Executive summary

The report is based on an investigative research of the UK oral hygiene market. Based on the research findings, the market is diverse and competitive with such major players being P&G, Colgate Palmolive, and GSK plc. The market is composed of products like mouthwash, toothbrushes, toothpaste, denture care, ancillaries, and dental floss, among others. The proposed new product is classified in the class of toothpaste which has unique characteristics as it combines both whitening and sensitivity reduction elements. The developed product targets the ageing generation, the young, and smokers. The anticipated market share of the product is estimated to be 5%, reaching more than 50% of the population in the first year. In addition, the new product is also expected to grow at a rate of 4%. The toothpaste will be packaged in different sizes with different prices. However, the price of the product is generally affordable and pocket friendly given the associated benefits. Since the product is unique, it is estimated that it will be a major investment worth the risk.

Introduction

The oral hygiene products available in the UK’s oral hygiene market are toothpaste; toothbrushes, dental floss, mouthwash, denture care, ancillaries, and non-confectionery breathe gums among others. The UK oral hygiene market is a mature market which produces these products and distributes them to other countries. Although the market has many players, the major key players are Colgate-Palmolive Plc UK, GlaxoSmithKline Plc, and Procter & Gamble Plc (GSK Plc 2010, p.17). These three companies possess the largest market share making it hard for small companies and new entrants. The research covers a background research using secondary methods to get secondary data and information of the market. Primary research is carried to analyse the feasibility of a new product. Moreover, the research report analyses the preliminary stages involved in new product development process in the oral hygiene market.

Market Background

The key players of the UK oral hygiene market are P&G, GlaxoSmithKline Plc (GSK), and Colgate-Palmolive Company. These three companies have established themselves well in the market to the point of almost dominating the market. Other companies include Church & Dwight, Johnson & Johnson, Fresh Breath Ltd, and Own Label ltd. Colgate-Palmolive is the market leader followed by GSK Plc, then P&G plc (Euromonitor International, 2011). Colgate toothpaste leads the market with an average market share of 43% and 23% in the manual brushes (Euromonitor International, 2011). Consumers of Oral hygiene products have increased given that tooth decay is a major oral hygiene problem in the UK and the ageing population is increasing. Based on a heath report released by the British Medical Association (2010), tooth decay is common among the 12 year olds especially those from areas with fluoride-rich water. As a result, the companies have designed products targeting this market segment

Market share

According to a report by Mintel (2012a), GSK Plc and Colgate-Palmolive are the dominant suppliers in the UK oral hygiene market. Based on the report findings, the two accounted for 84% of the total sales made in the oral hygiene industry in 2011. The Colgate brand which belongs to Colgate-Palmolive leads the toothpaste sector with more than 50% in sales. This has been attributed to the high brand loyalty and brand trust. Other players like GSK in 2011 enjoyed more than 33% of sales made in the toothpaste sector (Mintel, 212a). Church & Dwight Plc was ranked third based on 2011 sales of innovative oral hygiene products. In the toothpaste sector, Procter & Gamble is the market leader clinching 53% of the total toothbrushes sales in 2011. The major P&G brands are Crest and the Oral-B which dominate the UK oral hygiene market (Mintel, 2012a).

The company also leads in the production of rechargeable toothbrushes where more than 25% of the population owns a rechargeable toothbrush. P&G is followed by Colgate-Palmolive which commands 19% of toothbrushes market share sales. Lastly, Own-label is ranked third with a small market share in the toothbrush sector. However, according to Mintel (2012a), in every ten people four own ‘Own-label toothbrush’. Although the toothpaste sector seems to be dominated by two companies, the release of a new brand in the market can have an effect on the market share. For instance, Oral B which was launched in the toothpaste sector is believed to cause a major change of the market share (MIntel, 2012a).

The UK oral hygiene market structure is made of denture care, toothpaste, mouthwash, dental floss, and toothbrushes segments (GSK Plc 2010, p.17). In 2010, the oral hygiene market increased by 3.6% generating an estimated sales revenue of 929 million Euros (Euromonitor International, 2011). The trend has been as a result of increased oral care awareness carried by the market leaders. In a market that is generally dominated by the mentioned products, toothpaste has the highest market share of approximately 42.3%, followed by toothbrush and mouthwash (Cosmetic Business, 2011). Other results show that only 39% of the UK population use mouth wash and less than 18 percent use dental floss (Cosmetic Business, 2011). The major market leader for mouthwash is Johnson & Johnson followed by Fresh Breath’s Limited brands and Colgate-Palmolive. The major mouthwash brands for Johnson & Johnson are Rembrandt, Reach, and the Listerine while Fresh Breath Limited major product is Dentyl Active Mouthwash which is distributed through Denron company (Mintel 2012a)

The market for dental floss reduced by a rate of 9.4 percent in 2010 (Cosmetic Business, 2011). This could be attributed to the reduced spending as a result of the 2008-2010 recession. On average, forty percent of consumers purchase the same product regularly, hence promoting brand loyalty (Bainbridge 2004). The age group between 15 and 19 year olds oral products consumers saw a decrease of 27%. However, adults especially men have the highest brand loyalty compared to women (Mintel, 2012f). This implies that men are more likely to stick to same brand than women and the younger generation.

Distribution channels

The oral hygiene products are distributed into the market through different distribution outlets. The Grocery Multiples is the major distributor of the oral hygiene products with average total sales of 60% in 2011(Mintel 2012). This has been attributed to the increased promotions carried and the presence of its cheaper products. Boots follows with a share of 20% in total sales with most of its customers being retailers. The outlet carries occasional price based promotions as well as providing products under its own label. Other distributors are pharmacies, chemists, drug stores and supermarkets. The leading supermarkets involved in the distribution process are Tesco, Sainsbury (Mintel, 2012) and ASDA (Cosmetic Business, 2011). However, Sainsbury was the first UK supermarket to open a store offering dental surgeries in 2008. The major drug chain stores that distribute oral hygiene products include, but not limited to, Savers, Lloyds, and Superdrug who in 2011 accounted for 6% combined sales share value (Mintel, 2012).

Usually, consumers get prescription from independent chemists on the type of oral hygiene products before purchasing the products. The internet has become a major distribution outlet for the major key players in the market to increase the sales of their products. The online platform is used by customers for its convenience as the customer is not required to visit rug stores or Chemists to make purchases. Instead, customers buy the products online and they are delivered at the comfort of their homes. In 2011, online distribution channel accounted for 5% of the total sales made in the oral hygiene market (Mintel 2012). The major products distributed through these distribution channels are toothpaste, mouthwash, and tooth brushes which have become people daily essentials.

Brands and advertising costs

Colgate-Palmolive’s major brands are Colgate Whitening & Fresh Breath, Colgate Sensitive Multi Protection, Colgate Total Fluoride and Colgate Total Professional (Mintel, 2012d). GSK major innovative brands are Sensodyne, Macleans, Poligrip and Corsodyl while Aquafresh has been launched with different brand names (Mintel 2012d). Procter & Gamble major brands are Oral B toothbrushes and toothpaste.

In 2010, Colgate-Palmolive spent £12.7 million on adverts which is an equivalent of 22%. Conversely, GSK spend £23.6 million on adverts with Aquafresh brand, Sensodyne, Corsodyl, Macleans, and Poligrip contributing £8.2 million, £6.9 million, £5.4 million, £1.4 million and £1.7 million respectively (Mintel, 2012b). P&G spend £5.7 million in 2010 on promotion and advertising. Others companies that contributed to the advertising spending are Johnson & Johnson which spend £8.3 million and Church & Dwight spending £2.3 million. Based on these figures, GSK was the biggest advertising spender, followed by Colgate-Palmolive and Johnson & Johnson respectively. In total, the companies spend an estimate of £52.6 million on promotion and advertising. However, compared to 2009, the amount reduced by 17% as a result of recession (Mintel, 2012e).

Market segmentation: The UK’s market for oral care products is segmented based on product type and customer demographics. The major product types segments are denture care, toothpaste, mouthwash, dental floss, and toothbrushes. Toothpaste is the major segment with 97% of the UK’s population using toothpaste (Mintel, 2012c). Since toothpaste cannot be used singularly, the toothbrush segment has grown contributing to 30% of 2011 sales. The mouthwash segment has started to thrive and as a result, the segment accounted for 18% of the 2011 sales (Mintel, 2012c). The increase has been as a result of increased awareness and Hollywood influence. The sensitive toothpaste products, mouthwashes and whitening products have also increased targeting the aging groups who are prone to teeth decay and gum inflammations (Mintel, 2012b). This is a segment which is emerging for the oral care products.

Historical trends: The UK oral hygiene market has become saturated with common oral care products like toothpaste and manual toothbrush thus the need for value added products (Decker 2012). The saturation has led to market maturity where the key players have been forced to come up with new products. According to Datamonitor report of 2011, the UK market for sensitive toothpaste has increased by 4% in the last five years (Decker 2012).This emerging trend is overhauling the use of normal toothpastes. A good example is Sensodyne toothpaste manufactured by GlaxoSmithKline Plc and whitening toothpaste. The UK oral hygiene business has changed from keeping the teeth clean to a lucrative business. There has been emergent of new trends in tooth brushes segment. For example, in the last decade, manual tooth brushes were common; however, rechargeable tooth brushes have been innovated. For instance, Oral B has innovated rechargeable toothbrush where more than 25% of the population own and use rechargeable toothbrushes (Business Pharmacy, 2011). This shows how the oral care market is growing through innovation to offer value added products.

Environmental factors impacting the UK Oral Hygiene market

Political: In collaboration with the EU, the UK has put restrictions on the amount of hydrogen peroxide used in oral hygiene products (Mintel, 2012c). Hydrogen peroxide is believed to cause teeth corrosion if used in large quantities without dentist prescription. This is likely to affect the oral hygiene market especially in the production of whitening toothpaste. Also, there are restrictive antitrust laws and competitive laws in UK which are very restrictive and companies have to comply with these laws to keep good public relations (Colgate Palmolive 2010a, p10).

Economic: Despite the economic crunch and recession in the UK, the oral hygiene market has continued to expand. Based on Mintel (2012b), the market increased its sales by 3% between 2008 and 2011. This was attributed by the fact that toothpaste and toothbrushes are major basic essentials and people are putting more efforts on their oral hygiene to avoid the high costs incurred in dental treatment. Consequently, the oral hygiene market experienced total sales value of £ 938million (Mintel, 2012b). However, despite the increases in sales, recession has made consumers prefer cheap products under promotions.

Socio-cultural: The social and cultural trends that affect consumer purchasing behaviour and preferences are always changing. Because of the increased awareness on the importance of oral hygiene, the market share for toothpaste has increased to 43% (Mintel, 2012b). This is expected to increase as the number of people using toothpaste continues to increase. Other social factors affecting the UK oral hygiene market is the Hollywood influence where the consumers want to have that ‘Hollywood smile’. Consumers in UK want to have healthy gums and teeth hence the change in consumer trends.

Technological: Companies like Colgate-Palmolive UK and Procter &Gamble, have website platform from where they can sell their products, advertise and even communicate with their customers. The current expectations are that technological advancement will have an influence on the consumer choice of oral care products. The latest technology has led to innovation where products like “Colgate Plax Alcohol Free and Colgate Plax Ice mouth rinses” (Colgate Palmolive 2010) have been designed. According to the Colgate-Palmolive report, the increase in the company’s sales was as a result of the premium innovations necessitated by the technology advancements (Colgate Palmolive 2011). The implication made is that the latest technology plays a greater role in the oral hygiene industry of UK.

A Summary of the Proposed Market Segment with Rationale

The toothpaste segment is the proposed market segment for the new product under development. However, the segment will be more categorical in developing combined toothpaste for teeth whitening and for use on sensitive teeth. Based on a report released by Mintel, the sales of sensitive toothpaste increased between 1999 and 2003 by 18% (Bainbridge 2004). This has been attributed by an increase in the emerging market segment of the aging population which needs exploitation. Conversely, the cosmetic values associated with teeth whitening saw the sales increase by 70% in 2003 (Bainbridge 2004).

In most cases, tooth decay and sensitivity are accompanied by stained teeth; therefore, the toothpaste will be in a position to meet the needs of this segment as it exploits the availed market. Although the major key players are GSK and Colgate- Palmolive Plc with an estimate of more than 75% of the market share (Bainbridge 2004), the new product will be more competitive as it is multi-purpose toothpaste. The product will be able to compete with Sensodyne of GSK Plc and Colgate Total of Colgate-Palmolive among other brands.

According to Mintel (2012b), the ageing population is expected to increase by 13% which would account for 18% of the UK’s population. This offers an opportunity to provide a new product to this untapped market as part of the anti-ageing oral hygiene products. The product will also be available to smokers who are often faced with the problem of stained teeth. The new product therefore, will have the anticipated market share as it is less likely to receive much competition from the market key players.

New Product Development (NPD)

As mentioned in the preceding paragraph, the proposed new oral hygiene product is sensitive and whitening toothpaste.

Idea generation: Extensive brainstorming was used to generate the idea based on the oral hygiene market analysis. During the idea generating process, different organization group members were assigned the task of coming up with ideas related to the oral hygiene market. Notes were written and the different concepts listed based on priority.

Screening: All ideas where screened using cost benefit analysis tool. As a rule, the generated ideas had to satisfy the following:

First, the new product was to benefit and satisfy the targeted customer. Secondly, the new product was to be technically feasible in terms of manufacturing, availability of raw materials, and cost effective. It was also important to ensure the manufacture of the product would be profitable. After the screening process, it was agreed upon that toothpaste that would treat sensitive teeth at the same time whitening them would be the best concept.

Concept development and Testing: After the screening was completed, it was time to carry out a feasibility test of the idea. To make sure that the concept was original and not patented, an investigative research was carried on issues pertaining intellectual property and patents. Upon satisfaction that the idea was original, target market was sought. This was followed by devising the correct features that would be used on the product packaging and general brand look.

To prove its feasibility, different students in the university but taking different courses were asked to give their opinions on the new product. Later, qualitative research was carried through the use of focus group to test the feasibility of the study. The focus discussion group was made up of three groups consisting of different age groups. The first group participants were college students aged 15 to 27 years, second group 35 to 50 years and third group of ages between 50 to 65 year olds. The members of the sample joined the focus groups voluntarily. The members of the focus groups were engaged in a discussion using some structured questions regarding the concept. A moderator ensured that the focus discussion was a success.

Final product development: Upon the feasibility idea testing, it was high time to move from a product concept to a prototype. At this stage the concept has developed to whitening-sensitive toothpaste which would be a new product in the UK’s oral care/hygiene market.

Primary Research

During the concept development and testing, a qualitative research study had to be carried to ensure that the product was feasible and ready. Focus groups discussion was applied to get the attitudes, perceptions, and the opinions of the public on the proposed toothpaste.

Table 1: Focus groups

Research Outcomes

The following are the results of the primary research from the focus groups transcripts. The outcomes are responses on the expected benefits, fulfillment of the people needs, pricing, and the current brand the participants uses to solve the problem.

Table 2: Participants responses

Based on above table, most of the participants believed that their teeth would be whitened upon the use of the product. The young generation believed that solving their problems especially whitening and giving them would give that lucrative smile. The middle age group held on the belief that the product would be useful in whitening their stained teeth. In general, most of the people from the research believed that the project was achievable and would solve their problems.

83.3% of the sample believed that their needs would be met upon the use of the proposed product. 10% of the participants were neutral as they were concerned on the pricing if the commodity. 6.7% of the participants believed that the product was not feasible and achievable as the cost incurred in R&D would be high. With 83.3% which was above the anticipated threshold of 75%, the concept was good to go to the next stage.

Table 3: Likert’s Scale responses

Based on the table above, 25 of the participants had the belief that the product would solve their oral problems. Some of the responses and not limited to were like, “my sensitive teeth will be better”, I cannot wait to use the product”, “I think my stained teeth will be whitened”, and “tooth decay will be solved”. Based on these responses, it emerged that the proposed product would be of good effect to a cross-section of people in UK. On the issue of prices, 24(89%) believed that the prices were reasonable given that the product would offer combined benefits. 90% (27) of the people in the focus group shared their desire to buy the product upon its development and release in the market. However, 10% (3) of the participants said they would not buy the product. The reasons given were “it is expensive”, “am still young I need no sensitive toothpaste”, and “it is unachievable”. Lastly, 25 (83.3%) of the participants believed that the project was achievable and would be a success.

The results from the focus group discussion aligned with the secondary research results in the sense that there is a gap existence in the market on the need to solve problems related to tooth sensitivity and whitening. For example, the ageing population according to Mintel (2012b) would require special oral hygiene products. Also, the population of less than 35 years likes to have that cosmetic look hence the need for whitening product (Mintel, 2012b).

Marketing Strategy

Target market: The new product target market is the ageing population, smokers, and people with decaying teeth. The young adults who want to have that cosmetic look come as a supplement to the market share. Currently, there ageing population is increasing at a rate of 13% which may contribute to 18% of the total UK population by 2016 (Mintel, 2012b). The trend is believed to continue as what was referred as “baby boomer generation” is retiring at a high rate.

Competitive positioning

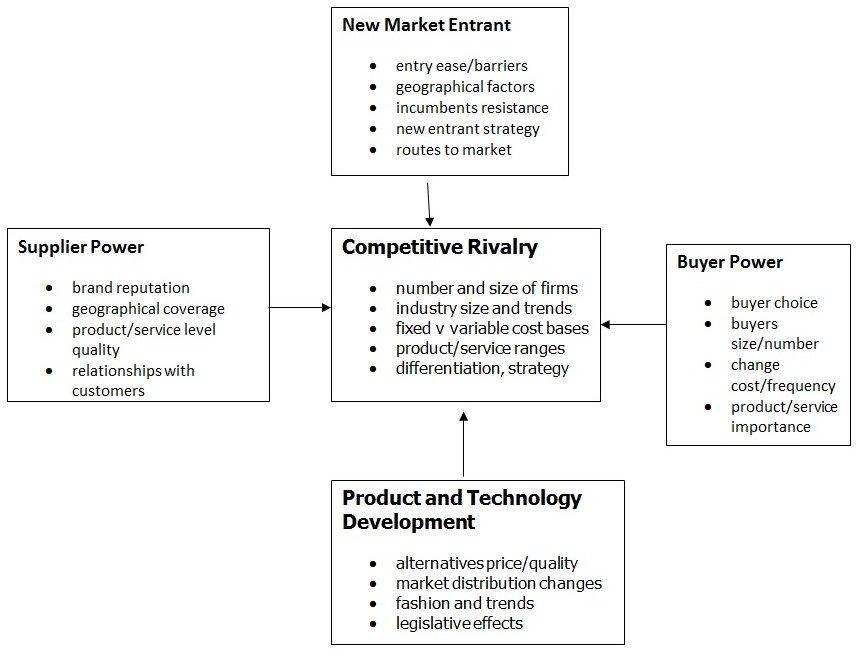

The five Porter’s forces of competitive positioning which include threat to new market entrants, power suppliers, bargaining power of the buyers, threat of substitute products and existing competitive rivalry will be applied (Chapman, 2005).

The product faces high levels of entry barrier given that huge capital requirement would be needed to produce and distribute the product. However, a new entry strategy would be adopted where the already existing supply chains would be used. Also, the company can merge with an already existing organization like P&G that has low market share and join their forces.

The major competitors existing in the market are GlaxoSmithKline Plc and Colgate Palmolive which have more than 84% of the market share sales (Mintel, 2012a) and P&G. However, this will be reduced given that these companies only produce products that serve either of the two benefits combined in the new product. Differentiation strategy will be applied in this case to reach the target population.

GlaxoSmithKline, Colgate-Palmolive and Proctor & Gamble are the main competitors in the market with well established products and consumer loyalty. However, the new product because of its uniqueness and different market segmentation will be able to gain the required market share.

The company expects high buyer bargaining power as they are used to the use of the already existing brands which have a proven performance record. However, to ensure that the product meets the high customer bargaining power, the company will make sure it satisfies its consumers through the production of high quality products. The high quality products will be based on the available technology and extensive research and development.

The company will depend on suppliers to provide most of the raw materials needed for the productions process. This implies that the suppliers bargaining power is expected to be very high. Therefore, the organization plans to have a closer relationship with the suppliers to ensure that the raw materials are availed in time. This would ensure brand reputation is achieved as the products will be produced and supplied in the required timeframe.

Target sales: It is a huge venture that requires a lot of capital investment. Therefore, the organization plans to meet half of the targeted population in the first quarter. No profits are expected during this period as the organization will be meeting the invested capital costs. (Refer the budget table).

Market share: The anticipated market share will be 5% in the first financial year with an expected increase in the years to follow. Because it is a new product in the market, the market growth rate is expected to be slow at the beginning then increase as the customers become familiar with the product. (Refer the budget table).

Marketing Mix

Price: The proposed price for the commodity will be a little higher than the current price for the available oral healthcare commodities. However, penetration pricing strategy (Lamb, Hair & McDaniel 2009, p.45), will be applied to reach the targeted customers in a period of six months. The price would be affordable and pocket friendly to the different customers in the target group. Since the products will be packaged in different sizes, the prices will also be affordable.

Place/distribution: The products will be distributed in a wide range of networks that would reach the targeted population in the right timeframe (Lamb, Hair & McDaniel 2009, p.45). It is proposed that existing stores in UK like ASDA and Tesco be used as distribution centers for the products. Also, different healthcare centers, drug stores and shops will be used to avail the product to the customers. Placing the product at this strategic position will offer a brand positing hence a competitive advantage.

Product: The product which is sensitive-whitening toothpaste is unique in its own making. It combines chemicals for whitening teeth and the same time reducing sensitivity of the teeth. The product will be packaged in different sizes like the Colgate Palmolive products or GSK sensodyne toothpaste. However, the packaging will be of different colour with the brand name on the top to enable customers differentiate it from other brands in the market. Different sizes will have different prices to meet the needs of the people.

Promotion: The promotion and the advertising of the product will use different methods like public relations, personal selling, sales promotions, and use of commercials (Lamb, Hair & McDaniel 2009, p.45). During the launch of the product, female celebrity from UK will be used to show the smile achieved as a result of the product use. The advert will appear on the home TV channels amid news as part of the commercial breaks for consecutive 6 months. The ageing people will also be featured in a commercial to show its reliability and what it can achieve.

Other than the use of commercials, traditional methods of advertising will also be used. For example, magazines, newsletters, health magazines, and newspapers will be used (Lamb, Hair & McDaniel 2009, p.45). Billboards and signboards will be displayed at different areas in the city to create awareness on the new product. Road show campaigns will be carried to create awareness and sensitize people on the need to use the product and the different needs associated with it. Lastly, social media marketing will be applied although not many old people use the social media like twitter and Facebook, the middle age will be targeted. The young will be reached through the social media platform from where they can inform their aging parents on the new product in the market.

Communication marketing

An integrated communication marketing plan will be designed that will help in aiding the marketing mix realize its objectives. The communication marketing plan will aid to get in touch with the targeted and potential customers (McDonald & Wilson 2011, p.261; Rainey 2005, 376). Impersonal and personal communication methods will be incorporated in the communication plan.

Impersonal communication will involve advertising, public relations, sales promotion, and sponsorship (Rainey 2005, 376). On the other hand, personal communication will include use of websites, blogs, moderated online forums, and online marketing (McDonald & Wilson 2011, p. 261). These forms of advertising will be incorporated in the marketing communication plan to ensure that the product reaches the customers at the set time frame.

P & L statement

Figure 2: Product launch in the year 2012 budget plan

Assumptions made:

- The market key players will take one year before developing a product that has the capacity of competing favourably with the new product.

- The organization will benefit from all the existing distribution and supply chains hence less cost.

- The organization will invest heavily in advertising and promotion of the new product hence the high cost.

- No macroeconomic factors like high inflation, increase in fuel prices, or raw products will occur in the next 1 year upon the launch of the product

Conclusions

Based on the UK oral hygiene market analysis, the market is competitive with a high consumer base. New entrants in the market would face entry barriers if they chose to produce the same products that exist in the market. It also lacks high levels consumer brand loyalty because of the many brands available in the market. For these reasons, a new product has been developed that is sensitive-whitening toothpaste’. The product developed targets the ageing population, the young and smokers. The new product is expected to gain a market share of 5% in the first year. During the first six months, the product will have reached 50% of the entire UK targeted population. Although it is a new product in the market, its uniqueness will act as a competitive advantage

Reference List

Bainbridge, John 2004, Sector Insight: Oral care – Dental diversification, Web.

British Medical Association 2010, Fluoridation of water, Web.

Business pharmacy 2011, Oral B – the leading brand in the UK toothbrush market, Web.

Chapman, Alan 2005, Porter’s five forces model: Michael E Porter’s five forces of competitive position model and diagrams, Web.

Colgate-Palmolive 2010, Colgate Announces strong 1st quarter – excellent worldwide sales and unit volume growth, Web.

Colgate-Palmolive 2010a, Colgate 2010 annual report, Web.

Colgate-Palmolive 2011, Colgate announces 1st quarter results – diluted earnings per share in line with expectations, Web.

Cosmetic Business, Oral Hygiene, UK, 2011, Web.

Decker, Charles 2012, Bite’s Back in Oral Care, Web.

Euromonitor International 2011, Oral Care in the United Kingdom, Web.

GSK Plc, GlaxoSmithKline annual report 2010, Web.

Lamb, C, Hair, J & McDaniel, C 2009, Marketing, Mason, Ohio, South-Western: Cengage Learning.

McDonald, M, & Wilson, H 2011, Marketing plans: how to prepare them, how to use them, Wiley, Chichester.

Mintel 2012, Oral Healthcare – UK, Web.

Mintel 2012a, Oral Healthcare – UK: Market share, Web.

Mintel 2012b, Oral Healthcare – UK: issues in the market, Web.

Mintel (2012c, Oral Healthcare-UK; Executive summary, Web.

Mintel 2012d, Oral healthcare-UK: Companies and products, Web.

Mintel 2012e, Oral healthcare –UK: Brand communication and promotion, Web.

Mintel 2012f, Oral healthcare-UK: The consumer –brand usage, Web.

Rainey, D 2005, Product innovation: leading change through integrated product development, Cambridge Univ. Press, Cambridge.

Appendices

Appendix 1: SWOT analysis

Appendix 2: PEST analysis

Appendix 3: Porter’s forces of competitions

Appendix 4: Store Audit Sheet

Category: Oral Hygiene

Signatures of group members:________________________________