Abstract

Mining companies worldwide are in constant competition to outdo the other and own the major portion of the market share. The competition can be seen through the different steps the companies are taking towards establishing that they are ahead of others. For instance, the top companies are continuously investing in new and advanced equipment to ensure that their work is more efficient and saves more time than others in the industry.

In the US alone, numerous companies compete for market share not only in the country but also in other regions of the world. Among top mining companies in the US, ABC Mining Company is among the ones trying to elevate above others in the market. Studies show that many underachieving mining companies with the lowest market share have not fully invested in the machinery and equipment they use, as suggested by (Almazan et al., 2017). This is one of the reasons the industry has remained with a few top companies and many that are struggling. ABC Company is already a leading company but wishes to take steps higher and enjoy a larger market share than the rest of its rivals.

Through its top management, the company plans to achieve this by improving efficiency in its extraction processes. To do so, a company has to ensure that it has the most advanced equipment in the industry, for example, hydraulic mining shovels. The hydraulic mining shovels are used to extract the materials during the mining process. The problem the company is facing is the dilemma any company in their situation would face.

The board of directors is discussing whether to act upon the proposal made by the company’s management that they should invest one million dollars in new machinery and equipment. The board of directors is trying to determine if it would be an excellent idea to invest a considerable amount of money in new and advanced equipment in the hope of generating more revenue. Improving efficiency would ensure that they are faster at delivering to customers, which is something that is appreciated in the marketplace. There is a concept that is thus introduced in this scenario to support decision-making capital budgeting.

Introduction

The mining industry is a growing industry that is very competitive, and many organizations are constantly finding ways to set themselves up for success in the industry. All major companies in the industry worldwide are continuously competing to outdo others and gain a more considerable portion of the market share. The competition is seen through various attempts they are having towards establishing that they are on the top of the clients’ lists. For example, some of the top companies in the United States are constantly investing in new technology and equipment to ensure that their work is more efficient as well as saves more time than others in the industry. In the US alone, numerous companies compete for the market share not only in the country but also in other regions of the world. Among top mining companies in the US, ABC Mining Company is among the ones trying to elevate above others in the market.

The easiest way ABC Company’s management proposes to accomplish this is through enhancing efficiency in its extraction processes. To achieve that, it has to ensure that it acquires the most advanced machinery and equipment in the sector, for instance, new hydraulic mining shovels. The new machinery and equipment are utilized in the extraction of materials during the mining procedure. The issue ABC Company is going through is the dilemma any company faces on their level.

The board of directors of ABC is trying to establish if it is an excellent idea to invest a massive sum of money for the new and advanced machinery and equipment in the hope of generating more revenue. Enhancing the efficiency at work ensures that they are faster at delivering to their clients, which sets them as more preferred than their rivals. To support the decision-making process, we thus introduce a concept called capital budgeting. In this case, it is therefore crucial that we establish capital budgeting, and this can happen using two methods, the payback period method and the time value of money.

Apart from that, it is a cost-effective technique that does not need the majority of the time of finance executives of a company and computer use. The payback period method also helps in preparing against risk. It favors a project that will generate substantial cash inflows in the initial years and discriminates versus a project that will bring significant inflows in later years. Hence, the payback period method helps root out risky projects. Lastly, the payback period is a method of liquidity. It stresses choosing projects with early recovery of the investment. Apart from using the payback period to calculate capital budgeting, we will also use the time value of money.

It is difficult and almost impossible to find an area of finance where this concept does not impact the decision-making procedure. It is a popular and influential method for valuing investment opportunities. The TVM is a critical part of financial planning as well as risk management activities. In this paper, we will look at how capital budgeting as well as the time value of money will support the deciding procedure of the company’s board of directors.

Literature Review

All investment decisions rely upon the decision rule that is applied under situations. The success of the decision rule depends on various factors that have been correctly evaluated. Estimation of cash flows needs great insight into a project before implementation, especially micro and macro view of the economy, company, and polity (Almazan et al., 2017). Project life is essential because it determines the complete picture of the project. The cost of capital is being considered as discounting factor which has experienced change over time. It had various implications in various economic philosophies. Specifically, Almazan et al. (2017) suggest that countries like India have undergone changes in their economic ideology from closed to open. Therefore, determining the cost of capital carries more significance on investment assessment.

The Payback period is the conventional way of calculating capital budgeting. It is the easiest method as well as the most widely utilized quantitative technique for assessing capital expenditure decisions. The payback period stands for the number of years needed to get back the initial amount of money invested in a project. For instance, in our case, the mining company ABC wishes to invest money in purchasing equipment that will help in improving efficiency at work. The period thus stands for the duration it will take ABC Company to get back the initially invested amount of money on the project.

Methodology and Results

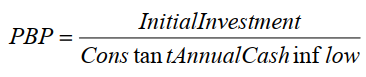

There are two ways to come up with the duration, according to (Lima et al., 2017). The first method is applied when there is uniformity in CFAT. In such circumstances, the investment’s original cost is divided by the constant annual cash flow. For instance, if a machine costs $ 1000000 and the anticipated cash inflow is $ 500000 per year for ten years, then the duration will be the initially invested amount divided by the constant annual cash inflow.

The second method is utilized when there is no uniformity in CFAT. In such circumstances, the payback duration is computed via the procedure of cumulating CFAT until the time when cumulative cash flow is equal to the initially invested amount. For instance, a company needs a first cash investment of $ 20000, and the annual returns of five years is $ 6000, $ 8000, $ 5000, $ 4000, and $ 4000, respectively.

To come up with the duration, it is correct to cumulate the returns earned for the initial three years, whereby $ 19000 is recovered. In the following year, the project generates $ 4000, but only $ 1000 is needed, so the time for recovering the remaining amount is calculated by dividing the remaining amount by the cash outflow of that year and multiplying the result by twelve months. The result is three months, and thus the payback period is three years and three months.

The payback period equips companies with enough knowledge about various projects to make it easier for them to select an investment proposal. On the one hand, companies accept projects only if the payback duration is less in comparison to the utmost duration. On the other hand, companies reject investment proposals when the duration is more in comparison to the utmost acceptable duration. It is a mechanism that can be utilized to compare real payback with a standard payback that is set up by organizational management in terms of the most amount of time during which the original investment has to be recovered, as suggested by (Lima et al., 2017). Management’s role is to determine the standard payback period based on numerous factors, such as the perceived risk of the project and the project type. The payback concept is also used to classify exclusive projects that are accomplished according to the length of the duration and projects with the least payback duration are chosen.

The idea of the time value of money, demonstrates how a specific amount of finances available is more worth in comparison to the similar amount at a forthcoming time. For instance, when presented with a choice between getting $ 100 now or $ 100 twelve months at a later time from now, one ought to take the money now. One could devote that amount of money in investment, and even though they only earn a 2% yearly return on the investment, they still make $ 102 from now, which is more than if they waited. This is something that ABC Company needs to consider as they decide whether to invest in acquiring new equipment. According to the time value of money, it is in the company’s best interest to invest in new equipment, which will help generate more income for the company.

The present or future worth of an amount is reliant on interest rates. An essential consideration in this concept is the discount rate. As per various experts in the area of finance, this refers to a rate a company utilizes to transform future sums of money into profits of now (Almazan et al., 2017). Numerous factors impact the rate, consisting of the interest rates charged on the amount of funds a firm is eligible to borrow, the earnings the firm gets from investing the borrowed amount, the return investors demand from the firm, inflation, and the risks involved project.

It is essentially a company’s management who comes up with reasonably correct figures for the discount rate. Wrong statistics can lead to making poor capital budgeting decisions (Almazan et al., 2017). To make informed capital budgeting decisions by applying the concept of TVM, a firm needs an estimation of every cash flow regarding the project, both negative as well as positive.

After that, the company management converts every cash flow into its present value. Using our case study, the amount of money needed to acquire the new equipment would reach up to $ 1000000. Therefore, this is a project that requires ten million dollars today and will return $500000 per annum for the next five years. Despite the fact, it seems as if the project generates a profit of $ 500000, the future cash flows have to be transformed to present value which underscores the relevance of accuracy in setting discount rates. Firms apply this concept in different ways to make decisions on big projects and decide between competing projects.

The internal rates of return as well as the present worth are two of the most utilized by most of the companies. The greater the NPV, the higher the chances of succeeding after investment. If IRR is better than the discount rate, then the project is a good investment. Time is money, and the concept of TVM proves this idea. The worth of money right now is not similar to what its future value will be. Understanding how to establish the time worth of funds by computing the current and future worth is essential for establishing the kind of investments they are worth at various times. In finance, an amount of finances one gets today is the current worth which refers to the present value of that money. Future value is the worth of money after a set duration.

Even though the method of payback period is appealing, it possesses major shortcomings. The first drawback is that time value of money is not measured as well as it does not thus fine-tune accordingly the returns (Lima et al., 2017). The concept, as mentioned earlier, is about how the worth of money now will be greater at a later time due to the present day’s earning capability. Therefore, an inflow earning of a certain amount from investments that happens in the second year after investment is perceived as possessing equal worth as cash outflow of the same amount that occurred in the investment year (Almazan et al., 2017).

This happens even though the purchasing power is probably lower after the two-year duration. Moreover, the payback period method fails to account for cash inflows that happen past the payback duration, thereby unable to account for a project’s profitability in comparison to another.

For instance, two suggested projects may have the same payback duration. However, cash inflow from one of the projects might drop after the payback duration ends. The other project’s cash inflows might rise for numerous years after the payback period ends. As countless significant projects offer investment earnings over the duration of several years, this is an excellent consideration. The straightforwardness of this method falls short in not accounting for the intricacy of cash flow that can happen with a significant investment (Almazan et al., 2017). In the real world, big projects are not an issue of a single major cash outflow and a steady cash inflow.

Extra cash outflow is needed eventually, and inflow may decline concerning sales as well as revenues. The technique also fails to account for factors like financing, risk, or other deliberations. Because of its shortcomings, the payback duration method is occasionally utilized as an initial assessment and accompanied by other estimates such as IRR or the NPV.

Recommendation

I would recommend that ABC Company invests money on the project of buying new equipment and machine. From the payback period method, it is evident that the money will be recovered within a short amount of time, and the company will benefit a lot. The company management suggests that the company invests $ 1000000. When using the payback period method, the amount of money that the company will earn per annum after the investment is $ 500000. Upon calculation, the initial amount invested is recovered after a period of two years which shows that the investment is worth it. I choose to recommend this because the project is about new machinery and equipment essential when a company wishes to improve efficiency.

Top companies in the mining industry rely on how efficient they are in their processes, especially extraction. Investing a huge amount of money in extraction machinery and equipment sets a company up for success in the industry and puts them ahead of others. For instance, clients want faster delivery and what efficiency does is ensure that specific processes do not have to be repeated. This saves a lot of time for the company, which is a characteristic that separates a better-performing company from a failing one in the marketplace.

Discussion and Conclusion

In the paper, we have seen that every investment decision depends on a decision rule applied under specific situations. The decision rule’s success is also dependent on various factors that are accurately examined. Approximation of cash flows needs an incredible amount of knowledge on a project prior to implementation, especially micro and macro view of the economy, company, and polity as mentioned earlier. We have also seen that project life is crucial since it determines the whole view of a project.

The payback duration method and the idea of money’s time worth have helped me reach my conclusion that the company should invest in acquiring new machinery and equipment. The payback period is a conventional way of establishing capital budgeting (Lima et al., 2017). It is an easy method and widely accepted among many firms to help in reaching decisions for investments. This method means the number of years a company needs to recover the initial amount of money they invest in a project. For example, in the paper, we have seen that the mining company wishes to invest money in buying new machinery and equipment that will aid in improving efficiency at work.

So, in this case, the payback is the duration measured in years it takes for ABC Company to earn back the money they originally invested. There are various ways of coming up with the payback period. One is applied when there is uniformity in CFAT and when there is no uniformity in CFAT. In the former situation, the investment’s original cost is divided by the constant annual cash flow.

Therefore, if the new machinery and equipment cost $ 1000000 and $ 500000 is the anticipated cash inflow per annum for ten years. This means that the payback period of the company’s initial investment is the initial investment divided by constant annual cash inflow. Apart from using the payback period to come to a final decision on the matter, I also considered the present or the future values as well as the discount rates, which are concepts used in determining money’s time worth. According to (Almazan et al., 2017), in the area of finance, this refers to the rate a firm can utilize to convert future sums of money into profits of today.

Various issues influence how the rate, and the paper has mentioned the interest rate that a firm borrows a sum of money, the earnings the firm gets from investing the borrowed amount, the return investors demand from the firm, inflation as well as the risks involved regarding the project. It is essential that the management of ABC Company come up with reasonable figures for the discount rate since inaccurate figures can lead the company to make poor investment decisions. To reach a capital budgeting decision by applying the concepts, ABC Company needs to estimate every cash flow involved with the purchase of new machinery and equipment.

However, it is also vital that the company management learns about the limitations of using the payback method to ensure that they are sure about the decision they make. There are two sides to every method, which include merits and demerits. In making financial decisions for a company, the board of directors depends on the company management and the finance department to offer insight on whether it is correct or not to invest in a project. Therefore, the finance department and management need to ensure that they properly evaluate proposed investments to check whether the company might benefit or should forfeit. That is why checking the merits and limitations of tools they use in their analysis is essential (Almazan et al., 2017). For example, the method fails to determine money’s time worth and modify the returns.

The idea of time value of money refers to the worth of money today that will be better than in the future as a result of today’s earning capacity. Thus, an inflow return of a particular amount from an investment that happens in the second year following the investment is perceived as having equal worth as cash outflow of the similar amount that happened in the investment year. This is happening, although the purchasing power is potentially lower after the two-year duration. Moreover, the method is not considerate with regards to cash inflows that happen beyond the payback duration, therefore, failing to account for the project’s profitability as compared to another.

References

Almazan, A., Chen, Z., & Titman, S. (2017). Firm investment and stakeholder choices: A top‐down theory of capital budgeting. The Journal of Finance, 72(5), 2179-2228. Web.

Lima, A. C., da Silveira, J. A. G., Matos, F. R. N., & Xavier, A. M. (2017). A qualitative analysis of capital budgeting in cotton ginning plants. Qualitative Research in Accounting & Management. Web.