Introduction

The history of managing stocks in the United Arab Emirates (UAE) retreats the to early 1960s when the administration set up some stock entities. The ensuing years witnessed a tolerant stock exchange market being expanded for the trade of stocks through certain agencies that were not specialized and/or licensed. Several factors were responsible for the non-performance of UAE’s stock market such as the absence of appropriate instruments, proper management, and transparency. The issues that resulted in the ambiguity and too many fluctuations in the stock prices necessitated a control over the stock market so that the transactions were immaculate and the benefits of the investors could be safeguarded.

Consequent to the sustained attempts necessitating the need for control over the stock market, the “UAE Federal law No. (4) Of 2000” (“Federal Law No. 4 of 2000 concerning the Emirates Securities & Commodities Authority and Market” par. 1) was passed. This law facilitated the formation of the ‘Emirates Stock and Commodity Exchange Board’. Subsequently, ‘Dubai Financial Market’ (DFM) and ‘Abu Dhabi Securities Market’ (ADSM) were also formed.

The Emirates Stock and Commodity Exchange Board

The board took over the responsibilities of administration and control of the ‘stock and commodity exchange market’ within UAE. It practices fundamental control and official capacities to release its relegated obligations and encourages the venture of funds in the stock trade. The functions of the board are inclined towards bettering the country’s economy and guaranteeing an ideal link between the ‘supply and demand factors to establish reasonable prices and safeguard the benefits of the investors. In addition to these functions, the board also promotes knowledge of investment so that economic stability might be achieved.

The Dubai Financial Market (DFM)

The Dubai Financial Market (DFM) was formed in 2000 as a public limited organization; DFM is sovereign. In the first place, DFM acts as a ‘secondary market’ for stock trading that is issued by ‘joint-stock companies. It also acts as a ‘secondary market’ for the trading of bonds issued by the country’s government or any of the seven emirates’ governments. The DFM is located in the ‘Trade Centre building’ in Dubai.

The Dubai Financial Market is the main organization that deals with stock exchange dealings. DFM deals mainly with domestic companies. For international dealings, there is the Dubai International Financial Exchange (DIFX). DFM is under the direct control of the ‘Emirates Securities and Commodities Authority (ESCA). The ESCA also controls Abu Dhabi’s stock market, the ‘Abu Dhabi Securities Exchange (ADX).

Regardless of the commendable growth of DFM from 2000 onwards, its contribution in the international stock trading is a mere 0.3% – according to 2006 statistics (“Dubai Financial Market” par. 3). Towards the end of 2005, the UAE stock market’s performance was commendable. During those times, it was common for the daily transactions to exceed the AED 2 billion mark. In August 2005, there were two consecutive days when the daily transactions were AED 5 billion and AED 11 billion respectively. The extraordinary increase in the transactions was attributed to the counterfeit trading of Dubai Islamic Bank shares (“Dubai Financial Market” par. 6).

Considering the fraudulent practice, all the transactions for these two days were annulled and the offenders were taken to court. By the year 2007, 63 companies had already got themselves registered with DFM. 90 stock agents also got engaged in assisting prospective ‘investors and traders’. Some of the stocks that were vigorously traded during that time were, Air Arabia, Dubai Islamic Insurance, Amlak Finance, Aramex Logistics, Arabtec Holding, Dubai Islamic Bank, Emaar properties, and Tamweel Finance.

DFM’s vision is to become a “world class regional marketplace” (DFM). DFM’s mission statement is “to provide stakeholders with innovative services in conducting trading, clearing, settlement and depository of securities, in an efficient, transparent and liquid environment” (DFM). At DFM, the behavior is guided by transparency, efficiency, confidentiality, innovation, and integrity. Certain rules and regulations have to be followed by domestic as well as international companies that want to commence trading activities at DFM.

The stock options in the UAE, specifically in Dubai.

Stock options are “financial instruments that can provide you, the individual investor, with the flexibility you need in almost any investment situation you might encounter. Options give you options; you’re not just limited to buying, selling or staying out of the market” (“Understanding stock options” 2). The investors are not bound to do the trading but they have an option to do so. The investors can adjust their trading according to their preferences and viewpoint. Among the benefits of stock options, the following are the important ones:

- Stock holdings can be safeguarded from a turndown.

- Earnings can be augmented in comparison to the ‘current stock holdings’.

- Buying stocks at feasible prices is possible.

- In spite of a lack of knowledge about the future market position, involvement in a major market-position shift is possible.

- The advantages of an increase or decrease in stock prices can be availed without having to bear the expenses of trading.

Basically, a stock option entitles the investor “to buy or sell shares of the underlying security at a specified price on or before a given date” (“Understanding stock options” 2). An important condition of a stock option is that once that particular date is crossed, the stock option is no more valid and “the seller of an option is, in turn, obligated to sell )or buy) the shares to (or from) the buyer of the option at the specified price upon the buyer’s request” (“Understanding stock options” 2).

In order to simplify the term ‘stock options’, we’ll consider an example. Suppose you have stock option of a company that allows you to purchase 1000 shares of the company at AED 25 per share (of course up to a certain date). Now, let us consider the price of that company’s shares is AED 100 per share (before the date expires). You have the liberty to buy these shares at AED 25 (despite their current price being AED 100) and sell them immediately so as to make an instant profit of AED 75,000.

A warning for the employees: Never accept stock options as a compensation for your salary. Very high risks are associated with stock options. It is possible that the price of the company’s share might drop below the agreed price before the shares are sold.

It is a common practice by large organizations to give stock options to their employees and include them in the business. This way, the organizations are able to increase their buoyancy through times of financial instabilities. Moreover, the stock options are given as incentives to the employees. Organizations, where such practice is followed, are called ‘Employee Owned Businesses’ (EOB).

But UAE is a nation where such stock options are not encouraged. This notion exists in the UAE due to the strict ownership limitations prevailing in the country. The reason behind this peculiarity is that most of the bigger businesses (in UAE) are owned by the government or royal (and otherwise) families. So it is not feasible to introduce such a system (Lowe).

Various factors reject the idea of stock options policy being adopted by organizations in the UAE. One of the major deterrents is the sponsorship form of the businesses. Another factor is the vast expatriate workforce in the country. Yet another factor is the temporary status of the expatriates’ jobs. The regulations of the company law also forbid organizations to adopt such a practice.

Volatility and volatility smile by employing examples in the market for stocks and stock options in Dubai or the UAE

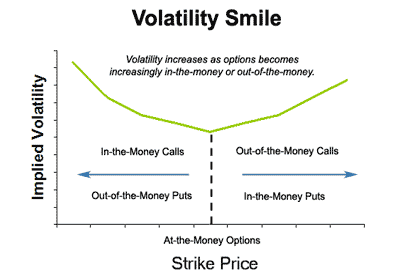

“A volatility smile refers to an implied volatility curve where the options above and below the at-the-money options have higher implied volatility than options that are at-the-money” (“What is volatility smile?” par. 1). The main factors responsible for the worth of a stock option are the strike price, expiry date, and the expected volatility. “The volatility component is known as the implied volatility of the option. And for options that share the same underlying and the same expiration date, you might expect them to have the same implied volatility” (“What is volatility smile?” par. 3).

It is understood that the ‘implied volatility’ suggests the level of volatility of the item in question within the time available for the stock option (before it expires). So, does it mean that this will be relevant to all the stock options (that have the same expiry date) on that particular item? In such circumstances, it is obvious that “the implied volatility curve would be flat, i.e. the implied volatility level would be the same for all the options regardless of their strikes” (“What is volatility smile?” par. 3)

But on the contrary, a volatility smile makes the arc look like a smile. The implication of volatility smile (of an item) is not just the likely volatility of the item but also the supply and demand of the item.

If the implied volatilities and the strike prices are compared in a chart, the subsequent chart will have the following smile shape:

“The volatility smile skew pattern is commonly seen in near-term equity options and options in the forex market. Volatility smiles tell us that demand is greater for options that are in-the-money or out-of-the-money” (“Volatility smiles and smirks” par. 3).

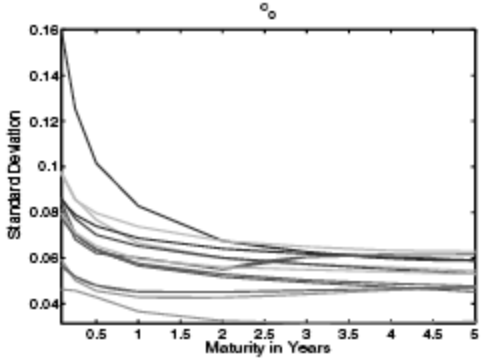

The following chart depicts that the “volatility of implied volatility decreases with expiration” (Derman 6).

“Short-term implied volatilities are more volatile. This suggests mean reversion or stationarity for the instantaneous volatility of the index” (Derman 6).

In UAE, as a result of continuous volatility, the indices have leveled up. Due to the volatility in both domestic and international stock markets, the UAE indices have improved. Emaar properties are in the lead as far as the total worth of the trading done is concerned. “The Dubai Financial Market General Index closed 1.14 percent higher to end at 2888.24” (Gaurav).

Regulatory or deregulatory proposals that affected the market for stocks and stock options in Dubai

Following are the seven regulatory or deregulatory proposals that affected the market for stocks and stock options in Dubai:

- Fake trading of DIB shares.

- Endeavors to develop various sectors.

- Syrian war.

- Mortgage caps by Central Bank.

- Unified accounting pattern.

- Recent financial crisis.

- International Finance Reporting Standards (IFRS).

How these regulatory and deregulatory proposals affected the market for stocks and stock options in Dubai by using the Dubai index between 2003 and 2013

The following chart depicts the Dubai index between 2004 and 2013:

Explanation of the factors mentioned in the previous answer:

Fake trading of DIB shares

Towards the end of 2005, the UAE stock market’s performance was commendable. During those times, it was common for the daily transactions to exceed the AED 2 billion mark. In August 2005, there were two consecutive days when the daily transactions were AED 5 billion and AED 11 billion respectively. The extraordinary increase in the transactions was attributed to the counterfeit trading of Dubai Islamic Bank shares (“Dubai Financial Market” par. 6). The following two charts depict the market index on 01/08/2005 and 01/09/2005:

It is evident from the charts that between 01/08/2005 and 01/09/2005, the index increased from 7,153.96 to 7,780.97 points. This proves that counterfeit trading had an impact on the market index of Dubai.

Endeavors to develop various sectors

In its endeavors to develop sectors like the real estate and tourism, the government of Dubai sidelined certain areas of importance such as the “financial and real estate bubbles” (Koren 23). It is agreeable that by virtue of its endeavors, the Dubai government was able to augment the living standards of its people but at the same time, it faced heavy downslide as far as the country’s economy is concerned (during the global financial crisis). The real estate sector suffered a heavy slaughter in terms of projects being stalled. From the graph, it is evident that the Dubai Market Index dropped heavily during this time.

Syrian war

Real estate and tourism are the two main industries on which Dubai’s economy is dependent. An increase in Syrian conflict might have a negative impact on both these industries. “The DFM General Index, which has risen more than any benchmark in the 40 largest equity markets in 2013, lost 1.3 percent after tumbling 7 percent yesterday, the most in four years and the biggest decline among 90 measures tracked by Bloomberg” (Sharif, Ivashchenko, and Pavliva). The Syrian crisis has inculcated fear in the minds of people who wanted to invest in the real estate market or wanted to visit Dubai for recreational purposes. This has proved to be a drawback for the country’s economy and hence the stock market index.

Mortgage caps by Central Bank

Recently, the Central Bank of Dubai issued guidelines pertaining to the mortgage of real estate properties. The bank has stakes in several real projects throughout the emirate. It wants to discourage property gambling and provide loans to genuine parties only. The recent global crisis had sent shockwaves across all the financial institutions. So, the step has been taken in order to safeguard its interests (Waheed and Siriani 2013). This step will definitely improve the market position and the index will rise.

Unified accounting pattern

The UAE government is planning major changes in its “corporate law to introduce unified accounting standards for all business, amend guidelines for share offerings in local capital markets, and extend the possibility of foreign majority ownership of companies nationwide” (Hamdan). The move will definitely attract more and even bigger investors to invest in the country. The recent provisions do not allow foreign companies to have more than 49% share in a company. But the proposed change is poised to bring in major conglomerates and this will help in bettering the economic condition of the country. As a result, the market index is ought to go high.

Recent financial crisis

The financial crisis of 2007 – 2010 had a great impact on the Dubai Market Index. From the graph, it is evident that the Dubai Market Index dropped sharply during this period.

International Finance Reporting Standards (IFRS)

The introduction of the International Finance Reporting Standards (IFRS) will be beneficial for the country’s economy because it will attract conglomerates to invest in various sectors. Till now conglomerates were hesitant to invest in the emirate because there were certain loopholes in the accounting system and there were more chances of frauds being committed and getting unnoticed. The new system (IFRS) will certainly prove to be a shot in the arm for the emirate and this will certainly improve the Dubai Market Index.

How these proposals affected the volatility in the market for stocks and stock options in Dubai

Allocating stock options is a general practice being followed by foreign organizations. But since Dubai’s law doesn’t permit, the system is not yet prevalent in the emirate to a greater extent. But the recent moves such as adopting a unified accounting system and adopting the International Finance Reporting Standards will certainly bring in conglomerates. Since such conglomerates have a policy of giving stock options to their employees, the emirate will also benefit from their policies.

The significance and effects of any other event that affected the market for stocks and stock options in Dubai and the UAE

The drop in property prices also has been one of the factors that have affected stocks and stock options in UAE and Dubai. Dropping real estate prices has discouraged foreign investments in the country and the emirate. As it is understood, the stock option can only be effective if foreign companies enter the country’s market. So to invite conglomerates and foreign investment, the property prices have to be controlled. The Central Bank’s step towards controlling the property mortgages is commendable.

Conclusion

Considering the uninterrupted economic growth of the UAE, the future of the country’s stock market seems to be quite encouraging. Owing to the increasing savings culture among the nationals and the increasing requirement for fresh opportunities in investment (such as shares), UAE is now poised to become the leading commercial hub in the Gulf region. Adding to the benefits of the nation’s stock market is the fact that several companies from diverse business interests are seeking to invest in stock-trading activities.

Works Cited

Derman, Emanuel. Modelling the volatility smile. 2006. Web.

DFM 2013. Overview. Web.

Dubai Financial Market. 2008. Web.

Federal Law No. 4 of 2000 concerning the Emirates Securities & Commodities Authority and Market 2000. Web.

Gaurav. UAE indices rise as volatility continues. 2013. Web.

Hamdan, Sara. Proposed law in UAE could encourage investing. 2011. Web.

Koren, Miklos. Volatility, diversification and development in the Gulf Cooperation Council countries. 2010. Web.

Lowe, Aya. Stock options could benefit UAE companies. 2010. Web.

Sharif, Arif, Valeriya Ivashchenko, and Halia Pavliva. Dubai stocks stung by Syria after world-beating advance. 2013. Web.

Understanding stock options. 1994. Web.

Volatility smiles and smirks. 2009. Web.

Waheed, Ahmad and Victor Siriani. Expert view: Five steps to prevent volatility in UAE property market. 2013. Web.

What is volatility smile? 2013. Web.