Internal Analysis (Traditional and Holistic Approach)

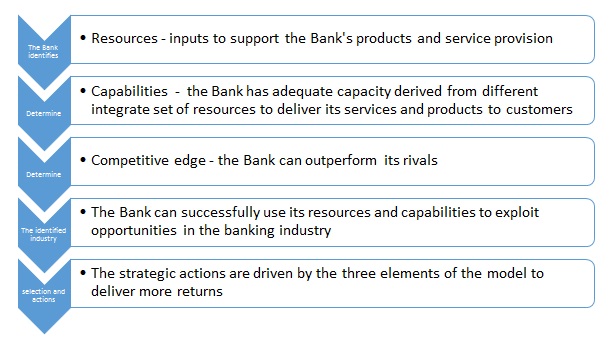

The Resource-Based View and value chain analyses are used to understand the internal analysis of Bank of America.

Resources

These resources include both tangible and intangible ones. Bank of America has a broad global network that it leverages to deliver its services. As such, the Bank has used its massive resources to expand globally, although a significant portion of its revenues still originates from the US market.

Bank acquired Merry Lynch and Countrywide Financial to increase its resource base. The Bank is well capitalized with US$2.14 trillion in assets and huge human capital of 220,000 employees to drive its growth strategies in 2015 and beyond. It not clear what values, the Bank has derived from the acquisition of Countrywide Financial because of numerous legal issues related to mortgage fraud and myriads of consumer complaints. With over 5,000 million branches, 16,000 ATMs, and millions of both online and mobile banking users accumulated significant tangible assets.

Its strong business culture, patents on new technologies, brand name and long history of a good reputation, and loyal customer base serve as imperative elements of intangible assets of the company. With enhanced effectiveness, Bank of America has acquired large volumes of resources to create a competitive advantage. It is understood that the Bank cannot attain a competitive edge by relying on single resources. Therefore, by using a synergistic combination and integration of its human capital, brand name, networks, industry expertise, and other supporting systems, which are its core assets, the Bank has been able to create a competitive edge to challenge its major rivals, including JP Morgan Chase & Co, Citigroup Inc., and Wells Fargo & Co.

Capabilities

Bank of America has created massive capabilities through resource integration to deliver all forms of banking services to its clients. Over the years, the bank has enhanced its capabilities to be among the top banks in the US. In fact, its capabilities are now stronger, intricate, and may not be easily copied or understood by competitors. The Bank’s capabilities are the major sources of its competitive advantage. As such, these capabilities are not easy to imitate and they are not too complex to defy internal operations of the company.

For instance, Bank of America has created ‘One Stop Shop’ using its business model that consists of traditional banking unit, investment banking unit, and asset and wealth management unit (Kendall 12). These units ensure that the Bank can meet all the needs of a single customer throughout their banking needs and life and, therefore, customers do not need to look for other services outside the Bank. As such, these capabilities give the Bank a competitive edge and make it one of the most powerful institutions globally (Hanson 1).

Another element of capabilities noted is responsiveness. The Bank uses its massive resources to respond immediately and aggressively to emerging trends in the consumer market. Bank of America, for instance, is working with FinTech companies to determine the next course of the banking industry. However, it has also been noted that the Bank has poorly responded to customer satisfaction issues, particularly among mortgage customers. Consequently, its mortgage business has started to decline as other institutions gain.

Finally, innovation in the areas of mobile and online banking also reflects Bank capabilities. As other banks aggressively partner with FinTech startups, Bank of America is still assessing the market to determine possibilities of partnership or takeover. Nevertheless, the Bank continues to invest heavily in innovative ideas to revamp its platform.

Competencies

Using human capital, physical capital and organizational capital, Bank of America has developed competencies to deliver superior returns relative to its rivals. The Bank can now offer a wide range of products to its customers globally while using core technologies and competencies to create strong internal capabilities that it leverages to provide value to customers. In addition, Bank of America has shown the tendency to integrate change in its processes.

Therefore, the company has now attained a competitive advantage through its brand awareness, innovation, resources, and service and product offerings among others.

It is observed that the supporting systems related to efficiency, innovation, and responsiveness are responsible for creating distinctive competencies for the Bank. As such, the Bank can acquire larger market shares, enhance service provision while leveraging centuries of experience and valuable fiscal and intellectual capital. These vita competencies have assisted the Bank to attain competitive advantage currently reflected in its leading market position, enhanced efficiency, and strengths to withstand economic turmoil and downturns.

The Bank derives its efficiency from several years of experience. However, Bank of America’s efficiency has been constantly threatened by acquired businesses. For instance, Countrywide Finance acquisition has affected the mortgage business, customer perception, and returns. Economies of scale and quality management have helped the Bank to enhance efficiency by reducing instances of errors, reworks, and customer service delays.

Moreover, the Bank strives to understand both the current and future needs of its customers in order to develop better services and products for such needs. Bank of America has scored abysmally in customer satisfaction surveys, although it struggles to meet the best standards in the industry.

It is understood that the banking industry is highly competitive, and innovation remains a critical challenge. Nevertheless, Bank of America has been able to introduce a mobile wallet, mobile banking, and online banking with a broad range of services. While innovation in the banking industry is to some extent incremental, the Bank strives to amalgamate its legacy systems with emerging technologies for service offering to create the best and perhaps attain a competitive edge.

SWOT Analysis

While the Bank has leveraged its resources well to lead its rivals, the current government regulations and mortgage troubles from Countrywide have generally affected operations of the Bank. In addition, many more non-banking institutions have emerged to compete with traditional banks. As such, Bank of America may be looking for a tough future. In fact, mortgage issues have led to a loss of market share in some markets while net profits have declined.

The Bank must, therefore, strive to improve customer service, particularly among the dissatisfied mortgage clients. It also observed that Bank of America is yet to partner with any FinTech company to improve its service and product offering. This implies that the Bank may lag behind as other financial institutions find new ways to work with these non-banking financial service providers. They offer robust ways of enhancing underwriting, encouraging savings, and consumer reach.

Value Chain Analysis

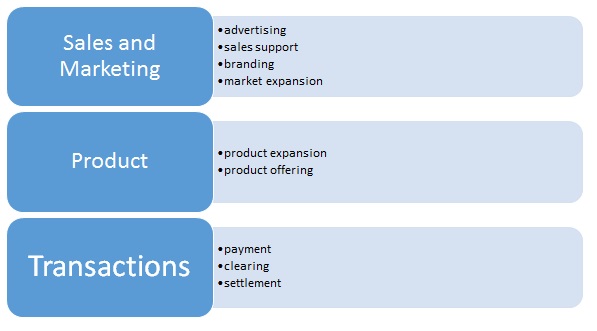

Primary Internal value chain analysis

Bank of America has adopted somewhat robust marketing strategies. The bank uses online and offline avenues to provide its customers and potential customers with information about products and services offered. Bank of America collects data on individual customer’s online undertakings from the website and pages visited. The information gathered is then used to determine the products to be advertised on the Web site or customers’ offline avenues such as emails, phones, or direct mails.

Sales

The Bank of America has adopted a consultative approach to identify the needs of prospective customers and, thus, it strives to offer tailored and day-to-day solutions. The bank trains its sales associates on each product and new technology to provide strategic guidance to potential customers.

Further, the bank strives to expand its market share by improving its leveraging aspects and operating outside the US.

Product offering and product expansion

Most of the Bank of America products are tailored to meet specific customers’ needs and are offered in a manner that enhances efficacy and effectiveness to customers. The bank has embraced technology to enhance services offered. Bank of America uses R&D to expand and improve products it offers (Bank of America 1).

However, the offering of some products is poorly done. For instance, the Bank the America mortgage offering and management has received criticism and complaints from customers.

Transactions

Bank of America has many avenues where customers can use in payment clearing and settlement. Thorough R&D and the embracing of online banking have enhanced transactional procedures. The bank offers both wholesale and retail funds transfer. In most of the wholesale level transactions, electronic funds transfer is used while the retail levels comprise check-clearing systems, cash payment, and credit debit card systems (Bank of America 1). However, the utmost efficiency in payment, clearing, and settlement is yet to be realized as manifested by the low rating of customer satisfaction.

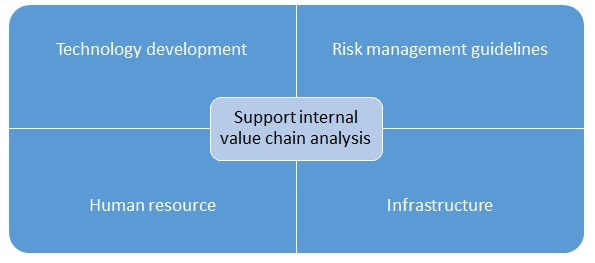

Support internal value chain analysis

Technology development

Over the last ten years, Bank of America has made drastic changes in technology. The company spends approximately $3 billion annually on technology development. The initiative of technology development is aimed at ensuring data centers are managed with the utmost efficiency while augmenting services delivery. The bank designs and implements technological infrastructure such as servers, networks, and market data centers. The technological infrastructures enhance efficacy in the complex banking industry.

Human resource

Bank of America strives to attract the best talents and professional to work with. The employees have played vital roles in the success of the bank over the many decades of operations. However, the level of customer satisfaction remains extreme law. Most of the customers complain that the bank has few tellers who have relatively poor issues resolving skills, poor product knowledge, and unfriendly.

Infrastructure

As a bank that has been in operation for decades, Bank of America has one of the best infrastructures. Most of the banks ATMs are accessible and relatively within reach in many states. In an attempt to make the infrastructure more accessible, the bank has put in place bilingual ATMs to target the visually impaired and Spanish-speaking clients in some of its branches (Bank of America 1).

Risk management guidelines

Bank of America is among the leaders in the US banking industry serving corporate and individual customers and, therefore, it has relatively elaborate risk management guidelines. One of the bank’s key operating principles is the “Manage Risk Well” code. The bank has adopted a holistic approach to risk management concentrating on businesses, the many products/services, and every transaction. Consequently, the bank gets insight into all risk types allowing for strategic and informed decision-making (Bank of America 1).

External Analysis

Porter’s Five Forces

In this section, the most relevant external factors that have influenced the banking industry include the mortgage market, strong competition, buyer influence, the emergence of fintech, and customer issues.

- Threat of Rivalry: this is significantly high in the banking industry because major rivals lack diversity. It is not possible for these large banks to exit the market, and they must cut costs to compete in tough economic times. The mortgage market is the most affected for Bank of America.

- Barriers to Entry: initially it was difficult to join the banking industry due to huge capital base and government regulations. Today, however, new technologies have shown that non-banking entities can now enter the market because they generally operate in unregulated environments. As such, Bank of America faces competition from unlikely sources.

- Supplier Power: IT vendors, human capital, and investor have vital supplier power. Bank of America needs modern technologies to drive down costs of operations. Cost saving remains a core area of concern. The bank is also most likely to lose its human resources to competitors.

- Buyer Power: while buyer power is minimal, Bank of America now faces challenges in the mortgage unit because of Buyer Power and influences on pricing. Buyers continue to focus on the best prices and low costs of transactions.

- Threat of Substitutes: this was initially considered low due to large volumes and amounts of loans larger banks can process. However, it has been noted that Bank of America is losing a significant market share to its major rivals, including Wells Fargo, Mortgage Master Inc., Citizens Bank, and Sovereign Bank, as well financial and non-financial institutions such as Leader Bank and Quicken Loans (Brown 2). In addition, small banks can now compete with major banks for the market.

Competitor Analysis

As mentioned above, Bank of America faces fierce competition from JP Morgan Chase, Citigroup, Wells Fargo, Mortgage Master Inc., Citizens Bank, and Sovereign Bank. In the mortgage market, for instance, these financial institutions recorded positive improves in Massachusetts except Bank of America.

It was also noted that non-financial institutions such as Leader Bank and Quicken Loans had emerged to compete with Bank of America and its rivals. Given the poor relations between the Bank and its mortgage customers, these institutions have emerged to offer better services and enhanced customer service to challenge the Bank. As such, this situation has caused the Bank to lose its market share, resulting into poor performance of the mortgage unit.

It is expected that competition will continue to increase, but these service providers will compete on better products, pricing, and customer service.

Macro Environment Forces Analysis

Global/Economic

Bank of America continues to recover from the aftermath of the global financial crisis of 2008 albeit gradually. Sub-prime mortgage meltdown was responsible for the crash. Consequently, many banks, including Bank of America continue to face stringent regulations and hefty fines because of fraud and illegal practices in the mortgage sector. The Bank acquired Countrywide Finance, but now faces multiple lawsuits, related legal costs, and fines (Rothacker 1). The Fed interest rate hike and increasing incomes among consumers have given the Bank a new opportunity to grow the deposit base and earn more revenues from the increased interest rates.

Social

Corporate social responsibility (CSR) continues to influence how banks operate. To remain relevant and the business, Bank of America now focuses on responsible business practices in lending, community development, inclusion, and philanthropy among others.

Technological

Bank of America, just like any other aggressive banks, must continuously invest in innovation and technologies to revamp its legacy system with the aim of cost saving. As fintech promises to disrupt the industry, the Bank is focusing on building in-house capabilities while looking for a suitable fintech partner.

Government

Today, the banking industry in the US highly regulated. As such, banks continue to operate in an expensive legal environment because of massive resources spent to ensure compliance. However, the better relationship between Bank of America, the political establishment, and politicians was reflected after the bailout. Nevertheless, legal claims continue to increase for the Bank because of practices that led to sub-prime mortgage meltdown.

Demographic trends

Bank of America has designed and developed products to serve individuals of all ages. Besides, these products and services are designed for a wide range of clients, including individuals, organizations, and businesses that are interested in investment banking, commercial banking, and wealth management. Most of these clients are located in the US.

Today, however, other demographic trends such as age, level of education, and incomes among others continue to define investment decisions of the Bank. For instance, the Bank now targets more technological savvy clients, who are generally young and interested in convenience through online and mobile banking.

Internal and external analyses alongside holistic approach for Bank of America reveal both strength and weaknesses, as well as threats and opportunities the Bank faces. Bank of America has used its tangible and intangible resources to create capabilities for growth. The strong brand and industry expertise supported with massive assets and human capital give the Bank competitive edge over its peers and emerging non-banking financial service providers. The Bank integrates various resources to create capabilities for meeting diverse needs of customers. It has developed competitive edge that many financial institutions in the US cannot rival. Hence, the Bank can rely on its capabilities to exploit market opportunities and create superior performance.

One major challenge noted in SWOT analysis is the issue of mortgage. While Bank of America intended to use Countrywide Finance to capture a huge share of the mortgage market, recent events, including customer attrition, liability for mortgage fraud, lawsuits, and fines have proved extremely expensive.

Analysis of the value chain reveals functional aspects of various business units that create and driver value to consumers (Harmon 1-6). It shows that Bank of America has multiple support systems to sustain its competitive edge through internal resources that drive value and create strategic position. The Bank has widely adopted IT platforms supported with huge human capital to create convenience.

The Bank however is not positioned to manage risks, customer issues, and government regulations adequately. As such, multiple challenges emerge. In addition, external factors continue to present uncertain future for the Bank, which it should overcome through enhanced customer service and product offering. While it could be simple to imitate value creators of the Bank, it has been able to leverage its capabilities for competitive edge and strategic position to deliver superior results.

Works Cited

Bank of America. Bank of America. 2016. Web.

Brown, Matthew L. “Bank of America’s market share slips in Mass. mortgage market.” Boston Business Journal (2013): 1-2. Print.

Hanson, David. “Bank of America’s Simple and Ingenious Business Model.” The Motley Fool. 2013. Web.

Harmon, Paul. “Defining a Value Chain for a Bank.” BPTrends 10.9 (2012): 1-6. Print.

Kendall, Gerald I. Viable Vision: Transforming Total Sales into Net Profits. Plantation, FL: J. Ross Publishing, 2004. Print.

Rothacker, Rick. “The deal that cost Bank of America $50 billion – and counting.” Charlotte Observer. 2014. Web.