer to compare insurance offerings throughout the UK offerings) etc.

The TPF usually makes tailored promotions. It uses point of sale of its parent’s supermarket chain for its promotional activities that are aimed at the shoppers. Furthermore, it usually uses different types of promotional activities for its insurance and banking offerings tailored to different consumer segments.

The integration of corporate social responsibility is to make its consumers valuable in its operations because successful business has to respond to its customers’ needs. This integration has paved the way to show off giving its consumers more value. According to tesco.com it is an opportunity for the corporation’s growth. It further stated that such integration was aimed to get consumers lifetime loyalty because they believed in consumers’ power, which can create positive changes.

The online presence with an unequal service, the TPF comparer, is also a differentiating strategy of TPF. By the service, the customers can easily compare different insurance offerings of different insurance companies including TPF. Moreover, only online presence itself is a competitive strategy. According to the annual report 2008 of TESCO, online sale of TPF rose by 20% in that year. Because of its ease of use and technological advancement, the online presence produces such a growth in UK.

Strengths and Weaknesses of Tesco’s Competitors

In 2008, ASDA & Sainsbury’s was the main competitor of Tesco Plc and among them Sainsbury’ holds strong position in market. However, the competitors of TPF comprise both direct and indirect competitors. The direct competitors are supermarket retail banks such as Abbey national, Nationwide, Halifax, First direct etc. and indirect competitors are high street banks such as Barclays, HSBC etc. The direct competitors are the competitors that are directly related to the firm’s operations, have almost equal offerings and marketing strategies, and have same category relations. The indirect competitors are the competitors who are not necessarily in same category of the firm rather have several unequal attributes than that of the firms. However, as the fact narrated in the case, competitors of TPF will completely change because of the inception of real retail banking by TPF. The inception will make it a direct competitor to high street banks.

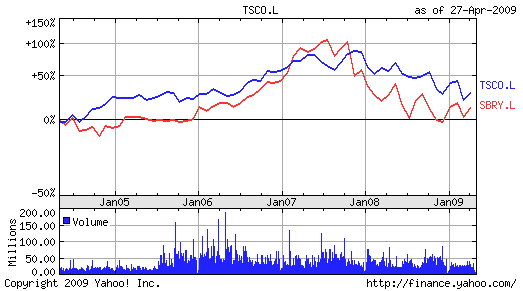

From the first chart, it can be found that the position of Tesco and Barclays bank is almost similar in the recessionary period. The second chart has demonstrated that the direct competitor Nationwide is now in a stable position so Tesco can consider its strategy.

Figure 33 compares the financial position between Tesco Plc and Sainsbury and it also represents that Tesco’s position is better than Sainsbury’s position in London Stock Exchange.

Strengths of Tesco’s Competitors

The competitors of TPF have the following strengths:

- Global presence: all the TPF competitors have a global presence. This strength helps them to sustain themselves in the UK. This notion helps them to obtain economies of scale and allows the financial service providers to spread their risk. Most importantly, they are capable of sharing risks inherent in the UK operation and therefore become successful banks in UK.

- Online presence: all the TPF competitors have also online presence. Such a presence helps the financial service operators to grow at a higher rate. For example, TPF has had almost 20% online sales growth in 2008 and this scenario is same for its competitors.

- Innovation: the competitors are highly innovative in their offerings. New financial product and service development is highly adopted by these service providers to become sustainable competitive over others. For example Barclays invented firstly the credit card in 1966 (Barclays bank plc, 2009). It is further developing new card ideas. Most recently, it has developed OnePlus card for its London-based customers. Such innovation scenarios are highly available in the industry and therefore retaining competitive advantage for a sustainable period has become tough.

- Well capitalization: the high street banks are highly well-capitalized. The supermarket retail banks are well-capitalized too. Such a pillar helps these banks to rely on their own capital base. Because of such capitalization, these banks neither require third-party help nor require help from the UK government in the present economical distress (HSBC group, 2009).

- Capability of expansion: there is a tendency of these banks to expand their operations through mergers and acquisitions. Each of the banks has been undertaking mergers and acquisitions like the TPF. This notion helps these banks by two-fold benefits, one is expansion of consumer base and another is cost savings. For example, according to the annual report nationwide (2008, p-12) it had completed its merger in 2008 with another building society, Portman, and had projected an approximate cost saving of £78 million per annum. Moreover, establishment of flagship branches throughout the UK is still a fruitful strategy for these banks.

Weakness of Tesco’s Competitors

The TPF competitors have the following weaknesses inherent in their operations:

- Brand positioning: brand positioning is a major problem in the industry. In brand positioning, the banks usually have problems differentiating themselves from others. These banks find it harder to differentiate their own offerings and to create an exceptional brand name. For example, HBOS and HSBC, two giants in the industry, look almost alike in name proposition. Such a brand positioning makes promotional activities tougher. Because such complexity in positioning may distort consumers and may lessen brand recognition. On the other hand, almost all the retail bankers have same kinds of offerings.

- Over-reliance on global presence: over-reliance on global presence may create consumer distortion and dissatisfaction. According to HSBC Group (2009) the over-reliance of HSBC on its global presence would be seen negatively by consumers because the consumers may find lack of homogenization and lack of personalization in the bank’s philosophy. The same thing is also true for supermarket retail banks.

- Large payouts to employees would create conflict of interest between stockholders and management because such a payment lessens value of stocks, and therefore de-motivates investors to retain the bank’s stocks. The overreliance on global presence is directly liable for such a disadvantage. To be competitive multinational corporate, the banks have to pay higher remuneration to their employees. Therefore, it increases complexity in banks’ operations. This also to some extent stops the dividend payout. For example, according to Barclays Bank Plc (2009) the bank has projected not to payout dividends up to second half of 2009. Such a decision would possess risks for these banks.

- Global financial downturns create some uncertainty future expenditure of the customer which may affect on discretionary of customers for example now customers would like to purchase other products than luxury products.

Strategies to Be Followed

The TPF needs to follow the following strategies to sustain its growth in near future in the UK:

- Psychographic market Segmentation: the demographic market segmentation basis is used in TPFs market positioning. For this very reason, it is more centric on TESCO’s large consumer base. However, to become sustainably competitive in the banking industry of UK, the TPF has to be more concerned about the psychological patterns of its target consumers. Campbell, S. (1998) argued that in the financial products and services market, psychographic segmentation must get extra consideration. Harris, G., (2009) argued that segmenting consumers should include variables such as consumers’ financial sophistication, decision-making process, and information processing. He further argued that such an analysis would open the door of stimuli, the financial offerings, which are to be used in attracting consumers.

- Delivering more choice: the competitors of TPF offer almost all the same offerings as TPF offers. Therefore, to become different in the marketplace it needs to extend its market offerings. As the case implies, it is great news that the TPF would launch retail banking in full shape very recently. In the marketplace, consumers are more attracted to the special offerings and therefore generic offerings have little value to consumers to select financial service providers. As the market is highly competitive and the growth of the market is slowed down, the TPF has to offer differentiated financial services and products to compete with its category competitors and with high street banks. Wide range of savings products is highly demanded in the present market scenario. Moreover, the commencement of TPF as the real retail bank would further increase this demand in UK.

- Innovation: in a highly saturated market, where market growth is slowed down, innovation has been seen as the most prominent strategy for the market players. Innovation creates sustainable competitive advantage over the competitors. For example, the ClubCard of TPF is playing the most important role in its present growth scenario and Barclays’s credit card innovation had been giving it competitive advantage over its competitors for an extended period of time. Here innovation means innovation of financial services and products, innovation of consumer services etc.

- Giving value to customers: in a highly saturated market, consumers of a product or service largely decide how a firm should operate in the marketplace. Therefore giving more value to consumers has become a prominent strategy. Forgiving more values to TPF’s consumers, it has already undertaken measures to have perpetual loyalty. Now the organization has to continue the measures and has to innovate new measures for this purpose. The TPF may employ consumers club-making systems such as that of Harley Davidson, a premium motorbike brand of the USA. The cost reduction also is to be carried out to give more value to its consumers because the reduction of cost increases consumers’ value.

To decide whether TESCO can use its resources and capabilities to compete successfully in UK or not, it is required to have some external market tests. Collis & Montgomery (1995) argued that resource or capability to be spirited and to be an effective strategy it needs to justify the following tests:

- Test of inimitability: Collis & Montgomery (1995) argued that inimitability comes from physical uniqueness, historical dependence, fundamental vagueness, and economic preclusion. In the case of TPF, some of its financial products and services are inimitable such as its ClubCard. In UK the placement of the bank’s stores is also inimitable because the parent of TPF is the largest supermarket chain in UK. Therefore, the inimitability, in this case, comes from physical uniqueness and causal ambiguity.

- Test of durability: it measures how fast a capability or a resource fades out. The ClubCard and the TESCO supermarket store network are highly durable in nature. Therefore, the TPF has enough durability in its resources and capabilities.

- Test of appropriability: it seeks to find out how the value created from a resource is captured by another resource(s). In this case, some of the TPF resources capture the value created from its other resources and therefore complete sustainability exists in the marketplace.

- Test of substitutability: the measure is used to seek the opportunity of substituting a resource by another resource(s). If a resource is substitutable then adjustment to the market ups and downs becomes easier. In this case, most of the resources of TPF are not substitutable. However, it will not hamper the TPF because these resources rarely need substitutes. For example, the TPF’s ClubCard is rarely substitutable.

- Test of competitive superiority: it seeks to find out superiority over the competitors. As per the study description stated above, there is various competitive superiority of TPF over its competitors range from ClubCard to very basic, location. In the UK, TPF has the highest possible point of sales because it can easily use its parent’s store network. It further has the largest consumer base, most cost-effective service offering etc. The most valued resource or capability of TPF is its strategy of bonding perpetual customer loyalty.

As firms can rarely meet these entire tests positively rather can have mixed, positive and negative, results, the TPF also is same. However, the TPF’s bondage between various valuable resources and capabilities would make it sustain profitably in UK. Collis and Montgomery, (1995) argued that for the very purpose, the TPF needs to embed three measures namely continuous improvement of resources and capabilities, interim upgrade in those resources and capabilities, and continual assessment of opportunity to inter in the new markets and in the new categories of products and services. Therefore, for the sustainable competitive advantage, the TPF’s present acquisition would open more opportunities, positive to its growth in the UK. In addition, the TPF can use its resources and capabilities to compete successfully in the UK.

Bibliography

- Bank of England, Financial Stability Report Summary.

- businessteacher.org HSBC Group: SWOT Analysis.

- businessteacher.org, Barclays Bank SWOT Analysis.

- Collis, David, & Montgomery, Cynthia, Competing on resources: strategy in the 1990s, Harvard Business Review.

- Creevy, Jennifer. Financial services: A market retail can bank on?. Web.

- Deloitte Development LLC, Panic, Turmoil and Rescues: Now What?-A CFO Perspective from Deloitte.

- Datamonitor. Tesco Plc Company Profile. Web.

- download-it.org, Case Study-Tesco.

- Fernandez-Corugedo, Emilio & Muellbauer, John. Consumer Credit Conditions in the U.K. Web.

- Griffin, Ricky, Management, 8th edition, Houghton Mifflin Company, Boston New York. (2006) Web.

- Hitt, Michael, Ireland, Duane, & Hoskisson, Robert, Strategic Management, 4th Edition, South-Western Thomson Learning, Singapore. (2001). Web.

- HSBC FINANCE CORPORATION, Annual Report of HSBC FINANCE CORPORATION.

- Hale, Kari, Challenges to the UK Banking Sector.

- HM Treasury, Competition in UK Banking: the Cruickshank Report.

- Harris, Gregg, Brand strategy in the U.K. Retail-Banking Sector: Adapting to the financial services revolution, Journal of financial transformation.

- Kotler, Philip & Kevin Lane Keller, Marketing Management, 12th edition, New Jersey: Pearson Prentice Hall, 2006.

- Leighton, Tommy, Tesco Ready to Take on U.S. Retail Market.

- myfinances.co.uk, Bank accounts news: Tesco to open 30 supermarket bank branches.

- Porter, E. Michael, Competitive Advantage: Creating and Sustaining Superior Performance, New York: Free Press, 1985.

- Lynch, Richard, Corporate Strategy, 4th edition, Prentice Hall. 2006. Web.

- Tesco, Tesco Annual Review and Summary Financial Statement 2008.

- Tesco PLC, More than the weekly shop- annual report and financial statements 2008.

- Tesco finance, Tesco finance and insurance.

- Tesco, Annual report and Financial Statement 2008.

- Yahoo Finance, Basic Chart of Tesco.

- Yahoo Finance, Basic Chart.

- Zeithaml, Valarie, Bitner, Mary & Gremler, Dwayne, Services Marketing, 3rd edition, McGraw-Hill/Irwin; (2006).

- Zikmund, William, Business Research Methods, 7th Edition, Orlando: Harcourt Publishers. 2006. Web.