Executive Summary

The sports drink market in Australia is a growing sector. However, PowerAde has not been able to capture the nerve of the market as competing brand Gatorade had already bagged the largest share of the market. For this reason, PowerAde needs to revamp its marketing strategy in order to gain market leadership position. This paper aims to provide PowerAde with a succinct plan to revamp the marketing strategy of the company.

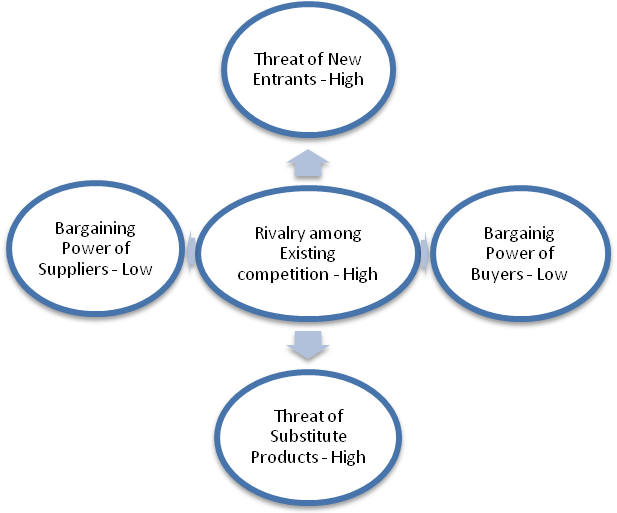

The Australian soft drink market is a $2424.5 million industry with a growth rate of 2.5 percent. The Australian functional drink market of Australia is a niche market with a 4.1 percent share of the total soft drink market in terms of market value (Datamonitor, 2007). The sports drink market has the major market share of 84 percent of the total functional drink market (Datamonitor, 2004). The five forces model by Porter it can be has shown that the industry is highly competitive with very high barriers to function or to exit. Thus, the industry attractiveness is low.

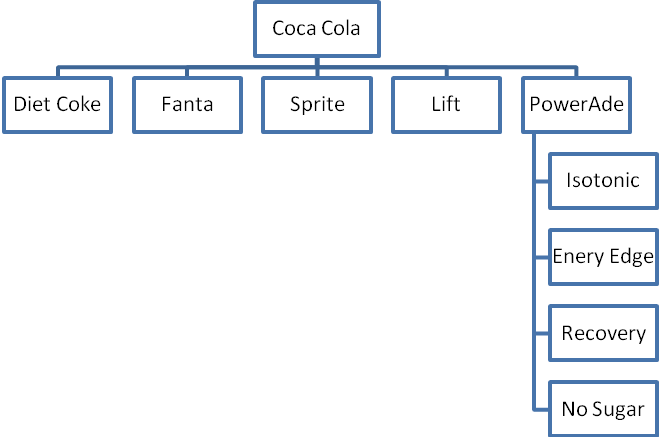

PowerAde is a sports drink company. The corporate brand of the company is Coca Cola, which is the leader in the global software market. The product brands of Coco Cola are Diet Coke, Fanta, Sprite, Lift, and PowerAde (CoCa-Cola, 2009). The brand is in the question mark stage in BCG matrix and thus requires aggressive marketing. The SWOT analysis of PowerAde shows that the brand’ strength are its healthy products and weakness is in its lack of market share and adoption.

Based on the industry study and brand study, the paper provides recommendations that PowerAde must divest its target market from niche sports market to a health conscious market as well as the young amateur sports market.

Introduction

The global market for soft drinks has been experiencing a growth and so has the Australian soft drink market (Datamonitor, 2007). According to Datamonitor forecast, the Australian soft drink market is expected to grow at a rate of 18.3% to $6.2 billion by 2011. The market leader of the Australian soft drink market is Coca Cola, which has a 50.1% share by volume. Soft drink market comprises the following categories viz. carbonates, juices, bottled water, functional drinks, tea and coffee, and smoothies. This paper discusses the market for the Australian functional drink market, which comprises of energy and sports drink market in Australia, with specific focus on PowerAde.

The functional drink market comprises energy and sports drinks. These drinks are meant to stimulate the nutrient process and hydrate the body. The functional drink market in Australia is moderately small. In this segment, sports drink comprise more than eighty percent of the market share. The leading companies in this market are PepsiCo, Cadbury Schweppes, Pokka Corporation, SmithKline Beecham, and Coca Cola’s PowerAde.

The Australian sport drink market is dominated by two sports drinks, Gatorade and PowerAde. PowerAde comprises of 21 percent of market share (Food Magazine, 27 October 2008). As PowerAde is a market-driven company, consumer demand for the product is very important for the product to stay competitive in the market. The problem that PowerAde faces currently is that it has to remain competitive in a niche market with increasing competition from other brands like Gatorade as well as other brands from China. The main aim of the paper is to understand the marketing strategy of PowerAde and strategies to stay competitive in the Australian market.

Industry Background and History

Australian soft drink market is a $2424.5 million industry with a growth rate of 2.5 percent. The Australian functional drink market of Australia is a niche market with a 4.1 percent share of the total soft drink market in terms of market value (Datamonitor, 2007). The sports drink market has the major market share of 84 percent of the total functional drink market (Datamonitor, 2004). Thus, the sports drink market has a small share in the total soft drink market.

In this section, the paper will discuss the industry structure of the sports drinks market of Australia using Porter’s five forces model.

Figure 1(see Appendix) shows the Porter’s Five Forces Model. The model shows that the industry attractiveness depends on the relative power of five external forces, which are new entrants, buyers, sellers, existing competitors and substitute products (Porter, 1996). The growth rate of the industry in CAGR for 1999-2003 was 2.4 percent and 3 percent in 2003-08. The market is small and has two main competitors viz. PowerAde and Gatorade. Thus, the existing competition in the market is duopolistic in nature.

Further, the rivalry among existing competition is high due to the introduction of new features in products and increased R&D activity to differentiate products. This increases the competition among existing players. Further, as there is little price difference between products and little difference in the feature offered in the products, the customer switching cost is low. This further increases the competition among rivals.

As the growth rate of the industry is high, the industry attractiveness is high. Therefore, the markets seem very attractive to new entrants. Nevertheless, the industry’s attractiveness is high as it is heavily dependent on new technology and R&D advancement. Therefore, any new company who can bring in innovative products may find ground in the market. For instance, Fructose entered the sports drink market of Australia with the first hypotonic sports drink using the brand name Mizone Rapid in 2007 (Food Week, 18 October 2007).

Suppliers are many in the industry and do not have much power over the market. This is so because as the market is duopolistic in nature, even the suppliers are under pressure. Therefore, the suppliers do not have much market power over the sports drink market in Australia.

The substitutes of sports drink are milk, water, juices, etc. As sports drink is a very small art of the beverages market in Australia, the market faces serious threats from such beverages. The main competition arises due to the easy availability and acceptance of these products instead of sports drink, which makes these substitutes more attractive.

As the nature of the industry is oligopolistic, the customers have little or no power over the market to set their terms and condition. So the customers have to pay the price that the companies set and do not have many choices to shift. Thus, the power of buyers in the market is low.

From the five forces model by Porter it can be derived that the sports drink market in Australia is not exactly attractive with only one force being attractive while others show high degree of barrier. Thus, the industry is highly competitive with very high barriers to function or to exit.

SWOT Analysis of PowerAde

A SWOT analysis (see Appendix, Figure 2) is an understanding of the internal and external strengths of the company. The strengths of PowerAde are in its products. The nine four-product line are focused to the target market keeping in mind the target market of the company –athletes, sportsmen, and women – who form a major part in ascertaining the product. However, the target is now being spread to a more general category of a health conscious group.

Strength and Weakness

The products are the main strength of the brand with the presence of electrolytes restoration product. Further, the brand has ventured in the no-sugar market where in the company has brought a line with no sugar sports drink. The energy boost of the sports drink and the maintaining of the hydration level in body are the key strengths of the product line of PowerAde. It has also improvised on its products and has introduced other variants as well as lines like PowerAde protein powder.

The corporate brand name helps PowerAde largely and has helped it to retain its more than 20 percent growth rate. The corporate brand name is strong as it is the global leader in the soft-drink market. The corporate brand name helps to increase credibility of the brand. As it is largely dependent on the brand image that the customers have in their mind, which determine the sale of the products, PowerAde’s association with Coca Cola helps it gain an added advantage.

The weaknesses of the brand are in its low market share and low growth rate. From the previous BCG analysis, it has been identified that PowerAde is in the question mark quadrant of the matrix where the brand eats away the corporate cash but does not generate the expected return.

Further, the positioning of the brand is unclear. The brand is positioned as sports drink, but it targets both the sports people as well as the health conscious market. Nevertheless, the promotions and TV advertisements does not promote that. Instead, in the promotions PowerAde takes an offensive stand against its competitor. Further PowerAde does not rely promoting the technological advancement. The promotion strategy of PowerAde is to complete with Gatorade directly by taking a strategy of smearing the reputation of the market. As the sports drinks market evolved out of scientific research and technological advancement, even the promotional strategy should be product oriented.

Opportunity and Threats

Macro Trends

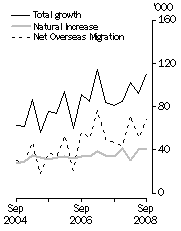

Economic growth in Australia has been slowing down. In 2007-08, the economic growth had slowed down considerably. The growth rate of the Australian economy is 3.6 percent for 2007 (ABS, 2007). Further, there has been a decline in the consumer demand in the country due to higher interest rates imposed by the central bank of Australia. Inflation too has been high which had off-sated the consumer demand. Terms of trade are buyout and unemployment too has been low. The unemployment rate for the country in 2007 has been 5.4 percent (ABS, 2007). This has increased wage rates and migration has grown rapidly.

The social changes that are occurring in Australia are significant for marketing purposes. The population growth rate in 2009 has been 1.8 percent (ABS, 2008). Australia has an aging population and thus, has serious implication to marketers.

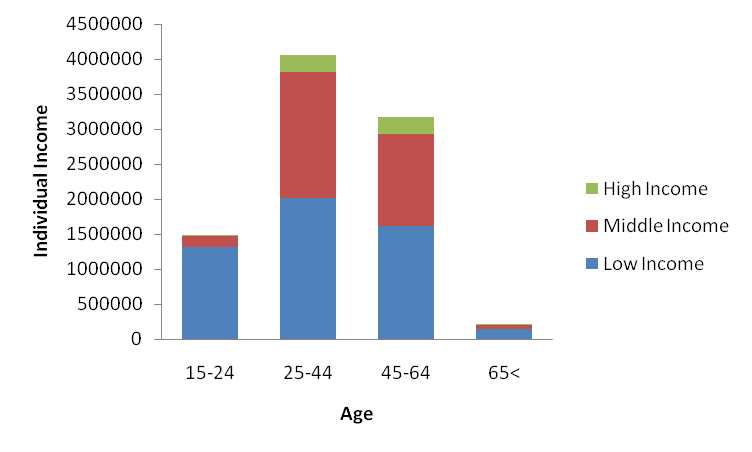

Figure 4 (see Appendix) shows the number of individual within the age group of 15 to 24 years mostly have low income. Further, the income level on an average becomes middle income for the age group of 25-44 years and 45-64 years. Again, in the age above 65 years, income becomes low and those who have income mostly have high income. Thus, the working age in Australia is mostly 25 years to 64 years and the income group of individuals is Middle-income group.

The market is facing changing demographics and consumer preferences. Australian consumers are becoming more health conscious. Thus sports drinks, which are essentially high-energy providing low calories health drinks, are being adopted in the market.

The macro economic and social trends in Australia it is clear that the Australian economy has been hit by a recessionary phase even though inflation and unemployment is relatively low. The consumer demand has been affected due to a tight monetary policy, which makes loans dearer. The consumer spending has been reducing. This is a threat to the Australian market.

The threats that the market faces are from competitors within the industry. High product competition for differentiation will decrease the market of PowerAde. New entrants in the market also reduce the market attractiveness. Economic recession and dwindling consumer demand will negatively affect the brand. Another threat to the industry is declining consumer demand.

Prognosis

The SWOT analysis presents the most important prognosis, which are a shift towards health oriented drinks due to the changing consumer preference and impending financial recession in Australia.

The opportunities that the sport drink market of Australia has are that it is a relatively nascent market, with the market not being saturated. The overall market is growing and the future trend of the market is towards growth. Therefore, it can be stated that sports drink in the Australian market is in the growth stage. Given this the strategy in the growing stage, PowerAde need to bank o n the growth of the market and get into more aggressive promotion of the brand so that the market share of the leader can be altered. Further, another opportunity is the higher income among individuals in lower and middle age group. More aging population shows the need towards more health conscious products.

Further, the technological advancement in the area provides the company with the opportunity of bringing in a new and more improved product, which will be adopted by the customers. Research and development in the sports drink market is important as the product was developed through an interaction of science and the needs of many athletes. Therefore, R&D of the products will help in innovating new products, which will have more demand in the market. Thus, research and development is extremely important for PowerAde.

The threats that are posed towards PowerAde are from competition of existing brands and substitutes. Gatorade is the leading sports drink brand in Australia. The competing brand ahs more than seventy percent of the market share and is the market leader. Further, the market is attractive to new entrants as the growth of the industry is high and the players in the market are making. Stronger competition and industry attractiveness posses threat to PowerAde.

Then there is the threat of the energy drinks, which are gaining more popularity and acceptance among non-sports consumers. For instance, it is believed that energy drinks do not target only athletes but all who need energy: “The demographics of the main buyers of the energy category are pretty much anyone in the community who requires energy. This includes, but is certainly not limited to athletes, drivers, office workers, shift workers, partygoers, young parents and university students.” (Anon., 2007)

Thus, from the above analysis the main problems that PowerAde faces in Australian market are:

- PowerAde lacks in market share and thus the growth of the brand is low.

- The target market for the product is niche to gain sustainable competitiveness.

- PowerAde’s brand positioning is not clear as it targets the households even when they call themselves sports drinks.

Strategic Solution

PowerAde is a brand under the Coco Cola Amatil (CCA), which is the principle Coco Cola licensee in Australia. CCA was introduced in Australia is 1937 and received the licensing the bottling rights of Coca Cola company in 1964. In 2007, the company the company posted a turnover of $2,399.5 million and EBTI margin of 18 percent (CCA, 2009). The corporate strategy of CCA is presented in figure 4 (see Appendix).

Figure 4 (see Appendix) shows that the corporate brand of the company is Coca Cola which is the leader in the global software market (Datamonitor, 2007). The product brands of Coco Cola are Diet Coke, Fanta, Sprite, Lift, and PowerAde (CoCa-Cola, 2009).

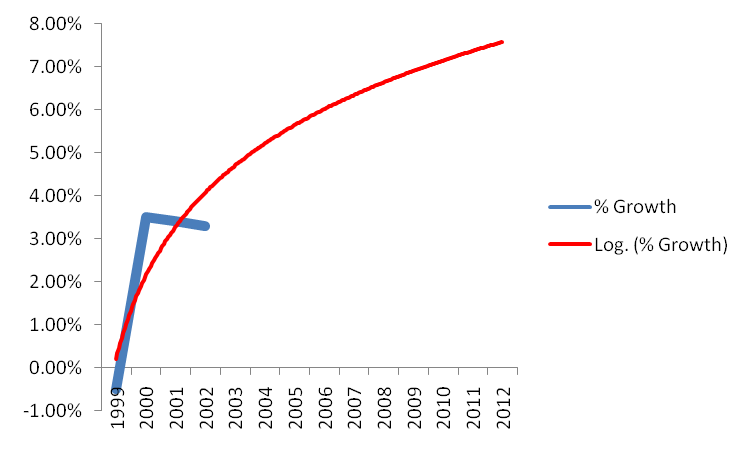

The sports drink market in Australia is small, with only 4 percent share in the large soft drink market. The Australian sports drink market started in 1999, when PepsiCo and PowerAde introduced their sports drink in the market. The market value of the industry has gone up from $24.5 million in 1999 to $26.9 million in 2003. Figure 5 (see Appendix) shows that the logarithmic trend of growth rate of the sports drink industry is on increasing. This indicates that the industry is on the rising or the maturing phase of the growth curve meaning that the industry at a nascent stage and will still grow.

Figure 6 (see Appendix) shows that PowerAde is in an initial stage of growth where the market is still expected to grow. It is still in a nascent stage in Australian market. Therefore, the business level strategy of PowerAde should be to become a Prospector. This strategy is taken when the product t of the company is still in the growing phase. As the product is still in the nascent or early stage, the target markets are still unidentified.

The product being a novel introduction based on newly emerging technology is not fully developed. Further porter’s five forces model suggested that the market is still underdeveloped with only one strong competitor who commands the major market share.

PowerAde is a sports drink company. Sports drink is an outcome of product innovation and rigorous research and development into the beverage. The development of the product was based on the need of human body to generate power from diet. So these drinks were made to meet the requirement of the sportsmen’s increased need of fluids, electrolyte, and energy. The product brands of PowerAde are Isotonic, Energy Edge, and recovery. The product was initially made a sports drink to cater to the needs of the athletes. Now the target market for the product is being broadened: “…but it is not just for athletes; anyone can enjoy the refreshing taste of ‘POWERaDE’, which is well received by a variety of consumers. ‘POWERaDE’ is Australia and New Zealand’s number one sports drink.” (CoCa-Cola, 2009).

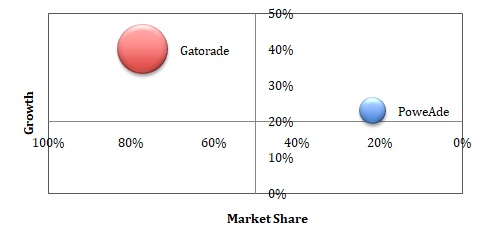

In order to understand the comparative position of PowerAde and Gatorade in the Australian sports drink market; we conduct BCG analysis to see the relative position of the brands in the market.

Figure 7 (see Appendix) shows the BCG matrix of the two competitors in the sports drink market of Australia. The data has been derived from various internet sources1. This shows that Gatorade is a star with both market share and growth to be high is a star brand. This is so because Gatorade’s market values as well the growth rate. Hence, Gatorade has a higher market share and is growing at a faster rate than PowerAde.

On the other hand, PowerAde is in the Question Mark. This indicates that the brand is PowerAde is growing rapidly but consumes large amount of company capital. However, as they have low market share, they do not generate as much cash as they consume. Marketing literature states that a question mark has the potential of becoming a star and eventually a cash cow when the market slows down. However, if the brand is not turned into a star, then after a few years of cash consumption, the brand will become a Dog when the industry is in the declining phase. Thus, now that the Australian sports drink market is in the growth phase, it is important to increase the market share and growth of PowerAde.

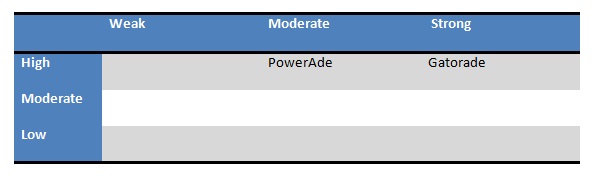

From the SWOT analysis, it is clear that the brand need to be more proactive in their advertising promoting of the brand and its products. Another analysis into the marketing strategy of PowerAde is done using Market Attractiveness Competitive Positioning Matrix. In figure 8 (see Appendix), the horizontal axis measures competitive position and the vertical axis measures market attractiveness. The market share of PowerAde as compared to Gatorade is moderate while the market potential for growth of sports drink market is high. Thus, PowerAde falls in the second quadrant where the market attractiveness is high while the competitive position is moderate. Thus, the strategy employed by PowerAde is the desirable potential target.

Strategies

The strategies that should be taken by PowerAde are:

- Marketing Strategy: PowerAde should target a different set of customers. All sports brands target sports men, especially who are involved in it professionally. However, the target group of PowerAde should be amateur sportspeople too, as they comprise a large group of people. So all sports enthusiast should be targeted, especially youths.

- Competitive strategies: As the Australian consumer market is showing signs of changing preferences; PowerAde should aim to target the health conscious market with their product. Their product differentiation will be based on a drink, which helps in revitalizing energy, low calorie and provides energy. Further in Australia, the demand for soft drinks are stable, and the market for functional drinks are increasing, in such as situation, product innovation for differentiation strategy plays a vital role (Food Magazine, 24 September 2007).

- Corporate growth strategies: PowerAde should aim to reposition their brand. Further they should indulge not only in business to consumer distribution channels, but also aim at direct selling strategies to business customers, like offices, schools and colleges.

- Prospector strategy: As the market is growing, PowerAde must be more aggressive in its advertisements and sponsorships. Greater sponsorships of sports events have a higher adoption rate as has been proven by research (Gwinner & Eaton, 1999).

The strategy that needs to be taken in this phase is: (a) challenge for leadership, (b) build on strengths, and (d) reinforce vulnerable areas. Thus, PowerAde must take the strategy to increase market share and pose challenge to Gatorade, which is the market leader in Australia.

Recommendations

Therefore, the recommendation that we feel that PowerAde should follow in its marketing strategy is:

- Position the brand as a sports health drink due to the increasing appeal for the health conscious market.

- Change the target market from hardcore sportspeople to (a) young sports enthusiast who are in and around 18, and (b) health conscious market, especially women who show more inclination towards health conscious drinks.

- Product differentiation will be the business level strategy.

- Create new sub-segments with packaging re-design, flavour innovation, and new marketing campaigns.

- Broaden the scope of sports drink market and promote rehydration beverage for everyone.

These recommendations will help the company move from its present status of question mark status to a star status. The brand must aim at making the brand more acceptable to consumers. Further, the brand must look at diversifying the market through targeting of new target customers. Clearly, the Australian sports market prefers Gatorade to PowerAde. Therefore, the target market where expansion is possible is the normal, non-sports market. As health awareness among Australians is increasing, it is required to project the brand as a need for both the sportspeople (which was the brand’s initial and core strategy) and individuals who are health conscious.

The target customers for this case should be the individuals who are health conscious. The target market for PowerAde should not be the market for athletes which is already taken by Gatorade, instead they should try to enter the target market groups of other heath drinks like energy drinks, juices, tea/coffee, flavoured water etc. Thus, the target market share of PowerAde will become 17 to 20 percent instead of 9.9 percent of functional drinks market. Further, there is growing demand for energy drinks in the households of Australia. This market can be captured if energy drinks and sports drinks are merged together which will then target both the markets.

The main image of PowerAde is that it is a sports drink meant for sportspeople and not for common person for everyday use. Once this myth is broken, the drink will enter everyday household drinks segment. As growth is one of the primary aims of he product, it must be kept in mind that a growth strategy will be initiated by targeting one or more lucrative target markets.

PowerAde should target the market segment, which is still not targeted: the health conscious adults and youths. Why this target should be chosen? The reason is derived from the macro analysis. Australian market has a more youths and below 44 adults who are in the middle-income group. For this the company need to first target the young under 18 sporting enthusiast who are yet untapped by the sports drink market by both PowerAde and Gatorade (Alarcon, 2005). Thus, the Australian sports drink market did not target the college sporting events or high school sporting events. Therefore, PowerAde should target these untapped markets. Here they can become sponsors to college or high school sporting events, which will again provide them entry into the domestic market as well as expand the market for sports drinks.

Further, there is a growth of low-calorie diet drink market in Australia. For this, the target market should be health conscious women. This is so because of market research conducted by Glaxo SmithKline who wanted to tap the health conscious market in Australia: “GlaxoSmithKline conducted intensive research into its target demographic. It found that women in this market value health and nutrition, have body image concerns, are socially oriented, aspire to clean living and are overwhelmed by health related advertising messages.” (Swinburn, 2005, p.7). Given this, the market segment should be targeted towards health conscious market, especially among women.

Australian Foods News (AFN) has shown that the Australian consumers have shown a distinct shift in the consumer demand and preference for lifestyle enhancing products (Palmer, April 1, 2008). Thus in the beverages and confectionery segment, there has been a rapid increase in the demand for sports drinks with the success of electrolyte replenishing drinks.

Further Austrians are facing a huge problem from obesity thus increasing consumer presence for healthy food and drink (O’Hagan, 4 November 2004; Barr & Cameron, 2005; IBISWorld , 2005). With increasing concern for obesity, carbonated drinks are losing market, and thus, there is need to put in more health conscious drinks into the market. Further, the baby boomer generation has taken up diet control and other health precautions mainly to avoid the ailments of their prior generation (IBISWorld , 2005).

As the health conscious consumer demand grows, PowerAde has more chance to enter into a different target market. With its no-sugar low calorie product line, PowerAde can target this health conscious market of Australia. For this, the positioning of the brand has to be changed and PowerAde must undergo a brand re-imaging. The main aim must be to position properly as a low calorie high energy sports drink which will appeal to the youths as well as the non-sports related consumers.

Further the changing lifestyle of Australians demand more meals to be eaten away from home. This has increased the demand for bottled water and soft drinks. With the new health conscious consumer entering the market, the demand has shifted from high calorie carbonated drinks to low calories juices or drinks: “Health conscious consumers downed more bottled water than in previous years, stealing market share from soft drinks, cordials and syrups.” (Food Magazine, 1 September 2006). Therefore products differentiation through innovation is essential.

Further, IBISWord research has shown that due to increased incidents of road accidents due to alcohol consumption has increased the awareness among drivers who have shifted towards bottled soft drinks. This market can also be targeted by PowerAde with their innovative bottle design: “functional bottles with pop-top caps designed for drinking when playing sport or training” (Food Magazine, 1 September 2006).

There has been a higher demand for premium quality non-alcoholic beverage where the main basis of competition between the soft drinks, energy drinks and sports drinks is “health appeal” which becomes the point of parity in the drinks industry marketing strategy.

Action & Control Plans

The action plan that we suggest to achieve these strategies are following. First, PowerAde must be positioned as a health and sports drink. This can be ensured through strategic positioning and increase the healthy appeal of the brand. Therefore, the stress of the drink must be on the electrode replacing and no sugar variants, which will immediately appeal to the health conscious market.

A deeper market research into the consumer preferences for health drinks over and above other health conscious s drinks must be done in order to identify the strengths and weaknesses of the brand as a health drink. Then these weaknesses must be built upon and marketed on the strengths that the product has.

The health conscious market can be targeted through direct advertisement campaigns in TV and radio or print media. Another simple way is to hold seminars for healthy drinks, which will provide detailed information regarding the healthy ingredients of the PowerAde and how they can boost the level of energy without adding calories. This should be done in the form of expert review. In addition, the reviews should be covered through the newspaper and news channels. This will increase consumer awareness. This step is important to initiate adoption of the products. Therefore, PowerAde must provide expert comment on the health effectiveness of the drink.

Second, in order to target the young sports enthusiast the best options are to sponsor sporting events of schools and colleges. This way the young sports enthusiast will have the opportunity to be introduced to health drinks and will start consumption of the drinks. Therefore, the main aim here will be to hold:

- Sponsor college or high school sporting events.

- Organize countrywide under 18 sports championship.

- Introduce a PowerAde water variant for targeting the increasing bottled water market.

- PowerAde Australia has a masculine promotional approach. So targeting women will take a new product, which will be made according to the preferences of female consumers. Targeting women with a new variant of drinks like PowerAde Aqua+ in US (Clark, 2005), which has no calorie or sugar or artificial flavours beverage for anyone.

- Continue with its association with sports events as well as endorse the product for

Baby-boomers are more positive towards in-program inclusion of branded products in sporting events. Therefore, as the population of Australia is aging, with more baby boomer, this strategy of in-programs product placements is a successful strategy to increase consumption (Schmoll et al, 2006).

To target the women health conscious customers it is important to increase their product line and make a hybrid of a sports and health drink. The promotion campaign for this product must concentrate solely on women in their middle ages. The target market here is women who are working, and have to take meals away from home. So the campaign must stress on the low calories drink, which provide high degree of energy through the scientific process with which it is being made. Further research has shown that women are more influenced through body image discoursing advertisements. Therefore, a simple campaign to target women will be to show the possible inches reduction or weight lost after usage of this health drink.

Conclusion

The sports drink market in Australia is small. PowerAde is the second largest player in the market after Gatorade. The main problem of PowerAde is to increase its market share and come to a leading position. This paper provides a detailed understanding of the industry and the company equation in the Australian sports drink market.

The industry analysis shows that even though the market for sports drinks are increasing, the market share of Gatorade overwhelms the market share of PowerAde. Therefore, the aim is to increase the market share and revenue earnings of PowerAde.

While doing a strategic recommendation, the implicit assumption that is taken is that bringing down the market share of a market leader is very difficult. However, it is wiser to divest into other target markets, which are yet not exploited by the industry. Therefore, the recommendations of the paper are not to get into a price war with Gatorade. Rather it is has been suggested to diversify the product offering to different markets like the younger amateur sports enthusiast and health conscious market for beverages.

In conclusion, it must be stated that brand positioning is key to changing the target market. So far PowerAde had be solely positioned as a sports drink, thus losing its larger appeal. It catered to the niche sports brand market. Now the positioning of the drink must be more of an energy boosting sports health drink, which is suitable for both sports people as well as non-athlete health conscious market.

Further, the promotional strategy should direct to the target customer with the product line. For instance, the PowerAde healthy no-sugar drink should target a working woman who needs lots of energy. Further, the promotion must also target the sports people who were the initial targets and the amateur sports enthusiast. This form of targeting will increase the target market and cater to various needs of the consumers.

Appendix

Reference

ABS, 2009. COUPLES IN AUSTRALIA. Web.

ABS, 2009. FUTURE POPULATION GROWTH AND AGEING. Web.

ABS, 2007. Key national Indicators. Web.

ABS, 2009. RETIREMENT AND RETIREMENT INTENTIONS. Web.

ABS, 2008. SEPTEMBER KEY FIGURES. Web.

Alarcon, C., 2005. Staminade goes after young sports lovers. B&T. p.7.

Anon., 2007. Australian non-alcoholic drinks market. Web.

Anon. 2009. Pepsi sues Coca-Cola over Powerade ads. Web.

Barr, E. & Cameron, A., 2005. The Australian Diabetes Obesity and Lifestyle Study. Research. International Diabetes Institute.

CCA, 2009. Coco Cola Amatil. Web.

Clark, N., 2005. Powerade eyes feminine appeal. Marketing , p.16.

CoCa-Cola, 2009. About CoCa-Cola. Web.

Datamonitor, 2004. Functional Drinks in Australia. Industry Profile. Datamonitor.

Datamonitor, 2007. Soft Drinks in Australia. Industry Profile. DataMonitor.

Food Magazine, 2007. Industry update: energy and sports drinks in high demand. Web.

Food Magazine, 2008. Powerade goes sugar free. Web.

Food Magazine, 2006. Primed for premium. Web.

Food Week, 2007. Hypotonic sports drink released in Australia. Web.

Gwinner, K.P. & Eaton, J., 1999. Building Brand Image Through Event Sponsorship: The Role of Image Transfer., Joumal of Advertising Vol. XXVIII. No. 4, p. 47-57.

IBISWorld , 2005. Health consciousness in Australia. Web.

O’Hagan, J.A., 2004. Health trends dominate food and drink market. Web.

Palmer, D. 2008. Consumer preferences shift toward lifestyle enhancing products. Web.

Porter, M., 1996. What is Strategy? Harvard Business Review, 74(6) p. 62-79.

Schmoll, N.M., Hafer, J., Hilt, M. & Reilly, H., 2006. Baby Boomers’ Attitudes Towards Product Placements., Journal of Current Issues and Research in Advertising Vol. 28 No. 2 , p. 33-53.

Swinburn, A., 2005. Ribena goes lowcalorie. B&T. p.7.

Zmuda, N., 2009. Gator baiter: Powerade jabs at powerhouse. Advertising Age Vol. 80 No. 10 . pp.3-29.